سوق الأغشية الخزفية في آسيا والمحيط الهادئ، حسب المادة (الألومينا، أكسيد الزركونيوم، التيتانيا، السيليكا، أخرى)، التطبيق (معالجة المياه والصرف الصحي، الأغذية والمشروبات، الأدوية، التكنولوجيا الحيوية ، أخرى)، التكنولوجيا (الترشيح الفائق، الترشيح الدقيق، الترشيح النانوي، أخرى) - اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل ورؤى حول سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ

إن الطلب المتزايد على الأغشية الخزفية من صناعات معالجة المياه والصرف الصحي والأغذية والمشروبات والأدوية والتكنولوجيا الحيوية يشكل محركًا مهمًا لسوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ. ومن المتوقع أن يؤدي التركيز المتزايد على الاستدامة والجودة وكفاءة الأغشية في عملية الترشيح إلى دفع نمو سوق الأغشية الخزفية.

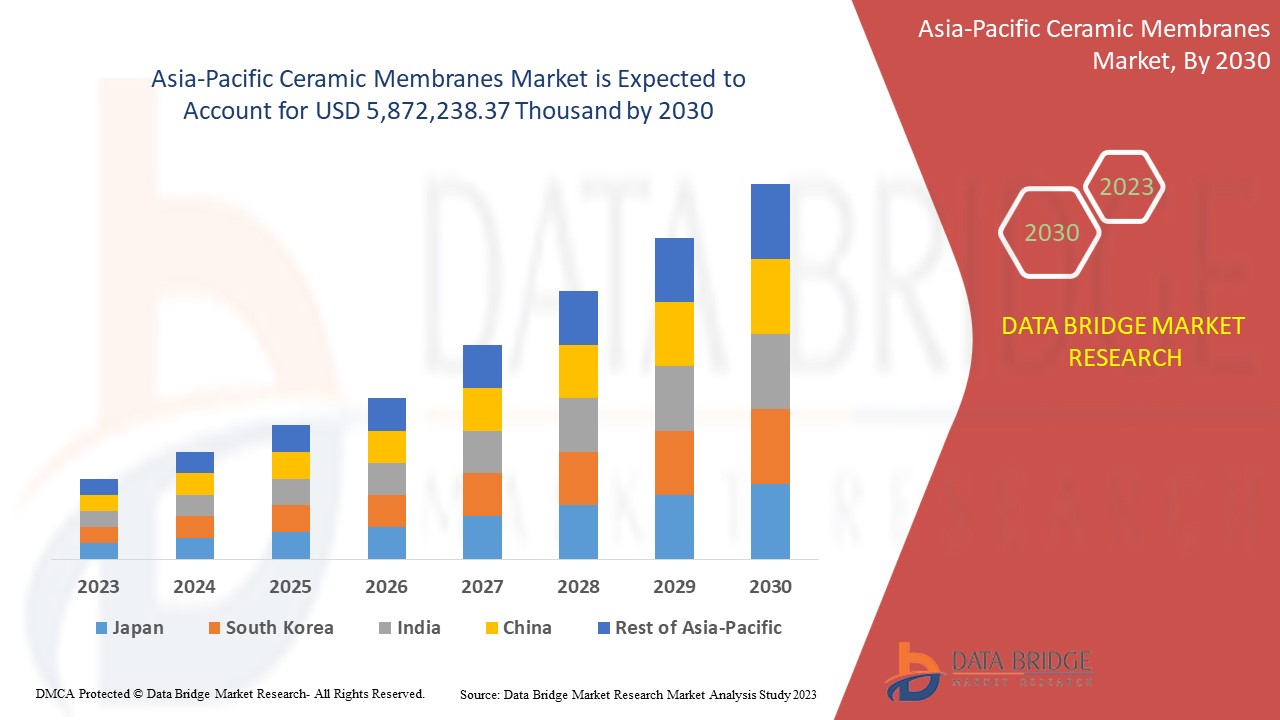

من المتوقع أن يشهد سوق الأغشية الخزفية نموًا كبيرًا في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب قدره 12.8٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 5،872،238.37 ألف دولار أمريكي بحلول عام 2030.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالآلاف من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب المادة (الألومينا، أكسيد الزركونيوم، التيتانيا، السيليكا، أخرى)، التطبيق (معالجة المياه والصرف الصحي، الأغذية والمشروبات، الأدوية، التكنولوجيا الحيوية، أخرى)، التكنولوجيا ( الترشيح الفائق ، الترشيح الدقيق، الترشيح النانوي، أخرى). |

