Europe Self Injections Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

12.08 Billion

USD

24.96 Billion

2024

2032

USD

12.08 Billion

USD

24.96 Billion

2024

2032

| 2025 –2032 | |

| USD 12.08 Billion | |

| USD 24.96 Billion | |

|

|

|

|

تجزئة سوق الحقن الذاتي في أوروبا، حسب نوع المنتج (أجهزة الحقن الذاتي وتركيبات الحقن الذاتي)، شكل الجرعة (جرعة واحدة وجرعات متعددة)، طريقة الإعطاء (تحت الجلد، داخل العضل، وغيرها)، الاستخدام (أمراض المناعة الذاتية، مسكنات الألم، أدوية الطوارئ، الأورام، الاضطرابات الهرمونية، وغيرها)، الفئة العمرية (بالغون، كبار السن، وأطفال)، الجنس (ذكور وإناث)، قنوات التوزيع (العطاء المباشر، صيدليات المستشفيات، الصيدليات الإلكترونية، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق الحقن الذاتي في أوروبا

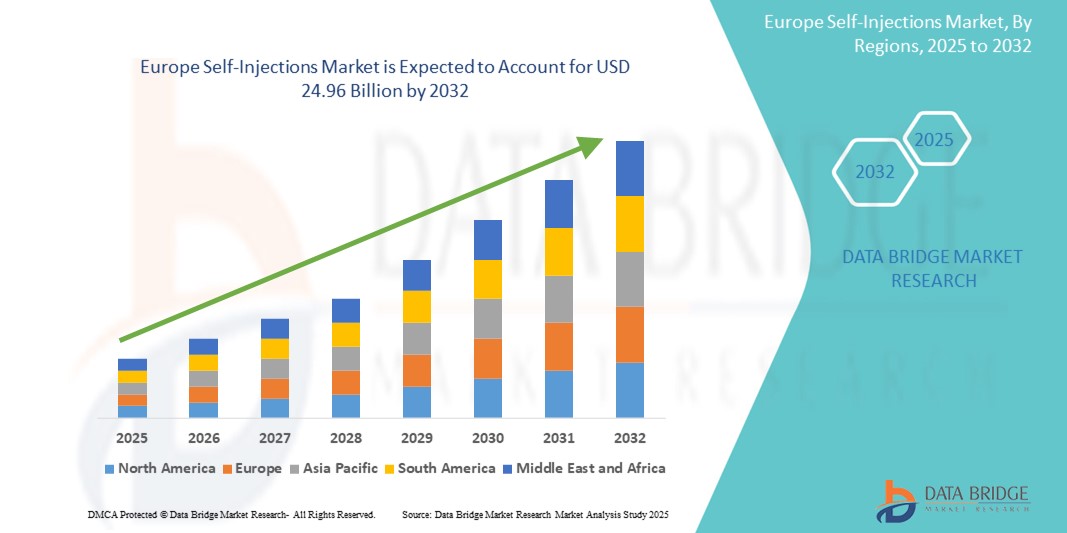

- تم تقييم حجم سوق الحقن الذاتي في أوروبا بـ 12.08 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 24.96 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 9.50٪ خلال الفترة المتوقعة

- إن نمو السوق مدفوع إلى حد كبير بالانتشار المتزايد للأمراض المزمنة مثل مرض السكري والتهاب المفاصل الروماتويدي والتصلب المتعدد ، والتي تتطلب علاجًا طويل الأمد وتدفع الطلب على طرق توصيل الأدوية المريحة.

- علاوة على ذلك، فإن تفضيل المرضى المتزايد للرعاية المنزلية، إلى جانب التقدم التكنولوجي في الحقن الآلي والحقن القلمي، يُرسّخ مكانة أجهزة الحقن الذاتي كأداة أساسية في الرعاية الصحية الحديثة. تُسرّع هذه العوامل المتقاربة من الإقبال على حلول الحقن الذاتي، مما يُعزز نمو هذا القطاع بشكل كبير.

