سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز، حسب الشكل (مسحوق / حبيبي، مواد ليفية، أفلام، وغيرها)، التطبيق (التحكم في الترسبات ومعالجتها، تحفيز الآبار الأفقية، إزالة الجبس ، إذابة النفثينات المعدنية، إزالة المواد العضوية القابلة للذوبان في الماء، التكسير الهيدروليكي، أدوات الحفر، إدارة الضغط، التحكم في الآبار، استخراج النفط ، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2029.

تحليل السوق والحجم

حمض البولي جليكوليك (PGA) هو بوليمر قابل للتحلل البيولوجي يتكون من بوليستر أليفاتي خطي بسيط. يتم تصنيع حمض البولي جليكوليك من مونومرات حمض الجليكوليك من خلال التكثيف المتعدد أو البلمرة بفتح الحلقة. إنه بوليمر يتحلل بكميات كبيرة وله قابلية ذوبان منخفضة في الماء والمذيبات العضوية بسبب درجة بلوريته العالية. المكون شديد البلورية وبالتالي فهو يقدم نقطة انصهار عالية وقابلية ذوبان منخفضة في المذيبات العضوية.

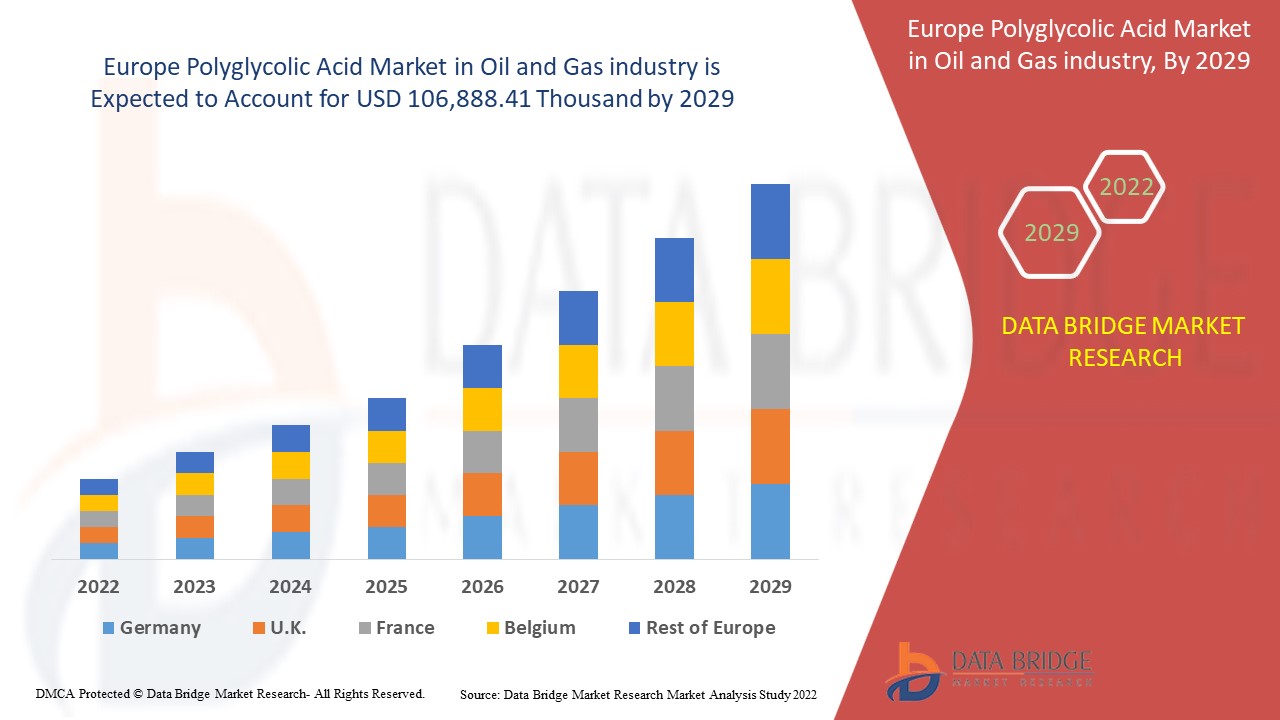

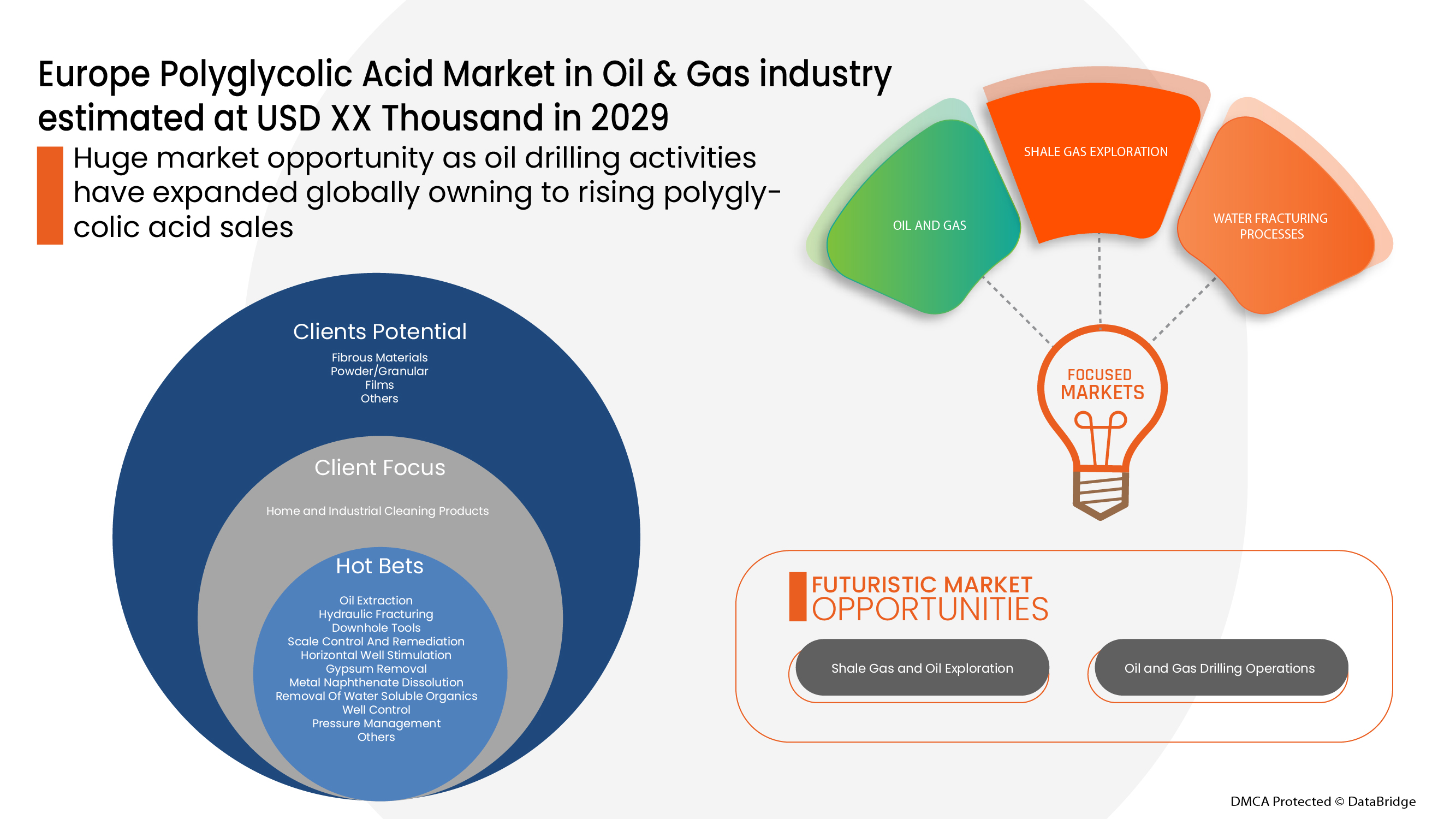

يعتبر حمض البولي جليكوليك مفيدًا للغاية في أنشطة حفر النفط. تحلل شركة Data Bridge Market Research أن سوق حمض البولي جليكوليك في صناعة النفط والغاز من المتوقع أن تصل قيمته إلى 106،888.41 ألف دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 4.6٪ خلال الفترة المتوقعة. تمثل المواد الليفية "شريحة