|

الدول المغطاة |

الصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ، |

|

الجهات الفاعلة في السوق المشمولة |

TAMI Industries، وatech innovations gmbh، وGEA Group Aktiengesellschaft، وNanostone، وLiqTech Holding A/S، وQua Group LLC، وTORAY INDUSTRIES, INC.، وSIVA Unit.، وMETAWATER. CO., LTD.، وKERAFOL Ceramic Films GmbH & Co. KG، وAquatech International LLC، وPaul Rauschert GmbH & Co. KG، وHYDRASYST، وMembratec SA، وMantec Filtration. |

تعريف السوق

الأغشية الخزفية هي أغشية صناعية مصنوعة من مواد غير عضوية. تُستخدم الأغشية الخزفية في صناعات مثل الترشيح ومعالجة السوائل. تشمل معظم الصناعات التي تُستخدم فيها الأغشية الخزفية الأغذية والمشروبات والأدوية والتكنولوجيا الحيوية ومعالجة المياه والصرف الصحي. تشمل عوامل نمو السوق الطلب المتزايد من الصناعات الدوائية ومعالجة المياه والصرف الصحي.

ديناميكيات سوق الأغشية الخزفية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- ارتفاع الطلب على الأغشية الخزفية من صناعات الأغذية والمشروبات

تعد صناعة الأغذية والمشروبات من أكبر الصناعات التي يتم فيها استخدام الأغشية الخزفية نظرًا لفوائدها المتعددة مثل خصائص الترشيح والنشاط المضاد للبكتيريا. بالإضافة إلى ذلك، فإن كفاءة الفصل العالية والاستقرار الكيميائي الجيد يجعلان الأغشية الخزفية أكثر أهمية لصناعات الأغذية والمشروبات.

تستطيع الأغشية الخزفية التغلب على القيود التي تفرضها الأغشية البوليمرية. ولهذا السبب، تتجه أغلب صناعات الأغذية والمشروبات، وخاصة مصنعي منتجات الألبان، نحو استخدام الأغشية الخزفية بدلاً من أي خدمات أغشية أخرى. وتتزايد الحاجة إلى الأغشية الخزفية في الشركات المصنعة القياسية للارتقاء النوعي بمرور الوقت.

علاوة على ذلك، تشمل التطبيقات التقنية التي تستخدم فيها الأغشية الخزفية تركيز المحليات وتنقيتها، وتركيز بروتينات الحليب، وعزل بروتينات الحليب. تُستخدم الترشيح المتقاطع للأغشية الخزفية في العديد من الصناعات لتنقية المنتجات المائية. على سبيل المثال، إنتاج النبيذ والبيرة وعصير الفواكه والخضروات. كما شهدت عملية فصل الخلايا في إنتاج الأحماض الأمينية وإنتاج حمض اللاكتيك في صناعات الألبان تقدمًا تقنيًا في الوقت الحاضر، كما تم استخدام الأغشية الخزفية في هذه القطاعات.

لتلبية الطلب المرتفع، تنمو صناعات الأغذية والمشروبات وتوسع إنتاجها بسرعة. وفي هذا الاتجاه المتزايد، ينمو الطلب على الأغشية الخزفية في صناعاتها أيضًا، ومن المتوقع أن يدفع ذلك سوق الأغشية الخزفية في السنوات القادمة. وبالتالي، هناك طلب متزايد على الأغشية الخزفية من صناعات الأغذية والمشروبات لعوامل فريدة مختلفة، ومن المتوقع أن يدفع ذلك الطلب والمبيعات في سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ.

