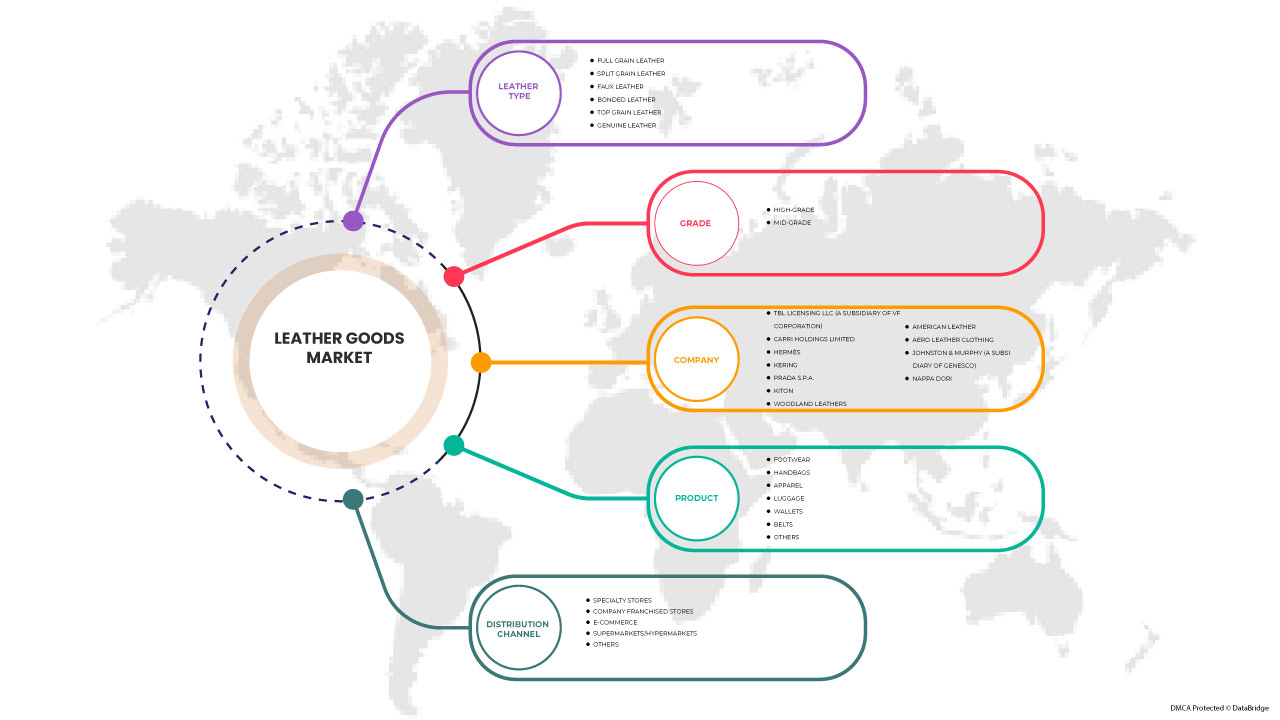

اتجاهات الصناعة وتوقعات سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ، حسب نوع الجلد (جلد محبب كامل، جلد محبب مشقوق، جلد محبب علوي، جلد طبيعي، جلد صناعي، وجلد لاصق)، المنتج ( الأحذية ، حقائب اليد، الملابس، الأمتعة، المحافظ، الأحزمة، وغيرها)، الدرجة (درجة عالية ومتوسطة)، قناة التوزيع (المتاجر المتخصصة، متاجر الامتياز للشركة، التجارة الإلكترونية، محلات السوبر ماركت/الهايبر ماركت، وغيرها) حتى عام 2030.

