سوق مواد الحماية من الحرائق في أستراليا، حسب المنتج (المواد اللاصقة والمواد المانعة للتسرب، الطلاءات المنتفخة، الألواح والرغوة، المعاجين، الملاط، كتل النار، الرش الأسمنتي، الأجهزة المشكلة مسبقًا، اختراقات الأنابيب الآمنة من الحرائق، أخرى)، أنواع الحرائق ( حرائق السليلوز ، حرائق الهيدروجين، حرائق النفاثات)، التطبيق ( أنابيب ، قنوات، مقاومة حرائق الفولاذ الهيكلي، مقاومة حرائق الكابلات وصواني الأسلاك، الأبواب، النوافذ، النظارات، أخرى)، اتجاهات الصناعة للاستخدام النهائي (السكني والتجاري والمؤسسي والبنية التحتية) والتوقعات حتى عام 2029.

تحليل السوق والرؤى

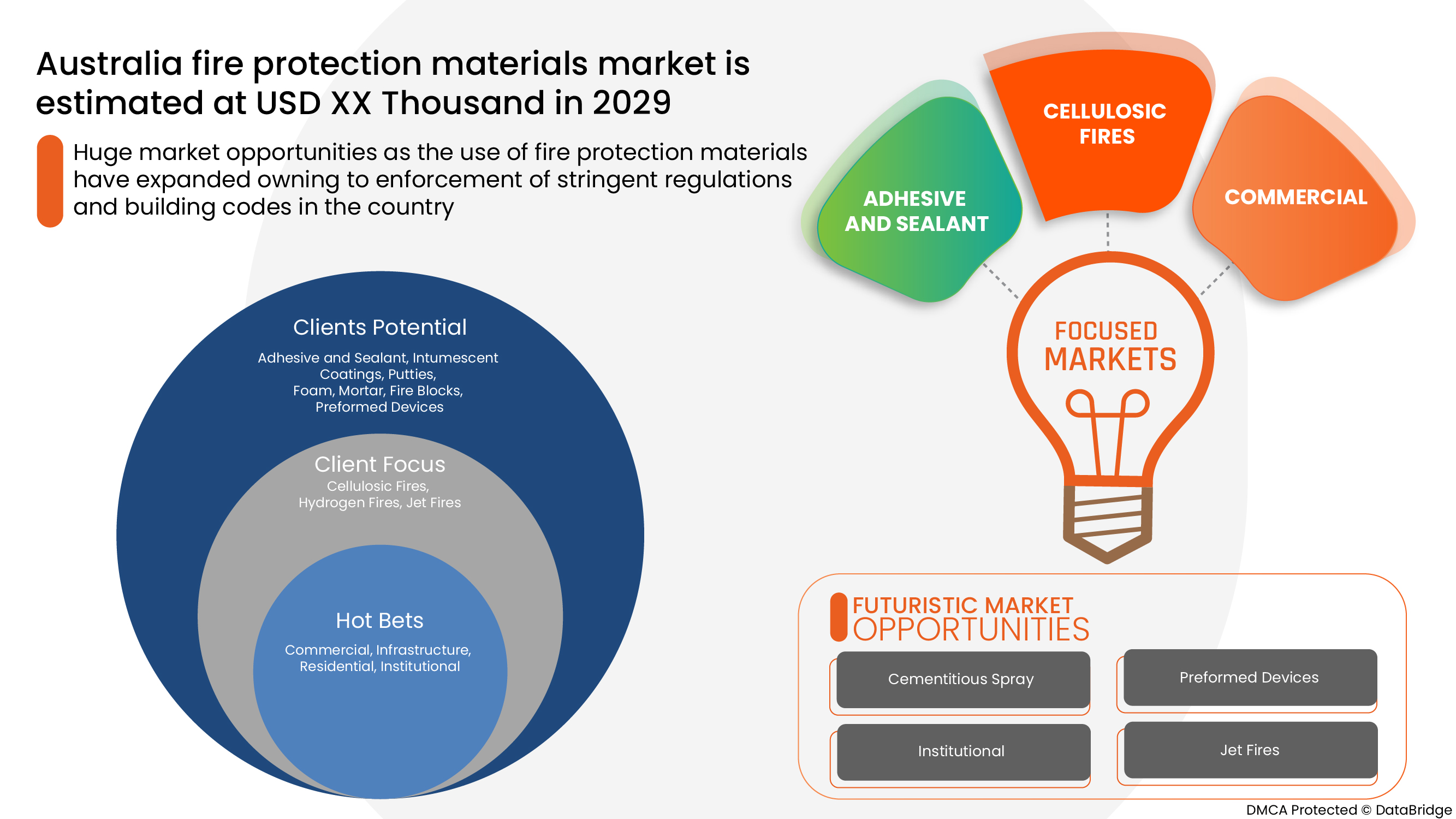

من المتوقع أن يشهد سوق مواد الحماية من الحرائق في أستراليا نموًا كبيرًا في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب قدره 5.2٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 165،601.87 ألف دولار أمريكي بحلول عام 2029.

++

++

من المتوقع أن يكون توسيع نطاق تطبيق مواد الحماية من الحرائق في مختلف الصناعات بمثابة محرك مهم لسوق مواد الحماية من الحرائق في أستراليا. قد يؤدي فرض إرشادات حكومية مواتية ومعايير السلامة من الحرائق إلى تسريع نمو السوق. ومن المتوقع أن يؤدي نمو أنشطة البناء والتشييد بسبب النمو السريع في عدد السكان إلى زيادة نمو سوق مواد الحماية من الحرائق في أستراليا.

يمكن أن تكون القيود الرئيسية التي قد تؤثر سلبًا على سوق مواد الحماية من الحرائق في أستراليا هي التقلبات في أسعار المواد الخام وتكامل واجهات المستخدم مع حلول الحماية من الحرائق.

من المتوقع أن توفر التطورات التكنولوجية السريعة في أنظمة ومنتجات الحماية من الحرائق والاستخدام المتزايد لرموز السلامة في المباني للسكان والمستخدمين فرصًا لسوق مواد الحماية من الحرائق في أستراليا. ومع ذلك، من المتوقع أن يشكل معدل التبني المنخفض بين المستخدمين النهائيين المحتملين بسبب الافتقار إلى الوعي وتكاليف التركيب والصيانة المرتفعة تحديًا لنمو سوق مواد الحماية من الحرائق في أستراليا.