الشكل الأكثر بروزًا في السوق المعنية بسبب الارتفاع في أنشطة حفر النفط. يتضمن تقرير السوق الذي أعده فريق Data Bridge Market Research تحليلًا متعمقًا من الخبراء، وتحليل الاستيراد / التصدير، وتحليل التسعير، وتحليل استهلاك الإنتاج، وسيناريو سلسلة المناخ.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي، الأحجام بالألف طن، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب الشكل (مسحوق/حبيبات، مواد ليفية، أغشية وغيرها) والتطبيق (التحكم في الترسبات ومعالجتها، تحفيز الآبار الأفقية، إزالة الجبس، إذابة النفثينات المعدنية، إزالة المواد العضوية القابلة للذوبان في الماء، التكسير الهيدروليكي، أدوات الحفر، إدارة الضغط، التحكم في الآبار، استخراج النفط وغيرها) |

|

البلد المغطى |

روسيا، المملكة المتحدة، بلجيكا، ألمانيا، إيطاليا، فرنسا، إسبانيا، هولندا، تركيا، سويسرا وبقية أوروبا |

|

الجهات الفاعلة في السوق المشمولة |

شركة كوريها وشركة كيمورز |

تعريف السوق

يتمتع حمض البولي جليكوليك (PGA) ببنية كيميائية مشابهة لحمض PLA ولكن بدون المجموعة الجانبية الميثيلية، مما يسمح لسلاسل البوليمر بالتجمع معًا بإحكام وينتج عنه درجة عالية من التبلور، وثبات حراري عالي، وحاجز غازي عالي بشكل استثنائي، بالإضافة إلى قوة وصلابة ميكانيكية عالية. حمض البولي جليكوليك قابل للتحلل البيولوجي بسرعة ويمكن تحويله إلى سماد بنسبة 100% وله خصائص جوهرية مثل قابلية عالية للماء، وتحلل سريع، وعدم قابلية للذوبان في معظم المذيبات العضوية.

