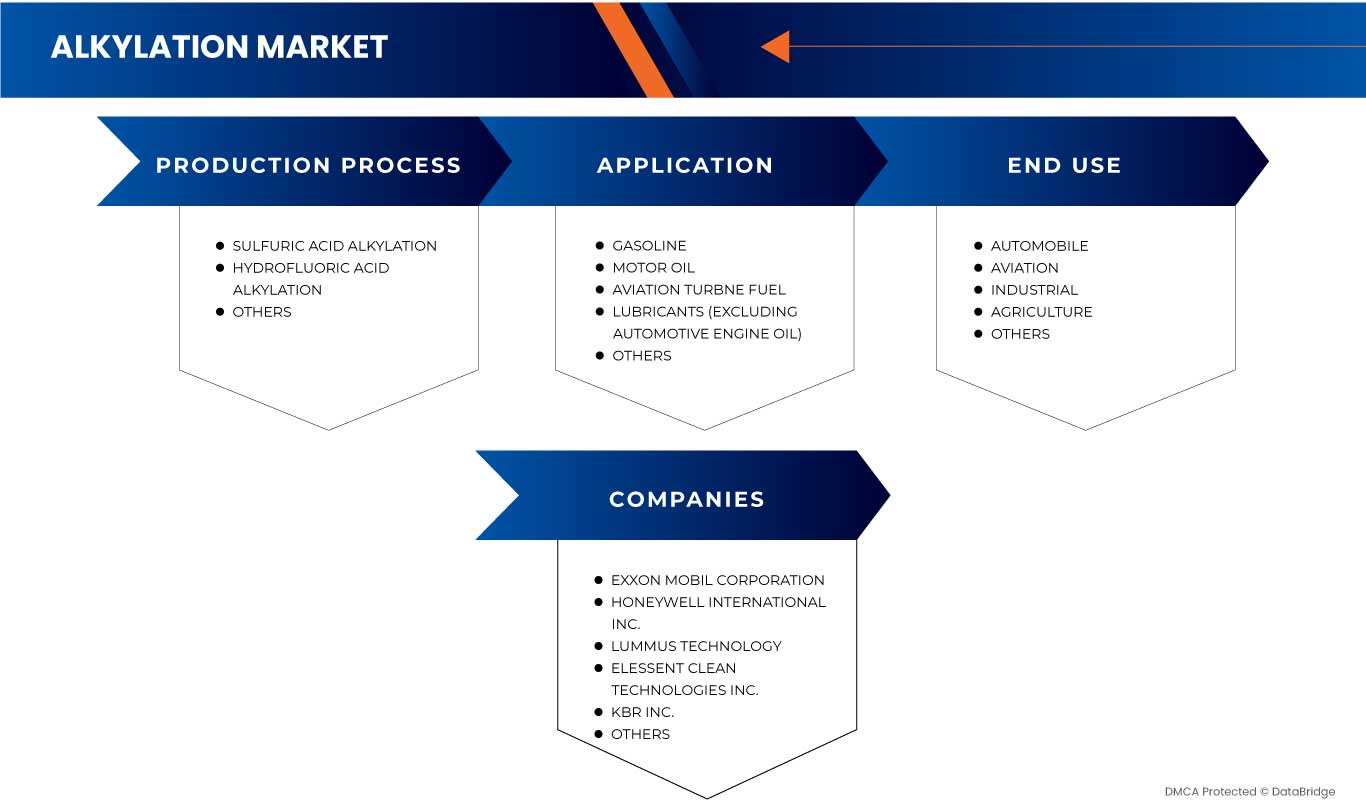

سوق الألكلة في أوروبا، حسب عملية الإنتاج (ألكلة حمض الكبريتيك، ألكلة حمض الهيدروفلوريك، وغيرها)، التطبيق (زيت المحرك، وقود توربينات الطيران، مواد التشحيم (باستثناء زيت محرك السيارات)، البنزين، وغيرها)، الاستخدام النهائي (السيارات، الطيران، الزراعة، الصناعة، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2040.

