Asia Pacific Next Generation Anode Materials Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

1.72 Billion

USD

4.84 Billion

2025

2033

USD

1.72 Billion

USD

4.84 Billion

2025

2033

| 2026 –2033 | |

| USD 1.72 Billion | |

| USD 4.84 Billion | |

|

|

|

|

تقسيم سوق مواد الأنود من الجيل التالي في منطقة آسيا والمحيط الهادئ، حسب المادة (مزيج السيليكون/أكسيد السيليكون، أكسيد الليثيوم والتيتانيوم، ألياف السيليكون والكربون، غرافين السيليكون، معدن الليثيوم، وغيرها)، والتطبيق (النقل، الكهرباء والإلكترونيات، تخزين الطاقة، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2033

ما هو حجم سوق مواد الأنود من الجيل التالي في منطقة آسيا والمحيط الهادئ ومعدل نموه؟

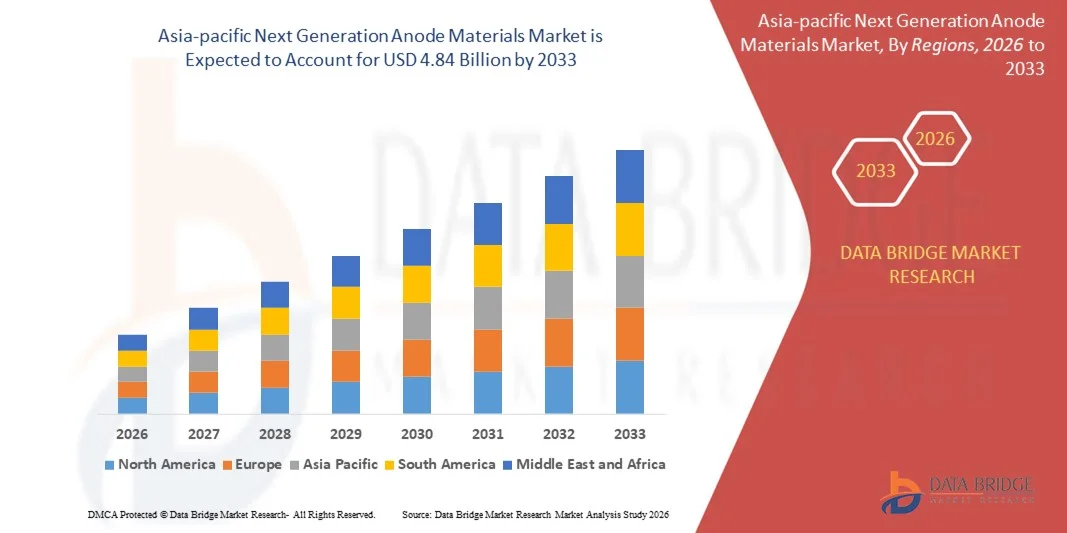

- بلغت قيمة سوق مواد الأنود من الجيل التالي في منطقة آسيا والمحيط الهادئ 1.72 مليار دولار أمريكي في عام 2025، ومن المتوقع أن تصل إلى 4.84 مليار دولار أمريكي بحلول عام 2033 ، بمعدل نمو سنوي مركب قدره 13.8% خلال فترة التوقعات.

- كان لارتفاع الطلب على البطاريات سريعة الشحن أثرٌ كبير على توسع سوق مواد الأنود من الجيل التالي. وفي هذا السياق، يُعدّ التزايد السريع في عدد مبادرات البحث والتطوير لتحسين كيمياء البطاريات، والطلب المستمر على بطاريات الليثيوم أيون عالية الكفاءة في المركبات الكهربائية والأجهزة الإلكترونية الاستهلاكية الأخرى، عاملاً رئيسياً يُسهم في نمو سوق مواد الأنود من الجيل التالي.

