Global Anti Aging Skincare Ingredients Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

1.87 Billion

USD

2.70 Billion

2024

2032

USD

1.87 Billion

USD

2.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.87 Billion | |

| USD 2.70 Billion | |

|

|

|

|

تجزئة سوق مكونات العناية بالبشرة المضادة للشيخوخة عالميًا، حسب المنتج (الريتينويد، حمض الهيالورونيك، مضادات الأكسدة، الببتيدات، النياسيناميد (فيتامين ب3)، أحماض ألفا هيدروكسي (AHAS)، السيراميدات، أكسيد الزنك وثاني أكسيد التيتانيوم، حمض بيتا هيدروكسي (BHA)، الإنزيم المساعد Q10 (يوبيكوينون)، مستخلص الشاي الأخضر، حمض ألفا ليبويك، الكافيين، الباكوتشيول، السكوالين، حمض الكوجيك، ألفا أربوتين، إيزوفلافون الصويا، وغيرها)، الشكل (مسحوق، سائل، وحبيبي)، الوظيفة (ترطيب، تعزيز الكولاجين، حماية من الشمس، تقشير، تفتيح البشرة، مضاد للالتهابات، إصلاح البشرة، وغيرها)، التطبيق (مضاد للتجاعيد، مضاد للتصبغ، مضاد للأكسدة، حشوات جلدية، وغيرها)، الاستخدام النهائي (سيروم، مرطب، منظف، كريم للعين، زيت للوجه، قناع). (الحبر، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق مكونات العناية بالبشرة المضادة للشيخوخة

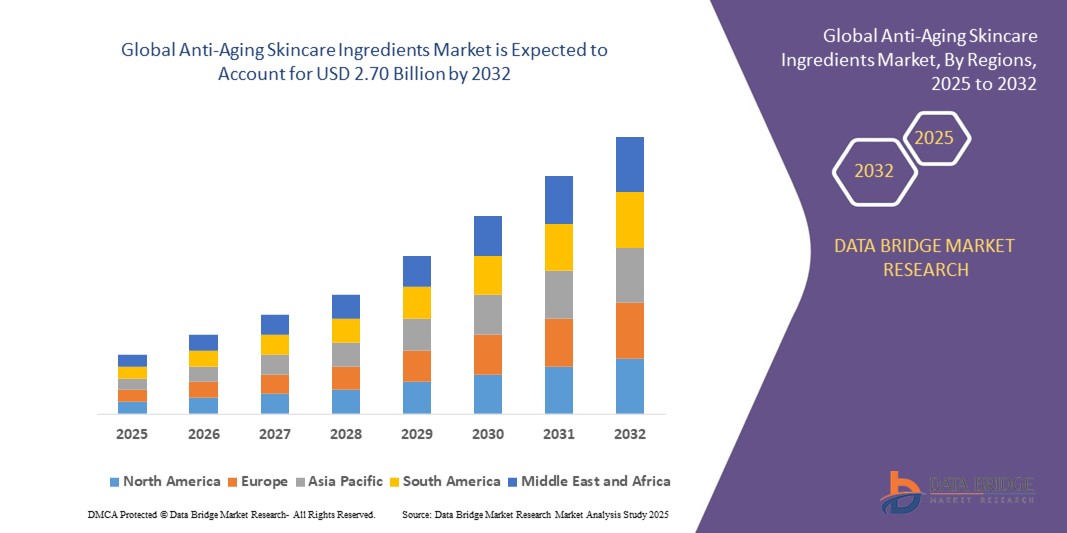

- تم تقييم حجم سوق مكونات العناية بالبشرة المضادة للشيخوخة العالمية بنحو 1.87 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 2.70 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 4.71٪ خلال الفترة المتوقعة.

- يتم دعم نمو السوق إلى حد كبير من خلال زيادة وعي المستهلكين بالعناية بالبشرة، وزيادة الطلب على الحلول الوقائية ومكافحة الشيخوخة، والابتكارات التكنولوجية في المكونات النشطة بيولوجيًا ومتعددة الوظائف، والتي تمكن تركيبات أكثر فعالية للحد من التجاعيد، وتفتيح البشرة، وترطيبها.

- علاوة على ذلك، فإنّ التفضيل المتزايد للمكونات الطبيعية، ذات المصادر المستدامة، والمنتجة بطريقة أخلاقية، يدفع نحو اعتماد تركيبات فاخرة مضادة للشيخوخة. تُسرّع هذه العوامل المتقاربة من استخدام مكونات العناية بالبشرة المتقدمة، مما يُعزز نمو هذه الصناعة بشكل كبير.

