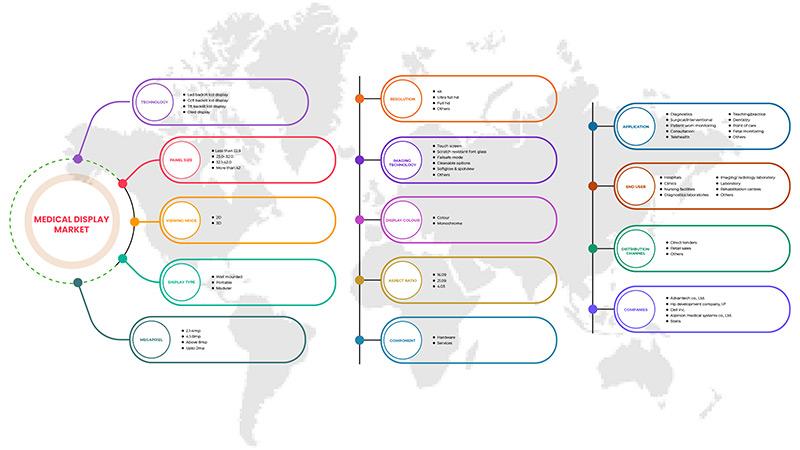

سوق شاشات العرض الطبية في آسيا والمحيط الهادئ، حسب التكنولوجيا (شاشة LCD بإضاءة خلفية LED، شاشة LCD بإضاءة خلفية CCFL، شاشة LCD TFT وشاشة OLED)، حجم اللوحة (أقل من 22.9 بوصة، 23.0 بوصة - 32.0 بوصة، 27.0-41.9 بوصة وأعلى من 42 بوصة)، وضع العرض (ثنائي الأبعاد وثلاثي الأبعاد )، ميجا بكسل (حتى 2 ميجابكسل، 2.1-4 ميجابكسل، 4.1-8 ميجابكسل وأعلى من 8 ميجابكسل)، الدقة (4K، Ultra Full HD، Full HD وغيرها)، نوع الشاشة (مثبتة على الحائط، محمولة، معيارية)، تقنية التصوير (شاشة تعمل باللمس، زجاج مقاوم للخدش، وضع آمن، خيارات قابلة للتنظيف، Softglow وSpotview وغيرها)، لون الشاشة (ملون، أحادي اللون)، نسبة العرض إلى الارتفاع (16.09، 21.09، 4.03)، المكون ( الأجهزة والخدمات)، التطبيق (الاستشارة، التشخيص ، الجراحة/التدخلية، الرعاية الصحية عن بعد، التدريس/الممارسة، مراقبة الجنين، طب الأسنان، نقطة الرعاية، أجهزة المراقبة التي يرتديها المريض وغيرها) المستخدم النهائي (المستشفيات، العيادات ، مرافق التمريض، مختبرات التشخيص، مختبر التصوير/الأشعة، المختبر، مراكز إعادة التأهيل وغيرها)، قناة التوزيع (العطاءات المباشرة، مبيعات التجزئة وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق شاشات العرض الطبية في منطقة آسيا والمحيط الهادئ

الأسباب الرئيسية لنمو سوق العرض الطبي هو الطلب المتزايد على العلاجات قليلة التدخل (MIT) بسبب فوائد متعددة مثل الألم الأقل بعد الجراحة، والمضاعفات الجراحية الأقل والرئيسية بعد الجراحة، وتقصير فترة الإقامة في المستشفى، وأوقات التعافي الأسرع، وندبات أقل، وضغط أقل على الجهاز المناعي، وشق أصغر، وبالنسبة لبعض الإجراءات فقد قلل من وقت التشغيل وخفض التكاليف أيضًا.

