Us Lighting Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

| 2025 –2031 | |

| USD 2.62 Billion | |

| USD 3.35 Billion | |

|

|

|

>تجزئة سوق الإضاءة في الولايات المتحدة ، حسب نوع الإضاءة (المصابيح الكهربائية، ومصابيح السقف، والمصابيح، والتجهيزات)، والموقع (داخلي وخارجي)، والاتصال (سلكي ولاسلكي)، ونوع التثبيت (تثبيت جديد وتحديث)، وقناة التوزيع (غير متصل بالإنترنت وعبر الإنترنت)، والمستخدم النهائي (تجاري وسكني) - اتجاهات الصناعة والتوقعات حتى عام 2031.

تحليل سوق الإضاءة

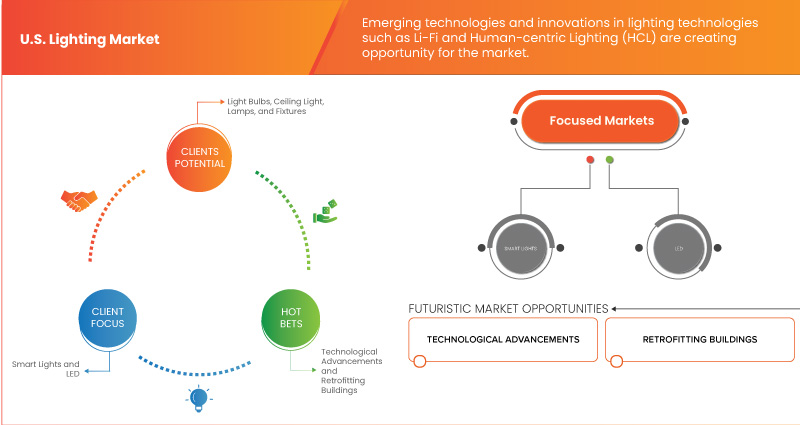

إن تفضيلات العملاء المتزايدة لحلول الإضاءة الموفرة للطاقة هي المحرك لنمو السوق. توفر الإضاءة الذكية وتكامل إنترنت الأشياء للمنازل الذكية والمباني التجارية فرصًا في السوق. علاوة على ذلك، فإن التوسع الحضري السريع وتطوير البنية التحتية يدفعان نمو السوق.

حجم سوق الإضاءة

تم تقييم حجم سوق الإضاءة في الولايات المتحدة بـ 2.62 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 3.35 مليار دولار أمريكي بحلول عام 2031، مع معدل نمو سنوي مركب بنسبة 3.7٪ خلال الفترة المتوقعة من 2025 إلى 2031. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا للخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي.

اتجاهات سوق الإضاءة

"اللوائح والسياسات الحكومية لتعزيز كفاءة الطاقة"

تلعب اللوائح والسياسات الحكومية التي تعزز كفاءة الطاقة دورًا محوريًا في دفع نمو سوق الإضاءة في الولايات المتحدة. تهدف هذه اللوائح إلى تقليل استهلاك الطاقة وخفض انبعاثات الغازات المسببة للانحباس الحراري وتعزيز الاستدامة في مختلف الصناعات، بما في ذلك القطاعات السكنية والتجارية والصناعية. ونتيجة لذلك، فإن الاتجاه نحو حلول الإضاءة الموفرة للطاقة، مثل تركيبات LED (الصمام الثنائي الباعث للضوء)، آخذ في الارتفاع، مما يؤثر بشكل كبير على ديناميكيات السوق.

إن أحد أكثر الأطر التنظيمية تأثيراً هو قانون استقلال الطاقة والأمن لعام 2007، والذي وضع الأساس للتخلص التدريجي من المصابيح المتوهجة غير الكفؤة وتشجيع البدائل الأكثر كفاءة في استخدام الطاقة. وقد وضع هذا التشريع معايير كفاءة دنيا للمصابيح الكهربائية، مما أدى إلى استبدال المصابيح المتوهجة التقليدية تدريجياً بمصابيح الفلورسنت المدمجة ومصابيح LED. وقد دفع قانون استقلال الطاقة والأمن إلى تبني تقنيات الإضاءة الموفرة للطاقة، وشجع المستهلكين والشركات على الاستثمار في حلول إضاءة أكثر كفاءة.

