Europe Corneal Transplant Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

106.27 Million

USD

165.58 Million

2024

2032

USD

106.27 Million

USD

165.58 Million

2024

2032

| 2025 –2032 | |

| USD 106.27 Million | |

| USD 165.58 Million | |

|

|

|

|

تقسيم سوق زراعة القرنية في أوروبا، حسب نوع الإجراء (زراعة القرنية البطانية، زراعة القرنية النافذة، زراعة القرنية الصفيحية الأمامية (ALK)، زراعة الخلايا الجذعية الطرفية القرنية، زراعة القرنية الاصطناعية، وغيرها)، النوع (قرنية بشرية وصناعية)، نوع المتبرع (طُعم ذاتي وطُعم خيفي)، نوع الطُعم (طُعم جزئي السُمك (صفاحي) وطُعم كامل السُمك (نافذ))، نوع الجراحة (الجراحة التقليدية والجراحة بمساعدة الليزر)، دواعي الاستعمال (ضمور بطانة الأوعية الدموية لفوش، التهاب القرنية المعدي، اعتلال القرنية الفقاعي، القرنية المخروطية، عمليات إعادة الزرع، تندب القرنية، قرح القرنية، وغيرها)، الجنس (أنثى وذكور)، الفئة العمرية (كبار السن، البالغين، والأطفال)، المستخدم النهائي (المستشفيات، عيادات العيون، عيادات الجراحة الخارجية). المراكز والمعاهد الأكاديمية والبحثية وغيرها - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق زراعة القرنية في أوروبا

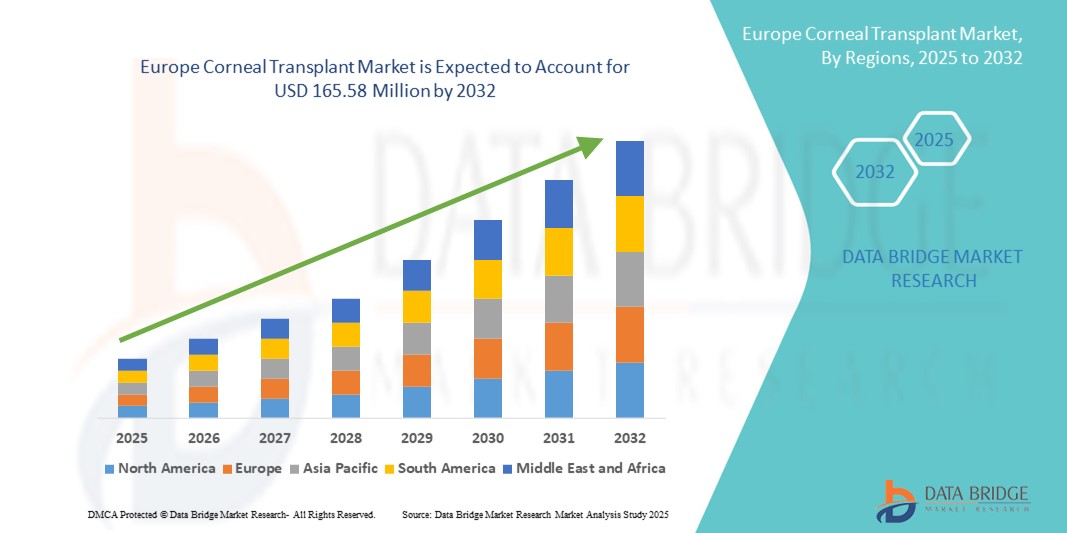

- تم تقييم حجم سوق زراعة القرنية في أوروبا بـ 106.27 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 165.58 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 5.70٪ خلال الفترة المتوقعة

- ينشأ نمو السوق في المقام الأول من خلال الانتشار المتزايد لأمراض القرنية مثل القرنية المخروطية ، واعتلال فوكس ، والتهاب القرنية المعدي، إلى جانب زيادة الوعي وتوافر تقنيات زراعة القرنية المتقدمة مثل DMEK وDSAEK في جميع أنحاء المنطقة.

- بالإضافة إلى ذلك، تُعزز الاستثمارات المتزايدة في البنية التحتية لرعاية العيون، وتوسيع نطاق توفر أنسجة المتبرعين، وسياسات السداد المواتية، فرص الحصول على عمليات زراعة القرنية. تُسهم هذه العوامل مجتمعةً في مسار نمو إيجابي لسوق زراعة القرنية في أوروبا خلال السنوات القادمة.

