تعد صناعة الثروة الحيوانية جزءًا أساسيًا من التنمية الزراعية في آسيا. وفي العقود الأخيرة، نمت بشكل ملحوظ، مما ساعد على تلبية الطلب المتزايد على المنتجات الحيوانية. تلعب حيوانات المزرعة، مثل الدواجن والخنازير والماشية، دورًا اقتصاديًا واجتماعيًا أساسيًا في البلدان الآسيوية. ومع النمو الاقتصادي السريع، ارتفع الطلب على بروتين اللحوم بشكل ملحوظ في آسيا، وخاصة في الهند وماليزيا والصين وتايلاند. وقد أدى ذلك إلى تزايد الطلب على الأعلاف الحيوانية، باعتبارها المصدر الرئيسي لتغذية الماشية. يمثل سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ فرصة متنامية للشركات القادرة على تلبية الطلب على الأعلاف المغذية عالية الجودة.

الوصول إلى التقرير الكامل في https://www.databridgemarketresearch.com/reports/asia-pacific-animal-feed-market

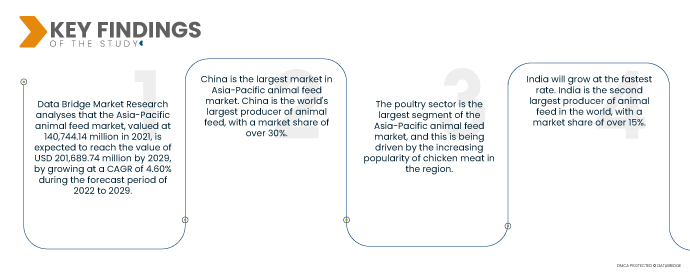

تحلل أبحاث سوق جسر البيانات أن سوق الأعلاف الحيوانية في آسيا والمحيط الهادئ، بقيمة 140,744.14 مليون دولار في عام 2021، ومن المتوقع أن تصل قيمتها إلى 201,689.74 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 4.60٪ خلال الفترة المتوقعة من 2022 إلى 2029. ويرجع تفوق المنطقة إلى ارتفاع الأرباح وزيادة استهلاك اللحوم ، وزيادة إنتاج اللحوم. تعد الصين وفيتنام وماليزيا والهند وإندونيسيا أكبر مستهلكي الأعلاف المركبة في المنطقة. وتعد الصين والهند أكبر الأسواق في المنطقة، حيث تساهمان بشكل كبير في ارتفاع الطلب. وتعد الصين إحدى الدول الرائدة في تصنيع الأعلاف المركبة في العالم، حيث تساهم بنصف إنتاج المنطقة. يقود السوق الاهتمام المتزايد برعاية الحيوان والمبادرات الحكومية.

الطلب المتزايد على البروتين الحيواني من المتوقع أن يقود معدل نمو السوق

أحد المحركات الرئيسية لسوق العلف الحيواني في منطقة آسيا والمحيط الهادئ هو الطلب المتزايد على البروتين الحيواني. ومع استمرار نمو الدخل في المنطقة، يتناول الناس المزيد من اللحوم والدواجن والأسماك. وهذا يزيد الطلب على الأعلاف الحيوانية، لأنه المصدر الرئيسي لتغذية الماشية. ومن المتوقع أن يصل عدد سكان آسيا إلى 5.3 مليار نسمة بحلول عام 2050، مقارنة بـ 4.5 مليار نسمة في عام 2020. وسيؤدي هذا النمو السكاني إلى زيادة الطلب على الغذاء، بما في ذلك اللحوم والدواجن والأسماك. هناك اتجاه متزايد نحو النظم الغذائية على النمط الغربي في آسيا، والتي عادة ما تكون أعلى في استهلاك اللحوم. ويرجع ذلك إلى عدد من العوامل، بما في ذلك التحضر، والتوافر المتزايد للأغذية المصنعة، وتأثير وسائل الإعلام الغربية.

