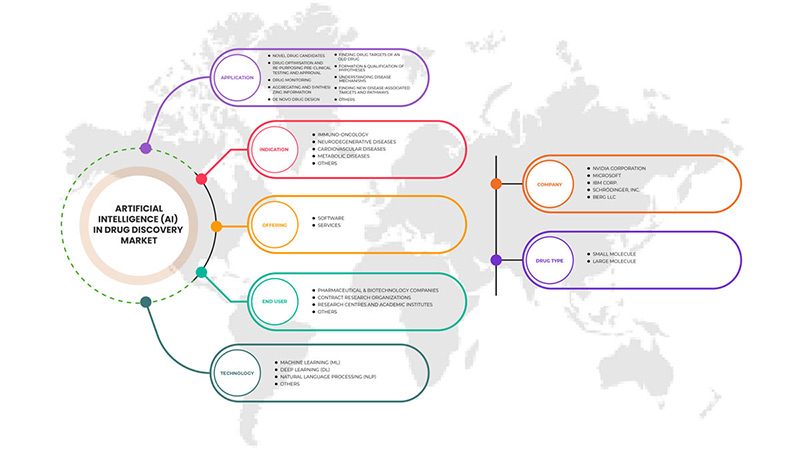

الذكاء الاصطناعي في سوق اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ، حسب التطبيق (مرشحي الأدوية الجدد، وتحسين الأدوية وإعادة استخدامها، والاختبارات والموافقات قبل السريرية، ومراقبة الأدوية، والعثور على أهداف ومسارات جديدة مرتبطة بالأمراض، وفهم آليات المرض، وتجميع المعلومات وتوليفها، وتشكيل وتأهيل الفرضيات، وتصميم الأدوية الجديدة، والعثور على أهداف دوائية لدواء قديم وغيرها)، والتكنولوجيا (التعلم الآلي، والتعلم العميق، ومعالجة اللغة الطبيعية وغيرها)، ونوع الدواء (الجزيء الصغير والجزيء الكبير)، والعرض (البرمجيات والخدمات)، والمؤشر (علم الأورام المناعي، والأمراض العصبية التنكسية، وأمراض القلب والأوعية الدموية، والأمراض الأيضية وغيرها)، والاستخدام النهائي (منظمات البحوث التعاقدية (CROs)، وشركات الأدوية والتكنولوجيا الحيوية، ومراكز البحوث والمعاهد الأكاديمية وغيرها) واتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ

من المتوقع أن يكون الذكاء الاصطناعي تقنية مربحة في صناعة الرعاية الصحية. إن تطبيق الذكاء الاصطناعي يقلل من فجوة البحث والتطوير في عملية تصنيع الأدوية ويساعد في التصنيع المستهدف للأدوية. وبالتالي، تتجه شركات الأدوية الحيوية إلى الذكاء الاصطناعي لتعزيز حصتها في السوق. الذكاء الاصطناعي لاكتشاف الأدوية هو تقنية تستخدم الآلات لمحاكاة الذكاء البشري لحل التحديات المعقدة في عملية تطوير الأدوية.

يؤدي تبني حلول الذكاء الاصطناعي في عملية التجارب السريرية إلى إزالة العقبات المحتملة، وتقليل وقت دورة التجارب السريرية، وزيادة إنتاجية ودقة عملية التجارب السريرية. تعد التطورات التكنولوجية في الذكاء الاصطناعي لاكتشاف الأدوية والحد من إجمالي الوقت المستغرق في عملية اكتشاف الأدوية عوامل أخرى تدفع نمو السوق في فترة التنبؤ. ومع ذلك، فإن البيانات المتاحة ذات الجودة المنخفضة وغير المتسقة ستعيق نمو السوق. كما أن التكلفة العالية المرتبطة بالتكنولوجيا والقيود الفنية ستقيد نمو السوق.

