Asia Pacific Fdm Composite Large Size Tooling Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

143.33 Million

USD

194.65 Million

2024

2032

USD

143.33 Million

USD

194.65 Million

2024

2032

| 2025 –2032 | |

| USD 143.33 Million | |

| USD 194.65 Million | |

|

|

|

|

تجزئة سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ، حسب المواد (ألياف الكربون، الألياف الزجاجية، السبائك المعدنية، المطاط السيليكوني، وغيرها)، والمستخدم النهائي (الفضاء والطيران، صناعة السيارات، الطاقة المتجددة، الكهرباء والإلكترونيات، البناء والتشييد، الطب، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ

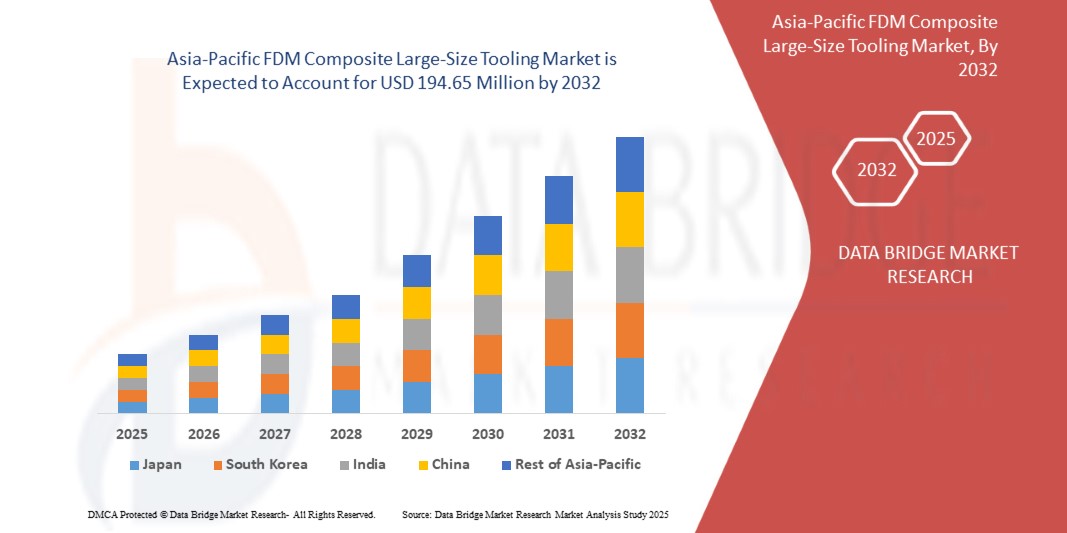

- تم تقييم حجم سوق الأدوات المركبة كبيرة الحجم FDM في منطقة آسيا والمحيط الهادئ بـ 143.33 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 194.65 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 3.90٪ خلال الفترة المتوقعة

- يتم دعم نمو السوق إلى حد كبير من خلال التبني المتزايد للتصنيع الإضافي في قطاعات الطيران والسيارات والبحرية والطاقة، والتي تتطلب حلول أدوات كبيرة وخفيفة الوزن وفعالة من حيث التكلفة

- لقد أدى التقدم في مجال اللدائن الحرارية عالية الأداء والخيوط المقواة بألياف الكربون إلى تعزيز الخصائص الميكانيكية للأدوات المنتجة بتقنية FDM بشكل كبير، مما يجعلها بدائل قابلة للتطبيق للأدوات المعدنية التقليدية

تحليل سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ

- أدى الطلب المتزايد على حلول الأدوات خفيفة الوزن والفعالة من حيث التكلفة والقابلة للإنتاج السريع إلى تسريع اعتماد الأدوات المركبة كبيرة الحجم FDM في الصناعات مثل الفضاء والسيارات والبحرية والطاقة

- أدى تطوير المواد البلاستيكية الحرارية عالية الأداء المقواة بألياف الكربون أو الزجاج إلى تحسين القوة الميكانيكية والاستقرار الحراري ومتانة أدوات FDM بشكل كبير

- من المتوقع أن تهيمن الصين على سوق أدوات FDM المركبة كبيرة الحجم العالمية خلال فترة التنبؤ، مدفوعة بالتصنيع السريع وتوسع قطاعات الطيران والسيارات والطاقة المتجددة.