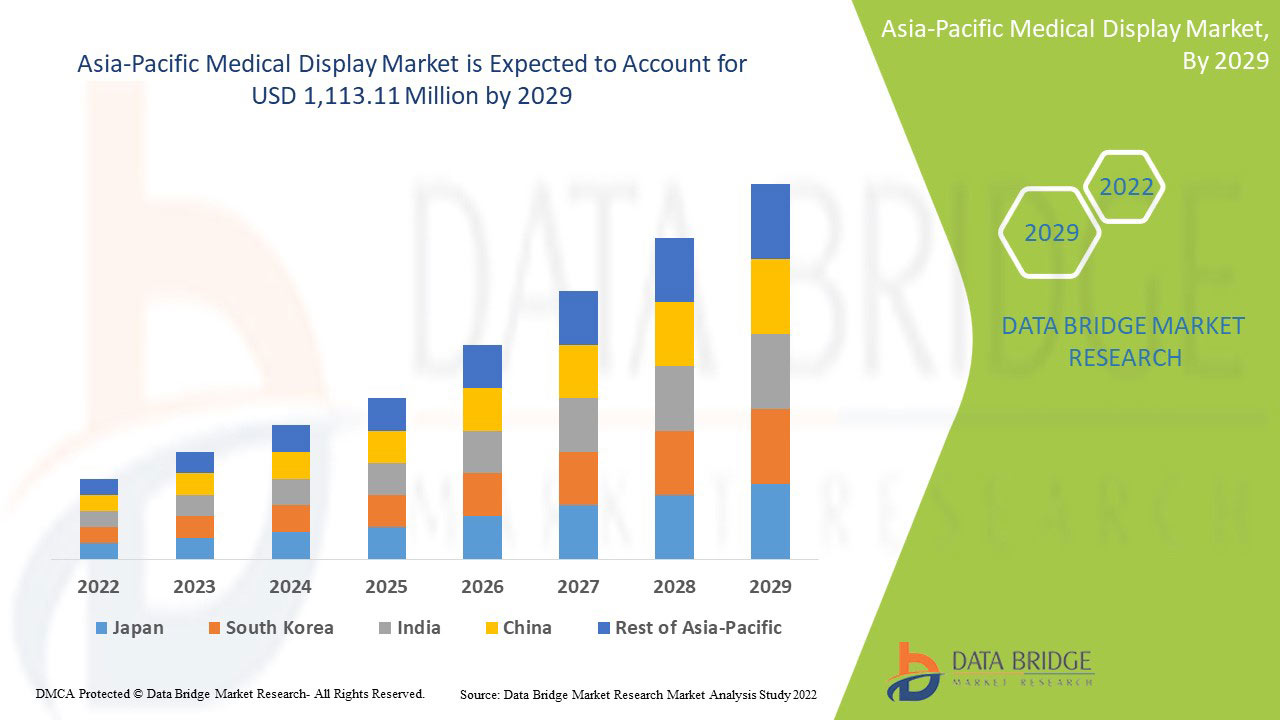

تحلل شركة Data Bridge Market Research أن سوق شاشات العرض الطبية من المتوقع أن تصل قيمته إلى 1,113.11 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 6.2% خلال الفترة المتوقعة. تشكل التكنولوجيا أكبر شريحة من النوع في السوق بسبب الطلب السريع على خدمات العرض والتصوير الطبي المتقدمة على مستوى العالم. يغطي تقرير السوق هذا أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب التكنولوجيا (شاشة LCD بإضاءة خلفية LED، شاشة LCD بإضاءة خلفية CCFL، شاشة LCD TFT وشاشة OLED)، حجم اللوحة (أقل من 22.9 بوصة، 23.0 بوصة - 32.0 بوصة، 27.0-41.9 بوصة وأعلى من 42 بوصة)، وضع العرض (ثنائي الأبعاد وثلاثي الأبعاد )، ميجا بكسل (حتى 2 ميجا بكسل، 2.1-4 ميجا بكسل، 4.1-8 ميجا بكسل وأعلى من 8 ميجا بكسل)، الدقة (4K، Ultra Full HD، Full HD وغيرها)، نوع الشاشة (مثبتة على الحائط، محمولة، معيارية)، تقنية التصوير (شاشة تعمل باللمس، زجاج مقاوم للخدش، وضع آمن، خيارات قابلة للتنظيف، Softglow وSpotview وغيرها)، لون الشاشة (ملون، أحادي اللون)، نسبة العرض إلى الارتفاع (16.09، 21.09، 4.03)، المكون ( الأجهزة والخدمات)، التطبيق (الاستشارة، التشخيص ، الجراحة/التدخلية، الرعاية الصحية عن بعد، التدريس/الممارسة، مراقبة الجنين، طب الأسنان، نقطة الرعاية، أجهزة المراقبة التي يرتديها المريض وغيرها) المستخدم النهائي (المستشفيات والعيادات ومرافق التمريض ومختبرات التشخيص ومختبرات التصوير/الأشعة والمختبرات ومراكز إعادة التأهيل وغيرها)، قناة التوزيع (العطاءات المباشرة ومبيعات التجزئة وغيرها) |

