سوق شاشات العرض الصناعية المتينة في آسيا والمحيط الهادئ، حسب التكنولوجيا (LCD، LED، OLED، شاشة E-Paper)، حجم الشاشة (8"-11"، 11"-12"، 13"-18"، 19"-25"، 40"-أعلى)، الدقة (1920x1200، 1920x1080، 1280x1024، 1024x768، 800x600، 1366x768)، التركيب (تركيب اللوحة، التركيب على الرف، التركيب على الحائط، التركيب على الذراع، الإطار المفتوح، أخرى)، نوع شاشة اللمس (مقاومة، PCAP، لمس بالأشعة تحت الحمراء، سعوية)، التطبيق (الطبي، HMI، الأتمتة الصناعية، كشك/نقاط البيع، اللافتات الرقمية، التصوير، الألعاب/اليانصيب)، العمودي (النفط والغاز، التصنيع، الكيماويات، الطاقة والكهرباء، التعدين و المعادن، النقل، العسكرية والدفاع، أخرى)، الدولة (الصين، كوريا الجنوبية، اليابان، الهند، أستراليا، سنغافورة، ماليزيا، إندونيسيا، تايلاند، الفلبين، بقية دول آسيا والمحيط الهادئ) اتجاهات الصناعة والتوقعات حتى عام 2028

تحليل السوق والرؤى: سوق شاشات العرض الصناعية المتينة في منطقة آسيا والمحيط الهادئ