تحليل سوق الحقن الذاتي في أوروبا

- الحقن الذاتي، الذي يتيح للمرضى إعطاء الأدوية عبر أجهزة أو تركيبات، أصبح ذا أهمية متزايدة لإدارة الأمراض المزمنة والعلاج الشخصي في كل من بيئات الرعاية المنزلية والسريرية نظرًا لراحته وفعاليته من حيث التكلفة وتحسين الالتزام.

- الطلب المتزايد على الحقن الذاتي مدفوع في المقام الأول بالانتشار المتزايد للأمراض المزمنة وأمراض المناعة الذاتية، والتحول المتزايد نحو الرعاية التي تركز على المريض، والتقدم المستمر في أجهزة الحقن الذاتي مثل الحقن التلقائي وحاقنات القلم.

- سيطرت ألمانيا على سوق الحقن الذاتي بأكبر حصة إيرادات بلغت 30.5% في عام 2024، بدعم من البنية التحتية المتقدمة للرعاية الصحية، وارتفاع عبء المرض، والاعتماد المبكر على المواد البيولوجية والبيولوجية المماثلة التي تتطلب الإدارة الذاتية، وخاصة للعلاجات المناعية الذاتية والهرمونية.

- من المتوقع أن تكون بولندا أسرع دولة نموًا في سوق الحقن الذاتي في أوروبا خلال فترة التوقعات بسبب التحسينات في إمكانية الوصول إلى الرعاية الصحية، والوعي المتزايد بالصحة العامة، والطلب المتزايد على الحلول العلاجية المنزلية.

- سيطرت أجهزة الحقن الذاتي على سوق الحقن الذاتي بحصة بلغت 65.9% في عام 2024، مدفوعة بسهولة استخدامها وميزات سلامة المرضى والتفضيل المتزايد بين الأطباء والمرضى لخيارات توصيل الأدوية القائمة على الجهاز.

نطاق التقرير وتقسيم سوق الحقن الذاتي في أوروبا

|

صفات |

رؤى رئيسية حول سوق الحقن الذاتي في أوروبا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أوروبا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق الحقن الذاتي في أوروبا

"التطورات التكنولوجية تدفع عجلة الابتكار في الأجهزة والرعاية المنزلية"

- إن الاتجاه المهم والمتسارع في سوق الحقن الذاتي في أوروبا هو الابتكار السريع في تكنولوجيا الأجهزة التي تهدف إلى تحسين قابلية الاستخدام والسلامة والالتزام - وخاصة بالنسبة لمرضى الأمراض المزمنة الذين يحتاجون إلى حقن متكررة في المنزل

- على سبيل المثال، تُقدّم شركات الأدوية، بالتعاون مع شركات الأجهزة الطبية، حاقنات آلية متطورة بميزات مثل الإبر المخفية، والإشارات الصوتية/البصرية، وقدرات الاتصال. على سبيل المثال، تتيح منصة الحقن الآلية المعيارية Molly® من SHL Medical سهولة التخصيص لمختلف العلاجات واحتياجات المرضى.

- يتم تجريب أجهزة الحقن الذاتي الذكية المزودة بتقنية البلوتوث أو الاتصال قريب المدى في ألمانيا وفرنسا، مما يتيح نقل البيانات إلى التطبيقات لتتبع أوقات الحقن والجرعات والالتزام، وبالتالي تسهيل المراقبة عن بعد من قبل المتخصصين في الرعاية الصحية.

- يُحسّن دمج التصاميم المريحة، وتثبيت درجة الحرارة، وسرعة الحقن المُتحكّم بها في أقلام الحقن تجربة الحقن الذاتي، خاصةً للمرضى كبار السن أو الأطفال. تُعدّ شركات مثل Ypsomed وOwen Mumford رائدة في تصميم أنظمة حقن ذاتي سهلة الاستخدام مُصمّمة خصيصًا لفئات مُحدّدة من المرضى.

- إن هذا الاتجاه نحو أجهزة الحقن الذاتي التي تركز على المريض، والذكية، والمتوافقة مع المنزل، يعيد تشكيل التوقعات فيما يتعلق بالرعاية المزمنة، مع دفع قوي من أنظمة الرعاية الصحية لتقليل زيارات العيادات وتعزيز العلاج المنزلي.

