Global Smart Grid Security Market

Market Size in USD Billion

CAGR :

%

USD

66.74 Billion

USD

214.37 Billion

2024

2032

USD

66.74 Billion

USD

214.37 Billion

2024

2032

| 2025 –2032 | |

| USD 66.74 Billion | |

| USD 214.37 Billion | |

|

|

|

|

Smart Grid Security Market Size

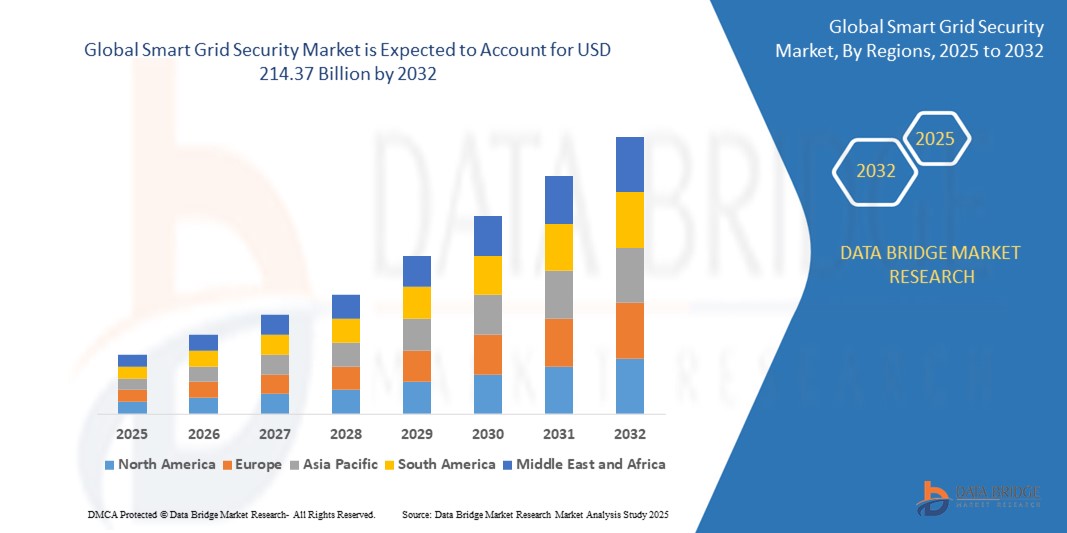

- The global smart grid security market size was valued at USD 66.75 billion in 2024 and is expected to reach USD 214.37 billion by 2032, at a CAGR of 15.70% during the forecast period

- This growth is driven by supportive regulatory framework of governments worldwide to promote deployment of smart grids

Smart Grid Security Market Analysis

- Smart Grid Security are revolutionizing enterprise communication infrastructures by delivering centralized network control, robust security protocols, and streamlined service management, helping organizations enhance operational efficiency and reduce overhead costs across diverse industry verticals

- The increasing reliance on cloud-based infrastructure, combined with the surge in IoT device deployments and the growing need for low-latency connectivity, is accelerating the demand for scalable, flexible, and agile managed network solutions among global enterprises

- Asia-Pacific is expected to dominate the smart grid security market, driven by large-scale government investments in smart grid technologies and a growing focus on cybersecurity within energy infrastructure

- North America is expected to witness the fastest growth rate (CAGR) due to a heightened focus on protecting critical infrastructure from cyberattacks, and strong regulatory mandates such as NERC CIP compliance

- The Supervisory Control and Data Acquisition (SCADA)/Industrial Control System (ICS) segment is expected to dominate the market with the largest market share of 38.25% due to increasing frequency and sophistication of cyberattacks targeting critical infrastructure have necessitated advanced protection frameworks, driving greater investment in securing SCADA/ICS systems

Report Scope and Smart Grid Security Market Segmentation

|

Attributes |

Smart Grid Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Smart Grid Security Market Trends

“Growing Emphasis on Zero Trust Architecture (ZTA)”

- A key trend shaping the smart grid security market is the increasing implementation of Zero Trust Architecture (ZTA) to counter sophisticated cyber threats targeting critical energy infrastructure