|

الدول المغطاة |

الصين، اليابان، الهند، أستراليا، كوريا الجنوبية، سنغافورة، تايلاند، ماليزيا، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ |

|

الجهات الفاعلة في السوق المشمولة |

BenQ، ALPINION MEDICAL SYSTEMS Co., Ltd، Nanjing Jusha Commercial &Trading Co,Ltd، COJE CO.,LTD.، Axiomtek Co., Ltd.، Dell Inc.، HP Development Company, LP، Reshin، Onyx Healthcare Inc.، Teguar Computers.، Shenzhen Beacon Display Technology Co., Ltd.، Rein Medical، STERIS.، Barco.، Hisense.، Sony Corporation، Advantech Co., Ltd.، LG Electronics.، Sharp NEC Display Solutions، Koninklijke Philips NV، EIZO INC.، Novanta Inc.، FSN Medical Technologies.، Quest، Ampronix.، Siemens Healthcare GmbH، Panasonic Corporation، وغيرها. |

تعريف سوق العرض الطبي

الشاشة الطبية هي شاشة تلبي المتطلبات العالية للتصوير الطبي. وعادة ما تأتي مزودة بتقنيات خاصة لتعزيز الصورة لضمان سطوع ثابت طوال عمر الشاشة، وصور خالية من الضوضاء، وقراءة مريحة، وامتثال تلقائي للتصوير الرقمي والاتصالات في الطب (DICOM) وغيرها من المعايير الطبية.

لقد أدى تطور تقنيات التصوير الطبي إلى تقدم الرعاية الصحية، حيث وفرت أدوات تشخيصية قوية، ودعمت التقييم غير الجراحي للإصابات والمشاكل الداخلية، ومكّنت من اكتشاف الأمراض في وقت أبكر بكثير من أي وقت مضى. تُفضَّل الشاشات الطبية على الشاشات الاستهلاكية عند استخدامها للتصوير الطبي. والسبب بسيط: فالشاشات الطبية تلبي المتطلبات المحددة لجودة الصورة واللوائح الطبية وضمان الجودة.

يعتمد مستقبل أجهزة العرض الطبية على التطورات في مجال الذكاء الاصطناعي وتحليل البيانات. تعمل الأجهزة الطبية على تعزيز إدارة الأمراض من خلال السماح للأطباء بتخصيص العلاج بشكل لم يسبق له مثيل. توفر هذه التقنيات رؤى كاشفة للمرضى الأفراد في الوقت الفعلي.

ديناميكيات سوق العرض الطبي

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- الاتجاه المتزايد نحو العلاج الأقل تدخلاً

الأسباب الرئيسية لنمو سوق العرض الطبي في منطقة آسيا والمحيط الهادئ هو الطلب المتزايد على العلاجات قليلة التدخل (MIT) بسبب فوائد متعددة مثل الألم الأقل بعد الجراحة، والمضاعفات الجراحية الأقل والرئيسية بعد الجراحة، وتقصير فترة الإقامة في المستشفى، وأوقات التعافي الأسرع، وندبات أقل، وضغط أقل على الجهاز المناعي، وشق أصغر، وبالنسبة لبعض الإجراءات فقد قلل من وقت التشغيل وخفض التكاليف أيضًا.

