Global Low Temperature Coating Market

Market Size in USD Billion

CAGR :

%

USD

5.97 Billion

USD

8.52 Billion

2024

2032

USD

5.97 Billion

USD

8.52 Billion

2024

2032

| 2025 –2032 | |

| USD 5.97 Billion | |

| USD 8.52 Billion | |

|

|

|

|

Low Temperature Coating Market Size

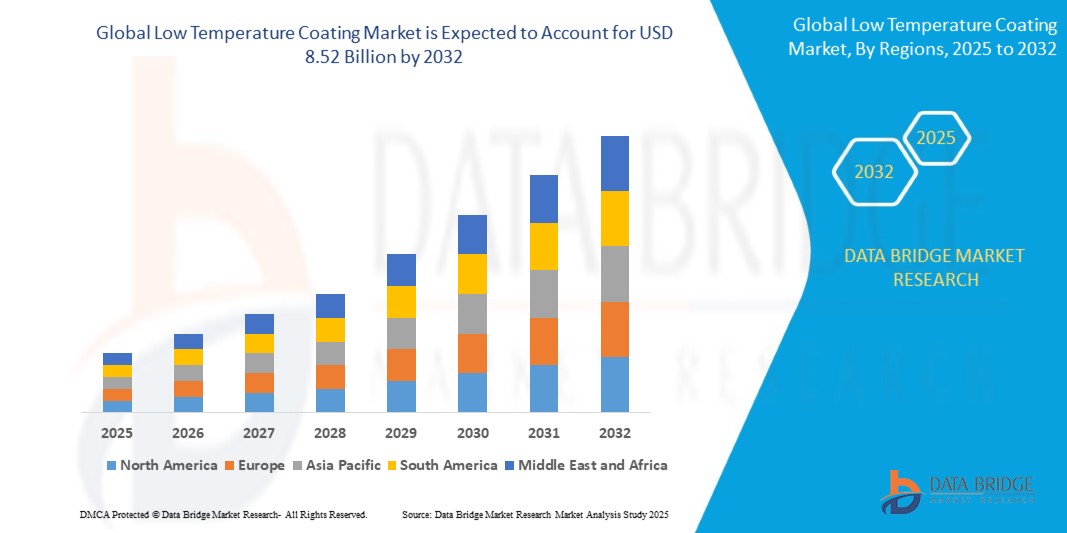

- The global Low temperature coating market size was valued at USD 5.97 billion in 2024 and is expected to reach USD 8.52 billion by 2032, at a CAGR of 5.2% during the forecast period

- This growth is driven by factors such as increasing demand for energy-efficient coatings, stringent environmental regulations, and the expansion of applications in automotive, aerospace, and electronics sectors.

Low Temperature Coating Market Analysis

- Low temperature coatings are specialized materials designed to cure at lower temperatures (typically 100°C to 160°C), reducing energy consumption and enabling application on heat-sensitive substrates like plastics and composites.

- The demand for low temperature coatings is significantly driven by the global push for sustainability, as these coatings emit fewer volatile organic compounds (VOCs) and align with environmental regulations.

- Asia-Pacific is expected to dominate the low temperature coating market due to rapid industrialization, high demand from automotive and electronics sectors, and government initiatives promoting eco-friendly solutions.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by the growth of electric vehicle production and infrastructure development in countries like China and India.

- The powder-based coating segment is expected to dominate the market with a market share of approximately 30% in 2025, driven by its eco-friendliness, ease of application, and suitability for diverse industries.

Report Scope and Low temperature coating Market Segmentation

|

Attributes |

Low temperature coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Low temperature coating Market Trends

“Leveraging Advanced Material Innovations for Enhanced Sustainability and Performance”

- One of the prominent trend in the low temperature coating market is the integration of advanced materials, such as water-based and UV-curable coatings, to enhance sustainability and performance.

- These innovations improve coating durability, corrosion resistance, and energy efficiency, making them ideal for demanding applications in automotive, electronics, and medical devices.

