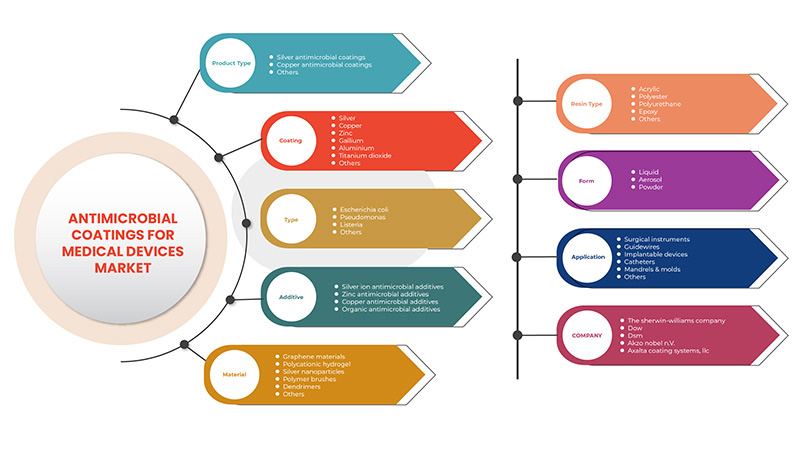

سوق الطلاء المضاد للميكروبات في أوروبا للأجهزة الطبية ، حسب نوع المنتج (طلاء مضاد للميكروبات من الفضة، طلاء مضاد للميكروبات من النحاس، أخرى)، الطلاء (الفضة، الكيتوزان، ثاني أكسيد التيتانيوم، الألومنيوم، النحاس ، الزنك، الجاليوم، أخرى)، النوع (الإشريكية القولونية، الزائفة الزنجارية، الليستيريا، أخرى)، المواد المضافة (مضافات أيون الفضة المضادة للميكروبات، المواد المضافة العضوية المضادة للميكروبات، المواد المضافة النحاسية المضادة للميكروبات، المواد المضافة الزنك المضادة للميكروبات)، المواد (مواد الجرافين، الجسيمات النانوية الفضية، هلام البولي كاتيوني، فرش البوليمر، الشجيرات، أخرى)، نوع الراتينج (الإيبوكسي، الأكريليك، البولي يوريثين، البوليستر، أخرى)، الشكل (سائل، مسحوق، رذاذ)، التطبيق (الأدوات الجراحية، الأجهزة القابلة للزرع، الأسلاك التوجيهية، المغزل والقوالب، القسطرات، أخرى)، اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى

في الوقت الحاضر، يتولى مقدمو الرعاية الصحية مهمة تحسين صحة المرضى مع تقليل خطر الإصابة بالعدوى. وقد أدى انتشار العدوى المكتسبة من المستشفيات إلى زيادة الحاجة إلى استراتيجيات ومنتجات تعمل بنشاط على تقليل خطر إصابة المرضى بالعدوى. وعلى هذا النحو، يُنظر إلى دمج المواد المضافة المضادة للميكروبات في أثاث الرعاية الصحية والمعدات الطبية بشكل متزايد كجزء من الحل للوقاية من العدوى ومكافحتها في بيئات الرعاية الصحية. وعلاوة على ذلك، فقد ارتفع الطلب المتزايد على الأجهزة القابلة للزرع كما ارتفع الطلب على الطلاء المضاد للميكروبات للأجهزة الطبية. ومع ذلك، فإن قيود طلاء أيونات الفضة قد تعيق نمو السوق إلى حد ما.

إن التقدم التكنولوجي المتزايد في الطلاء المضاد للميكروبات يخلق فرصة لنمو سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا في حين أن التأثير الضار للطلاء المضاد للميكروبات على صحة الإنسان قد يخلق تحديًا لنمو السوق.