يقدم تقرير سوق مواد الحماية من الحرائق في أستراليا تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل؛ سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنة تاريخية |

2020 (قابلة للتخصيص حتى 2014 - 2019) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي |

|

القطاعات المغطاة |

حسب المنتج (المواد اللاصقة والمواد المانعة للتسرب، والطلاءات المنتفخة، والألواح والرغوة، والمعاجين، والملاط، وكتل الحرائق، والرش الأسمنتي، والأجهزة المشكلة مسبقًا، واختراقات الأنابيب المقاومة للحرائق، وغيرها)، وأنواع الحرائق (حرائق السليلوز، وحرائق الهيدروجين، وحرائق النفاثات)، والتطبيق (الأنابيب، والقنوات، والفولاذ الهيكلي المقاوم للحرائق، وعزل الكابلات وصواني الأسلاك، والأبواب، والنوافذ، والنظارات، وغيرها)، والاستخدام النهائي (السكني، والتجاري، والمؤسسي، والبنية التحتية) |

|

البلد المغطى |

أستراليا |

|

الجهات الفاعلة في السوق المشمولة |

3M، BASF SE، PPG Industries, Inc.، The Sherwin-Williams Company، Morgan Advanced Materials والشركات التابعة لها، Hilti Group، Tremco Incorporated، Unifrax، Tenmat، Sika Australia Pty Ltd، وغيرها |

تعريف السوق

مواد الحماية من الحرائق هي تلك المواد المستخدمة لضمان سلامة المباني من المخاطر المرتبطة بالحرائق. وهذا يتضمن استخدام مواد الحماية السلبية من الحرائق مثل الألواح المقاومة للحريق والمواد المانعة للتسرب والمواد المقاومة للحريق، مثل الصوف المعدني والطلاءات المقاومة للحريق، أو قد تشمل مواد الحماية النشطة من الحرائق مثل رغاوي إطفاء الحرائق والمواد الكيميائية والماء والبخاخات. عند اختيار مادة تحمي من الحرائق، يتم النظر في عوامل متعددة، مثل قدرتها على تحمل الأحمال والتوصيل الحراري والميل إلى التحلل.

