Global In Vitro Diagnostic Ivd Regulatory Affairs Outsourcing Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

674,277.97 Thousand

USD

1,830,957.45 Thousand

2021

2029

USD

674,277.97 Thousand

USD

1,830,957.45 Thousand

2021

2029

| 2022 –2029 | |

| USD 674,277.97 Thousand | |

| USD 1,830,957.45 Thousand | |

|

|

|

|

السوق العالمية لخدمات الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD)، حسب الخدمة (الكتابة والتقديمات التنظيمية، التسجيل التنظيمي وطلبات التجارب السريرية ، الاستشارات التنظيمية، التمثيل القانوني، خدمات إدارة البيانات، خدمات تصنيع وضوابط الكيمياء (CMC)، وغيرها)، المؤشرات (علم الأورام، طب الأعصاب، أمراض القلب، الكيمياء السريرية والمقايسات المناعية، الطب الدقيق، الأمراض المعدية، داء السكري، الاختبارات الجينية، فيروس نقص المناعة البشرية/الإيدز، أمراض الدم، اختبارات الأدوية/علم الصيدلة الجيني، نقل الدم، نقطة الرعاية، وغيرها)، طريقة النشر (السحابة وفي الموقع)، حجم المؤسسة (الشركات الصغيرة والمتوسطة والكبيرة)، المرحلة (السريرية، ما قبل السريرية، وما بعد ترخيص التسويق)، الفئة (الفئة الأولى، الفئة الثانية، والفئة الثالثة)، المستخدم النهائي (شركات الأدوية، الأجهزة الطبية). الشركات، وشركات التكنولوجيا الحيوية، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2029

تحليل السوق والحجم

واجهت شركات الرعاية الصحية تحديات في مواكبة المعايير التنظيمية، لا سيما بسبب جائحة كوفيد-19 (فيروس كورونا). ولضمان ثقافة الجودة في شركات التكنولوجيا الطبية، تستخدم شركات الاستشارات برامج أنظمة إدارة الجودة. وتقدم الشركات المعنية بالاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) دعمًا قائمًا على المشاريع لمؤسسات الرعاية الصحية.

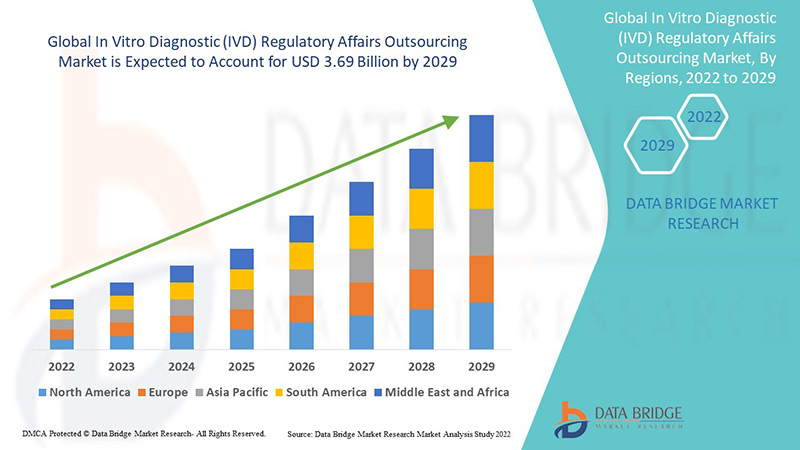

أدى تطبيق نظام الاستعانة بمصادر خارجية إلى إبرام اتفاقيات طويلة الأجل. وقد قُدّرت قيمة سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) العالمي بـ 1.6 مليار دولار أمريكي في عام 2021، ومن المتوقع أن تصل إلى 3.69 مليار دولار أمريكي بحلول عام 2029، مسجلةً معدل نمو سنوي مركب قدره 11% خلال الفترة المتوقعة 2022-2029. ومن المتوقع أن تشهد شركات الأدوية نموًا كبيرًا بفضل زيادة عدد الموافقات السريرية.

