Global Smart Building Market

Market Size in USD Billion

CAGR :

%

USD

106.29 Billion

USD

488.41 Billion

2023

2031

USD

106.29 Billion

USD

488.41 Billion

2023

2031

| 2024 –2031 | |

| USD 106.29 Billion | |

| USD 488.41 Billion | |

|

|

|

|

Smart Building Market Size

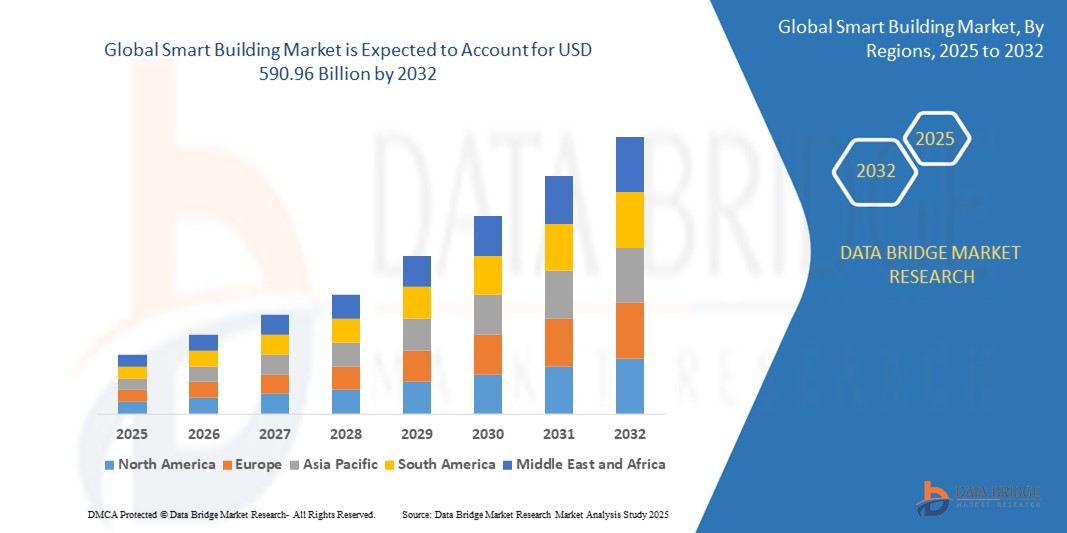

- The global smart building market size was valued at USD 128.61 billion in 2024 and is expected to reach USD 590.96 billion by 2032, at a CAGR of 21.00% during the forecast period

- This growth is driven by factors such as the rising adoption of IoT and AI technologies, increasing demand for energy-efficient systems, supportive government initiatives for smart infrastructure, and growing awareness about sustainability and occupant safety.

Smart Building Market Analysis

- The current smart building market is steadily advancing due to the growing focus on integrating intelligent systems that streamline energy use, maintenance, and overall building performance

- This trend highlights a shift in market dynamics where real-time data and automation tools, for instance smart sensors and centralized platforms, are increasingly becoming standard in modern infrastructure

- North America is expected to dominate the smart buildings market with market share of 35.07% due to its well-established technological infrastructure and early adoption of smart building solutions

- Asia-pacific is expected to be the fastest growing region in the smart building market during the forecast period due to accelerating urbanization and economic expansion

- The commercial segment is expected to dominate the smart building market with the largest share of 53.11% in 2025 due to the widespread adoption of intelligent systems in office complexes, shopping malls, hospitals, and airports to enhance operational efficiency, reduce energy costs, and improve occupant experience through automation and centralized management

Report Scope and Smart Building Market Segmentation

|

Attributes |

Smart Building Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Smart Building Market Trends

“Intelligent Maintenance Driving Smart Building Efficiency”

- Building management systems are increasingly utilizing artificial intelligence algorithms to analyze sensor data and anticipate equipment failures before they occur

- This proactive approach enables facility managers to schedule maintenance activities efficiently, thereby reducing unexpected downtime and extending the lifespan of building systems

- The adoption of predictive maintenance not only enhances operational efficiency but also contributes to significant cost savings by minimizing emergency repairs

- In conclusion, as the smart building market continues to evolve, the emphasis on artificial intelligence-driven predictive maintenance is expected to play a pivotal role in optimizing building performance and sustainability

Smart Building Market Dynamics

Driver

“Rising Emphasis on Energy Optimization in Buildings”

- The push for energy optimization is accelerating smart building adoption as buildings remain among the top global electricity consumers and require efficient systems to cut costs and emissions

- Smart technologies such as automated lighting and climate control enable real-time adjustments based on occupancy and usage patterns which help prevent energy waste and optimize resource use

- For instance, systems such as Enlighted by Siemens or Honeywell's Building Management Solutions allow facilities to monitor lighting and HVAC in real time to reduce energy bills and improve comfort

- Green certifications such as Leadership in Energy and Environmental Design and energy codes such as ASHRAE are driving both residential and commercial developers to integrate efficiency-focused infrastructure

- In conclusion, as governments offer tax incentives and rebates for smart energy systems and businesses aim for net-zero goals this makes energy optimization through intelligent technologies not just a sustainable choice but a necessary evolution

Opportunity

“Integration of Digital Twins to Enhance Building Intelligence”

- Digital twin technology offers a major opportunity by enabling virtual replicas of buildings that support real-time simulation monitoring and control for better management

- For instance, Microsoft’s Redmond campus uses digital twins to manage energy systems and maintenance proactively leading to improved efficiency and occupant comfort