هناك طلب متزايد على مواد الحماية من الحرائق بسبب قوانين البناء الصارمة وسياسات السلامة من الحرائق والمعايير الرسمية المختلفة الموضوعة لمراقبة وضمان فعالية المنتج في المنطقة الأسترالية. ومن المتوقع أن يؤدي هذا إلى دفع مواد الحماية من الحرائق على مدى السنوات المتوقعة. وعلاوة على ذلك، من المتوقع أيضًا أن يؤدي الوعي المتزايد بشأن الحماية من الحوادث المتعلقة بالحرائق بين المستهلكين إلى دفع نمو مواد الحماية من الحرائق.

ديناميكيات سوق مواد الحماية من الحرائق في أستراليا

السائقين

- تزايد نطاق تطبيق مواد الحماية من الحرائق في مختلف الصناعات

تُستخدم مواد الحماية من الحرائق المتقدمة في هذا القطاع لتجنب حوادث الحرائق. ويتطلب هذا القطاع أنظمة عالية الكفاءة للكشف عن الحرائق والوقاية منها لمنع الحوادث. وتُستخدم على نطاق واسع أنظمة إخماد الحرائق بالمواد النظيفة ومواد إخماد الحرائق بالمواد الكيميائية الجافة والرشاشات المائية والرغوية في قطاع التعدين.

تُستخدم أيضًا أنظمة إخماد الحرائق التي تعتمد على الغاز والتي تحتوي على ثاني أكسيد الكربون، وغازات نوفيك، والغازات الخاملة وأنظمة الرش في قطاع النفط والغاز. بالإضافة إلى ذلك، تساعد التطبيقات المتزايدة لمواد الحماية من الحرائق في مركبات التعدين لإخماد الحرائق من خلال تحسين عملية مكافحة الحرائق أيضًا في نمو السوق.

- فرض إرشادات حكومية مواتية ومعايير السلامة من الحرائق

يعد البناء التجاري أحد قطاعات التطبيقات المتنامية في سوق مواد الحماية من الحرائق، وقد طبقت الحكومة لوائح سلامة صارمة وأكواد بناء صارمة في بناء المكاتب ومراكز التسوق والمجمعات التجارية والمستشفيات والكليات والمدارس والجامعات والفنادق بسبب وجود عدد كبير من الأشخاص في هذه المباني. لذلك، فإن تطبيق لوائح وقوانين الحرائق هذه من شأنه أن يزيد بشكل كبير من الوعي بين المستهلكين، مما قد يساعد في تعزيز الطلب على مواد الحماية من الحرائق في سوق مواد الحماية من الحرائق في أستراليا.

- تزايد أنشطة البناء والتشييد بسبب النمو السريع في عدد السكان

إن هندسة الهياكل المقاومة للسلامة ضرورية لضمان استقرار الهيكل وجعل مخاطر الحرائق والانفجارات قابلة للإدارة. وعلاوة على ذلك، فإن الزيادة في عدد حوادث الحرائق، والتي تؤدي إلى خسارة الأرواح والأصول القيمة، جعلت شركات البناء المختلفة أكثر يقظة، مما أجبرها على استخدام تدابير الحماية من الحرائق من أجل السلامة. ومن المتوقع أن يؤدي هذا بدوره إلى تعزيز سوق مواد الحماية من الحرائق في أستراليا.

فرص

- التطورات التكنولوجية السريعة في أنظمة ومنتجات الحماية من الحرائق

لقد حدثت تطورات في تحسين مقاومة الحرائق لمواد معينة، بدءًا من التطورات في مثبطات اللهب الخالية من الفوسفور والهالوجين إلى استخدام المركبات النانوية كأنظمة جديدة لمقاومة الحرائق. وبالتالي، فإن التقدم التكنولوجي السريع في المواد وأنظمة الحماية من الحرائق قد يوفر فرصًا مربحة لنمو وتطوير سوق مواد الحماية من الحرائق الأسترالية.

- زيادة استخدام قواعد السلامة في المباني للسكان والمستخدمين

بالإضافة إلى ذلك، تعمل الهيئة الوطنية للحماية من الحرائق في أستراليا أيضًا على تعزيز استخدام مواد البناء منخفضة الاشتعال وطرق الخروج الآمنة للسكان في حجرات الحرائق المصممة جيدًا داخل المباني. تساعد كل هذه المواصفات في تحديد مستوى مقاومة الحرائق (FRL) للمباني، وضمان كفاية البنية التحتية وسلامتها والعزل المناسب في المبنى.