تحليل وحجم سوق الألكلة في أوروبا

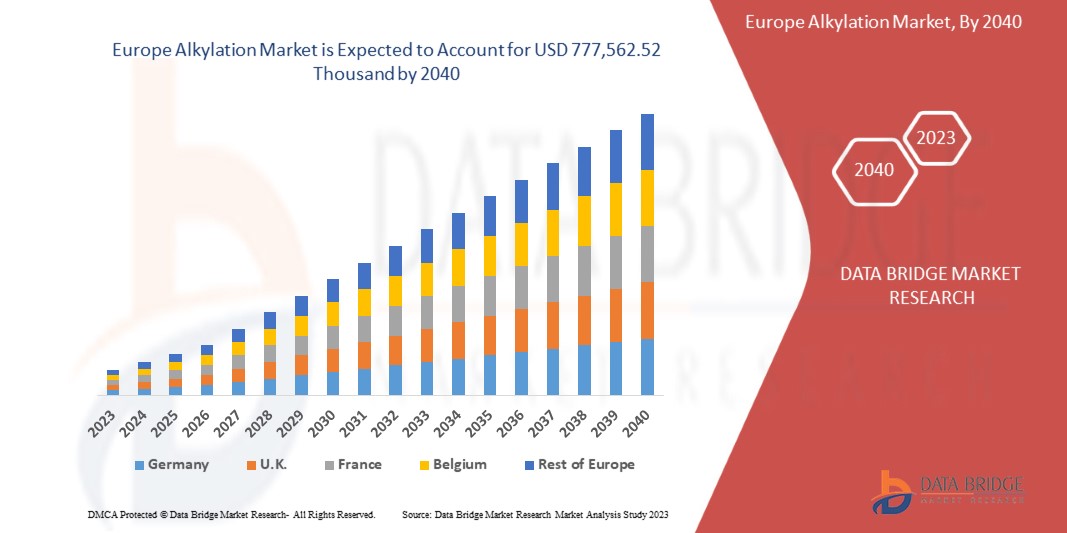

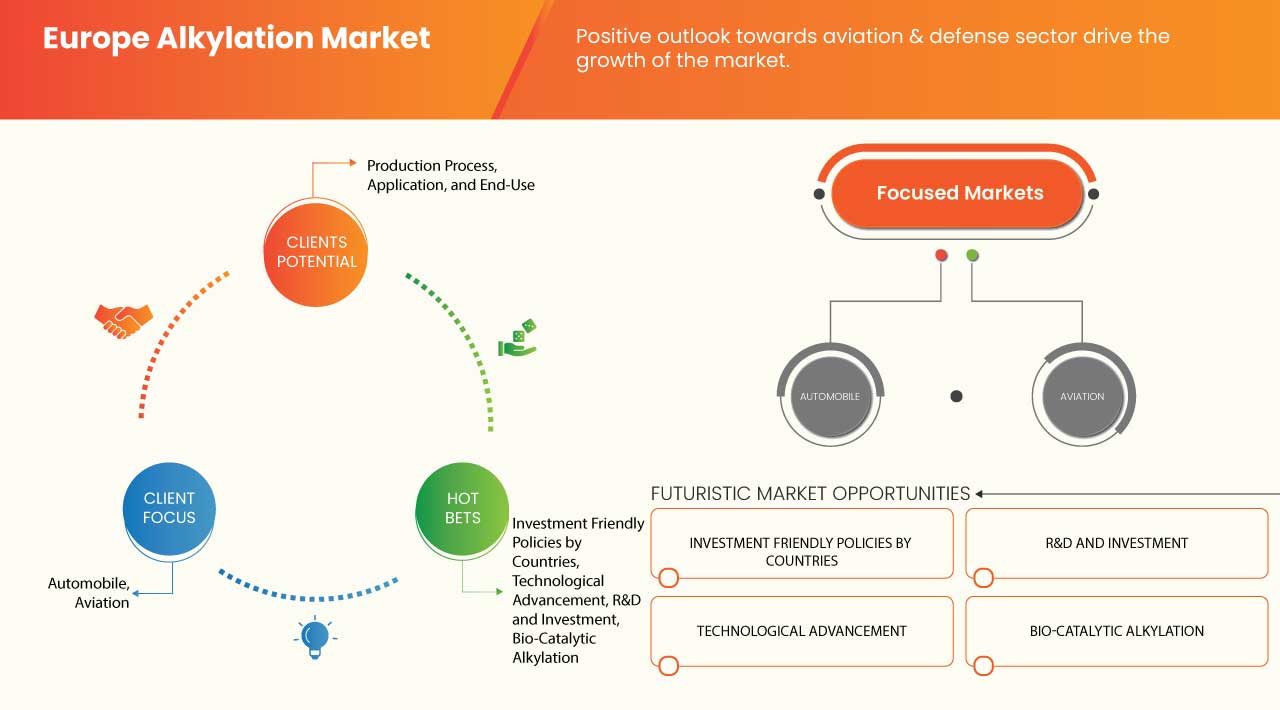

من المتوقع أن ينمو سوق الألكلة في أوروبا بشكل كبير في الفترة المتوقعة من 2023 إلى 2040. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 3.2٪ في الفترة المتوقعة من 2023 إلى 2040 ومن المتوقع أن يصل إلى 777،562.52 ألف دولار أمريكي بحلول عام 2040. العامل الرئيسي الذي يدفع نمو سوق الألكلة هو ارتفاع الطلب على البنزين عالي الكفاءة.

إن تفاعل الأوليفينات مع الأيزوبارافين لإنتاج بارافين ذو وزن جزيئي أعلى يُعرف بالألكلة، وهو يُستخدم عادةً في أعمال تكرير البترول. وعلى وجه الخصوص، تنتج هذه الطريقة بارافينًا متفرع السلسلة في نطاق غليان البنزين عن طريق تفاعل البروبيلين والبوتيلين مع الأيزوبوتين. يتمتع الألكيلات بتصنيفات أوكتان عالية وحساسية منخفضة، مما يجعله مخزونًا ممتازًا لخلط البنزين.

يقدم تقرير سوق الألكلة في أوروبا تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل يؤثر على الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2040 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2015-2020) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي |

|

القطاعات المغطاة |

عملية الإنتاج (ألكلة حمض الكبريتيك، وألكلة حمض الهيدروفلوريك، وغيرها)، التطبيق (زيت المحرك، ووقود توربينات الطيران، ومواد التشحيم (باستثناء زيت محرك السيارات)، والبنزين، وغيرها)، الاستخدام النهائي (السيارات، والطيران، والزراعة، والصناعة، وغيرها) |

|

الدول المغطاة |

ألمانيا، فرنسا، المملكة المتحدة، إيطاليا، روسيا، إسبانيا، هولندا، بلجيكا، سويسرا، تركيا، وبقية أوروبا |

|

الجهات الفاعلة في السوق المشمولة |

شركة إكسون موبيل، وشركة هانيويل إنترناشيونال، وشركة لوموس للتكنولوجيا، وشركة إليسينت كلين تكنولوجيز، وشركة سولزر المحدودة، وشركة كي بي آر المحدودة، وشركة ويل ريسورسز المحدودة وغيرها |

تعريف السوق

تنتج الألكلة هيدروكربونات ذات فروع أطول من الألكلة الأوليفينات، مثل البروبيلين والبوتيلين والأيزوبيوتين. تُعرف الهيدروكربونات عالية الأوكتان الناتجة عن الألكلة بالألكيلات. تم تقديم مزج هذه الألكلات بالبنزين لتحسين كفاءة أداء الآلات. العامل الرئيسي الذي يؤثر على الألكلة هو استخدام محفز مناسب. حمض الكبريتيك وحمض الهيدروفلوريك هما أكثر محفزات الألكلة استخدامًا.