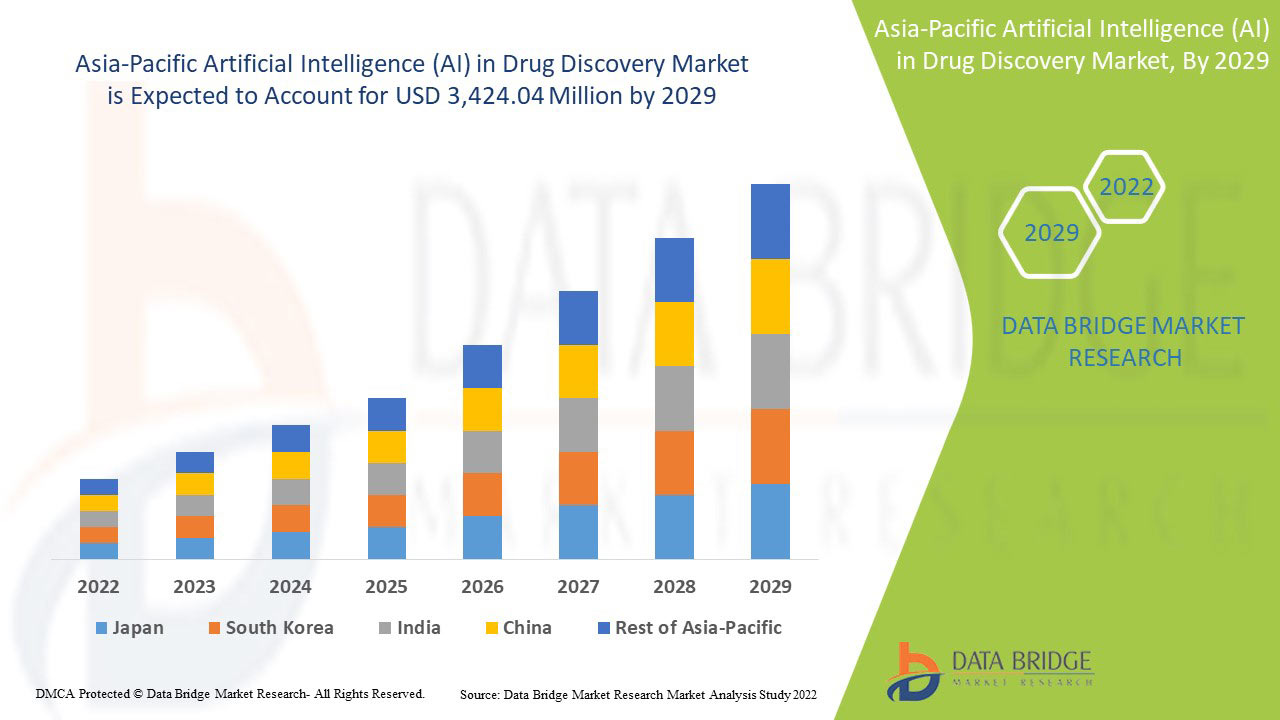

تحلل شركة Data Bridge Market Research أن سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ من المتوقع أن تصل قيمته إلى 3,424.04 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 50.9% خلال الفترة المتوقعة. تشكل البرمجيات أكبر شريحة تقنية في السوق بسبب التطورات السريعة في التقدم التكنولوجي لتسويق استخدام الذكاء الاصطناعي في سوق اكتشاف الأدوية. يغطي تقرير السوق هذا أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب التطبيق (مرشحي الأدوية الجديدة، وتحسين الأدوية وإعادة استخدامها، والاختبارات والموافقات السريرية المسبقة، ومراقبة الأدوية، والعثور على أهداف ومسارات جديدة مرتبطة بأمراض جديدة، وفهم آليات المرض، وتجميع المعلومات وتوليفها، وتكوين وتأهيل الفرضيات، وتصميم الأدوية الجديدة، والعثور على أهداف دوائية لدواء قديم وغيرها)، والتكنولوجيا (التعلم الآلي، والتعلم العميق، ومعالجة اللغة الطبيعية وغيرها)، ونوع الدواء (جزيء صغير وجزيء كبير)، والعرض (البرمجيات والخدمات)، والمؤشر ( علم الأورام المناعي ، والأمراض العصبية التنكسية، وأمراض القلب والأوعية الدموية، والأمراض الأيضية وغيرها)، والاستخدام النهائي (منظمات البحوث التعاقدية (CROs)، وشركات الأدوية والتكنولوجيا الحيوية، ومراكز البحوث والمعاهد الأكاديمية وغيرها) |