تحليل سوق زراعة القرنية في أوروبا

- تعد عمليات زرع القرنية، التي تتضمن استبدال أنسجة القرنية التالفة أو المريضة بأنسجة متبرع سليمة، إجراءات أساسية لاستعادة الرؤية وتحسين نوعية الحياة، وخاصة في حالات تندب القرنية أو ترققها أو ضمورها في كل من مؤسسات الرعاية الصحية العامة والخاصة.

- الطلب المتزايد على عمليات زرع القرنية في أوروبا مدفوع في المقام الأول بارتفاع معدل الإصابة باضطرابات القرنية المرتبطة بالعمر والوراثية، والتقدم في التقنيات الجراحية مثل رأب القرنية الصفائحي، وتحسين النتائج بعد الجراحة.

- سيطرت ألمانيا على سوق زراعة القرنية في أوروبا بأكبر حصة إيرادات بلغت 28.5% في عام 2024، بدعم من بنيتها التحتية المتقدمة للرعاية الصحية، وتوافر الأنسجة القوية للمتبرعين من خلال بنوك العيون المنظمة، والحجم الكبير من الإجراءات الطبية العينية التي يتم إجراؤها سنويًا.

- من المتوقع أن تكون بولندا أسرع دولة نموًا في سوق زراعة القرنية خلال الفترة المتوقعة بسبب التحسينات المستمرة في تقديم الرعاية الصحية، وزيادة الوعي حول العمى القرني، وتوسيع نطاق الوصول إلى خدمات زراعة القرنية.

- سيطرت شريحة زراعة القرنية الثاقبة (PK) على سوق زراعة القرنية بحصة سوقية بلغت 46.6% في عام 2024، ويعزى ذلك إلى تطبيقها الواسع في علاج تلف القرنية كامل السُمك واستمرار تفضيلها بين الجراحين لحالات القرنية المعقدة.

نطاق التقرير وتقسيم سوق زراعة القرنية في أوروبا

|

صفات |

رؤى رئيسية حول سوق زراعة القرنية في أوروبا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أوروبا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق زراعة القرنية في أوروبا

"التطورات التكنولوجية في عمليات زراعة القرنية الأقل تدخلاً"

- إن الاتجاه الرئيسي والمتسارع في سوق زراعة القرنية في أوروبا هو التحول نحو التقنيات المتقدمة قليلة التدخل مثل عملية زراعة القرنية باستخدام غشاء ديسيميه (DMEK) وعملية زراعة القرنية باستخدام غشاء ديسيميه الآلي (DSAEK)، والتي توفر أوقات تعافي أسرع ومضاعفات أقل ونتائج بصرية محسنة مقارنة بالطرق التقليدية.

- على سبيل المثال، اعتمد مستشفى جامعة توبنغن للعيون في ألمانيا تقنية DMEK كتقنية مفضلة لعلاج اضطرابات بطانة الأوعية الدموية، محققًا رضا المرضى بشكل أفضل وانخفاضًا في معدلات رفض الطعم. وبالمثل، يستخدم مستشفى مورفيلدز للعيون في المملكة المتحدة تقنية DSAEK بشكل متزايد لمجموعات محددة من المرضى نظرًا لنتائجها المتوقعة ومنحنى التعلم الأقصر للجراحين.

- لقد سهّل تزايد توفر أنسجة المتبرعين المقطوعة مسبقًا عبر بنوك العيون المتخصصة اعتماد هذه التقنيات، مما جعل الإجراءات أكثر سهولةً وفعاليةً في جميع أنظمة الرعاية الصحية. كما تُحسّن تقنيات التصوير المتقدمة، مثل التصوير المقطعي البصري للجزء الأمامي من العين، دقة الجراحة وتقييمات ما بعد الجراحة.