ديناميكيات سوق الألكلة في أوروبا

يتناول هذا القسم فهم محركات السوق والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- ارتفاع الطلب على البنزين عالي الكفاءة

إن قطاع السيارات، وهو مؤشر اقتصادي مهم، على أعتاب عصر جديد من التكنولوجيا والتطورات. وعلاوة على ذلك، فإن حاجة العملاء إلى ميزات مميزة ومكلفة هي التي تدفع قطاع السيارات في الفترة الحالية. ويستخدم المستهلكون اليوم المركبات متعددة الأغراض على نطاق أوروبي، وهو ما يؤدي إلى ارتفاع مبيعات السيارات في جميع أنحاء العالم. ويتم تصنيع معظم السيارات حول محرك احتراق داخلي يعمل بالديزل أو البنزين فقط. وبالتالي، فإن الطلب على البنزين يتزايد بشكل كبير، وستظل مجموعات نقل الحركة القائمة على محركات الاحتراق هي المهيمنة في المستقبل المنظور.

- نمو تطبيقات المشتقات، وخاصة البنزين ومواد التشحيم

هناك العديد من المنتجات التي يتم إنتاجها من النفط الخام في تكرير البترول. الألكلة هي عملية وحدة تكرير ثانوية تستخدمها العديد من المصافي في جميع أنحاء العالم لإضافة الهيدروكربونات عالية الأوكتان إلى بنزين السيارات والطائرات. إنها عملية إضافة مجموعات ألكيل إلى جزيء الركيزة وهي مفيدة في العديد من التطبيقات. تنتج الألكلة بنزينًا عالي الأوكتان عن طريق تحويل الأيزوبارافين والألكينات منخفضة الوزن الجزيئي إلى ألكيلات. هناك حاجة إلى الهيدروكربونات عالية الأوكتان لتجنب الاشتعال التلقائي للبنزين (الطرق) في المحرك وتلبية معايير أوكتان المحرك.

فرص

- تنفيذ سياسات صديقة للاستثمار في الدول، وخاصة الصين والهند

لقد أصبحت الألكلة عملية تكرير أساسية مع زيادة الحاجة إلى مكونات خلط البنزين عالية الأوكتان ومنخفضة الضغط البخاري. وسوف تكون أكثر أهمية في تلبية القوانين والمتطلبات الصارمة للحكومة. وتضغط الهيئات التجارية والتنظيمية على المصافي لاستخدام تقنيات آمنة ومستدامة لتوفير الوقود النظيف الصديق للبيئة. وبالتالي، قد تستغل شركات المصافي الراسخة في سوق الألكلة هذه الفرصة لإنفاق المزيد على قدرات إنتاجية جديدة. وعلى النقيض من ذلك، يمكن للشركات الجديدة أن تستثمر المزيد في دمج وحدات الألكلة للمساهمة في نمو الصناعة.

- التقدم التكنولوجي لتحسين عمليات الألكلة

إن الطلب الأوروبي الطويل الأجل على البنزين عالي الجودة مدفوع بعوامل كلية مثل قاعدة العملاء المتزايدة باستمرار وظهور محركات الضغط العالي التي تتطلب ضغط بخار منخفض. وفي الوقت نفسه، تعمل معايير الوقود والانبعاثات الأكثر صرامة، مثل متطلبات محتوى الكبريت المنخفض أو المنخفض للغاية من الكبريت، على زيادة الاعتماد على مخزونات المزج التي ترفع الأوكتان، مثل الألكيلات. وتستخدم المصافي العديد من التقنيات لإنشاء الألكيلات، ويجب على جميع المصافي استخدام تقنية الألكيلات المبتكرة والآمنة والمستدامة.

القيود/التحديات

- المخاوف المتعلقة بالسلامة فيما يتعلق باستخدام تقنية الألكلة

تحول تقنية الألكلة القائمة على الأحماض المواد الخام المختلطة من الأوليفينات إلى ألكيلات عالية الأوكتان لخلط البنزين باستخدام فلوريد الهيدروجين أو حمض الكبريتيك كمحفز. ومع ذلك، فإن الطبيعة المسببة للتآكل للغاية للحفازات الحمضية القوية تجعل تفاعلات الألكلة باستخدام فلوريد الهيدروجين وحمض الكبريتيك خطيرة. تستخدم المصافي التي تستخدم تقنية الألكلة القائمة على الأحماض معادن مختلفة لمعدات تقنية الألكلة وتتطلب أيضًا أنظمة أمان عالية التكلفة لحماية موظفي المصفاة والبنية الأساسية والبيئة الخارجية. يشعر المشغلون والمالكون بقلق بالغ بشأن سلامة عملية الألكلة ويراقبون بانتظام سلامة وحداتهم. ومع ذلك، نظرًا لأن كل عملية صناعية تنطوي على مخاطر، فمن المرجح أن تواجه عملية الألكلة مخاوف محتملة تتعلق بالسلامة.