تحليل سوق مكونات العناية بالبشرة المضادة للشيخوخة

- تشمل مكونات العناية بالبشرة المضادة للشيخوخة مركبات نشطة بيولوجيًا مثل الريتينويدات والببتيدات وحمض الهيالورونيك ومضادات الأكسدة والسيراميدات، والتي تساعد على تقليل علامات الشيخوخة الظاهرة، وتحسين مرونة البشرة، وتعزيز صحتها العامة. تُستخدم هذه المكونات على نطاق واسع في الأمصال والكريمات والأقنعة وواقيات الشمس للعناية بالبشرة وقائيًا وتصحيحيًا.

- يُعزى الطلب المتزايد على مكونات العناية بالبشرة المضادة للشيخوخة بشكل رئيسي إلى تزايد أعداد كبار السن، وزيادة الدخل المتاح للإنفاق، وتركيز المستهلكين المتزايد على العناية الشخصية، وتوسع انتشار منتجات العناية بالبشرة الفاخرة في الأسواق المتقدمة والناشئة. كما أن تزايد التفاعل الرقمي واعتماد التجارة الإلكترونية يُعززان إمكانية الوصول إلى المنتجات ونمو السوق.

- سيطرت منطقة آسيا والمحيط الهادئ على سوق مكونات العناية بالبشرة المضادة للشيخوخة بحصة بلغت 36.70% في عام 2024، وذلك بسبب زيادة وعي المستهلكين بالعناية بالبشرة، وزيادة الدخول المتاحة، وتأثير اتجاهات الجمال الكوري والجمال الياباني.

- من المتوقع أن تكون أمريكا الشمالية أسرع منطقة نموًا في سوق مكونات العناية بالبشرة المضادة للشيخوخة خلال فترة التنبؤ بسبب تفضيل المستهلكين المتزايد للعناية بالبشرة الفاخرة والطبيعية، والوعي المتزايد بالروتين الوقائي لمكافحة الشيخوخة، والوجود القوي للعلامات التجارية الرائدة في مجال مستحضرات التجميل.

- هيمن قطاع مضادات الأكسدة على السوق بحصة سوقية بلغت 34.2% في عام 2024، بفضل قدرتها المثبتة على تحييد الجذور الحرة، والحماية من الإجهاد التأكسدي، وإبطاء علامات الشيخوخة المرئية مثل التجاعيد والخطوط الدقيقة. تُستخدم مضادات الأكسدة، مثل فيتامين ج وفيتامين هـ ومستخلص الشاي الأخضر والإنزيم المساعد Q10، على نطاق واسع في الأمصال والكريمات وواقيات الشمس، مما يجعلها متعددة الاستخدامات في تركيبات المنتجات. وقد رسّخ دورها متعدد الوظائف في تفتيح البشرة، وتعزيز استقرار الكولاجين، وتوفير الحماية من العوامل البيئية الضارة مثل الأشعة فوق البنفسجية والتلوث، مكانتها كحجر أساس في مجال العناية بالبشرة المضادة للشيخوخة.

نطاق التقرير وتجزئة سوق مكونات العناية بالبشرة المضادة للشيخوخة

|

صفات |

مكونات العناية بالبشرة المضادة للشيخوخة: رؤى السوق الرئيسية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

أوروبا

آسيا والمحيط الهادئ

الشرق الأوسط وأفريقيا

أمريكا الجنوبية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء، وتحليل التسعير، وتحليل حصة العلامة التجارية، واستطلاع رأي المستهلكين، وتحليل التركيبة السكانية، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل Porter، والإطار التنظيمي. |

اتجاهات سوق مكونات العناية بالبشرة المضادة للشيخوخة

تحول التفضيل نحو المنتجات الطبيعية والعضوية

- يشهد سوق مكونات العناية بالبشرة المضادة للشيخوخة تحولاً ملحوظاً، حيث يُعطي المستهلكون الأولوية للمركبات الطبيعية والعضوية، باحثين عن بدائل أكثر أماناً من المواد الكيميائية الصناعية. يفتح هذا التوجه آفاقاً جديدة للنمو، ويدفع عجلة ابتكار المنتجات في كل من قطاعي المنتجات العامة والفاخرة.