تحليل ورؤى حول سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ

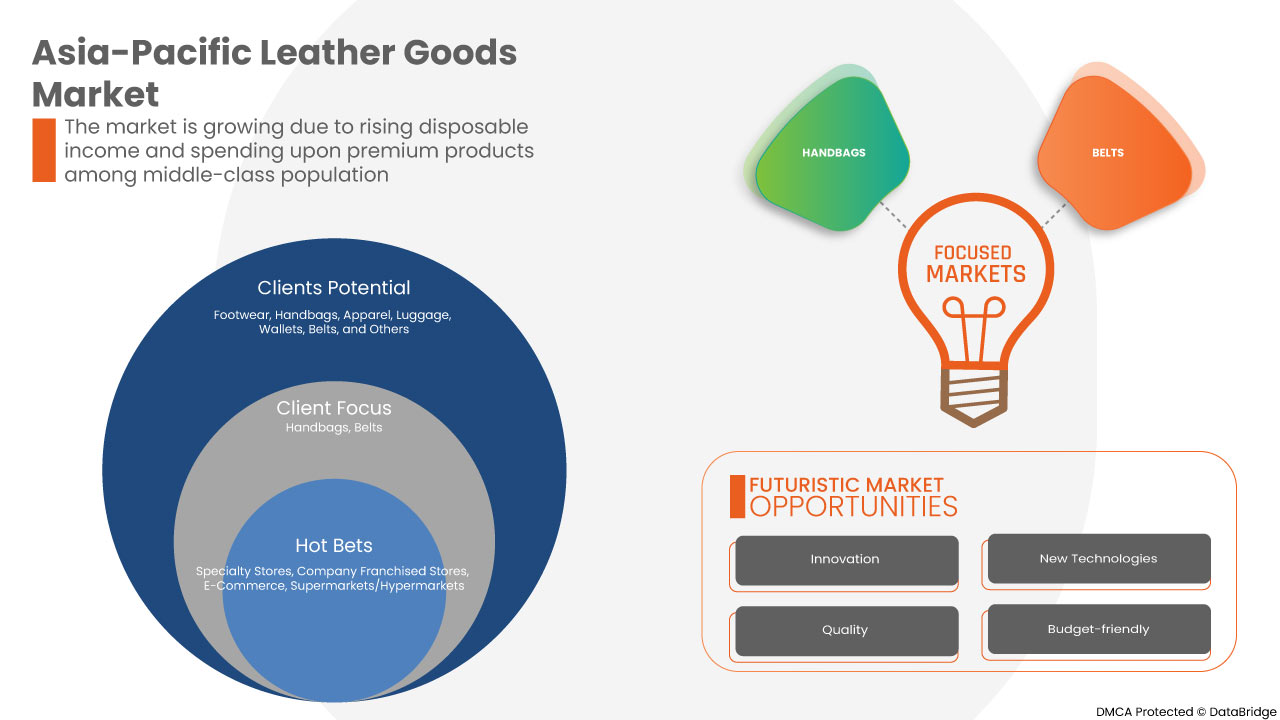

من المتوقع أن يوفر الابتكار المتزايد في السلع الجلدية بميزات وتصميمات جديدة وإدخال الجلود القائمة على المواد الحيوية فرصًا في سوق السلع الجلدية في منطقة آسيا والمحيط الهادئ. ومع ذلك، من المتوقع أن يشكل الوعي المتزايد بشأن التأثيرات الضارة للممارسات غير الأخلاقية في إنتاج السلع الجلدية ونقص المهارات والتكنولوجيا والمدخلات الوسيطة ومعدات المعالجة تحديًا لنمو السوق. إن انخفاض توافر المواد الخام، وتوافر البدائل الاصطناعية مثل الجلد البلاستيكي، وتوافر السلع الجلدية بتكلفة منخفضة هي بعض العوامل التي تحد من نمو السوق.

يقدم تقرير سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود.