- ZTA enforces continuous verification of devices and users, minimizing lateral movement of attackers and reducing the risk of insider threats or credential misuse

- This approach enables utilities to establish micro-segmentation, identity-based access, and strong endpoint controls across distributed grid environments

- For instance, in January 2024, Palo Alto Networks expanded its Zero Trust solutions to critical infrastructure clients, offering advanced visibility and control across smart grid ecosystems

- The widespread shift toward ZTA is redefining cybersecurity models in the smart grid space, aligning with regulatory frameworks and next-gen threat defense standards

Smart Grid Security Market Dynamics

Driver

“Regulatory Push for Grid Modernization and Cyber Resilience”

- Governments and regulatory bodies worldwide are mandating upgrades to outdated power grids to improve resilience, reliability, and protection against cyberattacks

- Initiatives such as NERC CIP (North America), ENISA regulations (Europe), and national smart grid policies are compelling utilities to invest in advanced security frameworks

- Smart Grid Security plays a central role in achieving compliance through real-time monitoring, event correlation, and automated threat mitigation

- For instance, in 2024, the European Commission announced new cyber resilience standards for smart grids under the Digital Decade strategy, requiring utilities to deploy end-to-end encryption and threat intelligence tools

- This regulatory momentum is accelerating the adoption of smart grid security solutions across both developed and developing regions

Opportunity

“Expansion of Smart City and Microgrid Projects”

- The rapid growth of smart cities and decentralized microgrids presents a significant opportunity for smart grid security providers

- These ecosystems require secure, interoperable platforms to manage distributed energy resources, IoT sensors, and automated grid controls in real time

- Government-backed urban transformation programs are creating new demand for edge security, AI-driven anomaly detection, and resilient network design

- For instance, in 2024, the Indian government allocated USD 2 billion for smart city energy infrastructure, with a portion dedicated to securing microgrid and sensor networks

- This expansion is driving investment in localized smart grid security deployments tailored to urban and remote energy infrastructures

Restraint/Challenge

“High Implementation Costs and Complexity”

- The deployment of smart grid security solutions often involves substantial upfront costs, integration complexities, and long deployment cycles

- Utilities operating on legacy systems face compatibility issues, requiring costly infrastructure upgrades and skilled personnel to manage transitions

- This cost barrier is especially restrictive for smaller utilities and public-sector providers with limited IT budgets or cybersecurity maturity

- For instance, in 2023, a municipal utility in Eastern Europe delayed its smart grid rollout due to financial and technical constraints tied to cybersecurity implementation

- To ensure broader market adoption, solution providers must focus on modular, scalable, and cost-effective security offerings with simplified integration paths

Smart Grid Security Market Scope

The market is segmented on the basis of solution, service, deployment mode, subsystem, and security type.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Service |

|

|

By Deployment Mode |

|

|

By Subsystem |

|

|

By Security Type |

|

In 2025, the Antivirus/Antimalware is projected to dominate the market with a largest share in Solution segment

The Antivirus/Antimalware segment is expected to dominate the smart grid security market in 2025 due to the increasing frequency and sophistication of cyber threats targeting smart grid infrastructures, necessitating robust protective measures.

The Supervisory Control and Data Acquisition (SCADA)/Industrial Control System (ICS) is expected to account for the largest share during the forecast period in Subsystem segment

In 2025, the Supervisory Control and Data Acquisition (SCADA)/Industrial Control System (ICS) segment is expected to dominate the market with the largest market share of 38.25% due to increasing frequency and sophistication of cyberattacks targeting critical infrastructure have necessitated advanced protection frameworks, driving greater investment in securing SCADA/ICS systems.