ما هي أهم النقاط الرئيسية التي يمكن استخلاصها من سوق مواد الأنود من الجيل التالي؟

- قد تشكل التحديات المختلفة المرتبطة بإنتاج بطاريات الليثيوم المعدنية، وعدم القدرة على إنتاج الجرافين عالي الجودة على نطاق واسع وبتكلفة منخفضة، قيودًا رئيسية على معدل نمو سوق مواد الأنود من الجيل التالي

- قد يُمثل تطوير إلكتروليتات جديدة لبطاريات الليثيوم المعدنية فرصةً جديدةً للسوق. في المقابل، قد يُشكل التزايد السريع في استخدام مصاعد السيليكون وتدهورها تحديًا لنمو سوق مواد المصاعد من الجيل التالي خلال الفترة المتوقعة.

- هيمنت الصين على سوق مواد الأنود من الجيل التالي في منطقة آسيا والمحيط الهادئ بحصة إيرادات بلغت 34.7% في عام 2024، مدفوعة باستثمارات ضخمة في تصنيع مواد البطاريات، وسلاسل إمداد قوية لبطاريات الليثيوم أيون، وقدرة إنتاج واسعة النطاق للسيارات الكهربائية.

- يشهد سوق مواد الأنود من الجيل التالي في اليابان أسرع معدل نمو بنسبة 9.21%، مدعومًا بالطلب القوي على البطاريات عالية الأداء المستخدمة في المركبات الكهربائية والإلكترونيات الاستهلاكية وأنظمة تخزين الطاقة الصناعية.

- هيمن قطاع المواد الفعالة سطحياً على السوق بحصة بلغت 28.6% في عام 2025، وذلك بفضل استخدامها الواسع في سوائل الحفر، وتقنيات استخلاص النفط المعزز، وعمليات الإنتاج. وتلعب هذه المواد دوراً بالغ الأهمية في خفض التوتر السطحي، وتحسين كفاءة إزاحة النفط، وتعزيز أداء السوائل في كل من المكامن التقليدية وغير التقليدية.

نطاق التقرير وتجزئة سوق مواد الأنود من الجيل التالي

|

صفات |

رؤى رئيسية حول سوق مواد الأنود من الجيل القادم |

|

القطاعات التي تم تغطيتها |

|

|

الدول المشمولة |

منطقة آسيا والمحيط الهادئ

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات بيانات القيمة المضافة |

بالإضافة إلى المعلومات المتعلقة بسيناريوهات السوق مثل قيمة السوق ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليلًا متعمقًا من قبل الخبراء، وتحليلًا للتسعير، وتحليلًا لحصة العلامة التجارية، واستطلاعًا للمستهلكين، وتحليلًا ديموغرافيًا، وتحليلًا لسلسلة التوريد، وتحليلًا لسلسلة القيمة، ونظرة عامة على المواد الخام/المستهلكات، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

ما هو الاتجاه الرئيسي في سوق مواد الأنود من الجيل التالي؟

تحول سريع نحو مواد الأنود عالية السعة والمستدامة والمخصصة لتطبيقات محددة في البطاريات المتقدمة

- يشهد سوق مواد الأنود من الجيل التالي تحولاً قوياً نحو مواد عالية السعة ومخصصة لتطبيقات محددة، مثل الأنودات القائمة على السيليكون، ومعدن الليثيوم، والأنودات المركبة، وذلك للتغلب على قيود كثافة الطاقة للجرافيت التقليدي.

- يركز المصنعون بشكل متزايد على مواد الأنود الهجينة ذات البنية النانوية والمهيمنة عليها السيليكون، والتي توفر سعة شحن أعلى، وشحنًا أسرع، وعمرًا تشغيليًا محسنًا للمركبات الكهربائية والإلكترونيات الاستهلاكية وأنظمة تخزين الطاقة

- إن التركيز المتزايد على مواد الأنود الصديقة للبيئة، والمنخفضة الكربون، والقابلة لإعادة التدوير يدفع الابتكار استجابةً لتشديد معايير الاستدامة ولوائح إعادة تدوير البطاريات

- فعلى سبيل المثال، تستثمر شركات مثل سيلا نانوتكنولوجيز، وإينوفيكس، ونيكسون، وألبيمارل كوربوريشن، وبوسكو كيميكال في مصاعد السيليكون، وتقنيات معدن الليثيوم، ومعالجة المواد المستدامة.