- على سبيل المثال، أطلقت علامات تجارية مثل شيسيدو وليدي جرين أمصالًا وكريمات عضوية مضادة للشيخوخة، تحتوي على مستخلصات نباتية مُخمّرة بيولوجيًا وعناصر نباتية فعّالة. وتحظى هذه المنتجات بإقبال كبير بين جيل الألفية والمستهلكين المهتمين بصحتهم، والذين يبحثون عن حلول أخلاقية ومستدامة للعناية بالبشرة.

- تُعزز التطورات التكنولوجية في أنظمة توصيل المكونات فعالية المنتجات وثقة المستهلك بها. وتستخدم الشركات تقنيات التغليف، والموائع الدقيقة، والتكنولوجيا الحيوية لجعل المواد الفعالة الطبيعية المضادة للشيخوخة، مثل حمض الهيالورونيك والببتيدات، أكثر فعالية وتوافرًا حيويًا في التطبيقات الموضعية.

- يتزايد الطلب على شفافية المكونات والتركيبات الآمنة، حيث يتجه العملاء نحو المنتجات ذات العلامات التجارية النظيفة والمعتمدة نباتيًا. تُعدّ ادعاءات الاستدامة والمصادر الأخلاقية دافعين رئيسيين للشراء، مما يؤثر على كيفية تسويق العلامات التجارية لمنتجاتها من مكونات مكافحة الشيخوخة عالميًا.

- أصبحت أنظمة التجميل المُخصصة باستخدام مكونات طبيعية مُضادة للشيخوخة شائعة. يبحث المستهلكون عن حلول مُخصصة لمشاكل مُحددة مثل التجاعيد، والتصبغات، وفقدان المرونة، مما يُلزم العلامات التجارية بتقديم خلطات مُخصصة ومجموعات مُتكاملة للعناية بالبشرة.

- اكتسبت منتجات مكافحة الشيخوخة متعددة الاستخدامات والبسيطة، التي تستخدم مكونات طبيعية عالية الجودة، رواجًا كبيرًا. تُسوّقها العلامات التجارية كحلول فعّالة لأسلوب حياة مزدحم وتقليل التعرض للإضافات غير الضرورية، مما يُواكب اتجاهات الصحة العامة والعناية الذاتية.

ديناميكيات سوق مكونات العناية بالبشرة المضادة للشيخوخة

سائق

أنشطة العلامات التجارية والإعلان المبتكرة للمنتجات

- تُعزز أنشطة بناء العلامات التجارية والإعلان الفعّالة نمو السوق من خلال تسهيل التعرف على مكونات العناية بالبشرة المضادة للشيخوخة، وتعزيز تفاعل المستهلكين، وتعزيز ولائهم في ظلّ بيئة تنافسية. وتستفيد العلامات التجارية من التصميم ووسائل التواصل الاجتماعي والتجارب الغامرة لتمييز عروضها.

- على سبيل المثال، استفادت شركة DSM وشركات التجميل الكبرى من شراكاتها مع المؤثرين وحملاتها الإلكترونية الموجهة لتسليط الضوء على فوائد المكونات الطبيعية، مثل الببتيدات ومضادات الأكسدة، المثبتة سريريًا في مكافحة الشيخوخة. وتُوسّع أساليب بناء العلامات التجارية القائمة على البيانات نطاق وصولها وتُسرّع تحويل المبيعات في الأسواق الرئيسية.

- تُمكّن التقنيات الرقمية المتقدمة العلامات التجارية من التفاعل مباشرةً مع المستهلكين، مما يُعزز الوعي بمنتجات العناية بالبشرة المبتكرة وتجربة منتجاتها. تُشكّل التجارب الافتراضية، والتخصيص المُولّد بالذكاء الاصطناعي، والإعلانات المتكاملة متعددة القنوات تفضيلات المستهلكين لإطلاق مكونات جديدة في سوق عالمية ديناميكية.

- يُحافظ الابتكار المستمر في المنتجات على حماس المستهلكين، حيث تُقدم العلامات التجارية قصصًا عن مكونات مُضادة للشيخوخة تُركز على الفعالية والعلم والصحة. تُروج الحملات الاستراتيجية لهذه المنتجات كعناصر أساسية ضمن روتين العناية بالبشرة متعدد الخطوات وأنظمة الصحة الشاملة لجميع الفئات العمرية.

- يساعد التفاعل عبر وسائل التواصل الاجتماعي وحلقات ردود فعل العملاء العلامات التجارية على التكيف السريع مع عروضها. تُحسّن الشركات هويتها التجارية ورسائلها لتلبية أولويات المستهلكين المتغيرة، مما يُهيئ بيئة سوقية متجاوبة تُحفّز الطلب المستدام وتوسّع السوق.