Smart Grid Security Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Smart Grid Security Market”

- Asia-Pacific is expected to dominate the smart grid security market, driven by large-scale government investments in smart grid technologies and a growing focus on cybersecurity within energy infrastructure

- Key countries such as China, Japan, and South Korea are spearheading the development of smart cities, rolling out IoT-enabled grids, and enhancing real-time monitoring systems to ensure energy reliability and data protection

- The region benefits from robust public-private partnerships, rapid urbanization, and increasing deployment of smart meters and grid automation technologies, strengthening its leadership in the global market

“North America is projected to register the Highest CAGR in the Smart Grid Security Market”

- North America is expected to witness the fastest growth rate (CAGR) due to a heightened focus on protecting critical infrastructure from cyberattacks, and strong regulatory mandates such as NERC CIP compliance

- The U.S. dominates regional momentum, with utilities rapidly adopting AI-driven threat detection, cloud-based security platforms, and real-time incident response tools

- Energy companies across the region are modernizing their grid systems with blockchain, edge computing, and zero-trust architectures, pushing cybersecurity spending to new heights

- With increasing digitization of energy operations and support from both federal and state governments, North America is emerging as a key hub for smart grid security innovation and investment

Smart Grid Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BAE Systems (U.K.)

- Cisco Systems, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- IBM (U.S.)

- Black & Veatch Corporation (U.S.)

- IOActive Inc. (U.S.)

- Entergy Corporation (U.S.)

- Alert Enterprise, Inc. (U.S.)

- Elasticsearch B.V. (U.S.)

- McAfee, LLC (U.S.)

- Eaton (Ireland)

- VeriSign, Inc. (U.S.)

- Broadcom (U.S.)

Latest Developments in Global Smart Grid Security Market

- In April 2025, SolarEdge Technologies, Inc., a global leader in smart energy solutions, launched its new ONE Controller for the German residential solar market, designed to comply with Germany’s updated §14a EnWG regulation. This regulation promotes the smart integration of controllable electrical loads by utilities. This launch is expected to strengthen SolarEdge’s position in the European smart grid ecosystem by aligning with regulatory trends and consumer energy demands.

- In August 2024, Siemens Smart Infrastructure introduced the SICAM Enhanced Grid Sensor (EGS), a solution developed to enhance distribution network transparency for grid operators. This innovation addresses a core challenge faced by utilities managing dynamic, decentralized energy flows. This product reinforces Siemens’ role in improving visibility and control across modern power grids

- In November 2022, Duke Energy Corporation collaborated with Amazon Web Services, Inc. to advance smart grid technologies by leveraging AWS’s cloud infrastructure. The partnership aims to enhance energy distribution, improve customer engagement, and support Duke Energy’s transition toward renewable energy sources. This alliance underscores the growing importance of cloud-driven digital transformation in the utility sector

- In March 2022, Analog Devices, Inc. and Gridspertise announced a partnership focused on enhancing smart grid technologies, especially in the area of distribution grid management and control. By combining Analog Devices’ semiconductor capabilities with Gridspertise’s power software, the collaboration seeks to improve the efficiency and reliability of smart grids. This initiative highlights the fusion of hardware and software as a pathway to smarter energy infrastructure

- In May 2021, Thailand-based Impact Solar joined hands with Hitachi ABB Power Grids to deliver an energy storage system for Thailand’s largest privately owned microgrid. This initiative supports sustainable energy independence and grid resilience in the region. This project represents a significant step toward decentralized energy development in Southeast Asia

- In February 2020, top CISOs and cybersecurity experts from across Europe gathered in Berlin to discuss new strategies for preventing, detecting, and responding to cyber threats in the smart grid space. The event focused on safeguarding critical infrastructure amid an evolving threat environment. This summit emphasized the growing need for cybersecurity leadership and collaboration in the energy sector

- In June 2021, AT&T Business and Cisco introduced Webex Calling with AT&T - Enterprise, integrating Cisco’s Unified Communications Manager Cloud (UCMC) to support flexible, cloud-based business communication. This integration showcases the trend of embedding unified communications into managed network offerings

- In May 2021, Cisco Webex and Box announced deeper integrations between their platforms, aimed at enabling customers to collaborate securely and efficiently in cloud environments. This partnership supports the continued shift toward cloud-native managed services that emphasize productivity and security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.