لقد زاد الطلب على عصائر الفاكهة مثل البرتقال والتفاح والمانجو والفواكه المختلطة وغيرها بسبب مجموعة واسعة من الفوائد الصحية. مع تزايد الطلب على عصائر الفاكهة، من المتوقع أيضًا أن يكون هناك طلب متسارع على مكثفات الطعام، مما يؤدي إلى نمو السوق. علاوة على ذلك، يقدم المصنعون مجموعة واسعة من النكهات وينتجون عصائر فواكه خالية من المواد الحافظة والسكر لتوسيع قاعدة المستهلكين، مما يعزز الطلب الإجمالي على عصائر الفاكهة في جميع أنحاء العالم. ولذلك، من المتوقع أن ينمو سوق مكثفات الأغذية العالمية بسرعة في الإطار الزمني المتوقع.

الوصول إلى التقرير الكامل @ https://www.databridgemarketresearch.com/reports/global-food-thickeners-market

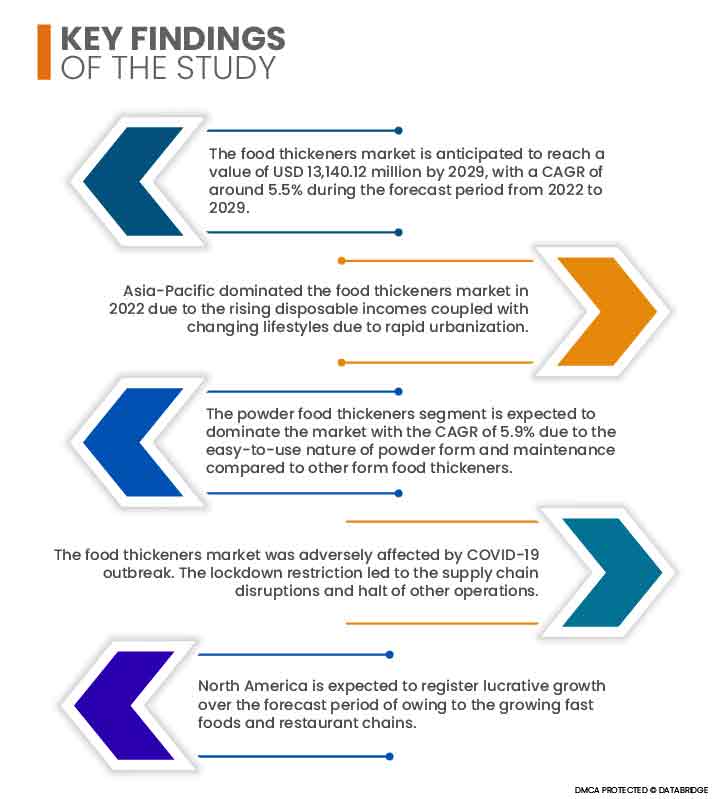

أبحاث سوق جسر البيانات التحليلات التي سوق مكثفات الغذاء من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 5.5٪ في الفترة المتوقعة من 2021 إلى 2029 ومن المتوقع أن يصل إلى 13,140.12 مليون دولار أمريكي بحلول عام 2029. ويؤثر دخل الفرد بشكل مباشر على زيادة الإنفاق على منتجات الصحة والعافية من الأطعمة والمشروبات. وهذا بدوره يعزز الطلب على مكثفات الطعام. ومن ثم، من المتوقع أن تكون الزيادة في دخل الفرد في جميع أنحاء العالم عاملاً دافعاً لنمو سوق مكثفات الأغذية العالمية.