- من المتوقع أن تشهد اليابان أعلى معدل نمو سنوي مركب (CAGR) في سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ بسبب التركيز على الابتكار التكنولوجي، والاعتماد المتزايد على المواد المركبة المتقدمة، والطلب المتزايد من قطاعات التصنيع الدقيق والإلكترونيات.

- حقق قطاع ألياف الكربون أكبر حصة من الإيرادات في عام ٢٠٢٤، بفضل نسبة قوته إلى وزنه الاستثنائية، وثبات أبعاده، وتوافقه مع عمليات درجات الحرارة العالية مثل التعقيم بالبخار. وتُستخدم اللدائن الحرارية المقواة بألياف الكربون بشكل متزايد في تطبيقات أدوات الطيران والسيارات والطاقة المتجددة، نظرًا لأدائها العالي ومتانتها.

نطاق التقرير وتجزئة سوق الأدوات المركبة FDM كبيرة الحجم في منطقة آسيا والمحيط الهادئ

|

صفات |

رؤى رئيسية حول سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

آسيا والمحيط الهادئ

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

اتجاهات سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ

صعود الأدوات الإضافية لتحقيق تصنيع سريع وفعال من حيث التكلفة

- يُحدث الاستخدام المتزايد لتقنية FDM (نمذجة الترسيب المندمج) في تصنيع الأدوات المركبة كبيرة الحجم تحولاً جذرياً في سير عمل التصنيع التقليدي من خلال تقليل فترات التسليم وتكاليف الأدوات. ويتجلى هذا التحول بشكل خاص في قطاعات مثل الطيران والسيارات، حيث تُعد مرونة الإنتاج والتصميم أمرًا بالغ الأهمية. تُمكّن تقنية FDM من تكرار أسرع وإنتاج أدوات التثبيت والتركيبات والقوالب وأدوات التشطيب حسب الطلب.

- يُحفّز الطلب المتزايد على حلول الأدوات عالية القوة وخفيفة الوزن الابتكار في مجال المركبات البلاستيكية الحرارية المستخدمة في عملية تشكيل المواد بالصهر (FDM). وتكتسب مواد مثل PEKK وULTEM™ المعززة بألياف الكربون زخمًا متزايدًا بفضل متانتها ومقاومتها الحرارية وملاءمتها لعمليات الأوتوكلاف وخارج الأوتوكلاف. تُمكّن هذه المواد الأدوات المضافة كبيرة الحجم من تلبية معايير الأداء التي كانت تُهيمن عليها سابقًا الأدوات المعدنية.

- يتيح التكامل المتزايد للتصميم الرقمي مع منصات FDM إنشاء نماذج أولية وتخصيص الأدوات بسرعة وبتكلفة أقل بكثير من التكلفة التقليدية. يستفيد مصنعو المعدات الأصلية من سرعة التحقق من صحة المنتج، وسهولة إعادة تصميم الأدوات، وتقليل وقت التوقف أثناء انتقالات الإنتاج. وهذا يساعد المصنّعين على الحفاظ على قدرتهم التنافسية في الأسواق سريعة التطور.

- على سبيل المثال، في عام ٢٠٢٣، أفاد العديد من المصنّعين بانخفاضٍ في زمن التسليم بنسبة تصل إلى ٥٠٪ وتوفيرٍ في التكاليف بنسبة ٦٠٪ بعد اعتمادهم أدواتٍ مُركّبة قائمة على FDM للإنتاج بكمياتٍ قليلةٍ والنماذج الأولية. عادةً ما تتطلب هذه الأدوات الحد الأدنى من المعالجة اللاحقة، وكانت قادرةً على تلبية معايير المتانة والأداء الحراري اللازمة للاستخدام التشغيلي.