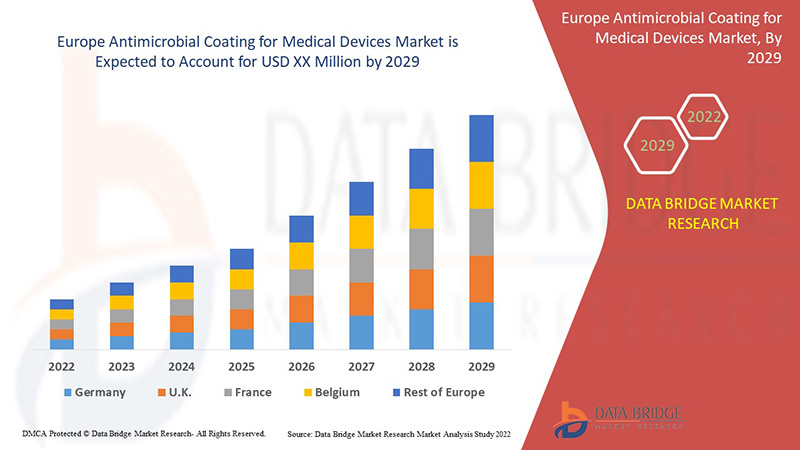

أدى الاستخدام المتزايد للطلاء المضاد للميكروبات للأجهزة الطبية إلى جانب الوعي المتزايد بشأن العدوى المكتسبة من المستشفيات إلى زيادة الطلب عليه. تحلل شركة Data Bridge Market Research أن سوق الطلاء المضاد للميكروبات للأجهزة الطبية سينمو بمعدل نمو سنوي مركب بنسبة 12.4٪ خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

الفترة المتوقعة |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2020 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالكيلو طن، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع المنتج (طلاء مضاد للميكروبات من الفضة، طلاء مضاد للميكروبات من النحاس، أخرى)، الطلاء (الفضة، الكيتوزان، ثاني أكسيد التيتانيوم، الألومنيوم، النحاس، الزنك، الجاليوم، أخرى)، النوع (الإشريكية القولونية، الزائفة الزنجارية، الليستيريا، أخرى)، المواد المضافة (إضافات أيون الفضة المضادة للميكروبات، إضافات عضوية مضادة للميكروبات، إضافات النحاس المضادة للميكروبات، إضافات الزنك المضادة للميكروبات)، المادة (مواد الجرافين، الجسيمات النانوية الفضية، هلام البولي كاتيوني، فرش البوليمر، شجيرات، أخرى)، نوع الراتينج (الإيبوكسي، الأكريليك، البولي يوريثين، البوليستر، أخرى)، الشكل (سائل، مسحوق، رذاذ)، التطبيق (الأدوات الجراحية، الأجهزة القابلة للزرع، الأسلاك التوجيهية، المغزل والقوالب، القسطرات، أخرى) |

|

الدول المغطاة |

ألمانيا، المملكة المتحدة، إيطاليا، فرنسا، إسبانيا، روسيا، تركيا، سويسرا، بلجيكا، هولندا، لوكسمبورج، بقية أوروبا |

|

الجهات الفاعلة في السوق المشمولة |

DSM، PPG Industries, Inc.، Akzo Nobel NV، Specialty Coating Systems Inc، Covalon Technologies Ltd.، AST Products, Inc.، Hydromer، Sciessent LLC، Microban International، Axalta Coating Systems, LLC، Biointeractions Ltd، Sika، Harland Medical Systems, Inc.، Biomerics، BioCote Limited وغيرها |

ديناميكيات سوق الطلاء المضاد للميكروبات للأجهزة الطبية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- ارتفاع الوعي بشأن العدوى المكتسبة من المستشفيات

لقد أدى ارتفاع حالات الإصابة بالعدوى المكتسبة من المستشفيات إلى زيادة العبء على نظام الرعاية الصحية، مما أثار مخاوف متزايدة بشأن صناعة الرعاية الصحية. لقد أدى العدد المتزايد من الأمراض المصابة في المستشفيات إلى زيادة العبء على قطاع الرعاية الصحية نسبيًا. تساعد الطلاءات المضادة للميكروبات في تقليل العدوى المكتسبة من المستشفيات لأنها تتمتع بخصائص مختلفة مثل التوافق البيولوجي

- ارتفاع الطلب على الأجهزة القابلة للزرع في أوروبا

ويتزايد الطلب على الأجهزة القابلة للزرع بسبب الانتشار المتزايد للأمراض المزمنة إلى جانب الشيخوخة السريعة للسكان، والارتفاع الحاد في حوادث الطرق، والتحسينات في الأجهزة الطبية المزروعة النشطة. ووفقاً لجمعية السفر البري الدولي الآمن، فإن ما يقرب من 4.4 مليون شخص يتعرضون لإصابات خطيرة بما يكفي لتتطلب رعاية طبية.