- يؤدي الطلب المتزايد على السيارات الكهربائية ذات المدى الطويل، والبطاريات سريعة الشحن، والتطبيقات عالية الطاقة إلى تسريع اعتماد حلول الأنود من الجيل التالي

- مع استمرار ارتفاع توقعات أداء البطاريات، أصبحت مواد الأنود من الجيل التالي بالغة الأهمية لتمكين كثافة طاقة أعلى، وعمر أطول، وسلامة محسّنة.

ما هي المحركات الرئيسية لسوق مواد الأنود من الجيل التالي؟

- يُعد الطلب المتزايد على البطاريات عالية الكثافة الطاقية في المركبات الكهربائية والإلكترونيات الاستهلاكية وتخزين الطاقة على نطاق الشبكة محركًا رئيسيًا للنمو

- فعلى سبيل المثال، خلال الفترة 2024-2025، قامت الشركات الرائدة في تصنيع البطاريات والمواد بتوسيع برامج تطوير الأنودات القائمة على السيليكون والليثيوم لدعم منصات السيارات الكهربائية من الجيل التالي

- تساهم الاستثمارات العالمية المتزايدة في مجال التنقل الكهربائي، ودمج الطاقة المتجددة، ومصانع البطاريات الضخمة في جميع أنحاء الولايات المتحدة وأوروبا وآسيا والمحيط الهادئ في تسريع الطلب على مواد الأنود.

- تساهم التطورات في هندسة النانو، وتقنيات طلاء المواد، وهياكل الأنودات المركبة في تحسين الأداء مع تقليل مشاكل التدهور.

- يؤدي تزايد استخدام بطاريات الحالة الصلبة وبطاريات الليثيوم المعدنية إلى خلق طلب مستمر على كيمياء الأنود المتقدمة

- من المتوقع أن يشهد سوق مواد الأنود من الجيل التالي نموًا قويًا على المدى الطويل، وذلك بفضل الحوافز الحكومية وأهداف خفض الانبعاثات الكربونية ومبادرات ابتكار البطاريات.

ما هو العامل الذي يتحدى نمو سوق مواد الأنود من الجيل التالي؟

- تُحدّ تكاليف الإنتاج المرتفعة وعمليات التصنيع المعقدة المرتبطة بالأنودات الغنية بالسيليكون والليثيوم المعدني من إمكانية التسويق التجاري على نطاق واسع

- فعلى سبيل المثال، خلال الفترة 2024-2025، أدت تحديات قابلية التوسع ومشاكل الإنتاجية إلى تأخير التبني الواسع النطاق للعديد من تقنيات الأنود المتقدمة.

- لا تزال تحديات تدهور عمر الدورة، وتمدد الحجم، ومخاوف السلامة تشكل تحديات تقنية بالغة الأهمية لمواد الأنود من الجيل التالي

- تؤدي إجراءات مراقبة الجودة الصارمة واختبارات السلامة والامتثال للوائح التنظيمية إلى زيادة الجداول الزمنية للتطوير والتكاليف التشغيلية.

- يؤدي تقلب أسعار المواد الخام وقيود سلسلة التوريد، وخاصة بالنسبة لليثيوم والمواد الكيميائية المتخصصة، إلى ضغوط على تكاليف المصنعين.

- ولمواجهة هذه التحديات، تركز الشركات على تقنيات تثبيت المواد، وأساليب التصنيع القابلة للتطوير، وتصميمات الأنودات الهجينة الفعالة من حيث التكلفة، مما يعزز اعتماد السوق في المستقبل.

كيف يتم تقسيم سوق مواد الأنود من الجيل التالي؟

يتم تقسيم السوق على أساس المادة والتطبيق .