نطاق التقرير وتقسيم السوق

|

تقرير المقياس

|

تفاصيل

|

|

فترة التنبؤ

|

2022 إلى 2029

|

|

سنة الأساس

|

2021

|

|

سنوات تاريخية

|

2020 (قابل للتخصيص حتى 2014-2019)

|

|

الوحدات الكمية

|

الإيرادات بمليون دولار أمريكي، الأحجام بالوحدات، التسعير بالدولار الأمريكي

|

|

القطاعات المغطاة

|

يكتب (حمض أميني، معادن، فيتامينات، محمضات، مزيلات السموم الفطرية، إنزيمات، فوسفات، كاروتينات، مضادات أكسدة، نكهات و المحليات، المضادات الحيوية، النيتروجين غير البروتيني وغيرها)، الثروة الحيوانية (الخنازير، الدواجن، الحيوانات المجترة، الحيوانات المائية وغيرها)، الشكل (الجاف والسائل)

|

|

البلدان المشمولة

|

اليابان، الصين، الهند، كوريا الجنوبية، نيوزيلندا، فيتنام، أستراليا، سنغافورة، ماليزيا، تايلاند، إندونيسيا، الفلبين، وبقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ (APAC)

|

|

تغطية لاعبي السوق

|

مركز حقوق الإنسان. Hansen Holdings A/S (الدنمارك)، Lallemand Inc. (كندا)، Novus International (الولايات المتحدة)، DSM (هولندا)، BASF SE (ألمانيا)، Alltech (الولايات المتحدة)، ADM (الولايات المتحدة)، Charoen Popkphand Foods PCL (تايلاند) ، Associated British Foods Plc (المملكة المتحدة)، Cargill Incorporated (الولايات المتحدة)، Purina Animal Nutrition LLC (الولايات المتحدة)، Zinpro Corp (الولايات المتحدة)، Dallas Keith (المملكة المتحدة)، Balchem Inc.، (الولايات المتحدة)، Kemin Industries, Inc. (الولايات المتحدة) )

|

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الأفكار حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تنظمها أبحاث سوق Data Bridge أيضًا تحليلًا متعمقًا للخبراء وإنتاجًا ممثلًا جغرافيًا للشركة و القدرة، وتخطيطات شبكة الموزعين والشركاء، وتحليل مفصل ومحدث لاتجاهات الأسعار وتحليل العجز في سلسلة التوريد والطلب

|

تحليل القطاع:

يتم تقسيم سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ إلى خمسة قطاعات بارزة بناءً على النوع والماشية والشكل.

- على أساس النوع، يتم تقسيم سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ إلى الأحماض الأمينية والمعادن، الفيتامينات، المحمضات، مزيلات السموم الفطرية، الإنزيمات، الفوسفات،الكاروتينات، مضادات الأكسدة، النكهات والمحليات، مضادات حيويةوالنيتروجين غير البروتيني وغيرها. من المتوقع أن يهيمن قطاع الأحماض الأمينية على سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ بأكبر حصة سوقية تبلغ 30.92%. الأحماض الأمينية هي المسؤولة بشكل رئيسي عن بناء لبنات الأنسجة وبروتينات الحليب في الحيوانات وأي نقص في الأحماض الأمينية يكسر الاستجابة المناعية ويقلل إنتاجها في الحيوانات.

- على أساس الثروة الحيوانية، يتم تقسيم سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ إلى الخنازير والدواجن والمجترات والحيوانات المائية وغيرها.

ومن المتوقع أن تهيمن الخنازير على سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ

ومن المتوقع أن يهيمن قطاع الخنازير على سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ بحصة سوقية أكبر تبلغ 35.83%. إن الطلب المتزايد واستهلاك اللحوم والبروتينات المعتمدة على اللحوم في دول آسيا والمحيط الهادئ يجعل من تربية الخنازير قطاع الماشية المهيمن في سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ.

- على أساس الشكل، يتم تقسيم سوق العلف الحيواني في آسيا والمحيط الهادئ إلى جاف وسائل.

من المتوقع أن يهيمن القطاع الجاف على سوق الأعلاف الحيوانية في منطقة آسيا والمحيط الهادئ

ومن المتوقع أن يهيمن القطاع الجاف على السوق بحصة سوقية تبلغ 75.96% بسبب أكبر سوق للماشية مع ارتفاع الناتج المحلي الإجمالي. ومع ذلك، فإن الجزء السائد في فئة الشكل يمكن أن يعتمد على عوامل مثل سهولة التعامل، واستقرار العناصر الغذائية، وملاءمتها لأنظمة التغذية المختلفة. تلعب ديناميكيات السوق والتقدم التكنولوجي وتركيبات المنتجات المحددة دورًا حاسمًا في تحديد قطاع الشكل المهيمن في سوق الأعلاف الحيوانية في منطقة آسيا والمحيط الهادئ.