- For instance, advanced powder coatings with low-VOC formulations are gaining traction for their ability to cure at lower temperatures, reducing energy costs and environmental impact in automotive and furniture applications.

- By leveraging material science advancements, the low temperature coating industry is moving toward more sustainable and high-performance solutions, addressing consumer and regulatory demands for environmentally friendly products.

Low temperature coating Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Eco-Friendly Coatings”

- The global emphasis on sustainability and energy efficiency is driving demand for low temperature coatings, which require less energy for curing and emit fewer VOCs compared to traditional coatings.

- These coatings are critical in industries like automotive and aerospace, where they protect heat-sensitive components, and in electronics, where they enhance the durability of printed circuit boards and semiconductors.

- Government regulations, such as those in the EU and U.S., are enforcing stricter environmental standards, further boosting the adoption of low temperature coatings.

For instance,

- The EU’s REACH regulation and China’s “Made in China 2025” initiative promote the use of eco-friendly coatings, increasing demand for low temperature solutions in automotive and infrastructure projects.

- The escalating global demand for energy-efficient and eco-friendly coatings, propelled by stringent environmental regulations and sustainability goals, is a pivotal force driving the low temperature coating market. By enabling reduced energy consumption and lower VOC emissions, these coatings align with the priorities of industries such as automotive, aerospace, and electronics, cementing their role as a cornerstone of sustainable manufacturing and fostering consistent market growth through 2032.

Opportunity

“Developing Advanced Low Temperature Coating Formulations for Emerging Applications”

- Innovate by developing specialized coatings with enhanced resistance to corrosion, extreme temperatures, and mechanical stress for applications in electric vehicles and renewable energy systems.

- Explore water-based and UV-curable coatings that offer superior environmental benefits and performance for electronics and medical device applications.

- Invest in coatings tailored for cryoelectronics and deep-sea exploration, where low temperature performance is critical.

For instance,

- in July 2024, a leading coating manufacturer introduced a new water-based low temperature coating for electric vehicle battery components, offering enhanced corrosion resistance and reducing curing energy by 20%. This innovation addresses the growing demand for sustainable coatings in the EV sector, creating a premium market opportunity.

- The opportunity to develop advanced low temperature coating formulations for emerging applications, such as electric vehicles, renewable energy systems, and cryoelectronics, presents a transformative pathway for market expansion. By innovating specialized coatings with enhanced performance characteristics, manufacturers can capture premium market segments, address evolving industry needs, and position low temperature coatings as critical enablers of next-generation sustainable technologies.

Restraint/Challenge

“High Costs and Technical Limitations of Low Temperature Coatings”

- The high cost of developing and applying low temperature coatings, particularly for large-scale or thin-film applications, can limit adoption, especially among SMEs.

- Technical challenges, such as longer curing times for large components and unsuitability for ultra-thin applications, pose barriers to market growth.

For instance,

- The furniture manufacturer planning to switch to low temperature coatings for wooden panels may face increased production costs due to the need for specialized equipment and longer curing times. This could lead them to retain traditional coatings or explore alternative materials, impacting market growth.

- Price volatility of raw materials, such as resins and additives, further complicates cost management, necessitating diversified sourcing and innovation to maintain competitiveness.

Low temperature coating Market Scope

The global low temperature coating market is segmented into three notable segments based on deployment type, enterprise size and component.

|

Segmentation |

Sub-Segmentation |

|

By Deployment Type |

|

|

By Enterprise Size |

|

|

By Component |

|

In 2025, the cloud is projected to dominate the market with a largest share in product form segment

The cloud segment is expected to dominate the low temperature coating market with a share of approximately 50.41% in 2025, driven by its scalability, cost-effectiveness, and ability to integrate with digital manufacturing systems. The rise of cloud-based coating management solutions enhances real-time monitoring and application efficiency.