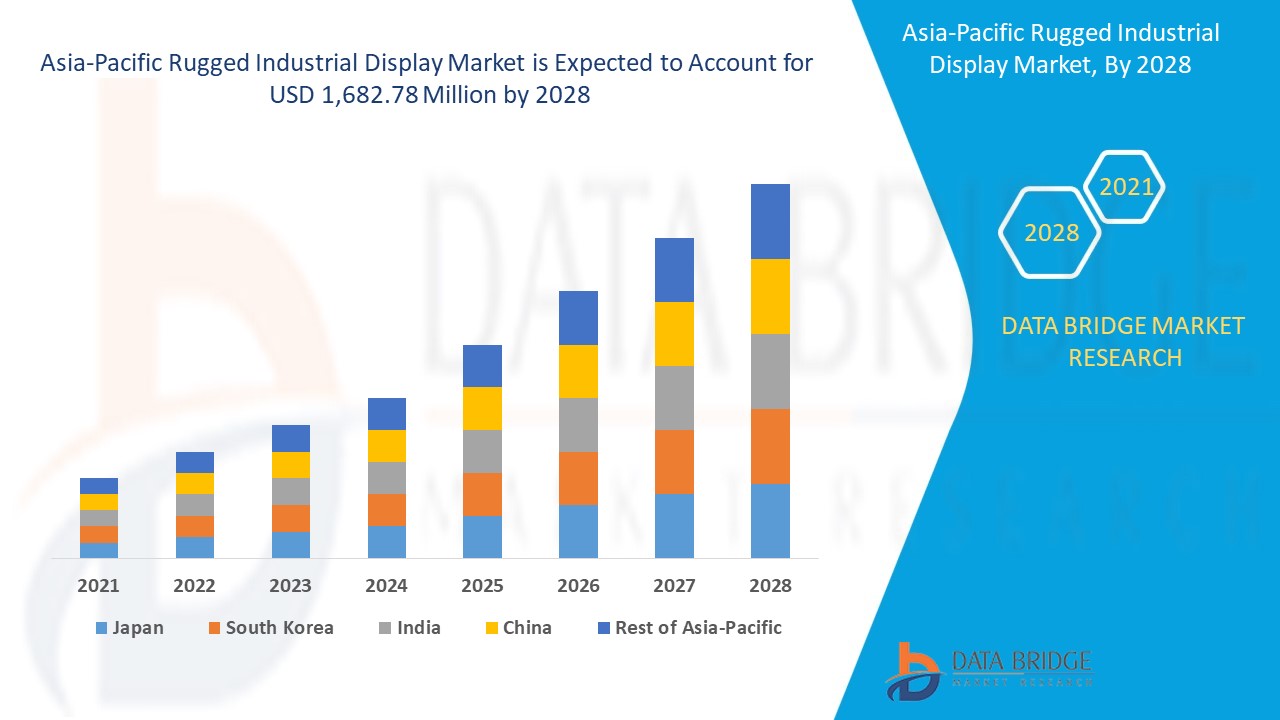

من المتوقع أن يكتسب سوق شاشات العرض الصناعية الوعرة نموًا في السوق في الفترة المتوقعة من 2021 إلى 2028. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 7.9٪ في الفترة المتوقعة من 2021 إلى 2028 ومن المتوقع أن يصل إلى 1،682.78 مليون دولار أمريكي بحلول عام 2028. تتطلب الأتمتة المتزايدة وإنترنت الأشياء في ظل الصناعة 4.0 وزيادة البيانات الرقمية في المجالات الطبية والتصنيعية والعسكرية والدفاعية شاشات للتفاعل أكثر ملاءمة للبيئات القاسية للقطاعات المعنية، وبالتالي تعمل كمحرك لنمو سوق شاشات العرض الصناعية الوعرة.

شاشات العرض الصناعية المتينة هي نوع خاص من الشاشات المصممة للبيئات القاسية في التطبيقات البحرية والعسكرية والصناعية حيث يكون الأداء العالي والصلابة أمرًا بالغ الأهمية. توفر هذه الشاشات ميزات مثل الغلاف الصلب المقاوم للصدمات والشاشات المقاومة للخدش ومقاومة التآكل والطلاءات الخاصة حسب حالة الاستخدام.

أثبتت التطورات التكنولوجية الناشئة والعمليات الآلية في الصناعات أنها المحرك الرئيسي لسوق شاشات العرض الصناعية المتينة في منطقة آسيا والمحيط الهادئ. وقد أدى زيادة التفاعل بين الإنسان والآلة في السنوات الأخيرة إلى ظهور سوق شاشات HMI في السنوات الأخيرة، كما أن التبني المتزايد للأتمتة في قطاع التصنيع يقود السوق. يمكن أن تكون التكلفة الأعلى لتبني الشاشات المتينة وتكلفة التطوير العالية للظروف الصعبة بمثابة قيد، ومع ذلك فإن العديد من الصناعات تنتقل إلى الصناعة 4.0 والرقمنة السريعة والأتمتة هي الفرصة الأكبر للسوق. يمكن أن يكون تطوير شاشات العرض في جميع الأحوال الجوية تحديًا والتحديات التي تواجهها بسبب تأثير COVID-19 على سلسلة توريد المواد الخام وخاصة الواردات من الصين التي تعد موردًا رئيسيًا للسلع الإلكترونية على المستوى الدولي.

يقدم تقرير سوق شاشات العرض الصناعية المتينة تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق شاشات العرض الصناعية المتينة، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق شاشات العرض الصناعية المتينة وحجم السوق

يتم تقسيم سوق شاشات العرض الصناعية المتينة على أساس التكنولوجيا وحجم الشاشة والدقة والتركيب ونوع شاشة اللمس والتطبيق والعمودي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- على أساس التكنولوجيا، يتم تقسيم سوق شاشات العرض الصناعية المتينة إلى شاشات LCD وLED وOLED وE-Paper. في عام 2021، تهيمن شريحة LCD على سوق شاشات العرض الصناعية المتينة لأنها الأرخص من حيث الاستخدام بين الجميع.

- على أساس حجم العرض، يتم تقسيم سوق شاشات العرض الصناعية المتينة إلى 8"-11"، 11"-12"، 13"-18"، 19"-25"، 40"-أعلى. في عام 2021، تهيمن شريحة 13"-18" على السوق لأنها حجم العرض الأمثل لجميع أنواع التطبيقات وأنواع التركيب.

