>سوق التغليف في أوروبا ، حسب نوع المنتج (الأكياس والصواني والكرتون وغيرها)، المواد (PET، البولي بروبيلين، رقائق الألومنيوم، البولي أميد (PA)، الورق والكرتون المقوى، EVOH وغيرها)، قناة التوزيع (غير متصلة بالإنترنت وعبر الإنترنت)، الاستخدام النهائي (الأغذية والمشروبات والأدوية وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والحجم

لقد أدت الصناعة والتحضر إلى تغيير تقنيات المعالجة وطرق شحن الوسائط أو السوائل، مما أدى إلى الحاجة إلى التغليف المعبأ في كل صناعة تقريبًا حيث تلعب السوائل دورًا رئيسيًا. لذلك، كان سوق التغليف المعبأ مدفوعًا بالحاجة إلى إنتاج أكثر أمانًا وبنية أساسية مناسبة.

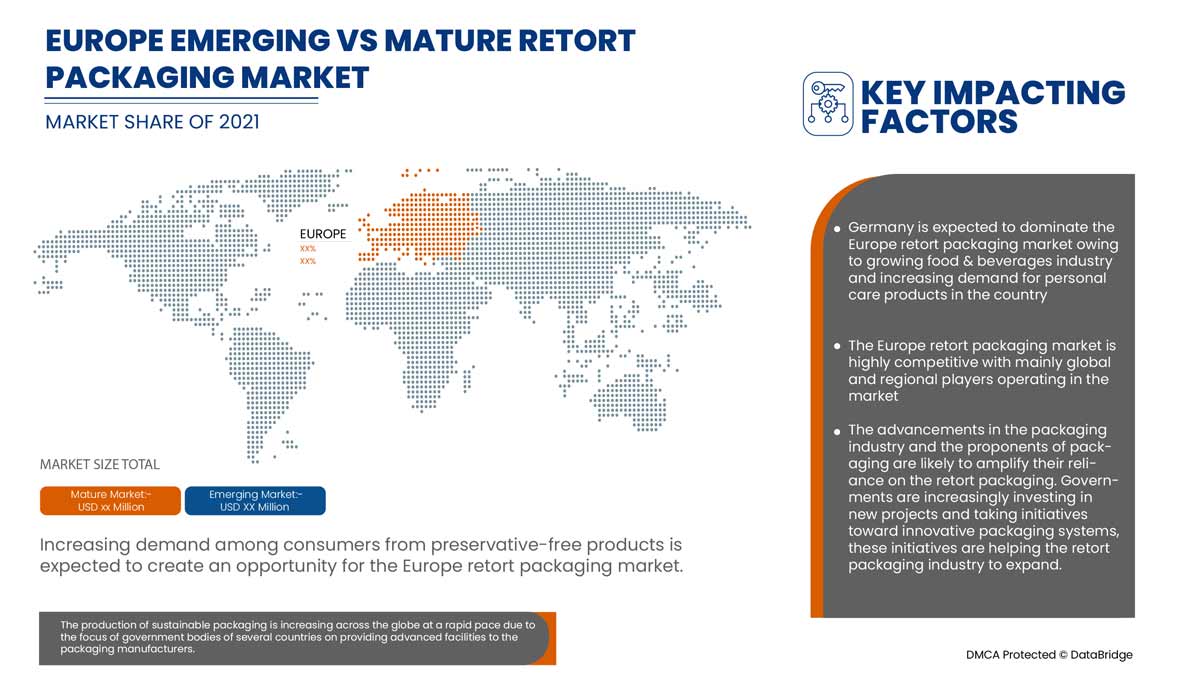

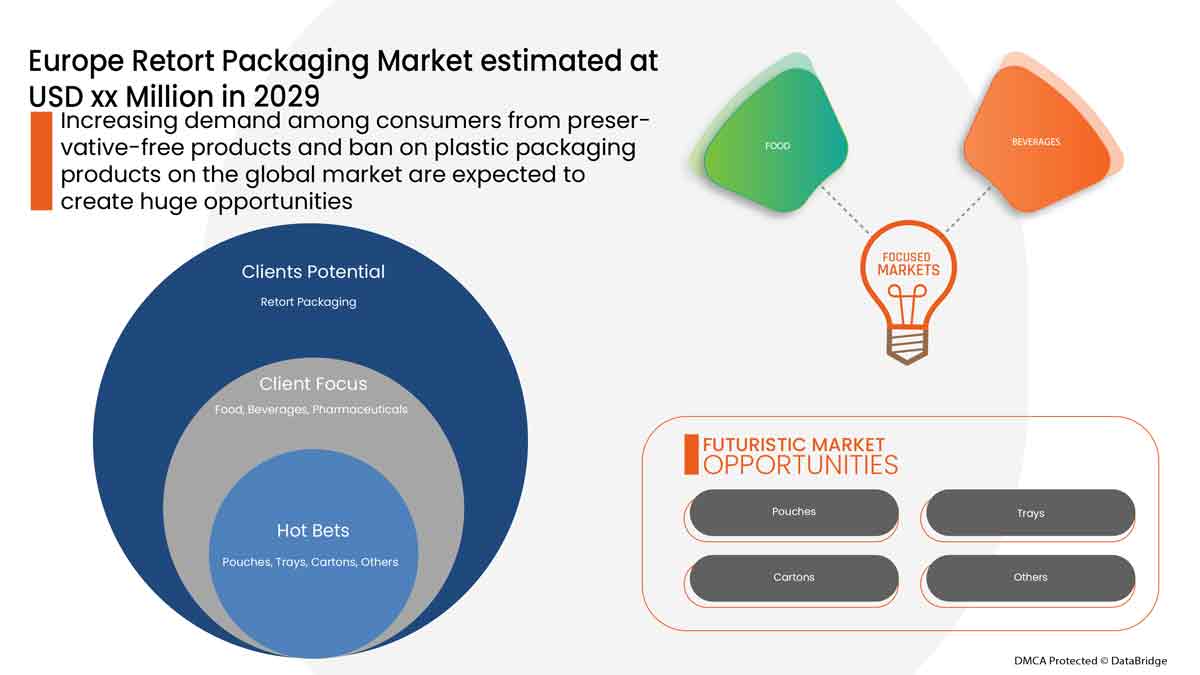

ومن بين العوامل التي تدفع السوق الطلب المتزايد بين المستهلكين على المنتجات الخالية من المواد الحافظة، والطلب المتزايد على حلول التغليف المستدامة والجمالية، والطلب المتزايد على التغليف الذكي لتجنب هدر الطعام. ومع ذلك، فإن التكلفة العالية المرتبطة بأنشطة البحث والتطوير هي العائق الذي يعيق نمو السوق.

