>سوق مستحضرات التجميل في آسيا والمحيط الهادئ، حسب نوع المنتج (العناية بالبشرة، العناية بالشعر، المكياج، العطور، أخرى)، الطبيعة (غير العضوية، العضوية)، الشكل (الكريمات والمواد الهلامية، المستحضرات، البخاخات، الصلبة وغيرها)، الفئة (منتج الكتلة، المنتج المتميز، المنتج المهني)، نوع التعبئة والتغليف (الزجاجات والبرطمانات، الأنابيب، الحاويات، المضخات والموزعات، العصي، علب الهباء الجوي، الأكياس ، حزم البثور والشرائط وغيرها)، قناة التوزيع (غير متصلة بالإنترنت وعبر الإنترنت)، المستخدم النهائي (النساء والرجال والأطفال) - اتجاهات الصناعة وتوقعاتها حتى عام 2029.

تحليل السوق والرؤى : سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ

تلعب صناعة مستحضرات التجميل دورًا مهمًا للغاية في كل اقتصاد متقدم ونامي. يعد التوسع الحضري المتسارع وزيادة عدد سكان المناطق الحضرية مع متطلبات نمط الحياة المتغيرة من المحركات المهمة للطلب المتزايد على منتجات العناية بالبشرة التجميلية في السوق. لقد أدى الاقتصاد العالمي المتنامي إلى زيادة الدخل المتاح مع زيادة عدد سكان العالم في المناطق الحضرية. وقد أدى هذا إلى زيادة القدرة الشرائية لسكان المناطق الحضرية.

يعد نمط الحياة المزدحم في المناطق الحضرية عاملاً رئيسيًا في دفع نمو سوق منتجات العناية بالبشرة التجميلية في جميع أنحاء المنطقة. غالبًا ما يعيش الناس حياة محمومة وسريعة الخطى، لذلك يواجهون الكثير من التوتر. وبالتالي، يريد الناس كريمات الوجه لتقديم مظهر جديد وإخفاء علامات الإرهاق على وجوههم. يشكل جيل الألفية جزءًا كبيرًا من سكان المناطق الحضرية والإنفاق الاستهلاكي. إنهم في طليعة اتجاه الجمال الرياضي. إنه يشكل عاملًا مهمًا رئيسيًا في الإنفاق على منتجات التجميل ومستحضرات التجميل. ومن المتوقع أن تؤدي اتجاهات وسائل التواصل الاجتماعي المتزايدة والحاجة إلى المظهر الجيد إلى تعزيز الطلب في السوق.