- على أساس الدقة، يتم تقسيم سوق شاشات العرض الصناعية المتينة إلى 1920x1200 و1920x1080 و1280x1024 و1024x768 و800x600 و1366x768. في عام 2021، تهيمن شريحة 1024x768 على السوق حيث أن نسبة العرض إلى الارتفاع 4:3 شائعة في شاشات HMI كما أنها تدعم البرامج القديمة.

- على أساس التركيب، يتم تقسيم سوق شاشات العرض الصناعية المتينة إلى تركيب على اللوحة، وتركيب على الرف، وتركيب على الحائط، وتركيب على الذراع، وإطار مفتوح وغيرها. في عام 2021، يهيمن قطاع تركيب اللوحة على السوق بسبب طبيعته المتعددة في التبني لمحولات مختلفة والتبني الواسع في قطاع التصنيع.

- على أساس نوع شاشة اللمس، يتم تقسيم سوق شاشات العرض الصناعية المتينة إلى شاشات مقاومة، وشاشات PCAP، وشاشات تعمل باللمس بالأشعة تحت الحمراء، وشاشات سعوية. في عام 2021، تهيمن شريحة الشاشات المقاومة على السوق بسبب انخفاض تكلفة تبنيها وسهولة استخدامها مع القفازات والقلم السلبي.

- على أساس التطبيق، يتم تقسيم سوق شاشات العرض الصناعية المتينة إلى الأجهزة الطبية، وواجهات الآلة البشرية ، والأتمتة الصناعية ، وأكشاك البيع/نقاط البيع، واللافتات الرقمية، والتصوير، والألعاب/اليانصيب. في عام 2021، يهيمن قطاع واجهات الآلة البشرية على السوق بسبب التصنيع السريع والاستخدام في الأتمتة.

- على أساس عمودي، يتم تقسيم سوق العرض الصناعي المتين إلى النفط والغاز والتصنيع والكيميائية والطاقة والكهرباء والتعدين والمعادن والنقل والجيش والدفاع وغيرها. في عام 2021، يهيمن قطاع التصنيع على السوق بسبب الطلب المرتفع بسبب زيادة الأتمتة ومرافق التصنيع المتنامية في جميع أنحاء منطقة آسيا والمحيط الهادئ.

تحليل سوق شاشات العرض الصناعية المتينة على مستوى الدولة

يتم تحليل سوق شاشات العرض الصناعية الوعرة وتوفير معلومات حجم السوق حسب البلد والتكنولوجيا وحجم العرض والدقة والتركيب ونوع شاشة اللمس والتطبيق والعمودي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق شاشات العرض الصناعية الوعرة هي الصين وكوريا الجنوبية واليابان والهند وأستراليا وسنغافورة وماليزيا وإندونيسيا وتايلاند والفلبين وبقية دول آسيا والمحيط الهادئ.

تهيمن الصين على منطقة آسيا والمحيط الهادئ بسبب النمو السريع للصناعات واستخدام واجهة الإنسان والآلة في التصنيع.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في منطقة آسيا والمحيط الهادئ والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

إن الأنشطة الاستراتيجية المتنامية من قبل كبار اللاعبين في السوق لتعزيز الوعي بشاشات العرض الصناعية الوعرة، تعمل على تعزيز نمو سوق شاشات العرض الصناعية الوعرة.

يوفر لك سوق شاشات العرض الصناعية المتينة أيضًا تحليلًا تفصيليًا للسوق لكل نمو في سوق معين. بالإضافة إلى ذلك، يوفر معلومات تفصيلية حول استراتيجية اللاعبين في السوق ووجودهم الجغرافي. تتوفر البيانات للفترة التاريخية من 2010 إلى 2019.

تحليل حصة السوق للمشهد التنافسي والعرض الصناعي القوي

يوفر المشهد التنافسي لسوق شاشات العرض الصناعية المتينة تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق شاشات العرض الصناعية المتينة.