- حسب المادة

استنادًا إلى نوع المادة، يُقسّم سوق مواد الأنود من الجيل التالي إلى مزيج السيليكون/أكسيد السيليكون، وأكسيد الليثيوم والتيتانيوم، وألياف السيليكون والكربون، والسيليكون والجرافين، ومعدن الليثيوم، ومواد أخرى. وقد هيمن مزيج السيليكون/أكسيد السيليكون على السوق بحصة بلغت 34.8% في عام 2025، مدفوعًا بقدرته على توفير كثافة طاقة أعلى بكثير من الجرافيت التقليدي مع الحفاظ على استقرار أفضل لدورة الشحن والتفريغ مقارنةً بالسيليكون النقي. وتُستخدم هذه المزيجات على نطاق واسع في بطاريات الليثيوم أيون للسيارات الكهربائية والإلكترونيات الاستهلاكية وتطبيقات الشحن السريع نظرًا لأدائها المتوازن وقابليتها للتوسع وتوافقها مع البنية التحتية الحالية لتصنيع البطاريات. كما تُسهم التطورات المستمرة في مجال الطلاء النانوي وهندسة المواد المركبة في تعزيز هذا الانتشار الواسع.

من المتوقع أن يشهد قطاع الليثيوم المعدني أسرع نمو سنوي مركب خلال الفترة من 2026 إلى 2033، وذلك بفضل التطور المتزايد لبطاريات الحالة الصلبة ومنصات الجيل القادم من السيارات الكهربائية. توفر مصاعد الليثيوم المعدني سعة نظرية فائقة، مما يجعلها عنصراً أساسياً في السيارات الكهربائية طويلة المدى وتخزين الطاقة عالي الأداء، على الرغم من التحديات المستمرة المتعلقة بالسلامة والتسويق.

- عن طريق التقديم

استنادًا إلى التطبيقات، يُقسّم سوق مواد الأنود من الجيل التالي إلى قطاعات النقل، والكهرباء والإلكترونيات، وتخزين الطاقة، وغيرها. وقد هيمن قطاع النقل على السوق بحصة إيرادات بلغت 46.2% في عام 2025، مدعومًا بالنمو السريع في إنتاج السيارات الكهربائية، واللوائح الصارمة المتعلقة بالانبعاثات، وتزايد طلب المستهلكين على بطاريات ذات مدى قيادة أطول وشحن أسرع. ويعمل مصنّعو السيارات والبطاريات على دمج مواد الأنود الغنية بالسيليكون والمتطورة بشكل مكثف لتعزيز كثافة الطاقة، وتقليل وقت الشحن، وتحسين كفاءة البطارية بشكل عام. كما تُعزز الحوافز الحكومية لتبني السيارات الكهربائية في الولايات المتحدة وأوروبا ومنطقة آسيا والمحيط الهادئ هيمنة هذا القطاع.

من المتوقع أن يسجل قطاع تخزين الطاقة أسرع معدل نمو سنوي مركب خلال الفترة من 2026 إلى 2033، مدفوعًا بتزايد استخدام أنظمة تخزين الطاقة على نطاق الشبكة، ودمج الطاقة المتجددة، والطلب على بطاريات ذات عمر تشغيلي طويل. كما أن زيادة الاستثمارات في أنظمة التخزين الثابتة، والشبكات الذكية، وحلول الطاقة الاحتياطية، تُسرّع من اعتماد مواد الأنود من الجيل التالي، والتي تتميز بالمتانة والسعة العالية.

أي منطقة تستحوذ على الحصة الأكبر من سوق مواد الأنود من الجيل التالي؟

- هيمنت الصين على سوق مواد الأنود من الجيل التالي في منطقة آسيا والمحيط الهادئ، محققةً أعلى حصة من الإيرادات بنسبة 34.7% في عام 2024، مدفوعةً باستثمارات ضخمة في تصنيع مواد البطاريات، وسلاسل إمداد قوية لبطاريات الليثيوم أيون، وقدرة إنتاجية واسعة النطاق للسيارات الكهربائية. ويساهم توجه الصين الحثيث نحو التنقل الكهربائي، وتخزين الطاقة المتجددة، ونشر البطاريات على نطاق الشبكة الكهربائية، في تسريع الطلب بشكل ملحوظ على مواد الأنود المصنوعة من السيليكون، ومعدن الليثيوم، والمواد المركبة.

