يتكون سوق التأمين الصحي من فئتين أساسيتين: المنتجات والحلول. تشير منتجات التأمين الصحي إلى سياسات محددة توفر تغطية للنفقات الطبية، مثل الخطط الصحية الفردية أو الجماعية، والتأمين على الحياة، وسياسات الأمراض الخطيرة. تشمل حلول التأمين الصحي مجموعة واسعة من العروض، بما في ذلك المنصات الرقمية، وخدمات التطبيب عن بعد، وبرامج الصحة التي تكمل التأمين التقليدي لتحسين نتائج الرعاية الصحية والوصول إليها. يعالج هذا النهج المزدوج الحماية المالية واحتياجات الرعاية الصحية المتطورة للأفراد والمنظمات في مشهد الرعاية الصحية المعقد والمترابط بشكل متزايد.

الوصول إلى التقرير الكامل @ https://www.databridgemarketresearch.com/reports/asia-pacific-health-insurance-market

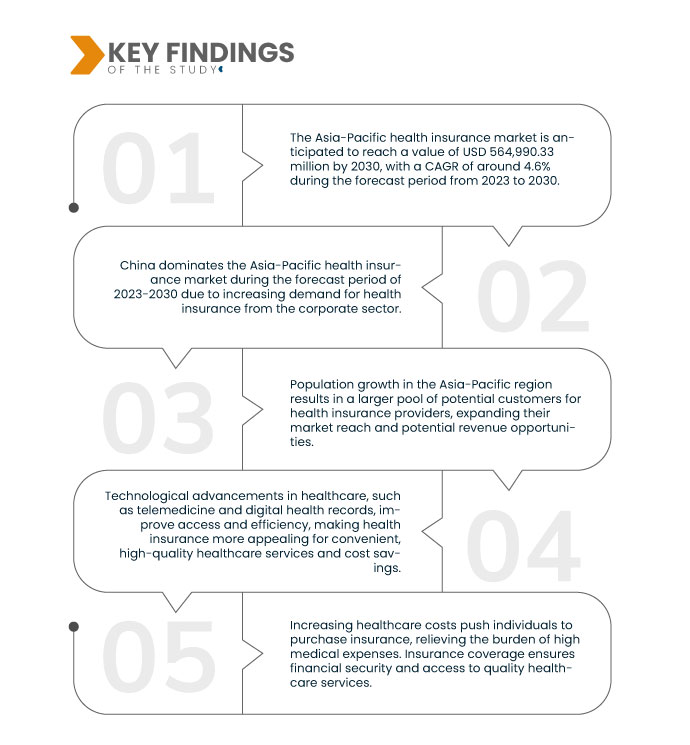

تحلل أبحاث سوق جسر البيانات أن سوق التأمين الصحي في آسيا والمحيط الهادئ من المتوقع أن تصل إلى 5,64,990.33 مليون دولار أمريكي بحلول عام 2030 من 3,94,264.38 مليون دولار أمريكي في عام 2022، بمعدل نمو سنوي مركب كبير قدره 4.6% في الفترة المتوقعة من 2023 إلى 2030. يوفر أصحاب العمل التأمين الصحي كميزة قيمة لجذب المهارات والاحتفاظ بها الموظفين، وتعزيز حزم التعويضات الشاملة وتعزيز الولاء، مما يؤدي إلى ميزة تنافسية في سوق التأمين الصحي.

النتائج الرئيسية للدراسة

ومن المتوقع أن يؤدي شيخوخة السكان إلى دفع معدل نمو السوق

تؤثر شيخوخة السكان، وهي تحول ديموغرافي عالمي، بشكل كبير على الطلب على خدمات الرعاية الصحية والتأمين في العديد من البلدان. مع تقدم الأشخاص في العمر، غالبًا ما يحتاجون إلى رعاية طبية وعلاجات أكثر شمولاً للحالات المزمنة، مما يزيد الضغط على أنظمة الرعاية الصحية. ومن الطبيعي أن تؤدي هذه الحاجة المتزايدة لخدمات الرعاية الصحية إلى زيادة الطلب على التأمين الصحي لتغطية النفقات الطبية. ويؤكد على الدور الحاسم للتأمين الصحي في توفير الأمن المالي والوصول إلى الرعاية الصحية الجيدة للأفراد المسنين، وضمان رفاهيتهم خلال المراحل اللاحقة من الحياة.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2023 إلى 2030

|

|

سنة الأساس

|

2022

|

|

سنوات تاريخية

|

2021 (قابل للتخصيص حتى 2015-2020)