|

الدول المغطاة |

الصين واليابان والهند وكوريا الجنوبية وسنغافورة وتايلاند وماليزيا وأستراليا ونيوزيلندا والفلبين وإندونيسيا وبقية دول آسيا والمحيط الهادئ |

|

الجهات الفاعلة في السوق المشمولة |

بعض اللاعبين الرئيسيين العاملين في السوق هم NVIDIA Corporation و IBM Corp. و Atomwise Inc. و Microsoft و Benevolent AI و Aria Pharmaceuticals, Inc. و DEEP GENOMICS و Exscientia و Cloud و Insilico Medicine و Cyclica و NuMedii, Inc. و Envisagenics و Owkin Inc. و BERG LLC و Schrödinger, Inc. و XtalPi Inc. و BIOAGE Inc. من بين آخرين |

تعريف سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ

لقد لفت الذكاء الاصطناعي انتباه وعقول ممارسي التكنولوجيا الطبية في السنوات القليلة الماضية، حيث عملت العديد من الشركات ومختبرات الأبحاث الكبرى على إتقان هذه التقنيات للاستخدام السريري. تتوفر الآن أول عروض تجارية لكيفية مساعدة الذكاء الاصطناعي (المعروف أيضًا باسم التعلم العميق (DL) أو التعلم الآلي (ML) أو الشبكات العصبية الاصطناعية (ANNs)) للأطباء. يمكن أن تؤدي هذه الأنظمة إلى تحول نموذجي في سير عمل الأطباء، وزيادة الإنتاجية مع تعزيز العلاج وإنتاجية المريض في نفس الوقت. الذكاء الاصطناعي لاكتشاف الأدوية هو تقنية تستخدم الآلات لمحاكاة الذكاء البشري لحل التحديات المعقدة في إجراءات تطوير الأدوية. يؤدي تبني حلول الذكاء الاصطناعي في عملية التجارب السريرية إلى إزالة العقبات المحتملة، وتقليل وقت دورة التجارب السريرية، وزيادة إنتاجية ودقة عملية التجارب السريرية. لذلك، يكتسب تبني حلول الذكاء الاصطناعي المتقدمة هذه في عمليات اكتشاف الأدوية شعبية بين أصحاب المصلحة في صناعة العلوم الحيوية. في قطاع الأدوية، يساعد في اكتشاف المركبات الجديدة، وتحديد الأهداف العلاجية، وتطوير الأدوية المخصصة. يمكن أن تثبت منصات الذكاء الاصطناعي المستخدمة في اكتشاف الأدوية أنها خيار ممكن لاستخلاص رؤى حول اكتشاف الأدوية لعلاج وتقليل شدة الأمراض المزمنة المختلفة.

ديناميكيات سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- ارتفاع معدلات الإصابة بالأمراض المزمنة يدفع إلى الحاجة إلى الذكاء الاصطناعي في اكتشاف الأدوية

يتزايد معدل الإصابة بالأمراض المزمنة بوتيرة سريعة في جميع أنحاء العالم. ووفقًا لمراكز السيطرة على الأمراض والوقاية منها (CDC)، فإن ستة من كل 10 بالغين في الولايات المتحدة يعانون من مرض مزمن. وعلاوة على ذلك، تسلط مراكز السيطرة على الأمراض والوقاية منها الضوء أيضًا على أن الأمراض المزمنة مثل أمراض القلب والسكري هي الأسباب الرئيسية للوفاة في الولايات المتحدة. تسلط مثل هذه الإحصائيات الضوء على الانتشار المتزايد للأمراض المزمنة والحاجة إلى خفض معدل الوفيات الناجمة عن هذه الأمراض.