- ارتفاع الطلب على الأغشية الخزفية من صناعات تنقية المياه

إن النمو السريع للسكان وزيادة كمية مياه الصرف الصحي يجعل الحاجة إلى خدمات تنقية المياه ومعالجة مياه الصرف الصحي أولوية. تعد الأغشية الخزفية واحدة من التطبيقات الرئيسية في عملية تنقية المياه. مع العديد من العوامل المفيدة، بما في ذلك القوة الميكانيكية العالية ومقاومة درجات الحرارة الكيميائية، تُستخدم الأغشية الخزفية في معالجة المياه ومياه الصرف الصحي.

تشمل مجموعة تطبيقات الأغشية الخزفية في معالجة المياه معالجة المياه البلدية ومياه الصرف الصحي ومعالجات مياه الصرف الصناعي. يجب معالجة مياه الصرف الصناعي مثل مياه الصرف الصحي الناتجة عن الصناعة الزيتية والنسيجية ومياه الصرف الصحي للطباعة والصباغة بانتظام. مع زيادة التصنيع في صناعات معالجة المياه في سوق آسيا والمحيط الهادئ، فإن الطلب على الأغشية الخزفية ينمو أيضًا، مما قد يدفع سوق الأغشية الخزفية في آسيا والمحيط الهادئ في المستقبل. بعض الأمثلة على مجالات معالجة المياه حيث يمكن استخدام الأغشية الخزفية هي مياه حقن حقول النفط ومياه صناعة الورق وتسرب مكبات النفايات ومياه الصرف الصحي لزيت النخيل ومياه الصرف الصحي لثاني أكسيد التيتانيوم وغير ذلك الكثير.

مع تزايد الحاجة إلى معالجة المياه وتنقيتها، يرتفع أيضًا الطلب على الأغشية الخزفية وتطبيقها. ومن المتوقع أن يؤدي هذا الاتجاه المتزايد إلى دفع نمو السوق في المستقبل القريب. وبالتالي، من المتوقع أن يؤدي الطلب المتزايد من صناعات تنقية المياه ومعالجتها إلى دفع سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ إلى النمو في السنوات القادمة.

فرص

- تطبيقات الأغشية الخزفية في الصناعات المختلفة

هناك مجموعة واسعة من الصناعات التي يمكن تطبيق الأغشية الخزفية فيها. إن الاستخدامات المتنوعة لتكنولوجيا الأغشية الخزفية تجعلها متعددة الاستخدامات. تستخدم صناعات مختلفة مثل صناعات النسيج والأغذية والمشروبات والمواد الكيميائية والورق الأغشية الخزفية للترشيح، وغيرها. تعد الصناعات الدوائية واحدة من المستهلكين الأساسيين لتكنولوجيا الأغشية الخزفية. نظرًا لنشاطها المضاد للبكتيريا والميكروبات، فقد تم استخدام الأغشية الخزفية لأغراض صحية مختلفة.

علاوة على ذلك، تم استخدام كفاءة فصل أي نوع من المواد المعينة عن السائل باستخدام الأغشية الخزفية في صناعة الأغذية والمشروبات. لهذا السبب، يزداد الطلب على الأغشية الخزفية في صناعات الأغذية والمشروبات والأدوية. إن الحاجة المتزايدة لمعالجة المياه لتلبية الأهداف المستدامة لمعالجة المياه لتلبية الأهداف المستدامة تخلق فرصة لسوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ بسبب التطبيقات الواسعة للأغشية الخزفية في معالجات مياه الصرف الصحي.