- مع التركيز المتزايد في مجال الرعاية الصحية في أوروبا على الفعالية من حيث التكلفة وإدارة الأمراض على المدى الطويل، تساعد ابتكارات هذه الأجهزة المرضى على التحكم في علاجهم بمزيد من الأمان والراحة والثقة.

ديناميكيات سوق الحقن الذاتي في أوروبا

سائق

"ارتفاع عبء الأمراض المزمنة والتحول نحو الرعاية الذاتية"

- إن الانتشار المتزايد للأمراض المزمنة مثل مرض السكري والتصلب المتعدد واضطرابات المناعة الذاتية في جميع أنحاء أوروبا، إلى جانب التحول المتزايد نحو الرعاية الذاتية والرعاية المنزلية، هو المحرك الرئيسي الذي يغذي سوق الحقن الذاتي.

- على سبيل المثال، يسلط المركز الأوروبي للوقاية من الأمراض والسيطرة عليها الضوء على ارتفاع معدلات الأمراض غير المعدية، مما يدفع أنظمة الرعاية الصحية إلى تشجيع العلاجات الخارجية والعلاجات الذاتية لتقليل العبء في المستشفيات.

- تشهد دول مثل ألمانيا والمملكة المتحدة وفرنسا زيادة في وصف المواد البيولوجية والبيولوجية المماثلة التي تعتمد على طرق توصيل الحقن الذاتي، مما يجعل الأجهزة مثل الحقن التلقائي والحقن المعبأة مسبقًا ضرورية في الرعاية الروتينية.

- إن تمكين المرضى، إلى جانب سياسات السداد الداعمة ومبادرات الصحة الإلكترونية، يعمل على تسريع اعتماد الحقن الذاتي، مع تطبيقات الهاتف المحمول ووسائل التدريب التي تعمل على تحسين ثقة المرضى والتزامهم.

- إن سهولة إعطاء الأدوية دون إشراف سريري، وتقليل الاعتماد على البنية التحتية للرعاية الصحية، وتحسين نوعية الحياة هي العوامل الرئيسية التي تدفع إلى تبني هذا النظام، وخاصة بين البالغين في سن العمل والمرضى المسنين الذين يسعون إلى الاستقلال.

ضبط النفس/التحدي

"تفاعلات موقع الحقن وتعقيد الامتثال التنظيمي"

- إن التحدي الرئيسي في سوق الحقن الذاتي في أوروبا هو حدوث تفاعلات في موقع الحقن مثل الألم أو التورم أو الاحمرار، مما قد يؤثر سلبًا على التزام المريض، وخاصة مع جداول الجرعات المتكررة

- بالإضافة إلى ذلك، يُشكّل التنقل بين البيئات التنظيمية المعقدة في العديد من دول الاتحاد الأوروبي عقبات أمام دخول السوق وتوحيد معايير المنتجات. كما أن التباين في لوائح الأجهزة الطبية، ومتطلبات وضع العلامات، وبروتوكولات السداد، قد يُؤخّر الموافقة على المنتجات وتسويقها.

- على سبيل المثال، قد تتطلب الاختلافات في عمليات ترخيص التسويق بين الدول الأعضاء في الاتحاد الأوروبي بيانات سريرية مخصصة، أو عبوات، أو تعليمات، مما يزيد من تكاليف التطوير والوقت اللازم لطرح المنتج في السوق بالنسبة للمصنعين.

- علاوة على ذلك، قد يكون من الصعب ضمان استيفاء الأجهزة لمعايير لائحة الأجهزة الطبية بالاتحاد الأوروبي (MDR) مع الحفاظ على أسعارها المعقولة، خاصةً بالنسبة للمصنّعين الصغار. كما أبلغت بعض الشركات عن تأخير في إصدار الشهادات بسبب تشديد متطلبات المراقبة بعد التسويق.

- إن معالجة هذه التحديات من خلال تثقيف المرضى، وتحسين تقنيات الصياغة لتقليل التفاعلات العكسية، والتعاون الوثيق مع السلطات التنظيمية أمر بالغ الأهمية للحفاظ على زخم السوق وتوسيع نطاق الوصول إلى علاجات الحقن الذاتي في جميع أنحاء أوروبا.