- القضايا البيئية المرتبطة بتكنولوجيا الألكلة

يتم إنتاج الألكيلات من خلال تقنية الألكلة من الأوليفينات الخفيفة والأيزوبوتين في وجود محفزات كيميائية. وهي ضرورية لإنتاج البنزين، لذا فإن العديد من القضايا البيئية مرتبطة بتقنية الألكيلات. تتطلب صناعة الألكيلات الاستفادة من العمليات المحفزة بالأحماض السائلة، على سبيل المثال، المحفزات الكيميائية بحمض الهيدروفلوريك أو حمض الكبريتيك. المحفزات غير آمنة وتآكلية وسامة بطبيعتها. ترتفع درجة الحرارة ويزداد حجم بخار الهواء عندما يتلامس حمض الهيدروفلوريك مع الماء. يتبخر حمض الهيدروفلوريك المسكوب بسرعة، لكن بعضه يبقى في بيئة التربة ويمكن أن يؤثر بشدة على جودة التربة والمياه الجوفية.

التطورات الأخيرة

- في يونيو 2021، نجحت شركة سينوبك في إطلاق وحدتين متخصصتين أخريين للألكلة من نوع STRATCO من شركة Elessent Clean Technologies Inc. وتعمل الشركة على توسيع قدرتها على الألكلة من خلال إضافة وحدة ألكلة خامسة وسادسة من نوع STRATCO إلى شبكة التكرير الخاصة بها.

- في مارس 2023، أعلنت شركة إكسون موبيل عن بدء التشغيل الناجح لمشروع توسعة مصفاة بومونت، والذي سيزيد من سعة أحد أكبر المجمعات البتروكيماوية والتكرير على ساحل الخليج الأمريكي بمقدار 250 ألف برميل يوميًا. ويدعم أكبر توسع للمصفاة منذ أكثر من عشر سنوات إنتاج الشركة المتزايد من النفط الخام في حوض بيرميان، والذي سيساعد في تلبية الحاجة المتزايدة إلى الطاقة بأسعار معقولة وموثوقة. مصفاة بومونت، حيث تنتج الشركة منتجات نهائية بما في ذلك الديزل والبنزين ووقود الطائرات من خلال النفط الخام في حوض بيرميان

نطاق سوق الألكلة في أوروبا

يتم تصنيف سوق الألكلة في أوروبا بناءً على عملية الإنتاج والتطبيق والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

عملية الإنتاج

- ألكلة حمض الكبريتيك

- ألكلة حمض الهيدروفلوريك

- آحرون

على أساس عملية الإنتاج، يتم تصنيف سوق الألكلة في أوروبا إلى ألكلة حمض الكبريتيك، ألكلة حمض الهيدروفلوريك، وغيرها.

طلب

- زيت المحرك

- وقود توربينات الطيران

- مواد التشحيم (باستثناء زيت محرك السيارات)

- الغازولين

- آحرون

على أساس التطبيق، يتم تصنيف سوق الألكلة الأوروبية إلى زيت المحرك، ووقود توربينات الطيران، ومواد التشحيم (باستثناء زيت محرك السيارات)، والبنزين، وغيرها .

الاستخدام النهائي

- السيارات

- الطيران

- زراعة

- صناعي

- آحرون

على أساس الاستخدام النهائي، يتم تصنيف سوق الألكلة في أوروبا إلى السيارات والطيران والزراعة والصناعة وغيرها.