- التطورات التكنولوجية في علم الأغشية الخزفية

تؤثر التكنولوجيا بشكل كبير على سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ، من حيث تحديث الأساليب القديمة واكتشاف طرق جديدة لتصنيع تكنولوجيا السيراميك بجودة محسنة وخفض التكاليف. يمكن أن يؤدي الابتكار المستمر في هذا القطاع واتجاهه المتزايد إلى مواجهة سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ لنمو شديد في المستقبل القريب. تعتمد جميع القطاعات مثل الأدوية والتكنولوجيا الحيوية وتكنولوجيا معالجة المياه بشكل أساسي على التقدم في تكنولوجيا السيراميك. هناك العديد من القيود الموجودة في تكنولوجيا الأغشية الخزفية، مثل الهشاشة، وانخفاض اللدونة وغيرها. ومع ذلك، يعمل الباحثون والمجتمع العلمي بجد للتغلب على القيود. على سبيل المثال، تم استخدام تكنولوجيا الأغشية الخزفية المسطحة لمعالجة مياه الصرف الصحي البلدية. لذلك، يتم خلق فرصة لسوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ. وبالتالي، فإن التطورات الأخيرة في العلوم والتكنولوجيا توفر دعمًا مستمرًا لنمو سوق الأغشية الخزفية.

القيود/التحديات

- استثمار عالي التكلفة في تصنيع الأغشية الخزفية

أحد القيود التي تؤثر على نمو سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ هو تكلفة إنتاجها. تكلفة الاستثمار المرتبطة بتصنيع الأغشية الخزفية أعلى من الأنواع الأخرى المماثلة من الأغشية. تحتاج محطات معالجة المياه إلى أنظمة أغشية لتصفية جزيئات الملوثات في مياه الصرف الصحي. ومع ذلك، عندما يتعلق الأمر بتثبيت الأغشية الخزفية، فإن عدد التثبيت الكامل في صناعات معالجة المياه منخفض حقًا. وبالتالي، فإن التكلفة المرتبطة بتثبيت أو تصنيع الأغشية الخزفية قد تحد من نمو سوق الأغشية الخزفية في منطقة آسيا والمحيط الهادئ.

- مشاكل الأداء بسبب هشاشة الأغشية الخزفية

تتكون الأغشية الخزفية من ركائز مسامية صغيرة توفر الدعم للأغشية الرقيقة الكثيفة. وعلى الرغم من وجود العديد من العوامل المفيدة مثل الاستقرار الكيميائي والحراري، إلا أن هذه الأغشية يمكن أن يكون بها شقوق دون الحرجة. وقد لوحظ أنه في حساسية معينة، تعمل الأغشية الخزفية كمكون هش للغاية، ويمكن أن يزداد نمو الشقوق داخلها. وبسبب الاختلافات في التمدد الحراري، يمكن أن تعمل الأغشية الخزفية كمادة هشة للغاية. وعلاوة على ذلك، إلى جانب الهشاشة، فإن الأغشية الخزفية لديها قابلية ضئيلة للسحب وقوة الشد وغيرها من المخاوف ذات الصلة. وبالتالي، فإن هذا العيب الرئيسي يمكن أن يمنع سوق الأغشية الخزفية في آسيا والمحيط الهادئ من النمو في السنوات القادمة.

التطورات الأخيرة

- في أكتوبر 2022، أعلنت شركة METAWATER CO., LTD. عن تلقيها طلبًا جديدًا من شركة PWNT، هولندا. يتعلق هذا الطلب بأغشية سيراميكية لأعمال معالجة المياه في Hampton Loade في المملكة المتحدة. بعد اكتماله، سيصبح أكبر مصنع لمعالجة المياه بأغشية سيراميكية في العالم. سيخلق هذا الإعلان المزيد من اهتمام العملاء وقيمة العلامة التجارية للشركة.

- في سبتمبر 2022، حصلت تقنية أغشية الترشيح الفائق الخزفية Nanostone على موافقة اللائحة 31 في المملكة المتحدة لاستخدامها في معالجة مياه الشرب في المملكة المتحدة. وهي تساعد في تحسين جودة مياه الشرب. تساعد هذه الموافقة الشركة على عرض معايير أفضل بين المنافسين.