- These models can replicate electrical mechanical and structural systems allowing operators to detect inefficiencies simulate emergency scenarios and plan predictive maintenance

- Integration of Internet of Things and artificial intelligence makes it feasible to gather vast data streams from sensors and devices supporting real-time decision-making and automation

- As buildings grow more complex digital twins help optimize space usage reduce costs and assess environmental impact making them vital tools for future-ready infrastructure

- In conclusion, with increasing adoption digital twins are set to become a standard in smart building design offering enhanced operational visibility and innovation potential

Restraint/Challenge

“High Initial Investment and Implementation Complexity”

- High upfront investment remains a key obstacle as smart building implementation demands costly hardware software systems and skilled labor for installation and maintenance

- Retrofitting older buildings with intelligent infrastructure requires structural changes integration with legacy systems and extended timelines which raise both cost and complexity

- For instance, installing sensor networks and control units in traditional commercial facilities can disrupt operations and delay project timelines creating reluctance among owners

- Lack of standardized protocols among different vendors' solutions leads to interoperability issues complicating integration and increasing the risk of security or performance failures

- Continuous investment in cybersecurity updates and technical training adds to the operational load especially for small businesses with limited budgets or technical resources

- In conclusion, while smart buildings promise long-term savings and operational benefits the high initial cost and technical hurdles continue to restrict adoption across many markets

Smart Building Market Scope

The market is segmented on the basis of solution, service, and building type.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Service |

|

|

By Building Type

|

|

In 2025, the commercial segment is projected to dominate the market with a largest share in building type segment

The commercial segment is expected to dominate the Smart Building market with the largest share of 53.11% in 2025 due to the widespread adoption of intelligent systems in office complexes, shopping malls, hospitals, and airports to enhance operational efficiency, reduce energy costs, and improve occupant experience through automation and centralized management

The support and maintenance segment is expected to account for the largest share during the forecast period in service segment

In 2025, the support and maintenance segment is expected to dominate the market with the largest market share of 38.14% due to the rising need for continuous system monitoring, timely software updates, and technical assistance to ensure optimal performance and security of integrated smart building solutions

Smart Building Market Regional Analysis

“North America Holds the Largest Share in the Smart Building Market”

- North America holds the largest share of the global smart building market with market share of 35.07% due to its well-established technological infrastructure and early adoption of smart building solutions

- The U.S. leads with a strong commercial building sector and a growing focus on energy-efficient systems

- High internet connectivity and the presence of leading industry players contribute to the region’s dominance

- Government policies and incentives support the implementation of advanced building automation and energy management

- Demand for integrated security systems and smart controls is particularly high among commercial and institutional buildings

“Asia-Pacific is Projected to Register the Highest CAGR in the Smart Building Market”

- Asia Pacific is experiencing rapid growth in the smart building market due to accelerating urbanization and economic expansion

- Countries such as China, India, and Singapore are investing heavily in smart infrastructure to support increasing urban populations

- The rise of connected devices and artificial intelligence technologies is speeding up smart building adoption

- Government programs promoting sustainability and energy efficiency further boost market growth

- The region sees significant activity both in new construction and retrofitting existing buildings with smart systems

Smart Building Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell International Inc. (U.S.)

- Johnson Controls Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Siemens (Germany)

- IBM (U.S.)

- Schneider Electric (France)

- Intel Corporation (U.S.)

- Huawei Technologies Co. Ltd. (China)

- ABB (Switzerland)

- L&T Technology Services Limited (India)

- 75F (U.S.)

- Telit Cinterion (U.K.)

- PointGrab (Israel)

- Spacewell International (Belgium)

- PTC (U.S.)

- Avnet Inc. (U.S.)

- Softdel (India)

- HCL Technologies Limited (India)

Latest Developments in Global Smart Building Market

- In May 2024, ABB Ltd. entered into a partnership with Powrmatic to deliver advanced electrical distribution solutions in Canada. This collaboration combines ABB’s cutting-edge electrical products with Powrmatic’s wide-reaching distribution network, aiming to meet the rising demand for reliable and efficient electrical systems in residential, commercial, and industrial sectors across the region

- In March 2023, Siemens Smart Infrastructure launched the Connect Box, an intuitive IoT solution designed for small- to medium-sized buildings. This new addition to the Siemens Xcelerator portfolio enables efficient monitoring of building performance, offering the potential to enhance energy efficiency by up to 30% and significantly improve indoor air quality in spaces such as schools, retail stores, and small offices

- In May 2023, Delta, a leader in power and thermal management, introduced a smart community hub powered by its IoT-based Smart Green Solutions. The "Intelligent Sustainable Connecting Hub" integrates an Operation Center with a multifunctional management platform, carbon emissions inventory, renewable power matching, and energy-efficient solutions, demonstrating how Delta’s technologies contribute to sustainable development across various sectors

- In September 2023, Johnson Controls formed a strategic partnership with BT to combine Johnson Controls' building automation and energy management expertise with BT's digital connectivity services. The aim of this partnership is to provide smart building solutions that improve energy efficiency, reduce carbon footprints, and support businesses in their transition to net zero carbon emissions

- In July 2023, Siemens partnered with Prodea Investments to develop smart and sustainable buildings in Greece. The collaboration focuses on integrating Siemens' advanced building technologies to improve energy efficiency, comfort, and connectivity in Prodea's real estate projects, setting new standards for sustainability and smart building solutions in the Greek market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.