تعد الجراحة قليلة التوغل طريقة ممتازة لتشخيص وعلاج مجموعة واسعة من الاضطرابات الصدرية التي كانت تتطلب في السابق شق القص أو شق الصدر المفتوح. وقد زاد انتشار الأمراض المزمنة التي تتطلب الجراحة في جميع أنحاء العالم. ونظرًا للمزايا العديدة للعلاج بأقل قدر من التوغل، فإن العديد من المرضى يفضلونه. بالإضافة إلى ذلك، يتم إجراء جراحات الأوعية الدموية والأوعية الدموية الداخلية، وجراحات الأعصاب والعمود الفقري، ورعاية الصدمات العظمية، وجراحات القلب في غرف العمليات الهجينة. تتيح هذه الميزة للمستشفيات إجراء عمليات جراحية متقدمة، مما يزيد من الطلب على الشاشات الطبية. بالإضافة إلى ذلك، فإن ارتفاع تكاليف الرعاية الصحية وعدد مختبرات علم الأمراض والأشعة يدفع الطلب على شاشات المراقبة الطبية.

تتيح الجراحة الأقل توغلاً للجراحين استخدام التكنولوجيا الحديثة والتقنيات الجراحية المتقدمة لإجراء العمليات على جسم الإنسان بطريقة أقل ضرراً. ومن المتوقع أن يؤدي هذا إلى زيادة الطلب على الجراحات الأقل توغلاً.

- البنية التحتية المتنامية للرعاية الصحية

تركز الحكومات والمنظمات غير الربحية في العديد من البلدان بشكل أساسي على تطوير البنية التحتية الصحية لتقليل عبء المرض وتوفير خدمات صحية أفضل. بالإضافة إلى ذلك، زاد اعتماد الأجهزة الطبية المتقدمة تقنيًا والشاشات وأجهزة المراقبة والعديد من الأجهزة الأخرى. من المرجح أن تخلق كل هذه العوامل فرصًا مواتية لنمو السوق خلال فترة التنبؤ. بالإضافة إلى ذلك، يمكن للاستثمارات الضخمة من قبل اللاعبين الرئيسيين في إطلاق المنتجات المبتكرة والميزات المحدثة في السنوات القادمة أن تعزز السوق أيضًا.

علاوة على ذلك، من المتوقع أن يؤدي الطلب المتزايد على خدمات الرعاية الصحية الفعالة من حيث التكلفة، والطلب المتزايد على الحلول التقنية، وزيادة القدرة العالية على نقل المعلومات، وزيادة المبادرات والحوافز الحكومية، وزيادة التمويل لشاشات العرض الطبية عالية الجودة في المستشفيات ومراكز الأبحاث إلى دفع هذه المرافق الصحية إلى السوق. شكلت البنية التحتية للبرمجيات الطبية الأساس للتقدم الأخير في شاشات العرض الطبية والمكتبات الطبية الرقمية وأنظمة المعلومات الإدارية. ومن المتوقع أن تدفع هذه العوامل نمو سوق شاشات العرض الطبية في منطقة آسيا والمحيط الهادئ.