يمكن أن تثبت منصات الذكاء الاصطناعي المستخدمة في اكتشاف الأدوية أنها خيار مجدٍ لاستخلاص رؤى حول اكتشاف الأدوية لعلاج وتقليل شدة الأمراض المزمنة المختلفة. وبالتالي، من المتوقع أن تعمل هذه العوامل كمحرك لنمو السوق خلال فترة التنبؤ.

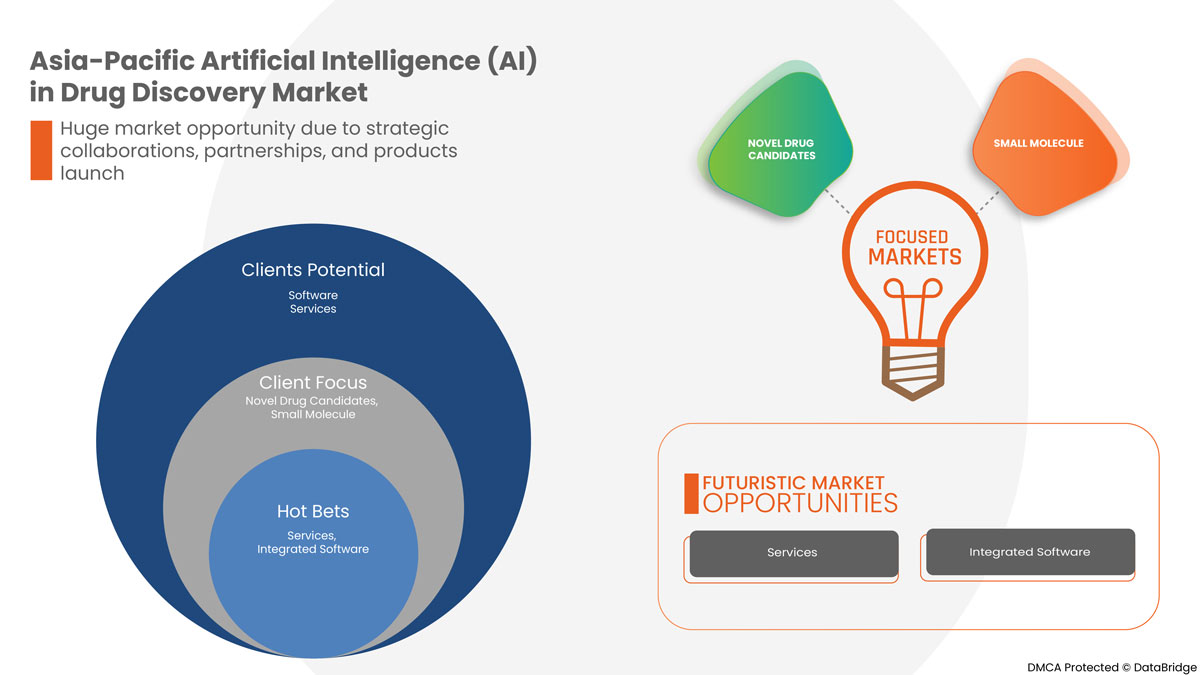

- التعاون الاستراتيجي والشراكات وإطلاق المنتجات

تتمتع الذكاء الاصطناعي بالقدرة على تحويل اكتشاف الأدوية من خلال تسريع الجدول الزمني للبحث والتطوير، مما يجعل تطوير الأدوية أرخص وأسرع، وتحسين احتمالات الموافقة. كما يمكن للذكاء الاصطناعي أن يزيد من فعالية أبحاث إعادة استخدام الأدوية.

إن زيادة التحالفات والتعاونات بين الصناعات المختلفة تدفع السوق إلى الأمام. ومن المتوقع أن يؤدي ارتفاع أهمية الذكاء الاصطناعي في اكتشاف الأدوية وتطويرها، وزيادة التمويل لأنشطة البحث والتطوير، بما في ذلك تكنولوجيا الذكاء الاصطناعي في مجال أبحاث الأدوية، إلى دفع نمو السوق العالمية. وبالتالي، فإن زيادة التعاونات والشراكات بين الصناعات المختلفة تدفع السوق إلى الأمام.