- مع سعي أنظمة الرعاية الصحية في أوروبا إلى تحسين الكفاءة ونتائج المرضى، تستثمر المستشفيات والعيادات بشكل متزايد في التدريب والبنية الأساسية لدعم هذه التقنيات الحديثة

- يُعيد هذا التوجه نحو مناهج جراحية أقل تدخلاً وأكثر استهدافاً تعريف معايير زراعة القرنية، ويُسرّع الانتقال من عمليات زراعة القرنية كاملة السُمك إلى عمليات زراعة القرنية الصفائحية الانتقائية. ونتيجةً لذلك، تُولي المؤسسات الطبية والجراحون في جميع أنحاء أوروبا أولويةً لدمج تقنية DMEK وDSAEK في الرعاية الطبية الروتينية لطب العيون، مما يُعزز الطلب على الأدوات ذات الصلة وتقنيات معالجة أنسجة المتبرعين.

- يعكس التفضيل المتزايد لحلول زراعة القرنية الأقل تدخلاً تحولات أوسع في جراحة العيون، ومن المرجح أن يؤدي ذلك إلى تعزيز نمو السوق على المدى الطويل من خلال تحسين نتائج المرضى وخفض تكاليف الرعاية الصحية.

ديناميكيات سوق زراعة القرنية في أوروبا

سائق

"ارتفاع معدل انتشار اضطرابات القرنية وتوسع برامج التبرع بالأنسجة"

- إن العبء المتزايد لأمراض القرنية مثل القرنية المخروطية، وخلل بطانة الأوعية الدموية فوكس، والندبات المرتبطة بالصدمات هو المحرك الرئيسي للطلب المتزايد على عمليات زرع القرنية في جميع أنحاء أوروبا

- على سبيل المثال، في عام 2024، أبلغت جمعية بنوك العيون الأوروبية (EEBA) عن ارتفاع مطرد في الطلب على قرنيات المتبرع وتوافرها، وخاصة في دول مثل ألمانيا وإيطاليا وهولندا، بسبب زيادة حملات التوعية والتحسينات في أنظمة التبرع بالقرنية.

- إن البرامج الوطنية التي تهدف إلى تحسين معدلات التبرع بالعين، إلى جانب تنفيذ شبكات توزيع الأنسجة المركزية، تعمل على تعزيز كفاءة خدمات زراعة القرنية بشكل كبير.

- بالإضافة إلى ذلك، يساهم شيخوخة السكان في جميع أنحاء أوروبا، الذين هم أكثر عرضة لأمراض العيون التنكسية، في زيادة حجم العمليات الجراحية

- إن توسيع نطاق توافر أنسجة المتبرعين وتبسيط تنسيق عمليات الزراعة عبر المنصات الرقمية يعززان قدرة أنظمة الرعاية الصحية على الاستجابة السريعة لحالات العمى القرني. ونتيجةً لذلك، يتمكن المزيد من المرضى من الحصول على علاج فعال وفي الوقت المناسب، مما يدعم استمرار نمو السوق.

ضبط النفس/التحدي

"مشاكل تهيج الجلد وعائق الامتثال للأنظمة"

- على الرغم من التقدم، لا تزال التفاوتات في الوصول إلى إجراءات زراعة القرنية قائمة في جميع أنحاء أوروبا، وخاصة في بلدان وسط وشرق أوروبا حيث لا تزال البنية التحتية للرعاية الصحية والتدريب الجراحي المتخصص في طب العيون في طور التطور.

- على سبيل المثال، في بلدان مثل رومانيا وبلغاريا، لا يزال الوصول إلى أنسجة المتبرعين عالية الجودة والتقنيات الجراحية المتقدمة مثل DMEK محدودًا بسبب نقص تمويل أنظمة الصحة العامة ونقص جراحي القرنية المدربين.

- علاوة على ذلك، فإن التحديات اللوجستية المتعلقة بنقل الأنسجة عبر الحدود، واللوائح المختلفة حول شراء الأنسجة وزرعها، وهياكل السداد غير المتسقة يمكن أن تعيق كفاءة برامج زراعة الأعضاء وقابليتها للتوسع.

- يمكن أن تؤدي هذه المشكلات النظامية إلى أوقات انتظار أطول للمرضى، ونتائج جراحية دون المستوى الأمثل، والاعتماد على طرق زرع أقدم مثل عملية زراعة القرنية كاملة السُمك، والتي قد تحمل معدلات مضاعفات أعلى

- إن التغلب على هذه الحواجز سيتطلب جهودًا سياسية تعاونية، وزيادة الاستثمار في التدريب والبنية الأساسية، وتوحيد معايير التعامل مع الأنسجة في جميع الدول الأوروبية لضمان الوصول العادل وتحقيق نتائج أفضل على المدى الطويل.