الشركات الكبرى التي تتعامل في شاشات العرض الصناعية المتينة هي SAMSUNG ELECTRONICS AMERICA وAdvantech Co., Ltd. وAU Optronics Corp. وBOE Technology UK Limited وCurtiss-Wright Corporation وGETAC وKyocera وPeppell+Fuchs SE وRockwell Automation, Inc. وSiemens وTCI GmbH من بين اللاعبين المحليين الآخرين. يفهم محللو DBMR نقاط القوة التنافسية ويقدمون تحليلاً تنافسيًا لكل منافس على حدة.

كما يتم أيضًا إبرام العديد من العقود والاتفاقيات من قبل الشركات في جميع أنحاء العالم والتي تعمل أيضًا على تسريع سوق شاشات العرض الصناعية الوعرة.

على سبيل المثال،

- في أبريل 2021، تم اختيار قسم حلول الدفاع في شركة Curtiss-Wright من قبل شركة Scientific Research Corporation (SRC) لتوفير نسخة من نظام مسجل الطيران Fortress الرائد في الصناعة لترقية طائرة التدريب T-6 Texan II التي تستخدمها الولايات المتحدة. قدمت الشركة لشركة SRC نسخة جديدة من Fortress CVR25 والتي تم تطويرها للاستخدام على المنصات الجوية الثابتة الجناح والطائرات العمودية العسكرية. سيساعد هذا الشركة على استكشاف تطبيقات مسجل الطيران الأخرى داخل وزارة الدفاع في قسم الدفاع الخاص بها

- في مارس 2021، أعلنت شركة Advantech Co. Ltd، وهي شركة رائدة في منطقة آسيا والمحيط الهادئ في مجال تقنية إنترنت الأشياء، عن إطلاق أكبر سلسلة مؤتمرات شركاء عبر الإنترنت في العالم، وكان موضوع السلسلة هو "Edge+ لمستقبل إنترنت الأشياء الاصطناعي". جمعت السلسلة أكثر من 60 خبيرًا صناعيًا ومتعاونًا في النظام البيئي لمشاركة حلول وتقنيات Edge+ الجديدة. تخطط الشركة أيضًا للعمل مع هؤلاء المتعاونين على أساس طويل الأمد لخلق بيئة مستدامة وتحسين فرص الأعمال في مجال إنترنت الأشياء.

إن التعاون وإطلاق المنتج وتوسيع الأعمال والجوائز والتقدير والمشاريع المشتركة والاستراتيجيات الأخرى التي يتبعها اللاعب في السوق تعمل على تعزيز بصمة الشركة في سوق شاشات العرض الصناعية القوية مما يوفر أيضًا فائدة لنمو أرباح المنظمة.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRIAL DISPLAY TYPES

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAYS

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRIC MANUFACTURERS ASSOCIATION (NEMA) RATINGS

4.3 KEY CUSTOMERS BY INDUSTRY

4.3.1 MILITARY & DEFENSE INDUSTRY

4.3.2 INDUSTRIAL AUTOMATION & MANUFACTURING

4.3.3 OIL & GAS INDUSTRY

4.3.4 CHEMICAL INDUSTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES RISK OF EYE DAMAGE

5.1.3 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES

5.1.4 INCREASE IN MANUFACTURING FACILITIES WORLDWIDE ENHANCES ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.1.6 RISE IN DEMAND FOR COST-EFFECTIVE KIOSKS FOR INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS/PANELS

5.2.2 DEVELOPING & DESIGNING OF DISPLAY EQUIPMENT FOR ALL WEATHER CONDITIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASE IN DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISE IN ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 TRANSFORMATION OF MANUAL PROCESS INTO DIGITAL PROCESS BY COMPANIES

5.3.5 INCREASE IN PARTNERSHIPS AND ACQUISITIONS AMONGST DIFFERENT MARKET PLAYERS

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCY OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LCD

7.3 LED

7.3.1 FULL ARRAY

7.3.2 EDGE LIT

7.3.3 DIRECT LIT

7.4 OLED

7.4.1 AMOLED DISPLAY

7.4.2 PMOLED DISPLAY

7.5 E-PAPER DISPLAY

8 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE

8.1 OVERVIEW

8.2” – 18”