من المتوقع أن تؤدي زيادة الاستخدام عبر التطبيقات الغذائية إلى زيادة معدل نمو السوق

مكثفات الطعام هي في الأساس عوامل تعديل الطعام التي تستخدم لتعديل بنية الملمس وزيادة سمك الأطعمة والمشروبات، مما يساعد على امتصاص محتوى الماء في الأطعمة بمجرد دمجها في المنتجات. يتم استخدام هذه المنتجات بشكل رئيسي لتعديل لزوجة هذه المنتجات، مما يمنحها هيكلًا عامًا متسقًا. مكثفات الطعام الأكثر استخدامًا في السوق هي النشويات، تليها الغرويات المائية والبروتينات. تُستخدم مكثفات الطعام في التطبيقات الغذائية مثل منتجات المخابز ومنتجات الحلويات والصلصات والضمادات والمخللات والمرق والمشروبات ومنتجات الألبان والحلويات المجمدة والأطعمة المصنعة. ولذلك، من المتوقع أن يؤدي الاستخدام العالي لمكثفات الأغذية عبر تطبيقات الأغذية والمشروبات إلى تعزيز نمو السوق.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2022 إلى 2029

|

|

سنة الأساس

|

2021

|

|

سنوات تاريخية

|

2020 (قابل للتخصيص حتى 2014 - 2019)

|

|

الوحدات الكمية

|

الإيرادات بمليون دولار أمريكي، الأحجام بالوحدات، التسعير بالدولار الأمريكي

|

|

القطاعات المغطاة

|

حسب النوع (غروانيات مائية، بروتين، نشاء، بكتين وغيرها)، الشكل (مسحوق، حبيبات، جل، أخرى)، الطبيعة (غير معدلة وراثيًا، كائنات معدلة وراثيًا)، المصدر (نباتي، حيواني، بحري، ميكروبي)، التطبيق (الأغذية والمشروبات )

|

|

البلدان المشمولة

|

الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا، تايلاند، إندونيسيا، الفلبين، بقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)، المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA) والبرازيل والأرجنتين وبقية أمريكا الجنوبية كجزء من أمريكا الجنوبية.

|

|

تغطية لاعبي السوق

|

Ingredion (الولايات المتحدة)، Cargill, Incorporated (الولايات المتحدة)، CP Kelco US, Inc. (الولايات المتحدة)، Tate & Lyle PLC (المملكة المتحدة)، DuPont (الولايات المتحدة)، J&K المكونات، Inc. (الولايات المتحدة)، Fiberstar (الولايات المتحدة)، Sunbloom Proteins GmbH (ألمانيا)، فيسمر ليسيثين (ألمانيا)، All American Foods (الولايات المتحدة)، Bob's Red Mill Natural Foods (الولايات المتحدة)، Cargill Incorporated (الولايات المتحدة)، Puratos (الولايات المتحدة)، Arla Foods amba (الدنمارك)، ADM (الولايات المتحدة) وGlanbia Plc (أيرلندا)، وKerry Group (أيرلندا)، وFlorida Food Products (الولايات المتحدة)، وCorbion (هولندا)، ومجموعة Emsland (ألمانيا)، وAshland (الولايات المتحدة)، وADM (الولايات المتحدة)، وJungbunzlauer Suisse AG (الولايات المتحدة)، وSolvay ( بلجيكا).

|

|

نقاط البيانات المشمولة في التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وقطاعات السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، يتضمن تقرير السوق الذي أعده فريق أبحاث السوق Data Bridge تحليلاً متعمقًا للخبراء وتحليل الاستيراد / التصدير، تحليل التسعير، تحليل استهلاك الإنتاج، تحليل براءات الاختراع وسلوك المستهلك.

|

تحليل القطاع:

يتم تقسيم سوق مكثفات الطعام على أساس نوع المنتج ونوع الجرح وفئة الجرح والمستخدم النهائي وقناة التوزيع.

- على أساس النوع، يتم تقسيم سوق مكثفات الأغذية العالمية إلى البروتين والنشا والغرويات المائية والبكتين وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع مكثفات المواد الغذائية الغروانية المائية على السوق بمعدل نمو سنوي مركب يبلغ 5.0٪ في الفترة المتوقعة من 2022 إلى 2029. ويعزى النمو المرتفع لهذا القطاع إلى استخدامه المتزايد في منتجات الحلويات، بما في ذلك المربى والهلام والحلويات. مربى البرتقال، والعلكة، والمواد الهلامية منخفضة السكر/السعرات الحرارية.