فرصة

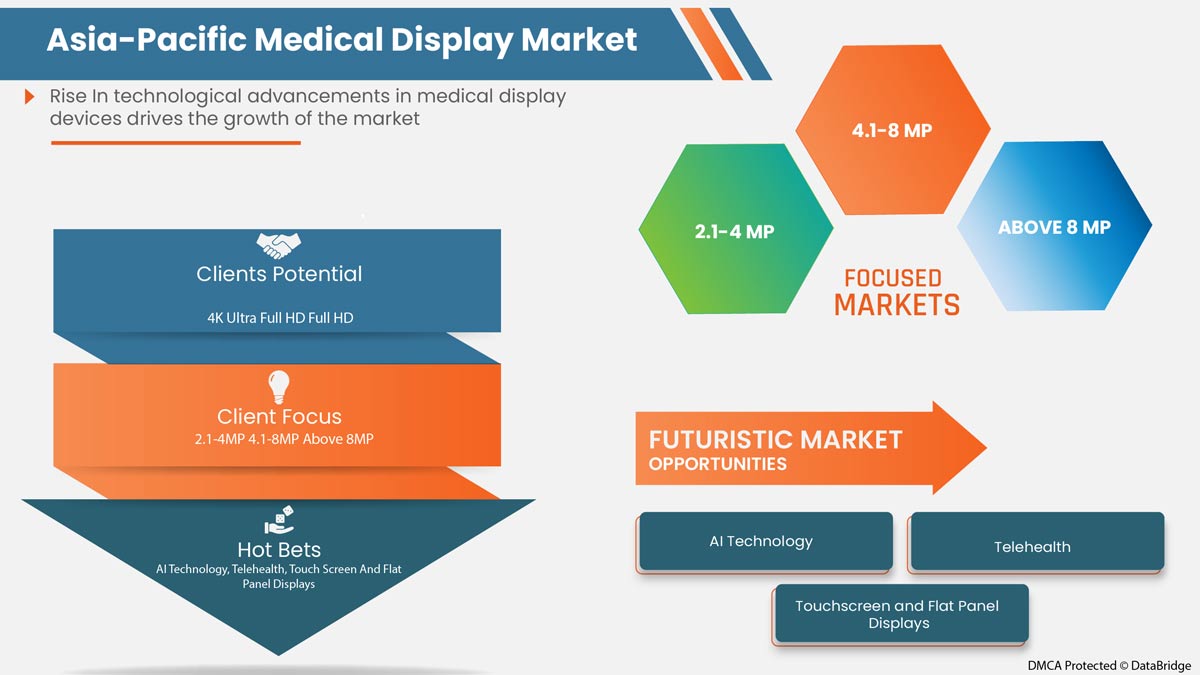

- التطورات التكنولوجية في أجهزة العرض الطبية

مع توجه السوق نحو إنتاج أشكال جرعات يمكن تناولها عن طريق الفم، هناك صراع مستمر لتطوير تركيبات مناسبة من الجزيئات الجديدة التي تسمح بالإعطاء عن طريق الفم، وفي الوقت نفسه، تضمن أن الدواء يتمتع بتوافر بيولوجي مثالي لدى المرضى. وللتغلب على هذا، يعمل مصنعو المواد الصيدلانية المساعدة على تطوير منتجات أسهل وتقليل وقت التطوير والتكلفة. لقد أدى تطوير تقنيات العرض الطبي إلى تغيير صناعة الرعاية الصحية، حيث وفر أدوات التشخيص والرعاية الصحية عن بعد، وقدم الدعم للعلاج غير الجراحي، مما يسمح بتقييم الأمراض والسماح باكتشاف الأمراض في وقت مبكر.

إن إطلاق التطورات التكنولوجية في أجهزة العرض الطبية يعزز كفاءة العرض الطبي ويزيد من سهولة استخدام أجهزة العرض الطبية. إن الارتفاع في التطبيقات التكنولوجية في أجهزة العرض الطبية من شأنه أن يؤدي إلى تقليل القوى العاملة والتشخيص السريع والشفاء من الأمراض. في المستقبل، ستحل تقنية الذكاء الاصطناعي محل سوق العرض الطبي. ومن المتوقع أن يعمل هذا العامل كفرصة لنمو سوق العرض الطبي في منطقة آسيا والمحيط الهادئ في فترة التنبؤ.

ضبط النفس/التحديات

- ارتفاع تكاليف أجهزة العرض الطبية

إن التكلفة العالية لأجهزة العرض والتنفيذ المرتفع هو العامل الرئيسي الذي يعيق نمو السوق، وخاصة في البلدان التي يكون فيها سيناريو السداد ضعيفًا. لا تستطيع معظم مرافق الرعاية الصحية في البلدان النامية، مثل المستشفيات ومراكز التشخيص، تحمل تكاليف هذه الأجهزة بسبب تكاليف التركيب والصيانة المرتفعة وبسبب التكلفة العالية لهذه المعدات الطبية والموارد المالية المنخفضة، فإن مرافق الرعاية الصحية في البلدان الناشئة مترددة في الاستثمار في أنظمة جديدة متقدمة تقنيًا. يمكن أن تعيق هذه العوامل التحول الرقمي في مرافق الرعاية الصحية وتؤثر على تبني التقنيات المتقدمة للتشخيص والتحليل.