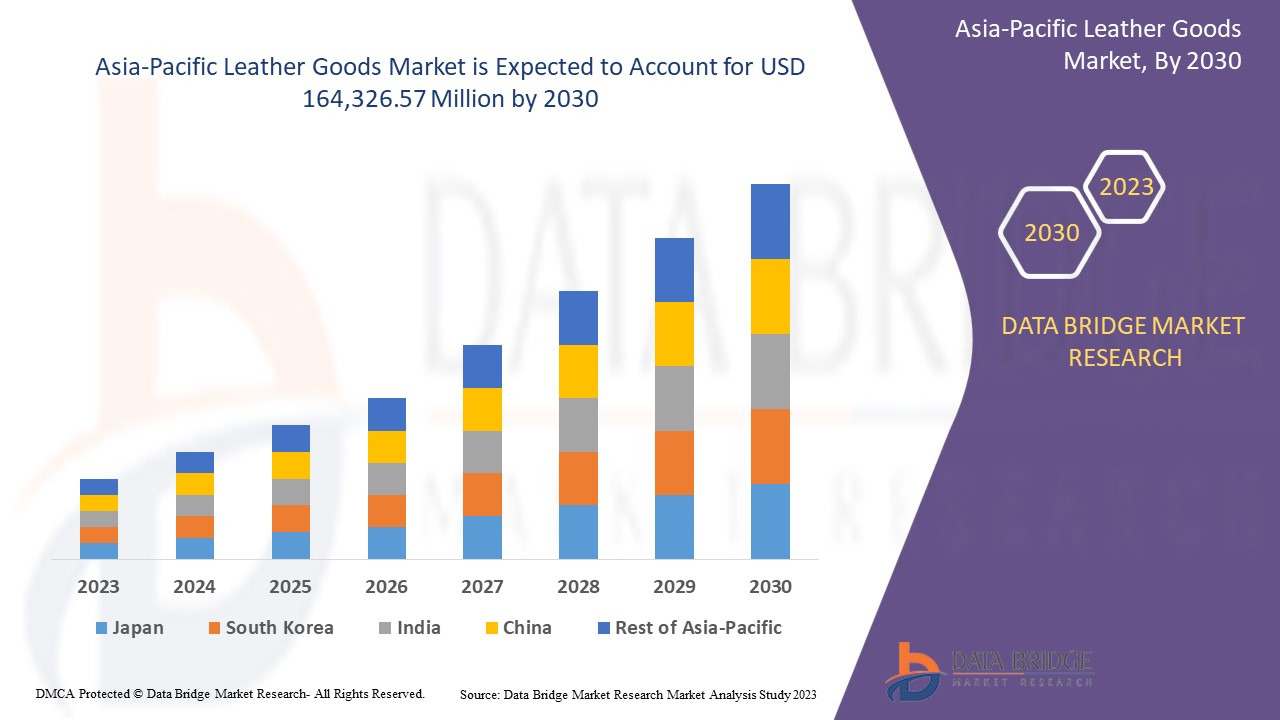

من المتوقع أن يحقق سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ نموًا كبيرًا في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 7.3٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 164،326.57 مليون دولار أمريكي بحلول عام 2030. العامل الرئيسي الذي يدفع نمو السوق هو صناعة الأزياء سريعة التوسع والتي زادت بشكل كبير من الطلب الاستهلاكي على المنتجات الجلدية عالية الجودة والفاخرة.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنة تاريخية |

2021 (قابلة للتخصيص حتى 2020-2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب نوع الجلد (جلد محبب كامل، جلد محبب منقسم، جلد محبب علوي، جلد طبيعي، جلد صناعي، وجلد لاصق)، المنتج (الأحذية، حقائب اليد، الملابس، الأمتعة، المحافظ، الأحزمة، وغيرها)، الدرجة (عالية الجودة ومتوسطة الجودة)، قناة التوزيع (المتاجر المتخصصة، متاجر الامتياز الخاصة بالشركة، التجارة الإلكترونية، محلات السوبر ماركت/الهايبر ماركت، وغيرها). |

|

الدول المغطاة |

اليابان والصين وكوريا الجنوبية والهند وسنغافورة وتايلاند وإندونيسيا وماليزيا والفلبين وأستراليا ونيوزيلندا وبقية دول آسيا والمحيط الهادئ. |

|

الجهات الفاعلة في السوق المشمولة |

شركة TBL Licensing LLC (شركة تابعة لشركة VF Corporation)، وشركة CAPRI HOLDINGS LIMITED، وشركة Hermès، وشركة KERING، وشركة PRADA SPA، وشركة Kiton، وشركة Woodland Leathers، وشركة American Leather، وشركة Aero Leather Clothing، وشركة JOHNSTON & MURPHY (شركة تابعة لشركة Genesco)، وشركة NAPPA DORI وغيرها. |