وبالإضافة إلى ذلك، تعمل برامج الحوافز على المستوى الفيدرالي والولائي، مثل الخصومات والإعفاءات الضريبية، على تعزيز تبني منتجات الإضاءة الموفرة للطاقة. وتعمل هذه الحوافز على خفض التكاليف الأولية لأنظمة الإضاءة LED، مما يجعلها في متناول مجموعة أوسع من المستهلكين والشركات. على سبيل المثال، تقدم مبادرة المباني الأفضل التابعة لوزارة الطاقة الأمريكية حوافز مالية للشركات لترقية أنظمة الإضاءة الخاصة بها إلى خيارات أكثر كفاءة في استخدام الطاقة. ولا تدعم هذه البرامج التحول إلى الإضاءة الموفرة للطاقة فحسب، بل تساهم أيضًا في خفض تكاليف الطاقة، وهو عامل مهم لكل من العملاء السكنيين والتجاريين.

على سبيل المثال،

- في عام 2020، وفقًا لمدونة نُشرت على موقع ANP Lighting, Inc.، عززت كاليفورنيا كفاءة الطاقة من خلال معايير كفاءة الطاقة في المباني بموجب العنوان 24. تطلب تحديث عام 2020 لهذه المعايير أن تلبي المباني السكنية والتجارية الجديدة متطلبات أكثر صرامة لكفاءة الطاقة، بما في ذلك استخدام أنظمة الإضاءة الموفرة للطاقة مثل مصابيح LED.

ومن ثم، فإن اللوائح والسياسات الحكومية التي تعزز كفاءة الطاقة تظهر اتجاهًا متزايدًا في سوق الإضاءة في الولايات المتحدة. ومن خلال تشجيع التحول إلى تقنيات إضاءة أكثر كفاءة، تعمل هذه اللوائح على تشكيل مشهد السوق وخلق فرص للابتكار والنمو في صناعة الإضاءة. ومع استمرار كفاءة الطاقة في كونها أولوية على المستويين الفيدرالي والولائي، فمن المتوقع أن يرتفع الطلب على حلول الإضاءة الموفرة للطاقة، مما يدعم توسع السوق في السنوات القادمة.

نطاق التقرير وتقسيم السوق

|

صفات |

رؤى أساسية حول سوق الإضاءة |

|

التجزئة |

|

|

الدول المغطاة |

نحن |

|

اللاعبون الرئيسيون في السوق |

Lutron Electronics Co., Inc (الولايات المتحدة)، Koncept Inc. (الولايات المتحدة)، Ottlite (الولايات المتحدة)، من بين شركات أخرى، Herman Miller, Inc. (الولايات المتحدة)، Inter IKEA Systems BV (هولندا)، Artemide SpA (إيطاليا)، Pablo Design (كاليفورنيا)، Flos SpA (إيطاليا)، Wipro Lighting (الهند)، Havells India Ltd. (الهند)، Signify Holding (هولندا)، ams-OSRAM AG (النمسا)، من بين شركات أخرى. |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lighting Market Definition

A lighting product refers to any device or system designed to produce light for various applications, including residential, commercial, industrial, and outdoor environments. These products range from traditional incandescent bulbs to modern energy-efficient solutions such as LEDs (Light Emitting Diodes) and CFLs (Compact Fluorescent Lamps). Lighting products can be standalone units like lamps and light fixtures or integrated systems that combines with smart technologies for enhanced control and automation. They serve multiple functions, including illumination, ambiance creation, and task specific lighting, playing a crucial role in safety, aesthetics, and energy efficiency.

Lighting Market Dynamics

Drivers

- Growing Consumer Preferences for Energy Efficient Lighting Solutions

The growing preference for energy-efficient lighting solutions is becoming a significant driver of the U.S. lighting market. With increasing awareness of environmental sustainability and the need to reduce energy consumption, both consumers and businesses are seeking lighting options that offers high efficiency while lowering energy costs. This factor is driving the adoption of advanced lighting technologies such as LED (light-emitting diode) fixtures, which are recognized for their superior energy efficiency compared to the traditional incandescent and fluorescent lighting.

One of the primary reasons for this shift in customer preferences is the long-term cost savings associated with energy-efficient lighting. LEDs, for instance, use up to 75% less energy than incandescent bulbs and lasts significantly longer, reducing the need for frequent replacements. As energy costs continue to rise and consumers become more conscious of their utility bills, the appeal of lighting solutions that offer substantial savings on energy consumption is increasing. This financial benefit is especially attractive to commercial and industrial sectors, where lighting is a major operational expense. Consequently, businesses are increasingly investing in energy-efficient lighting systems to reduce their overall operational costs.

In addition to cost savings, the environmental benefits of energy-efficient lighting are driving consumer preferences. The global push towards sustainability and reduction of carbon footprints have made energy efficiency a priority for many consumers and businesses alike. LEDs, which produce less heat and have lower carbon emissions, align with these environmental goals. As a result, government regulations and incentives promoting the use of energy-efficient products are further accelerating the adoption of these lighting solutions. Programs like ENERGY STAR certification in the U.S. provide consumers with reliable information on energy efficient products, making it easier for them to choose lighting solutions that meet environmental standards.

