Asia Pacific Premium Wine Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

11,250.16 Million

USD

19,164.08 Million

2021

2029

USD

11,250.16 Million

USD

19,164.08 Million

2021

2029

| 2022 –2029 | |

| USD 11,250.16 Million | |

| USD 19,164.08 Million | |

|

|

|

|

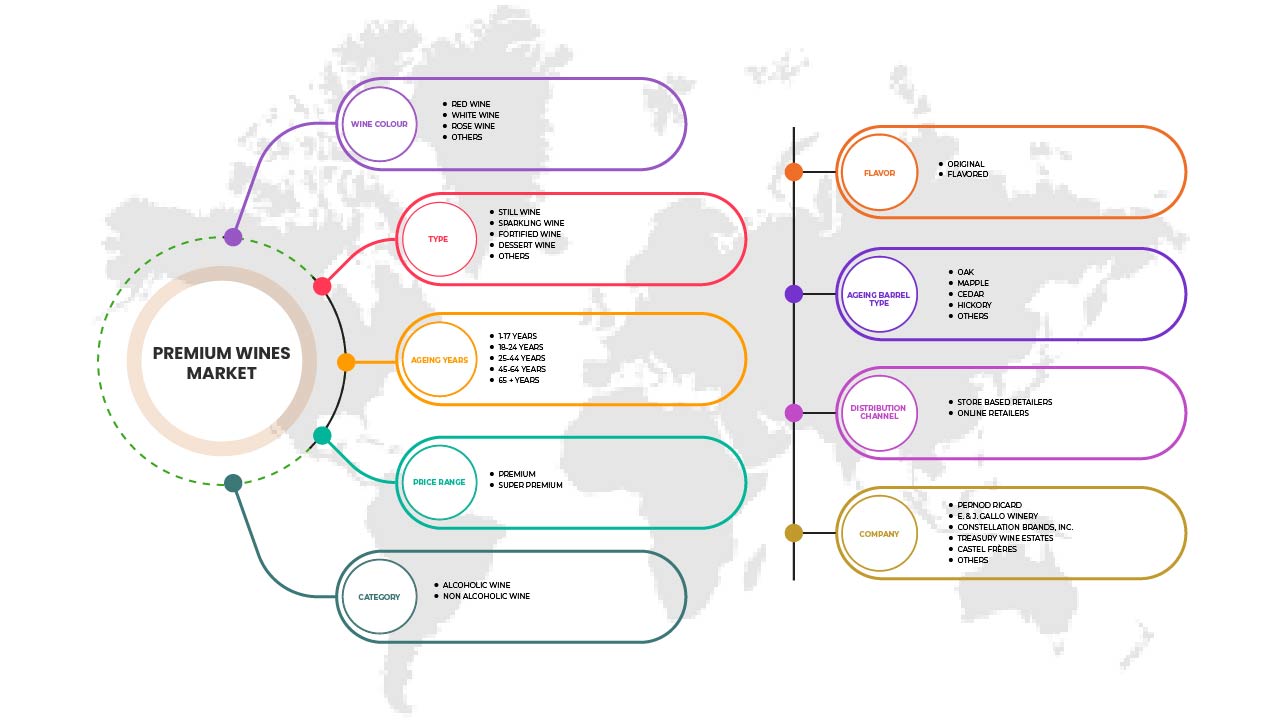

سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ، حسب لون النبيذ ( النبيذ الأحمر ، والنبيذ الأبيض، والنبيذ الوردي، وغيرها)، نوع المنتج ( نبيذ ساكن ، نبيذ مدعم، نبيذ فوار، نبيذ حلوى)، فئة المنتج (نبيذ كحولي ونبيذ غير كحولي)، النكهة (أصلي ونكهة)، سنوات التعتيق (1-17 سنة، 18-24 سنة، 25-44 سنة، 45-64 سنة و65+ سنة)، نوع برميل التعتيق (البلوط، القيقب، الأرز، الهيكوري وغيرها)، نطاق السعر (ممتاز وفائق الجودة)، قناة التوزيع (تجار التجزئة في المتاجر وتجار التجزئة عبر الإنترنت) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ

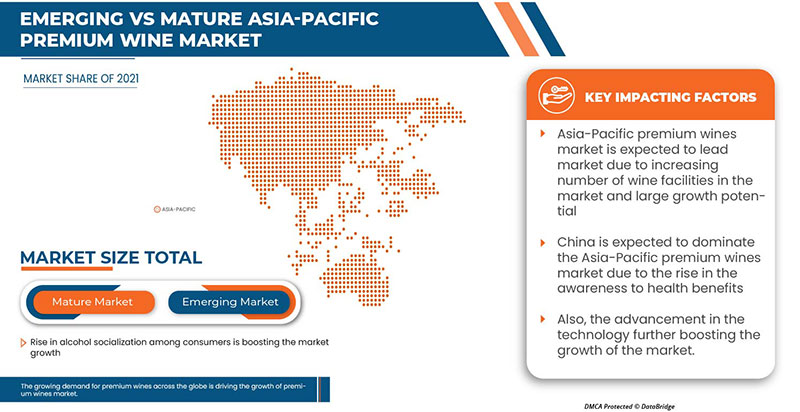

يساعد الطلب المتزايد على النبيذ بسبب الفوائد الصحية المختلفة في تعزيز نمو السوق الإجمالي. كما تساهم التجارة الإلكترونية المتزايدة وخدمات التوصيل السريع وتوصيل النبيذ في نمو السوق. يركز اللاعبون الرئيسيون في السوق بشكل كبير على إطلاق أنواع جديدة مختلفة من النبيذ. بالإضافة إلى ذلك، يساهم ارتفاع معدلات التنشئة الاجتماعية للكحول بين المستهلكين أيضًا في زيادة الطلب على السوق.

يشهد سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ نموًا في عام التوقعات بسبب زيادة عدد اللاعبين في السوق وتوافر العديد من العلامات التجارية للنبيذ الفاخر في السوق. إلى جانب ذلك، يشارك المصنعون في إنتاج أنواع مختلفة من النبيذ في السوق. كما تعمل الحانات والمطاعم المتزايدة على تعزيز نمو السوق. ومع ذلك، فإن التكلفة العالية لإنتاج النبيذ والتحول التدريجي للمستهلكين نحو المشروبات الكحولية الأخرى قد يعيق نمو سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ في فترة التوقعات.

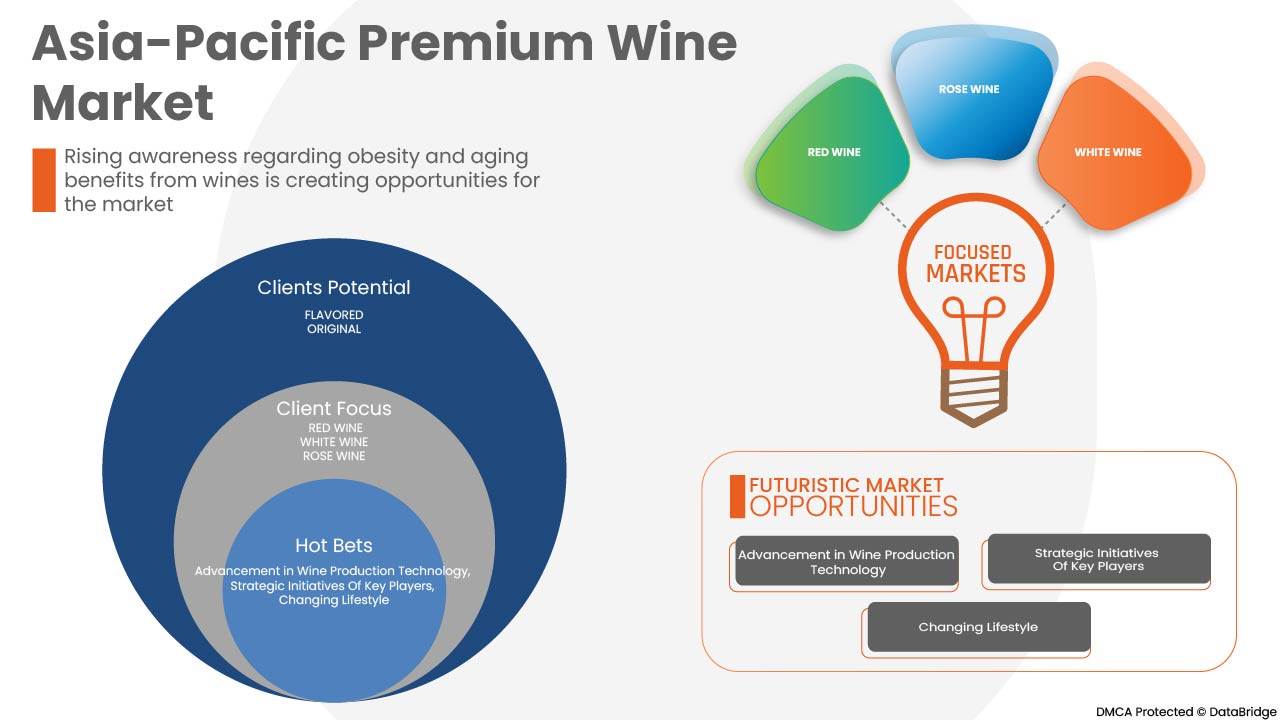

إن الفوائد الصحية المتنوعة، وأسلوب الحياة المتغير، والمبادرات الاستراتيجية التي يتخذها اللاعبون في السوق توفر فرصًا للسوق. ومع ذلك، فإن الإفراط في استهلاك النبيذ الذي يعيق العديد من الأمراض الخطيرة، والانتهاء من الطلب على النبيذ والمضاعفات التي تطرأ عليه، تشكل تحديات رئيسية لنمو السوق.