نطاق سوق الحقن الذاتي في أوروبا

يتم تقسيم السوق على أساس نوع المنتج، وشكل الجرعة، وطريقة الإدارة، والتطبيق، والفئة العمرية، والجنس، وقناة التوزيع.

- حسب نوع المنتج

بناءً على نوع المنتج، يُقسّم سوق الحقن الذاتي في أوروبا إلى أجهزة الحقن الذاتي وتركيبات الحقن الذاتي. وقد هيمن قطاع أجهزة الحقن الذاتي على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 65.9% في عام 2024، مدفوعًا بالانتشار الواسع لأجهزة الحقن الذاتي وقلم الحقن. تتميز هذه الأجهزة بسهولة الاستخدام، وسلامتها العالية، وتُستخدم على نطاق واسع في علاج الأمراض المزمنة مثل داء السكري وأمراض المناعة الذاتية. كما أن تصميمها المريح وأنظمة إبرها المخفية تُحسّن التزام المريض بالعلاج وتُقلل من قلق الحقن.

ومن المتوقع أن يشهد قطاع تركيبات الحقن الذاتي نموًا مطردًا خلال فترة التوقعات، بدعم من الابتكارات في مجال المواد البيولوجية والمستحضرات الحيوية المماثلة التي تتطلب التوصيل تحت الجلد أو العضل، وتطوير تركيبات مستقرة للاستخدام في البيئات غير السريرية.

- حسب شكل الجرعة

بناءً على شكل الجرعة، يُقسّم السوق إلى جرعة واحدة وجرعات متعددة. وقد هيمنت فئة الجرعة الواحدة على السوق محققةً أكبر حصة من إيرادات السوق بنسبة 59.8% في عام 2024، ويعزى ذلك إلى انخفاض مخاطر التلوث، وزيادة دقة الجرعات، وتزايد استخدامها في أدوية الطوارئ وعلاجات الأمراض المزمنة. وتُستخدم هذه الأدوية غالبًا في الحقن الآلية التي تُستخدم لمرة واحدة، والتي توفر الأمان والراحة للمرضى الذين يتلقون العلاج في المنزل.

من المتوقع أن يشهد قطاع الجرعات المتعددة نموًا مطردًا خلال فترة التوقعات، نظرًا لفعاليته من حيث التكلفة وفائدته في العلاجات الحالية، مثل الأنسولين والعلاجات الهرمونية. ويدعم تثقيف المرضى والتطورات في الأجهزة اعتماده في فئات علاجية متعددة.

- عن طريق الإدارة

بناءً على طريقة الإعطاء، يُقسّم السوق إلى حقن تحت الجلد، وحقن عضلي، وغيرها. وقد هيمنت حقن تحت الجلد على السوق محققةً أكبر حصة من إيرادات السوق، بنسبة 71.2% في عام 2024، نظرًا لقلة تدخلها الجراحي وملاءمتها للعلاجات المزمنة، بما في ذلك اضطرابات المناعة الذاتية والهرمونية. ويُفضّل الإعطاء المنزلي نظرًا لقلة تدريبه وقلة انزعاجه مقارنةً بالحقن العضلي.

ومن المتوقع أن يشهد قطاع العلاج العضلي نموًا معتدلًا خلال فترة التوقعات، وخاصة في قطاع الرعاية الطارئة والحقن طويلة المفعول المستخدمة في الصحة العقلية والأورام.

- حسب الطلب

بناءً على التطبيق، يُقسّم سوق الحقن الذاتي في أوروبا إلى أمراض المناعة الذاتية، وتسكين الألم، وأدوية الطوارئ، والأورام، والاضطرابات الهرمونية، وغيرها. وقد هيمن قطاع أمراض المناعة الذاتية على السوق محققًا أكبر حصة من إيرادات السوق، بنسبة 34.6% في عام 2024، مدفوعًا بتزايد حالات مثل التهاب المفاصل الروماتويدي والتصلب اللويحي، والتي تتطلب علاجًا بيولوجيًا طويل الأمد يُعطى عن طريق الحقن الذاتي.