تحليل/رؤى إقليمية لسوق الألكلة في أوروبا

يتم تقسيم سوق الألكلة في أوروبا على أساس عملية الإنتاج والتطبيق والاستخدام النهائي.

الدول المشاركة في سوق الألكلة في أوروبا هي ألمانيا وفرنسا والمملكة المتحدة وإيطاليا وروسيا وإسبانيا وهولندا وبلجيكا وسويسرا وتركيا وبقية دول أوروبا. تهيمن روسيا على سوق الألكلة في أوروبا من حيث الحصة والإيرادات بسبب التكنولوجيات المتنامية في هذه المنطقة.

يقدم قسم الدولة في التقرير أيضًا عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الألكلة في أوروبا

يوفر المشهد التنافسي لسوق الألكلة في أوروبا تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتجات، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الألكلة في أوروبا.

ومن بين المشاركين البارزين العاملين في سوق الألكلة في أوروبا شركة إكسون موبيل، وشركة هانيويل الدولية، وشركة لوموس للتكنولوجيا، وشركة إليسينت كلين تكنولوجيز، وشركة سولزر المحدودة، وشركة كي بي آر، وشركة ويل ريسورسز وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 APPLICATION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 LIST OF FEW ALKYLATION SERVICE PROVIDERS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE

6.1.2 APPLICATION GROWTH OF DERIVATIVES, NAMELY GASOLINE, AND LUBRICANTS

6.1.3 POSITIVE OUTLOOK TOWARDS AVIATION AND DEFENSE SECTOR

6.1.4 GROWING IMPORTANCE OF IMPROVING REFINING MARGINS

6.2 RESTRAINTS

6.2.1 SAFETY CONCERNS RELATED TO THE USE OF ALKYLATION TECHNOLOGY

6.2.2 CREDIBLE THREAT FROM ALTERNATIVE FUEL SOURCES

6.3 OPPORTUNITIES

6.3.1 IMPLEMENTATION OF INVESTMENT-FRIENDLY POLICIES IN COUNTRIES, NAMELY CHINA AND INDIA

6.3.2 TECHNOLOGICAL ADVANCEMENT TO IMPROVISE ALKYLATION PROCESSES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL ISSUES ASSOCIATED WITH ALKYLATION TECHNOLOGY

6.4.2 STRINGENT RULES AND REGULATIONS

6.4.3 VOLATILITY IN RAW MATERIAL PRICES

7 EUROPE ALKYLATION MARKET, BY PRODUCTION PROCESS

7.1 OVERVIEW

7.2 SULFURIC ACID ALKYLATION

7.3 HYDROFLUORIC ACID ALKYLATION

7.4 OTHERS

8 EUROPE ALKYLATION MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOBILE

8.3 AVIATION

8.4 AGRICULTURE

8.5 INDUSTRIAL

8.6 OTHERS

9 EUROPE ALKYLATION MARKET BY APPLICATION

9.1 OVERVIEW

9.2 MOTOR OIL

9.3 AVIATION TURBINE FUEL

9.4 GASOLINE

9.5 OTHERS

10 EUROPE ALKYLATION MARKET, BY REGION

10.1 EUROPE

10.1.1 RUSSIA

10.1.2 GERMANY

10.1.3 ITALY

10.1.4 NETHERLANDS

10.1.5 SPAIN

10.1.6 U.K.

10.1.7 TURKEY

10.1.8 FRANCE

10.1.9 BELGIUM

10.1.10 POLAND

10.1.11 REST OF EUROPE

11 EUROPE ALKYLATION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 EXPANSION

11.3 NEW PROJECT

11.4 COLLABORATION

11.5 NEW UNIT

12 COMPANY PROFILES

12.1 EXXON MOBIL CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT ANALYSIS

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENT

12.2 HONEYWELL INTERNATIONAL INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT ANALYSIS

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENTS

12.3 LUMMUS TECHNOLOGY

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 SWOT ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 KBR INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 SWOT ANALYSIS

