سوق تنقية الهواء الداخلي في أوروبا، حسب المنتج (جامعي الغبار والمكانس الكهربائية، جامعو الدخان والأبخرة، مزيلات الضباب، الروائح الكريهة والغازات الضارة، عوادم الحرائق والطوارئ والفيروسات والفطريات) الفئة (غرفة صغيرة، غرفة متوسطة، غرفة كبيرة) التكنولوجيا (HEPA، الرواسب الكهروستاتيكية، الكربون المنشط، المرشحات الأيونية وغيرها) الوظيفة (يدوي، مستشعر وغيرها) المواد (البلاستيك والمعادن) نطاق السعر (منخفض، متوسط، ممتاز) قناة التوزيع (البيع المباشر، التجارة الإلكترونية، محلات السوبر ماركت / هايبر ماركت، المتاجر المتخصصة وغيرها) التطبيق (الصناعية والتجارية والسكنية) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم سوق تنقية الهواء الداخلي في أوروبا

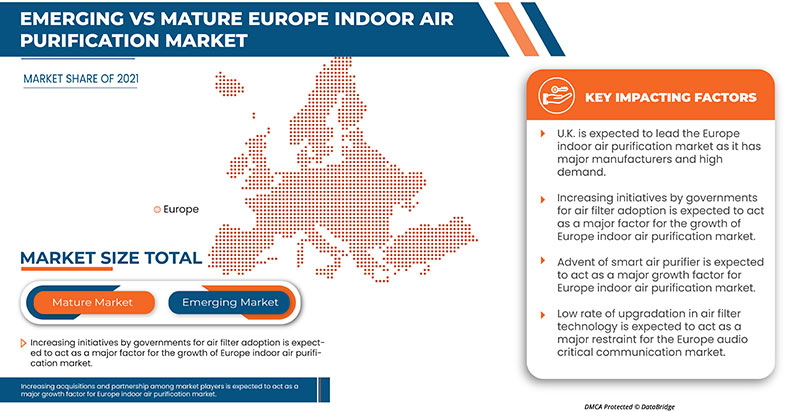

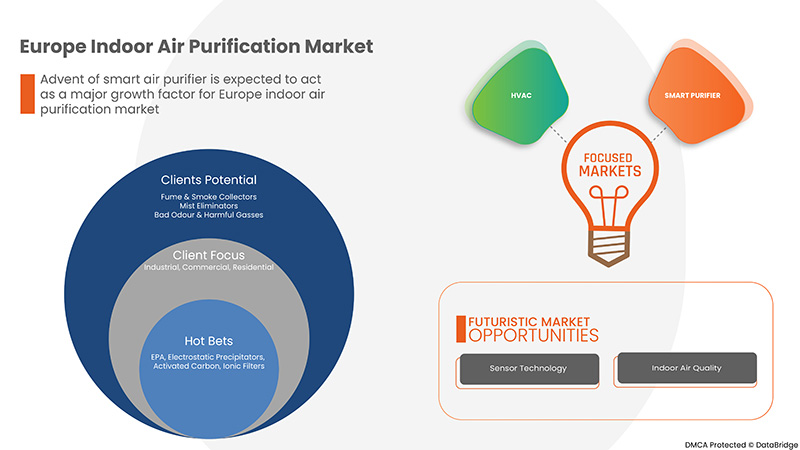

إن الاستخدام المتزايد لتنقية الهواء لاحتواء الملوثات المحمولة جوًا وظهور أجهزة تنقية الهواء الذكية هي التي تدفع سوق تنقية الهواء الداخلي في أوروبا. بالإضافة إلى ذلك، سمح النمو في قطاع التجارة الإلكترونية باختراق أكبر لأجهزة تنقية الهواء في جميع أنحاء العالم، كما أدى التحسن في تكنولوجيا الاستشعار إلى تصغير حجم أجهزة تنقية الهواء . ومع ذلك، من المتوقع أن تعمل التكلفة العالية المرتبطة بأجهزة تنقية الهواء والمخاوف المختلفة المتعلقة بأجهزة تنقية الهواء كقيد للسوق. علاوة على ذلك، فإن التقلبات المستمرة في أسعار المواد الخام وارتفاع استهلاك الكهرباء مما يؤدي إلى ارتفاع تكلفة الكهرباء بسبب أجهزة تنقية الهواء تشكل تحديًا لنمو السوق. بالإضافة إلى ذلك، أدى انخفاض معدل الترقية في تكنولوجيا فلتر الهواء إلى إبطاء السوق. ومع ذلك، من المتوقع أن يوفر ارتفاع الطلب على فلتر الهواء بسبب الوعي الصحي بين المستهلكين والمبادرات المتزايدة من قبل الحكومات لتبني فلتر الهواء فرصًا لنمو سوق تنقية الهواء الداخلي في أوروبا.

