Global Low Noise Amplifier Lna Market

Market Size in USD Billion

CAGR :

%

USD

1.10 Billion

USD

2.30 Billion

2024

2032

USD

1.10 Billion

USD

2.30 Billion

2024

2032

| 2025 –2032 | |

| USD 1.10 Billion | |

| USD 2.30 Billion | |

|

|

|

|

Low Noise Amplifier Market Size

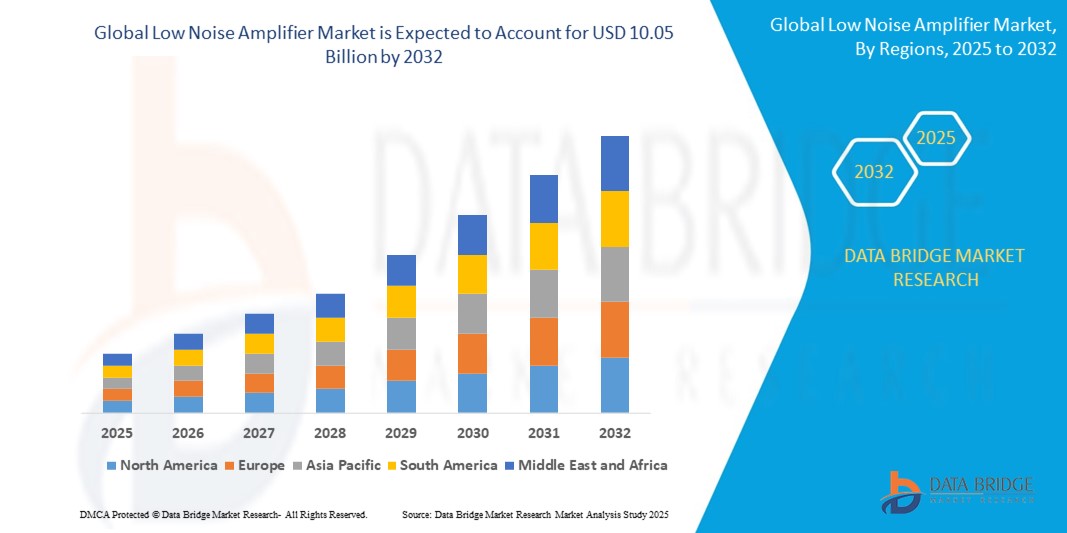

- The global Low Noise Amplifier Market size was valued at USD 3.20 billion in 2024 and is expected to reach USD 10.05 billion by 2032, at a CAGR of 13.6% during the forecast period

- This growth is driven by factors such as the Expansion of 5G Networks, Proliferation of IoT Devices, and Developments in Semiconductor Materials

Low Noise Amplifier Market Analysis

- The low noise amplifier is an electronic amplifying device that increases weak and low-power sound wave signals received through an antenna. It increases the power of both the signal and the noise present at its input without significantly degrading its signal-to-noise ratio.

- It is highly used in end-use industries such as medical, and automotive, military and defense.

- Asia-Pacific region dominates the low noise amplifier market due to rising adoption of consumer electronics devices like wearable devices, smartphones, tablets and laptops during the forecast period.

- The North America region is projected to undergo substantial during the forecast period due to the shift toward higher-speed mobile technology and a higher growing range of mobile services consumed within the region.

- 6 Hz to 60 Hz segment is expected to dominate the market with a market share of 48.67% due to its widespread use in low-frequency applications such as seismic data acquisition, medical instrumentation, and audio systems, where low noise and high signal fidelity are critical for performance and accuracy.

Report Scope and Low Noise Amplifier Market Segmentation

|

Attributes |

Low Noise Amplifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Low Noise Amplifier Market Trends

“Rising Demand in High-Frequency Communication & Space Applications”

- A significant trend shaping the LNA market is the increasing deployment of LNAs in high-frequency and high-precision communication systems, such as 5G networks, satellite communication, and aerospace systems.

- These applications require signal clarity over long distances and in environments with significant interference, making low-noise performance essential.