ومن المتوقع أن يسجل قطاع الأورام أسرع نمو خلال الفترة المتوقعة، حيث أصبح الحقن الذاتي قابلاً للتطبيق بشكل متزايد لعلاجات الرعاية الداعمة، والبيولوجيا المستهدفة، والعلاجات لإدارة أعراض السرطان خارج المستشفيات.

- حسب الفئة العمرية

بناءً على الفئات العمرية، يُقسّم السوق إلى فئات: البالغين، وكبار السن، والأطفال. وقد هيمنت فئة البالغين على السوق بحصة سوقية بلغت 63.7% في عام 2024، مما يعكس الانتشار الواسع للأمراض المزمنة المرتبطة بنمط الحياة، مثل داء السكري وأمراض المناعة الذاتية، في هذه الفئة العمرية. كما أن البالغين أكثر قدرة على إدارة حالاتهم المرضية بشكل مستقل، مما يجعلهم مرشحين مثاليين للعلاج بالحقن الذاتي.

ويشهد قطاع طب الشيخوخة أيضًا نموًا كبيرًا خلال الفترة المتوقعة، بسبب ارتفاع عدد السكان المسنين في أوروبا وزيادة حالات الأمراض المرتبطة بالعمر والتي تتطلب علاجًا بالحقن طويل الأمد.

- حسب الجنس

يُقسّم السوق حسب الجنس إلى ذكور وإناث. وقد هيمنت شريحة الإناث على السوق بحصة سوقية بلغت 51.2% في عام 2024، وذلك بفضل ارتفاع معدل انتشار أمراض المناعة الذاتية لدى النساء، وتزايد الطلب على العلاجات الهرمونية، مثل علاجات الخصوبة وإدارة انقطاع الطمث، والتي تُعطى عن طريق الحقن الذاتي.

ويشهد قطاع الذكور أيضًا نموًا مطردًا خلال فترة التوقعات، مع زيادة تشخيصات مرض السكري واختلال التوازن الهرموني الذي يتطلب علاجات قابلة للحقن.

- حسب قناة التوزيع

بناءً على قنوات التوزيع، يُقسّم السوق إلى مناقصة مباشرة، وصيدليات مستشفيات، وصيدليات إلكترونية، وغيرها. وقد هيمن قطاع صيدليات المستشفيات على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 42.9% في عام 2024، مدفوعًا بخطط العلاج في المستشفيات، وسهولة الوصول الموثوقة إلى الأدوية البيولوجية والحقن، والدعم المقدم للمرضى لتدريبهم على الاستخدام الذاتي السليم.

من المتوقع أن يشهد قطاع الصيدليات عبر الإنترنت أسرع نمو خلال الفترة المتوقعة، مدفوعًا بالرقمنة المتزايدة للرعاية الصحية، وسهولة التوصيل إلى المنازل، وتفضيل المرضى المتزايد لخيارات الشراء السرية والمتاحة، خاصة للعلاجات المزمنة والهرمونية.

تحليل إقليمي لسوق الحقن الذاتي في أوروبا

- سيطرت ألمانيا على سوق الحقن الذاتي بأكبر حصة إيرادات بلغت 30.5% في عام 2024، بدعم من البنية التحتية المتقدمة للرعاية الصحية، وارتفاع عبء المرض، والاعتماد المبكر على المواد البيولوجية والبيولوجية المماثلة التي تتطلب الإدارة الذاتية، وخاصة للعلاجات المناعية الذاتية والهرمونية.

- يفضل المرضى في البلاد بشكل متزايد علاجات الحقن الذاتي لأمراض مثل مرض السكري والتهاب المفاصل الروماتويدي والتصلب المتعدد، حيث يقدرون الراحة وتقليل زيارات العيادات وتحسين الالتزام الذي توفره أجهزة الحقن الذاتي الحديثة.

- ويتم دعم هذا التبني الواسع النطاق من خلال سياسات السداد المواتية، والوعي المتزايد بالرعاية الذاتية، ومشهد الأجهزة الطبية المتقدمة من الناحية التكنولوجية، مما يضع الحقن الذاتي كحل موثوق لإدارة العلاج طويل الأمد عبر الفئات العمرية المختلفة.