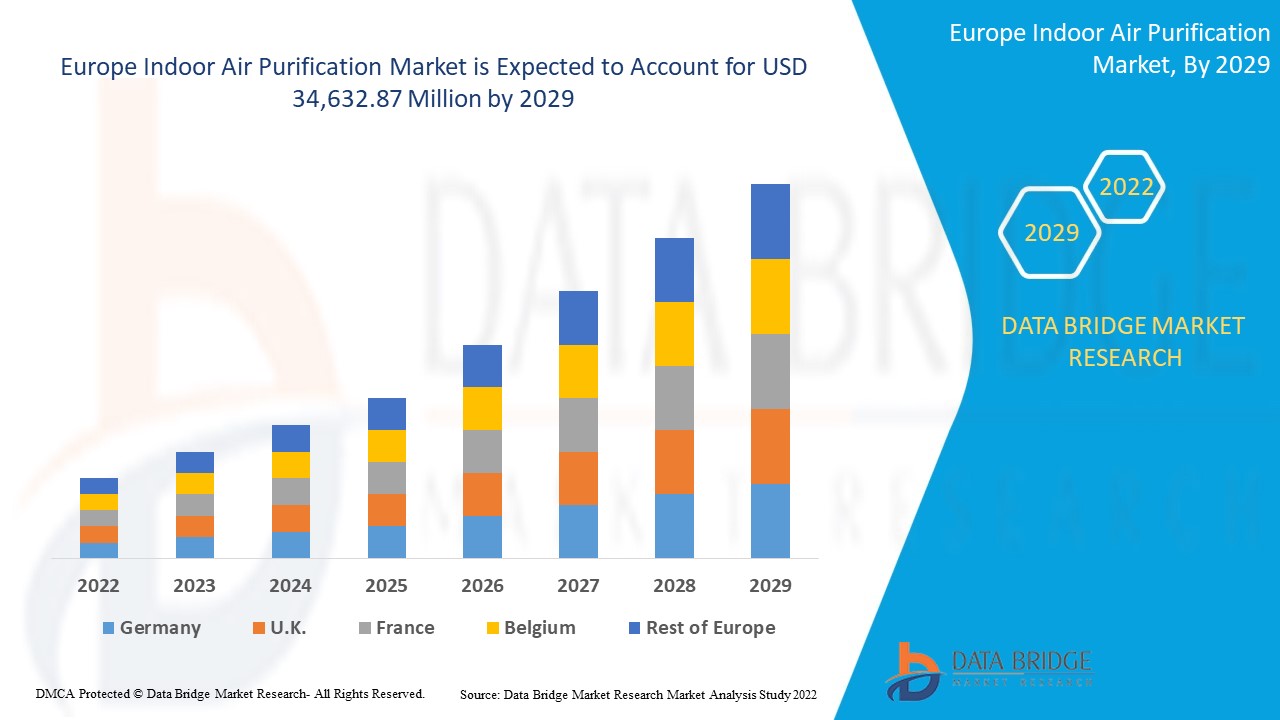

تحلل شركة Data Bridge Market Research أن سوق تنقية الهواء الداخلي من المتوقع أن تصل قيمته إلى 34,632.87 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب يبلغ 7.9% خلال الفترة المتوقعة. يشكل قطاع الحلول أكبر قطاع عروض في سوق تنقية الهواء. يغطي تقرير سوق تنقية الهواء الداخلي أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