- بينما لا تزال أدوات FDM تحل محل الأدوات التقليدية في تطبيقات مختارة، يعتمد انتشارها على تحسين سرعات الطباعة، وتحسين جودة تشطيب الأسطح، وأتمتة خطوات ما بعد المعالجة. ومن المتوقع أن يُسهم تطوير أنظمة متعددة المواد وتحسين مسار الطباعة باستخدام الذكاء الاصطناعي في دفع عجلة الابتكار في هذا المجال مستقبلًا.

ديناميكيات سوق الأدوات المركبة كبيرة الحجم FDM في منطقة آسيا والمحيط الهادئ

سائق

الطلب المتزايد على حلول الأدوات خفيفة الوزن والقابلة للتخصيص والفعالة من حيث التكلفة

- مع تحول الصناعات نحو هياكل أخف وزنًا وأكثر تعقيدًا، يتزايد الطلب على أدوات كبيرة الحجم قادرة على استيعاب التغيرات السريعة في التصميم والهندسة. تلبي تقنية FDM هذه الحاجة من خلال توفير إنتاج مرن للأدوات باستخدام مركبات بلاستيكية حرارية تلبي متطلبات الأداء الهيكلي والحراري دون وزن وتكلفة المعدن.

- يسعى المُصنِّعون بشكل متزايد إلى أدوات يُمكن إنتاجها في دورات أقصر دون التضحية بالجودة. تُوفِّر أدوات FDM مزايا كبيرة في سرعة طرح المنتجات في السوق، خاصةً في عمليات الإنتاج والنماذج الأولية منخفضة الحجم، حيث تكون الطرق التقليدية باهظة التكلفة والوقت. كما تُمكِّن قابلية التوسع لمنصات FDM من إنتاج الأدوات بالتوازي لتحسين الإنتاجية.

- تُسرّع الاستثمارات في الأتمتة وطابعات FDM عالية الإنتاجية من اعتمادها بين مُصنّعي المعدات الأصلية (OEM) والموردين من مختلف المستويات. من قوالب هياكل الطائرات إلى أدوات تشذيب السيارات، تُدمج الشركات تقنية FDM في عمليات تصنيع الأدوات الرئيسية لزيادة كفاءة ومرونة الإنتاج.

- على سبيل المثال، في عام ٢٠٢٢، بدأت العديد من شركات تصنيع السيارات بتحويل جزء كبير من أدواتها الداخلية إلى تقنية FDM، مستشهدةً بسرعات في أوقات التسليم وتحسين سلامة العمال بفضل انخفاض وزن الأدوات المركبة. كما دعم هذا التحول مبادرات الاستدامة من خلال تقليل هدر المواد وخفض إجمالي استهلاك الطاقة.

- مع استمرار نمو الطلب، يبقى تقييم الأداء المستمر، وإصدار شهادات المواد، وتدريب المشغلين أساسيًا لتمكين تطبيق أوسع نطاقًا. ومع تزايد دراسات الحالة التي تثبت فعالية أدوات FDM في التطبيقات الحيوية، من المتوقع أن ترتفع ثقة الصناعة ومعدلات تبنيها.

ضبط النفس/التحدي

حدود جودة السطح ومتطلبات ما بعد المعالجة لأدوات الاستخدام النهائي

- على الرغم من التطورات الكبيرة، غالبًا ما تواجه أدوات FDM تحديات تتعلق بتشطيب السطح ودقة الأبعاد. تتطلب معظم الأدوات المطبوعة عمليات تشغيل إضافية، أو إحكامًا، أو طلاءً لتلبية المعايير الصناعية، خاصةً في التطبيقات التي تتطلب ضغطًا عاليًا أو تعبئةً بالتفريغ. هذا يزيد من تكلفة العمالة، وقد يُعوّض عن التوفير الأولي في الوقت والتكلفة.