اللاعبين الرئيسيين

تعترف Data Bridge Market Research بالشركات التالية باعتبارها اللاعبين الرئيسيين في السوق: CHR. Hansen Holdings A/S (الدنمارك)، Lallemand Inc. (كندا)، Novus International (الولايات المتحدة)، DSM (هولندا)، BASF SE (ألمانيا)، Alltech (الولايات المتحدة)، ADM (الولايات المتحدة)، Charoen Popkphand Foods PCL (تايلاند) ، Associated British Foods Plc (المملكة المتحدة)، Cargill Incorporated (الولايات المتحدة)، Purina Animal Nutrition LLC (الولايات المتحدة)، Zinpro Corp (الولايات المتحدة)، Dallas Keith (المملكة المتحدة)، Balchem Inc.، (الولايات المتحدة)، Kemin Industries, Inc. (الولايات المتحدة) ).

سوق الأعلاف الحيوانية في آسيا والمحيط الهادئ

تطوير السوق

- في عام 2022، استحوذت شركة ADM Animal Nutrition، وهي شركة عالمية رائدة في مجال تغذية الحيوانات، على مطحنة الأعلاف التابعة لشركة South Sunrays Milling Corporation في بولومولوك، جنوب كوتاباتو، في مايو. وتمثل هذه الإضافة خطوة إلى الأمام في توفير مجموعة متنوعة من العناصر المتطورة لتناسب الطلب الآسيوي على حلول تغذية الحيوانات المبتكرة وعالية الجودة.

- في عام 2021، كثفت ADM قدراتها الغذائية في جميع أنحاء العالم في أكتوبر مع افتتاح ADM Food Technology (Pinghu)، وهي منشأة متطورة لإنتاج النكهات مؤتمتة بالكامل في Pinghu، مقاطعة Zhejiang، الصين. سيكون مصنع النكهات المتطور الجديد في Pinghu بمثابة مركز توريد النكهات لشركة ADM في منطقة آسيا والمحيط الهادئ، مما يسمح لشركة ADM بتسخير المعرفة والتكنولوجيا المتطورة لتلبية احتياجات العملاء بشكل أكبر وتعزيز هدف النمو لدينا.

التحليل الإقليمي

جغرافيًا، البلدان المشمولة في تقرير السوق هي اليابان والصين والهند وكوريا الجنوبية ونيوزيلندا وفيتنام وأستراليا وسنغافورة وماليزيا وتايلاند وإندونيسيا والفلبين وبقية دول آسيا والمحيط الهادئ (APAC) في منطقة آسيا والمحيط الهادئ ( منطقة آسيا والمحيط الهادئ).

وفقًا لتحليل أبحاث سوق Data Bridge:

الصين هي المنطقة المهيمنة في تغذية الحيوانات في منطقة آسيا والمحيط الهادئ سوق خلال الفترة المتوقعة 2022-2029

الصين هي أكبر سوق في سوق العلف الحيواني في منطقة آسيا والمحيط الهادئ. تعد الصين أكبر منتج للأعلاف الحيوانية في العالم، حيث تبلغ حصتها في السوق أكثر من 30%. يعتمد سوق العلف الحيواني الصيني على عدد السكان الكبير والمتزايد في البلاد، فضلاً عن ثراءها المتزايد.

الهند من المقدر أن تكون المنطقة الأسرع نموًا في تغذية الحيوانات في آسيا والمحيط الهادئ سوق في الفترة المتوقعة 2022-2029

وسوف تنمو الهند بأسرع معدل. تعد الهند ثاني أكبر منتج للأعلاف الحيوانية في العالم، حيث تبلغ حصتها في السوق أكثر من 15%. تعمل الحكومة الهندية على تعزيز نمو صناعة الثروة الحيوانية، حيث يُنظر إليها على أنها وسيلة لتعزيز النمو الاقتصادي وخلق فرص العمل.

للحصول على معلومات أكثر تفصيلاً حول سوق الأعلاف الحيوانية في آسيا والمحيط الهادئ التقرير اضغط هنا –https://www.databridgemarketresearch.com/reports/asia-pacific-animal-feed-market