فترة التنبؤ |

2022 – 2029 |

|

سنوات تاريخية |

2020 |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب المنتج (جامعي الغبار والمكانس الكهربائية، جامعو الدخان والأبخرة، مزيلات الضباب، الروائح الكريهة والغازات الضارة، عوادم الحرائق والطوارئ والفيروسات والفطريات) الفئة (غرفة صغيرة، غرفة متوسطة، غرفة كبيرة) التكنولوجيا (HEPA، أجهزة ترسيب الكهروستاتيكية، الكربون المنشط، المرشحات الأيونية وغيرها) الوظيفة (يدوي، مستشعر وغيرها) المادة (بلاستيك ومعادن) نطاق السعر (منخفض، متوسط، ممتاز) قناة التوزيع (البيع المباشر، التجارة الإلكترونية، محلات السوبر ماركت/الهايبر ماركت، المتاجر المتخصصة وغيرها) التطبيق (صناعي، تجاري وسكني)، المنطقة (أمريكا الشمالية، أوروبا، آسيا والمحيط الهادئ، الشرق الأوسط، أفريقيا وأمريكا الجنوبية)، اتجاهات الصناعة والتوقعات حتى عام 2029 |

|

الدول المغطاة |

ألمانيا، فرنسا، المملكة المتحدة، هولندا، سويسرا، بلجيكا، روسيا، إيطاليا، إسبانيا، تركيا، بقية دول أوروبا في أوروبا |

|

الجهات الفاعلة في السوق المشمولة |

Koninklijke Philips NV؛ LG Electronics، Panasonic Corporation، DAIKIN INDUSTRIES ltd.، Aerus LLC، Legend Brands، xpower، Abatement Technologies، Omnitech Design، B-AIR، Pulllman-Ermator؛ Envirco، AEROSPACE AMERICA, INC.؛ Camfil؛ Carrier، Hamilton Beach Brands, Inc.؛ Whirlpool، Lifa Air Ltd.، NIKRO INDUSTRIES, INC. وCOWAY CO. LTD. من بين شركات أخرى |

تعريف السوق

تتم تنقية الهواء الداخلي من خلال منتجات مثل أجهزة الترطيب وأجهزة تنقية الهواء وأجهزة إزالة الرطوبة في القطاعات الصناعية والتجارية والسكنية. يتم تطوير وإنتاج هذه المنتجات بهدف تغيير جودة الهواء الداخلي، في غرفة فردية أو داخل منطقة. تكون هذه المنتجات صغيرة الحجم عادةً بحيث يمكن نقلها بكفاءة، ولا تتطلب تركيبات في حالة الاستخدام السكني. تحظى عناصر جودة الهواء باهتمام وطلب كبيرين من الطب التكميلي والبديل (CAM) ذي التأثيرات الشرقية. الطب التكميلي والبديل هو مجموعة من العلاجات والمعالجات وأنظمة الصحة؛ القديمة والجديدة؛ يمكن تحديدها عادةً كممارسات صحية وعافية تقع خارج نطاق الطب الغربي العادي وعادات المستهلك الغربي. مع نمو معرفة المستهلك والاهتمام بجودة الهواء الأفضل، هناك فرصة كبيرة للشركات المصنعة والشركات لوضع عناصر جودة الهواء كمنتجات ضرورية للمنزل والمكتب وفي المساحات التجارية.

ديناميكيات سوق تنقية الهواء الداخلي

يتناول هذا القسم فهم محركات السوق والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- زيادة استخدام أجهزة تنقية الهواء لاحتواء الملوثات المحمولة جواً

الأمراض المحمولة جواً هي أمراض تنتقل عن طريق كائنات دقيقة تنتقل عن طريق الهواء. وقد تنتشر هذه الكائنات عن طريق العطس أو السعال أو رش السوائل أو انتشار الغبار أو أي نشاط يؤدي إلى توليد جزيئات محمولة في الهواء. وهناك العديد من الأمراض المحمولة جواً والتي لها أهمية سريرية وتشمل البكتيريا والفيروسات والفطريات. وقد تنتشر الكائنات الدقيقة عن طريق العطس أو السعال أو رش السوائل أو انتشار الغبار أو أي نشاط يؤدي إلى توليد جزيئات محمولة في الهواء. ويمكن أن تنتشر الكائنات الدقيقة التي تنتقل عن طريق الهواء عن طريق رذاذ ناعم أو غبار أو رذاذ أو سوائل. بالإضافة إلى ذلك، قد تتولد الجزيئات المحمولة جواً من مصدر عدوى، مثل إفرازات جسم مريض مصاب أو حتى حيوان. وغالباً ما تظل الجزيئات المحمولة جواً معلقة في تيارات الهواء وقد تنتقل لمسافات كبيرة، على الرغم من أن العديد من الجزيئات سوف تسقط في الجوار. ومع زيادة المسافة التي تقطعها جزيئات الرذاذ، يزداد خطر الإصابة بالعدوى. تتطلب الاحتياطات المتعلقة بالهواء منع العدوى واستخدام التدخلات المتاحة في المرافق الصحية لمنع انتقال الجسيمات المحمولة جوًا مثل مرشحات الهواء. عند استخدامها بشكل صحيح، يمكن لمنظفات الهواء ومرشحات التدفئة والتهوية وتكييف الهواء أن تساعد في تقليل الملوثات المحمولة جوًا بما في ذلك الفيروسات في مبنى أو مساحة صغيرة. يعد استخدام جهاز تنقية الهواء لاحتواء الملوثات المحمولة جوًا والعدوى سببًا في زيادة الطلب على جهاز تنقية الهواء على مستوى العالم؛ حيث يعمل كمحرك لسوق تنقية الهواء الداخلي في أوروبا.