- يمكن أن تؤثر مسامية السطح وخطوط الطبقات أيضًا على الأداء الحراري والميكانيكي للأدوات إذا لم تُعالَج بشكل صحيح أثناء مرحلة ما بعد المعالجة. تُعد هذه العوامل بالغة الأهمية للأدوات المتوافقة مع الأوتوكلاف حيث تكون سلامة الختم بالغة الأهمية. كما أن عدم اتساق النتائج بين مختلف الطابعات والمواد يُعقّد مراقبة الجودة بشكل أكبر.

- محدودية توافر أنظمة FDM واسعة النطاق ذات البيئات المُتحكم بها (مثل غرف البناء المُدفأة) تُقيد قدرات الإنتاج في بعض المناطق. بالإضافة إلى ذلك،

- ، فجوات المعرفة في سلوك المواد المركبة ومعايرة الطابعة تعيق التبني الفعال، وخاصة في الشركات متوسطة الحجم ذات الموارد التقنية المحدودة

- على سبيل المثال، في عام ٢٠٢٣، أُبلغ عن عدة أعطال في الأدوات المستخدمة في إنتاج المكونات البحرية بسبب عدم كفاية المعالجة وتجهيز السطح في أدوات FDM غير المُحكمة الإغلاق. وقد أبرزت هذه الحوادث الحاجة إلى تحسين بروتوكولات التحقق وتكامل أفضل لمبادئ التصميم الإضافي.

- للتغلب على هذه التحديات، يجب على المصنّعين التركيز على سير عمل متكامل يجمع بين الطباعة الإضافية والمعالجة اللاحقة الدقيقة. وسيكون تطوير طلاءات جديدة، ومنصات FDM-CNC الهجينة، وبرامج تقطيع ذكية، أمرًا حيويًا في سد الفجوة بين جودة النماذج الأولية وجودة الأدوات الإنتاجية.

نطاق سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ

يتم تقسيم السوق على أساس المادة والمستخدم النهائي.

• حسب المادة

بناءً على المادة، يُقسّم سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ إلى ألياف الكربون، والألياف الزجاجية، والسبائك المعدنية، والمطاط السيليكوني، وغيرها. وقد حقق قطاع ألياف الكربون أكبر حصة من الإيرادات في عام 2024، بفضل نسبة قوته إلى وزنه الاستثنائية، وثبات أبعاده، وتوافقه مع عمليات درجات الحرارة العالية مثل التعقيم بالبخار. وتُستخدم اللدائن الحرارية المقواة بألياف الكربون بشكل متزايد في تطبيقات أدوات الطيران والسيارات والطاقة المتجددة، نظرًا لأدائها العالي ومتانتها.

من المتوقع أن يُسجل قطاع الألياف الزجاجية أسرع معدل نمو بين عامي 2025 و2032، بفضل فعاليته من حيث التكلفة، وخصائصه متوسطة المتانة، وملاءمته لتطبيقات التشكيل بالأدوات متوسطة الحمل. تتميز المواد المصنوعة من الألياف الزجاجية بقابلية طباعة ممتازة، ومقاومة حرارية، وخصائص ميكانيكية عالية، مما يجعلها مثالية للقطاعات التي تتطلب تشكيلًا سريعًا وبأسعار معقولة دون المساس بالموثوقية.

• حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم السوق إلى قطاعات الفضاء والطيران، وصناعة السيارات، والطاقة المتجددة، والكهرباء والإلكترونيات، والبناء والتشييد، والقطاع الطبي، وغيرها. هيمن قطاع الفضاء والطيران على السوق في عام 2024 بفضل اعتماده المتزايد على الأدوات المركبة خفيفة الوزن وعالية الدقة لمكونات الطائرات والهياكل الداخلية. ويدعم هذا الطلب معايير أداء صارمة والحاجة إلى أدوات قادرة على تحمل دورات إنتاج متكررة.