For instance,

- In October 2023, according to an article published by Energy News Network, Duke Energy, a major utility company in the U.S., offers rebates for businesses and homeowners who switch to energy efficient LED lighting. Programs like this encourage consumers to adopt LEDs by offsetting the initial costs, making energy-efficient solutions more affordable

Therefore, the growing customer preference for energy-efficient lighting solutions is a powerful driver of the U.S. lighting market. With benefits such as cost savings, environmental sustainability, and technological advancements, energy-efficient lighting is becoming the preferred choice for both consumers and businesses, driving market growth and shaping the future of the lighting industry. As awareness and adoption continue to rise, the demand for energy-efficient lighting solutions is expected to grow, further propelling the U.S. lighting market forward.

- Rapid Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are poised to be significant drivers of the U.S. lighting market in the coming years. As cities expand and populations increase, the demand for modern, efficient, and sustainable lighting solutions is growing exponentially. This trend is particularly pronounced in urban areas where the need for energy-efficient and aesthetically appealing lighting systems are becoming priority.

One of the key aspects of urbanization is the construction of new residential and commercial buildings. As more people move into cities, the need for housing and commercial spaces, such as offices, retail stores, and entertainment venues, increases. This surge in construction directly fuels the demand for lighting products. Modern buildings are increasingly designed with energy efficiency in mind, which includes the installation of advanced lighting systems. LED lighting, in particular, is seeing heightened demand due to its energy-saving capabilities, longer lifespan, and reduced maintenance costs.

As developers and homeowners seek to minimize energy consumption and lower long-term costs, the shift towards LED lighting is accelerating. Along with it, residential and commercial spaces, urbanization also drives the expansion and upgrading of public infrastructure. This includes roads, bridges, public transportation systems, parks, and recreational facilities, all of which requires adequate lighting. Public infrastructure projects are increasingly adopting energy-efficient lighting solutions to reduce energy consumption and lower operational costs. For instance, the shift from traditional street lighting to LED streetlights is a growing trend across many U.S. cities. LED streetlights not only provide better illumination and enhance safety but also significantly reduces

energy costs for municipalities. This shift is expected to contribute substantially to the growth of the U.S. lighting market.

For instance,

- According to an article published on United Nations website, urbanization is a growing global trend, with over half of the world's population now living in cities, a significant increase from previous decades. By 2050, it's estimated that two-thirds of the global population will reside in urban areas. In the U.S., this trend is reflected in the rapid growth of cities, mirroring global urban expansion. As urban populations continue to rise, sustainable management of this growth becomes essential to ensure cities can provide necessary infrastructure, housing, and services to support large populations effectively.

The rapid urbanization and infrastructure development in the U.S. are creating robust opportunities for the lighting market. The increasing construction of residential, commercial, and public infrastructure, combined with the adoption of energy-efficient and smart lighting solutions, is set to drive significant growth in the market. As cities continue to expand and modernize, the demand for advanced lighting products will only increase, supporting the overall growth of the U.S. lighting industry.

Opportunities

- Smart Lighting and IoT Integration for Smart Homes and Commercial Buildings

The integration of smart lighting and Internet of Things (IoT) technologies in smart homes and commercial buildings represents a significant growth opportunity for the U.S. lighting market. As the demand for connected and automated systems rises, smart lighting solutions are poised to become a cornerstone of modern infrastructure, offering enhanced functionality, energy efficiency, and user convenience. Homeowners are increasingly seeking to automate their living spaces, and smart lighting is a fundamental component of this trend. Smart lighting systems allow users to control lighting settings remotely through smartphones or voice-activated devices, such as Amazon Alexa or Google Assistant. This level of control extends beyond simple on-off functions; users can adjust brightness, color, and lighting schedules to suit their preferences and lifestyles. For instance,

homeowners can program lights to dim in the evening, simulate occupancy while away, or integrate lighting with other smart devices like thermostats and security systems. The appeal of these advanced features is driving adoption and creating a robust market for smart lighting products.

In addition to it, the commercial sector is experiencing a similar shift towards smart lighting and IoT integration. Businesses, office spaces, and industrial facilities are increasingly implementing smart lighting systems to enhance energy efficiency and reduce operational costs. Smart lighting in commercial settings can automatically adjust based on the occupancy, daylight levels, and time of day, leading to significant energy savings. For example, a smart office building can use sensors to detect when a room is unoccupied and dim or turn off the lights accordingly. This not only conserves energy but also contributes to sustainability goals, making smart lighting an attractive option for companies focused on reducing their carbon footprint. Moreover, the growing focus on smart cities and sustainable urban development presents further opportunities for smart lighting. Municipalities are investing in smart street lighting that integrates with IoT networks to optimize energy usage,

improve public safety, and enable data collection. These systems can automatically adjust brightness based on pedestrian or vehicular traffic, enhancing both efficiency and safety. As cities across the U.S. continues to prioritize smart infrastructure, the demand for smart lighting solutions is expected to rise significantly.