الإطار التنظيمي

- US9303118B2: طريقة تحضير بولي (حمض الجليكوليك) (PGA) من المواد الخام C1 أول أكسيد الكربون والفورمالديهايد أو ما يعادلهما. من خلال التحكم في نسب تغذية المونومر المشترك ودرجات حرارة البلمرة، يمكن تحضير بولي (حمض الجليكوليك) عالي الجودة. تمتد الطريقة إلى البوليمرات المشتركة لبولي (حمض الجليكوليك) حيث يتم تضمين أكاسيد الألكيلين أو المونومرات الأثيرية الحلقية في خليط البلمرة مع المونومرات C1 لإنتاج اللدائن الحرارية المصنوعة من البوليستر الأثيري.

توفر هذه المعايير التأهيل لإنتاج PGA والبروتوكولات والمبادئ التوجيهية التي تضمن مستوى عالٍ من الأمان وتصدق على المواد للاستخدام.

كان لـ COVID-19 تأثير ضئيل على سوق حمض البولي جليكوليك في صناعة النفط والغاز في أوروبا

أثرت جائحة كوفيد-19 على العديد من الصناعات التحويلية في عام 2020-2021 حيث أدت إلى إغلاق أماكن العمل وتعطيل سلاسل التوريد والقيود المفروضة على النقل. ومع ذلك، لوحظ تأثير كبير على سوق حمض البولي جليكوليك. كانت عمليات وسلسلة توريد حمض البولي جليكوليك، مع وجود العديد من مرافق التصنيع، لا تزال تعمل في المنطقة. واصل مقدمو الخدمة تقديم حمض البولي جليكوليك باتباع تدابير التعقيم والسلامة في سيناريو ما بعد كوفيد.