ضبط النفس/التحدي

تزايد الآثار الجانبية لبعض مكونات العناية بالبشرة

- تُشكّل الآثار الجانبية المرتبطة ببعض مكونات مكافحة الشيخوخة تحديًا مستمرًا، مما يؤثر على ثقة المستهلك والرقابة التنظيمية. تُقوّض التقارير عن ردود الفعل التحسسية والطفح الجلدي وحساسية الجلد الناتجة عن الإضافات الصناعية أو المنتجات المقلدة الثقة في حلول مكافحة الشيخوخة التقليدية.

- على سبيل المثال، أدى تزايد الوعي بالبارابينات والكبريتات والعطور الاصطناعية إلى سحب بعض المنتجات وفرض قيود عليها في العديد من الدول. يُجبر هذا التدقيق المصنّعين على إعادة النظر في تركيباتهم والامتثال للوائح السلامة المتطورة باستمرار، مما يزيد من تعقيد عمليات السوق.

- تُبطئ إجراءات الموافقة المطولة على المنتجات ومتطلبات الاختبار الصارمة طرح مكونات جديدة. وتتطلب الأطر التنظيمية، لا سيما في أوروبا وأمريكا الشمالية، إجراء تجارب شاملة للتحقق من السلامة والفعالية، مما يُؤخر إطلاق المنتجات ويرفع تكاليف التطوير على الموردين.

- تُفاقم المنتجات المقلدة وذات الجودة المنخفضة تحديات السوق، إذ يُغري انتشارها الواسع والأسعار التنافسية المستهلكين بالبحث عن بدائل غير آمنة. تُحفز هذه المشكلات زيادة استثمار القطاع في حملات التحقق من الأصالة والتتبع وتوعية المستهلكين.

- الطلب المتزايد على الحلول العضوية والطبيعية، مدفوعًا بمخاوف الآثار الجانبية، يزيد الضغط على سلاسل توريد المكونات. يجب على العلامات التجارية ضمان الاتساق وإمكانية التتبع والسلامة مع مواجهة تقلبات التكلفة ومشاكل التوسع في مجال المستخلصات النباتية والعناصر الطبيعية الفعالة.

نطاق سوق مكونات العناية بالبشرة المضادة للشيخوخة

يتم تقسيم السوق على أساس المنتج والشكل والوظيفة والتطبيق والاستخدام النهائي.

- حسب المنتج

بناءً على المنتج، يُقسّم سوق مكونات العناية بالبشرة المضادة للشيخوخة إلى: الريتينويد، وحمض الهيالورونيك، ومضادات الأكسدة، والببتيدات، والنياسيناميد (فيتامين ب3)، وأحماض ألفا هيدروكسي (AHAs)، والسيراميدات، وأكسيد الزنك وثاني أكسيد التيتانيوم، وحمض بيتا هيدروكسي (BHA)، والإنزيم المساعد Q10 (يوبيكوينون)، ومستخلص الشاي الأخضر، وحمض ألفا ليبويك، والكافيين، والباكوتشيول، والسكوالين، وحمض الكوجيك، وألفا أربوتين، وإيزوفلافون الصويا، وغيرها. وقد هيمن قطاع مضادات الأكسدة على أكبر حصة من إيرادات السوق بنسبة 34.2% في عام 2024، ويعزى ذلك إلى قدرتها المثبتة على تحييد الجذور الحرة، والحماية من الإجهاد التأكسدي، وإبطاء علامات الشيخوخة المرئية مثل التجاعيد والخطوط الدقيقة. وتُستخدم مضادات الأكسدة، مثل فيتامين ج، وفيتامين هـ، ومستخلص الشاي الأخضر، والإنزيم المساعد Q10، على نطاق واسع في الأمصال والكريمات وواقيات الشمس، مما يجعلها متعددة الاستخدامات للغاية في تركيبات المنتجات. إن دورها المتعدد الوظائف في تفتيح البشرة، وتعزيز استقرار الكولاجين، وتوفير الحماية ضد العوامل البيئية الضارة مثل الأشعة فوق البنفسجية والتلوث، عزز مكانتها كحجر الزاوية في العناية بالبشرة المضادة للشيخوخة.