يؤدي التقدم في التكنولوجيا إلى تطوير أجهزة عرض متطورة ومبتكرة مما يؤدي إلى ارتفاع تكلفة الأجهزة. وبالتالي، من المتوقع أن تعمل التكلفة المرتفعة لأجهزة العرض على كبح نمو السوق.

التطورات الأخيرة

- في يونيو 2022، أطلقت شركة EIZO Corporation جهاز RadiForce MX243W - شاشة مقاس 24.1 بوصة بدقة 2.3 ميجابكسل (1920 × 1200 بكسل). تم تصميم الشاشة مقاس 24.1 بوصة بدقة 2.3 ميجابكسل (1920 × 1200 بكسل) لمراقبة وتشخيص وظائف الجسم الكاملة للمريض في العيادات والمستشفيات بعناية. أدى الإطلاق إلى إضافة جهاز طبي جديد إلى المحفظة وتقديم نقاء استثنائي للسوق

- في مايو 2021، أطلقت شركة باركو شاشة Nio Fusion الطبية بدقة 12 ميجابكسل. أدى إطلاق المنتج إلى تعزيز مجموعة المنتجات وزيادة المبيعات وتوسيع خط منتجات شاشات العرض الطبية في جميع أنحاء أمريكا الشمالية وأوروبا

نطاق سوق العرض الطبي في منطقة آسيا والمحيط الهادئ

يتم تصنيف سوق شاشات العرض الطبية في منطقة آسيا والمحيط الهادئ إلى ثلاثة عشر قطاعًا بارزًا يعتمد على التكنولوجيا وحجم اللوحة ووضع العرض والميجابكسل والدقة ونوع العرض وتكنولوجيا التصوير ولون العرض ونسبة العرض إلى الارتفاع والمكون والتطبيق والمستخدم النهائي وقناة التوزيع. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب التكنولوجيا

- شاشة LCD بإضاءة خلفية LED

- شاشة LCD بإضاءة خلفية CCFL

- شاشة LCD TFT

- شاشة OLED

على أساس التكنولوجيا، يتم تقسيم سوق شاشات العرض الطبية إلى شاشة LCD بإضاءة خلفية LED، وشاشة LCD بإضاءة خلفية CCFL، وشاشة TFT LCD، وشاشة OLED.

سوق شاشات العرض الطبية في منطقة آسيا والمحيط الهادئ، حسب حجم اللوحة

- لوحات أقل من 22.9 بوصة

- لوحات مقاس 23.0-26.9 بوصة

- لوحات مقاس 27.0-41.9 بوصة

- لوحات أعلى من 42 بوصة

على أساس حجم اللوحة، يتم تقسيم سوق العرض الطبي إلى لوحات أقل من 22.9 بوصة، ولوحات 23.0 بوصة - 32.0 بوصة، ولوحات 27.0 بوصة - 41.9 بوصة ولوحات فوق 42 بوصة.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب طريقة العرض

- 2D

- ثلاثي الأبعاد

على أساس وضع العرض، يتم تقسيم سوق العرض الطبي إلى ثنائي الأبعاد وثلاثي الأبعاد.