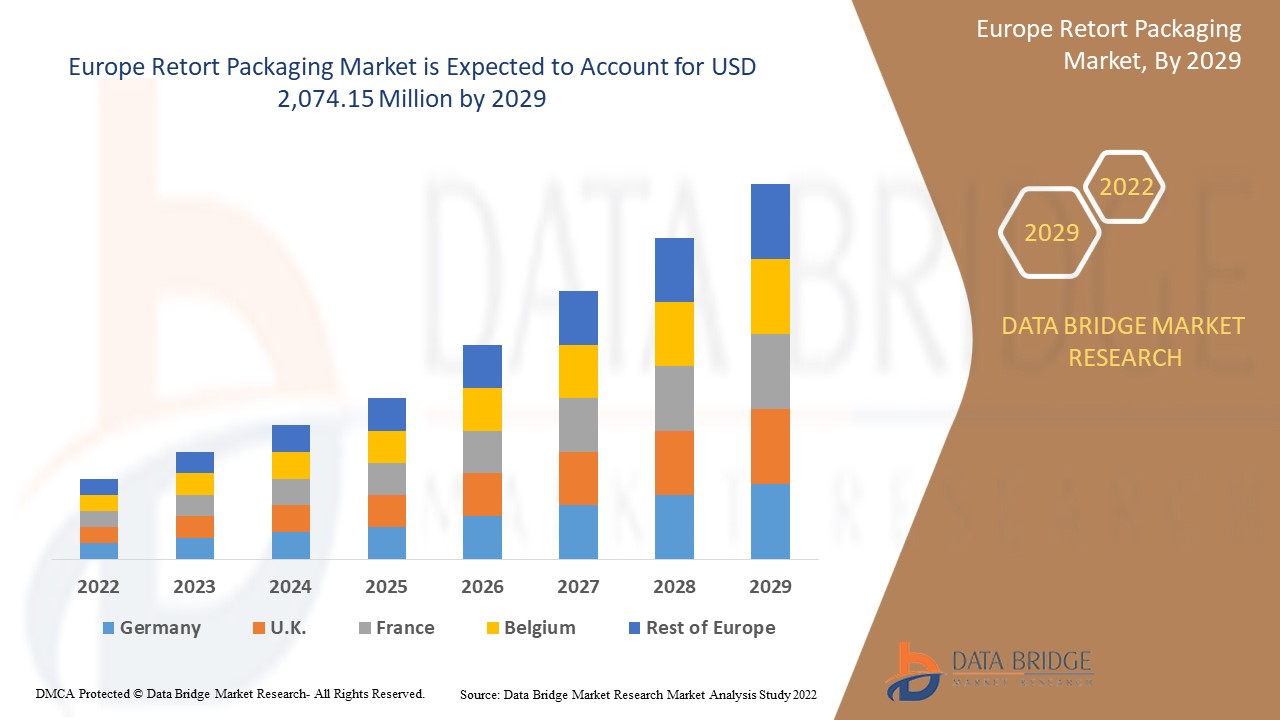

تحلل شركة Data Bridge Market Research أن سوق التغليف من المتوقع أن تصل قيمته إلى 2,074.15 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 5.6% خلال الفترة المتوقعة. تشكل "الأكياس" أكبر شريحة من أنواع المنتجات في سوق التغليف بسبب التطورات السريعة في المسارات التكنولوجية لتسويق استخدام التغليف التقليدي البديل. يغطي تقرير سوق التغليف أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع المنتج (الأكياس والصواني والكرتون وغيرها)، حسب المادة (PET، البولي بروبيلين، رقائق الألومنيوم، البولي أميد (PA)، الورق والكرتون المقوى، EVOH وغيرها)، حسب قناة التوزيع (غير متصلة بالإنترنت وعبر الإنترنت)، حسب الاستخدام النهائي (الأغذية والمشروبات والأدوية وغيرها) |

|

الدول المغطاة |

المملكة المتحدة، ألمانيا، فرنسا، إسبانيا، إيطاليا، هولندا، سويسرا، روسيا، بلجيكا، تركيا، لوكسمبورج وبقية أوروبا، |

|

الجهات الفاعلة في السوق المشمولة |

Coveris، FLAIR Flexible Packaging Corporation، IMPAK CORPORATION، PORTCO PACKAGING، Constantia Flexibles، Mondi، Tetra Pak، Clifton Packaging Group Limited، وغيرها. |

تعريف السوق

Retort packaging is a type of food packaging made from a laminate of flexible plastic and metal foils. It allows the sterile packaging of a wide variety of food and drink handled by aseptic processing, and is used as an alternative to traditional industrial canning methods. Packaged foods range from water to fully cooked, thermo-stabilized (heat-treated), high-caloric (1,300 kcal on average) meals like Meals, Ready-to-Eat (MREs), which can be eaten cold, warmed by submerging in hot water, or heated with a flameless ration heater, a meal component first introduced by the military in 1992. Field rations, space food, fish products, camping meals, quick noodles, and companies like Capri Sun and Tasty Bite all employ retort packaging.