من المتوقع أن يشهد قطاع حمض الهيالورونيك أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد طلب المستهلكين على حلول مكافحة الشيخوخة القائمة على الترطيب. ويُقدّر حمض الهيالورونيك على نطاق واسع لخصائصه في الاحتفاظ بالرطوبة، مما يُحسّن مرونة البشرة ويُقلل من ظهور التجاعيد. ويتماشى استخدامه في الأمصال والأقنعة الورقية والمرطبات مع التوجه نحو المنتجات النظيفة، نظرًا لتركيبه الطبيعي في الجسم وتحمله جميع أنواع البشرة. كما أن الإقبال المتزايد على علاجات الترطيب غير الجراحية واستخدامه المتزايد في تركيبات حشو الجلد يُعزز من سرعة انتشاره.

- حسب النموذج

بناءً على الشكل، يُقسّم السوق إلى مسحوق، وسائل، وحبيبي. وقد هيمن قطاع السوائل على أكبر حصة من إيرادات السوق في عام ٢٠٢٤، ويعود ذلك أساسًا إلى سهولة استخدامه في الأمصال والمرطبات والكريمات. تتميز السوائل بذوبان أفضل للمكونات، وامتصاص أسرع من الجلد، وسهولة في تركيب منتجات متعددة الوظائف لمكافحة الشيخوخة. وهذا يجعلها الخيار الأمثل لدى المصنّعين الذين يسعون إلى دمج العديد من المكونات النشطة، مثل مضادات الأكسدة والببتيدات والريتينويدات، في تركيبة واحدة.

من المتوقع أن يشهد قطاع المساحيق أسرع معدل نمو سنوي مركب بين عامي 2025 و2032، مع توجه العلامات التجارية بشكل متزايد نحو المكونات المسحوقة لتحقيق الاستقرار وإطالة مدة الصلاحية. تتيح المساحيق للمستخدمين النهائيين مزج المنتجات قبل الاستخدام، مما يحافظ على فاعليتها ويقلل الحاجة إلى المواد الحافظة. كما يكتسب هذا الشكل رواجًا في منتجات العناية بالبشرة المنزلية، وروتينات التجميل البسيطة، والتغليف المستدام، مما يتماشى بشكل جيد مع اتجاهات المستهلكين المهتمين بالبيئة.

- حسب الوظيفة

بناءً على وظيفتها، تُقسّم السوق إلى منتجات ترطيب، ومعززات للكولاجين، وحماية من الشمس، وتقشير، وتفتيح البشرة، ومضادات للالتهابات، وإصلاح البشرة، وغيرها. وقد استحوذ قطاع الترطيب على الحصة السوقية الأكبر في عام ٢٠٢٤، إذ لا يزال الترطيب هو الفائدة الأكثر طلبًا في مجال العناية بالبشرة المضادة للشيخوخة. تُعزز مكونات الترطيب، مثل حمض الهيالورونيك والسيراميد والسكوالين، وظيفة حاجز البشرة، مما يجعلها أساسية في جميع تركيبات مكافحة الشيخوخة تقريبًا. ويستفيد هذا القطاع من تطبيقه الشامل على مختلف الفئات العمرية وأنواع البشرة والمناخات، مما يعزز هيمنته على المدى الطويل.

من المتوقع أن ينمو قطاع تعزيز الكولاجين بأسرع وتيرة بين عامي 2025 و2032، مدعومًا بتزايد الطلب على بشرة أكثر تماسكًا وشبابًا. وتُستخدم مكونات مثل الببتيدات والريتينويدات وفيتامين ج بشكل متزايد في تركيبات مكافحة الشيخوخة لقدرتها على تحفيز تخليق الكولاجين وتقليل علامات الشيخوخة الظاهرة. ويساهم الاهتمام المتزايد بالعناية الوقائية بالبشرة في مرحلة مبكرة، إلى جانب الابتكارات العلمية في تكنولوجيا الببتيدات، في تسريع وتيرة تبني هذه المنتجات.

- حسب الطلب

بناءً على التطبيق، يُقسّم السوق إلى مُضادات التجاعيد، ومُضادات التصبغ، ومُضادات الأكسدة، وحشوات الجلد، وغيرها. وقد هيمن قطاع مُضادات التجاعيد على أكبر حصة من إيرادات السوق في عام 2024، نظرًا لمكانته كمحرك رئيسي لطلب المستهلكين في قطاع مُكافحة الشيخوخة. وبفضل مُكونات مثل الريتينويدات والببتيدات وحمض الهيالورونيك التي تُعالج مُشكلة التجاعيد بشكل مُباشر، يحظى هذا القطاع باستثمارات كبيرة في تطوير المنتجات والادعاءات السريرية. كما أن انتشار الشيخوخة في الأسواق المُتقدمة يُعزز هيمنته.