For instance,

- According to a blog published by my supplier, the ability to reduce energy costs is a major factor in smart lighting system. Companies can achieve up to 90% energy savings compared to the traditional lighting systems, leading to long-term financial benefits. Additionally, smart lighting enhances employee productivity through improved lighting conditions and offers better security features with automated and responsive lighting systems

The integration of smart lighting and IoT technologies in smart homes and commercial buildings presents a substantial growth opportunity for the U.S. lighting market. As consumers and businesses continue to embrace connected systems, the demand for innovative, energy-efficient, and customizable lighting solutions is set to increase, providing a strong opportunity for market expansion.

- Rise in Trend of Retrofitting in Existing Buildings with Energy-Efficient Lighting

The growing trend of retrofitting existing buildings with energy-efficient lighting solutions presents a significant opportunity for the U.S. lighting market. As energy efficiency becomes a critical priority for both residential and commercial property owners, the demand for lighting upgrades in older buildings is poised to drive substantial growth in the market. This trend not only opens new revenue streams for manufacturers and service providers but also aligns with broader sustainability goals, making it a key area of focus for the future of the lighting industry.

Many older buildings in the U.S. still rely on outdated lighting systems, such as incandescent or fluorescent bulbs, which are far less efficient as compared to modern LED technology. By retrofitting these buildings with energy efficient lighting, property owners can significantly reduce their energy consumption and utility bills. This economic incentive is compelling, especially in commercial sectors where lighting represents a substantial portion of operating costs. As more building owners recognize the long-term financial benefits of energy-efficient lighting, the demand for retrofitting projects is expected to increase, fueling market growth.

In addition to cost savings, the rise in environmental awareness and sustainability initiatives is another factor driving the retrofitting trend. Governments, corporations, and even individual homeowners are increasingly committed to reduce their carbon footprint, and energy-efficient lighting is a key component of these efforts. Programs like LEED (Leadership in Energy and Environmental Design) certification encourage the adoption of sustainable building practices, including the installation of energy-efficient lighting. This creates a strong incentive for building owners to invest in retrofitting projects, providing a steady stream of opportunities for lighting companies. Furthermore, regulatory pressures are accelerating the adoption of energy-efficient lighting retrofits. Various states and municipalities across the U.S. have implemented energy codes and standards that mandate the use of efficient lighting in both new constructions and renovations.

For instance,

- In June 2024, according to an article published on The Falcon Group website, New York City implemented Local Law 88, which required large commercial buildings to upgrade their lighting systems to energy-efficient standards. This law mandates that all non-residential spaces larger than 25,000 square feet must undergo lighting retrofits by 2025 to improve energy efficiency. As a result, many property owners and developers in the city began retrofitting their buildings with LED lighting and advanced control systems to comply with the regulation

Henceforth, the rise in the trend of retrofitting existing buildings with energy-efficient lighting presents a major growth opportunity for the U.S. lighting market. As building owners seek to reduce energy costs, comply with regulations, and meet sustainability goals, the demand for lighting retrofits will continue to rise.

Restraints/Challenges

- High Initial Cost of LED Lighting and Smart Lighting Systems

The high initial cost of LED and smart lighting systems is a significant restraint on the growth of the U.S. lighting market. Despite their long-term benefits, the upfront expense associated with these advanced technologies poses a substantial barrier for many consumers and businesses. The complexity and cost of manufacturing LEDs, along with the additional components required for smart lighting systems, make these products more expensive compared to traditional lighting solutions.

One of the primary factors contributing to the high cost of LED and smart lighting systems is the advanced technology embedded in these products. LEDs, while more efficient and durable than traditional incandescent and fluorescent bulbs, require complex manufacturing processes and expensive materials, such as semiconductor components. This results in a higher upfront cost compared to conventional lighting solutions. While LED prices have been decreasing over time, the initial investment remains a barrier for many consumers, particularly in price-sensitive segments.

Smart lighting systems, which include features like remote control, automation, and integration with smart home ecosystems, further exacerbate the cost issue. These systems often require additional components, such as sensors, controllers, and connectivity modules, which adds to the overall expense. Moreover, the complexity of installation and the need for professional setup in some cases can lead to additional costs, making smart lighting systems less accessible to the average consumer.