من المتوقع أن يُسجل قطاع صناعة السيارات أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بزيادة اعتماد الأدوات الإضافية في النماذج الأولية، وإنتاج القطع بكميات قليلة، وتصنيع مكونات السيارات الكهربائية. تُمكّن تقنية FDM مُصنّعي وموردي السيارات من خفض تكاليف الأدوات، وتسريع جداول التطوير، وتحسين مرونة التصميم في ظل بيئة تنافسية متزايدة.

تحليل إقليمي لسوق الأدوات المركبة كبيرة الحجم FDM في منطقة آسيا والمحيط الهادئ

- من المتوقع أن تهيمن الصين على سوق أدوات FDM المركبة كبيرة الحجم العالمية خلال فترة التنبؤ، مدفوعة بالتصنيع السريع وتوسع قطاعات الطيران والسيارات والطاقة المتجددة.

- إن التركيز القوي للبلاد على تقنيات التصنيع المتقدمة، والدعم الحكومي للتصنيع الإضافي، والاستثمارات المتزايدة في حلول الأدوات خفيفة الوزن وعالية الأداء تعمل على تغذية نمو السوق

- بالإضافة إلى ذلك، فإن سلسلة التوريد القوية في الصين والاعتماد المتزايد على ممارسات الصناعة 4.0 تمكن من دورات إنتاج أسرع وكفاءة في التكلفة

نظرة عامة على سوق الأدوات المركبة كبيرة الحجم من FDM في اليابان

من المتوقع أن تُسجل اليابان أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالتقدم التكنولوجي والطلب المتزايد من صناعات التصنيع الدقيق، مثل صناعة السيارات والإلكترونيات. ويُسهم التزام اليابان بالابتكار، إلى جانب زيادة استثماراتها في البحث والتطوير للمواد المركبة والتصنيع الإضافي، في تسريع وتيرة تبني هذه التقنيات. علاوة على ذلك، يُسهم تركيز اليابان على ممارسات التصنيع المستدامة وتحسين الكفاءة في تسريع توسع السوق.

حصة سوق الأدوات المركبة FDM كبيرة الحجم في منطقة آسيا والمحيط الهادئ

إن صناعة الأدوات الكبيرة الحجم المصنوعة من المواد المركبة FDM في منطقة آسيا والمحيط الهادئ يقودها في المقام الأول شركات راسخة، بما في ذلك:

- شركة شاينينج 3D للتكنولوجيا المحدودة (الصين)

- شركة فارسون للتكنولوجيا المحدودة (الصين)

- شركة يونيون تك لتكنولوجيا الأبعاد المحدودة (الصين)

- شركة XYZprinting Inc. (تايوان)

- شركة ريكو المحدودة (اليابان)

- شركة ماتسورا للآلات (اليابان)

- شركة رايز ثري دي تكنولوجيز (الصين)

- شركة تيرتايم (الصين)

- صانع السناب (الصين)

أحدث التطورات في سوق أدوات FDM المركبة كبيرة الحجم في منطقة آسيا والمحيط الهادئ

- في يوليو 2024، حصلت ستراتاسيس على أربع جوائز تقديرية للاستدامة خلال القمة السنوية لجمعية AMGTA لعام 2024، مما يُبرز ريادتها في مجال الاستدامة البيئية من خلال شهادة ISO 14001 EMS، وإعداد تقارير الاستدامة، والبحوث، وممارسات التصنيع المستدامة. وهذا يُعزز التزام ستراتاسيس بالتصنيع الواعي، ويعزز مكانتها في السوق كرائدة في مجال الاستدامة.

- في ديسمبر 2023، فازت ستراتاسيس بجائزة صناعة الطباعة ثلاثية الأبعاد عن طابعاتها ثلاثية الأبعاد لطب الأسنان والطب التي تعتمد على تقنية بولي جيت، كما حصلت على إشادات شرفية كأفضل شركة للعام (للمؤسسات) وأفضل طابعة ثلاثية الأبعاد للمؤسسات للعام (للبوليمرات). تؤكد هذه الجوائز ابتكار ستراتاسيس وريادتها في تطبيقات الرعاية الصحية.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.