سوق شاشات العرض الطبية في منطقة آسيا والمحيط الهادئ، من خلال ميجابيكسل

- حتى 2 ميجا بكسل

- 2.1–4 ميجا بكسل

- 4.1–8 ميجا بكسل

- أعلى من 8 ميجا بكسل

على أساس الميجابكسل، يتم تقسيم سوق شاشات العرض الطبية إلى ما يصل إلى 2 ميجابكسل، 2.1–4 ميجابكسل، 4.1–8 ميجابكسل وفوق 8 ميجابكسل.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب القرار

- كامل الدقة العالية

- دقة فائقة كاملة

- 4ك

- آحرون

على أساس الدقة، يتم تقسيم سوق شاشات العرض الطبية إلى Full HD، وUltra-Full HD، و4K، وغيرها.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب نوع العرض

- مثبت على الحائط

- محمول

- وحدات

على أساس نوع العرض، يتم تقسيم سوق العرض الطبي إلى مثبت على الحائط، ومحمول، ومعياري.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، من خلال تكنولوجيا التصوير

- شاشة تعمل باللمس

- زجاج الخط المقاوم للخدش

- وضع الأمان

- خيارات قابلة للتنظيف

- إضاءة ناعمة ورؤية واضحة

- آحرون

على أساس تكنولوجيا التصوير، يتم تقسيم سوق العرض الطبي إلى شاشة تعمل باللمس، وزجاج خط مقاوم للخدش، ووضع آمن، وخيارات قابلة للتنظيف، وSoftglow & Spotview وغيرها.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب لون العرض

- لون

- أحادي اللون

على أساس لون العرض، يتم تقسيم سوق العرض الطبي إلى ملون وأحادي اللون.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب نسبة العرض إلى الارتفاع

- 16:09

- 21:09

- 4:03

على أساس نسبة العرض إلى الارتفاع، يتم تقسيم سوق العرض الطبي إلى 16:09 و21:09 و4:03.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب المكونات

- الأجهزة

- خدمات

على أساس المكون، يتم تقسيم سوق العرض الطبي إلى أجهزة وخدمات.

سوق العرض الطبي في منطقة آسيا والمحيط الهادئ، حسب التطبيق

- التشخيص

- جراحي/تدخلي

- مراقبة المريض

- الاستشارة

- الرعاية الصحية عن بعد

- التدريس/الممارسة

- طب الأسنان

- نقطة الرعاية

- مراقبة الجنين

- آحرون

On the basis of application, the medical display market is segmented into consultation, diagnostic, surgical/interventional, telehealth, teaching / practice, fetal monitoring, dentistry, point of care, patient-worn monitoring and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY END USER

- HOSPITALS

- BY TECHNOLOGY

- CLINICS

- NURSING FACILITIES

- DIAGNOSTIC LABORATORIES

- IMAGING/RADIOLOGY LAB

- LABORATORY

- REHABILITATION CENTERS

- OTHERS

On the basis of end user, the medical display market is segmented into hospitals, clinics, nursing facilities, diagnostic laboratories, imaging/radiology lab, laboratory, rehabilitation centers and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the medical display market is segmented into direct tender, retail sales and others.

Medical Display Market Regional Analysis/Insights

The medical display market is analyzed and market size information is provided technology, panel size, viewing mode, megapixel, resolution, display type, imaging technology, display color, aspect ratio, component, application, end user and distribution channel.

The countries covered in this market report are China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific.