تعريف السوق

تلعب الشؤون التنظيمية دورًا بالغ الأهمية في صناعة أجهزة التشخيص المختبري (IVD). تُعنى هذه الشؤون بدورة حياة مختلف منتجات الرعاية الصحية، وتُقدم الدعم والتوجيه الاستراتيجي والتكتيكي والتشغيلي لشركات التصنيع للعمل ضمن الإطار التنظيمي.

نطاق التقرير وتقسيم السوق

|

مقياس التقرير |

تفاصيل |

|

فترة التنبؤ |

من 2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

السنوات التاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

الوحدات الكمية |

الإيرادات بالملايين من الدولارات الأمريكية، والحجم بالوحدات، والتسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

الخدمة (الكتابة التنظيمية والتقديمات، التسجيل التنظيمي وطلبات التجارب السريرية، الاستشارات التنظيمية، التمثيل القانوني، خدمات إدارة البيانات، خدمات تصنيع وضوابط الكيمياء (CMC)، وغيرها)، المؤشرات (علم الأورام، طب الأعصاب، أمراض القلب، الكيمياء السريرية والمقايسات المناعية، الطب الدقيق، الأمراض المعدية، داء السكري، الاختبارات الجينية، فيروس نقص المناعة البشرية/الإيدز، أمراض الدم، اختبار الأدوية/علم الصيدلة الجيني، نقل الدم، نقطة الرعاية، وغيرها)، وضع النشر (السحابي والمحلي)، حجم المؤسسة (الشركات الصغيرة والمتوسطة والكبيرة)، المرحلة (السريرية، ما قبل السريرية، وما بعد ترخيص التسويق)، الفئة (الفئة الأولى، الفئة الثانية، والفئة الثالثة)، المستخدم النهائي (شركات الأدوية، شركات الأجهزة الطبية، شركات التكنولوجيا الحيوية، وغيرها). |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية، ألمانيا، فرنسا، المملكة المتحدة، هولندا، سويسرا، بلجيكا، روسيا، إيطاليا، إسبانيا، تركيا، بقية أوروبا في أوروبا، الصين، اليابان، الهند، كوريا الجنوبية، سنغافورة، ماليزيا، أستراليا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، بقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA)، البرازيل والأرجنتين وبقية دول أمريكا الجنوبية كجزء من أمريكا الجنوبية. |

|

الجهات الفاعلة في السوق المغطاة |

Freyr Solutions (الهند)، PPD Inc. (الولايات المتحدة)، EMERGO (الولايات المتحدة)، ICON (الرعاية الصحية)، Parexel International Corporation (الولايات المتحدة)، CRITERIUM, INC. (الولايات المتحدة)، Groupe ProductLife SA (فرنسا)، Labcorp Drug Development (الولايات المتحدة)، WuXi AppTec (الصين)، Genpact (الولايات المتحدة)، Medpace (الولايات المتحدة)، Dor Pharmaceutical Services (إسرائيل)، Qserve (هولندا)، وغيرها. |

|

فرص السوق |

|

ديناميكيات سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD)

يتناول هذا القسم فهم محركات السوق، ومزاياه، وفرصه، ومعوقاته، وتحدياته. ويُناقش كل ذلك بالتفصيل على النحو التالي:

- الاستخدام العالي في صناعة الرعاية الصحية

يُعدّ ازدياد استخدام خدمات التعهيد الخارجي في قطاع الرعاية الصحية أحد العوامل الرئيسية الدافعة لنمو سوق تعهيد الشؤون التنظيمية للتشخيص المخبري (IVD). كما أن ازدياد أنشطة التوسع الجغرافي الهادفة إلى تسريع الموافقات في الأسواق المحلية يُسهم في هذا النمو.

- البحث والتطوير

إن الزيادة في أنشطة البحث والتطوير التي تزيد من حجم طلبات التجارب السريرية وتسجيل المنتجات تعمل على تسريع نمو السوق.