فرص

- قطاع الرعاية الصحية الصاعد في الاقتصادات الناشئة

من المتوقع أن يخلق قطاع الرعاية الصحية الصاعد في الاقتصادات الناشئة مثل الهند والصين فرصة للطلب على منتجات الطلاء المضادة للميكروبات في الأجهزة الطبية. تعد عوامل مثل النمو السكاني وتغير أنماط الحياة وارتفاع عدد كبار السن، وخاصة في الصين، وزيادة السياحة الطبية من العوامل الرئيسية وراء دفع نمو قطاع الرعاية الصحية. وفقًا للمقال الذي نشرته مؤسسة India Brand Equity Foundation (IBEF)، في مارس 2022، جاء حوالي 697300 سائح أجنبي إلى الهند لتلقي العلاج الطبي في عام 2019 وكشف أيضًا أن الهند تحتل المرتبة العاشرة من بين 46 وجهة في مؤشر السياحة الطبية (MTI) لعام 2020-2021.

القيود/التحديات

ومع ذلك، فإن محدودية طلاء أيونات الفضة، والإصلاحات الصحية غير المواتية في الولايات المتحدة، من شأنها أن تحد من معدل نمو السوق. كما أن انخفاض القدرة الإنتاجية للاقتصادات الناشئة من شأنه أن يشكل تحديًا كبيرًا.

يقدم تقرير سوق الطلاء المضاد للميكروبات للأجهزة الطبية تفاصيل عن التطورات الحديثة الجديدة واللوائح التجارية وتحليل الاستيراد والتصدير وتحليل الإنتاج وتحسين سلسلة القيمة وحصة السوق وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغيرات في لوائح السوق وتحليل نمو السوق الاستراتيجي وحجم السوق ونمو سوق الفئات ومنافذ التطبيق والهيمنة وموافقات المنتجات وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول سوق الطلاء المضاد للميكروبات للأجهزة الطبية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

تأثير ما بعد كوفيد-19 على سوق الطلاء المضاد للميكروبات للأجهزة الطبية

مرض فيروس كورونا (كوفيد-19) هو مرض معدٍ يسببه فيروس سارس-كوف-2 المكتشف حديثًا، في حين يتأثر عدد كبير من السكان بفيروس كوفيد-19. سيعاني الأشخاص المصابون بفيروس كوفيد-19 من أمراض تنفسية خفيفة إلى متوسطة ويتعافون دون الحاجة إلى علاج خاص. ومع ذلك، فإن انتشار فيروس كورونا (كوفيد-19) يتوسع في أوروبا خلال الأشهر القليلة الماضية، ويزداد عدد المرضى بشكل كبير.

على سبيل المثال،

- وفقًا لمنظمة الصحة العالمية (WHO) حتى 31 مارس 2022، تم العثور على 481،756،671 حالة مؤكدة من COVID-19 بما في ذلك 6،127،981 حالة وفاة. في حين أن أوروبا لديها معدل انتشار مرتفع لـ COVID-19 مقارنة بالمناطق الأخرى. حتى 31 مارس 2022، كان هناك 199،889،200 حالة مؤكدة من COVID-19 في أوروبا

لقد أثر جائحة كوفيد-19 سلبًا على سلسلة التوريد وأنشطة التصنيع. بالإضافة إلى ذلك، مع توقف العالم وتوقف خدمات النقل في جميع أنحاء العالم، تم إغلاق الحدود لمنع انتشار الفيروس. كما واجهت الممارسات التجارية تحديات كبيرة أثناء الوباء. ونتيجة لذلك، تأثرت إمدادات الغرسات واستيرادها وتصديرها ونقلها محليًا وتوريد المواد الخام بشكل خطير.