ضبط النفس

- التكلفة العالية المرتبطة بالتكنولوجيا والقيود التقنية

يواجه قطاع الرعاية الصحية الحالي العديد من التحديات المعقدة، مثل ارتفاع تكلفة الأدوية والعلاجات، ويحتاج المجتمع إلى تغييرات كبيرة محددة في هذا المجال. يعتمد نجاح الذكاء الاصطناعي بالكامل على توافر كمية كبيرة من البيانات لأن هذه البيانات تُستخدم للتدريب اللاحق المقدم للنظام. يمكن أن يتسبب الوصول إلى البيانات من مزودي قواعد البيانات المختلفة في تكاليف إضافية للشركة. تتجه التجارب السريرية نحو تحديد سلامة وفعالية منتج دوائي لدى البشر لحالة مرضية معينة وتتطلب من ست إلى سبع سنوات إلى جانب استثمار مالي كبير. ومع ذلك، فإن جزيءًا واحدًا فقط من كل عشرة يدخل هذه التجارب يحصل على الموافقة الناجحة، وهو خسارة فادحة للصناعة. يمكن أن تنتج هذه الإخفاقات عن اختيار غير مناسب للمريض ونقص المتطلبات الفنية والبنية التحتية الرديئة. وبالتالي، فإن زيادة التكاليف مع التكنولوجيا تعمل كقيد لنمو السوق.

فرصة

-

ارتفاع الاستثمارات في البحث والتطوير

إن الارتفاع في أنشطة البحث والتطوير والاعتماد المتزايد على الخدمات والتطبيقات المستندة إلى السحابة من شأنه أن يوفر فرصًا مفيدة لنمو السوق.

تستمر صناعة الذكاء الاصطناعي في مجال الأدوية الحيوية في النمو بعد فترة طويلة من الإنتان. وينعكس هذا في التدفق المستمر للاستثمارات وزيادة عدد التعاونات بين شركات الأدوية وشركات الذكاء الاصطناعي في عام 2021 مقارنة بالأعوام السابقة. يتأثر نمو صناعة الأدوية الحيوية إلى حد كبير بالمشاركة النشطة لشركات الأدوية الرائدة في الاستثمارات المتعلقة بالذكاء الاصطناعي. يتزايد عدد المنشورات العلمية في مجال الذكاء الاصطناعي في مجال الأدوية الحيوية والتعاون البحثي بين شركات الأدوية وبائعي الخبرة في مجال الذكاء الاصطناعي بسرعة، ومع ذلك، لا تزال بعض شركات الأدوية تنتقد تطبيقات الذكاء الاصطناعي. تؤدي تطبيقات التعلم الآلي والذكاء الاصطناعي في صناعات الأدوية والرعاية الصحية إلى تشكيل مجال جديد متعدد التخصصات لاكتشاف الأدوية القائم على البيانات في مجال الرعاية الصحية. وبالتالي، فإن ارتفاع الاستثمار في أنشطة البحث والتطوير يعمل كفرصة لنمو السوق.

تحدي

- نقص المهنيين المهرة

ومن المتوقع أن يعيق نقص المهنيين المهرة نمو السوق. إذ يتعين على الموظفين إعادة التدريب أو تعلم مجموعات مهارات جديدة للعمل بكفاءة على آلات الذكاء الاصطناعي المعقدة للحصول على النتائج المرجوة للدواء. ويشمل هذا التحدي الذي يمنع التبني الكامل للذكاء الاصطناعي في صناعة الأدوية الافتقار إلى الموظفين المهرة لتشغيل المنصات القائمة على الذكاء الاصطناعي، والميزانية المحدودة للمنظمات الصغيرة، والخوف من استبدال البشر مما يؤدي إلى فقدان الوظائف، والتشكك في البيانات التي يولدها الذكاء الاصطناعي، وظاهرة الصندوق الأسود (أي كيف يتم التوصل إلى الاستنتاجات من خلال منصة الذكاء الاصطناعي). ويعمل نقص المهارات كعائق رئيسي أمام اكتشاف الأدوية من خلال الذكاء الاصطناعي، مما يثبط عزيمة الشركات عن تبني الآلات القائمة على الذكاء الاصطناعي لاكتشاف الأدوية.