- على أساس الشكل، يتم تقسيم سوق مكثفات الأغذية العالمية إلى هلام ومسحوق وحبيبات وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع مكثفات الأغذية المجففة على السوق بمعدل نمو سنوي مركب يبلغ 5.9٪ في الفترة المتوقعة من 2022 إلى 2029. ويُعزى النمو المرتفع لهذا القطاع إلى طبيعة الاستخدام السهل لشكل المسحوق والصيانة. مقارنة بمكثفات الطعام ذات الأشكال الأخرى.

- على أساس الطبيعة، يتم تقسيم سوق مكثفات الأغذية العالمية إلى كائنات معدلة وراثيًا وغير معدلة وراثيًا. في عام 2022، من المتوقع أن يهيمن قطاع مكثفات الأغذية غير المعدلة وراثيًا على السوق بمعدل نمو سنوي مركب يبلغ 5.5%.

من المتوقع أن يهيمن قطاع مكثفات الأغذية غير المعدلة وراثيًا على السوق بمعدل نمو سنوي مركب يبلغ 5.5%

في عام 2022، من المتوقع أن يهيمن قطاع مكثفات الأغذية غير المعدلة وراثيًا على السوق بمعدل نمو سنوي مركب يبلغ 5.5٪ في الفترة المتوقعة من 2022 إلى 2029. ويعزى النمو المرتفع لهذا القطاع إلى الطلب المتزايد على الأطعمة العضوية المزروعة بشكل طبيعي تعد الأطعمة غير المعدلة وراثيًا المزروعة عضويًا أكثر ثراءً بالعناصر الغذائية مثل أحماض أوميجا الدهنية والعديد من الفيتامينات والمعادن الحيوية. الأطعمة غير المعدلة وراثيًا خالية من المواد الكيميائية والمواد الحافظة والسموم التي يمكن أن تهدد حياة الجسم على المدى الطويل.

- على أساس المصدر، يتم تقسيم سوق مكثفات الأغذية العالمية إلى نباتية وحيوانية وبحرية وميكروبية. في عام 2022، من المتوقع أن يهيمن قطاع مكثفات الأغذية النباتية على السوق بمعدل نمو سنوي مركب يبلغ 5.8%.

من المتوقع أن يهيمن قطاع مكثفات الأغذية النباتية على السوق بمعدل نمو سنوي مركب يبلغ 5.8%

في عام 2022، من المتوقع أن يهيمن قطاع مكثفات الأغذية النباتية على السوق بمعدل نمو سنوي مركب يبلغ 5.8% في الفترة المتوقعة من 2022 إلى 2029. ويعزى النمو المرتفع لهذا القطاع إلى تزايد شعبية مكثفات الأغذية النباتية مثل كالنشاء المستخرج من حبوب الذرة، أو القمح، أو الأرز، والخضروات الجذرية مثل البطاطس، والكسافا، والأروروت.

- على أساس التطبيق، يتم تقسيم سوق مكثفات الأغذية العالمية إلى المواد الغذائية والمشروبات. في عام 2022، من المتوقع أن يهيمن قطاع الأغذية على السوق بمعدل نمو سنوي مركب يبلغ 5.7٪ في الفترة المتوقعة من 2022 إلى 2029. ويعزى النمو المرتفع لهذا القطاع إلى زيادة الفوائد المرتبطة بالمنتج الذي يقدم أكثر من مجرد زيادة سمكه. قدرات.