من المتوقع أن يشهد قطاع مكافحة التصبغات أسرع نمو بين عامي 2025 و2032، مدفوعًا بتزايد وعي المستهلكين بفرط التصبغ، وتفاوت لون البشرة، والبقع الناتجة عن التعرض لأشعة الشمس. وتشهد مكونات مثل النياسيناميد، وحمض الكوجيك، وألفا أربوتين إقبالًا كبيرًا في تركيبات تفتيح البشرة ومكافحة البقع. ويعزز هذا التوجه الطلب المتزايد في أسواق آسيا والمحيط الهادئ، حيث يُعدّ توحيد لون البشرة من أهم أولويات الجمال، وفي الأسواق الغربية حيث يزداد التركيز على تصحيح أضرار أشعة الشمس.

- حسب الاستخدام النهائي

بناءً على الاستخدام النهائي، يُقسّم السوق إلى سيروم، ومرطب، وغسول، وكريم للعين، وزيت للوجه، وأقنعة، وتونر، وغيرها. وقد استحوذ قطاع السيروم على أكبر حصة من إيرادات السوق في عام 2024، إذ يوفر السيروم تركيزًا عاليًا من المكونات الفعالة المضادة للشيخوخة. تركيبته الخفيفة وقدرته على اختراق البشرة بعمق تجعله فعالًا للغاية في تقليل التجاعيد، وتفتيح البشرة، وترطيبها، وهو ما يلقى صدىً واسعًا لدى المستهلكين من ذوي المنتجات الفاخرة والعامة على حد سواء. كما أن تفضيل المستهلكين المتزايد للسيروم متعددة الوظائف التي تحتوي على مزيج من مضادات الأكسدة والببتيدات ومعززات الترطيب يعزز ريادة هذا القطاع.

من المتوقع أن يشهد قطاع كريمات العيون أسرع نمو بين عامي 2025 و2032، مما يعكس تزايد الوعي بعلامات الشيخوخة المبكرة التي غالبًا ما تظهر حول منطقة العين الحساسة. تُصنع كريمات العيون بمكونات مُخصصة، مثل الكافيين والببتيدات وحمض الهيالورونيك، لمعالجة الانتفاخات والخطوط الدقيقة والهالات السوداء. ويساهم الطلب المتزايد بين الفئات العمرية الأصغر سنًا على الحلول الوقائية، والابتكارات المتنامية في تركيبات مُناسبة للبشرة الحساسة، في دفع عجلة نمو هذا القطاع.

تحليل إقليمي لسوق مكونات العناية بالبشرة المضادة للشيخوخة

- سيطرت منطقة آسيا والمحيط الهادئ على سوق مكونات العناية بالبشرة المضادة للشيخوخة بأكبر حصة إيرادات بلغت 36.70% في عام 2024، مدفوعة بوعي المستهلكين المتزايد بالعناية بالبشرة، وزيادة الدخول المتاحة، وتأثير اتجاهات الجمال الكوري والجمال الياباني.

- إن قاعدة التصنيع القوية في المنطقة وإطلاق المنتجات المبتكرة وتزايد انتشار التجارة الإلكترونية تعمل على تغذية توسع السوق

- إن التوسع الحضري السريع، وتأثير وسائل التواصل الاجتماعي المتزايد، والطلب على التركيبات المتميزة والطبيعية تعمل على تسريع اعتماد مكونات العناية بالبشرة المضادة للشيخوخة في جميع أنحاء منطقة آسيا والمحيط الهادئ

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في الصين

استحوذت الصين على الحصة الأكبر في سوق مكونات العناية بالبشرة المضادة للشيخوخة في منطقة آسيا والمحيط الهادئ عام ٢٠٢٤، بفضل مكانتها الرائدة عالميًا في تصنيع وإنتاج مكونات مستحضرات التجميل. وتُعدّ القاعدة الصناعية القوية للبلاد، واللوائح التنظيمية المواتية لمنتجات العناية الشخصية، وشبكات التصدير الواسعة لمكونات العناية بالبشرة، عوامل رئيسية للنمو. ويدعم الطلب أيضًا تزايد تبني اتجاهات الجمال الكوري، وزيادة الدخل المتاح، وتزايد تفضيل المستهلكين للتركيبات المتقدمة ومتعددة الاستخدامات المضادة للشيخوخة.