تعريف السوق

المنتجات الجلدية هي منتجات مصنوعة من الجلد. ويمكن أن تأتي في منتجات مختلفة مثل الملابس والأحذية والحقائب والقفازات وغيرها. ونظرًا لخصائص الجلد مثل مقاومة الغبار ومقاومة الحرائق والمتانة، فإن المنتجات الجلدية مفضلة على الموارد الأخرى. إن الطلب المتزايد على الجلود في إنتاج الملابس يدفع نمو السوق.

ديناميكيات سوق السلع الجلدية في منطقة آسيا والمحيط الهادئ

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- زيادة الطلب على المنتجات الجلدية الفاخرة عالية الجودة

لقد أدى التوسع السريع لصناعة الأزياء إلى زيادة الطلب الاستهلاكي على المنتجات الجلدية الفاخرة عالية الجودة. ويقدر العملاء الجماليات ويبحثون عن المنتجات الراقية لخلق بيان أزياء. وعلاوة على ذلك، فإن العدد المتزايد من الأفراد ذوي القيمة الصافية العالية (HNWIs)، إلى جانب الاتجاه المتزايد للملابس المصممة والعلامات التجارية في الأسواق الرئيسية، مثل الولايات المتحدة وفرنسا والصين، يعزز الطلب على المنتجات الجلدية الفاخرة. المنتجات الجلدية حصرية وغالبًا ما تكون بأسعار ممتازة.

- تصنيع منخفض التكلفة وقوي التحمل لمنتجات الجلود الاصطناعية

الجلد الصناعي ، المعروف أيضًا باسم الجلد الصناعي، أرخص من الجلد الحقيقي، وصديق للحيوانات، ويمكن إنتاجه بكل الألوان تقريبًا، ويمكن تصنيعه ليكون له لمسة نهائية شديدة اللمعان، ويمكن تنظيفه بسهولة بقطعة قماش مبللة، ويتطلب القليل من الصيانة، ولا يتشقق بسهولة مثل الجلد الحقيقي، ومقاوم للبهتان بسبب الأشعة فوق البنفسجية ولا يحتوي على رائحة الجلد الحقيقي، ومن المتوقع أن يجذب الطلب عليه في فترة التنبؤ. الجلد الصناعي هو منتج من صنع الإنسان ومتين للغاية. في هذه الأيام، يكون الجلد الصناعي أقوى عادةً من الجلد الحقيقي. الجلود الصناعية مثل الجلد الصناعي، والناوجاهيد، والجلد النباتي، وقماش اللحاء، والفلين، والقطن المزجج، والبوليستر PET المعاد تدويره متوفرة في السوق. يستخدم الجلد الصناعي عادة لصنع الملابس الجلدية الصناعية. إنه مصنوع من البلاستيك وأقل تكلفة وأخف وزنًا من الجلد الأصلي. المنتجات المصنوعة من الجلد الصناعي متوفرة بمجموعة متنوعة من الألوان. مادة أخرى تستخدم للجلد هي الناوجاهيد الذي يشبه جلد الحيوان. من المتوقع أن تؤدي كل هذه العوامل والمزايا التي يقدمها الجلد الصناعي إلى نمو السوق.

- ارتفاع الطلب على الملابس والأحذية والإكسسوارات الجلدية المريحة والعصرية والفاخرة

تأتي السلع الجلدية في منتجات متنوعة مثل القفازات والحقائب والأحذية والساعات والأثاث وغيرها الكثير. إن زيادة الطلب على الجلود في إنتاج الملابس هي أحد العوامل الرئيسية الدافعة التي قد تؤثر بشكل إيجابي على نمو السوق. علاوة على ذلك، غالبًا ما يتم تفضيل الخصائص الخاصة للجلد، مثل الطبيعة المقاومة للحريق والغبار والتشقق ومتانة السلع الجلدية، على الموارد والمواد الأخرى، مما ساعد في زيادة الطلب والمبيعات في السوق.