اللاعبين الرئيسيين

تعترف Data Bridge Market Research بالشركات التالية باعتبارها اللاعبين الرئيسيين في سوق مكثفات الأغذية في سوق مكثفات الأغذية وهي Ingredion (الولايات المتحدة)، وCargill, Incorporated (الولايات المتحدة)، وCP Kelco US, Inc. (الولايات المتحدة)، وTate & Lyle PLC (المملكة المتحدة)، DuPont (الولايات المتحدة)، J&K إنغرينتس (الولايات المتحدة)، Fiberstar (الولايات المتحدة)، Sunbloom Proteins GmbH (ألمانيا)، Fismer Lecithin (ألمانيا)، All American Foods (الولايات المتحدة)، Bob's Red Mill Natural Foods (الولايات المتحدة)، Cargill Incorporated. (الولايات المتحدة)، وPuratos (الولايات المتحدة)، وArla Foods amba (الدنمارك)، وADM (الولايات المتحدة)، وGlanbia Plc (أيرلندا)، وKerry Group (أيرلندا)، وFlorida Food Products (الولايات المتحدة)، وCorbion (هولندا)، ومجموعة Emsland Group (ألمانيا). ، أشلاند (الولايات المتحدة)، ADM (الولايات المتحدة)، Jungbunzlauer Suisse AG (الولايات المتحدة) وسولفاي (بلجيكا).

تطوير السوق

- في فبراير 2021، استحوذت شركة Grupo Bimbo على شركة Modern Foods. تم الاستحواذ عليها من صندوق الأسهم الخاصة المحلي Everstone Capital التابع لشركة Grupo Bimbo. بالإضافة إلى ذلك، استحوذت Everstone على العلامة التجارية من شركة Hindustan Unilever في عام 2016. تتكون منصة الخبز والمخابز الخاصة بشركة Everstone Everfoods Asia من العلامة التجارية Modern Bread وغيرها مثل Cookie Man.

- في مايو 2021، استحوذت شركة Mondelez International (MDLZ) على شركة Chipita SA مقابل ما يقرب من 2 مليار دولار أمريكي. تشيبيتا هي شركة وجبات خفيفة يونانية تنتج وتسوق الوجبات الخفيفة المالحة والحلوة. تشتمل محفظة Chipita من العلامات التجارية للكرواسون والوجبات الخفيفة المخبوزة على 7Days وChipicao وFineti. يعد الاستحواذ خطوة مهمة إلى الأمام في الخطة الإستراتيجية للشركة، والتي تركز على تسريع النمو في مجالات الوجبات الخفيفة الأساسية مع توسيع نطاق وجودها في الأسواق الرئيسية.

- في سبتمبر 2021، قامت مجموعة Finsbury Food Group بتوسيع مجموعة كعكة سوبر ماركت Mary Berry الخاصة بها مع إطلاق كعك Bundt. تأتي كعكات البوندت بنكهتين – الليمون والشوكولاتة. المنتجات هي كعكة الليمون الإسفنجية، ومثلج الليمون، ورذاذ خثارة الليمون، وتجعيد الشوكولاتة البيضاء البلجيكية المزينة يدويًا. وكعكة الشوكولاتة الإسفنجية، تتميز بطبقة من الشوكولاتة ومزينة يدويًا بالشوكولاتة البلجيكية الداكنة والبيضاء.

- في عام 2021، أطلقت شركة PepsiCo عصيرًا مائيًا يسمى Frutyl، وهو مزيج من عصير الفاكهة والماء والكهارل، مما يساعد في الحفاظ على رطوبة المستهلك. لتوفير ترطيب لذيذ ومصدر جيد للفيتامينات C وE، يتم تصنيع Frutly من الماء وعصير الفاكهة والكهارل لتحسين المذاق. يستهدف عصير الفاكهة هذا شريحة المراهقين، الذين سيكونون المستهلكين الأساسيين لعصائر الفاكهة. عصائر الفاكهة هذه متوفرة بثلاث نكهات ومعبأة في زجاجات سعة 35 أونصة تحتوي على صفر سكر و60 سعرة حرارية.

- في عام 2020، أطلقت شركة Coca-Cola India منتجين مختلفين تحت علامتها التجارية Minute Made لتقديم تغذية الفاكهة المبهجة من المزرعة إلى المائدة. يتم تصنيع Vita Punch وNutri Force من عصير الفاكهة مع العناصر الغذائية المدعمة مثل فيتامين C والحديد.