من المتوقع أن يحقق سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 7.0٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 19،164.08 مليون دولار أمريكي بحلول عام 2029 من 11،250.16 مليون دولار أمريكي في عام 2021.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب لون النبيذ ( نبيذ أحمر ، نبيذ أبيض، نبيذ وردي، وأنواع أخرى)، نوع المنتج ( نبيذ ساكن ، نبيذ مدعم، نبيذ فوار، نبيذ حلوى)، فئة المنتج (نبيذ كحولي ونبيذ غير كحولي)، النكهة (أصلي ومنكه)، سنوات التعتيق (1-17 سنة، 18-24 سنة، 25-44 سنة، 45-64 سنة و65+ سنة)، نوع برميل التعتيق (البلوط، القيقب، الأرز، الهيكوري وأنواع أخرى)، نطاق السعر (ممتاز وفائق الجودة)، قناة التوزيع (تجار التجزئة في المتاجر وتجار التجزئة عبر الإنترنت) |

|

الدول المغطاة |

الصين، اليابان، الهند، كوريا الجنوبية، أستراليا، سنغافورة، تايلاند، ماليزيا، إندونيسيا، الفلبين، فيتنام، نيوزيلندا، بقية دول آسيا والمحيط الهادئ |

|

الجهات الفاعلة في السوق المشمولة |

الشركات الرئيسية التي تتعامل في السوق هي Vina Concha Y Toro و Treasury Wine Estates و Mount Mary Vineyard و Vins Grands Crus و Sula Vineyards و Moss Wood و Leeuwin Estate و E. & J. Gallo Winery و Constellation Brands، Inc. و Castel Freres و The Wine Group و Accolade Wines و Pernod Ricard و Rockford و Henschke Cellars و Gioconda و Cullen Wines و Bass Philip و Changyu Pioneer Wine Company و Casella و Chateau Cheval Blanc و Miguel Torres SA و Fetzer و GRUPO PENFLOR وغيرها. |

تعريف سوق النبيذ الفاخر

النبيذ هو مشروب كحولي يتم إنتاج الكحول فيه بشكل طبيعي من خلال التخمير. التخمير هو الخطوة الأولى في العملية، والتي تتم بواسطة البكتيريا الموجودة على قشرة العنب. بعد ذلك، يتم إضافة سلالة معينة من الخميرة إلى المنتج المخمر الرئيسي للحصول على النتيجة المرجوة. يتم تحويل السكر في العنب إلى ثاني أكسيد الكربون والإيثانول بواسطة الخميرة أو البكتيريا في النبيذ. النبيذ الذي يحتوي على الكثير من السكر له طعم مختلف، والنبيذ الصحراوي هو واحد منهم. السحق، والتخمير الكحولي، والتخمير المالولاكتيكي، وسحب النبيذ من الرواسب، والاستقرار والعتيق، والتكرير في الزجاجة هي العمليات الأساسية الستة المشاركة في إنتاج النبيذ.

ديناميكيات سوق النبيذ الفاخر

السائقين

- تزايد الطلب على النبيذ بسبب الفوائد الصحية المختلفة

زاد استهلاك النبيذ في السنوات القليلة الماضية بسبب زيادة الوعي بفوائده الصحية المختلفة. ووفقًا للباحثين، فإن الاستهلاك المعتدل للنبيذ، الذي يحتوي على نسبة كحول تتراوح بين 12% و15% يوميًا، يساعد في الوقاية من العديد من الأمراض. وفيما يلي بعض الفوائد الصحية للنبيذ:

يتمتع النبيذ بخصائص مضادة للأكسدة. ومضادات الأكسدة هي مركبات تمنع تلف الخلايا الناجم عن الالتهاب والإجهاد التأكسدي. يحتوي العنب على مستويات عالية من البوليفينول ومضادات الأكسدة التي ثبت أنها تقلل من الإجهاد التأكسدي والالتهاب.

- ارتفاع في خدمات التجارة الإلكترونية والتوصيل والنبيذ

تتغير صناعة التجارة الإلكترونية باستمرار وتلعب دورًا حيويًا في حياتنا اليومية. توفر التجارة الإلكترونية منصة للأشخاص لشراء أو بيع ما يريدون، في أي وقت يريدون. يعمل التجار باستمرار على إنشاء وتحسين استراتيجيات وأساليب أعمال التجارة الإلكترونية الخاصة بهم لتلبية الطلب المتغير للمستهلكين.