فرص

- زيادة الابتكار في المنتجات الجلدية مع ميزات وتصميمات جديدة

لقد تغير سلوك المستهلك بشكل كبير خلال العقد الماضي. ومع استغلال التقنيات القديمة بشكل أكبر، وخاصة في تطوير وتسويق منتجات الأزياء، أصبحت الشركات تكتسب إمكانيات جديدة لتلبية احتياجات العملاء من خلال أصناف مختلفة من المنتجات. وهناك حاجة إلى تطوير تشطيبات وزخارف سطحية جديدة باستخدام تقنيات قابلة للتطبيق لتطوير منتجات مبتكرة وإضافة التفرد والقيمة إلى المنتجات.

مع التطور السريع وتغير نمط الحياة يوميًا وارتفاع الدخل المتاح، أصبح المستهلكون أكثر ميلًا نحو المنتجات العصرية. يعمل المستهلكون على تحسين مستويات معيشتهم بناءً على دخلهم المتاح ويستهلكون المزيد من المنتجات العصرية. لذا فإن هذه الأنواع من ميول المستهلك ستخلق فرصة للاعبين في السوق العاملين في السوق.

- مقدمة عن الجلود المتحيزة بيولوجيًا

لا توجد عواقب سلبية لعملية تصنيع الجلود القائمة على المواد الحيوية على النظام البيئي. يجب أن يكون الجلد الصناعي المصنوع من ألياف طبيعية مثل القطن أو ألياف القطن إلى جانب الذرة والنخيل وفول الصويا وغيرها من الألياف محور اهتمام الشركات المصنعة للحصول على حصة سوقية تنافسية في سوق السلع الجلدية في منطقة آسيا والمحيط الهادئ مع ظهور الجلود القائمة على المواد الحيوية. وبصرف النظر عن هذا، يتم بالفعل استخدام أوراق فاكهة الأناناس في تصنيع "بيناتكس"، وهو منتج جلدي صناعي جديد. تتميز أوراق الأناناس هذه بألياف مرنة وصلبة تجعلها ممتازة للاستخدام في عملية التصنيع.

القيود/التحديات

- توافر السلع الجلدية الرخيصة ونقص السلع الجلدية في جميع أنحاء العالم

إن ارتفاع تكلفة الجلود الطبيعية هو أحد العوامل التي دفعت الحاجة إلى استبدال الجلود الطبيعية. إن انخفاض جودة الجلود ونقص الجلود في جميع أنحاء العالم يشكلان عقبة أمام صناعة السلع الجلدية. بعض أنواع السلع الجلدية المتاحة في السوق منخفضة التكلفة. كما أن هذا من شأنه أن يعيق العرض والطلب على المنتجات الجلدية عالية الجودة وسعرها. علاوة على ذلك، فإن النقص العالمي في السلع الجلدية والمواد الخام، مثل الجلود الطبيعية، يؤدي إلى ارتفاع أسعار هذه المنتجات. ونتيجة لذلك، يبحث المشترون الأوروبيون عن موردين منخفضي التكلفة يمكنهم إنتاج الجلود من الحيوانات الغريبة مثل الثعابين والتماسيح. هذه العوامل تحد من نمو السوق. كما أن انخفاض توافر المواد الخام، وتوافر البدائل الاصطناعية مثل الجلود البلاستيكية، وتوافر السلع الجلدية بتكلفة منخفضة هي بعض العوامل التي تحد من نمو السوق.

- قواعد حكومية صارمة بشأن إنتاج واستخدام الجلود الطبيعية

إن القيود الحكومية الصارمة في مناطق مثل أوروبا والولايات المتحدة، وغيرها، تؤدي إلى إغلاق العديد من المدابغ ووحدات معالجة الجلود. وقد فرضت هذه الحكومات لوائح تنظيمية فيما يتصل باستخدام الجلود، وهو ما من شأنه أن يعمل كعائق أمام نمو السوق في السنوات القادمة. كما عملت السياسات الحكومية على إتاحة بدائل صناعية جديدة، مثل الجلود البلاستيكية، في السوق.