نطاق سوق الأغشية الخزفية

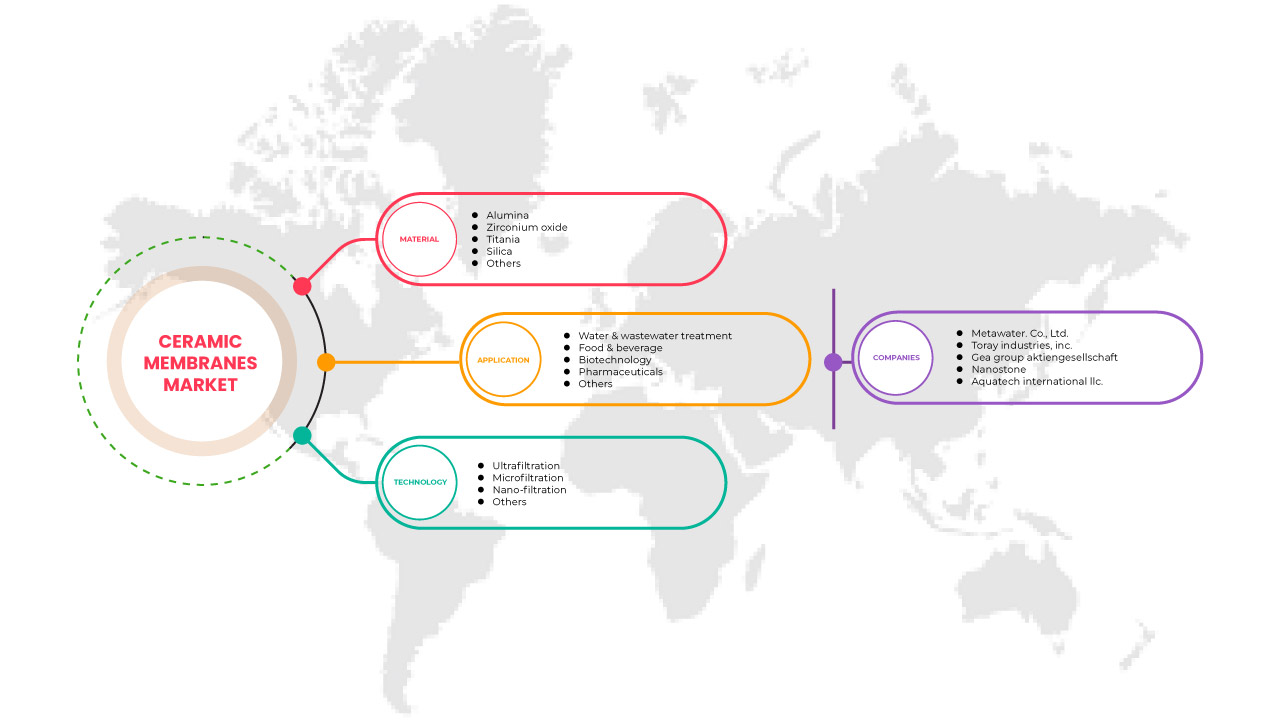

يتم تصنيف سوق الأغشية الخزفية بناءً على المواد والتطبيق والتكنولوجيا. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

مادة

- الألومينا

- أكسيد الزركونيوم

- تيتانيا

- السيليكا

- آحرون

على أساس المادة، يتم تصنيف سوق الأغشية الخزفية إلى الألومينا وأكسيد الزركونيوم والتيتانيا والسيليكا وغيرها.

طلب

- معالجة المياه والصرف الصحي

- الأطعمة والمشروبات

- التكنولوجيا الحيوية

- المستحضرات الصيدلانية

- آحرون

على أساس التطبيق، يتم تصنيف سوق الأغشية الخزفية إلى معالجة المياه والصرف الصحي، والأغذية والمشروبات، والتكنولوجيا الحيوية، والمستحضرات الصيدلانية، وغيرها.

تكنولوجيا

- الترشيح الفائق

- الترشيح الدقيق

- الترشيح النانوي

- آحرون

على أساس التكنولوجيا، يتم تصنيف سوق الأغشية الخزفية إلى الترشيح الفائق، والترشيح الدقيق، والترشيح النانوي، وغيرها.