- ظهور جهاز تنقية الهواء الذكي

تم استخدام أجهزة تنقية الهواء منذ القرن العشرين، في البداية للأغراض الصناعية ولكن مع ارتفاع مستويات التلوث في جميع أنحاء العالم وظهور الحلول التكنولوجية؛ زاد استخدامها. إن ارتفاع مستوى تلوث الهواء في المناطق الحضرية يشكل مصدر قلق رئيسي لصحة شريحة كبيرة من المجتمع. وبالتوازي مع ذلك، أدى استخدام التكنولوجيا من أجل زيادة الكفاءة وتسهيل استخدام مرشح الهواء إلى تطوير أجهزة تنقية الهواء الذكية. تتيح أجهزة تنقية الهواء الذكية للمستخدم مراقبة جودة الهواء الداخلي والتحكم فيها من خلال تطبيق مخصص في الهاتف الذكي. يساعد المنتج أيضًا في تتبع جودة الهواء الداخلي على مدار فترة زمنية مما يمكن المستهلكين من ملاحظة وقت اليوم بأفضل وأسوأ جودة للهواء. وهذا يزيد من تأثيره على المستخدم، ونتيجة لذلك فإن الطلب على أجهزة تنقية الهواء الذكية يتزايد في جميع أنحاء الدول مما يدفع السوق

- النمو في قطاع التجارة الإلكترونية

التجارة الإلكترونية (أو التجارة الإلكترونية) هي شراء وبيع السلع أو الخدمات عبر الإنترنت. وهي تشمل مجموعة واسعة من البيانات والأنظمة والأدوات للمشترين والبائعين عبر الإنترنت، بما في ذلك التسوق عبر الهاتف المحمول وتشفير الدفع عبر الإنترنت. في الوقت الحالي، تستخدم معظم الشركات التي لديها حضور عبر الإنترنت متجرًا و/أو منصة عبر الإنترنت لإجراء أنشطة التسويق والمبيعات للتجارة الإلكترونية والإشراف على الخدمات اللوجستية والوفاء بالمتطلبات مما يؤدي إلى النمو السريع لقطاعات التجارة الإلكترونية. مع نمو قطاع التجارة الإلكترونية، أصبحت القدرة على شراء المنتجات وفقًا لمتطلبات العميل أسهل ويمكن للشركات أيضًا إدراج السلع بأسعار تنافسية على منصات التجارة الإلكترونية المتعددة لتوسيع إمكانية الوصول إلى السوق. الطلب المتزايد على أجهزة تنقية الهواء في المناطق الحضرية بسبب مزاياها؛ عززت الوظيفة مبيعاتها على مواقع التجارة الإلكترونية مثل أمازون وشوبيفاي وفليب كارت. يعمل نمو قطاع التجارة الإلكترونية بشكل إيجابي على سوق تنقية الهواء الداخلي في أوروبا حيث يمكن للعميل رؤية جميع أجهزة تنقية الهواء المتاحة برمز بريدي ومقارنتها ويمكنه طلب أفضل ما يناسب متطلباته وميزانيته. وهكذا، فإن نمو قطاع التجارة الإلكترونية يؤثر إيجابًا على نمو سوق تنقية الهواء الداخلي في أوروبا.