- الموافقات السريرية

يشهد الطلب على الاستعانة بمصادر خارجية لإدارة الشؤون التنظيمية للتشخيص المخبري (IVD) تزايدًا ملحوظًا، إذ تتعرض الشركات لضغوط مستمرة للحصول على الموافقات السريرية من الجهات التنظيمية في الوقت المناسب. ويتزايد الطلب على خدمات الشؤون التنظيمية نتيجةً لهذه الإجراءات.

فرص

علاوة على ذلك، فإن تطوير المؤشرات الحيوية والاختبارات الخاصة بالأمراض، وأهمية التشخيصات المصاحبة، يوفر فرصًا مربحة للاعبين في السوق في الفترة المتوقعة من 2022 إلى 2029. كما أن الزيادة في الاستثمارات ستؤدي إلى توسيع السوق بشكل أكبر.

القيود/التحديات

من ناحية أخرى، من المتوقع أن تُعيق اللوائح المتغيرة المتعلقة بالأجهزة الطبية والاستعانة بمصادر خارجية لتنظيم شؤون التشخيص المخبري (IVD) نمو السوق. كما يُتوقع أن يُشكل نقص البنية التحتية في خدمات الرعاية الصحية تحديًا لسوق الاستعانة بمصادر خارجية لتنظيم شؤون التشخيص المخبري (IVD) في الفترة المتوقعة 2022-2029.

يقدم هذا التقرير عن سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) تفاصيل عن أحدث التطورات، واللوائح التجارية، وتحليل الاستيراد والتصدير، وتحليل الإنتاج، وتحسين سلسلة القيمة، وحصة السوق، وتأثير الجهات الفاعلة المحلية والمحلية، ويحلل الفرص من حيث مصادر الإيرادات الناشئة، والتغيرات في لوائح السوق، وتحليل النمو الاستراتيجي للسوق، وحجم السوق، ونمو فئات السوق، ومجالات التطبيق والهيمنة، وموافقات المنتجات، وإطلاق المنتجات، والتوسعات الجغرافية، والابتكارات التكنولوجية في السوق. لمزيد من المعلومات حول سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD)، تواصل مع شركة Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في اتخاذ قرار سوقي مدروس لتحقيق نمو السوق.

تأثير كوفيد-19 على سوق الاختبارات التشخيصية

كان لجائحة كوفيد-19 تأثير سلبي على قطاع الرعاية الصحية. وقد لجأت الجهات الفاعلة الرئيسية إلى تبني استراتيجيات مبتكرة لمواجهة الوضع المتغير بسرعة خلال تفشي كوفيد-19. وحرصت الدول على إجراء تغييرات جوهرية في قطاع الرعاية الصحية حتى تراجعت آثار الأزمة. ومن المتوقع أن تشهد إصلاحات الرعاية الصحية احتواءً للتكاليف، وزيادة في إمكانية الوصول، وتقدمًا تكنولوجيًا في السنوات القادمة. وقد ازداد الطلب على الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) نظرًا للتركيز على أهمية التشخيص والرعاية والاستشارات عن بُعد. وتخفف هذه الخدمات العبء عن المستشفيات في مرحلة ما بعد الجائحة.

التطورات الأخيرة

- أدرجت مجلة USA-9 للتكنولوجيا شركة Freyr ضمن "أفضل 10 مزودي حلول تكنولوجية لعام 2021" في نوفمبر 2021. وقد أدرج موقع USA-9.com، وهي مجلة تقنية، شركة Freyr Solutions، الرائدة عالميًا في مجال الحلول التنظيمية والخدمات، ضمن "أفضل 10 مزودي حلول تكنولوجية لعام 2021"، حيث تواصل Fryer تصميم حلول برمجية مبتكرة ودعم العملاء في تحقيق أهدافهم المتعلقة بالامتثال. وقد ساهم ذلك في تعزيز شعبية الشركة.

نطاق وحجم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري العالمي

يُقسّم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) بناءً على الخدمات، والمؤشرات، وطريقة النشر، وحجم المؤسسة، والمرحلة، والفئة، والمستخدم النهائي. سيساعدك نمو هذه القطاعات على تحليل قطاعات النمو المتواضعة في هذه الصناعات، وتزويد المستخدمين بنظرة عامة قيّمة على السوق ورؤى ثاقبة لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الرئيسية.