تحليل/رؤى إقليمية لسوق الأغشية الخزفية

يتم تقسيم سوق الأغشية الخزفية على أساس المادة والتطبيق والتكنولوجيا.

الدول التي يغطيها تقرير سوق الأغشية الخزفية هي الصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC).

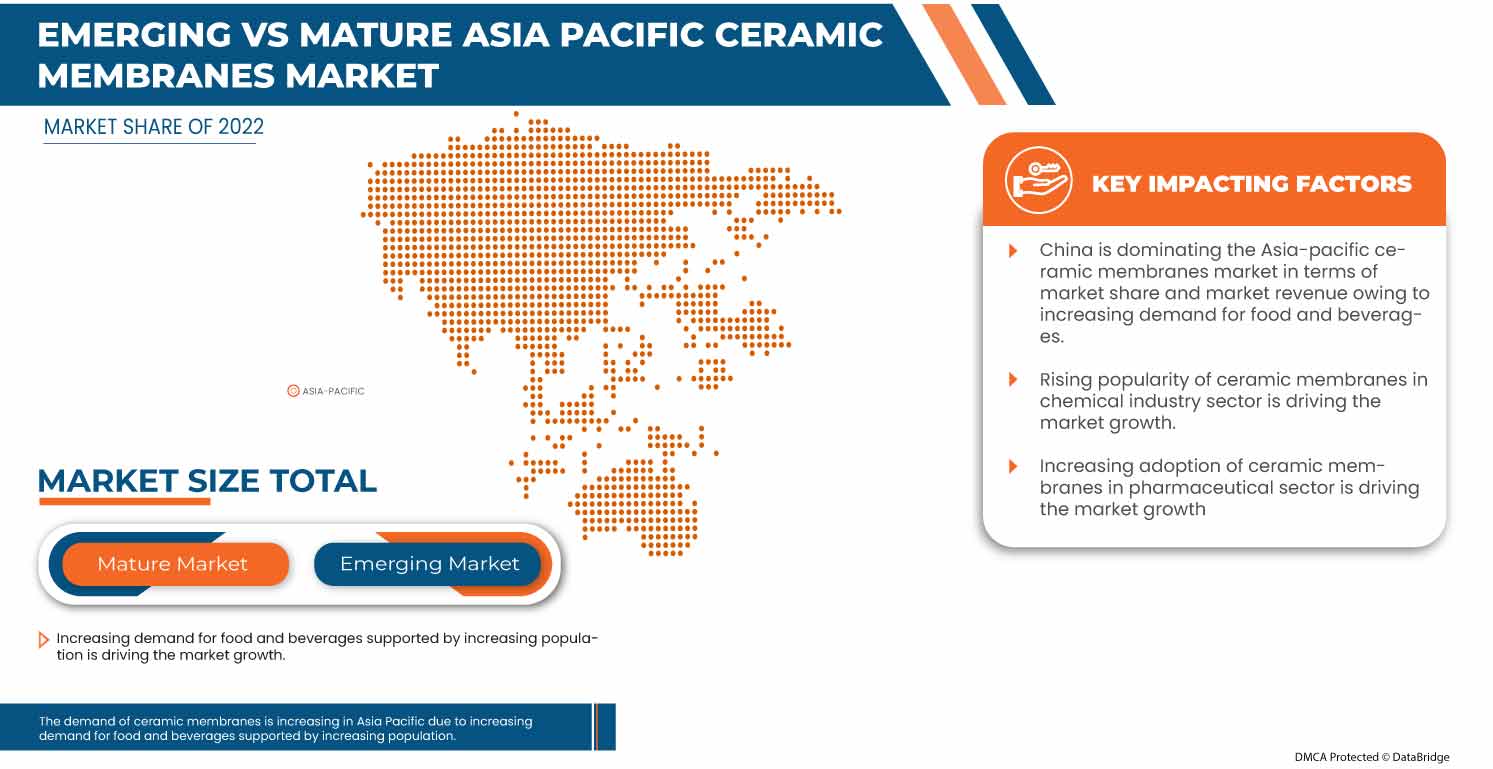

من المتوقع أن تهيمن منطقة آسيا والمحيط الهادئ على سوق الأغشية الخزفية بسبب التركيز المتزايد على الاستدامة والجودة وسلامة العمال. تهيمن الصين على منطقة آسيا والمحيط الهادئ بسبب الطلب المتزايد على الأغشية الخزفية من صناعات معالجة المياه والصرف الصحي والأغذية والمشروبات والأدوية والتكنولوجيا الحيوية.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات وتحليل سلسلة القيمة المصب والمصب والاتجاهات الفنية وتحليل قوى بورتر الخمس ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في منطقة آسيا والمحيط الهادئ والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل الحصة التنافسية لسوق المناظر الطبيعية والأغشية الخزفية

يوفر المشهد التنافسي لسوق الأغشية الخزفية تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان حياة المنتج. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الأغشية الخزفية.

بعض اللاعبين الرئيسيين في السوق الذين يعملون في السوق هم TAMI Industries و atech innovations gmbh و GEA Group Aktiengesellschaft و Nanostone و LiqTech Holding A/S و Qua Group LLC و TORAY INDUSTRIES, INC و SIVA Unit و METAWATER. CO., LTD. و KERAFOL Ceramic Films GmbH & Co. KG و Aquatech International LLC و Paul Rauschert GmbH & Co. KG و HYDRASYST و Membratec SA و Mantec Filtration.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC CERAMIC MEMBRANE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 CERAMIC MEMBRANE MATERIAL LIFE LINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 IMPORT-EXPORT DATA

2.15 SECONDARY SOURCES

2.16 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 IMPORT EXPORT SCENARIO

4.6 PRODUCTION CONSUMPTION ANALYSIS- ASIA PACIFIC CERAMIC MEMBRANE MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CERAMIC MEMBRANES FROM THE FOOD AND BEVERAGES INDUSTRIES