ومن ثم، فمن المتوقع أن يوفر الاستخدام والتبني المتزايد لقواعد وبروتوكولات السلامة في مختلف المباني السكنية والتجارية للسكان والمستخدمين فرص نمو للمستثمرين واللاعبين العاملين في سوق مواد الحماية من الحرائق في أستراليا.

القيود/التحديات

- تقلبات أسعار المواد الخام

إن ارتفاع أسعار المواد الخام يؤدي إلى زيادة تكاليف الإنتاج على مستوى الشركة. وهذا بدوره يؤثر على المستهلكين حيث أن المنتجات النهائية تكلفهم أكثر، وبالتالي فإن هذا يحد من الطلب عليهم حيث يتوقف المستهلكون إما عن استهلاك هذه المنتجات والمواد الباهظة الثمن أو يبدأون في البحث عن بدائل متاحة في السوق.

بالإضافة إلى ذلك، فإن ارتفاع أسعار المواد الخام المختلفة مثل الفولاذ والخرسانة والزجاج أثر بشكل مباشر وسلبي على سوق العقارات، مما قد يعيق نمو سوق مواد الحماية من الحرائق في أستراليا. لذلك، من المتوقع أن تعيق أسعار المواد الخام المتقلبة والمتزايدة بسرعة نمو السوق.

- دمج واجهات المستخدم مع حلول الحماية من الحرائق

إن التنسيق السليم بين المقاولين المختصين بالميكانيكا والكهرباء والحماية من الحرائق والتركيب أمر ضروري لضمان الأداء السليم لأنظمة مكافحة الحرائق. بالإضافة إلى ذلك، مع دمج جميع أنظمة الأمن ومكافحة الحرائق في مكان واحد، تصبح واجهة المستخدم مربكة ومعقدة للغاية للاستخدام.

إن المرة الأولى التي يتفاعل فيها العديد من المشغلين مع لوحة التحكم الخاصة بواجهة المستخدم هذه تكون في أوقات عدم اليقين أو الطوارئ. وكلما كانت واجهة المستخدم أكثر تعقيدًا، كلما كان تشغيلها أكثر صعوبة. يمكن أن تؤدي أنظمة القوائم المعقدة بسهولة إلى الارتباك وإثارة الخوف وشل حركة المستخدم بسبب نقص التوجيه أو حدس اللوحة. لذلك، فإن دمج واجهة المستخدم مع نظام ومواد الحماية من الحرائق ليس بالمهمة السهلة وقد يعيق نمو سوق مواد الحماية من الحرائق في أستراليا.

- معدل تبني منخفض بين المستخدمين النهائيين المحتملين بسبب نقص الوعي

ومع ذلك، يفتقر السكان الأستراليون إلى الوعي الأساسي بسلامة الحرائق، بما في ذلك طبيعة الحرائق وأسبابها وسلوك الحرائق وإدارة سلامة الحرائق. ومع انخفاض الوعي بين مستخدمي مواد الحماية من الحرائق، يفضل الناس عادةً المواد الرخيصة التي لا توفر الحماية من الحرائق أو غير المناسبة لاحتواء الحرائق في حالة وقوع أي حوادث. ومن المتوقع أن تشكل هذه مشكلة صعبة لنمو سوق الحماية من الحرائق في أستراليا.

- تكلفة التركيب والصيانة عالية

بالإضافة إلى ذلك، فإن تركيب أنظمة الحماية من الحرائق المختلفة يزيد من تكلفة الميزانية الإجمالية للمبنى. على سبيل المثال، يتطلب تركيب نظام رشاشات المياه الأوتوماتيكي معدات إضافية، وأنابيب، ومجموعات صمامات، ومضخات تعزيز، وتخزين المياه، وهي ليست في متناول جميع شاغلي المبنى أو المستخدمين. علاوة على ذلك، فإن استخدام مواد الحماية من الحرائق الأثقل في المبنى يزيد أيضًا من الحمل على شعاع المبنى، مما يؤثر سلبًا على قدرة المبنى على تحمل الأحمال، مما يجعله أقل استقرارًا لفترة أطول. لذلك، فإن عيب التكاليف المرتفعة لتركيب وصيانة مواد الحماية من الحرائق والمنتجات والأنظمة في المبنى سيعمل كتحدي لنمو سوق الحماية من الحرائق في أستراليا.