لقد غيرت التجارة الإلكترونية طريقة ممارسة الأعمال في مختلف أنحاء العالم. وقد نتج جزء كبير من النمو الذي شهدته هذه الصناعة عن زيادة انتشار الإنترنت والهواتف الذكية. كما أن التقدم التكنولوجي ونمو الأسواق المتاحة جعل من السهل شراء وبيع السلع من خلال البوابات الإلكترونية. ويواصل التجار وخدمات التوصيل متابعة طلب المستهلكين في المنصات الإلكترونية، حيث يتوافدون على التجارة الإلكترونية بأعداد قياسية.

- ارتفاع معدلات تعاطي الكحول بين المستهلكين

لقد شهد إنتاج واستهلاك النبيذ نموًا سريعًا في العقود الأخيرة، مما أدى إلى زيادة الاستهلاك. وفي الوقت الحاضر، تعد المشاركات الاجتماعية والتحديث والاحتضان المتزايد للثقافة الغربية من العناصر التي تشجع المستهلكين على الاختلاط بالكحول، الأمر الذي من شأنه أن يسرع من نمو السوق.

لقد أصبح استهلاك الكحول علامة على المكانة الاجتماعية، مما يدعم نمو سوق المشروبات منخفضة الكحول. كما اكتسب شعبية كبيرة بين جيل الألفية والشباب، وذلك بسبب جاذبيته المنعشة وعروضه منخفضة الكحول. ويرتبط الكحول بشكل رئيسي بالعديد من المناسبات ويقدم كمشروب على المائدة مع الطعام العادي في البلدان النامية.

ويشجع الطلب المتزايد الشركات المصنعة على إطلاق وتقديم منتجات مبتكرة، وهو ما من المتوقع أيضًا أن يعزز نمو السوق في السنوات القادمة.

فرص

- تغيير نمط الحياة

يفضل الناس النبيذ الفاخر بسبب مذاقه الأصيل. وقد أصبح النبيذ بمثابة المكانة الاجتماعية والشيء العام للحفلات والمناسبات المختلفة على الرغم من المركبات الصحية وغير الصحية. تكشف الدراسات الوبائية من العديد من السكان المتباينين أن الأفراد الذين اعتادوا على استهلاك النبيذ المعتدل يوميًا يتمتعون بانخفاض كبير في الوفيات الناجمة عن جميع الأسباب وخاصة أمراض القلب والأوعية الدموية مقارنة بالأفراد الذين يمتنعون عن تناول الكحول أو يشربونه بشكل مفرط.

- زيادة عدد الحانات والصالات

يتزايد الطلب على النبيذ الفاخر بسبب زيادة عدد المطاعم والحانات وبارات النبيذ الخاصة في جميع أنحاء العالم. ونظرًا لأن هذه النبيذ الفاخر متوفر بسهولة في الحانات والصالات، فإن الطلب على بارات النبيذ الخاصة يتزايد أيضًا. إن بارات النبيذ والصالات التي تقدم اشتراكًا سنويًا للنبيذ الفاخر الأصلي تجعل الناس أكثر انغماسًا

القيود/التحديات

- ارتفاع تكلفة إنتاج النبيذ

في جميع أنحاء العالم، ارتفعت تكاليف إنتاج النبيذ. تواجه صناعات النبيذ العديد من التحديات، مثل تكلفة السلع وشحنها بسبب ارتفاع أسعار الغاز. أصبح الحصول على زجاجة النبيذ الفعلية أكثر صعوبة، خاصة مع التحديات في سلسلة التوريد وارتفاع أسعار الغاز. بسبب كوفيد، وارتفاع أسعار الغاز، والتضخم، ليس من السهل الحصول على زجاجات النبيذ. شهدت صناعة النبيذ زيادة في التكاليف بنسبة 30 في المائة في عام 2022. وبالتالي، فإن زيادة تكلفة إنتاج النبيذ تعيق نمو السوق

- التحول التدريجي للمستهلكين نحو المشروبات الكحولية الأخرى

إن التحديث المتزايد وارتفاع استهلاك الكحول من الاتجاهات المستمرة في جميع أنحاء العالم، مما دفع منتجي الكحول إلى إطلاق أنواع مبتكرة وجريئة من المشروبات الكحولية. ويتحول المستهلكون تدريجيًا إلى تفضيلات مختلفة تجاه المشروبات الكحولية المختلفة مثل الخمور والمشروبات الروحية والبيرة وغيرها بسبب توفرها بأسعار اقتصادية.