خدمات

- الكتابة التنظيمية والتقديمات

- التسجيل التنظيمي وتطبيقات التجارب السريرية

- الاستشارات التنظيمية

- التمثيل القانوني

- خدمات إدارة البيانات

- خدمات التصنيع والتحكم الكيميائي (CMC)

- آحرون

على أساس الخدمات، يتم تقسيم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) العالمي إلى الكتابة التنظيمية والتقديمات، والتسجيل التنظيمي وتطبيقات التجارب السريرية، والاستشارات التنظيمية، والتمثيل القانوني، وخدمات إدارة البيانات، وخدمات التصنيع الكيميائي والضوابط (CMC)، وغيرها.

إشارة

- علم الأورام

- علم الأعصاب

- طب القلب

- الكيمياء السريرية والاختبارات المناعية

- الطب الدقيق

- الأمراض المعدية

- السكري

- الاختبارات الجينية

- فيروس نقص المناعة البشرية/الإيدز

- أمراض الدم

- اختبار الأدوية/علم الصيدلة الجيني

- نقل الدم

- نقطة الرعاية

- آحرون

على أساس المؤشر، يتم تقسيم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) العالمي إلى علم الأورام، وعلم الأعصاب، وأمراض القلب، والكيمياء السريرية والمقايسات المناعية، والطب الدقيق، والأمراض المعدية، والسكري، والاختبارات الجينية، وفيروس نقص المناعة البشرية / الإيدز، وأمراض الدم، واختبار الأدوية / علم الأدوية الجيني، ونقل الدم، ونقطة الرعاية ، وغيرها.

وضع النشر

- سحاب

- في الموقع

على أساس وضع النشر، يتم تقسيم سوق الاستعانة بمصادر خارجية لتنظيم التشخيص المختبري (IVD) العالمي إلى السحابة والمحلية.

حجم المنظمة

- الشركات الصغيرة والمتوسطة

- الشركات الكبيرة

على أساس حجم المنظمة، يتم تقسيم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) العالمي إلى الشركات الصغيرة والمتوسطة (SMES) والشركات الكبيرة.

منصة

- سريري

- ما قبل السريرية

- PMA (الترخيص بعد التسويق)

على أساس المرحلة، يتم تقسيم سوق الاستعانة بمصادر خارجية لتنظيم التشخيص المختبري (IVD) العالمي إلى السريرية، وما قبل السريرية، وPMA (ترخيص ما بعد التسويق).

فصل

- الصف الأول

- الصف الثاني

- الصف الثالث

على أساس الفئة، يتم تقسيم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) العالمي إلى الفئة الأولى والفئة الثانية والفئة الثالثة.

المستخدم النهائي

- شركات الأدوية

- شركات الأجهزة الطبية

- شركات التكنولوجيا الحيوية

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) العالمي إلى شركات الأدوية وشركات الأجهزة الطبية وشركات التكنولوجيا الحيوية وغيرها.

تحليل/رؤى إقليمية لسوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD)

يتم تحليل سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) وتوفير رؤى حجم السوق واتجاهاتها حسب البلد والخدمات والمؤشر وطريقة النشر وحجم المنظمة والمرحلة والفئة والمستخدم النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) هي الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC) والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب إفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA) والبرازيل والأرجنتين وبقية دول أمريكا الجنوبية كجزء من أمريكا الجنوبية.

تهيمن منطقة آسيا والمحيط الهادئ (APAC) على سوق الاستعانة بمصادر خارجية لتنظيم التشخيص المختبري (IVD) بسبب الارتفاع في عدد التجارب السريرية والعدد المتزايد من الشركات داخل المنطقة.

ومن المتوقع أن تشهد أمريكا الشمالية نموًا كبيرًا خلال الفترة المتوقعة من 2022 إلى 2029 بسبب وجود شركات الأدوية والأجهزة الطبية الرئيسية وارتفاع الإنفاق على البحث والتطوير في المنطقة.