التطورات الأخيرة

- في مارس 2022، أطلقت شركة PPG Industries, Inc. طلاء الإيبوكسي الجديد متعدد الأغراض PPG AMERLOCK 600 للتطبيقات التي تتطلب أقصى قدر من التنوع. تتميز مجموعة الطلاءات الجديدة هذه بأنها طلاء عالي الجودة معالج بالبولي أميد يجمع بين نطاق واسع من سمك التطبيق وأوقات الجفاف السريعة ونافذة إعادة الطلاء لمدة عام واحد.

نطاق سوق مواد الحماية من الحرائق في أستراليا

يتم تصنيف سوق مواد الحماية من الحرائق في أستراليا بناءً على المنتج وأنواع الحرائق والتطبيق والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعة وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

منتج

- لاصق ومانع تسرب

- الطلاءات المنتفخة

- الألواح والصفائح

- المعاجين

- هاون

- رغوة

- كتل النار

- اختراقات الأنابيب الآمنة من الحرائق

- الأجهزة المُشكَّلة مسبقًا

- رش أسمنتي

- آحرون

على أساس المنتج، يتم تقسيم سوق مواد الحماية من الحرائق في أستراليا إلى مواد لاصقة ومانعة للتسرب، وطلاءات منتفخة، وألواح وألواح، ورغوة، ومعاجين، ومدافع الهاون، وكتل النار، ورذاذ أسمنتي، وأجهزة مسبقة التشكيل، واختراقات الأنابيب الآمنة من الحرائق، وغيرها.

أنواع الحرائق

- حرائق السليلوز

- حرائق الهيدروجين

- حرائق الطائرات النفاثة

على أساس أنواع الحرائق، يتم تقسيم سوق مواد الحماية من الحرائق في أستراليا إلى حرائق السليلوز وحرائق الهيدروجين وحرائق النفاثة.

طلب

- ماسورة

- القناة

- حماية الهياكل الفولاذية من الحرائق

- حماية الكابلات والأسلاك من الحرائق

- الأبواب

- نوافذ

- نظارات

- آحرون

على أساس التطبيق، يتم تقسيم سوق مواد الحماية من الحرائق في أستراليا إلى أنابيب، قنوات، مواد مقاومة للحريق من الفولاذ الهيكلي، مواد مقاومة للحريق من الكابلات والأسلاك، الأبواب، النوافذ، النظارات، وغيرها.

الاستخدام النهائي

- تجاري

- بنية تحتية

- مؤسسي

- سكني

على أساس الاستخدام النهائي، يتم تقسيم سوق مواد الحماية من الحرائق في أستراليا إلى سكنية وتجارية ومؤسسية والبنية التحتية.

تحليل حصة السوق التنافسية ومواد الحماية من الحرائق في أستراليا

يقدم المشهد التنافسي لسوق مواد الحماية من الحرائق في أستراليا تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتجات، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق مواد الحماية من الحرائق في أستراليا.

بعض اللاعبين البارزين الذين يعملون في سوق مواد الحماية من الحرائق في أستراليا هم 3M، BASF SE، PPG Industries، Inc.، The Sherwin-Williams Company، Morgan Advanced Materials والشركات التابعة لها، Hilti Group، Tremco Incorporated، Unifrax، Tenmat، Sika Australia Pty Ltd، وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق البحث في DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، وأستراليا مقابل المنطقة، وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AUSTRALIA FIRE PROTECTION MATERIALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 TECHNOLOGY ADVANCEMENTS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATION OVERVIEW

5 COUNTRY ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ESCALATING APPLICATION SCOPE OF FIRE PROTECTION MATERIALS IN VARIOUS INDUSTRIES

6.1.2 IMPOSITION OF FAVOURABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

6.1.3 GROWING BUILDING AND CONSTRUCTION ACTIVITIES DUE TO RAPID GROWTH IN POPULATION

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS IN THE PRICE OF RAW MATERIALS