التحليل الإقليمي

جغرافيًا، البلدان المشمولة في تقرير سوق مكثفات الأغذية هي الولايات المتحدة وكندا والمكسيك في أمريكا الشمالية وألمانيا وفرنسا والمملكة المتحدة وهولندا وسويسرا وبلجيكا وروسيا وإيطاليا وإسبانيا وتركيا وبقية أوروبا في أوروبا والصين واليابان. والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط شرق وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA)، والبرازيل والأرجنتين وبقية أمريكا الجنوبية كجزء من أمريكا الجنوبية.

وفقًا لتحليل أبحاث سوق Data Bridge:

آسيا والمحيط الهادئ هي المنطقة المهيمنة في سوق مكثفات الغذاء خلال فترة التوقعات

سيطرت منطقة آسيا والمحيط الهادئ على سوق مكثفات الأغذية بسبب نمو الاستثمارات والتعاون في مجال مكثفات الأغذية. ستستمر أمريكا الشمالية في السيطرة على سوق مكثفات الأغذية من حيث الحصة السوقية وإيرادات السوق وستستمر في ازدهار هيمنتها خلال الفترة المتوقعة. من المتوقع أن تهيمن الصين على السوق العالمية لمكثفات الأغذية في منطقة آسيا والمحيط الهادئ بسبب ارتفاع الدخل المتاح إلى جانب تغير أنماط الحياة بسبب التحضر السريع.

أمريكا الشمالية من المقدر أن تكون المنطقة الأسرع نموًا في سوق مكثفات الأغذية

من المتوقع أن تنمو أمريكا الشمالية خلال الفترة المتوقعة بسبب تزايد الوجبات السريعة وسلاسل المطاعم في هذه المنطقة.

تحليل تأثير كوفيد-19

أثر تفشي فيروس كورونا (COVID-19) على صناعة الأغذية والمشروبات. ومع ذلك، فقد تأثر سوق مكثفات الأغذية سلبًا بها. لقد أثر تفشي جائحة كوفيد-19 على جميع الصناعات، بما في ذلك سوق مكثفات الأغذية. يتعرض سوق مكثفات الأغذية لتأثير سلبي بسبب التفشي المفاجئ للوباء. لقد فرضت حكومات المنطقة عمليات إغلاق في جميع أنحاء العالم، مما أدى إلى فرض قيود على حركة البضائع ونقلها واستيرادها وتصديرها، مما أثر على سلسلة التوريد وعملية سوق مكثفات الأغذية. علاوة على ذلك، أدى الإغلاق إلى انخفاض توافر المواد الخام لعمليات التصنيع، ونقص العمالة، والأسعار. لقد أثر فيروس كوفيد-19 بشكل كبير على توريد المواد الخام للغروانيات المائية، وهي مادة مكثفة للطعام. علاوة على ذلك، أثر الوباء إلى حد كبير على لوجستيات مكثفات الأغذية، مما ساهم في زيادة أسعار المواد الخام، مما يزيد من تكلفة الشركات المصنعة لمكثفات الأغذية.

على الجانب المشرق، كان هناك انخفاض في عدد مرضى كوفيد-19 في جميع أنحاء العالم، مما سيؤدي إلى انتعاش السوق. علاوة على ذلك، من المرجح أن يتم تخفيف القيود والتدابير، مما سيساعد السوق على أن يشهد زيادة طفيفة، حيث يركز المصنعون على التطورات والابتكارات المختلفة، واتجاهات السوق، واستراتيجيات التوسع الأخرى. وهكذا، مكثفات الغذاء سينمو السوق بوتيرة متسارعة بعد فيروس كورونا.

للحصول على معلومات أكثر تفصيلاً حول سوق مكثفات الغذاء التقرير اضغط هنا – https://www.databridgemarketresearch.com/reports/global-food-thickeners-market