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في الهند

تشهد الهند أسرع نمو في منطقة آسيا والمحيط الهادئ، مدفوعًا بارتفاع الدخل المتاح، وتوسع التحضر، وتزايد الإقبال على منتجات العناية بالبشرة الفاخرة والطبيعية. ويعزز الوعي المتزايد بعادات العناية الوقائية بالبشرة، وتأثير التسويق الرقمي، وتفضيل المنتجات النباتية والنباتية ذات المصادر الأخلاقية، هذا الإقبال. كما أن جيل الشباب المتمكن من التقنيات الرقمية، والنمو السريع لمنصات التجارة الإلكترونية، يعززان توسع السوق الهندية.

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في أوروبا

يشهد سوق مكونات العناية بالبشرة المضادة للشيخوخة في أوروبا نموًا مطردًا، مدعومًا بطلب المستهلكين القوي على التركيبات الطبيعية والعضوية، واللوائح التجميلية الصارمة، والاعتماد المتزايد على منتجات العناية بالبشرة الفاخرة. تُولي أوروبا الغربية اهتمامًا كبيرًا للسلامة والفعالية والاستدامة، مما يُعزز تفضيل المكونات ذات العلامات التجارية النظيفة. كما يُسهم الاهتمام المتزايد بمنتجات مكافحة الشيخوخة متعددة الاستخدامات والصديقة للبيئة في تعزيز نمو السوق.

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في ألمانيا

يعتمد السوق الألماني على تفضيل التركيبات عالية الجودة والمُختبرة من قِبَل أطباء الجلدية، وقطاع قوي للعناية بالبشرة الطبيعية والعضوية، واستثمارات مُستمرة في البحث والتطوير. تُسهم قنوات البيع بالتجزئة الراسخة في البلاد وتركيز المستهلكين على الجمال النظيف في تسريع الابتكار في تركيبات مُكافحة الشيخوخة. ويزداد الطلب بشكل خاص بين المستهلكين المُهتمين بصحتهم وبيئتهم.

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في المملكة المتحدة

يستفيد سوق المملكة المتحدة من تزايد الإقبال على منتجات العناية بالبشرة الفاخرة، وتفضيل التركيبات المستدامة والخالية من القسوة، والطلب القوي على المنتجات متعددة الاستخدامات. يُولي المستهلكون الأولوية للمصادر الأخلاقية والتغليف الصديق للبيئة، بينما يُعزز انتشار التجارة الإلكترونية سهولة الوصول. كما تُعزز التعاونات بين علامات مستحضرات التجميل وأطباء الجلدية ثقة المستهلك وزيادة الإقبال على المنتجات في السوق.

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في أمريكا الشمالية

من المتوقع أن تشهد أمريكا الشمالية نموًا بمعدل نمو سنوي مركب هو الأسرع بين عامي 2025 و2032، مدفوعًا بتزايد تفضيل المستهلكين للعناية بالبشرة الفاخرة والطبيعية، وتنامي الوعي بالروتين الوقائي لمكافحة الشيخوخة، والحضور القوي لعلامات مستحضرات التجميل الرائدة. ويساهم الطلب على منتجات العناية بالبشرة المصممة خصيصًا، والتركيبات النظيفة، والقوام المبتكر في تعزيز التوسع الإقليمي.

نظرة عامة على سوق مكونات العناية بالبشرة المضادة للشيخوخة في الولايات المتحدة

استحوذت الولايات المتحدة على أكبر حصة في سوق أمريكا الشمالية عام ٢٠٢٤، مدعومةً بصناعة العناية بالبشرة الناضجة، وارتفاع إنفاق المستهلكين على العناية الشخصية، وقدرات البحث والتطوير المتقدمة. ويدعم تزايد الإقبال على المكونات الطبيعية والخالية من القسوة، بالإضافة إلى التبني القوي للتجارة الإلكترونية، انتشار استخدام هذه المنتجات على نطاق واسع. كما أن وجود علامات تجارية عالمية رائدة في مجال التجميل واستراتيجيات تسويقية فعّالة يعزز ريادة الولايات المتحدة في المنطقة.