نظرة عامة على سوق الحقن الذاتي في ألمانيا

استحوذ سوق الحقن الذاتي في ألمانيا على أكبر حصة من الإيرادات في أوروبا عام ٢٠٢٤، مدعومًا ببنية تحتية متينة للرعاية الصحية، وانتشار واسع لاضطرابات المناعة الذاتية والتمثيل الغذائي، وميل قوي نحو العلاجات البيولوجية ذاتية الإدارة. وتستفيد البلاد من تقنيات توصيل الأدوية المتقدمة وقطاع دوائي متطور يركز على الابتكار وامتثال المرضى للعلاج. وتساهم الجهود المستمرة لتخفيف أعباء المستشفيات وتحسين الالتزام بالعلاج في زيادة الطلب على أنظمة الحقن الذاتي في برامج الانتقال من المستشفى إلى المنزل وإدارة الأمراض المزمنة.

نظرة عامة على سوق الحقن الذاتي في فرنسا

من المتوقع أن ينمو سوق الحقن الذاتي في فرنسا بمعدل نمو سنوي مركب ملحوظ خلال فترة التوقعات، مدفوعًا بتزايد قبول نماذج الرعاية الذاتية والاستثمارات في حلول الرعاية الصحية المتصلة. يُظهر المرضى الفرنسيون اهتمامًا متزايدًا بأجهزة الحقن الذاتي الذكية المزودة بخاصية التتبع والتذكير الرقمي. كما تُعزز المبادرات الحكومية الداعمة للتحول الرقمي في مجال الصحة وبرامج الوصول المبكر للأدوية البيولوجية استخدام علاجات الحقن الذاتي، لا سيما في تطبيقات أمراض الروماتيزم والأورام والغدد الصماء.

نظرة عامة على سوق الحقن الذاتي في المملكة المتحدة

من المتوقع أن يشهد سوق الحقن الذاتي في المملكة المتحدة نموًا مطردًا، مدفوعًا بتزايد الوعي باستراتيجيات الإدارة الذاتية والدعم القوي للرعاية الصحية عن بُعد. وتشجع هيئة الخدمات الصحية الوطنية (NHS) العلاج المنزلي للحالات المزمنة المؤهلة، مما يزيد الحاجة إلى أجهزة حقن موثوقة وسهلة الاستخدام. علاوة على ذلك، تشجع الشراكات بين شركات التكنولوجيا الحيوية ومقدمي الرعاية الصحية على اعتماد علاجات الحقن التي تركز على المريض، بما في ذلك الأدوية الحيوية المماثلة وأدوات الحقن الذاتي الرقمية.

نظرة عامة على سوق الحقن الذاتي في بولندا

من المتوقع أن ينمو سوق الحقن الذاتي في بولندا بأسرع معدل نمو سنوي مركب في أوروبا خلال فترة التوقعات، مدعومًا بالتحسينات المستمرة في توفير الرعاية الصحية، وارتفاع معدل انتشار الأمراض المزمنة، والجهود الحكومية لتحديث رعاية المرضى الخارجيين. تشهد البلاد إقبالًا متزايدًا على الأدوية الحيوية المشابهة والأدوية البيولوجية القابلة للحقن، لا سيما في أمراض الروماتيزم والغدد الصماء. وتساهم حملات التوعية المتزايدة، واستراتيجيات التسعير المواتية، والتحول نحو العلاج المنزلي في زيادة الطلب على أجهزة وتركيبات الحقن الذاتي بين سكان المناطق الحضرية والريفية على حد سواء.

حصة سوق الحقن الذاتي في أوروبا

إن صناعة الحقن الذاتي في أوروبا تقودها في المقام الأول شركات راسخة، بما في ذلك:

- باير إيه جي (ألمانيا)

- يو سي بي فارما (بلجيكا)

- شركة إيبسين للأدوية الحيوية (فرنسا)

- شركة تيفا للصناعات الدوائية المحدودة (إسرائيل)

- Recipharm AB (السويد)

- شركة شوت فارما (ألمانيا)

- ليلي (الولايات المتحدة)

- أسترازينيكا (المملكة المتحدة)

- شركة تاكيدا للأدوية المحدودة (اليابان)

- شركة نوفارتيس إيه جي (سويسرا)