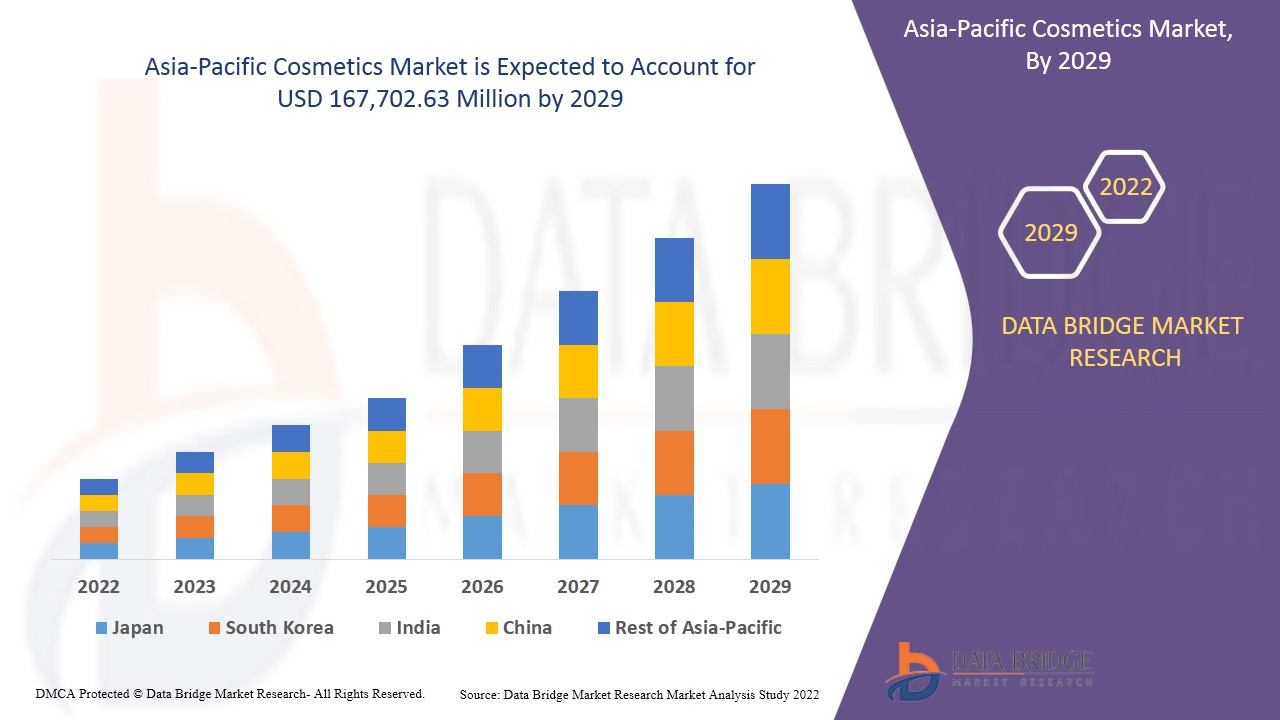

من المتوقع أن يحقق سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ نموًا كبيرًا في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 6.5٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 167،702.63 مليون دولار أمريكي بحلول عام 2029. العامل الرئيسي الذي يدفع نمو سوق مستحضرات التجميل هو الطلب المتزايد على منتجات العناية الذاتية لمكافحة التوتر والقلق وميل المستهلكين إلى زيادة مشاركتهم في روتين العناية الذاتية كوسيلة للشعور بالرضا والمظهر الأفضل باستخدام المكونات الطبيعية والعضوية.

يقدم تقرير سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Skin Care, Hair Care, Make Up, Fragrances, Others), Nature (Inorganic, Organic), Form (Creams & Gels, Lotions, Sprays, Solid and Others), Category (Mass Product, Premium Product, Professional Product), Packaging Type (Bottles and Jars, Tubes, Containers, Pumps & Dispensers, Sticks, Aerosol Cans, Pouches, Blisters and Strip Packs and Others), Distribution Channel (Offline and Online), End-User (Women, Men and Kids) |

|

Regions Covered |

China, Japan, Australia & New Zealand, India, Philippines, Indonesia, Singapore, South Korea, Malaysia, Thailand and the Rest of Asia-Pacific |

|

Market Players Covered |

Unilever, L'Oreal S.A., Shiseido Company, Limited, The Estée Lauder Companies, Procter & Gamble, Kao Corporation, Colgate-Palmolive Company, Oriflame Cosmetics Global SA, Beiersdorf AG, Johnson & Johnson Services, Inc., Amorepacific, Coty Inc., AVON PRODUCTS, Revlon, Inc. and The Body Shop International Limited among others |

Market Definition

Cosmetics are largely designed to use or applied in order to enhance the beauty and physical appearance of a person. Chiefly, these cosmetic products are manufactured from artificial sources. The purpose of cosmetic products is mainly intended for external cleaning, perfumes, changing appearances, correcting body odor, protecting the skin and conditioning among others. Ranging from antiperspirants, fragrances, make-up and shampoos, to soaps, sunscreens and toothpaste, cosmetics and personal care products play an essential role in all stages of a consumer's life.

Cosmetics are manufactured using mixtures of chemical compounds. These compounds are either derived from natural sources or are artificial in nature. The use of cosmetics can be for personal use for retail buyers or for professional uses in the beauty and entertainment industry. In the entertainment industry, cosmetics are heavily used for enhancing one's natural features, adding color to a person's face and can be used to change the appearance of the face entirely to resemble a different person, creature or object.