For Instance,

- In August 2023, according to an article on Teague Electric, the installation of smart lighting systems can be quite costly, with basic systems ranging from USD 200 to USD 500 per room and advanced systems costing between USD 500 and USD 2,000 per room. Whole-house systems, depending on the home's size and the number of rooms, can escalate between USD 3,000 to over USD 10,000. These high upfront costs for more sophisticated smart lighting systems, including features like voice control integration and color-changing lights, make them a significant investment, potentially limiting their adoption among budget-conscious consumers

Henceforth, while LED and smart lighting systems offer numerous benefits, the high initial cost remains a significant barrier to their widespread adoption in the U.S. lighting market. Overcoming this challenge will require continuous efforts to reduce costs, increase consumer awareness, and provide financial incentives that make these technologies more accessible to a broader range of consumers and businesses.

- High Competitive Market with Numerous Players

The U.S. lighting market is characterized by intense competition with numerous players competing for market share. This highly competitive landscape presents several significant challenges that can impede market growth and affect overall profitability. With a large number of companies operating in the market, including both established industry giants and emerging players, competition is fierce. This often leads to aggressive pricing strategies as companies attempt to differentiate themselves and capture market share.

Such pricing pressures can erode profit margins, making it difficult for the companies to maintain profitability while still investing in innovation and quality improvements. Additionally, the need to offer competitive pricing can lead to reduced margins, which can be particularly challenging for smaller firms that lack the scale to absorb these pressures. Furthermore, the crowded market makes it difficult for companies to stand out and establish a strong brand identity. With numerous players offering similar products, distinguishing oneself becomes a critical, yet challenging task. Companies must invest significantly in marketing and branding efforts to capture consumer attention and build brand loyalty. This often involves substantial expenditures on advertising, promotions, and customer engagement activities, which can strain financial resources and impact overall profitability.

Additionally, the competitive environment drives rapid product lifecycle changes, with companies frequently introducing new models and features to meet evolving consumer demands. This fast-paced environment requires companies to manage inventory and production schedules efficiently to avoid overstocking or stock outs. Balancing these logistics can be complex and costly, particularly for small players with limited resources. In summary, the highly competitive nature of the U.S. lighting market, with its numerous players, presents several challenges that can hinder market growth. Pricing pressures, branding difficulties, the need for constant innovation, logistical complexities, and heightened customer service expectations all contribute to a challenging environment for companies seeking to thrive and expand in this sector.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Lighting Market Scope

يتم تقسيم السوق إلى ستة قطاعات بارزة بناءً على نوع الإضاءة والموقع والاتصال ونوع التثبيت وقناة التوزيع والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع الإضاءة

- المصابيح الكهربائية

- ضوء السقف

- المصابيح

- المصابيح حسب النوع

- مصباح مكتبي

- مصباح أرضي

- المصابيح حسب النوع

- تركيبات

موقع

- داخلي

- في الهواء الطلق

الاتصال

- سلكي

- سلكي، حسب النوع

- مودبوس

- إيثرنت

- آحرون

- سلكي، حسب النوع

- لاسلكي

- لاسلكي حسب النوع

- واي فاي

- زيجبي

- خلوي

- آحرون

- لاسلكي حسب النوع

نوع التثبيت

- التثبيت الجديد

- التحديث

قناة التوزيع

- غير متصل

- غير متصل، حسب النوع

- متجر بيع بالتجزئة

- استوديو المصممين

- آحرون

- غير متصل، حسب النوع

- متصل

- عبر الإنترنت، حسب النوع

- التجارة الإلكترونية

- موقع الشركة

- عبر الإنترنت، حسب النوع

المستخدم النهائي

- تجاري

- تجاري حسب النوع

- المكاتب

- بيع بالتجزئة

- ضيافة

- الفنادق/المطاعم

- المستشفيات

- المؤسسات

- آحرون

- تجاري، حسب نوع الإضاءة

- المصابيح الكهربائية

- ضوء السقف

- المصابيح

- المصابيح حسب النوع

- مصباح مكتبي

- مصباح أرضي

- المصابيح حسب النوع

- تركيبات

- تجاري حسب النوع

- سكني

- سكني حسب النوع

- منازل فردية

- شقق سكنية

- المساكن

- آحرون

- سكني، حسب نوع الإضاءة

- المصابيح الكهربائية

- ضوء السقف

- المصابيح

- المصابيح حسب النوع

- مصباح مكتبي

- مصباح أرضي

- تركيبات

- سكني حسب النوع

حصة سوق الإضاءة في الولايات المتحدة

يوفر المشهد التنافسي للسوق تفاصيل حسب المنافسين. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الدولة، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بالسوق.