وبما أن متطلبات المهارات مرتفعة للغاية، فقد تجلى ذلك في شكل تحدٍ للاحتفاظ بالمهنيين ذوي المهارات المحددة وإدارتهم. وعلاوة على ذلك، فإن التقدم التكنولوجي هو جانب آخر يؤدي إلى زيادة الطلب على المهنيين المهرة. وهناك حاجة ملحة لتثقيف المهنيين على التكنولوجيا القائمة على الذكاء الاصطناعي. إن الافتقار إلى المهنيين المدربين وذوي الخبرة والفجوات المستمرة في المهارات تحد من آفاق التوظيف والوصول إلى وظائف ذات جودة. ومن الواضح إذن أن توافر المهنيين المجهزين بالمهارات الكافية يشكل تحديًا لنمو السوق.

تأثير ما بعد كوفيد-19 على سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ

كان لتفشي فيروس كورونا المستجد تأثير مفيد على توسع الذكاء الاصطناعي في صناعة اكتشاف الأدوية بسبب استخدامه على نطاق واسع من قبل العديد من المنظمات لتحديد وفحص الأدوية الموجودة المستخدمة في علاج فيروس كورونا المستجد. يعد الذكاء الاصطناعي مفيدًا في اكتشاف المواد الكيميائية النشطة للوقاية من فيروس سارس-كوف، وفيروس نقص المناعة البشرية، وفيروس سارس-كوف-2، وفيروس الأنفلونزا، وغيرها. خلال الوباء، اعتمدت الاقتصادات في جميع أنحاء العالم على اكتشاف الأدوية القائمة على الذكاء الاصطناعي بدلاً من عمليات اكتشاف اللقاحات التقليدية، والتي تستغرق سنوات لإنشائها وهي مكلفة بنفس القدر، مما يساهم في نمو السوق.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة لتحسين التكنولوجيا المستخدمة في الميكروفون اللاسلكي. وبهذا، ستجلب الشركات برامج الذكاء الاصطناعي المتقدمة والدقيقة إلى السوق.

التطورات الأخيرة

- في مارس 2022، أطلقت شركة NVIDIA Corporation برنامج Clara Holoscan MGX لتطوير ونشر تطبيقات الذكاء الاصطناعي في الوقت الفعلي. يعمل برنامج Clara Holoscan MGX على توسيع منصة Clara Holoscan لتوفير بنية مرجعية شاملة ومخصصة للأجهزة الطبية، بالإضافة إلى دعم البرامج على المدى الطويل، لتسريع الابتكار في صناعة الأجهزة الطبية. سيساعد هذا الشركة على تحسين أداء الذكاء الاصطناعي في قطاع الصحة للجراحة والتشخيص واكتشاف الأدوية.

- في مايو 2022، أعلنت شركة Benevolent AI، وهي شركة رائدة في مجال اكتشاف الأدوية المدعومة بالذكاء الاصطناعي في المرحلة السريرية، أن شركة أسترازينيكا قد اختارت هدفًا جديدًا إضافيًا للتليف الرئوي مجهول السبب (IPF) لمحفظة تطوير الأدوية الخاصة بها، مما أدى إلى دفع مبلغ مهم لشركة Benevolent AI. هذا هو الهدف الجديد الثالث من التعاون الذي تم تحديده باستخدام منصة Benevolent في منطقتين من الأمراض، التليف الرئوي مجهول السبب وأمراض الكلى المزمنة، وتم التحقق من صحته لاحقًا واختياره لدخول المحفظة من قبل شركة أسترازينيكا. ويستند هذا إلى التمديد الأخير للتعاون مع أسترازينيكا ليشمل منطقتين جديدتين من الأمراض، الذئبة الحمامية الجهازية، وقصور القلب، والذي تم توقيعه في يناير 2022. وقد ساعد هذا الشركة على جعل تعاونها أقوى.