تتضمن ديناميكيات السوق لسوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز ما يلي:

العوامل المحركة/الفرص التي تواجه سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز

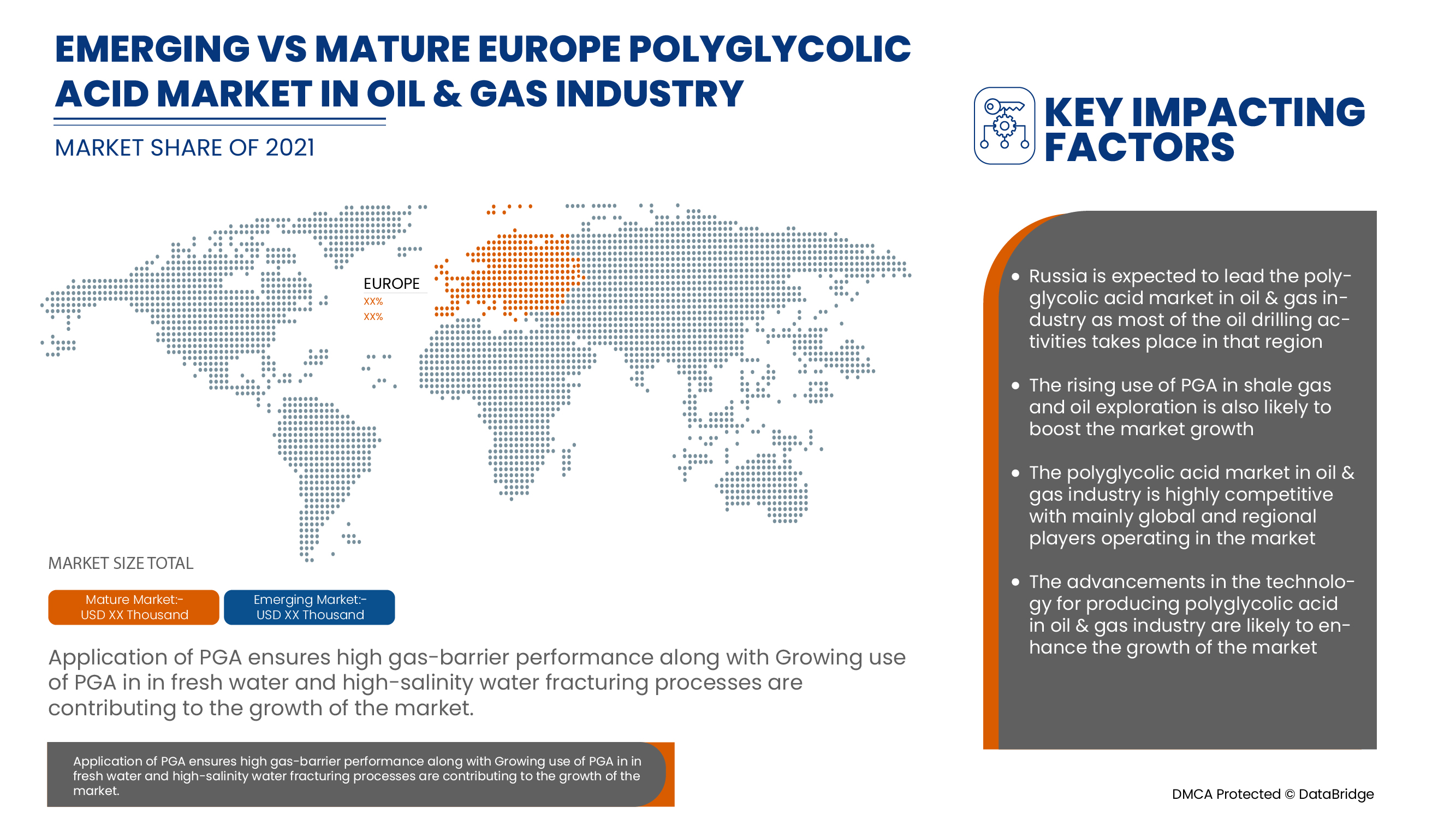

- الاستخدام المتزايد لـ PGA في التنقيب عن الغاز الصخري والنفط

مع تقدم تكنولوجيا الاستخراج، أدى إنتاج الغاز الصخري إلى وفرة جديدة من إمدادات الغاز الطبيعي في جميع أنحاء العالم على مدى العقد الماضي، ومن المتوقع أن يستمر ذلك في المستقبل المنظور. بشكل عام، غالبًا ما يؤدي زيادة الإنتاج المحلي لموارد الطاقة إلى زيادة الإمدادات وانخفاض الأسعار، وتقليل الحاجة إلى الواردات وتعزيز أمن الطاقة في البلدان. في الختام، حددت وحدات إنتاج استكشاف الغاز هدفًا طموحًا لزيادة المساحة قيد الاستكشاف والإنتاج بهدف زيادة الإنتاج المحلي من النفط والغاز. وهذا بدوره يزيد الطلب على حمض البولي جليكوليك وبالتالي يساهم في نمو سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز.