|

|

الوحدات الكمية

|

الإيرادات بمليون دولار أمريكي، الأحجام بالوحدات، التسعير بالدولار الأمريكي

|

|

القطاعات المغطاة

|

النوع (المنتج، الحلول)، الخدمات (علاج المرضى الداخليين، علاج المرضى الخارجيين، المساعدة الطبية، أخرى)، مستوى التغطية (برونزية، الفضي، الذهبي، البلاتيني)، مقدمو الخدمات (مقدمو خدمات التأمين الصحي العام، مقدمو التأمين الصحي الخاص)، خطط التأمين الصحي (نقطة الخدمة (POS)، منظمة المزودين الحصريين (EPOS)، التأمين الصحي للتعويض، حساب التوفير الصحي (HSA) ، ترتيبات السداد الصحي لأصحاب العمل الصغار المؤهلين (QSEHRAS)، منظمة مقدم الخدمة المفضلة (PPO)، منظمة صيانة الصحة (HMO)، أخرى)، التركيبة السكانية (البالغون، القصر، كبار السن)، نوع التغطية (تغطية مدى الحياة، تغطية المدة)، المستخدم النهائي (الشركات، الأفراد، الآخرين) قناة التوزيع (المبيعات المباشرة، المؤسسات المالية، التجارة الإلكترونية، المستشفيات، العيادات، أخرى).

|

|

البلدان المشمولة

|

الصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC).

|

|

تغطية لاعبي السوق

|

Cigna (الولايات المتحدة)، Bupa (المملكة المتحدة)، Now Health International (الصين)، Aetna Inc. (الولايات المتحدة)، AXA (فرنسا)، HBF Health Limited (أستراليا)، International Medical Group, Inc. (الولايات المتحدة)، Allianz Care (أيرلندا). )، شبكة الرعاية الصحية الدولية العالمية المحدودة (المملكة المتحدة)، أفيفا (المملكة المتحدة)، مابفري (إسبانيا).

|

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وقطاعات السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، يتضمن تقرير السوق الذي أعده فريق أبحاث السوق Data Bridge تحليلاً متعمقًا للخبراء وبائيات المرضى وتحليل خطوط الأنابيب. وتحليل الأسعار والإطار التنظيمي.

|

تحليل القطاع:

يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ على أساس النوع والخدمات ومستوى التغطية ومقدمي الخدمات وخطط التأمين الصحي والتركيبة السكانية ونوع التغطية والمستخدم النهائي وقناة التوزيع.

- على أساس النوع، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى منتجات وحلول.

- على أساس الخدمات، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى علاج المرضى الداخليين، وعلاج المرضى الخارجيين، والمساعدة الطبية، وغيرها.

- على أساس مستوى التغطية، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى البرونز والفضة والذهب والبلاتين.

- على أساس مقدمي الخدمات، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى مقدمي التأمين الصحي العام ومقدمي التأمين الصحي الخاص.

- على أساس خطط التأمين الصحي، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى منظمة المزود الحصري لنقاط الخدمة (POS)، والتأمين الصحي للتعويضات، وحساب التوفير الصحي (HSA)، وترتيبات السداد الصحي لأصحاب العمل الصغار المؤهلين (QSEHRAS). )، ومنظمة المزود المفضل (PPO)، ومنظمة الصيانة الصحية (HMO)، وغيرها.

- على أساس التركيبة السكانية، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى البالغين والقصر وكبار السن.

- على أساس نوع التغطية، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى تغطية مدى الحياة وتغطية محددة المدة.

- على أساس المستخدم النهائي، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى شركات وأفراد وغيرهم.

- على أساس قناة التوزيع، يتم تقسيم سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ إلى المبيعات المباشرة والمؤسسات المالية والتجارة الإلكترونية والمستشفيات والعيادات وغيرها.

اللاعبين الرئيسيين

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها الجهات الفاعلة في سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ في سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ: Cigna (الولايات المتحدة)، Bupa (المملكة المتحدة)، Now Health International (الصين)، Aetna Inc. (الولايات المتحدة)، AXA ( فرنسا)، HBF Health Limited (أستراليا)، International Medical Group, Inc. (الولايات المتحدة).