فرص

-

ارتفاع الطلب على فلتر الهواء نتيجة الوعي الصحي بين المستهلكين

عند مقارنتها بالهواء الخارجي، يمكن أن تكون مستويات تلوث الهواء الداخلي أعلى بخمس مرات. سواء في راحة منازلهم أو مكان عملهم، يقضي الناس أكثر من 90٪ من وقتهم في الداخل. ترتبط جودة الهواء الداخلي (IAQ) والصحة والرفاهية ارتباطًا وثيقًا. إن استنشاق الهواء الخالي من الملوثات لا يحسن نوعية الحياة فحسب، بل يقلل أيضًا من خطر الإصابة بعدوى الجهاز التنفسي، ويقلل من خطر الإصابة بمجموعة متنوعة من الأمراض المزمنة. لدى المنظمات، ولا سيما American Air Filter (AAF)، عدد من الخيارات للتواصل مع الجمهور المستهدف وإعلامهم بجودة الهواء الداخلي وأهميته. إن زيادة وعي المستهلك تجاه التأثير الصحي مثل تهيج العينين والأنف والحنجرة والصداع والدوخة والتعب وأمراض الجهاز التنفسي وأمراض القلب والسرطان يخلق احتمالًا لنمو سوق أجهزة تنقية الهواء العالمية. تعد مرشحات الهواء واحدة من الأسواق المتنامية في جميع أنحاء العالم. مع تزايد وعي الناس بالحاجة إلى تنفس هواء نظيف خالٍ من المواد المسببة للحساسية والكائنات الحية الدقيقة المسببة للأمراض، زاد الطلب على أجهزة تنقية الهواء بشكل كبير في السنوات الأخيرة.

القيود/التحديات

- أجهزة تنقية الهواء المرتبطة بالتكلفة العالية

تزداد أهمية أجهزة تنقية الهواء مع تدهور جودة الهواء الخارجي والداخلي بسبب التوسع الحضري السريع، مما يؤدي إلى زيادة العدوى/الأمراض المحمولة جوًا في جميع أنحاء العالم. أصبح تلوث الهواء مصدر قلق أكثر خطورة فيما يتعلق بالمخاطر الصحية، حيث ارتبط بحوالي 7 ملايين حالة وفاة في عام 2012 وفقًا لتقرير حديث لمنظمة الصحة العالمية. تكشف البيانات الجديدة أيضًا عن وجود صلة أقوى بين التعرض لتلوث الهواء الداخلي والخارجي وأمراض القلب والأوعية الدموية، مثل السكتات الدماغية وأمراض القلب الإقفارية، وكذلك بين تلوث الهواء والسرطان. نظرًا لأن التلوث الداخلي والخارجي يؤثران على الصحة، فإن المستهلكين يميلون إلى أجهزة تنقية الهواء من أجل الحصول على جودة هواء داخلي جيدة. سمح هذا للشركة المصنعة بزيادة التكلفة المرتبطة بأجهزة تنقية الهواء من خلال زيادة ميزاتها التكنولوجية؛ من أجل تلبية الطلب العالمي. هذه التكلفة العالية المرتبطة بأجهزة تنقية الهواء وأجهزة تنقية الهواء الذكية؛ تحد من نمو سوقها حيث لا تستطيع الطبقة المتوسطة تحمل إنفاق الكثير على المعدات. وهذا في النهاية يعمل كقيد لنمو سوق تنقية الهواء الداخلي في أوروبا.

التطورات الأخيرة

- في أغسطس 2022، أعلنت شركة Carrier عن خطتها لتقديم حزمة بدء تشغيل الهواء الصحي بكثرة للجامعات وأماكن الترفيه والمدارس والمؤسسات العقارية التجارية. بموجب هذه الخطة، ستوفر الشركة طريقة بسيطة وسريعة وفعالة من حيث التكلفة لمراقبة وتصور والتفاعل مع المكونات غير المرئية لجودة الهواء الداخلي (IAQ)، مما يساعد في دعم صحة شاغلي المباني. من خلال هذه الخطوة، تهدف الشركة إلى زيادة هيمنتها على سوق تنقية الهواء الداخلي في أوروبا

- في يونيو 2021، أعلنت شركة Hamilton Beach Brands, Inc. عن شراكتها مع شركة Clorox Company. وبموجب الاتفاقية، تخطط شركة Hamilton Beach Brands لإطلاق مجموعة من أجهزة تنقية الهواء الفاخرة تحت العلامة التجارية Clorox والتي ستزيل 99.97% من المواد المسببة للحساسية والجسيمات من حبوب اللقاح والغبار والدخان. ومن المتوقع أن يسمح هذا للشركة باستخدام ترخيص شركة Clorox للمنتج الذي تقدمه لسوق تنقية الهواء الداخلي.