- LNAs are now being engineered with newer semiconductor materials like Gallium Nitride (GaN) and Silicon Germanium (SiGe), which offer better thermal stability and higher gain.

- For instance, in space missions and satellite ground stations, LNAs are used to amplify faint signals received from orbiting satellites or deep-space probes, ensuring signal integrity even in extremely low-noise environments.

- These technological advancements are not only enhancing system performance but also opening new doors for LNA applications in advanced wireless and aerospace industries.

Low Noise Amplifier Market Dynamics

Driver

“Expanding Global 5G Infrastructure”

- The widespread rollout of 5G infrastructure is a major driver for the LNA market growth.

- 5G technology operates on higher frequencies and requires sensitive, low-noise amplification to maintain signal strength and clarity.

- LNAs play a critical role in reducing noise and boosting weak signals in base stations, small cells, and user devices.

For instance,

- As telecom operators increase 5G network coverage in urban and suburban areas, they install LNAs in receivers to manage high-speed data transmission and connectivity performance.

- This rapid technological shift is increasing the volume demand for LNAs across both developed and emerging markets.

Opportunity

“Rising Adoption of 5G and Beyond”

- With 5G networks expanding globally and early research into 6G already underway, there's a strong opportunity for LNAs to play a critical role in enabling high-speed, low-latency communication.

- These amplifiers are vital for processing weak signals at millimeter-wave frequencies, which are common in 5G infrastructure.

For instance,

- Telecom operators rolling out 5G base stations need LNAs to boost signal quality in densely populated urban areas. Consumer devices like smartphones and tablets rely on LNAs for consistent connectivity in high-speed mobile networks.

Restraint/Challenge

“High Development and Component Costs”

- Despite their critical role in modern electronics, LNAs come with high development and production costs due to advanced fabrication processes and materials.

- This becomes a significant barrier, especially for small-scale manufacturers or industries in budget-sensitive regions.

- Additionally, maintaining quality and minimizing noise while optimizing for power and size adds to the design complexity and cost burden.

For instance,

- In countries where R&D investment is limited, telecommunication or aerospace programs may struggle to adopt the latest LNA technologies due to high unit prices and licensing costs.

- These cost factors can restrict market penetration and slow the adoption of LNAs in emerging technologies and developing economies.

Low Noise Amplifier Market Scope

The market is segmented on the basis frequency, material, application and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Frequency |

|

|

Material |

|

|

Application |

|

|

Vertical |

|

In 2025, the 6 Hz to 60 Hz is projected to dominate the market with a largest share in segment

In 2025, the 6 Hz to 60 Hz frequency range is expected to dominate the market, holding the largest share of 48.67%. This frequency range is critical in various applications, particularly in industrial and consumer electronics. It serves a broad range of low-to-medium frequency applications, including audio systems, communication devices, and certain medical equipment. The demand for these devices continues to rise as the need for low-noise performance becomes more vital. Industries are increasingly relying on these frequencies for applications requiring stable and clear signal processing. Additionally, the affordability and versatility of equipment in this range make it a preferred choice in many sectors. This segment’s significant share reflects its well-established role across multiple industries, making it the dominant force in the market.

The Greater than 60hertz is expected to account for the largest share during the forecast period in market

The frequency range greater than 60 Hz is projected to account for 44.78% of the market share during the forecast period, showcasing its significant growth potential. This segment covers a range of high-frequency applications, including telecommunications, satellite communications, and high-end audio systems. As demand for advanced technologies increases, this frequency range plays a crucial role in applications that require greater signal clarity and stability over long distances. The adoption of 5G networks and other high-speed data transmission technologies relies heavily on frequencies above 60 Hz to maintain signal integrity and efficiency. High-performance electronics and wireless systems, such as radars, sensors, and medical imaging, also require these higher frequencies for improved functionality. The expansion of space exploration and satellite communication systems further drives the demand for high-frequency LNAs.

Low Noise Amplifier Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Low Noise Amplifier Market”

- Asia-Pacific holds the largest share in the Low Noise Amplifier (LNA) market, driven by several factors. The region is home to some of the world’s leading electronics manufacturers, including China, Japan, South Korea, and Taiwan, which are major consumers of LNAs in various applications.