Asia-Pacific Cosmetics Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail below:

Drivers

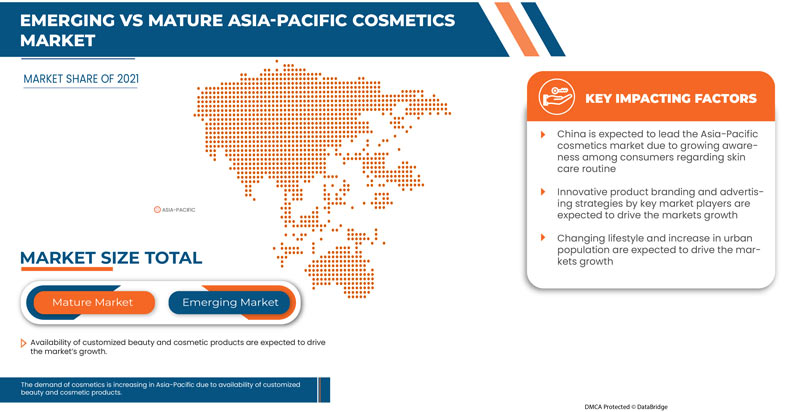

- Growing awareness among consumers regarding skin care routine

In recent years, the cosmetics market has benefitted from the renewed focus on hygiene and self-care routines. The increasing demand for self-care products to combat stress & anxiety and the tendency of consumers to increase their engagement in self-care routines as a means of feeling good and looking better, has been the major driver for the cosmetics market. The interest in natural and organic ingredients has further increased the awareness and demand for skin care products such as face masks, body scrubs, toners and serums among users, as it emphasizes changing their existing skin care.

- Innovative product branding and advertising strategies by key market players

The advent of digital technologies has influenced consumers' buying behavior in the cosmetics market across the globe. The major cosmetics brands in the market are leveraging digital technologies to enable consumers to experience brands in an entirely new way, as the modern consumer expects a two-way conversation to connect more with the brand. Technological advancements, innovative branding and advertising strategies have made it easy for beauty lovers to access trends, looks, content and experiences.

Major beauty companies and brands are continuously involved in innovating their product branding and advertising strategies to reach a wider audience base and increase customer engagement. Many brands use social media platforms to enhance brand reach, which has been the major strategy in recent years. This has enabled the brands to increase their user base and popularity in the cosmetics market which is expected to drive the market's growth.

- Availability of customized beauty & cosmetic products

Beauty companies and manufacturers are continuously introducing customization and digitalization in cosmetic products, attributed to the increasing demand for personalized skin care. Consumers are becoming aware of the beauty and skin care products in the market. The technological advancements in the industry are leading consumers away from the cosmetic product just made for the generic skin type. Consumers are becoming extremely careful about choosing the product according to their skin type. As a result, beauty companies focus on catering to such consumers with products that are ideal for their use, enabling them to increase consumer engagement in the market.

Opportunities

-

Focus on research and developments in the production of sustainable cosmetics

Sustainability is becoming a key priority for several brands across the ever-evolving beauty industry. Companies are constantly focusing on moving forward with greener initiatives without compromising the product's quality and reach to appeal to a growing population of eco-conscious consumers. Many major players are making efforts and setting goals to reach carbon neutrality. Companies are actively involved in reducing the environmental impact of their packaging processes across the lifecycle. The beauty industry is witnessing valuable collaborations and partnerships for exploring alternative materials and more responsible concepts in packaging design.

-

Rising demand for vegan beauty products

In recent years, the adoption of an alternative vegan lifestyle among the world population has increased. People are taking up the lifestyle to improve their overall health while benefitting their bodies both inside and out. Such developments are influencing the cosmetic industry also. Consumers are actively trying to search and switch to vegan cosmetic products as awareness about the same increases. This can be attributed to the ease of accessibility to online information about benefits and environmental impact.

The awareness regarding animal products such as hair, fur and others in cosmetics brands is increasing among consumers. Consumers find cruelty towards animals unethical and are spreading awareness against this act. This has set the trend in the global cosmetics marketplace to embrace plant-based personal care products. Major cosmetics manufacturing companies across the globe realize the importance of making products that use ingredients that are mineral-based or plant-based rather than manufacturing products that are infused with animal-extracted ingredients.