تأثير ما بعد كوفيد-19 على سوق النبيذ الفاخر

لقد أثر فيروس كورونا المستجد كوفيد-19 سلبًا على السوق. فقد تسببت عمليات الإغلاق والعزلة أثناء الأوبئة في إغلاق معظم الحانات والمطاعم، وبالتالي، أثرت على بيع النبيذ. كما زادت عمليات شراء النبيذ عبر الإنترنت مقارنة بعمليات الشراء من البائعين. وبالتالي، أثر فيروس كورونا المستجد سلبًا على سوق النبيذ الفاخر.

التطورات الأخيرة

- في يونيو 2022، أعلنت شركة بيرنو ريكارد عن إطلاق نظام ملصقات رقمية لإعلام المستهلكين بشكل أفضل بالمنتجات التي يشترونها وكذلك الشرب المسؤول. تهدف هذه المبادرة إلى تقديم حل فعال للمستهلكين لرغبتهم في مزيد من الشفافية بشأن محتوى المنتج والمعلومات الصحية. تم إطلاق برنامج تجريبي أوروبي في يوليو 2022، قبل طرحه عالميًا عبر جميع العلامات التجارية في محفظة المجموعة بحلول عام 2024. وقد ساعد هذا الشركة على تقديم خدمات أفضل للمستهلكين من خلال مثل هذه الابتكارات في المنظمة.

- في أغسطس 2022، أعلنت شركة E. & J. Gallo Winery أن شركة Gallo هي الراعي الرسمي للنبيذ في الدوري الوطني لكرة القدم الأمريكية (NFL). وقد ساعد هذا الشركة على زيادة حضورها في سوق آسيا والمحيط الهادئ

نطاق سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ

يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى لون النبيذ ونوع المنتج وفئة المنتج ونوع برميل التعتيق ونطاق السعر وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

لون النبيذ

- خمر أحمر

- النبيذ الأبيض

- خمر وردي

- آحرون

على أساس لون النبيذ، يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى النبيذ الأحمر والنبيذ الأبيض والنبيذ الوردي وغيرها.

نوع المنتج

- نبيذ ساكن

- النبيذ الفوار

- النبيذ المدعم و

- نبيذ الحلوى

اعتمادًا على نوع المنتج، يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى نبيذ ساكن، ونبيذ فوار، ونبيذ مدعم، ونبيذ حلوى.

فئة المنتج

- النبيذ الكحولي

- نبيذ غير كحولي

استنادًا إلى فئة المنتج، يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى نبيذ كحولي ونبيذ غير كحولي.

نكهة

- إبداعي

- منكه

على أساس النكهة، يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى الأصلي والمنكه.

سنوات الشيخوخة

- 1-7 سنوات

- 18-24 سنة

- 25-44 سنة

- 45-64 سنة

- 65+ سنة

بناءً على سنوات الشيخوخة، يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى 1-7 سنوات، و18-24 سنة، و25-44 سنة، و45-64 سنة، و65 سنة فأكثر.

نوع برميل الشيخوخة

- البلوط

- القيقب

- خشب الارز

- جوز

- آحرون

اعتمادًا على نوع البرميل، يتم تقسيم سوق النبيذ الفاخر في منطقة آسيا والمحيط الهادئ إلى أنواع من خشب البلوط، والقيقب، والأرز، والجوز الأمريكي وغيرها.

حسب نطاق السعر

- غالي

- سوبر بريميوم

Based on price range, the Asia-Pacific premium wine market is segmented into premium and super premium.

Distribution Channel

- Store Based Retailers

- Online Retailers

Based on distribution channel, the Asia-Pacific premium wine market is segmented into store based retailers and online retailers.

Premium Wine Market Regional Analysis/Insights

The premium wine market is analysed and market size insights and trends are provided by country, wine colour, product type, product category, ageing barrel type, by price range, distribution channel.

The countries in the premium wine market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, New Zealand, Rest of Asia-Pacific.

China dominates the premium wine marketing terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

The China premium wine market is expected to grow due to a rise in wine consumption with meals, consumption of premium wine at social gatherings and celebrations, an increase in consumer preference for premium wines, Increase in options to customize the flavor, color, and packaging of premium wine are expected to drive the regional market in the forecasted period.

The rapid technological advancements and perfection in traditional art of wine making are increasing the demand for premium wine. The growing population of alcohol consuming adults is further fuelling the market growth. Moreover, the different packaging options of premium wine, along with its customization, online availability, presence of major market players in the region, and high living standards, are also boosting the market's growth.

Competitive Landscape and Premium Wine Market Share Analysis

The premium wine market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on premium wine market.