الشركات الرائدة في سوق الإضاءة في الولايات المتحدة والتي تعمل في السوق هي:

- شركة لوترون للإلكترونيات (الولايات المتحدة)

- شركة كونسيبت (الولايات المتحدة)

- أوتليت (الولايات المتحدة)

- شركة هيرمان ميلر (الولايات المتحدة)

- شركة إنتر إيكيا سيستمز بي في (هولندا)

- أرتيميد سبا (إيطاليا)

- بابلو ديزاين (كاليفورنيا)

- فلوس سبا (إيطاليا)

- ويبرو للإضاءة (الهند)

- شركة هافيلز الهندية المحدودة (الهند)

- سيجنفاي القابضة (هولندا)

- شركة ams-OSRAM AG (النمسا)

أحدث التطورات في سوق الإضاءة

- في مايو 2024، قدمت شركة Lutron Electronics Co., Inc. منتجات جديدة في مجال الإضاءة الفاخرة، والتي أطلق عليها اسم Ketra D2 وRania D2 للإضاءة المعمارية. وقد أدى هذا إلى تعزيز مجموعة منتجات الشركة للإضاءة

- في أغسطس 2023، أعلنت شركة Lutron Electronics Co., Inc. عن إصدار تطبيق Luxury Experience الجديد، المتاح على App Store. من المقرر أن يعمل تطبيق iPad المبتكر هذا على تحويل كيفية تفاعل المستخدمين مع مجموعة Lutron، مما يوفر تجربة رقمية استثنائية لحلول السكن الفاخرة

- في سبتمبر 2023، كشفت شركة Lutron Electronics Co., Inc. عن حل الضيافة من Lutron، والذي يتضمن نظام غرف الضيوف المتطور myRoom XC. يتيح هذا الحل المتصل بالسحابة إدارة سلسة لجميع مناطق الممتلكات - غرف الضيوف والأماكن العامة وأماكن الفعاليات والمنازل الخاصة - من خلال لوحة تحكم موحدة

- في نوفمبر 2022، دخلت شركة Wipro Lighting في شراكة مع شركة Aura Air، للتركيز على تزويد الشركات بحلول للهواء الداخلي النظيف. يدمج هذا التعاون تقنيات تنقية الهواء المتقدمة مع حلول الإضاءة من Wipro لتحسين جودة الهواء الداخلي في أماكن العمل. الهدف هو خلق بيئات أكثر صحة من خلال توفير الإضاءة الفعالة والهواء النظيف

- في أبريل 2023، تم إدراج مصباح TO Pendant من Pablo Designs في القائمة المختصرة لأفضل إضاءة لهذا العام. احتفالاً بأهمية الضوء، يتميز بعصا أنيقة معلقة بأحزمة من النايلون المنسوج مع دوران 360 درجة لإضاءة متعددة الاستخدامات. يتحول بسهولة من ضوء المهمة المباشر إلى الإضاءة المحيطة ويدعم تكوينات مختلفة، بما في ذلك الإعدادات الخطية ومتعددة المحاور ومتعددة المستويات، وهي مناسبة لكل من البيئات السكنية وأماكن العمل