نطاق سوق تنقية الهواء الداخلي

يتم تقسيم سوق تنقية الهواء الداخلي على أساس المنتج والفئة والتكنولوجيا والوظيفة والمواد الخارجية ونطاق السعر وقناة التوزيع والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب المنتج

- جامعات الغبار والمكانس الكهربائية

- مجمعات الدخان والأبخرة

- مزيلات الضباب

- رائحة كريهة وغازات ضارة

- عادم الحرائق والطوارئ

- الفيروسات والفطريات

على أساس المنتج، يتم تقسيم سوق تنقية الهواء الداخلي إلى جامعي الغبار والمكانس الكهربائية؛ جامعي الدخان والأبخرة؛ مزيلات الضباب؛ الروائح الكريهة والغازات الضارة؛ عوادم الحرائق والطوارئ والفيروسات والفطريات.

حسب الفئة

- غرفة صغيرة

- غرفة متوسطة الحجم

- غرفة كبيرة

على أساس الفئة، يتم تقسيم سوق تنقية الهواء الداخلي إلى غرفة صغيرة وغرفة متوسطة وغرفة كبيرة

حسب التكنولوجيا

- مرشح هواء عالي الكفاءة

- المترسبات الكهروستاتيكية

- الكربون المنشط

- المرشحات الأيونية

- آحرون

على أساس التكنولوجيا، يتم تقسيم سوق تنقية الهواء الداخلي إلى HEPA؛ والمترسبات الكهروستاتيكية؛ والكربون المنشط؛ والمرشحات الأيونية وغيرها.

حسب الوظيفة

- يدوي

- المستشعر

- آحرون

على أساس الوظيفة، يتم تقسيم سوق تنقية الهواء الداخلي إلى يدوي، ومستشعر وغيرها.

حسب المادة الخارجية

- بلاستيك

- معدن

على أساس المادة الخارجية، يتم تقسيم سوق تنقية الهواء الداخلي إلى البلاستيك والمعادن.

حسب نطاق السعر

- قليل

- منتصف

- غالي

على أساس نطاق السعر، يتم تقسيم سوق تنقية الهواء الداخلي إلى منخفض ومتوسط ومتميز.

حسب قناة التوزيع

- البيع المباشر

- التجارة الإلكترونية

- محلات السوبر ماركت/الهايبر ماركت

- المتاجر المتخصصة

- آحرون

على أساس قناة التوزيع، يتم تقسيم سوق تنقية الهواء الداخلي إلى البيع المباشر؛ التجارة الإلكترونية؛ محلات السوبر ماركت/الهايبر ماركت؛ المتاجر المتخصصة وغيرها.

حسب الطلب

- صناعي

- تجاري

- سكني

على أساس التطبيق، يتم تقسيم سوق تنقية الهواء الداخلي إلى صناعي وتجاري وسكني.

تحليل/رؤى إقليمية لسوق تنقية الهواء الداخلي

يتم تحليل سوق تنقية الهواء الداخلي، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والمنتج والفئة والتكنولوجيا والوظيفة والمادة الخارجية ونطاق السعر وقناة التوزيع والتطبيق، كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق تنقية الهواء الداخلي هي ألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية دول أوروبا في أوروبا.

وفي أوروبا، من المتوقع أن تهيمن ألمانيا على السوق بسبب النمو في قطاع التجارة الإلكترونية.

يقدم قسم الدولة في التقرير أيضًا عوامل فردية تؤثر على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، وتحليل الاتجاهات الفنية لقوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل حصة السوق التنافسية وتنقية الهواء الداخلي

يوفر المشهد التنافسي لسوق تنقية الهواء الداخلي تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق تنقية الهواء الداخلي.

بعض اللاعبين الرئيسيين العاملين في السوق هم Koninklijke Philips NV؛ LG Electronics، Panasonic Corporation، DAIKIN INDUSTRIES ltd.، Aerus LLC، Legend Brands، xpower، Abatement Technologies، Omnitech Design، B-AIR، Pulllman-Ermator؛ Envirco، AEROSPACE AMERICA، INC.؛ Camfil؛ Carrier، Hamilton Beach Brands، Inc.؛ Whirlpool، Lifa Air Ltd.، NIKRO INDUSTRIES، INC. وCOWAY CO. LTD. من بين آخرين.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE INDOOR AIR PURIFICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTERS MODEL

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3.1 PHOTOELECTROCHEMICAL OXIDATION