يقدم قسم الدولة في التقرير أيضًا العوامل المؤثرة على السوق المحلية، والتغيرات في اللوائح التنظيمية، والتي تؤثر على اتجاهات السوق الحالية والمستقبلية. وتُستخدم بيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة، كمؤشرات للتنبؤ بسيناريو السوق لكل دولة على حدة. كما يُراعى وجود العلامات التجارية العالمية وتوافرها، والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة، عند تقديم تحليل تنبؤي لبيانات الدولة.

نمو البنية التحتية للرعاية الصحية والقاعدة المركبة واختراق التكنولوجيا الجديدة

يوفر سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) تحليلاً مفصلاً للسوق لنمو الإنفاق على المعدات الرأسمالية في كل دولة، والقاعدة المُركّبة من مختلف أنواع المنتجات المُستخدمة في سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD)، وتأثير التكنولوجيا المُستخدمة في منحنيات خط الحياة، والتغيرات في سيناريوهات تنظيم الرعاية الصحية وتأثيرها على سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD). البيانات متاحة للفترة التاريخية 2010-2020.

تحليل حصة سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) في ظل المنافسة

يقدم المشهد التنافسي لسوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD) تفاصيل لكل منافس. تشمل هذه التفاصيل لمحة عامة عن الشركة، وبياناتها المالية، وإيراداتها المحققة، وإمكانياتها السوقية، واستثماراتها في البحث والتطوير، ومبادراتها التسويقية الجديدة، وحضورها العالمي، ومواقع ومرافق الإنتاج، وقدراتها الإنتاجية، ونقاط قوتها وضعفها، وإطلاق المنتجات، ونطاقها، وهيمنة تطبيقاتها. وتتعلق البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المخبري (IVD).

بعض اللاعبين الرئيسيين العاملين في سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للتشخيص المختبري (IVD) هم:

- حلول فريير (الهند)

- شركة بي بي دي (الولايات المتحدة)

- إيميرغو (الولايات المتحدة)

- أيقونة (الرعاية الصحية)

- شركة باركسيل الدولية (الولايات المتحدة)

- كريتيريوم، المحدودة (الولايات المتحدة)

- Groupe ProductLife SA (فرنسا)

- شركة لابكورب لتطوير الأدوية (الولايات المتحدة)

- ووشي أبتيك (الصين)

- جينباكت (الولايات المتحدة)

- ميدبايس (الولايات المتحدة)

- شركة دور للخدمات الصيدلانية (إسرائيل)

- Qserve (هولندا)

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MULTIVARIATE MODELLING

2.2.4 TOP TO BOTTOM ANALYSIS

2.2.5 STANDARDS OF MEASUREMENT

2.2.6 VENDOR SHARE ANALYSIS

2.2.7 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.8 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5. INDUSTRY INSIGHTS

5.1 MICRO AND MACRO ECONOMIC FACTORS

5.2 PENETRATION AND GROWTH PROSPECT MAPPING

5.3 KEY PRICING STRATEGIES

5.4 INTERVIEWS WITH SPECIALIST

5.5 ANALYIS AND RECOMMENDATION

6. INTELLECTUAL PROPERTY (IP) PORTFOLIO

6.1 PATENT QUALITY AND STRENGTH

6.2 PATENT FAMILIES

6.3 LICENSING AND COLLABORATIONS

6.4 COMPETITIVE LANDSCAPE

6.5 IP STRATEGY AND MANAGEMENT

6.6 OTHER

7. COST ANALYSIS BREAKDOWN

8. TECHNONLOGY ROADMAP

9. INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10. REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY CLASSIFICATIONS

10.2.1 CLASS I

10.2.2 CLASS II

10.2.3 CLASS III

10.3 REGULATORY SUBMISSIONS

10.4 INTERNATIONAL HARMONIZATION

10.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.6 REGULATORY CHALLENGES AND STRATEGIES