Initially, the retort packaging were developed for industrial applications and pipe-organs. Gradually the design was adapted in the bio-pharmaceutical industry for sterilizing methods by using compliant materials. And now it is being used in almost every industry for safe production and adequate infrastructure, such as food & beverage, and chemical processing among other verticals.

Retort packaging Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Increasing demand among consumers for preservative-free products

Retort takes place when non-sterile products are hermetically sealed, which literally means non-sterile packaging. The packaging is loaded into a retort pressure vessel and subjected to pressurized steam. The product is also exposed to high temperatures for a much longer period than in hot-filling. The additional time can significantly deteriorate the overall quality and nutritional content of the product.

The increasing demand among consumers across the globe for preservative-free products is a key driver for the Europe retort packaging market. As consumers are getting more concerned about the harmful effects of preservatives in their beverages, the demand for preservative-free products is at its peak.

- Increase in demand for retort packaging by airlines

Recently, there is an increasing shift of consumers toward sustainable and environment friendly packaging options that has further introduced fully recyclable packaging and stand-up bags of various designs. In addition to providing environmental advantages, sustainable packaging can also help companies to increase profits and eliminate unnecessary manufacturing spare parts, thereby improving the safety of production lines, and minimizing disposal costs. The main objective of packaging is not only to protect the product from damage during transit, but to protect the warehouse and retail shops before selling the product. Different types of packaging are used for different kind of products. Also, retort packaging is used for heavy and bulky food products and also used for other products.

- Growing demand for intelligent packaging to avoid food wastage

Intelligent packaging offers various solutions to reduce food wastage as it provides different indicators to avoid food spoilage. Thus, increasing food wastage is attracting consumers to buy food with intelligent packaging.

Intelligent packaging includes indicators (time-temperature indicators; integrity or gas indicators; freshness indicators); barcodes and radiofrequency identification tags (RFID); sensors (biosensors; gas sensors; fluorescence-based oxygen sensors), among others. Hence, intelligent packaging helps food manufacturers to track the status of their food products in real-time, thus contributing to a reduction in food wastage.

Furthermore, intelligent packaging can also act as the primary tool for consumers to choose their products at the retail level as intelligent packaging concepts can enable consumers to judge the quality of the products. As a result, intelligent packaging is expected to play a major role in attracting consumers.

- High cost associated with research and development activities

Research and development expenses are associated directly with the research and development of a company's goods or services and any intellectual property generated in the process. A company generally incurs R&D expenses in the process of finding and creating new products or services.

Packaging companies rely heavily on their research and development capabilities; so they can relatively outsize R&D expenses. For instance, changing the preferences of consumers from regular packaging to intelligent and active packaging, increasing consumers' awareness about food safety, among others. Thus, companies have to invest in research & development activities to diversify their business and find new growth opportunities as technology continues to evolve.

- Ban on plastic packaging products on the Europe market

With rise in environmental concerns in several regions, the government has taken strict steps toward banning single-use plastic products and non-biodegradable packaging products in the market. This is because plastic products take longer to decompose and is dangerous for aquatic and land animals.

For instance,

Natural Environment estimates that approximately 100,000 sea turtles and other marine animals die every year because they get strangled in bags or mistake them for food.

In North America, single-use plastic bags used for the food products and consumer goods packaging are banned. As a result, the demand for paperboard and retort packaging is increasing in the region.

Several types of packaging are used in different applications, resulting in the production of the waste and are very harmful to the environment. Plastic packaging is used for consumer goods packaging, which produces non-biodegradable plastic packaging waste, releases toxic gases in the soil, which is dangerous for animals and ground water. Hence, steps have been taken to ban plastic bag packaging as it is harmful to the environment.