- الافتقار إلى المهارات والتكنولوجيا والمدخلات الوسيطة ومعدات المعالجة

إن ندرة الجامعات المحلية التي تقدم درجات علمية في تكنولوجيا الجلود تساهم في هذا الوضع. وقد أدى هذا إلى خلق فجوة في المهارات التي يجب أن تكون الأولوية في تطوير قطاع الجلود. إن الافتقار إلى المهنيين ومراكز التدريب غير الكافية لتدريب الفنيين والمشغلين المطلوبين في هذا القطاع هي أسباب الوضع السائد. إن الافتقار إلى التكنولوجيا والمهارة والوسيطة يشكل تحديًا لسوق السلع الجلدية حيث تساعد هذه الميزات في إنتاج سلع جلدية عالية الجودة. إن جودة السلع الجلدية هي الأكثر أهمية لنمو الصناعة.

التطورات الأخيرة

- في أغسطس 2017، أطلقت العلامة التجارية السويسرية الفاخرة، Bally، أول متجر رئيسي لها في الهند في إطار شراكة مشتركة مع Reliance Brands Limited. يتضمن هذا المتجر أحذية نسائية ورجالية وإكسسوارات ومنتجات جلدية فاخرة.

نطاق سوق السلع الجلدية في منطقة آسيا والمحيط الهادئ

يتم تصنيف سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ إلى أربعة قطاعات بارزة بناءً على نوع الجلد والمنتج والدرجة وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع الجلد

- جلد محبب بالكامل

- جلد محبب منقسم

- جلد صناعي

- جلد ملتصق

- جلد محبب علوي

بناءً على نوع الجلد، يتم تقسيم السوق إلى جلد محبب بالكامل، وجلد محبب مقسم، وجلد محبب علوي، وجلد أصلي، وجلد صناعي، وجلد ملتصق، وغيرها.

منتج

- الأحذية

- حقائب اليد

- ملابس

- أمتعة السفر

- المحافظ

- أحزمة

- آحرون

على أساس المنتج، يتم تقسيم السوق إلى الأحذية، وحقائب اليد، والملابس، والأمتعة، والمحافظ، والأحزمة، وغيرها .

درجة

- عالية الجودة

- الصف المتوسط

بناءً على الدرجة، يتم تقسيم السوق إلى درجة عالية ودرجة متوسطة.

قناة التوزيع

- المتاجر المتخصصة

- متاجر الشركة الحاصلة على امتياز

- التجارة الإلكترونية

- محلات السوبر ماركت/الهايبر ماركت

- آحرون

بناءً على قناة التوزيع، يتم تقسيم السوق إلى متاجر متخصصة، ومتاجر امتياز الشركة، والتجارة الإلكترونية، ومحلات السوبر ماركت/الهايبر ماركت، وغيرها.

تحليل/رؤى إقليمية لسوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ

يتم تقسيم سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ على أساس نوع الجلد والمنتج والدرجة وقناة التوزيع.

الدول في سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ هي اليابان والصين وكوريا الجنوبية والهند وسنغافورة وتايلاند وإندونيسيا وماليزيا والفلبين وأستراليا ونيوزيلندا وبقية دول آسيا والمحيط الهادئ. تهيمن الصين على سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ من حيث حصة السوق وإيرادات السوق بسبب الوعي المتزايد بالخصائص والخصائص الممتازة للمنتجات الجلدية في المنطقة.

يقدم قسم الدولة في التقرير أيضًا عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، وتحليل الاتجاهات الفنية لقوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في منطقة آسيا والمحيط الهادئ والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق السلع الجلدية في منطقة آسيا والمحيط الهادئ

يوفر المشهد التنافسي لسوق السلع الجلدية في منطقة آسيا والمحيط الهادئ تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق السلع الجلدية في منطقة آسيا والمحيط الهادئ.