6.2.2 INTEGRATION OF USER INTERFACES WITH FIRE PROTECTION SOLUTIONS

6.3 OPPORTUNITIES

6.3.1 RAPID TECHNOLOGICAL ADVANCEMENTS IN FIRE PROTECTION SYSTEMS AND PRODUCTS

6.3.2 INCREASING UTILIZATION OF SAFETY CODES IN BUILDINGS FOR OCCUPANTS AND USERS

6.4 CHALLENGES

6.4.1 LOW ADOPTION RATE AMONG THE POTENTIAL END-USERS DUE TO LACK OF AWARENESS

6.4.2 HIGH INSTALLATION AND MAINTENANCE COST

7 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ADHESIVE & SEALANT

7.2.1 SILICONE

7.2.2 ACRYLIC

7.2.3 OTHERS

7.3 INTUMESCENT COATINGS

7.3.1 STYRENE ACRYLICS

7.3.2 VINYL TOULENE ACRYLICS

7.3.3 SILICONE ACRYLICS

7.3.4 FLUOROPOLYMER

7.3.5 EPOXIES

7.3.6 URETHANES

7.3.7 CHLORINATED RUBBER

7.3.8 OTHERS

7.4 SHEETS & BOARDS

7.4.1 GYPSUM BOARDS

7.4.2 PERLITE BOARDS

7.4.3 PROPLEX SHEETS

7.4.4 CALCIUM SILICATE

7.4.5 SODIUM SILICATE

7.4.6 POTASSIUM SILICATE

7.4.7 OTHERS

7.5 PUTTIES

7.6 MORTAR

7.7 FOAM

7.8 FIRE BLOCKS

7.9 FIRE SAFE PIPE PENETRATIONS

7.9.1 FIRE SAFE PIPE PENETRATIONS, BY PRODUCT

7.9.1.1 OUTER INSULATION PRODUCT

7.9.1.1.1 TAPE

7.9.1.1.2 BANDAGE

7.9.1.1.3 OTHERS

7.9.1.2 BASE INSULATION PRODUCT

7.9.1.2.1 STONE WOOL

7.9.1.2.2 GLASS WOOL

7.9.1.2.3 OTHERS

7.9.2 FIRE SAFE PIPE PENETRATIONS, BY RESISTANCE CLASS

7.9.2.1 EI 120

7.9.2.2 EI 90

7.9.2.3 OTHERS

7.9.3 FIRE SAFE PIPE PENETRATIONS, BY SOLUTION

7.9.3.1 CONTINUOUS SUSTAINED (CS)

7.9.3.2 LOCAL SUSTAINED (LS)

7.9.3.3 OTHERS

7.1 PREFORMED DEVICES

7.10.1 WRAP STRIPS

7.10.2 COLLARS

7.10.3 PILLOW

7.10.4 PU-BRICK

7.10.5 CAST-IN DEVICE

7.11 CEMENTITIOUS SPRAY

7.12 OTHERS

8 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY TYPE OF FIRE

8.1 OVERVIEW

8.2 CELLULOSIC FIRES

8.3 HYDROGEN FIRES

8.4 JET FIRES

9 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PIPE

9.2.1 STAINLESS STEEL PIPE

9.2.2 STEEL PIPE

9.2.3 COPPER PIPE

9.2.4 IRON PIPE

9.2.5 COMPOSITE PIPE

9.2.6 PLASTIC PIPE

9.3 DUCT

9.4 STRUCTURAL STEEL FIREPROOFING

9.5 CABLE & WIRE TRAY FIREPROOFING

9.6 DOORS

9.7 WINDOWS

9.8 GLASSES

9.9 OTHERS

10 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 ADHESIVE & SEALANT

10.2.2 INTUMESCENT COATINGS

10.2.3 SHEETS & BOARDS

10.2.4 PUTTIES

10.2.5 MORTAR

10.2.6 FOAM

10.2.7 FIRE BLOCKS

10.2.8 FIRE SAFE PIPE PENETRATION

10.2.9 PREFORMED DEVICES

10.2.10 CEMENTITIOUS SPRAY

10.2.11 OTHERS

10.3 INFRASTRUTURE

10.3.1 ADHESIVE & SEALANT

10.3.2 INTUMESCENT COATINGS

10.3.3 SHEETS & BOARDS

10.3.4 PUTTIES

10.3.5 MORTAR

10.3.6 FOAM

10.3.7 FIRE BLOCKS

10.3.8 FIRE SAFE PIPE PENETRATION

10.3.9 PREFORMED DEVICES

10.3.10 CEMENTITIOUS SPRAY

10.3.11 OTHERS

10.4 INSTITUTIONAL

10.4.1 ADHESIVE & SEALANT

10.4.2 INTUMESCENT COATINGS

10.4.3 SHEETS & BOARDS

10.4.4 PUTTIES

10.4.5 MORTAR

10.4.6 FOAM

10.4.7 FIRE BLOCKS

10.4.8 FIRE SAFE PIPE PENETRATION

10.4.9 PREFORMED DEVICES

10.4.10 CEMENTITIOUS SPRAY

10.4.11 OTHERS

10.5 RESIDENTIAL

10.5.1 ADHESIVE & SEALANT

10.5.2 INTUMESCENT COATINGS

10.5.3 SHEETS & BOARDS

10.5.4 PUTTIES

10.5.5 MORTAR

10.5.6 FOAM

10.5.7 FIRE BLOCKS

10.5.8 FIRE SAFE PIPE PENETRATION

10.5.9 PREFORMED DEVICES

10.5.10 CEMENTITIOUS SPRAY

10.5.11 OTHERS

10.6 RESIDENTIAL, BY SEGMENT

10.6.1 APARTMENTS

10.6.2 MULTI FAMILY HOME

10.6.3 SINGLE FAMILY HOME

10.6.4 OTHERS

11 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: AUSTRALIA