نطاق سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ

يتم تقسيم سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ إلى التطبيق والتكنولوجيا ونوع الدواء والعرض والمؤشر والاستخدام النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

طلب

- مرشحو الأدوية الجديدة

- تحسين الأدوية وإعادة استخدامها والاختبارات والموافقات قبل السريرية

- مراقبة الأدوية

- العثور على أهداف ومسارات جديدة مرتبطة بالأمراض

- فهم آليات المرض

- تجميع المعلومات وتلخيصها

- تكوين وتأهيل الفرضيات

- تصميم جديد للأدوية

- العثور على أهداف دوائية لدواء قديم

- آحرون

Based on application, the market is segmented into novel drug candidates, drug optimization and repurposing preclinical testing and approval, drug monitoring, finding new diseases associated targets and pathways, understanding disease mechanisms, aggregating and synthesizing information, formation & qualification of hypotheses, de novo drug design, finding drug targets of an old drug, and others.

TECHNOLOGY

- Machine Learning (ML)

- Deep Learning (DL)

- Natural Language Processing (NLP)

- Others

Based on technology, the market is segmented into Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), and others.

DRUG TYPE

- Small Molecule

- Large Molecule

Based on drug type, the market is segmented into small molecule and large molecule.

OFFERING

- Software

- Services

Based on offering, the market is segmented into software and services.

INDICATION

- Immuno-Oncology

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Others

Based on indication, the market is segmented into immuno-oncology, neurodegenerative diseases, cardiovascular diseases, metabolic diseases, and others.

END USE

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Research Centres And Academic Institutes

- Others

Based on end use, the market is segmented into pharmaceutical & biotechnology companies, Contract Research Organizations (CROs), research centers and academic institutes, and others.

Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Regional Analysis/Insights

The Asia-Pacific Artificial Intelligence (AI) in drug discovery market is analyzed and market size information is provided by application, technology, drug type, offering, indication, and end use.

The countries covered in this market report are China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia & New Zealand, Philippines, Indonesia, rest of Asia-Pacific.

- In 2022, Asia-Pacific is the third most dominating region due to the higher demand for infectious diseases diagnostic kits due to increasing patient pool and rising awareness among people. China is expected to grow due to rise in technological advancements in AI for drug discovery.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Share Analysis

يوفر المشهد التنافسي لسوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والمالية، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونفسه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة على سوق الذكاء الاصطناعي في اكتشاف الأدوية في منطقة آسيا والمحيط الهادئ.

بعض اللاعبين الرئيسيين العاملين في السوق هم NVIDIA Corporation و IBM Corp. و Atomwise Inc. و Microsoft و Benevolent AI و Aria Pharmaceuticals، Inc. و DEEP GENOMICS و Exscientia و Cloud و Insilico Medicine و Cyclica و NuMedii، Inc. و Envisagenics و Owkin Inc. و BERG LLC و Schrödinger، Inc. و XtalPi Inc. و BIOAGE Inc. من بين آخرين.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORETSR’S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN INCIDENCE OF CHRONIC DISEASES PROPELS NEED FOR ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY

5.1.2 STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND PRODUCTS LAUNCH

5.1.3 REDUCTION IN TOTAL TIME INVOLVED IN DRUG DISCOVERY PROCESS

5.1.4 ADVANCEMENT OF ARTIFICIAL INTELLIGENCE IN THE HEALTHCARE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH TECHNOLOGY AND TECHNICAL LIMITATIONS

5.2.2 DISADVANTAGES AND RISKS ASSOCIATED WITH AI IN DRUG DISCOVERY

5.2.3 LACK OF AVAILABLE QUALITY DATA

5.3 OPPORTUNITIES

5.3.1 RISE IN THE INVESTMENTS FOR R&D

5.3.2 RISING HEALTHCARE INFRASTRUCTURE

5.3.3 DEVELOPMENT OF NOVEL TOOLS

5.4 CHALLENGES

5.4.1 THE ASIA PACIFIC SHORTAGE OF AI TALENT

5.4.2 ETHICAL, LEGAL, AND REGULATORY ISSUES FOR AI ADOPTION IN THE PHARMACEUTICAL SCIENCES

6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 INTEGRATED

6.2.2 STANDALONE

6.3 SERVICES

7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING (ML)