11. REIMBURSEMENT FRAMEWORK

12. OPPUTUNITY MAP ANALYSIS

13. INSTALLED BASE DATA

14. VALUE CHAIN ANALYSIS

15. HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.10 ECONOMIC DEVELOPMENT

16. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

16.1 OVERVIEW

16.2 REGULATORY WRITING & SUBMISSIONS

16.3 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

16.4 REGULATORY CONSULTING

16.5 LEGAL REPRESENTATION

16.6 DATA MANAGEMENT SERVICES

16.7 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

16.8 OTHERS

17. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

17.1 OVERVIEW

17.2 ONCOLOGY

17.3 NEUROLOGY

17.4 CARDIOLOGY

17.5 CLINICAL CHEMISTRY AND IMMUNOASSAYS

17.6 PRECISION MEDICINE

17.7 INFECTIOUS DISEASES

17.7.1 SEPSIS

17.7.2 VIROLOGY

17.7.3 BACTERIOLOGY

17.7.4 MICROBIOLOGY AND MYCOLOGY

17.7.5 HEPATITIS B

17.7.6 HEPATITIS C

17.7.7 SYPHILIS

17.7.8 TUBERCULOSIS

17.7.9 MALARIA

17.7.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

17.7.11 OTHERS

17.8 DIABETES

17.9 GENETIC TESTING

17.10 HIV/AIDS

17.11 HAEMATOLOGY

17.12 DRUG TESTING/PHARMACOGENOMICS

17.13 BLOOD TRANSFUSION

17.14 OTHERS

18. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

18.1 OVERVIEW

18.2 PRECLINICAL

18.3 CLINICAL

18.4 PMA (POST MARKET AUTHORIZATION)

19. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

19.1 OVERVIEW

19.2 CLASS I

19.3 CLASS II

19.4 CLASS III

20. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE

20.1 OVERVIEW

20.2 POINT-OF-CARE (POC) IVD PRODUCT

20.3 LABORATORY-DEVELOPED TESTS (LDTS) IVD PRODUCT

20.4 COMPANION DIAGNOSTICS IVD PRODUCT

20.5 DIRECT-TO-CONSUMER (DTC) TESTING IVD PRODUCT

20.6 OTHERS IVD PRODUCT

21. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

21.1 OVERVIEW

21.2 CLOUD

21.3 ON-PREMISES

22. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZARION SIZE

22.1 OVERVIEW

22.2 SMALL & MEDIUM ENTERPRISES (SMES)

22.3 LARGE ENTERPRISES

23. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

23.1 OVERVIEW

23.2 PHARMACEUTICAL COMPANIES

23.2.1 BY ORGANIZATION SIZE

23.2.1.1. SMALL & MEDIUM ENTERPRISES (SMES)

23.2.1.2. LARGE ENTERPRISES

23.2.2 BY SERVICE

23.2.2.1. REGULATORY WRITING & SUBMISSIONS

23.2.2.2. REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

23.2.2.3. REGULATORY CONSULTING

23.2.2.4. LEGAL REPRESENTATION

23.2.2.5. DATA MANAGEMENT SERVICES

23.2.2.6. CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

23.2.2.7. OTHERS

23.3 MEDICAL DEVICE COMPANIES

23.3.1 BY ORGANIZATION SIZE

23.3.1.1. SMALL & MEDIUM ENTERPRISES (SMES)

23.3.1.2. LARGE ENTERPRISES

23.3.2 BY SERVICE

23.3.2.1. REGULATORY WRITING & SUBMISSIONS

23.3.2.2. REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

23.3.2.3. REGULATORY CONSULTING

23.3.2.4. LEGAL REPRESENTATION

23.3.2.5. DATA MANAGEMENT SERVICES

23.3.2.6. CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

23.3.2.7. OTHERS

23.4 BIOTECHNOLOGY COMPANIES

23.4.1 BY ORGANIZATION SIZE

23.4.1.1. SMALL & MEDIUM ENTERPRISES (SMES)

23.4.1.2. LARGE ENTERPRISES

23.4.2 BY SERVICE

23.4.2.1. REGULATORY WRITING & SUBMISSIONS

23.4.2.2. REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

23.4.2.3. REGULATORY CONSULTING

23.4.2.4. LEGAL REPRESENTATION

23.4.2.5. DATA MANAGEMENT SERVICES