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKET TRENDS

4.1.1 BUYER’S TRENDS

4.1.1.1 SHIFT TOWARDS LED LIGHTING

4.1.1.2 ENERGY EFFICIENCY AND SUSTAINABILITY

4.1.1.3 SMART LIGHTING AND IOT INTEGRATION

4.1.1.4 CUSTOMIZATION AND DESIGN TRENDS

4.1.1.5 HEALTH AND WELLNESS LIGHTING

4.1.1.6 INCREASED ONLINE PURCHASES

4.1.1.7 RETROFIT AND NEW INSTALLATION PREFERENCES

4.1.1.8 PRICE SENSITIVITY AND VALUE PERCEPTION

4.1.1.9 COMMERCIAL SECTOR DEMAND

4.1.2 MANUFACTURING TRENDS

4.1.2.1 TECHNOLOGICAL ADVANCEMENTS

4.1.2.2 SUSTAINABILITY AND ECO-FRIENDLY PRODUCTS

4.1.2.3 DESIGN AND CUSTOMIZATION

4.1.2.4 MARKET CONSOLIDATION

4.1.2.5 GROWTH IN SMART LIGHTING

4.1.2.6 REGULATORY COMPLIANCE

4.1.2.7 EMERGING MARKETS AND APPLICATIONS

4.1.2.8 SUPPLY CHAIN AND LOGISTICS

4.1.2.9 INNOVATION IN LIGHTING CONTROLS

4.1.3 RAW MATERIAL/CONSUMABLE SUPPLIER TRENDS

4.1.3.1 HIGH-QUALITY LED COMPONENTS

4.1.3.2 SOURCING OF SUSTAINABLE MATERIALS

4.1.3.3 SUPPLY CHAIN DIVERSIFICATION

4.1.3.4 ADVANCEMENTS IN PHOSPHOR AND COATING MATERIALS

4.1.3.5 FOCUS ON DURABILITY AND LONGEVITY

4.1.3.6 INNOVATIONS IN OPTICS AND LENSES

4.1.3.7 SUPPLY OF SMART LIGHTING COMPONENTS

4.1.3.8 COLLABORATIONS AND PARTNERSHIPS

4.1.4 REGULATORY FRAMEWORK AND GUIDELINES

4.1.5 TECHNOLOGICAL TRENDS

4.1.5.1 SMART LIGHTING INTEGRATION

4.1.5.2 SUSTAINABLE AND ENERGY-EFFICIENT DESIGNS

4.1.5.3 HUMAN-CENTRIC LIGHTING (HCL)

4.1.5.4 AESTHETIC INNOVATIONS

4.1.5.5 ADVANCED MATERIALS AND FINISHES

4.2 BRAND SHARE MATRIX

4.3 COMPETITIVE INTELLIGENCE

4.3.1 MAJOR PLAYERS

4.4 COMPETITOR KEY PRICING STRATEGIES

4.4.1 COST-PLUS PRICING

4.4.2 COMPETITIVE PRICING

4.4.3 VALUE-BASED PRICING

4.4.4 PENETRATION PRICING

4.4.5 DYNAMIC PRICING

4.4.6 PREMIUM PRICING

4.4.7 BUNDLE PRICING

4.4.8 SEASONAL PRICING

4.5 INDUSTRY INSIGHTS

4.5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.5.1.1 CURRENT MARKET LANDSCAPE

4.5.1.2 TECHNOLOGY TRENDS

4.5.1.3 REGULATORY ENVIRONMENT

4.5.1.4 COMPETITIVE LANDSCAPE

4.5.1.5 FUTURE OUTLOOK

4.5.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.5.2.1 SEGMENTAL PENETRATION

4.5.2.2 GROWTH PROSPECTS

4.5.2.3 MARKET CHALLENGES AND OPPORTUNITIES

4.6 MARKET OUTLOOK AND IMPLICATIONS

4.6.1 MARKET OUTLOOK

4.6.2 IMPLICATIONS FOR THE U.S. LIGHTING MARKET

4.7 TECHNOLOGY ANALYSIS

4.7.1 LED DOMINANCE AND INNOVATIONS

4.7.2 OLED TECHNOLOGY

4.7.3 HUMAN-CENTRIC LIGHTING (HCL)

4.7.4 ENERGY EFFICIENCY AND SUSTAINABILITY

4.8 TOP RETAILERS AND BRANDS

4.9 TOP USE CASES AND CUSTOMER FEEDBACK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CUSTOMER PREFERENCES FOR ENERGY EFFICIENT LIGHTING SOLUTIONS

5.1.2 GOVERNMENT REGULATIONS AND POLICIES PROMOTING ENERGY EFFICIENCY

5.1.3 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COST OF LED LIGHTING AND SMART LIGHTING SYSTEMS

5.2.2 MARKET SATURATION OF LED LIGHTING IN RESIDENTIAL SECTOR IN THE U.S.

5.3 OPPORTUNITIES

5.3.1 SMART LIGHTING AND IOT INTEGRATION FOR SMART HOMES AND COMMERCIAL BUILDINGS

5.3.2 RISE IN TREND OF RETROFITTING EXISTING BUILDINGS WITH ENERGY-EFFICIENT LIGHTING

5.3.3 EMERGING TECHNOLOGIES AND INNOVATIONS IN LIGHTING TECHNOLOGIES SUCH AS LI-FI AND HUMAN-CENTRIC LIGHTING (HCL)

5.4 CHALLENGES

5.4.1 HIGHLY COMPETITIVE MARKET WITH NUMEROUS PLAYERS

5.4.2 SUPPLY CHAIN CHALLENGES AND MATERIAL COSTS RELATED TO LIGHTENING COMPONENTS

6 U.S. LIGHTING MARKET, BY LIGHTING TYPE

6.1 OVERVIEW

6.2 LIGHT BULBS

6.3 CEILING LIGHT

6.4 LAMPS

6.5 FIXTURES

7 U.S. LIGHTING MARKET, BY LOCATION

7.1 OVERVIEW

7.2 INDOOR

7.3 OUTDOOR

8 U.S. LIGHTING MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

9 U.S. LIGHTING MARKET, BY INSTALLATION TYPE

9.1 OVERVIEW

9.2 NEW INSTALLATION

9.3 RETROFIT

10 U.S. LIGHTING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 U.S. LIGHTING MARKET, BY END-USER

11.1 OVERVIEW

11.2 COMMERCIAL

11.3 RESIDENTIAL

12 U.S. LIGHTING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 SIGNIFY HOLDING

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 AMS-OSRAM AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 LUTRON ELECTRONICS CO., INC