- Supply chain disruption due to pandemic

The COVID-19 has disrupted the supply chain and has declined markets of retort packaging worldwide. Disruptions have led to the delayed stock of the products as well as lower access, and supplies of food and beverage products. With the persistent persistence of COVID-19, there have been restrictions on transportation, import, and export of materials. Also, with the movement restriction on workers as well, the manufacturing of retort packaging has been affected due to which the demand for consumers has not been fulfilled. Also, with restrictions on import and export, it made it difficult for the manufacturers to supply the raw materials and their end products across the countries in the world which also has impacted the prices of retort packaging. Thus, with ongoing restrictions due to COVID-19, the supply chain for retort packaging has been disrupted which is creating a major challenge for the manufacturers.

With the persistence of COVID-19 and restrictions on movement, there is a disruption in the supply chain which is posing a major challenge for the Europe retort packaging market.

Post COVID-19 Impact on Retort Packaging Market

COVID-19 created a major impact on the retort packaging market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

Due to the outbreak of the pandemic caused by the virus, many small sectors were closed down and on the other hand some sectors decided to cut off some of the employees which resulted in a major unemployment. Retort packaging are also used in the packaging of products as well as in industries. Due to the outbreak of a pandemic, the demand for such products has gone up to an extent especially for the medical sector, healthcare, pharmaceutical, groceries, e-commerce, and various other sectors. But the unexpected demand, along with limited production capacities and supply chain interruptions is continuing to cause difficulties in all of these industries.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة لتحسين التكنولوجيا المستخدمة في التغليف. وبهذا، ستجلب الشركات أجهزة تحكم متقدمة ودقيقة إلى السوق. بالإضافة إلى ذلك، أدى استخدام السلطات الحكومية للتغليف في الأغذية والمشروبات إلى نمو السوق.

التطورات الأخيرة

- في فبراير 2022، استثمرت شركة تيترا باك في أربعة مرافق إعادة تدوير جديدة، مما مكن إعادة تدوير العبوات العالمية من تجاوز خمسين مليار يورو سنويًا. استثمرت تيترا باك أكثر من 11.5 مليون يورو مع شركات إعادة التدوير والجهات الفاعلة في الصناعة، للمساعدة في إنشاء أربعة حلول إعادة تدوير جديدة تمامًا للعبوات في تركيا والمملكة العربية السعودية وأوكرانيا وأستراليا. يساعد هذا الاستثمار في تحسين محفظة المنتجات والحضور العالمي للشركة.

- في أبريل 2022، أطلقت شركة أمكور عبوات أكثر استدامة للأدوية. صفائح جديدة أكثر استدامة من نوع High Shield لمجموعتها الخاصة بتغليف الأدوية. تعمل خيارات التغليف الجديدة منخفضة الكربون والجاهزة لإعادة التدوير على تحقيق هدفين، حيث توفر متطلبات الحاجز العالي والأداء اللازمة للصناعة مع دعم أجندات إعادة التدوير لشركات الأدوية. ستساعد هذه الإطلاقات الجديدة في توسيع مجموعة المنتجات والأرباح. كما تعمل على توسيع حضور الشركة العالمي بشكل أكبر.

نطاق سوق التغليف في أوروبا

يتم تقسيم سوق التغليف المعبأ على أساس نوع المنتج والمادة وقناة التوزيع والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع المنتج

- صواني

- الأكياس

- كرتون

- آحرون

على أساس نوع المنتج، يتم تقسيم سوق التغليف في أوروبا إلى صواني وأكياس وكرتون وغيرها.

مادة

- حيوان أليف

- البولي بروبلين

- رقائق الألومنيوم

- بولي أميد (PA)

- الورق والكرتون

- إيفوه

- آحرون

على أساس المادة، تم تقسيم سوق التغليف المعوج في أوروبا إلى PET، والبولي بروبيلين، ورقائق الألومنيوم، والبولي أميد (PA)، والورق والكرتون، وEVOH وغيرها.

قناة التوزيع

- غير متصل

- متصل

على أساس قناة التوزيع، تم تقسيم سوق التغليف المعبأ في أوروبا إلى سوق غير متصل بالإنترنت وسوق عبر الإنترنت.