7.2.1 SUPERVISED LEARNING

7.2.2 UNSUPERVISED LEARNING

7.2.3 REINFORCEMENT LEARNING

7.3 DEEP LEARNING

7.4 NATURAL LANGUAGE PROCESSING (NLP)

7.5 OTHERS

8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY DRUG TYPE

8.1 OVERVIEW

8.2 SMALL MOLECULE

8.3 LARGE MOLECULE

9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NOVEL DRUG CANDIDATES

9.2.1 PREDICT BIOACTIVITY OF SMALL MOLECULE

9.2.2 IDENTIFY BIOLOGICS TARGET

9.2.3 OTHERS

9.3 DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL

9.4 DRUG MONITORING

9.5 AGGREGATING AND SYNTHESIZING INFORMATION

9.6 DE NOVO DRUG DESIGN

9.7 FINDING DRUG TARGETS OF AN OLD DRUG

9.8 FORMATION & QUALIFICATION OF HYPOTHESES

9.9 UNDERSTANDING DISEASE MECHANISMS

9.1 FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS

9.11 OTHERS

10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION

10.1 OVERVIEW

10.2 IMMUNE-ONCOLOGY

10.2.1 BREAST CANCER

10.2.2 LUNG CANCER

10.2.3 COLORECTAL CANCER

10.2.4 PROSTATE CANCER

10.2.5 PANCREATIC CANCER

10.2.6 BRAIN CANCER

10.2.7 LEUKEMIA

10.2.8 OTHERS

10.3 NEURODEGENERATIVE DISEASES

10.4 CARDIOVASCULAR DISEASES

10.5 METABOLIC DISEASES

10.6 OTHERS

11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY END USE

11.1 OVERVIEW

11.2 CONTRACT RESEARCH ORGANIZATIONS

11.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.4 RESEARCH CENTERS AND ACADEMIC INSTITUTES

11.5 OTHERS

12 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA & NEW ZEALAND

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NVIDIA CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MICROSOFT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 IBM CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SCHRÖDINGER, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BERG LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ARDIGEN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 EXSCIENTIA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 ARIA PHARMACEUTICALS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ATOMWISE INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BENEVOLENT AI

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 BIOAGE INC.,

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CLOUD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CYCLICA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEEP GENOMICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ENVISAGENICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INSILICO MEDICINE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NUMEDII, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 OWKIN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XTALPI INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DEEP LEARNING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC NATURAL LANGUAGE PROCESSING (NLP) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SMALL MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LARGE MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC DRUG MONITORING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AGGREGATING AND SYNTHESIZING INFORMATION IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DE NOVO DRUG DESIGN IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FINDING DRUG TARGETS OF AN OLD DRUG IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC FORMATION & QUALIFICATION OF HYPOTHESES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UNDERSTANDING DISEASE MECHANISMS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC NEURODEGENERATIVE DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC CARDIOVASCULAR DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC METABOLIC DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOB ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RESEARCH CENTRES AND ACADEMIC INSTITUTES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 CHINA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 52 CHINA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 CHINA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 JAPAN SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 JAPAN MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 JAPAN NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 67 JAPAN IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 68 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 INDIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 INDIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 INDIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 INDIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 88 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA & NEW ZEALAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE AARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 THAILAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 THAILAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 THAILAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 117 THAILAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 149 REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING NEED TO CURB DRUG DISCOVERY COSTS AND REDUCE TIME INVOLVED IN THE DRUG DEVELOPMENT PROCESS, THE RISING ADOPTION OF CLOUD-BASED APPLICATIONS AND SERVICES, AND THE IMPENDING PATENT EXPIRY OF BLOCKBUSTER DRUGS ARE EXPECTED TO DRIVE THE GROWTH OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

FIGURE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2021

FIGURE 15 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2021

FIGURE 19 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2021

FIGURE 23 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2021

FIGURE 27 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2021

FIGURE 31 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2021

FIGURE 35 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, CAGR (2022-2029)

FIGURE 37 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 40 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING (2022-2029)

FIGURE 43 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.