4.3.2 HIGH-EFFICIENCY PARTICULATE AIR PURIFIERS

4.3.3 ACTIVATED CARBON

4.3.4 ELECTROSTATIC PRECIPITATOR

4.3.5 IONIC FILTERS

4.3.6 AUTOMATED AIR PURIFICATION SYSTEM

4.4 VENDOR SELECTION CRITERIA

4.5 REGULATORY STANDARD

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF AIR PURIFIERS TO CONTAIN AIRBORNE CONTAMINANTS

6.1.2 ADVENT OF SMART AIR PURIFIER

6.1.3 GROWTH IN E- COMMERCE SECTOR

6.1.4 IMPROVEMENT IN SENSOR TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS ASSOCIATED WITH AIR PURIFIERS

6.2.2 RISING CONCERNS REGARDING AIR PURIFIER

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR AIR FILTER DUE TO HEALTH AWARENESS AMONG CONSUMERS

6.3.2 MORE OF PARTNERSHIP AND ACQUISITION AMONGST MARKET PLAYERS

6.3.3 INCREASING INITIATIVES BY GOVERNMENTS FOR AIR FILTER ADOPTION

6.4 CHALLENGES

6.4.1 CONTINUOUS FLUCTUATIONS IN THE PRICES OF RAW MATERIALS

6.4.2 HIGH ELECTRICITY CONSUMPTION LEADING TO HIGH ELECTRICITY COST

6.4.3 LOW RATE OF UPGRADATION IN AIR FILTER TECHNOLOGY

7 EUROPE INDOOR AIR PURIFICATION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 DUST COLLECTORS & VACCUMS

7.3 FUME & SMOKE COLLECTORS

7.4 VIRUSES & FUNGUS

7.5 BAD ODOUR & HARMFUL GASES

7.6 MIST ELIMINATORS

7.7 FIRE & EMERGENCY EXHAUST

8 EUROPE INDOOR AIR PURIFICATION MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 LARGE ROOM

8.3 MEDIUM ROOM

8.4 SMALL ROOM

9 EUROPE INDOOR AIR PURIFICATION MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 SENSOR

9.3 MANUAL

9.4 OTHERS

10 EUROPE INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 HEPA

10.3 ACTIVATED CARBON

10.4 ELECTROSTATIC PRECIPITATORS

10.5 IONIC FILTERS

10.6 OTHERS

11 EUROPE INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.2.1 POLYCARBONATE (PC)

11.2.2 ABS

11.2.3 POLYVINYL CHLORIDE (PVC)

11.2.4 HIGH-DENSITY POLYETHYLENE (PE)

11.2.5 OTHERS

11.3 METAL

11.3.1 STAINLESS STEEL

11.3.2 ALUMINIUM

11.3.3 OTHERS

12 EUROPE INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE

12.1 OVERVIEW

12.2 MID

12.3 LOW

12.4 PREMIUM

13 EUROPE INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 E-COMMERCE

13.3 SPECIALTY STORES

13.4 DIRECT SELLING

13.5 SUPERMARKETS/HYPERMARKETS

13.6 OTHERS

14 EUROPE INDOOR AIR PURIFICATION MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COMMERCIAL

14.3 RESIDENTIAL

14.4 INDUSTRIAL

15 EUROPE INDOOR AIR PURIFICATION MARKET, BY REGION

15.1 EUROPE

15.1.1 U.K.

15.1.2 GERMANY

15.1.3 FRANCE

15.1.4 ITALY

15.1.5 TURKEY

15.1.6 SPAIN

15.1.7 RUSSIA

15.1.8 SWITZERLAND

15.1.9 BELGIUM

15.1.10 NETHERLANDS

15.1.11 REST OF EUROPE

16 EUROPE INDOOR AIR PURIFICATION MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 PANASONIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 DAIKIN INDUSTRIES, LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 LG ELECTRONICS

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 HONEYWELL INTERNATIONAL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KONINKLIJKE PHILIPS N.V

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ABATEMENT TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AEROSPACE AMERICA, INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AERUS LLC

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 B-AIR

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 CAMFIL

18.10.3 COMPANY SNAPSHOT

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 CARRIER (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 COWAY CO. LTD. (2021)

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 ENVIRCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 HAMILTON BEACH BRANDS, INC. (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 LEGEND BRANDS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LIFA AIR LTD. (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 NIKRO INDUSTRIES, INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 OMNITEC DESIGN

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PULLMAN-ERMATOR

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 WHIRLPOOL (2021)