23.4.2.6. CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

23.4.2.7. OTHERS

23.5 OTHERS

24. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

24.1 GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. ITALY

24.1.2.5. SPAIN

24.1.2.6. RUSSIA

24.1.2.7. TURKEY

24.1.2.8. BELGIUM

24.1.2.9. NETHERLANDS

24.1.2.10. SWITZERLAND

24.1.2.11. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. EGYPT

24.1.5.3. ISRAEL

24.1.5.4. UAE

24.1.5.5. SAUDI ARABIA

24.1.5.6. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, COMPANY PROFILE

26.1 FREYR SOLUTIONS

26.1.1 COMPANY OVERVIEW

26.1.2 COMPANY SNAPSHOT

26.1.3 REVENUE ANALYSIS

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 AXSOURCE CONSULTING INC.

26.2.1 COMPANY OVERVIEW

26.2.2 COMPANY SNAPSHOT

26.2.3 REVENUE ANALYSIS

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 LORENZ LIFE SCIENCES GROUP

26.3.1 COMPANY OVERVIEW

26.3.2 COMPANY SNAPSHOT

26.3.3 REVENUE ANALYSIS

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 LABORATORY CORPORATION OF AMERICA HOLDINGS

26.4.1 COMPANY OVERVIEW

26.4.2 COMPANY SNAPSHOT

26.4.3 REVENUE ANALYSIS

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 REG IQ PTY LTD.

26.5.1 COMPANY OVERVIEW

26.5.2 COMPANY SNAPSHOT

26.5.3 REVENUE ANALYSIS

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION (IUVO BIOSCIENCES)

26.6.1 COMPANY OVERVIEW

26.6.2 COMPANY SNAPSHOT

26.6.3 REVENUE ANALYSIS

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 MAKROCARE

26.7.1 COMPANY OVERVIEW

26.7.2 COMPANY SNAPSHOT

26.7.3 REVENUE ANALYSIS

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 EMERGO BY UL

26.8.1 COMPANY OVERVIEW

26.8.2 COMPANY SNAPSHOT

26.8.3 REVENUE ANALYSIS

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 ICON PLC

26.9.1 COMPANY OVERVIEW

26.9.2 COMPANY SNAPSHOT

26.9.3 REVENUE ANALYSIS

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.10 WUXI APPTEC

26.10.1 COMPANY OVERVIEW

26.10.2 COMPANY SNAPSHOT

26.10.3 REVENUE ANALYSIS

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 THERMO FISHER SCIENTIFIC INC.

26.11.1 COMPANY OVERVIEW

26.11.2 COMPANY SNAPSHOT

26.11.3 REVENUE ANALYSIS

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 CHARLES RIVER LABORATORIES.

26.12.1 COMPANY OVERVIEW

26.12.2 COMPANY SNAPSHOT

26.12.3 REVENUE ANALYSIS

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 ACCELL CLINICAL RESEARCH, LLC

26.13.1 COMPANY OVERVIEW

26.13.2 COMPANY SNAPSHOT

26.13.3 REVENUE ANALYSIS

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 PAREXEL INTERNATIONAL (MA) CORPORATION

26.14.1 COMPANY OVERVIEW

26.14.2 COMPANY SNAPSHOT

26.14.3 REVENUE ANALYSIS

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 METECON GMBH

26.15.1 COMPANY OVERVIEW

26.15.2 COMPANY SNAPSHOT

26.15.3 REVENUE ANALYSIS

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 GENPACT

26.16.1 COMPANY OVERVIEW

26.16.2 COMPANY SNAPSHOT

26.16.3 REVENUE ANALYSIS

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 CRITERIUM, INC

26.17.1 COMPANY OVERVIEW

26.17.2 COMPANY SNAPSHOT

26.17.3 REVENUE ANALYSIS

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 MEDPACE

26.18.1 COMPANY OVERVIEW

26.18.2 COMPANY SNAPSHOT

26.18.3 REVENUE ANALYSIS

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 GROUPE PRODUCTLIFE S.A.