12.4.6 RECENT DEVELOPMENT

12.5 ELESSENT CLEAN TECHNOLOGIES INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT ANALYSIS

12.5.5 RECENT DEVELOPMENTS

12.6 SULZER LTD

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 SWOT ANALYSIS

12.6.5 RECENT DEVELOPMENT

12.7 WELL RESOURCES INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE ALKYLATION MARKET, BY COUNTRY, 2021-2040 (USD THOUSAND)

TABLE 3 EUROPE ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 4 EUROPE ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 5 EUROPE ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 6 EUROPE AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 7 EUROPE AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 8 EUROPE AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 9 RUSSIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 10 RUSSIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 11 RUSSIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 12 RUSSIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 13 RUSSIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 14 RUSSIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 15 GERMANY ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 16 GERMANY ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 17 GERMANY ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 18 GERMANY AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 19 GERMANY AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 20 GERMANY AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 21 ITALY ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 22 ITALY ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 23 ITALY ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 24 ITALY AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 25 ITALY AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 26 ITALY AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 27 NETHERLANDS ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 28 NETHERLANDS ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 29 NETHERLANDS ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 30 NETHERLANDS AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 31 NETHERLANDS AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 32 NETHERLANDS AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 33 SPAIN ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 34 SPAIN ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 35 SPAIN ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 36 SPAIN AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 37 SPAIN AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 38 SPAIN AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 39 U.K. ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 40 U.K. ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 41 U.K. ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 42 U.K. AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 43 U.K. AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 44 U.K. AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 45 TURKEY ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 46 TURKEY ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 47 TURKEY ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 48 TURKEY AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 49 TURKEY AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 50 TURKEY AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 51 FRANCE ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 52 FRANCE ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 53 FRANCE ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 54 FRANCE AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 55 FRANCE AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 56 FRANCE AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 57 BELGIUM ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 58 BELGIUM ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 59 BELGIUM ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 60 BELGIUM AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 61 BELGIUM AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 62 BELGIUM AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 63 POLAND ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 64 POLAND ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 65 POLAND ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 66 POLAND AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 67 POLAND AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 68 POLAND AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 69 REST OF EUROPE ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE ALKYLATION MARKET

FIGURE 2 EUROPE ALKYLATION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALKYLATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALKYLATION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALKYLATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALKYLATION MARKET: THE APPLICATION LIFE LINE CURVE

FIGURE 7 EUROPE ALKYLATION MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE ALKYLATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE ALKYLATION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE ALKYLATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE ALKYLATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE ALKYLATION MARKET: SEGMENTATION

FIGURE 13 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE IS EXPECTED TO DRIVE THE EUROPE ALKYLATION MARKET IN THE FORECAST PERIOD

FIGURE 14 THE SULFURIC ACID ALKYLATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALKYLATION MARKET IN 2023 AND 2040

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ALKYLATION MARKET

FIGURE 17 NUMBER OF CAR SALES IN U.S. 2018 TO 2022 (IN MILLION)

FIGURE 18 CONSUMPTION OF REFINERY PRODUCTS FROM 2018 TO 2021 IN INDIA (IN ‘000 METRIC TONS)

FIGURE 19 U.S. JET FUEL CONSUMPTION 2017 TO 2021 (IN THOUSAND BARRELS PER DAY)

FIGURE 20 EUROPE ALKYLATION MARKET: BY PRODUCTION PROCESS, 2022

FIGURE 21 EUROPE ALKYLATION MARKET: BY END-USE, 2022

FIGURE 22 EUROPE ALKYLATION MARKET: BY APPLICATION, 2022

FIGURE 23 EUROPE ALKYLATION MARKET: SNAPSHOT (2022)

FIGURE 24 EUROPE ALKYLATION MARKET: BY COUNTRY (2022)

FIGURE 25 EUROPE ALKYLATION MARKET: BY COUNTRY (2023 & 2040)

FIGURE 26 EUROPE ALKYLATION MARKET: BY COUNTRY (2022 & 2040)

FIGURE 27 EUROPE ALKYLATION MARKET: BY PRODUCTION PROCESS (2023 - 2040)

FIGURE 28 EUROPE ALKYLATION MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.