نطاق سوق زراعة القرنية في أوروبا

يتم تقسيم السوق على أساس نوع الإجراء، والنوع، ونوع المتبرع، ونوع الطعم، ونوع الجراحة، والمؤشر، والجنس، والفئة العمرية، والمستخدم النهائي.

- حسب نوع الإجراء

بناءً على نوع الإجراء، يُقسّم سوق زراعة القرنية في أوروبا إلى: زراعة القرنية البطانية، وزراعة القرنية النافذة، وزراعة القرنية الصفيحية الأمامية (ALK)، وزراعة الخلايا الجذعية الطرفية القرنية، وزراعة القرنية الاصطناعية، وغيرها. هيمنت زراعة القرنية النافذة على السوق محققةً أكبر حصة إيرادات بلغت 46.6% في عام 2024، بفضل استمرار استخدامها في علاج أمراض القرنية كاملة السُمك، وانتشار الخبرة الجراحية في جميع أنحاء الدول الأوروبية.

من المتوقع أن يشهد قطاع زراعة القرنية البطانية أسرع معدل نمو في الفترة من 2025 إلى 2032، بدعم من زيادة التبني لعلاج اضطرابات بطانة الأوعية الدموية، وانخفاض معدلات الرفض، والتعافي بشكل أسرع بعد الجراحة.

- حسب النوع

يُقسّم سوق زراعة القرنية في أوروبا، حسب النوع، إلى قرنية بشرية وقرنية صناعية. وقد استحوذ قطاع القرنية البشرية على الحصة السوقية الأكبر في عام ٢٠٢٤، بفضل معدلات النجاح العالية لزراعة القرنية من متبرعين بشريين، والحضور القوي لبرامج التبرع بالعين في دول مثل ألمانيا وفرنسا وإيطاليا.

ومن المتوقع أن يسجل قطاع القرنية الاصطناعية أسرع نمو خلال الفترة المتوقعة، مدفوعًا بالتقدم التكنولوجي في مواد القرنية الاصطناعية واستخدامها في المرضى الذين يعانون من فشل متكرر في الطعم أو مخاطر الرفض.

- حسب نوع المتبرع

بناءً على نوع المتبرع، يُقسّم السوق إلى طُعم ذاتي وطُعم مُستنسخ. وقد هيمن قطاع الطُعم المُستنسخ على السوق في عام ٢٠٢٤، حيث تُشكّل أنسجة المتبرعين من المتوفين المصدرَ الأساسي لمعظم عمليات زراعة القرنية في أوروبا.

ومن المتوقع أن يشهد قطاع الطعم الذاتي أسرع نمو خلال الفترة المتوقعة، وخاصة في الإجراءات التجديدية وتطبيقات زراعة الخلايا الجذعية حيث يتم استخدام أنسجة المريض نفسه لتقليل المخاطر المناعية.

- حسب نوع الطعم

بناءً على نوع الطعوم، يُقسّم السوق إلى طعوم جزئية السُمك (صفائحية) وطعوم كاملة السُمك (نافذة). وقد شكّل قطاع الطعوم كاملة السُمك (نافذة) الحصة الأكبر من الإيرادات في عام ٢٠٢٤، نظرًا لاستخدامه الروتيني في حالات تلف القرنية الشديد أو الكامل.

من المتوقع أن يشهد قطاع الطعوم ذات السُمك الجزئي (Lamellar) أسرع معدل نمو سنوي مركب من عام 2025 إلى عام 2032، بدعم من التفضيل المتزايد لتقنيات Lamellar مثل DMEK و DSAEK، والتي تقدم نتائج سريرية محسنة ومضاعفات أقل.

- حسب نوع الجراحة

بناءً على نوع الجراحة، يُقسّم السوق إلى الجراحة التقليدية والجراحة بمساعدة الليزر. تصدّر قطاع الجراحة التقليدية السوق في عام ٢٠٢٤، ويعود ذلك أساسًا إلى تطبيقه طويل الأمد، وتكاليفه المعقولة، وسهولة الوصول إليه على نطاق أوسع في المستشفيات العامة في جميع أنحاء أوروبا.