الاستخدام النهائي

- طعام

- المشروبات

- المستحضرات الصيدلانية

- آحرون

على أساس الاستخدام النهائي، تم تقسيم سوق التغليف المعبأ في أوروبا إلى الأغذية والمشروبات والأدوية وغيرها.

تحليل/رؤى إقليمية لسوق التغليف

يتم تحليل سوق التغليف المعبأ وتوفير رؤى حجم السوق والاتجاهات حسب نوع المنتج والمادة وقناة التوزيع وصناعة الاستخدام النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق التغليف المعبأ هي المملكة المتحدة وألمانيا وفرنسا وإسبانيا وإيطاليا وهولندا وسويسرا وروسيا وبلجيكا وتركيا ولوكسمبورج وبقية أوروبا،

تهيمن ألمانيا على سوق التغليف في أوروبا، وذلك بسبب زيادة الاستثمارات في نمو التغليف. بالإضافة إلى ذلك، من المتوقع أن يكون الطلب في هذه المنطقة مدفوعًا بزيادة الطلب على التغليف من قبل الأغذية والمشروبات.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل حصة السوق للمنافسة والتغليف

يوفر المشهد التنافسي لسوق التغليف المعبأ تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في أوروبا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق التغليف المعبأ.

بعض اللاعبين الرئيسيين العاملين في سوق التغليف المعوج هم Coveris، FLAIR Flexible Packaging Corporation، IMPAK CORPORATION، PORTCO PACKAGING، Constantia Flexibles، Mondi، Tetra Pak، Clifton Packaging Group Limited، وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 introduction

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE RETORT PACKAGING MARKET

1.4 Currency and Pricing

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 geographicAL scope

2.3 years considered for the study

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 primary interviews with key opinion leaders

2.6 DBMR MARKET POSITION GRID

2.7 vendor share analysis

2.8 Multivariate Modeling

2.9 PRODUCT type timeline curve

2.1 MARKET APPLICATION COVERAGE GRID

2.11 secondary sourcEs

2.12 assumptions

3 EXECUTIVE SUMMARY

4 premium insights

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 overview

4.1.2 development of advanced smart packaging products

4.1.3 temperature balancing smart packaging

4.1.4 smart packaging to improve consumer safety

4.2 regulations

4.2.1 overview

4.2.2 Food and Drug Administration

4.2.3 european Food Packaging Regulations

4.2.4 Food Safety and Standards Authority of India (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 production consumption analysis