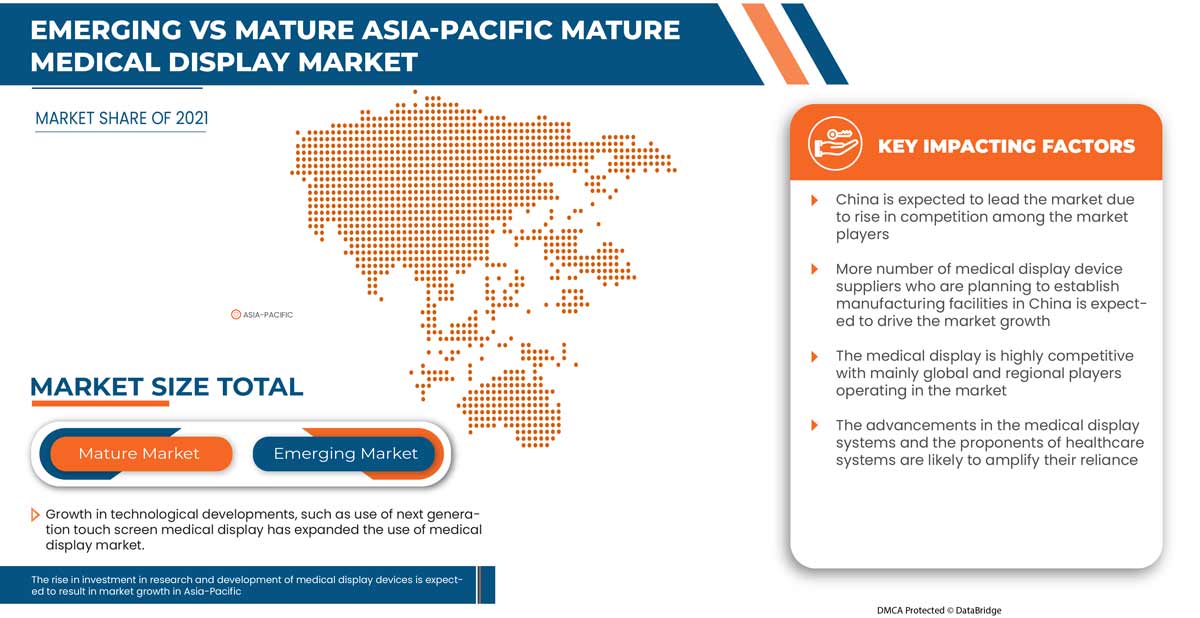

China dominates the Asia-Pacific region due to rapidly growing healthcare market coupled with rise in medical display production.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Medical Display Market Share Analysis

The medical display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the medical display market.

بعض اللاعبين الرئيسيين العاملين في السوق هم BenQ و ALPINION MEDICAL SYSTEMS Co.، Ltd و Nanjing Jusha Commercial &Trading Co، Ltd و COJE CO.، LTD. و Axiomtek Co.، Ltd. و Dell Inc. و HP Development Company، LP و Reshin و Onyx Healthcare Inc. و Teguar Computers. و Shenzhen Beacon Display Technology Co.، Ltd. و Rein Medical و STERIS. و Barco. و Hisense. و Sony Corporation و Advantech Co.، Ltd. و LG Electronics. و Sharp NEC Display Solutions و Koninklijke Philips NV و EIZO INC. و Novanta Inc. و FSN Medical Technologies. و Quest و Ampronix. و Siemens Healthcare GmbH و Panasonic Corporation وغيرها.

منهجية البحث: سوق العرض الطبي

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي مثلث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، وآسيا والمحيط الهادئ مقابل المنطقة، وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE ASIA PACIFIC MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: ASIA PACIFIC MEDICAL DISPLAY MARKET

5 ASIA PACIFIC MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 ASIA-PACIFIC

20.1.1 CHINA

20.1.2 JAPAN

20.1.3 SOUTH KOREA

20.1.4 INDIA

20.1.5 AUSTRALIA

20.1.6 SINGAPORE

20.1.7 THAILAND

20.1.8 MALAYSIA

20.1.9 INDONESIA

20.1.10 PHILIPPINES

20.1.11 REST OF ASIA-PACIFIC

21 ASIA PACIFIC MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 ASIA PACIFIC REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 ASIA PACIFIC TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 ASIA PACIFIC FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 ASIA PACIFIC SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 ASIA PACIFIC 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 ASIA PACIFIC 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 ASIA PACIFIC 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 ASIA PACIFIC DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 ASIA PACIFIC RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MEDICAL DISPLAYMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA PACIFIC MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE ASIA PACIFIC MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC MEDICAL DISPLAY MARKET

FIGURE 15 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 16 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 20 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 24 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 28 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 32 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 36 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 39 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 40 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 41 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 42 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 43 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 44 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 45 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 46 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 47 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 48 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 49 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 50 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 51 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 52 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 53 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 54 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 55 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 56 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 57 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 58 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 59 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 60 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 61 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 62 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 63 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 64 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 65 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 66 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 67 ASIA-PACIFIC MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 68 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 69 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 70 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 71 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 72 ASIA PACIFIC MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.