- تزايد عمليات حفر النفط والغاز في جميع أنحاء العالم

إن ارتفاع أنشطة حفر النفط يوفر فوائد لكل من الاقتصاد الأوروبي والبيئة الأوروبية. يتطلب حفر النفط عملية تنقية تجعل المنتجات البترولية صالحة للاستخدام في جميع أنحاء العالم. تتطلب تقنيات حفر النفط حمض البولي جليكوليك الذي يستخدم بعد ذلك للتحكم في تلوث الهواء، وخاصة لإزالة المواد الجسيمية الضارة من الغازات العادمة في المنشآت الصناعية ومحطات توليد الطاقة. في الختام، يمكن أن يؤدي استخدام حمض البولي جليكوليك في المرشحات الصناعية والمرسبات إلى إزالة عدد من عناصر العادم الجسيمية مثل دخان الفحم أو الزيت، وكعكة الملح، ومستخلصات اللب الكيميائية، والعناصر الغازية. وهذا بدوره يزيد الطلب على حمض البولي جليكوليك وبالتالي يساهم في نمو سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز.

- الاستخدام المتزايد لـ PGA في عمليات التكسير في المياه العذبة والمياه عالية الملوحة

يُنظر إلى الطفرة في إنتاج النفط والغاز من خلال التكسير الهيدروليكي ، أو التكسير، على أنها نعمة لتلبية احتياجات العالم من الطاقة. يمكن أن تكون المياه المنتجة من آبار الوقود الأحفوري ملوحة من ثلاثة إلى ستة أضعاف ملوحة مياه البحر ويمكن إزالة هذا الملح بفعالية من خلال سلسلة من مراحل التحليل الكهربائي. في الختام، يمكن أن يعمل حمض البولي جليكوليك أيضًا كحمض بطيء الإطلاق من خلال التحلل، مما يتيح تحلل أو تنشيط أنواع مختلفة من سوائل التشطيب. هذا بدوره خلق فرصة لسوق حمض البولي جليكوليك وبالتالي تسريع نمو سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز.

- ارتفاع في أنشطة البحث والتطوير في PGA

إن عمليات النفط والغاز التي يتم إجراؤها في مناطق مختلفة تعمل على تحسين مستوى معيشة المجتمع من خلال تعزيز التنمية المستدامة للمناطق المهمشة غالبًا حيث توجد وحدات الإنتاج عادةً. في الآونة الأخيرة، كانت حكومات البلدان المختلفة تستثمر في أنشطة البحث للعديد من السوائل المستخدمة في إنتاج الغاز بما في ذلك حمض البولي جليكوليك لتطوير الإدارة البيئية جنبًا إلى جنب مع التركيز على تكاليف البنية التحتية لاستضافة عمليات النفط والغاز في المناطق المعينة. وفي الختام، تعطي حكومات البلدان النامية أيضًا الأولوية لتطوير شبكات CGD لتعزيز توزيع الغاز المحلي إلى قطاعات بابوا غينيا الجديدة (المحلية) والغاز الطبيعي المضغوط (النقل). وهذا بدوره خلق فرصة لسوق حمض البولي جليكوليك وبالتالي تسريع نمو سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز.

القيود/التحديات التي تواجه سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز

- ارتفاع تكلفة الإنتاج لـ PGA

إن زيادة كفاءة الحفر والتشطيب والتحول إلى آبار أطول لاستخراج الغاز مع مراحل تشطيب أكثر تعقيدًا تميل إلى رفع تكاليف النفط والغاز الطبيعي، مما يؤثر على سوق إمدادات الحفر والتشطيب، مما يؤثر على عمليات الحفر. نظرًا لأن امتلاك الأراضي للاستكشاف مكلف، والحفر هو في بعض الأحيان شرط من شروط العقد، فإن الشركات تحفر في الحقل وتحافظ على تشغيل البئر حتى لو انخفضت الأسعار. كما هو الحال مع أي صناعة لاستخراج الموارد، لا يمكن تعطيل الإنتاج، وبالتالي فإن الطلب على العمالة وتكاليف المعدات والإيجار والمزيد يستمر في النمو حتى عندما ينخفض الإنتاج وبالتالي زيادة التكاليف الإجمالية لاستكشاف الغاز. بالإضافة إلى ذلك، فإن إشراك أنواع مختلفة من المعدات والآلات التي تستخدم حمض البولي جليكوليك لاستخراج النفط والغاز من مستوى سطح البحر العميق يشمل تكاليف إنتاج ضخمة. وهذا بدوره يعيق نمو سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز.

- تقلبات أسعار الغاز الطبيعي

إن تقلبات أسعار الغاز الطبيعي هي وظيفة العرض والطلب في السوق. والبدائل للغاز الطبيعي محدودة، وخاصة في الأمد القريب. وهذا يعني أن أي تغيير في العرض أو الطلب على الغاز الطبيعي، حتى على مدى فترات قصيرة، يمكن أن يؤدي إلى تغييرات كبيرة في الأسعار. وبسبب قيود البنية الأساسية لإمدادات الغاز الطبيعي والقيود المفروضة على قدرة العديد من مستهلكي الغاز الطبيعي على تغيير الوقود بسرعة، فإن الزيادات قصيرة الأجل في الطلب و/أو التخفيضات في العرض قد تتسبب في تغييرات كبيرة في أسعار الغاز الطبيعي. وفي الختام، تجبر الظروف الجوية النموذجية مصافي الغاز الطبيعي على إبطاء الإنتاج أو إيقافه خلال الفترات التي تشكل فيها الأحداث الجوية تهديدًا للعمال والمرافق. وهذا بدوره يقلل من الطلب على حمض البولي جليكوليك وبالتالي يعيق نمو سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز.

يقدم تقرير سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز هذا تفاصيل عن التطورات الحديثة الجديدة واللوائح التجارية وتحليل الاستيراد والتصدير وتحليل الإنتاج وتحسين سلسلة القيمة وحصة السوق وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغيرات في لوائح السوق وتحليل نمو السوق الاستراتيجي وحجم السوق ونمو سوق الفئات ومنافذ التطبيق والهيمنة وموافقات المنتجات وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول سوق مبيدات القوارض، اتصل بـ Data Bridge Market Research للحصول على موجز محلل. سيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

التطورات الأخيرة

- في يوليو 2021، قامت شركة KUREHA CORPORATION ببناء مصنع جديد لفلوريد البولي فينيلدين ("PVDF") في شركتها التابعة المملوكة بالكامل، Kureha Changshu Fluoropolymers Co.، في الصين. وقد مكن هذا الشركة من تعزيز مكانتها في منطقة آسيا والمحيط الهادئ.

- في أبريل 2022، أعلنت شركة Chemours أنها ستستضيف ندوة عبر الإنترنت للمستثمرين في 16 مايو 2022 مع التركيز على قطاع الحلول الحرارية والمتخصصة وتسليط الضوء على الديناميكيات العلمانية ومحركات الأعمال الرئيسية والمبادرات الاستراتيجية للنمو. وقد ساعد هذا بدوره الشركة على جذب المزيد من العملاء في جميع أنحاء العالم.

نطاق سوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز

يتم تقسيم سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز على أساس الشكل والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

استمارة

- المواد الليفية

- مسحوق/حبيبي

- الأفلام

- آحرون

بناءً على الشكل، يتم تقسيم سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز إلى مسحوق/حبيبات، ومواد ليفية، وأفلام وغيرها.

طلب

- استخراج النفط

- التكسير الهيدروليكي

- أدوات الحفر

- التحكم في الترسبات ومعالجتها

- تحفيز الآبار الأفقية

- إزالة الجبس

- إذابة النفثينات المعدنية

- إزالة المواد العضوية القابلة للذوبان في الماء

- التحكم في الآبار

- إدارة الضغط

- آحرون

على أساس التطبيق، يتم تقسيم سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز إلى التحكم في الترسبات ومعالجتها، وتحفيز الآبار الأفقية، وإزالة الجبس، وإذابة النفثينات المعدنية، وإزالة المواد العضوية القابلة للذوبان في الماء، والتكسير الهيدروليكي، وأدوات البئر، وإدارة الضغط، والتحكم في الآبار، واستخراج النفط وغيرها.