- شركة فايزر (الولايات المتحدة)

- سانوفي (فرنسا)

- آبيفي (الولايات المتحدة)

- بيوجين (الولايات المتحدة)

- YPSOMED (سويسرا)

- شركة بوش الصحية المحدودة (كندا)

- شركة ميرك وشركاه (الولايات المتحدة)

- شركة أمجين (الولايات المتحدة)

- شركة جونسون آند جونسون للخدمات، المحدودة (الولايات المتحدة)

- فارما جيت (الولايات المتحدة)

- شركة Societe Industrielle de Sonceboz SA (سويسرا)

- شركة تيرومو (اليابان)

- هاسلماير (ألمانيا)

- أوين مومفورد (المملكة المتحدة)

- شركة ميداس فارما المحدودة (ألمانيا)

ما هي التطورات الأخيرة في سوق الحقن الذاتي في أوروبا؟

- في يونيو 2024، أعلنت شركة Ypsomed AG عن توسعة مصنعها لتصنيع أجهزة الحقن الذاتي في شفيرين، ألمانيا، لتلبية الطلب الأوروبي المتزايد على أجهزة الحقن الذاتي والأجهزة القابلة للارتداء. يعزز هذا التوسع التزام Ypsomed بتلبية الحاجة المتزايدة للرعاية المزمنة ذاتية الإدارة، لا سيما لمرضى المناعة الذاتية والسكري، مع تعزيز قدراتها التوريدية في أسواق الاتحاد الأوروبي الرئيسية.

- في مايو 2024، أطلقت شركة نيميرا ملحقها الإلكتروني القابل لإعادة الاستخدام للحقن المعبأة مسبقًا، e-Advancia®، في عدة دول أوروبية. يهدف هذا الابتكار إلى تحسين التزام المرضى بالعلاج من خلال توفير تتبع للجرعات، وتذكيرات بالحقن، وملاحظات فورية، بما يتماشى مع التوجه المتزايد نحو دمج الصحة الرقمية في العلاجات ذاتية الإدارة. يُظهر هذا الإطلاق تركيز نيميرا على الجمع بين توصيل الأدوية والرعاية المتصلة لتحسين نتائج العلاج.

- في مارس 2024، حصلت شركة أوين مومفورد المحدودة على شهادة CE لجهاز الحقن الذاتي UniSafe سعة 1 مل بدون زنبرك، مما أتاح انتشارًا تجاريًا واسع النطاق في جميع أنحاء أوروبا. صُمم الجهاز لضمان السلامة وسهولة الاستخدام وتقليل قلق المستخدم، خاصةً لمرضى التهاب المفاصل الروماتويدي وغيره من الحالات المزمنة التي تتطلب حقنًا بيولوجية منتظمة. يعزز هذا الإنجاز بصمة الشركة في سوق أجهزة الحقن الذاتي في الاتحاد الأوروبي.

- في فبراير 2024، أبرمت شركة بيوكورب برودكشن إس إيه اتفاقية استراتيجية مع شركة أدوية أوروبية رائدة لتزويدها بجهازها المتصل للحقن الذاتي، ماليا®، لمراقبة أقلام الأنسولين. تهدف هذه الشراكة إلى توسيع نطاق مراقبة المرضى عن بُعد والرعاية الشخصية لمرضى السكري في جميع أنحاء فرنسا وألمانيا ودول الشمال الأوروبي، مما يُسهم في زيادة الالتزام بالعلاج وتخفيف الضغط على نظام الرعاية الصحية.

- في يناير 2024، أعلنت شركة SHL Medical عن تعاونها مع شركة رائدة في مجال التكنولوجيا الحيوية لإنتاج محاقن ذاتية مُخصصة للأسواق الأوروبية. تُركز المبادرة على تصميمات تُركز على المريض، تُبسط عملية الحقن الذاتي وتُلبي المعايير التنظيمية للاتحاد الأوروبي. ومن خلال الاستفادة من مركز التصنيع المُتقدم التابع لها في سويسرا، تهدف SHL إلى تلبية الطلب المتزايد على حلول الحقن الذاتي المُريحة والآمنة والبديهية.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.