8.3 8” – 11”

8.4” – 12”

8.5” – 25”

8.6 ABOVE 40"

9 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION

9.1 OVERVIEW

9.24X768

9.36X768

9.40X1080

9.5X600

9.60X1024

9.70X1200

10 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING

10.1 OVERVIEW

10.2 PANEL MOUNTING

10.3 OPEN-FRAME

10.4 RACK MOUNTING

10.5 WALL MOUNTING

10.6 ARM-MOUNTED

10.7 OTHERS

11 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE

11.1 OVERVIEW

11.2 RESISTIVE

11.3 P CAP

11.4 CAPACITIVE

11.5 IR TOUCH

12 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HMI

12.2.1” – 18”

12.2.2 8” – 11”

12.2.3” – 25”

12.2.4” – 12”

12.2.5 ABOVE 40"

12.3 MEDICAL

12.3.1” – 18”

12.3.2” – 25”

12.3.3” – 12”

12.3.4 8” – 11”

12.3.5 ABOVE 40"

12.4 INDUSTRIAL AUTOMATION

12.4.1 ABOVE 40"

12.4.2” – 25”

12.4.3” – 18”

12.4.4” – 12”

12.4.5 8” – 11”

12.5 DIGITAL SIGNAGE

12.5.1 ABOVE 40"

12.5.2” – 25”

12.5.3” – 18”

12.5.4” – 12”

12.5.5 8” – 11”

12.6 KIOSK/ POS

12.6.1 8” – 11”

12.6.2” – 12”

12.6.3” – 18”

12.6.4” – 25”

12.6.5 ABOVE 40"

12.7 GAMING/ LOTTERY

12.7.1” – 18”

12.7.2” – 25”

12.7.3” – 12”

12.7.4 8” – 11”

12.7.5 ABOVE 40"

12.8 IMAGING

12.8.1” – 18”

12.8.2” – 25”

12.8.3 ABOVE 40"

12.8.4” – 12”

12.8.5 ABOVE 40"

13 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 MANUFACTURING

13.2.1 LCD

13.2.2 LED

13.2.3 OLED

13.3 MILITARY & DEFENCE

13.3.1 LCD

13.3.2 LED

13.3.3 OLED

13.4 ENERGY & POWER

13.4.1 LCD

13.4.2 LED

13.4.3 OLED

13.5 OIL & GAS

13.5.1 LCD

13.5.2 LED

13.5.3 OLED

13.6 CHEMICAL

13.6.1 LCD

13.6.2 LED

13.6.3 OLED

13.7 TRANSPORTATION

13.7.1 LCD

13.7.2 LED

13.7.3 OLED

13.8 METAL & MINING

13.8.1 LCD

13.8.2 LED

13.8.3 OLED

13.9 OTHERS

14 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY GEOGRAPHY

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 SINGAPORE

14.1.6 AUSTRALIA

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILLIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SAMSUNG ELECTRONICS AMERICA

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 AU OPTRONICS CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALSYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 KYOCERA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CURTISS-WRIGHT CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 ROCKWELL AUTOMATION INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 GETAC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ADVANCED EMBEDDED SOLUTIONS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ADVANTECH CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 BIT TRADITION GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BLUESTONE TECHNOLOGY LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BOE TECHNOLOGY UK LIMITED

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BRESSNER TECHNOLOGY GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 CRYSTAL GROUP INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 GENERAL DIGITAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 HEMATEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HOPE INDUSTRIAL SYSTEMS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NOAX TECHNOLOGIES AG

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PEPPERL+FUCHS SE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SIEMENS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 TCI GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 DESCRIPTION OF VARIOUS IP RATING NUMBERS