من المتوقع أن ينمو قطاع الجراحة بمساعدة الليزر بأعلى معدل خلال فترة التوقعات، مدفوعًا بزيادة الاستثمار في منصات الليزر في طب العيون، وتحسين الدقة الجراحية، وأوقات تعافي المرضى الأقصر.

- حسب الإشارة

بناءً على دواعي الاستعمال، يُقسّم سوق زراعة القرنية في أوروبا إلى: ضمور فوكس البطاني، والتهاب القرنية المعدي، واعتلال القرنية الفقاعي، والقرنية المخروطية، وإجراءات إعادة الزرع، وتندب القرنية، وقرح القرنية، وغيرها. وقد استحوذ ضمور فوكس البطاني على الحصة الأكبر في عام ٢٠٢٤ نظرًا لانتشاره الواسع بين كبار السن، وفعالية زراعة القرنية البطانية في العلاج.

من المتوقع أن ينمو مرض القرنية المخروطية بأسرع معدل خلال فترة التنبؤ، وذلك بسبب تحسن التشخيص المبكر، وزيادة الوعي بين المرضى الأصغر سنا، والزيادة في استخدام عملية رأب القرنية الأمامية لإدارتها.

- حسب الجنس

يُقسّم السوق حسب الجنس إلى ذكور وإناث. وقد هيمنت شريحة الذكور على السوق في عام ٢٠٢٤، متأثرةً بارتفاع معدلات إصابات العين وشدة الأمراض المُبلّغ عنها بين الرجال في عدة مناطق أوروبية.

ومن المتوقع أن ينمو قطاع النساء بشكل مطرد خلال الفترة المتوقعة بسبب زيادة الوصول إلى خدمات العناية بالعيون ومبادرات التوعية التي تستهدف النساء الأكبر سناً المتأثرات باضطرابات القرنية.

- حسب الفئة العمرية

بناءً على الفئات العمرية، يُقسّم السوق إلى فئات عمرية: كبار السن، والبالغين، والأطفال. وسيستحوذ قطاع كبار السن على الحصة الأكبر في عام ٢٠٢٤، إذ يُعدّ كبار السن أكثر عرضة لتنكس القرنية، والضمور، والحالات التي تتطلب زراعة.

من المتوقع أن ينمو قطاع طب الأطفال بمعدل كبير خلال فترة التنبؤ، بسبب التركيز المتزايد على أمراض القرنية الخلقية وتحسين معدلات نجاح العمليات الجراحية لدى الأطفال.

- حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم سوق زراعة القرنية في أوروبا إلى مستشفيات، وعيادات عيون، ومراكز جراحة خارجية، ومعاهد أكاديمية وبحثية، وغيرها. وقد استحوذت المستشفيات على أكبر حصة من الإيرادات في عام ٢٠٢٤ بفضل توافر بنية تحتية شاملة لرعاية العيون، وإمكانية الوصول إلى أطباء عيون مدربين، وارتفاع عدد العمليات الجراحية المُجراة.

ومن المتوقع أن تنمو عيادات العيون بأسرع وتيرة خلال فترة التوقعات، بدعم من زيادة الخصخصة، وإجراءات الجراحة الخارجية، واعتماد أنظمة التصوير القرني المتقدمة والليزر في المرافق المستقلة.

تحليل إقليمي لسوق زراعة القرنية في أوروبا

- سيطرت ألمانيا على سوق زراعة القرنية في أوروبا بأكبر حصة إيرادات بلغت 28.5% في عام 2024، بدعم من بنيتها التحتية المتقدمة للرعاية الصحية، وتوافر الأنسجة القوية للمتبرعين من خلال بنوك العيون المنظمة، والحجم الكبير من الإجراءات الطبية العينية التي يتم إجراؤها سنويًا.

- يستفيد المرضى ومقدمو الرعاية الصحية في الدولة من التشخيص المبكر، والوصول الواسع إلى قرنيات المتبرع، وتوافر التقنيات المتقدمة مثل DMEK وDSAEK، والتي تساهم في تحقيق نتائج سريرية أفضل وتقليل أوقات التعافي.

- ويتم دعم هذا الوجود القوي في السوق من خلال مبادرات الصحة العامة التي تشجع على التبرع بالأعضاء والأنسجة، وجراحي القرنية المهرة، وسياسات السداد المواتية، مما يجعل ألمانيا مركزًا رائدًا لزراعة القرنية في مرافق الرعاية الصحية العامة والخاصة.