Restraints/Challenges

- Increasing trends in product recall

Recalling cosmetics and beauty products from a marketplace is an expeditious and effective method of removing products that violate norms and regulations, particularly those that present a danger to health. Recall of such a product can be initiated for several reasons, such as many consumer complaints, violation of norms set by the regulating bodies regarding the use of ingredients, voluntary company recalls and others.

For instance,

- In November 2021, Procter & Gamble recalled more than 15 different deodorant and aerosol sprays manufactured under its Old Spice and Secret brands. The recall was initiated after the company found that the sampling of its aerosol products detected benzene, a known carcinogen, in a suite of deodorants. Such recalls impact the pockets of the company and may impact the revenue. It also impacts the company's brand value and thus affects its reputation in the market, which may restrain its growth in the market

- Rise in awareness regarding side effects caused due to use of synthetic chemicals and ingredients

There are many instances in the beauty industry where the users have claimed not getting the result as projected by the brand. Substandard quality, grade and harmful compositions can result in allergies, discoloration, texture alteration, or permanent damage to the skin or hair. Increased usage and unregulated production have led to a steep rise in side effects suffered by consumers.

It is important for the consumer to thoroughly inspect and study the cosmetic product before using it, as it may contain ingredients not suited for one's skin or to which one is allergic. The product's chemical may get absorbed into the skin and cause irritation and other side effects. The increasing awareness regarding such instances may restrain the growth of the market.

Post-COVID-19 Impact on Asia-Pacific Cosmetics Market

The cosmetics industry has been directly impacted by the coronavirus (COVID-19) pandemic's dramatic shifts in consumer behavior. The COVID-19 pandemic has increased customers' concern for sustainability and health. The industry has responded positively to the crisis, with brands switching their manufacturing to produce hand sanitizers and cleaning agents and offering free beauty services for frontline response workers.

Recent Developments

- In August 2021, Unilever announced the acquisition of Paula's Choice, the digital-led skin care brand. The brand is famous for its industry-leading innovation, accessible jargon-free science, high-performing ingredients and cruelty-free products. With the acquisition, the company integrated the band into its product portfolio and hence increased the brand's visibility to a larger consumer base. This catered to the company's strategic priorities of expanding the company's portfolio of premium skin care products in the cosmetics market

- In March 2021, Coty Inc. announced the partnership with LanzaTech, a producer of next-generation green and sustainable ingredients. Accordingly, the companies will invest in introducing sustainable ethanol made from captured-carbon emissions into their fragrance products. This move supported the company's goals of developing clean and green products in the market

Asia-Pacific Cosmetics Market Scope

Asia-Pacific cosmetics market is segmented based on product type, nature, form, category, packaging type, distribution channel and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Skin Care

- Hair Care

- Fragrances

- Make Up

- Others

On the basis of type, the Asia-Pacific cosmetics market is segmented into skin care, hair care, fragrances, make up and others.

Nature

- Organic

- Inorganic

On the basis of nature, the Asia-Pacific cosmetics market is segmented into organic and inorganic.

Form

- Creams & Gels

- Lotions

- Sprays

- Solid

- Others

على أساس الشكل، يتم تقسيم سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ إلى كريمات وهلامية، ومستحضرات، وبخاخات، ومواد صلبة وغيرها.

فئة

- المنتج الشامل

- منتج ممتاز

- منتج احترافي

على أساس التطبيق، يتم تقسيم سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ إلى منتجات شاملة ومنتجات متميزة ومنتجات احترافية.

نوع التغليف

- زجاجات و برطمانات

- أنابيب

- الحاويات

- الأكياس

- العصي

- المضخات والموزعات

- بثور وحزم شرائط

- علب الهباء الجوي

- آحرون

على أساس التطبيق، يتم تقسيم سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ إلى زجاجات ومرطبانات وأنابيب وحاويات وأكياس وأعواد ومضخات وموزعات وعبوات بثور وشرائط وعلب رذاذ وغيرها.