ومن بين المشاركين البارزين العاملين في سوق المنتجات الجلدية في منطقة آسيا والمحيط الهادئ شركة TBL Licensing LLC (شركة تابعة لشركة VF Corporation)، وشركة CAPRI HOLDINGS LIMITED، وشركة Hermès، وشركة KERING، وشركة PRADA SPA، وشركة Kiton، وشركة American Leather، وشركة Aero Leather Clothing، وشركة JOHNSTON & MURPHY (شركة تابعة لشركة Genesco)، وشركة NAPPA DORI وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC LEATHER GOODS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN THE DEMAND FOR COMFORTABLE, TRENDY, FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES

5.1.2 INCREASE IN THE DEMAND FOR PREMIUM AND HIGH-QUALITY LUXURY LEATHER PRODUCTS

5.1.3 LOW-COST AND HEAVY-DUTY CONSTRUCTION OF SYNTHETIC LEATHER PRODUCTS

5.1.4 RISE IN THE EXPENDITURE ON HOME FURNISHING AND RENOVATION

5.2 RESTRAINTS

5.2.1 THE AVAILABILITY OF CHEAPER LEATHER GOODS AND THE SHORTAGE OF LEATHER GOODS WORLDWIDE

5.2.2 STRICT GOVERNMENTAL REGULATIONS ON THE PRODUCTION AND USE OF NATURAL LEATHER

5.3 OPPORTUNITIES

5.3.1 INCREASE IN INNOVATION IN LEATHER GOODS WITH NEW FEATURES AND DESIGNS

5.3.2 INTRODUCTION OF BIO-BIASED LEATHER

5.4 CHALLENGES

5.4.1 RISE IN THE AWARENESS REGARDING THE DETRIMENTAL EFFECTS OF UNETHICAL PRACTICES IN THE PRODUCTION OF LEATHER GOODS

5.4.2 LACK OF SKILLS, TECHNOLOGY, INTERMEDIATE INPUTS, AND PROCESSING EQUIPMENT

6 ASIA PACIFIC LEATHER GOODS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 FOOTWEAR

6.2.1 FOOTWEAR, BY TYPE

6.2.1.1 BOOTS

6.2.1.2 FORMAL SHOES

6.2.1.3 LOAFERS

6.2.1.4 BALLERINAS

6.2.1.5 SANDALS

6.2.1.6 OTHERS

6.3 HANDBAGS

6.3.1 HANDBAGS, BY TYPE

6.3.1.1 SLING BAG

6.3.1.2 CLUTCHES

6.3.1.3 SATCHEL BAG

6.3.1.4 TOTE BAGS

6.3.1.5 WRISTLET BAG

6.3.1.6 OTHERS

6.4 APPAREL

6.4.1 APPAREL, BY TYPE

6.4.1.1 JACKET

6.4.1.2 CAPS

6.4.1.3 SUIT

6.4.1.4 WAISTCOAT

6.4.1.5 SHIRTS

6.4.1.6 OTHERS

6.5 LUGGAGE

6.5.1 LUGGAGE, BY TYPE

6.5.1.1 TRAVEL BAGS

6.5.1.2 BUSINESS BAGS

6.5.1.3 DUFFEL BAGS

6.5.1.4 SUITCASE & BRIEFCASE

6.5.1.5 ROLLABLE LUGGAGE

6.5.1.6 OTHERS

6.6 WALLETS

6.7 BELTS

6.8 OTHERS

7 ASIA PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE

7.1 OVERVIEW

7.2 FULL GRAIN LEATHER

7.3 SPLIT GRAIN LEATHER

7.4 TOP GRAIN LEATHER

7.5 GENUINE LEATHER

7.6 FAUX LEATHER

7.7 BONDED LEATHER

8 ASIA PACIFIC LEATHER GOODS MARKET, BY GRADE

8.1 OVERVIEW

8.2 HIGH-GRADE

8.3 MID-GRADE

9 ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 SPECIALTY STORES

9.3 COMPANY FRANCHISED STORES

9.4 E-COMMERCE

9.5 SUPERMARKETS/HYPERMARKETS

9.6 OTHERS

10 ASIA PACIFIC LEATHER GOODS MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA & NEW ZEALAND

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 EVENT

11.3 ACQUISITION

11.4 AWARD

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 KERING

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 PRADA S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 CAPRI HOLDINGS LIMITED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 HERMÈS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 TBL LICENSING LLC (A SUBSIDIARY OF VF CORPORATION)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AERO LEATHER CLOTHING