التطورات الأخيرة

- في سبتمبر 2021، عرضت شركة BioCote Limited تقنية طلاء مضادة للميكروبات مبتكرة، بما في ذلك أحدث تطوراتها لمنتجات الطلاء البلاستيكية المضادة للميكروبات. وقد أدى هذا إلى تعزيز الإيرادات السنوية للشركة

- في يناير 2022، افتتحت الشركة مصنعها الثاني للتصنيع في كوستاريكا. سيشارك المصنع في تصنيع حلول الأجهزة الطبية للبثق والقولبة بالحقن ومعالجة المعادن الدقيقة وعمليات التجميع النهائي في غرف نظيفة. تم اتخاذ هذه الخطوة لتلبية الطلب المتزايد على حلول الأجهزة الطبية في السوق

- في مايو 2021، أعلنت شركة Hydromer أنها اختيرت كشريك رئيسي في مجال الطلاء والخدمات لشركة Avinger, Inc. تساعد هذه الخطوة الشركة على تعزيز نموها في السوق

نطاق سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا

يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية إلى نوع المنتج والطلاء والنوع والمواد المضافة والمواد ونوع الراتينج والشكل والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع المنتج

- طلاءات فضية مضادة للميكروبات

- طلاءات النحاس المضادة للميكروبات

- آحرون

على أساس نوع المنتج، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى طلاءات فضية مضادة للميكروبات، وطلاءات نحاسية مضادة للميكروبات، وغيرها.

طلاء

- فضي

- نحاس

- الزنك

- الجاليوم

- الألومنيوم

- ثاني أكسيد التيتانيوم

- آحرون

على أساس الطلاء، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى الفضة والنحاس والزنك والغاليوم والألمنيوم وثاني أكسيد التيتانيوم وغيرها.

يكتب

- الإشريكية القولونية

- الزائفة الزنجارية

- ليستيريا

- آحرون

على أساس النوع، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى الإشريكية القولونية، والزائفة الزنجارية، والليستيريا، وغيرها.

مادة مضافة

- إضافات مضادة للميكروبات من أيونات الفضة صغيرة الحجم

- إضافات الزنك المضادة للميكروبات

- إضافات النحاس المضادة للميكروبات

- إضافات مضادة للميكروبات العضوية

على أساس المادة المضافة، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى إضافات مضادة للميكروبات من أيونات الفضة، وإضافات مضادة للميكروبات من الزنك، وإضافات مضادة للميكروبات من النحاس، وإضافات مضادة للميكروبات العضوية.

مادة

- مواد الجرافين

- هيدروجيل متعدد الكاتيونات

- جسيمات النانو الفضية

- فرش البوليمر

- شجيرات شجرية

- آحرون

على أساس المادة، يتم تقسيم سوق الطلاء المضاد للميكروبات في أوروبا للأجهزة الطبية إلى مواد الجرافين، وهلام البولي كاتيوني، وجسيمات النانو الفضية، وفرش البوليمر، والدندريمرات، وغيرها.

نوع الراتينج

- أكريليك

- البوليستر

- البولي يوريثين

- إيبوكسي

- آحرون

على أساس نوع الراتينج، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى الأكريليك والبوليستر والبولي يوريثين والإيبوكسي وغيرها.

استمارة

- سائل

- الهباء الجوي

- مسحوق

على أساس الشكل، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى سائل ورذاذ ومسحوق.

طلب

- الأدوات الجراحية

- أسلاك التوجيه

- الأجهزة القابلة للزرع

- القسطرة

- المندرات والقوالب

- آحرون

على أساس التطبيق، يتم تقسيم سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا إلى أدوات جراحية، وأسلاك توجيه، وأجهزة قابلة للزرع، وقسطرة، ومداخن وقوالب، وغيرها.

تحليل/رؤى إقليمية لسوق الطلاء المضاد للميكروبات للأجهزة الطبية

يتم تحليل سوق الطلاء المضاد للميكروبات للأجهزة الطبية ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد ونوع المنتج والطلاء والمواد والمواد المضافة والنوع ونوع الراتينج والنوع والتطبيق.

الدول التي يغطيها تقرير سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا هي ألمانيا والمملكة المتحدة وإيطاليا وفرنسا وإسبانيا وروسيا وسويسرا وتركيا وبلجيكا وهولندا ولوكسمبورج وبقية أوروبا.