Some of the major players operating in the premium wine market are Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres S.A., Fetzer, GRUPO PENFLOR and among others.

Research Methodology

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين وتحليل الخط الزمني للسوق ونظرة عامة على السوق والدليل وشبكة وضع الشركة وتحليل حصة الشركة في السوق ومعايير القياس وتحليل آسيا والمحيط الهادئ مقابل التحليل الإقليمي وحصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PREMIUM WINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 WINE COLOUR LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET WINE COLOUR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 REGULATORY FRAMEWORK AND GUIDELINES

4.3.1 ADVERTISING & PROMOTIONS –

4.4 TAXATION AND DUTY LEVIES

4.5 COMPARATIVE ANALYSIS OF TYPES OF WINE

4.6 DEMOGRAPHIC PREFERENCES

4.7 BRAND COMPETITIVE ANALYSIS

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 ASIA PACIFIC PREMIUM WINE MARKET: REGULATIONS

8 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK –

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW –

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING DEMAND FOR WINE OWING TO DIFFERENT HEALTH BENEFITS

10.1.2 RISING E-COMMERCE, COURIER, AND WINE DELIVERY SERVICES

10.1.3 RISE IN ALCOHOL SOCIALIZATION AMONG CONSUMERS

10.2 RESTRAINTS

10.2.1 INCREASED COST OF WINE PRODUCTION

10.2.2 GRADUAL SHIFT OF CONSUMERS TOWARD OTHER ALCOHOLIC BEVERAGES

10.3 OPPORTUNITIES

10.3.1 CHANGING LIFESTYLE

10.3.2 INCREASING NUMBER OF BARS AND LOUNGES

10.3.3 RISING AWARENESS REGARDING OBESITY AND AGING BENEFITS FROM WINES

10.4 CHALLENGES

10.4.1 HIGH CONSUMPTION LEADING SEVERE HEALTH PROBLEMS

10.4.2 LABOUR-INTENSIVE AND TIME-CONSUMING

11 ASIA PACIFIC PREMIUM WINE MARKET, BY WINE COLOR

11.1 OVERVIEW

11.2 RED WINE

11.2.1 FULL-BODIED

11.2.2 MEDIUM-BODIED

11.2.3 LIGHT-BODIED

11.3 WHITE WINE

11.4 ROSE WINE

11.5 OTHERS

12 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 STILL WINE

12.3 SPARKLING WINE

12.4 FORTIFIED WINE

12.5 DESSERT WINE

12.5.1 LIGHT SWEET

12.5.2 RICHLY SWEET

12.5.3 SWEET RED WINE

13 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 ALCOHOLIC

13.3 NON-ALCOHOLIC

13.3.1 0.5% ABV

13.3.2 MORE THAN 0.05% ABV

13.3.3 0.05% ABV

13.3.4 LESS THAN 0.05% ABV

14 ASIA PACIFIC PREMIUM WINE MARKET, BY FLAVOR

14.1 OVERVIEW

14.2 FLAVORED

14.2.1 FRUITS

14.2.1.1 CHERRY

14.2.1.2 PEACH

14.2.1.3 LEMON

14.2.1.4 GREEN APPLE

14.2.1.5 ORANGE

14.2.1.6 POMOGRANATE

14.2.1.7 MELON

14.2.1.8 FIG

14.2.1.9 MANGO

14.2.1.10 PINEAPPLE

14.2.1.11 OTHERS

14.2.2 BERRY

14.2.2.1 CRANBERRIES

14.2.2.2 BLUEBERRY

14.2.2.3 RASPBERRY

14.2.2.4 STRAWBERRY

14.2.2.5 OTHERS

14.2.3 FLORAL

14.2.3.1 ROSE

14.2.3.2 HIBISCUS

14.2.3.3 OTHERS

14.2.4 HERBAL

14.2.4.1 SMOKED TOBACCO

14.2.4.2 TRUFFLE

14.2.4.3 OTHERS

14.2.5 SPICES

14.2.5.1 CINNAMON

14.2.5.2 NUTMEG

14.2.5.3 PEPPER

14.2.5.4 GINGER

14.2.5.5 CLOVES

14.2.5.6 OTHERS

14.2.6 CHOCOLATE

14.2.7 MAPLE

14.2.8 HONEY

14.2.9 VANILLA

14.2.10 CARAMEL

14.3 ORIGINAL

15 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING YEARS

15.1 OVERVIEW

15.2 1-17 YEARS

15.3 18-24 YEARS

15.4 25-44 YEARS

15.5 45-64 YEARS

15.6 65+ YEARS