حصة سوق مكونات العناية بالبشرة المضادة للشيخوخة

إن صناعة مكونات العناية بالبشرة المضادة للشيخوخة يقودها في المقام الأول شركات راسخة، بما في ذلك:

- شركة أديكا (اليابان)

- شركة بايرسدورف إيه جي (ألمانيا)

- شركة كرودا الدولية (المملكة المتحدة)

- شركة باسف إس إي (ألمانيا)

- شركة واكر كيمي أيه جي (ألمانيا)

- لونزا (سويسرا)

- كلاريانت (سويسرا)

- شركة إيفونيك للصناعات (ألمانيا)

- DSM (هولندا)

- شركة كاو (اليابان)

- بايو ثرايف ساينسز (الولايات المتحدة)

- كونتيبرو (جمهورية التشيك)

أحدث التطورات في سوق مكونات العناية بالبشرة المضادة للشيخوخة عالميًا

- في فبراير 2025، تعاونت شركات إستي لودر (ELC) مع شركة سيربين فارما لتطوير مكونات مبتكرة للعناية بالبشرة مضادة للشيخوخة، تُركز على إطالة العمر. تستفيد هذه الشراكة من خبرة سيربين فارما في أبحاث مضادات الالتهاب، وخاصةً مثبطات السيرين بروتياز، التي تُساعد الجسم على إصلاح الخلايا الملتهبة. من المتوقع أن يُعزز هذا التعاون محفظة شركة إستي لودر في حلول العناية بالبشرة المتقدمة، مما يُعزز فعالية المنتجات ويجذب المستهلكين الباحثين عن فوائد طويلة الأمد ومدعومة علميًا لمكافحة الشيخوخة.

- في فبراير 2025، أطلقت نيفيا للرجال خط منتجات العناية بالبشرة "إيج ديفينس"، الذي يستهدف علامات التقدم في السن الشائعة، مثل التجاعيد والجفاف وخشونة البشرة وبهتانها وفقدان مرونتها. تتضمن المجموعة مكونات رئيسية مثل الثياميدول وحمض الهيالورونيك لتحقيق نتائج ملحوظة مع الحفاظ على روتين عناية بسيط. ومن المرجح أن يعزز هذا الإطلاق، الذي يشمل سيرومات متطورة وكريمات للعينين ومرطبًا يوميًا بعامل حماية من الشمس 30، حصة العلامة التجارية في السوق من خلال استقطاب المستهلكين الرجال الباحثين عن حلول شاملة ومريحة لمكافحة الشيخوخة.

- في يناير 2025، أعلنت شركة كرودا إنترناشونال عن إطلاق منتج LongevityActive، وهو مكون حيوي مصمم لمكافحة شيخوخة الخلايا والإجهاد التأكسدي. يعزز هذا المكون إصلاح البشرة ويعزز دفاعاتها الطبيعية المضادة للأكسدة، مما يدعم تركيبات الأمصال والمرطبات المتطورة. من المتوقع أن يعزز هذا الإطلاق تميز المنتجات واعتمادها بين العلامات التجارية الرائدة في مجال العناية بالبشرة التي تركز على حلول فعالة لمكافحة الشيخوخة.

- في سبتمبر 2023، وسّعت شركة باسف نطاق إنتاجها في منطقة آسيا والمحيط الهادئ بإطلاق منتج Uvinul A Plus، وهو أحد فلاتر الأشعة فوق البنفسجية القليلة المقاومة للضوء، والذي يحمي من الأشعة فوق البنفسجية الضارة والجذور الحرة وتلف الجلد. يوفر المنتج، على شكل حبيبات قابلة للذوبان في الزيت، مرونة في التركيبة، وكفاءة عالية بتركيزات منخفضة، وفوائد خالية من المواد الحافظة، مما يدعم منتجات العناية بالبشرة طويلة الأمد ومقاومة علامات التقدم في السن. من المتوقع أن يعزز هذا التوسع مكانة باسف في سوق العناية بالبشرة سريع النمو في منطقة آسيا والمحيط الهادئ.

- في مارس 2023، وسّعت شركة DSM محفظة منتجاتها PARSOL بإطلاق PARSOL® DHHB، وهو فلتر متعدد الاستخدامات للأشعة فوق البنفسجية مناسب لمنتجات العناية بالبشرة متعددة الاستخدامات. تُمكّن قابليته الممتازة للذوبان وتوافقه الواسع مع تركيبات متنوعة من إنتاج واقيات الشمس، ومنتجات العناية بالوجه، ومستحضرات التجميل الملونة التي توفر حماية كافية من الأشعة فوق البنفسجية، وتتمتع بتصنيفات بيئية عالية. يوفر هذا الابتكار لصانعي المنتجات مرونةً لتلبية الطلب المتزايد من المستهلكين على منتجات عناية بالبشرة مستدامة، متعددة الاستخدامات، وعالية الأداء، ومضادة للشيخوخة.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.