قناة التوزيع

- غير متصل

- متصل

على أساس قناة التوزيع، يتم تقسيم سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ إلى سوق غير متصل بالإنترنت وسوق عبر الإنترنت.

المستخدم النهائي

- نحيف

- الرجال

- أطفال

على أساس المستخدم النهائي، يتم تصنيف سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ إلى النساء والرجال والأطفال.

تحليل/رؤى إقليمية لسوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ

يتم تقسيم سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ على أساس نوع المنتج والطبيعة والشكل والفئة ونوع التعبئة والتغليف وقناة التوزيع والمستخدم النهائي

الدول الموجودة في سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ هي اليابان والصين وكوريا الجنوبية والهند وسنغافورة وتايلاند وإندونيسيا وماليزيا والفلبين وأستراليا وبقية دول آسيا والمحيط الهادئ.

- من المتوقع أن تهيمن الصين على سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ في عام 2022 من حيث حصة السوق وإيرادات السوق بسبب الوجود القوي للاعبين الرئيسيين في السوق في المنطقة.

يقدم قسم الدولة في التقرير أيضًا عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل قوى بورتر الخمس ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية الأوروبية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ

توفر سوق مستحضرات التجميل التنافسية في منطقة آسيا والمحيط الهادئ تفاصيل حول المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في منطقة آسيا والمحيط الهادئ، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف لدى الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ.

بعض اللاعبين الرئيسيين العاملين في سوق مستحضرات التجميل في منطقة آسيا والمحيط الهادئ هم Unilever و L'Oreal SA و Shiseido Company Limited و The Estée Lauder Companies و Procter & Gamble و Kao Corporation و Colgate-Palmolive Company و Oriflame Cosmetics Global SA و Beiersdorf AG و Johnson & Johnson Services، Inc. و Amorepacific و Coty Inc. و AVON PRODUCTS و Revlon، Inc. و The Body Shop International Limited وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق البحث في DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكات وضع البائعين وتحليل الخط الزمني للسوق ونظرة عامة على السوق والدليل وشبكة وضع الشركة وتحليل حصة الشركة في السوق ومعايير القياس وتحليل آسيا والمحيط الهادئ مقابل المنطقة وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC COSMETICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 BMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING AWARENESS AMONG CONSUMERS REGARDING SKINCARE ROUTINE