- The rapid growth of 5G infrastructure and the ongoing expansion of telecommunication networks in countries like China and India are fueling the demand for LNAs, which are crucial for maintaining signal quality in high-frequency communication systems.

- Additionally, the booming electronics industry, particularly in consumer electronics like smartphones and IoT devices, relies heavily on LNAs for clear and noise-free signal transmission.

- The automotive sector in Asia-Pacific is also a key contributor, as advanced driver-assistance systems (ADAS) and autonomous vehicles require LNAs to process signals from radar and other sensors.

“North America is Projected to Register the Highest CAGR in the Low Noise Amplifier Market”

- North America is projected to register the highest Compound Annual Growth Rate (CAGR) in the Low Noise Amplifier (LNA) market, driven by several key factors. The region is experiencing significant advancements in 5G deployment, with the U.S. at the forefront of this transformation. LNAs are essential for ensuring the clarity and reliability of signals in high-speed 5G networks, contributing to their growing demand in North America.

- Additionally, the increasing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) in the U.S. and Canada is creating a surge in demand for LNAs in automotive radar systems. The aerospace and defense industries, which are major contributors to the North American economy, also heavily rely on LNAs for satellite communications, secure transmissions, and space exploration applications.

- With the growing emphasis on connected devices, the Internet of Things (IoT), and smart cities, the need for high-performance LNAs to manage large amounts of data and signals continues to rise. North American companies are also leading in technological innovation, further driving the demand for low-noise amplification solutions in new applications like healthcare, industrial automation, and consumer electronics.

Low Noise Amplifier Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NXP Semiconductors,

- Analog Devices, Inc.,

- Infineon Technologies AG,

- L3Harris Narda-MITEQ,

- Qorvo, Inc.,

- Skyworks Solutions, Inc.,

- Semiconductor Components Industries, LLC.,

- Panasonic Corporation,

- Sage Millimeter, Inc.,

- Texas Instruments Incorporated,

- Teledyne Defense Electronics,

- Custom MMIC Design Services, Inc.,

- Macom,

- Technical Solutions Holdings, Inc.,

- Qotana Technologies Co., Ltd.,

- Norsat International Inc.,

- B&Z Technologies,

- PSEMI Corporation,

- Broadcom

Latest Developments in Global Low Noise Amplifier Market

- In March 2024 Teledyne e2v HiRel introduced the TDLNA2050SEP, a rad-tolerant S-band LNA developed on a 90 nm enhancement-mode pHEMT process. It offers a gain of 17.5 dB from 2 GHz to 5 GHz, a noise figure of less than 0.4 dB, and an output power of 19.5 dBm. This device is ideal for space and radar applications requiring low noise and minimal power consumption.

- In March 2025 MACOM unveiled its new Opto-Amp product line at SATELLITE 2025, aimed at enhancing optical connectivity between satellites and ground stations. The line features output power ranges from 10–50W, offering leading power efficiency and compact size to meet the growing demand for satellite communications.

- In July 2024 Teledyne e2v HiRel released two enhanced plastic VHF to S-band LNAs: the TDLNA2050EP and TDLNA0430EP. Developed on a 250 nm pHEMT process, these LNAs provide exceptional performance with low noise figures and minimal power consumption, suitable for military and industrial applications.

- In June 2024 Teledyne e2v HiRel announced the TDLNA0840SEP, a UHF to S-band LNA developed on a 150 nm pHEMT process. This device offers ultra-low power consumption and low noise figure, making it ideal for new space applications requiring high reliability.

- In September 2023 Teledyne e2v HiRel introduced the TDLNA002093SEP, a rad-tolerant L- and S-band LNA developed on a 0.15 μm InGaAs pHEMT technology. It delivers a gain of 21 dB from 1 GHz to 6 GHz with a noise figure of less than 0.37 dB, suitable for space and radar applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Low Noise Amplifier Lna Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Low Noise Amplifier Lna Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Low Noise Amplifier Lna Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.