5.1.2 RISING DEMAND FOR CERAMIC MEMBRANES FROM WATER PURIFICATION INDUSTRIES

5.1.3 INCREASING DEMAND FOR CERAMIC MEMBRANES FROM PHARMACEUTICAL INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH-COST INVESTMENT FOR MANUFACTURING CERAMIC MEMBRANES

5.2.2 PERFORMANCE ISSUES DUE TO THE BRITTLENESS OF CERAMIC MEMBRANES

5.3 OPPORTUNITIES

5.3.1 APPLICATIONS OF CERAMIC MEMBRANES IN DIFFERENT INDUSTRIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN CERAMIC MEMBRANE SCIENCE

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVES SUCH AS POLYMERIC MEMBRANES

6 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 ALUMINA

6.3 ZIRCONIUM OXIDE

6.4 TITANIA

6.5 SILICA

6.6 OTHERS

7 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 WATER & WASTEWATER TREATMENT

7.3 FOOD & BEVERAGE

7.4 PHARMACEUTICALS

7.5 BIOTECHNOLOGY

7.6 OTHERS

8 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ULTRAFILTERATION

8.3 MICROFILTERATION

8.4 NANO-FILTERATION

8.5 OTHERS

9 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 JAPAN

9.1.3 SOUTH KOREA

9.1.4 INDIA

9.1.5 THAILAND

9.1.6 SINGAPORE

9.1.7 INDONESIA

9.1.8 AUSTRALIA & NEW ZEALAND

9.1.9 PHILIPPINES

9.1.10 MALAYSIA

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC CERAMIC MEMBRANES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.2 ANNOUNCEMENTS

10.3 DEVELOPMENT

10.4 PROJECT

10.5 TECHNOLOGY

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 METAWATER. CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 SWOT

12.1.6 RECENT DEVELOPMENT

12.2 TORAY INDUSTRIES, INC. (2022)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 SWOT

12.2.6 RECENT DEVELOPMENTS

12.3 GEA GROUP AKTIENGESELLSCHAFT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 SWOT

12.3.6 RECENT DEVELOPMENTS

12.4 NANOSTONE

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 AQUATECH INTERNATIONAL LLC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENTS

12.6 A-TECH INNOVATION GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 HYDRASYST

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 KERAFOL CERAMIC FILMS GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 LIQTECH HOLDING A/S (2022)

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 SWOT

12.9.5 RECENT DEVELOPMENTS

12.1 MANTEC FILTRATION

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT UPDATES

12.11 MEMBRATEC SA

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 PAUL RAUSCHERT GMBH & CO.KG

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 QUA GROUP LLC.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATES

12.14 SIVA UNIT

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 SWOT

12.14.4 RECENT UPDATES

12.15 TAMI INDUSTRIES

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 3 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC ALUMINA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA PACIFIC ZIRCONIUM OXIDE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC TITANIA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA PACIFIC SILICA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC FOOD & BEVERAGE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC PHARMACEUTICALS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC BIOTECHNOLOGY IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC ULTRAFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC MICROFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC NANO-FILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (PRICE)

TABLE 23 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 25 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 26 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 30 CHINA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 31 CHINA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 JAPAN CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 34 JAPAN CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 35 JAPAN CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 36 JAPAN CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 JAPAN CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 38 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 39 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 40 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 41 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 43 INDIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 44 INDIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 45 INDIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 46 INDIA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 47 INDIA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 48 THAILAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 49 THAILAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 50 THAILAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 51 THAILAND CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 THAILAND CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 53 SINGAPORE CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 54 SINGAPORE CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 55 SINGAPORE CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 56 SINGAPORE CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 57 SINGAPORE CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 INDONESIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 INDONESIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 60 INDONESIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 61 INDONESIA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 62 INDONESIA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 63 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 64 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 65 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 66 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 67 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 68 PHILIPPINES CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 69 PHILIPPINES CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 70 PHILIPPINES CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 71 PHILIPPINES CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 72 PHILIPPINES CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 73 MALAYSIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 MALAYSIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 75 MALAYSIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 76 MALAYSIA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 MALAYSIA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 78 REST OF ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 79 REST OF ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 80 REST OF ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

List of Figure

FIGURE 1 ASIA PACIFIC CERAMIC MEMBRANE MARKET

FIGURE 2 ASIA PACIFIC CERAMIC MEMBRANE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CERAMIC MEMBRANE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CERAMIC MEMBRANE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CERAMIC MEMBRANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CERAMIC MEMBRANE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC CERAMIC MEMBRANE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC LIFE LINE CURVE

FIGURE 9 ASIA PACIFIC CERAMIC MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 ASIA PACIFIC CERAMIC MEMBRANE MARKET: DBMR MARKET POSITION GRID

FIGURE 11 ASIA PACIFIC CERAMIC MEMBRANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 ASIA PACIFIC CERAMIC MEMBRANE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 ASIA PACIFIC CERAMIC MEMBRANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 ASIA PACIFIC CERAMIC MEMBRANE MARKET: SEGMENTATION

FIGURE 15 GROWING DEMAND FOR CERAMIC MEMBRANES ACROSS VARIOUS INDUSTRIES IS EXPECTED TO DRIVE ASIA PACIFIC CERAMIC MEMBRANE MARKET IN THE FORECAST PERIOD

FIGURE 16 ALUMINA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CERAMIC MEMBRANE MARKET IN 2023 & 2030

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC CERAMIC MEMBRANES MARKET

FIGURE 19 ASIA PACIFIC CERAMIC MEMBRANE MARKET: BY MATERIAL, 2022

FIGURE 20 ASIA PACIFIC CERAMIC MEMBRANE MARKET: BY APPLICATION, 2022

TABLE 10 ASIA PACIFIC WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

FIGURE 21 ASIA PACIFIC CERAMIC MEMBRANE MARKET: BY TECHNOLOGY, 2022

FIGURE 22 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: SNAPSHOT (2022)

FIGURE 23 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY COUNTRY (2022)

FIGURE 24 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY MATERIAL (2023 & 2030)

FIGURE 27 ASIA PACIFIC CERAMIC MEMBRANES MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.