5.1.2 INNOVATIVE PRODUCT BRANDING AND ADVERTISING STRATEGIES BY KEY MARKET PLAYERS

5.1.3 AVAILABILITY OF CUSTOMIZED BEAUTY & COSMETIC PRODUCTS

5.1.4 CHANGING LIFESTYLES AND INCREASE IN URBAN POPULATION

5.2 RESTRAINTS

5.2.1 RISE IN AWARENESS REGARDING SIDE EFFECTS CAUSED DUE TO USE OF SYNTHETIC CHEMICALS AND INGREDIENTS

5.2.2 INCREASING TRENDS IN PRODUCT RECALLS

5.3 OPPORTUNITIES

5.3.1 FOCUS ON RESEARCH AND DEVELOPMENTS IN THE PRODUCTION OF SUSTAINABLE COSMETICS

5.3.2 RISING DEMAND FOR VEGAN BEAUTY PRODUCTS

5.4 CHALLENGE

5.4.1 NECESSITY OF TRANSPARENCY FOR INGREDIENTS USED IN COSMETIC PRODUCTS

6 ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SKIN CARE

6.2.1 MASKS

6.2.2 MOISTURIZERS

6.2.3 BODY LOTIONS

6.2.4 TONER

6.2.5 CLEANSING CREAM

6.2.6 FACIAL REMOVER

6.2.7 SUNSCREENS

6.2.8 BODY WASH

6.2.9 NIGHT SERUM

6.2.10 DAY CREAM

6.2.11 HAND & FOOT CREAM

6.2.12 OTHERS

6.3 HAIR CARE

6.3.1 SHAMPOO

6.3.2 CONDITIONERS

6.3.3 HAIR COLOR

6.3.3.1 HAIR DYES AND COLORS

6.3.3.2 HAIR BLEACHES

6.3.3.3 HAIR TINTS

6.3.3.4 OTHERS

6.3.3.4.1 NORMAL

6.3.3.4.2 OILY

6.3.3.4.3 DRY

6.4 SERUMS

6.5 OIL

6.6 SPRAYS

6.7 OTHERS

6.8 MAKE UP

6.8.1 LIPSTICK

6.8.2 EYE SHADOWS

6.8.3 MASCARA

6.9 FOUNDATION

6.9.1 BRONZER

6.9.2 BLUSH

6.9.3 OTHERS

6.1 FRAGRANCES

6.11 OTHERS

7 ASIA-PACIFIC COSMETICS MARKET, BY NATURE

7.1 OVERVIEW

7.2 INORGANIC

7.3 ORGANIC

8 ASIA-PACIFIC COSMETICS MARKET, BY FORM

8.1 OVERVIEW

8.2 CREAMS & GELS

8.3 LOTIONS

8.4 SPRAYS

8.5 SOLID

8.6 OTHERS

9 ASIA-PACIFIC COSMETICS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 MASS PRODUCT

9.3 PREMIUM PRODUCT

9.4 PROFESSIONAL PRODUCT

10 ASIA-PACIFIC COSMETICS MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 BOTTLES AND JARS

10.3 TUBES

10.4 CONTAINERS

10.5 PUMPS & DISPENSERS

10.6 STICKS

10.7 AEROSOL CANS

10.8 POUCHES

10.9 BLISTERS AND STRIP PACKS

10.1 OTHERS

11 ASIA-PACIFIC COSMETICS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.2.1 SPECIALTY STORES

11.2.2 SUPERMARKETS/HYPERMARKETS

11.2.3 PHARMACIES

11.2.4 SALONS

11.2.5 OTHERS

11.3 ONLINE

12 ASIA-PACIFIC COSMETICS MARKET, BY END USER

12.1 OVERVIEW

12.2 WOMEN

12.2.1 SKIN CARE

12.2.2 HAIR CARE

12.2.3 MAKE UP

12.2.4 FRAGRANCES

12.2.5 OTHERS

12.3 MEN

12.3.1 SKIN CARE

12.3.2 HAIR CARE

12.3.3 FRAGRANCES

12.3.4 MAKE UP

12.3.5 OTHERS

12.4 KIDS

12.4.1 SKIN CARE

12.4.2 HAIR CARE

12.4.3 FRAGRANCES

12.4.4 MAKE UP

12.4.5 OTHERS

13 ASIA-PACIFIC COSMETICS MARKET, BY COUNTRY

13.1 CHINA

13.2 JAPAN

13.3 INDIA

13.4 SOUTH KOREA

13.5 AUSTRALIA & NEW ZEALAND

13.6 INDONESIA

13.7 PHILIPPINES

13.8 THAILAND

13.9 MALAYSIA

13.1 SINGAPORE

13.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC COSMETICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.2 COLLABORATION

14.3 EXPANSION

14.4 PRODUCT LAUNCH

14.5 ACQUISITION

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 UNILEVER

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 L’ORÉAL S.A.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 SHISEIDO COMPANY, LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 THE ESTÉE LAUDER COMPANIES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 PROCTER & GAMBLE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 AMOREPACIFIC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 AVON PRODUCTS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 BEIERSDORF GROUP

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 COLGATE-PALMOLIVE COMPANY

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 COTY INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 JOHNSON & JOHNSON SERVICES, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 KAO CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 ORIFLAME COSMETICS GLOBAL SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT UPDATES