4.6 import-export scenario

4.7 porter’s five force analysis

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 market overview

5.1 drivers

5.1.1 increasing demand among consumers for preservative-free products

5.1.2 rising demand for sustainable and aesthetic packaging solutions

5.1.3 growing demand for intelligent packaging to avoid food wastage

5.1.4 growing consumption of packaged products

5.2 restraints

5.2.1 high costS associated with research and development activities

5.2.2 availability of ALTERNATIVES IN THE MARKET

5.3 opportunities

5.3.1 ban on plastic packaging products in the Europe market

5.3.2 recent innovation and new product launches

5.3.3 increasing cases of food contamination

5.4 challenge

5.4.1 supply chain disruption due to pandemic

6 EUROPE Retort packaging market, BY product type

6.1 overview

6.2 Pouches

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 Trays

6.4 cartons

6.5 others

7 EUROPE Retort packaging market, BY Material

7.1 overview

7.2 PET

7.3 Polypropylene

7.4 ALUMINIUM Foil

7.5 Polyamide (PA)

7.6 Paper & Paperboard

7.7 EVOH

7.8 Others

8 EUROPE Retort packaging market, BY Distribution channel

8.1 overview

8.2 Offline

8.3 Online

9 EUROPE Retort packaging market, BY End-Use

9.1 overview

9.2 Food

9.2.1 Ready to Eat Meals

9.2.2 Meat, Poultry, & Sea Food

9.2.3 Pet Food

9.2.4 Baby Food

9.2.5 Soups & Sauces

9.2.6 Spices & Condiments

9.2.7 Others

9.3 Beverages

9.3.1 NON-ALCOHOLIC

9.3.2 Alcoholic

9.4 Pharmaceuticals

9.5 Others

10 Europe Retort packaging Market, by REGION

10.1 Europe

10.1.1 GERMANY

10.1.2 ITALY

10.1.3 FRANCE

10.1.4 SPAIN

10.1.5 U.K.

10.1.6 RUSSIA

10.1.7 BELGIUM

10.1.8 SWITZERLAND

10.1.9 NETHERLANDS

10.1.10 TURKEY

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE Retort packaging market: COMPANY landscape

11.1 company share analysis: EUROPE

12 swot analysis

13 company profile

13.1 Tetra Pak

13.1.1 COMPANY snapshot

13.1.2 company share analysis

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 Sealed Air

13.2.1 COMPANY snapshot

13.2.2 REVENUE ANALYSIS

13.2.3 company share analysis

13.2.4 Product PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 Sonoco Products Company

13.3.1 COMPANY snapshot

13.3.2 REVENUE ANALYSIS

13.3.3 company share analysis

13.3.4 Product PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 proampac

13.4.1 COMPANY snapshot

13.4.2 company share analysis

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 Amcor plc

13.5.1 COMPANY snapshot

13.5.2 REVENUE ANALYSIS

13.5.3 company share analysis

13.5.4 Product PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 berry Europe inc.

13.6.1 COMPANY snapshot

13.6.2 COMPANY snapshot

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 Clifton Packaging Group Limited

13.7.1 COMPANY snapshot

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 Constantia Flexibles

13.8.1 COMPANY snapshot

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 coveris

13.9.1 COMPANY snapshot

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP America, LLC.

13.10.1 COMPANY snapshot

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 flair flexible packaging corporation

13.11.1 COMPANY snapshot

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 Floeter India Retort Pouches (P) Ltd

13.12.1 COMPANY snapshot

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 Huhtamaki

13.13.1 COMPANY snapshot

13.13.2 REVENUE ANALYSIS

13.13.3 Product PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 impak corporation

13.14.1 COMPANY snapshot

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY snapshot

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 Mondi

13.16.1 COMPANY snapshot

13.16.2 REVENUE ANALYSIS

13.16.3 Product PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 Paharpur 3P

13.17.1 COMPANY snapshot

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 portco packaging

13.18.1 COMPANY snapshot

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 Printpack

13.19.1 COMPANY snapshot

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY snapshot

13.20.2 REVENUE ANALYSIS

13.20.3 Product PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 questionnaire

15 related reports

List of Table

TABLE 1 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 EUROPE CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 EUROPE PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 EUROPE POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 EUROPE ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 EUROPE POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 EUROPE PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 EUROPE EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 EUROPE OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 EUROPE ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 EUROPE FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 GERMANY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 GERMANY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 GERMANY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 ITALY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 ITALY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 ITALY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 FRANCE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 FRANCE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 FRANCE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 SPAIN POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 SPAIN FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 U.K. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 U.K. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 U.K. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 116 RUSSIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 119 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 121 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 123 RUSSIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 125 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 127 BELGIUM POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 130 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 132 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 134 BELGIUM FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 138 SWITZERLAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 141 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 143 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 145 SWITZERLAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 SWITZERLAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 149 NETHERLANDS POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 152 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 154 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 156 NETHERLANDS FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 158 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 160 TURKEY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 162 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 163 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 165 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 167 TURKEY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 171 LUXEMBURG POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 173 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 174 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 176 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 177 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 178 LUXEMBURG FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 179 LUXEMBURG BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 180 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 EUROPE RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE RETORT PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 EUROPE RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE EUROPE RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE EUROPE RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF EUROPE RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 EUROPE RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 EUROPE RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 EUROPE RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 EUROPE RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 EUROPE RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.