26.19.1 COMPANY OVERVIEW

26.19.2 COMPANY SNAPSHOT

26.19.3 REVENUE ANALYSIS

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.20 DOR PHARMACEUTICAL SERVICES

26.20.1 COMPANY OVERVIEW

26.20.2 COMPANY SNAPSHOT

26.20.3 REVENUE ANALYSIS

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 QSERVE

26.21.1 COMPANY OVERVIEW

26.21.2 COMPANY SNAPSHOT

26.21.3 REVENUE ANALYSIS

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 ORTHO CLINICAL DIAGNOSTICS.

26.22.1 COMPANY OVERVIEW

26.22.2 COMPANY SNAPSHOT

26.22.3 REVENUE ANALYSIS

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 ANGSTROM BIOTECH PVT. LTD.

26.23.1 COMPANY OVERVIEW

26.23.2 COMPANY SNAPSHOT

26.23.3 REVENUE ANALYSIS

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 RQM+

26.24.1 COMPANY OVERVIEW

26.24.2 COMPANY SNAPSHOT

26.24.3 REVENUE ANALYSIS

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 REGULATORY COMPLIANCES ASSOCIATES (SOTERA HEALTH)

26.25.1 COMPANY OVERVIEW

26.25.2 COMPANY SNAPSHOT

26.25.3 REVENUE ANALYSIS

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 RESEARCHDX

26.26.1 COMPANY OVERVIEW

26.26.2 COMPANY SNAPSHOT

26.26.3 REVENUE ANALYSIS

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

26.27 CMIC HOLDINGS CO., LTD.

26.27.1 COMPANY OVERVIEW

26.27.2 COMPANY SNAPSHOT

26.27.3 REVENUE ANALYSIS

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPMENTS

26.28 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

26.28.1 COMPANY OVERVIEW

26.28.2 COMPANY SNAPSHOT

26.28.3 REVENUE ANALYSIS

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPMENTS

26.29 QARAD BV

26.29.1 COMPANY OVERVIEW

26.29.2 COMPANY SNAPSHOT

26.29.3 REVENUE ANALYSIS

26.29.4 PRODUCT PORTFOLIO

26.29.5 RECENT DEVELOPMENTS

26.30 TRANSCRIP

26.30.1 COMPANY OVERVIEW

26.30.2 COMPANY SNAPSHOT

26.30.3 REVENUE ANALYSIS

26.30.4 PRODUCT PORTFOLIO

26.30.5 RECENT DEVELOPMENTS

26.31 CLIN-R+

26.31.1 COMPANY OVERVIEW

26.31.2 COMPANY SNAPSHOT

26.31.3 REVENUE ANALYSIS

26.31.4 PRODUCT PORTFOLIO

26.31.5 RECENT DEVELOPMENTS

26.32 VCLS

26.32.1 COMPANY OVERVIEW

26.32.2 COMPANY SNAPSHOT

26.32.3 REVENUE ANALYSIS

26.32.4 PRODUCT PORTFOLIO

26.32.5 RECENT DEVELOPMENTS

26.33 PROPHARMA GROUP

26.33.1 COMPANY OVERVIEW

26.33.2 COMPANY SNAPSHOT

26.33.3 REVENUE ANALYSIS

26.33.4 PRODUCT PORTFOLIO

26.33.5 RECENT DEVELOPMENTS

26.34 ARRIELLO IRELAND LIMITED

26.34.1 COMPANY OVERVIEW

26.34.2 COMPANY SNAPSHOT

26.34.3 REVENUE ANALYSIS

26.34.4 PRODUCT PORTFOLIO

26.34.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27. RELATED REPORTS

28. QUESTIONNAIRE

29. ABOUT DATA BRIDGE MARKET RESEARCH

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.