11.2 COLLABORATION

11.3 PRODUCT LAUNCHES

11.4 FACILITY EXPANSION

11.5 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 PPG INDUSTRIES, INC

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 SIKA AUSTRALIA PTY LTD

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATE

13.4 HILTI GROUP

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 BASF SE

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 TREMCO INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 MORGAN ADVANCED MATERIALS AND ITS AFFILIATES

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 TENMAT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATE

13.9 THE SHERWIN-WILLIAMS COMPANY

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 UNIFRAX

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PARTS OF FIRE EXTINGUISHERS, SPRAY GUNS AND SIMILAR APPLIANCES, STEAM OR SAND BLASTING; HS CODE - 842490 (USD THOUSAND)

TABLE 2 EXPORT IMPORT DATA OF PARTS OF FIRE EXTINGUISHERS, SPRAY GUNS AND SIMILAR APPLIANCES, STEAM OR SAND BLASTING; HS CODE - 842490 (USD THOUSAND

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 AUSTRALIA ADHESIVE & SEALANT IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 AUSTRALIA INTUMESCENT COATINGS IN FIRE PROTECTION MATERIALS MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 7 AUSTRALIA SHEETS & BOARDS IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 8 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 9 AUSTRALIA OUTER INSULATION PRODUCT IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 AUSTRALIA BASE INSULATION PRODUCT IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY RESISTANCE CLASS, 2020-2029 (USD THOUSAND)

TABLE 12 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 13 AUSTRALIA PERFORMED DEVICES IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 14 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY TYPE OF FIRE, 2020-2029 (USD THOUSAND)

TABLE 15 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 AUSTRALIA PIPE IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 18 AUSTRALIA COMMERCIAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 AUSTRALIA INFRASTRUCTURE IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 AUSTRALIA INSTITUTIONAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 AUSTRALIA RESIDENTIAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 AUSTRALIA RESIDENTIAL IN FIRE PROTECTION MATERIALS MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: SEGMENTATION

FIGURE 13 ESCALATING APPLICATION SCOPE OF FIRE PROTECTION MATERIALS IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE AUSTRALIA FIRE PROTECTION MATERIALS MARKET IN THE FORECAST PERIOD

FIGURE 14 ADHESIVE & SEALANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA FIRE PROTECTION MATERIALS MARKET IN 2022 & 2029

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF AUSTRALIA FIRE PROTECTION MATERIALS MARKET

FIGURE 17 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY PRODUCT, 2021

FIGURE 18 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY TYPE OF FIRE, 2021

FIGURE 19 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY APPLICATION, 2021

FIGURE 20 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY END USE, 2021

FIGURE 21 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.