تحليل/رؤى إقليمية لسوق حمض البولي جليكوليك في صناعة النفط والغاز

يتم تقسيم سوق حمض البولي جليكوليك الأوروبي في صناعة النفط والغاز على أساس الشكل والتطبيق.

تشمل الدول الأوروبية التي تستورد حمض البولي جليكوليك في صناعة النفط والغاز روسيا والمملكة المتحدة وبلجيكا وألمانيا وإيطاليا وفرنسا وإسبانيا وهولندا وتركيا وسويسرا وبقية دول أوروبا. وقد سيطرت روسيا على السوق بسبب زيادة أنشطة حفر النفط في البلاد.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وسوق حمض البولي جليكوليك في أوروبا في صناعة النفط والغاز

يقدم سوق حمض البولي جليكوليك الأوروبي في المشهد التنافسي لصناعة النفط والغاز تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أوروبا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الأنابيب البلاستيكية في المملكة العربية السعودية.

اللاعبون العاملون في سوق حمض البولي جليكوليك في صناعة النفط والغاز هم شركة KUREHA CORPORATION وشركة Chemours.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.2 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, PESTEL ANALYSIS

4.2.1 OVERVIEW

4.2.2 POLITICAL FACTORS

4.2.3 ECONOMIC FACTORS

4.2.4 SOCIAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.2.7 LEGAL FACTORS

4.2.8 CONCLUSION

4.3 BUYERS’ LIST

4.4 SUPPLIERS LIST (GLYCOLIC ACID)

4.5 PORTER’S FIVE FORCES:

4.6 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, RAW MATERIALS COVERAGE

4.7 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, REGULATION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 VENDOR SELECTION CRITERIA

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS IN PRODUCTION

4.10.1 CONVENTIONAL METHOD/ MELTING OF GLYCOLIC ACID OLIGOMER(GAO)

4.10.2 DEHYDRATING REACTION

4.10.3 RING-OPENING POLYMERIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING USE OF PGA IN SHALE GAS AND OIL EXPLORATION

5.1.2 INCREASING OIL AND GAS DRILLING OPERATIONS AROUND THE WORLD

5.1.3 APPLICATION OF PGA ENSURES HIGH GAS-BARRIER PERFORMANCE

5.2 RESTRAINTS

5.2.1 HIGH COST OF PRODUCTION FOR PGA

5.2.2 STRICT GOVERNMENT REGULATIONS OF THE OIL AND GAS SECTORS

5.3 OPPORTUNITIES

5.3.1 RISE IN R&D ACTIVITIES OF PGA

5.3.2 GROWING USE OF PGA IN FRESH WATER AND HIGH-SALINITY WATER FRACTURING PROCESSES

5.4 CHALLENGES

5.4.1 FLUCTUATIONS IN THE PRICES OF NATURAL GAS

5.4.2 VOLATILITY OF OIL PRICES

6 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM

6.1 OVERVIEW

6.1.1 FIBROUS MATERIALS

6.1.2 POWDER/GRANULAR

6.1.3 FILMS

6.1.4 OTHERS

7 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION

7.1 OVERVIEW

7.1.1 OIL EXTRACTION

7.1.2 HYDRAULIC FRACTURING

7.1.3 DOWNHOLE TOOLS

7.1.4 SCALE CONTROL AND REMEDIATION

7.1.5 HORIZONTAL WELL STIMULATION

7.1.6 GYPSUM REMOVAL

7.1.7 METAL NAPHTHENATE DISSOLUTION

7.1.8 REMOVAL OF WATER SOLUBLE ORGANICS

7.1.9 WELL CONTROL

7.1.10 PRESSURE MANAGEMENT

7.1.11 OTHERS

8 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY GEOGRAPHY

8.1 EUROPE

8.1.1 RUSSIA

8.1.2 U.K.

8.1.3 BELGIUM

8.1.4 GERMANY

8.1.5 ITALY

8.1.6 FRANCE

8.1.7 SPAIN

8.1.8 NETHERLANDS

8.1.9 TURKEY

8.1.10 SWITZERLAND

8.1.11 REST OF EUROPE

9 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: EUROPE

9.1.1 EXPANSIONS

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 KUREHA CORPORATION

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 THE CHEMOURS COMPANY

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 BUYERS’ LIST EUROPELY (POTENTIONAL BUYERS/CURRENT BUYERS)