16 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING BARREL TYPE

16.1 OVERVIEW

16.2 OAK

16.3 HICKORY

16.4 MAPLE

16.5 CEDAR

16.6 OTHERS

17 ASIA PACIFIC PREMIUM WINE MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 PREMIUM

17.3 SUPER PREMIUM

18 ASIA PACIFIC PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 STORE BASED RETAILERS

18.2.1 LIQUOR STORES

18.2.2 CONVENIENCE STORE

18.2.3 SUPERMARKETS/HYPERMARKETS

18.2.4 WHOLESALERS

18.2.5 SPECIALITY STORES

18.2.6 GROCERY STORES

18.2.7 OTHERS

18.3 ONLINE RETAILERS

19 ASIA PACIFIC PREMIUM WINE MARKET, BY REGION

19.1 ASIA-PACIFIC

19.1.1 CHINA

19.1.2 AUSTRALIA

19.1.3 JAPAN

19.1.4 SOUTH KOREA

19.1.5 INDIA

19.1.6 THAILAND

19.1.7 SINGAPORE

19.1.8 VIETNAM

19.1.9 NEW ZEALAND

19.1.10 MALAYSIA

19.1.11 PHILIPPINES

19.1.12 REST OF ASIA-PACIFIC

20 COMPANY LANDSCAPE

20.1 ASIA PACIFIC PREMIUM WINE MARKET: COMPANY LANDSCAPE

20.1.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 PERNOD RICARD

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 E. & J. GALLO WINERY

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 CONSTELLATION BRANDS, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 TREASURY WINE ESTATES

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 CASTEL FRÈRES

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ACCOLADE WINES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 BASS PHILLIP WINES

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CASELLA

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 CHANGYU

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUS ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.1 CHATEAU CHEVAL BLANC

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 CULLEN WINES

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 FETZER

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 GIACONDA MARKETING PTY. LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 GRUPO PEÑAFLOR

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 HENSCHKE

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 LEEUWIN ESTATE

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 MIGUEL TORRES S.A

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOSS WOOD

22.18.1 COMANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOUNT MARY VINEYARD

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

22.2 ROCKFORD

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 SULA VINEYARDS PVT. LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 THE WINE GROUP

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 VINA CONCHA Y TORO

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT DEVELOPMENT

22.24 VINS GRAND CRUS

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

List of Table

TABLE 1 BELOW ARE THE MOST COMMON RED WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 2 BELOW ARE THE MOST COMMON WHITE WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 3 BELOW IS THE TABULAR REPRESENTATION OF THE OVERALL TOTAL CONSUMPTION OF WINE IN DIFFERENT COUNTRIES :

TABLE 4 THE PRICES OF THESE WINES VARY FROM REGION TO REGION. BELOW ARE THE PRICES OF SOME OF THE MOST POPULAR RED WINES ACROSS THE GLOBE.

TABLE 5 BELOW ARE THE PRICES OF SOME OF THE WORLD’S BEST WHITE WINES ACROSS THE GLOBE.