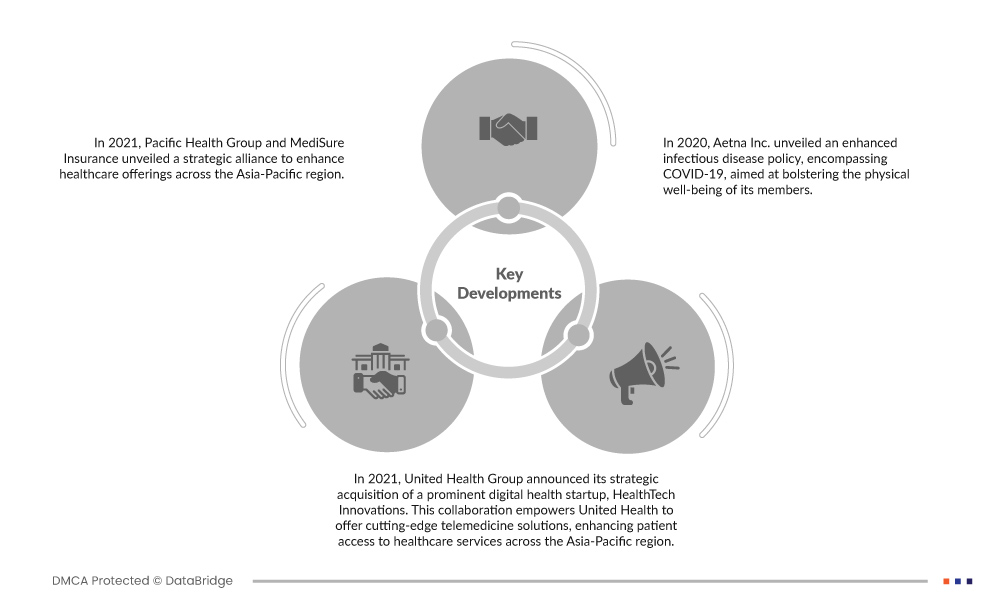

تطورات السوق

- في عام 2021، كشفت مجموعة Pacific Health Group وMediSure Insurance عن تحالف استراتيجي لتعزيز عروض الرعاية الصحية في جميع أنحاء منطقة آسيا والمحيط الهادئ. ستعمل هذه الشراكة على الاستفادة من شبكة Pacific Health Group لتوسيع تغطية MediSure، وتقديم مجموعة واسعة من الخدمات وتعزيز تواجدها في السوق، مما يفيد قاعدة عملاء أكثر شمولاً وإثراء محفظة الرعاية الصحية المشتركة الخاصة بها.

- في عام 2021، أعلنت United Health Group عن استحواذها الاستراتيجي على شركة ناشئة بارزة في مجال الصحة الرقمية، HealthTech Innovations. يمكّن هذا التعاون شركة United Health من تقديم حلول التطبيب عن بعد المتطورة، مما يعزز وصول المرضى إلى خدمات الرعاية الصحية في جميع أنحاء منطقة آسيا والمحيط الهادئ. يعمل هذا الاستحواذ الهام على توسيع محفظة United Health Group، مما يجعلها الشركة الرائدة في مجال تقديم الرعاية الصحية المبتكرة.

- في عام 2020، كشفت شركة Aetna Inc. عن سياسة معززة للأمراض المعدية، تشمل فيروس كوفيد-19، بهدف تعزيز الصحة البدنية لأعضائها. يمكّن هذا التحديث الاستراتيجي Aetna من تلبية احتياجات قاعدة عملاء أوسع مع توسيع وتنويع محفظة شركاتها، مما يعزز مكانتها في سوق التأمين الصحي.

التحليل الإقليمي

جغرافيًا، الدول المشمولة في تقرير سوق التأمين الصحي في آسيا والمحيط الهادئ هي الصين واليابان والهند وكوريا الجنوبية وسنغافورة وماليزيا وأستراليا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ ( منطقة آسيا والمحيط الهادئ).

وفقًا لتحليل أبحاث سوق Data Bridge:

الصين هي المنطقة المهيمنة في سوق التأمين الصحي في آسيا والمحيط الهادئ خلال فترة التوقعات 2023 - 2030

تقود الصين السوق بفضل الرعاية الصحية الخاصة، مما يتيح مواعيد مريحة، وأوقات انتظار أقصر، ومعدات متقدمة، وعلاجات متفوقة، وأدوية. ويؤدي الطلب المتزايد في قطاع الشركات على التأمين الصحي إلى تضخيم هذا النمو، مما يؤكد أهمية الوصول السريع إلى الرعاية الجيدة. ويسلط هذا الاتجاه الضوء على هيمنة الصين، التي تعمل على تشكيل مشهد الرعاية الصحية في المنطقة من خلال الخدمات المحسنة ومتطلبات التأمين التي تقودها الشركات.

للحصول على معلومات أكثر تفصيلاً حول تقرير سوق التأمين الصحي في منطقة آسيا والمحيط الهادئ، انقر هنا –https://www.databridgemarketresearch.com/reports/asia-pacific-health-insurance-market