The Small and Medium Enterprises (SMEs) segment is expected to account for the largest share during the forecast period in low temperature coating market

In 2025, the Small and Medium Enterprises (SMEs) segment is expected to dominate the market with the largest market share of 63.97% due to owing to the flexibility, affordability, and ease of adoption of low temperature coatings in small-scale manufacturing, furniture, and electronics applications.

Low temperature coating Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Low temperature coating Market”

- Asia-Pacific dominates the low temperature coating market, driven by rapid industrialization, infrastructure development, and strong manufacturing activity in countries like China, India, and Japan.

- China holds a significant share due to its massive consumption in automotive, electronics, and renewable energy sectors, supported by government initiatives like “Made in China 2025.”

- The increasing adoption of electric vehicles and green technologies further fuels market growth across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Low temperature coating Market”

- The Asia-Pacific region is expected to witness the highest growth rate, with a CAGR of over 6%, driven by booming manufacturing, infrastructure investments, and the shift toward sustainable coatings.

- China and India are key markets due to their extensive investments in electric vehicles, renewable energy, and electronics manufacturing.

- Japan’s focus on technological innovation drives demand for advanced low temperature coating formulations for high-performance applications.

Low temperature coating Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- PPG Industries, Inc. (U.S.)

- Axalta Coating Systems (U.S.)

- The Sherwin-Williams Company (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Hempel A/S (Denmark)

- Vitracoat America (U.S.)

- Forrest Technical Coatings (U.S.)

- Specialty Polymer Coatings, Inc. (Canada)

- Bowers Industrial (U.S.)

- Tulip Paints (India)

Latest Developments in Global Low temperature coating Market

- In June 2024, PPG Industries, Inc. unveiled a groundbreaking UV-curable low temperature coating specifically designed for automotive plastics, launched to cater to the rapidly expanding electric vehicle (EV) market. This innovative coating offers a remarkable 30% reduction in curing times compared to traditional coatings, significantly boosting manufacturing efficiency. Additionally, it provides enhanced durability, ensuring long-lasting protection for heat-sensitive automotive components. The product aligns with the growing demand for sustainable and high-performance solutions in the EV sector, reinforcing PPG’s leadership in eco-friendly coating technologies.

- In March 2024, Axalta Coating Systems announced a strategic partnership with a globally recognized electronics manufacturer to develop an advanced water-based low temperature coating tailored for semiconductor applications. This cutting-edge coating reduces volatile organic compound (VOC) emissions by an impressive 25%, contributing to environmental sustainability and compliance with stringent regulations. By optimizing curing processes, the coating also enhances production efficiency, enabling faster throughput and improved performance in semiconductor manufacturing. This collaboration underscores Axalta’s commitment to innovative, eco-conscious solutions for the electronics industry.

- In November 2023, The Sherwin-Williams Company introduced a state-of-the-art powder-based low temperature coating designed specifically for furniture applications, addressing the need for sustainable manufacturing practices. Launched to meet the European Union’s stringent environmental regulations, this coating reduces curing energy consumption by 15%, lowering operational costs and carbon footprints for manufacturers. Its robust formulation ensures high durability and aesthetic appeal, making it ideal for wooden and composite furniture, while supporting the industry’s shift toward greener production methods.

- In August 2023, Akzo Nobel N.V. significantly expanded its production capacity for low temperature coatings at its advanced manufacturing facility in China, responding to surging demand from the automotive and renewable energy sectors. This strategic investment enhances the company’s ability to deliver high-performance, eco-friendly coatings that cater to the unique needs of electric vehicle production and renewable energy infrastructure. The expansion strengthens Akzo Nobel’s market presence in Asia-Pacific, positioning it as a key supplier in the region’s rapidly growing industrial landscape.

- In February 2023, Hempel A/S announced a collaboration with a renewable energy firm to develop corrosion-resistant low temperature coatings for offshore wind turbine components, enhancing durability in harsh marine environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Low Temperature Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Low Temperature Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Low Temperature Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.