- يدعم ريادة الصين في مجال البحث والتطوير في علوم المواد، وأنظمة تصنيع البطاريات المتكاملة، والطلب المحلي الكبير، الإنتاج الضخم لمواد الأنود المتقدمة. وتركز كبرى الشركات الإقليمية والعالمية، مثل مجموعة بي تي آر للمواد الجديدة، وشركة شانشان للتكنولوجيا، وشركة غانفنغ لليثيوم، على حلول الأنود عالية السعة، وطويلة العمر، وذات التكلفة المنخفضة، لتلبية متطلبات الجيل القادم من البطاريات.

- إن الدعم الحكومي القوي من خلال السياسات الصناعية ومبادرات توطين صناعة البطاريات وأهداف الطاقة النظيفة يرسخ مكانة الصين كمركز للابتكار والتصدير لمواد الأنود من الجيل التالي في جميع أنحاء منطقة آسيا والمحيط الهادئ.

نظرة عامة على سوق مواد الأنود من الجيل التالي في اليابان

يشهد سوق مواد الأنود من الجيل التالي في اليابان أسرع معدل نمو بنسبة 9.21%، مدعومًا بالطلب القوي على البطاريات عالية الأداء المستخدمة في المركبات الكهربائية والإلكترونيات الاستهلاكية وأنظمة تخزين الطاقة الصناعية. ويركز المصنعون اليابانيون على مركبات السيليكون والكربون، وتيتانات الليثيوم، وبدائل الجرافيت المتقدمة لتعزيز السلامة، وقدرة الشحن السريع، وكثافة الطاقة. ويساهم الاستثمار المستمر في التصنيع الدقيق، وابتكار المواد، والتعاون بين مصنعي البطاريات الأصليين ومعاهد البحوث في تعزيز دور اليابان في تطوير مواد الأنود المتميزة في منطقة آسيا والمحيط الهادئ.

نظرة عامة على سوق مواد الأنود من الجيل التالي في كوريا الجنوبية

يشهد سوق مواد الأنود من الجيل التالي في كوريا الجنوبية نموًا سريعًا، مدفوعًا بوجود الشركات العالمية الرائدة في مجال البطاريات وارتفاع صادرات بطاريات السيارات الكهربائية. ويُعزى الطلب القوي على مواد الأنود المصنوعة من السيليكون والجرافين والسيليكون والكربون إلى التطورات في تقنيات بطاريات الليثيوم أيون عالية الكثافة وبطاريات الحالة الصلبة. وتساهم برامج البحث والتطوير المدعومة حكوميًا، والبنية التحتية التصنيعية المتقدمة، والتكامل الوثيق مع مصنعي المعدات الأصلية للسيارات، في تسريع طرح حلول الأنود من الجيل التالي في الأسواق.

نظرة عامة على سوق مواد الأنود من الجيل التالي في الهند

تبرز الهند كسوقٍ واعدةٍ لمواد الأنود من الجيل الجديد، مدعومةً بتزايد استخدام السيارات الكهربائية، ومبادرات تصنيع البطاريات الحكومية، ونشر تقنيات تخزين الطاقة المتجددة. وتساهم الاستثمارات المتزايدة في تصنيع الخلايا محلياً، ومعالجة المعادن، وبنية تخزين الطاقة التحتية في تعزيز الطلب على مواد الأنود الفعّالة من حيث التكلفة والقابلة للتوسع. كما يُعزز الدعم الحكومي في إطار برامج التنقل النظيف وانتقال الطاقة مكانة الهند كمركزٍ مستقبلي لتصنيع واستهلاك مواد البطاريات المتقدمة في منطقة آسيا والمحيط الهادئ.