نظرة عامة على سوق زراعة القرنية في ألمانيا

استحوذ سوق زراعة القرنية في ألمانيا على أكبر حصة من الإيرادات في سوق زراعة القرنية في أوروبا عام ٢٠٢٤، مدعومًا ببنية تحتية قوية للرعاية الصحية، وشبكات راسخة لبنوك العيون، وإمكانية وصول واسعة النطاق إلى الإجراءات الجراحية المتقدمة مثل DMEK وDSAEK. تساهم حملات التوعية العامة والعدد الكبير من العمليات الجراحية في تعزيز مكانة ألمانيا الرائدة. بالإضافة إلى ذلك، من المتوقع أن تعزز سياسات السداد المواتية والاستثمار في تقنيات طب العيون السوق في البلاد.

نظرة عامة على سوق زراعة القرنية في فرنسا

من المتوقع أن يشهد سوق زراعة القرنية في فرنسا نموًا ملحوظًا خلال فترة التوقعات، بفضل مبادرات الصحة العامة الفعّالة المتعلقة بالتبرع بالأعضاء والحفاظ على البصر. وتستفيد فرنسا من التنسيق المركزي لعمليات الزراعة، وإمكانية الوصول الواسعة إلى قرنيات المتبرعين. ويدعم استخدام الأدوات الجراحية الحديثة في كل من المستشفيات الجامعية وعيادات العيون الخاصة الابتكار في الإجراءات الجراحية وسلامة المرضى.

نظرة عامة على سوق زراعة القرنية في إيطاليا

يبرز سوق زراعة القرنية في إيطاليا كلاعب رئيسي في سوق زراعة القرنية في جنوب أوروبا، مدفوعًا ببرامج التبرع بالعين الوطنية النشطة والاعتماد المتزايد على زراعة القرنية البطانية. وتستثمر المستشفيات ومراكز زراعة القرنية الإيطالية بشكل متزايد في التشخيص الدقيق ومعالجة أنسجة المتبرعين، مما يُحسّن معدلات نجاح عمليات الزرع بشكل عام. ومن المتوقع أن يُحسّن التعاون المُعزز مع بنوك العيون الأوروبية من فرص الحصول على الخدمات ونتائجها.

نظرة عامة على سوق زراعة القرنية في المملكة المتحدة

من المتوقع أن يشهد سوق زراعة القرنية في المملكة المتحدة نموًا ملحوظًا، مدعومًا بأنظمة التبرع التي تنظمها هيئة الخدمات الصحية الوطنية (NHS) والقدرات المتقدمة في رعاية القرنية في المستشفيات المتخصصة مثل مستشفى مورفيلدز للعيون. ويساهم تزايد عدد كبار السن ووجود جراحي عيون ماهرين في زيادة حجم عمليات الزراعة. كما أن التركيز التنظيمي في البلاد على التعامل الآمن مع الأنسجة والابتكار في جراحات العيادات الخارجية يُسهمان بشكل إضافي في توسع السوق.

نظرة عامة على سوق زراعة القرنية في إسبانيا

يشهد سوق زراعة القرنية في إسبانيا طلبًا متزايدًا على عمليات زراعة القرنية، بفضل ازدياد الوعي بأمراض العيون والنمو المستمر في توافر المتبرعين، مدعومًا بإطار التبرع بالأعضاء المعترف به عالميًا. وتوسّع مؤسسات الرعاية الصحية الإسبانية نطاق استخدامها لتقنيات الصفائح، لا سيما في المدن، وتستفيد من التطبيب عن بُعد لتحسين فرص الحصول على الرعاية بعد الجراحة.

نظرة عامة على سوق زراعة القرنية في بولندا

من المتوقع أن ينمو سوق زراعة القرنية في بولندا بأسرع معدل نمو سنوي مركب في سوق زراعة القرنية الأوروبية خلال الفترة المتوقعة، مدفوعًا بتحسين البنية التحتية للرعاية الصحية، وزيادة فرص الوصول إلى جراحي القرنية المؤهلين، والجهود الحكومية الرامية إلى تعزيز خدمات زراعة القرنية. ويساهم التوسع في استخدام تقنيتي DSAEK وDMEK في مستشفيات الرعاية الصحية، وزيادة الدعم من برامج الرعاية الصحية الأوروبية، في تسريع نمو السوق في بولندا.