TABLE 2 SIGNIFICANCE OF NEMA RATING

TABLE 3 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 4 ASIA-PACIFIC LCD IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 5 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 6 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 8 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC E-PAPER DISPLAY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 10 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC 13” – 18” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 12 ASIA-PACIFIC 8” – 11” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 13 ASIA-PACIFIC 11” – 12” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 14 ASIA-PACIFIC 19” – 25” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 15 ASIA-PACIFIC ABOVE 40" IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 16 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC 1024X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 18 ASIA-PACIFIC 1366X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 19 ASIA-PACIFIC 1920X1080 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 20 ASIA-PACIFIC 800X600 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 21 ASIA-PACIFIC 1280X1024 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 22 ASIA-PACIFIC 1920X1200 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 23 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC PANEL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 25 ASIA-PACIFIC OPEN-FRAME IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 26 ASIA-PACIFIC RACK MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 27 ASIA-PACIFIC WALL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 28 ASIA-PACIFIC ARM-MOUNTED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 29 ASIA-PACIFIC OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 30 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC RESISTIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 32 ASIA-PACIFIC P CAP IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 33 ASIA-PACIFIC CAPACITIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 34 ASIA-PACIFIC IR TOUCH IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 35 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 ASIA-PACIFIC HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 37 ASIA-PACIFIC HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 38 ASIA-PACIFIC MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 39 ASIA-PACIFIC MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 40 ASIA-PACIFIC INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 41 ASIA-PACIFIC INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 43 ASIA-PACIFIC DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 44 ASIA-PACIFIC KIOSK/POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 45 ASIA-PACIFIC KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 46 ASIA-PACIFIC GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 47 ASIA-PACIFIC GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 49 ASIA-PACIFIC IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 50 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 51 ASIA-PACIFIC MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 52 ASIA-PACIFIC MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 ASIA-PACIFIC MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 54 ASIA-PACIFIC MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 55 ASIA-PACIFIC ENERGY AND POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 56 ASIA-PACIFIC ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 ASIA-PACIFIC OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 58 ASIA-PACIFIC OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 59 ASIA-PACIFIC CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 60 ASIA-PACIFIC CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 ASIA-PACIFIC TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 62 ASIA-PACIFIC TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 63 ASIA-PACIFIC METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 64 ASIA-PACIFIC METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 ASIA-PACIFIC OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 66 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 67 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 68 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 71 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 72 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 73 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 74 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (THOUSAND UNITS)