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 HERMAN MILLER INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 INTER IKEA SYSTEMS B.V.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 ARTEMIDE S.P.A.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 FLOS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 HAVELLS INDIA LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 KONCEPT INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 OTTLITE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 PABLO DESIGN

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 WIPRO LIGHTING

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 COMPETITIVE INTELLIGENCE

TABLE 3 U.S. LIGHTING MARKET, BY LIGHTING TYPE, 2023-2031 (USD THOUSAND)

TABLE 4 U.S. LIGHTING MARKET, BY LIGHTING TYPE, 2023-2031 (THOUSAND UNITS)

TABLE 5 U.S. LAMPS IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 6 U.S. LIGHTING MARKET, BY LOCATION, 2023-2031 (USD THOUSAND)

TABLE 7 U.S. LIGHTING MARKET, BY LOCATION, 2023-2031 (THOUSAND UNITS)

TABLE 8 U.S. LIGHTING MARKET, BY CONNECTIVITY, 2023-2031 (USD THOUSAND)

TABLE 9 U.S. LIGHTING MARKET, BY CONNECTIVITY, 2023-2031 (THOUSAND UNITS)

TABLE 10 U.S. WIRED IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 11 U.S. WIRELESS IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 12 U.S. LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2031 (USD THOUSAND)

TABLE 13 U.S. LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2031 (THOUSAND UNITS)

TABLE 14 U.S. LIGHTING MARKET, BY DISTRIBUTION CHANNEL, 2023-2031 (USD THOUSAND)

TABLE 15 U.S. LIGHTING MARKET, BY DISTRIBUTION CHANNEL, 2023-2031 (THOUSAND UNITS)

TABLE 16 U.S. OFFLINE IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 17 U.S. ONLINE IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 18 U.S. LIGHTING MARKET, BY END-USER, 2023-2031 (USD THOUSAND)

TABLE 19 U.S. LIGHTING MARKET, BY END-USER, 2023-2031 (THOUSAND UNITS)

TABLE 20 U.S. COMMERCIAL IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 21 U.S. COMMERCIAL IN LIGHTING MARKET, BY LIGHTING TYPE, 2023-2031 (USD THOUSAND)

TABLE 22 U.S. LAMPS IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 23 U.S. RESIDENTIAL IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

TABLE 24 U.S. RESIDENTIAL IN LIGHTING MARKET, BY LIGHTING TYPE, 2023-2031 (USD THOUSAND)

TABLE 25 U.S. LAMPS IN LIGHTING MARKET, BY TYPE, 2023-2031 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. LIGHTING MARKET: SEGMENTATION

FIGURE 2 U.S. LIGHTING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. LIGHTING MARKET: DROC ANALYSIS

FIGURE 4 U.S. LIGHTING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. LIGHTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. LIGHTING MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. LIGHTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. LIGHTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. LIGHTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. LIGHTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 U.S. LIGHTING MARKET: SEGMENTATION

FIGURE 12 FOUR SEGMENTS COMPRISE THE U.S. LIGHTING MARKET, BY LIGHTING TYPE

FIGURE 13 U.S. LIGHTING MARKET: EXECUTIVE SUMMARY

FIGURE 14 U.S. LIGHTING MARKET: STRATEGIC DECISIONS

FIGURE 15 GROWING CUSTOMER PREFERENCES FOR ENERGY-EFFICIENT LIGHTING SOLUTIONS ARE EXPECTED TO DRIVE THE U.S. LIGHTING MARKET IN THE FORECAST PERIOD

FIGURE 16 THE LIGHT BULBS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. LIGHTING MARKET IN 2025 AND 2031

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S. LIGHTING MARKET

FIGURE 18 U.S. LIGHTING MARKET: BY LIGHTING TYPE, 2024

FIGURE 19 U.S. LIGHTING MARKET: BY LOCATION, 2024

FIGURE 20 U.S. LIGHTING MARKET: BY CONNECTIVITY, 2024

FIGURE 21 U.S. LIGHTING MARKET: BY INSTALLATION TYPE, 2024

FIGURE 22 U.S. LIGHTING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 23 U.S. LIGHTING MARKET, BY END-USER, 2024

FIGURE 24 U.S. LIGHTING MARKET: COMPANY SHARE 2024 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.