TABLE 2 SUPPLIERS LIST (EUROPELY)

TABLE 3 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 5 EUROPE FIBROUS MATERIALS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE FIBROUS MATERIALS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 7 EUROPE POWDER/GRANULAR IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE POWDER/GRANULAR IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 9 EUROPE FILMS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE FILMS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 11 EUROPE OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 13 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 15 EUROPE OIL EXTRACTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE OIL EXTRACTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 17 EUROPE HYDRAULIC FRACTURING IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE HYDRAULIC FRACTURING IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 19 EUROPE DOWNHOLE TOOLS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE DOWNHOLE TOOLS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 21 EUROPE SCALE CONTROL AND REMEDIATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE SCALE CONTROL AND REMEDIATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 23 EUROPE HORIZONTAL WELL STIMULATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE HORIZONTAL WELL STIMULATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 25 EUROPE GYPSUM REMOVAL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE GYPSUM REMOVAL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 27 EUROPE METAL NAPHTHENATE DISSOLUTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE METAL NAPHTHENATE DISSOLUTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 29 EUROPE REMOVAL OF WATER SOLUBLE ORGANICS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE REMOVAL OF WATER SOLUBLE ORGANICS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 31 EUROPE WELL CONTROL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE WELL CONTROL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 33 EUROPE PRESSURE MANAGEMENT IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE PRESSURE MANAGEMENT IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 35 EUROPE OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 37 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY COUNTRY, 2020-2029 (THOUSAND KILO)

TABLE 39 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 41 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 43 RUSSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 44 RUSSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 45 RUSSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 RUSSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 47 U.K. POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 U.K. POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 49 U.K. POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 U.K. POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 51 BELGIUM POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 BELGIUM POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 53 BELGIUM POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 BELGIUM POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 55 GERMANY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 56 GERMANY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 57 GERMANY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 GERMANY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 59 ITALY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 60 ITALY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 61 ITALY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 ITALY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 63 FRANCE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 65 FRANCE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 67 SPAIN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 68 SPAIN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 69 SPAIN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 SPAIN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 71 NETHERLANDS POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 NETHERLANDS POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 73 NETHERLANDS POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 NETHERLANDS POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 75 TURKEY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 TURKEY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 77 TURKEY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 TURKEY POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 79 SWITZERLAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 SWITZERLAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 81 SWITZERLAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 SWITZERLAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 83 REST OF EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 REST OF EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

List of Figure

FIGURE 1 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: SEGMENTATION

FIGURE 2 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: DATA TRIANGULATION

FIGURE 3 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: DROC ANALYSIS

FIGURE 4 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: FORM LIFE LINE CURVE

FIGURE 7 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: MULTIVARIATE MODELLING

FIGURE 8 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASING OIL AND GAS DRILLING OPERATIONS AROUND THE WORLD IS DRIVING THE EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 FIBROUS MATERIALS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY IN 2022 & 2029

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 POLYGLYCOLIC ACID MANUFACTURING FOR OIL & GAS INDUSTRY - SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY

FIGURE 20 NATURAL GAS RESERVES BY COUNTRY (MMCF) IN 2017

FIGURE 21 PERCENTAGE BREAKDOWN OF COST SHARES FOR ONSHORE OIL AND NATURAL GAS DRILLING AND COMPLETION

FIGURE 22 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2021

FIGURE 23 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2021

FIGURE 24 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: SNAPSHOT (2021)

FIGURE 25 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY COUNTRY (2021)

FIGURE 26 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY COUNTRY (2022 & 2029)

FIGURE 27 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY COUNTRY (2021 & 2029)

FIGURE 28 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY FORM (2022-2029)

FIGURE 29 EUROPE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.