حصة سوق زراعة القرنية في أوروبا

وتدار صناعة زراعة القرنية في أوروبا بشكل أساسي من قبل شركات راسخة، بما في ذلك:

- شركة كورنياجين (الولايات المتحدة)

- كيرالينك الدولية (الولايات المتحدة)

- أورولاب (الهند)

- شركة AJL لطب العيون (إسبانيا)

- شركة ديوبتكس المحدودة (النمسا)

- شركة جودر أيه جي (ألمانيا)

- شركة هيومان أوبتكس إيه جي (ألمانيا)

- شركة بريسبيا بي إل سي (أيرلندا)

- شركة كيراميد (الولايات المتحدة)

- شركة ألكون (سويسرا)

- شركة كارل زايس ميديتيك إيه جي (ألمانيا)

- شركة بوش + لومب المحدودة (كندا)

- شركة زيمر لأنظمة طب العيون (سويسرا)

- شركة مورشر المحدودة (ألمانيا)

- شركة أوفتيك بي في (هولندا)

- شركة تيرلاب (الولايات المتحدة)

- شركة VSY للتكنولوجيا الحيوية (ألمانيا)

- شركة آيون الطبية المحدودة (إسرائيل)

- شركة ميديفاكوس المحدودة (البرازيل)

- LinkoCare Life Sciences AB (السويد)

ما هي التطورات الأخيرة في سوق زراعة القرنية في أوروبا؟

- في مايو 2024، أعلن مستشفى توبنغن الجامعي الألماني للعيون عن نجاح دمج أدوات التخطيط الجراحي المدعومة بالذكاء الاصطناعي في عمليات زراعة القرنية بتقنية DMEK، بهدف تحسين الدقة ونتائج المرضى في جراحة زراعة القرنية البطانية. يعكس هذا التقدم ريادة ألمانيا المستمرة في تبني الحلول التكنولوجية المتقدمة في طب العيون، والتزامها بتحسين معدلات النجاح ومدة التعافي المرتبطة بزراعات القرنية.

- في أبريل 2024، أطلق مستشفى مورفيلدز للعيون، ومقره المملكة المتحدة، مبادرة تعاونية مع قسم الدم وزراعة الأعضاء في هيئة الخدمات الصحية الوطنية (NHS Blood and Transplant) لزيادة الوعي بالتبرع بأنسجة القرنية في جميع أنحاء إنجلترا. تتضمن الحملة برامج توعية على مستوى البلاد وأدوات تفاعل رقمية مصممة لمعالجة نقص المتبرعين وتبسيط أوقات انتظار عمليات الزرع. تؤكد هذه المبادرة على أهمية التوعية العامة في زيادة توافر الأنسجة لإجراء جراحات تُغير حياة المرضى.

- في مارس 2024، أدخل مستشفى مؤسسة روتشيلد الفرنسي تقنيات ليزر الفيمتو ثانية في رأب القرنية الصفيحي الأمامي (ALK)، ليصبح من أوائل المراكز في أوروبا الغربية التي اعتمدت هذا النهج على نطاق واسع. وقد ارتبطت الدقة التي توفرها هذه الطريقة بتحسين ثبات الطعم وتقليل مضاعفات ما بعد الجراحة، مما يعزز دور فرنسا في الابتكار في جراحة العيون.

- في فبراير 2024، أقامت الجمعية الإيطالية لطب العيون شراكة مع بنوك عيون رائدة في ميلانو وروما لتنفيذ منصة رقمية مركزية لتتبع وتوزيع قرنيات المتبرعين. تعزز هذه المنصة الشفافية، وتقلل من هدر الأنسجة، وتضمن التوزيع العادل، مما يُبرز الخطوات الاستباقية التي اتخذتها إيطاليا نحو التحول الرقمي في لوجستيات زراعة الأعضاء.

- في يناير 2024، خصصت وزارة الصحة البولندية تمويلًا جديدًا لدعم برامج التدريب المتخصصة في زراعة القرنية في المستشفيات الأكاديمية في وارسو وكراكوف. يهدف هذا الاستثمار إلى سد النقص في جراحي القرنية وتوسيع نطاق الإجراءات المتقدمة مثل DSAEK وDMEK، مما يضع بولندا في مكانة رائدة في مجال زراعة القرنية في أوروبا.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.