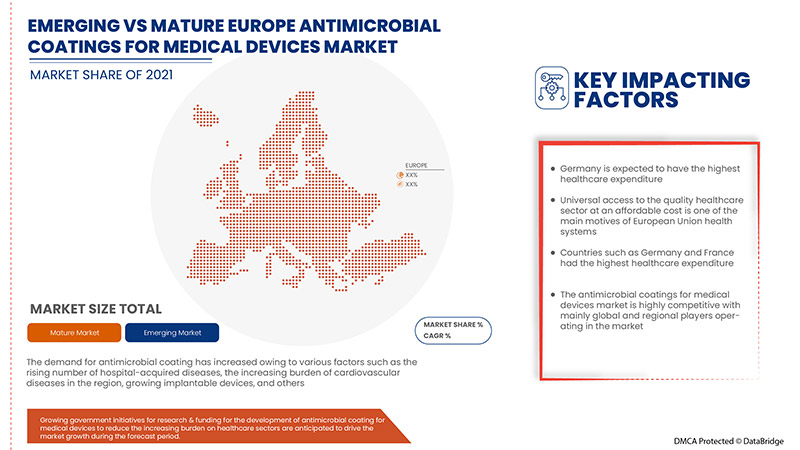

تهيمن ألمانيا على سوق الطلاء المضاد للميكروبات للأجهزة الطبية في أوروبا من حيث حصة السوق وإيرادات السوق وستستمر في تعزيز هيمنتها خلال فترة التوقعات. ويعزى ذلك إلى أن دولًا مثل ألمانيا وفرنسا لديها أعلى إنفاق على الرعاية الصحية. يعد الوصول الشامل إلى قطاع الرعاية الصحية عالي الجودة بتكلفة معقولة أحد الدوافع الرئيسية لأنظمة الصحة في الاتحاد الأوروبي. ومن المتوقع أن يؤدي النمو السكاني لكبار السن إلى جانب ارتفاع حالات الأمراض المزمنة إلى زيادة الطلب على الأجهزة الطبية، ومن المرجح أن يؤدي ذلك إلى زيادة الطلب على الطلاء المضاد للميكروبات في الأجهزة الطبية.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في اللوائح في السوق والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات، مثل المبيعات الجديدة والاستبدالية، والتركيبة السكانية للدولة، وعلم الأوبئة المرضية، ورسوم الاستيراد والتصدير، من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. بالإضافة إلى ذلك، يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الشديدة من العلامات التجارية المحلية والمحلية، وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المنافسة وحصة سوق الطلاء المضاد للميكروبات للأجهزة الطبية

يقدم المشهد التنافسي لسوق الطلاء المضاد للميكروبات للأجهزة الطبية تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، والمبادرات الجديدة في السوق، والحضور في دول مجلس التعاون الخليجي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الطلاء المضاد للميكروبات للأجهزة الطبية.

بعض اللاعبين الرئيسيين العاملين في سوق الطلاء المضاد للميكروبات للأجهزة الطبية هم DSM و PPG Industries، Inc. و Akzo Nobel NV و Specialty Coating Systems Inc و Covalon Technologies Ltd. و AST Products، Inc. و Hydromer و Sciessent LLC و Microban International و Axalta Coating Systems، LLC و Biointeractions Ltd و Sika و Harland Medical Systems، Inc. و Biomerics و BioCote Limited وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين وتحليل الخط الزمني للسوق ونظرة عامة على السوق والدليل وشبكة وضع الشركة وتحليل حصة الشركة في السوق ومعايير القياس وتحليل GCCVsRegional وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE

4.2 PESTEL ANALYSIS

4.2.1 POLITICS

4.2.2 ECONOMY

4.2.3 SOCIAL

4.2.4 TECHNOLOGY

4.2.5 ENVIRONMENTAL:

4.2.6 LEGAL

4.3 PORTER ANALYSIS

4.3.1 THREATS OF NEW ENTRANTS

4.3.2 POWER OF SUPPLIERS

4.3.3 BARGAINING POWER OF BUYERS

4.3.4 THREATS OF SUBSTITUTE PRODUCTS

4.3.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.4 REGULATION

4.4.1 FDA

4.5 PRODUCTION AND CONSUMPTION ANALYSIS

4.6 RAW MATERIAL ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 PRICE TREND ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN AWARENESS REGARDING HOSPITAL-ACQUIRED INFECTIONS (HAI)