ما هي أبرز الشركات في سوق مواد الأنود من الجيل التالي؟

تتولى قيادة صناعة مواد الأنود من الجيل التالي بشكل أساسي شركات راسخة، بما في ذلك:

- ألتيرنانو (الولايات المتحدة)

- شركة ليدن جار تكنولوجيز بي في (هولندا)

- شركة نيكسيون المحدودة (المملكة المتحدة)

- شركة بي إتش ماتر ذ.م.م. (الولايات المتحدة الأمريكية)

- شركة سيلا لتقنيات النانو (الولايات المتحدة)

- كيوبيرج (الولايات المتحدة)

- شركة شنغهاي شانشان للتكنولوجيا المحدودة (الصين)

- شركة أمبيروس تكنولوجيز (الولايات المتحدة الأمريكية)

- بطارية الليثيوم في كاليفورنيا (الولايات المتحدة الأمريكية)

- إينوفيكس (الولايات المتحدة)

- شركة بوسكو للمواد الكيميائية (كوريا الجنوبية)

- شركة ألبيمارل (الولايات المتحدة الأمريكية)

- مجموعة تالغا المحدودة (أستراليا)

- شركة تيانكي لليثيوم (الصين)

- شركة جيانغشي جانفينج لليثيوم المحدودة (الصين)

- شركة ون دي لعلوم البطاريات (الولايات المتحدة الأمريكية)

- شركة JSR (اليابان)

- SCT HK (هونغ كونغ)

- شركة إيدجتك للصناعات المحدودة (الولايات المتحدة الأمريكية)

- شركة إينيفيت (الولايات المتحدة الأمريكية)

ما هي التطورات الأخيرة في سوق مواد الأنود من الجيل التالي في منطقة آسيا والمحيط الهادئ؟

- في مايو 2024، شهد القطاع زيادة في تبني تقنيات الرقمنة والأتمتة، حيث قام موردو المواد الكيميائية المتخصصة في حقول النفط بتطوير حلول مراقبة وتحكم عن بعد لتحسين عمليات المعالجة ورفع كفاءة التشغيل، مما يسلط الضوء على تحول القطاع نحو عمليات حقول نفط أكثر ذكاءً وكفاءة.

- في مارس 2024، استمر نشاط الدمج والاستحواذ في سوق المواد الكيميائية المتخصصة لحقول النفط، حيث انخرطت الشركات الرائدة في عمليات الاندماج والاستحواذ لتوسيع نطاق منتجاتها وتعزيز حضورها الجغرافي، مما يشير إلى تركيز الصناعة على نطاق واسع، والقدرة التنافسية، والنمو طويل الأجل.

- في أكتوبر 2023، أعلنت شركة لوبريزول عن اتفاقية توزيع جديدة مع مجموعة IMCD، وهي شركة رائدة في مجال توزيع وتطوير المواد الكيميائية والمكونات المتخصصة في منطقة آسيا والمحيط الهادئ، مما يعزز نطاق وصول لوبريزول إلى السوق وقدرات سلسلة التوريد الخاصة بها

- في يوليو 2022، صرحت شركة سولفاي إس إيه أنها ستسعى للحصول على دعم استشاري من بنك أوف أمريكا لتقييم البيع المحتمل لأعمالها في مجال الكيماويات لحقول النفط كجزء من مراجعة استراتيجية، مما يعكس الجهود المبذولة لتبسيط العمليات وإعادة التركيز على مجالات النمو الأساسية.

- في مارس 2022، افتتحت شركة هاليبرتون أول مصنع لها لإنتاج المواد الكيميائية المتخصصة في حقول النفط في المملكة العربية السعودية لدعم حلول الجيل القادم من المواد الكيميائية وتعزيز القدرات الإنتاجية الإقليمية، مما يمثل توسعاً كبيراً لبصمة الشركة في نصف الكرة الشرقي.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.