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMERICAN LEATHER

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 JOHNSTON & MURPHY (A SUBSIDIARY OF GENESCO)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 KITON

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAPPA DORI

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 WOODLAND LEATHERS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 3 ASIA PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC APPAREL IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC WALLETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC BELTS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC FULL GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC SPLIT GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC TOP GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC GENUINE LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC FAUX LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC BONDED LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC HIGH-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC MID-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC SPECIALTY STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC COMPANY FRANCHISED STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC E-COMMERCE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC SUPERMARKETS/HYPERMARKETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC LEATHER GOODS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 40 CHINA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 41 CHINA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CHINA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 CHINA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 47 CHINA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 INDIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 INDIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 INDIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 INDIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 INDIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 INDIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 54 INDIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 55 INDIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 JAPAN LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 57 JAPAN FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 JAPAN HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 JAPAN APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 JAPAN LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 JAPAN LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 62 JAPAN LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 63 JAPAN LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 64 SOUTH KOREA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 SOUTH KOREA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SOUTH KOREA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SOUTH KOREA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 SOUTH KOREA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SOUTH KOREA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 70 SOUTH KOREA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH KOREA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA & NEW ZEALAND FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA & NEW ZEALAND HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA & NEW ZEALAND APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA & NEW ZEALAND LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 SINGAPORE FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 SINGAPORE HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 SINGAPORE APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SINGAPORE LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 SINGAPORE LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 86 SINGAPORE LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 87 SINGAPORE LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 88 THAILAND LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 89 THAILAND FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 THAILAND HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 THAILAND APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 THAILAND LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 THAILAND LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 94 THAILAND LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 95 THAILAND LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 96 INDONESIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 INDONESIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 INDONESIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 INDONESIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 INDONESIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 INDONESIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 102 INDONESIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 103 INDONESIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 104 MALAYSIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 105 MALAYSIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MALAYSIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MALAYSIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MALAYSIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MALAYSIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 110 MALAYSIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 111 MALAYSIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 PHILIPPINES LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 PHILIPPINES FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 PHILIPPINES HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 PHILIPPINES APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 PHILIPPINES LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 PHILIPPINES LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 118 PHILIPPINES LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 119 PHILIPPINES LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC LEATHER GOODS MARKET

FIGURE 2 ASIA PACIFIC LEATHER GOODS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC LEATHER GOODS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC LEATHER GOODS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC LEATHER GOODS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC LEATHER GOODS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC LEATHER GOODS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC LEATHER GOODS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC LEATHER GOODS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC LEATHER GOODS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA PACIFIC LEATHER GOODS MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR COMFORTABLE, TRENDY, AND FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES IS EXPECTED TO DRIVE THE ASIA PACIFIC LEATHER GOODS MARKET IN THE FORECAST PERIOD

FIGURE 14 FOOTWEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC LEATHER GOODS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC LEATHER GOODS MARKET

FIGURE 16 ASIA PACIFIC LEATHER GOODS MARKET: BY PRODUCT, 2022

FIGURE 17 ASIA PACIFIC LEATHER GOODS MARKET: BY LEATHER TYPE, 2022

FIGURE 18 ASIA PACIFIC LEATHER GOODS MARKET: BY GRADE, 2022

FIGURE 19 ASIA PACIFIC LEATHER GOODS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 ASIA-PACIFIC LEATHER GOODS MARKET: SNAPSHOT (2022)

FIGURE 21 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2022)

FIGURE 22 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 ASIA-PACIFIC LEATHER GOODS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 25 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.