16.14 REVLON, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 THE BODY SHOP INTERNATIONAL LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF BEAUTY OR MAKE-UP PREPARATIONS AND PREPARATIONS FOR THE CARE OF THE SKIN; HS CODE – 3304 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BEAUTY OR MAKE-UP PREPARATIONS AND PREPARATIONS FOR THE CARE OF THE SKIN; HS CODE – 3304 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC HAIR COLOR COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC HAIR COLOR COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC COSMETICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 20 CHINA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 21 CHINA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 CHINA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 CHINA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 CHINA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 25 CHINA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 CHINA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 27 CHINA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 28 CHINA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 29 CHINA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 30 CHINA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 CHINA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 33 CHINA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 JAPAN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 JAPAN HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 JAPAN HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 JAPAN HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 41 JAPAN MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 JAPAN COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 44 JAPAN COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 45 JAPAN COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 46 JAPAN COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 JAPAN OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 49 JAPAN WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 INDIA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 INDIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 INDIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 INDIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 INDIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 57 INDIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 INDIA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 59 INDIA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 INDIA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 61 INDIA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 INDIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDIA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 INDIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 INDIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 INDIA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA & NEW ZEALAND SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA & NEW ZEALAND HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA & NEW ZEALAND HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA & NEW ZEALAND HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA & NEW ZEALAND MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA & NEW ZEALAND KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDONESIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDONESIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 INDONESIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDONESIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 INDONESIA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDONESIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 PHILIPPINES COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 PHILIPPINES SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 PHILIPPINES HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 PHILIPPINES HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 PHILIPPINES HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 121 PHILIPPINES MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 PHILIPPINES COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 123 PHILIPPINES COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 124 PHILIPPINES COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 125 PHILIPPINES COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 126 PHILIPPINES COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 PHILIPPINES OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 PHILIPPINES COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 129 PHILIPPINES WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 PHILIPPINES MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 PHILIPPINES KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 THAILAND COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 141 THAILAND COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 142 THAILAND COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 143 THAILAND OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 THAILAND COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 145 THAILAND WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 THAILAND MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 THAILAND KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 MALAYSIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 MALAYSIA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 SINGAPORE COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 SINGAPORE SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 173 SINGAPORE COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 174 SINGAPORE COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SINGAPORE OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SINGAPORE COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 177 SINGAPORE WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 SINGAPORE MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 REST OF ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA-PACIFIC COSMETICS MARKET

FIGURE 2 ASIA-PACIFIC COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC COSMETICS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC COSMETICS MARKET: THE FORM LINE CURVE

FIGURE 7 ASIA-PACIFIC COSMETICS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA-PACIFIC COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA-PACIFIC COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA-PACIFIC COSMETICS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 ASIA-PACIFIC COSMETICS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA-PACIFIC COSMETICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA-PACIFIC COSMETICS MARKET: SEGMENTATION

FIGURE 14 GROWING AWARENESS AMONG CONSUMERS REGARDING SKINCARE ROUTINES IS EXPECTED TO DRIVE THE ASIA-PACIFIC COSMETICS MARKET GROWTH IN THE FORECAST PERIOD OF 2022-2029

FIGURE 15 SKIN CARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC COSMETICS MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC COSMETICS MARKET

FIGURE 17 ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 ASIA-PACIFIC COSMETICS MARKET, BY NATURE, 2021

FIGURE 19 ASIA-PACIFIC COSMETICS MARKET: BY FORM, 2021

FIGURE 20 ASIA-PACIFIC COSMETICS MARKET: BY CATEGORY, 2021

FIGURE 21 ASIA-PACIFIC COSMETICS MARKET: BY PACKAGING TYPE, 2021

FIGURE 22 ASIA-PACIFIC COSMETICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC COSMETICS MARKET: BY END-USER, 2021

FIGURE 24 ASIA-PACIFIC COSMETICS MARKET: SNAPSHOT (2021)

FIGURE 25 ASIA-PACIFIC COSMETICS MARKET: BY COUNTRY (2021)

FIGURE 26 ASIA-PACIFIC COSMETICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 ASIA-PACIFIC COSMETICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 ASIA-PACIFIC COSMETICS MARKET: BY PRODUCT TYPE (2022 - 2029)

FIGURE 29 ASIA-PACIFIC COSMETICS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.