TABLE 6 ASIA PACIFIC PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC RED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC RED WINE IN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC WHITE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ROSE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC STILL WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC SPARKLING WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC FORTIFIED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DESSERT WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY ABV %, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC FLAVORED IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FRUITS IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC ORIGINAL IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC 1-17 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC 18-24 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC 25-44 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC 45-64 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC 65+ YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OAK IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC HICKORY IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC MAPLE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC CEDAR IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SUPER PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC ONLINE RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC PREMIUM WINE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 66 ASIA-PACIFIC PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 ASIA-PACIFIC STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 CHINA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 69 CHINA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 CHINA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 CHINA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 74 CHINA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 75 CHINA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 76 CHINA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 77 CHINA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 78 CHINA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 CHINA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 CHINA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 CHINA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 82 CHINA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 84 CHINA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 CHINA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 JAPAN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 105 JAPAN RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 JAPAN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 JAPAN DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 JAPAN PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 JAPAN NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 110 JAPAN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 111 JAPAN FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 112 JAPAN FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 113 JAPAN BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 JAPAN FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 JAPAN HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 JAPAN SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 JAPAN PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 118 JAPAN PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 119 JAPAN PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 120 JAPAN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 JAPAN STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 SOUTH KOREA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 123 SOUTH KOREA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SOUTH KOREA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 SOUTH KOREA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 SOUTH KOREA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 127 SOUTH KOREA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 128 SOUTH KOREA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 129 SOUTH KOREA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 130 SOUTH KOREA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 131 SOUTH KOREA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 132 SOUTH KOREA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 133 SOUTH KOREA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 134 SOUTH KOREA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 SOUTH KOREA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 136 SOUTH KOREA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH KOREA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH KOREA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 SOUTH KOREA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 INDIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 141 INDIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 INDIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 INDIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 INDIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 145 INDIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 146 INDIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 147 INDIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 148 INDIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 149 INDIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 150 INDIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 151 INDIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 152 INDIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 153 INDIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 154 INDIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 155 INDIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 INDIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 THAILAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 158 THAILAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 THAILAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 THAILAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 THAILAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 162 THAILAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 163 THAILAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 164 THAILAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 165 THAILAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 166 THAILAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 167 THAILAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 168 THAILAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 169 THAILAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 170 THAILAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 171 THAILAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 173 THAILAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 THAILAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SINGAPORE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 176 SINGAPORE RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SINGAPORE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 SINGAPORE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 180 SINGAPORE NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 181 SINGAPORE FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 182 SINGAPORE FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 183 SINGAPORE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 184 SINGAPORE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 185 SINGAPORE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 186 SINGAPORE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 187 SINGAPORE PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 188 SINGAPORE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 189 SINGAPORE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 190 SINGAPORE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 191 SINGAPORE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 192 VIETNAM PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 193 VIETNAM RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 VIETNAM PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 195 VIETNAM DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 VIETNAM PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 197 VIETNAM NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 198 VIETNAM PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 199 VIETNAM FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 200 VIETNAM FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 201 VIETNAM BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 202 VIETNAM FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 203 VIETNAM HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 204 VIETNAM SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 205 VIETNAM PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 206 VIETNAM PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 207 VIETNAM PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 208 VIETNAM PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 VIETNAM STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 NEW ZEALAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 211 NEW ZEALAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 NEW ZEALAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 213 NEW ZEALAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 214 NEW ZEALAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 215 NEW ZEALAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 216 NEW ZEALAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 217 NEW ZEALAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 218 NEW ZEALAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 219 NEW ZEALAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 220 NEW ZEALAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 221 NEW ZEALAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 222 NEW ZEALAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 223 NEW ZEALAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 224 NEW ZEALAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 225 NEW ZEALAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 226 NEW ZEALAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 227 NEW ZEALAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 228 MALAYSIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 229 MALAYSIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 MALAYSIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 231 MALAYSIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 232 MALAYSIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 233 MALAYSIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 234 MALAYSIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 235 MALAYSIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 236 MALAYSIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 237 MALAYSIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 238 MALAYSIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 239 MALAYSIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 240 MALAYSIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 241 MALAYSIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 242 MALAYSIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 243 MALAYSIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 244 MALAYSIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 MALAYSIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 246 PHILIPPINES PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 247 PHILIPPINES RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 PHILIPPINES PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 249 PHILIPPINES DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 250 PHILIPPINES PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 251 PHILIPPINES NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 252 PHILIPPINES PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 253 PHILIPPINES FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 254 PHILIPPINES FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 255 PHILIPPINES BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 256 PHILIPPINES FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 257 PHILIPPINES HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 258 PHILIPPINES SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 259 PHILIPPINES PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 260 PHILIPPINES PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 261 PHILIPPINES PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 262 PHILIPPINES PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 263 PHILIPPINES STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 264 REST OF ASIA-PACIFIC PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC PREMIUM WINE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PREMIUM WINE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PREMIUM WINE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PREMIUM WINE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PREMIUM WINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PREMIUM WINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PREMIUM WINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC PREMIUM WINE MARKET: MARKET WINE COLOUR COVERAGE GRID

FIGURE 9 ASIA PACIFIC PREMIUM WINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC PREMIUM WINE MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND OF WINE OWING TO DIFFERENT HEALTH BENEFITS AND RISING E-COMMERCE, COURIER AND WINE DELIVERY SERVICES ARE EXPECTED TO DRIVE THE ASIA PACIFIC PREMIUM WINE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RED WINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PREMIUM WINE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PREMIUM WINE MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN THE CONSUMPTION OF WINE IN THE U.S.

FIGURE 15 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 16 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, 2021

FIGURE 17 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 25 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, 2021

FIGURE 29 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, 2021

FIGURE 33 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2021

FIGURE 37 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2022-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, 2021

FIGURE 41 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, LIFELINE

FIGURE 44 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE

FIGURE 48 ASIA-PACIFIC PREMIUM WINE MARKET: SNAPSHOT (2021)

FIGURE 49 ASIA-PACIFIC PREMIUM WINE MARKET: BY COUNTRY (2021)

FIGURE 50 ASIA-PACIFIC PREMIUM WINE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 ASIA-PACIFIC PREMIUM WINE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 ASIA-PACIFIC PREMIUM WINE MARKET: BY WINE COLOUR (2022-2029)

FIGURE 53 ASIA PACIFIC PREMIUM WINE MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.