TABLE 76 ASIA-PACIFIC HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 77 ASIA-PACIFIC MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 78 ASIA-PACIFIC INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 79 ASIA-PACIFIC MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 80 ASIA-PACIFIC KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 81 ASIA-PACIFIC GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 82 ASIA-PACIFIC IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 83 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 ASIA-PACIFIC MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 ASIA-PACIFIC MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 86 ASIA-PACIFIC ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 87 ASIA-PACIFIC OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 ASIA-PACIFIC CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 ASIA-PACIFIC TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 ASIA-PACIFIC METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 92 CHINA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 CHINA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 95 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 96 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 97 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 98 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 CHINA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 100 CHINA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 101 CHINA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 102 CHINA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 103 CHINA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 104 CHINA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 105 CHINA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 106 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 107 CHINA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 CHINA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 109 CHINA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 CHINA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 CHINA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 112 CHINA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 113 CHINA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 114 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 115 JAPAN LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 JAPAN OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 118 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 119 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 120 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 121 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 JAPAN HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 123 JAPAN MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 124 JAPAN INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 125 JAPAN MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 126 JAPAN KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 127 JAPAN GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 128 JAPAN IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 129 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 130 JAPAN MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 131 JAPAN MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 JAPAN ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 133 JAPAN OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 134 JAPAN CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 JAPAN TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 136 JAPAN METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 138 SOUTH KOREA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 SOUTH KOREA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 141 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 142 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 143 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 144 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 SOUTH KOREA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 146 SOUTH KOREA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 147 SOUTH KOREA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 148 SOUTH KOREA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 149 SOUTH KOREA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 150 SOUTH KOREA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 151 SOUTH KOREA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 152 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 153 SOUTH KOREA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 154 SOUTH KOREA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 SOUTH KOREA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 156 SOUTH KOREA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 157 SOUTH KOREA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 SOUTH KOREA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 159 SOUTH KOREA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 160 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 INDIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 INDIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 164 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 165 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 166 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 167 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 168 INDIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 169 INDIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 170 INDIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 171 INDIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 172 INDIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 173 INDIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 174 INDIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 175 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 176 INDIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 177 INDIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 178 INDIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 179 INDIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 180 INDIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 181 INDIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 182 INDIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 183 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 184 SINGAPORE LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 SINGAPORE OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 187 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 188 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 189 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 190 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 191 SINGAPORE HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 192 SINGAPORE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 193 SINGAPORE INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 194 SINGAPORE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 195 SINGAPORE KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 196 SINGAPORE GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 197 SINGAPORE IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 198 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 199 SINGAPORE MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 200 SINGAPORE MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 201 SINGAPORE ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 202 SINGAPORE OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 203 SINGAPORE CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 204 SINGAPORE TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 205 SINGAPORE METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 206 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 207 AUSTRALIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 208 AUSTRALIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 209 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 210 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 211 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 212 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 213 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 214 AUSTRALIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 215 AUSTRALIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 216 AUSTRALIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 217 AUSTRALIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 218 AUSTRALIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 219 AUSTRALIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 220 AUSTRALIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 221 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 222 AUSTRALIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 223 AUSTRALIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 224 AUSTRALIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 225 AUSTRALIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 226 AUSTRALIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 227 AUSTRALIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 228 AUSTRALIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 229 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 230 MALAYSIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 231 MALAYSIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 232 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 233 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 234 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 235 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 236 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 237 MALAYSIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 238 MALAYSIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 239 MALAYSIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 240 MALAYSIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 241 MALAYSIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 242 MALAYSIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 243 MALAYSIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 244 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 245 MALAYSIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 246 MALAYSIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 247 MALAYSIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 248 MALAYSIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 249 MALAYSIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 250 MALAYSIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 251 MALAYSIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 252 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 253 THAILAND LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 254 THAILAND OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 255 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 256 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 257 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 258 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 259 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 260 THAILAND HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 261 THAILAND MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 262 THAILAND INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 263 THAILAND MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 264 THAILAND KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 265 THAILAND GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 266 THAILAND IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 267 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 268 THAILAND MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 269 THAILAND MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 270 THAILAND ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 271 THAILAND OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 272 THAILAND CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 273 THAILAND TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 274 THAILAND METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 275 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 276 INDONESIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 277 INDONESIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 278 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 279 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 280 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 281 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 282 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 283 INDONESIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 284 INDONESIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 285 INDONESIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 286 INDONESIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 287 INDONESIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 288 INDONESIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 289 INDONESIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 290 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 291 INDONESIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 292 INDONESIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 293 INDONESIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 294 INDONESIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 295 INDONESIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 296 INDONESIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 297 INDONESIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 298 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 299 PHILLIPPINES LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 300 PHILLIPPINES OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 301 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 302 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 303 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 304 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 305 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 306 PHILLIPPINES HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 307 PHILLIPPINES MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 308 PHILLIPPINES INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 309 PHILLIPPINES MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 310 PHILLIPPINES KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 311 PHILLIPPINES GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 312 PHILLIPPINES IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 313 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 314 PHILLIPPINES MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 315 PHILLIPPINES MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 316 PHILLIPPINES ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 317 PHILLIPPINES OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 318 PHILLIPPINES CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 319 PHILLIPPINES TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 320 PHILLIPPINES METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 321 REST OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 10 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE TH ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 LCD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

FIGURE 13 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 14 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY DISPLAY SIZE, 2020

FIGURE 15 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY RESOLUTION, 2020

FIGURE 16 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY MOUNTING, 2020

FIGURE 17 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TOUCH SCREEN TYPE, 2020

FIGURE 18 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 19 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 20 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 21 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 22 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 23 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 24 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY (2019-2028)

FIGURE 25 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.