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 XPOWER.COM

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 AIR PURIFIER AND COST ASSOCIATED WITH THEM IN USD

TABLE 2 COMPARISON OF THE ENERGY CONSUMPTION OF HOME APPLIANCES AND ELECTRONICS

TABLE 3 EUROPE INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE DUST COLLECTORS & VACCUMS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE FUME & SMOKE COLLECTORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE VIRUSES & FUNGUS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE BAD ODOUR & HARMFUL GASES IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE MIST ELIMINATORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE FIRE & EMERGENCY EXHAUST IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 11 EUROPE LARGE ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE MEDIUM ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SMALL ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE SENSOR IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE MANUAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE INDOOR AIR PURIFICATION MARKET , BY TECHNOLOGY 2020-2029 (USD MILLION)

TABLE 19 EUROPE HEPA IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE ACTIVATED CARBON IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE ELECTROSTATIC PRECIPITATORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE IONIC FILTERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 25 EUROPE PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE METAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE MID IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE LOW IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE PREMIUM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 EUROPE E-COMMERCE IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE SPECIALTY STORES IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE DIRECT SELLING IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE SUPERMARKETS/HYPERMARKETS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE COMMERCIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE RESIDENTIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE INDUSTRIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE INDOOR AIR PURIFICATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 EUROPE INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 EUROPE IN INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 EUROPE INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 48 EUROPE INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 49 EUROPE PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 EUROPE INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.K. INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 U.K. INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 56 U.K. INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 U.K. INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 58 U.K. INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 U.K. PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 62 U.K. INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 U.K. INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 GERMANY INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 GERMANY INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 66 GERMANY INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 67 GERMANY INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 68 GERMANY INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 GERMANY PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 GERMANY METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 72 GERMANY INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 GERMANY INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 FRANCE INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 FRANCE INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 FRANCE INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 78 FRANCE INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 FRANCE PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 FRANCE INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 ITALY INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 ITALY INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 86 ITALY INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 ITALY INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 88 ITALY INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 ITALY PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 92 ITALY INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 ITALY INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 TURKEY INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 TURKEY INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 96 TURKEY INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 97 TURKEY INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 98 TURKEY INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 TURKEY PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 TURKEY METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 TURKEY INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 TURKEY INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 TURKEY INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 SPAIN INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 SPAIN INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 106 SPAIN INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 SPAIN INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 108 SPAIN INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 SPAIN PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SPAIN METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 SPAIN INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 112 SPAIN INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 113 SPAIN INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 118 RUSSIA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 137 BELGIUM INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 138 BELGIUM INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 REST OF EUROPE INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE INDOOR AIR PURIFICATION MARKET: SEGMENTATION

FIGURE 2 EUROPE INDOOR AIR PURIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE INDOOR AIR PURIFICATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE INDOOR AIR PURIFICATION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE INDOOR AIR PURIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE INDOOR AIR PURIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE INDOOR AIR PURIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE INDOOR AIR PURIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE INDOOR AIR PURIFICATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 EUROPE INDOOR AIR PURIFICATION MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF AIR PURIFIER TO CONTAIN AIRBORNE CONTAMINANTS IS EXPECTED TO BE KEY DRIVERS FOR EUROPE INDOOR AIR PURIFICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DUST COLLECTORS & VACUUMS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE INDOOR AIR PURIFICATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE INDOOR AIR PURIFICATION MARKET

FIGURE 14 EUROPE INDOOR AIR PURIFICATION MARKET: BY PRODUCT, 2021

FIGURE 15 EUROPE INDOOR AIR PURIFICATION MARKET: BY CATEGORY, 2021

FIGURE 16 EUROPE INDOOR AIR PURIFICATION MARKET: BY FUNCTION, 2021

FIGURE 17 EUROPE INDOOR AIR PURIFICATION MARKET: BY TECHNOLOGY, 2021

FIGURE 18 EUROPE INDOOR AIR PURIFICATION MARKET: BY OUTER MATERIAL, 2021

FIGURE 19 EUROPE INDOOR AIR PURIFICATION MARKET: BY PRICE RANGE, 2021

FIGURE 20 EUROPE INDOOR AIR PURIFICATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 EUROPE INDOOR AIR PURIFICATION MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE INDOOR AIR PURIFICATION MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE INDOOR AIR PURIFICATION MARKET: BY PRODUCT (2022-2029)

FIGURE 27 EUROPE INDOOR AIR PURIFICATION MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.