5.1.2 RISE IN GOVERNMENT INITIATIVES FOR RESEARCH & FUNDING

5.1.3 RISE IN DEMAND FOR IMPLANTABLE DEVICES EUROPELY

5.1.4 INCREASE IN THE BURDEN OF CARDIOVASCULAR DISEASES ACROSS THE GLOBE

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF SILVER ION COATING

5.2.2 UNFAVORABLE HEALTHCARE REFORMS IN THE U.S.

5.3 OPPORTUNITIES

5.3.1 THE RISING HEALTHCARE SECTOR IN EMERGING ECONOMIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN THE ANTIMICROBIAL COATING

5.3.3 ANTIMICROBIAL COATINGS HAVE SHOWN GREAT POTENTIAL AGAINST NOSOCOMIAL INFECTIONS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUT TO COVID-19 PANDEMIC OUTBREAK

5.4.2 THE ADVERSE EFFECTS OF ANTIMICROBIAL COATINGS ON THE ENVIRONMENT

6 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATING

6.3 COPPER ANTIMICROBIAL COATING

6.4 OTHERS

7 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 FUNCTIONALIZED POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 SURGICAL INSTRUMENTS

13.3 IMPLANTABLE DEVICES

13.4 GUIDEWIRES

13.5 MANDRELS & MOLDS

13.6 CATHETERS

13.7 OTHERS

14 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K

14.1.3 FRANCE

14.1.4 SPAIN

14.1.5 ITALY

14.1.6 SWITZERLAND

14.1.7 NETHERLANDS

14.1.8 RUSSIA

14.1.9 BELGIUM

14.1.10 TURKEY

14.1.11 LUXEMBURG

14.1.12 REST OF EUROPE

15 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PPG INDUSTRIES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 SIKA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT UPDATE

17.3 AKZO NOBEL N.V

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 AXALTA COATING SYSTEMS, LLC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUS ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AST PRODUCTS, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BIOCOTE LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BIOINTERACTIONS LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOMERICS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 COVALON TECHNOLOGIES LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUS ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 HARLAND MEDICAL SYSTEMS, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HYDROMER

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 MICROBAN INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SCIESSENT LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SPECIALTY COATING SYSTEMS INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION OF COPPER FROM 2017-TO 2021, THOUSAND METRIC TONS

TABLE 2 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 4 EUROPE SILVER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE COPPER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SILVER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CHITOSAN IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TITANIUM DIOXIDE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ALUMINUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE COPPER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE ZINC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE GALLIUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ESCHERICHIA COLI IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PSEUDOMONAS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE LISTERIA IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 EUROPE GRAPHENE MATERIALS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SILVER NANOPARTICLES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 32 EUROPE DENDRIMERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE EPOXY IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE ACRYLIC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE POLYURETHANE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE POLYESTER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LIQUID IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE POWDER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE AEROSOL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE SURGICAL INSTRUMENTS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE IMPLANTABLE DEVICES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE GUIDEWIRES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 48 EUROPE MANDRELS & MOLDS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE CATHETERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 50 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 55 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 56 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 58 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 EUROPE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 65 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 66 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 68 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 GERMANY POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 70 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 75 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 76 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 78 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 U.K POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 82 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 85 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 86 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 88 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 FRANCE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 90 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 91 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 95 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 96 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 98 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 SPAIN POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 105 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 106 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 108 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 ITALY POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 111 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 115 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 116 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 125 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 NETHERLANDS POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 130 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 131 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 135 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 145 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 151 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 152 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 155 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 156 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 158 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 159 TURKEY POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 160 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 161 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 165 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 166 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 168 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 171 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 REST OF EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 REST OF EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET AND ASIA-PACIFIC GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING AWARENESS REGARDING HOSPITAL ACQUIRED INFECTION IS DRIVING THE EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SILVER ANTIMICROBIAL COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN 2022 & 2029

FIGURE 13 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET, BY PRODUCTION (USD MILLION)

FIGURE 14 CONSUMPTION OF ANTIMICROBIAL COATING IN MEDICAL DEVICES, BY REGION (USD MILLION)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

FIGURE 16 GROWTH TREND OF HEALTHCARE SECTOR IN INDIA, USD BILLION

FIGURE 17 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2021

FIGURE 19 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2021

FIGURE 20 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2021

FIGURE 21 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2021

FIGURE 22 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2021

FIGURE 23 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2021

FIGURE 24 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2021

FIGURE 25 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: SNAPSHOT (2021)

FIGURE 26 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021)

FIGURE 27 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 30 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.