Global Blood Culture Test Market

Market Size in USD Billion

CAGR :

%

USD

5.50 Billion

USD

8.77 Billion

2024

2032

USD

5.50 Billion

USD

8.77 Billion

2024

2032

| 2025 –2032 | |

| USD 5.50 Billion | |

| USD 8.77 Billion | |

|

|

|

|

Blood Culture Test Market Size

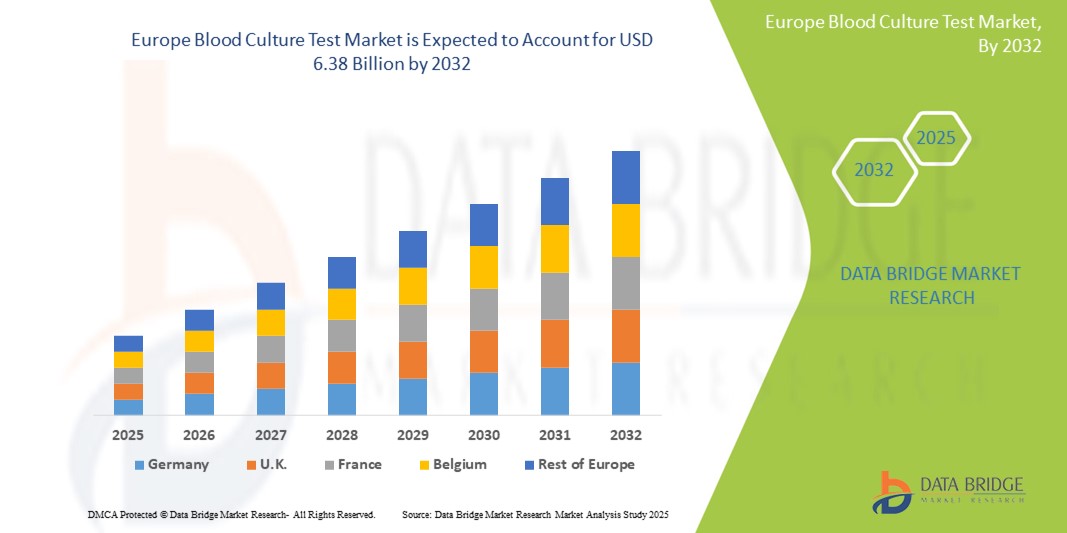

- The global blood culture test market size was valued at USD 5.50 billion in 2024 and is expected to reach USD 8.77 billion by 2032, at a CAGR of 6.00% during the forecast period

- This growth is driven by factors such as the increasing prevalence of bloodstream infections and sepsis, advancements in rapid diagnostic technologies, rising healthcare expenditure, and growing demand for early and accurate infection detection

Blood Culture Test Market Analysis

- A blood culture test is a diagnostic procedure used to detect the presence of bacteria or fungi in the bloodstream

- It involves drawing blood samples under sterile conditions and incubating them in a laboratory to see if any microorganisms grow. This test helps identify bloodstream infections (sepsis) and guides appropriate treatment with antibiotics or antifungals

- North America is expected to dominate the blood culture tests market with 40.63% due to well-established healthcare infrastructure and advanced diagnostic capabilities

- Asia-pacific is expected to be the fastest growing region in the blood culture test market during the forecast period due to significant demand for blood culture tests driven by increasing infection rates and healthcare advancements

- Consumables segment is expected to dominate the market with a market share of 59.4% due to its growing number of blood culture tests, rising incidence of infectious diseases, and growing awareness about the benefits of the procedure are major factors responsible for market dominance

Report Scope and Blood Culture Test Market Segmentation

|

Attributes |

Blood Culture Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Blood Culture Test Market Trends

“Rise of Automated and Rapid Diagnostic Technologies”

- Manual blood culture methods are being replaced by automated systems such as BD BACTEC FX and bioMérieux BacT/ALERT VIRTUO, which offer faster and more accurate detection

- Molecular diagnostics such as T2Bacteria Panel reduce detection time to 3–5 hours, eliminating the need for culture in some cases

- Hospitals in the US and Europe are increasingly investing in automated microbiology labs for efficiency and better infection control

- COVID-19 accelerated adoption of rapid diagnostic tools due to increased demand for fast and reliable infection testing

- This trend supports early intervention for sepsis, helping reduce mortality and treatment costs

Blood Culture Test Market Dynamics

Driver

“High Global Burden of Sepsis and Bloodstream Infections”

- Blood culture tests are the clinical standard for identifying bloodstream infections and guiding antibiotic therapy

- Increasing HAIs due to invasive procedures and antibiotic resistance has raised the demand for reliable testing

- Healthcare systems now integrate these tests in sepsis management bundles and quality metrics for reimbursement

Opportunity

“Growth Potential in Emerging Markets”

- Countries such as India, Brazil, and Indonesia are investing in healthcare infrastructure and diagnostics to reduce infection-related mortality

- Programs such as India’s Ayushman Bharat are expanding access to testing and enabling adoption of advanced technologies

- Local manufacturing and public-private partnerships are reducing costs and boosting availability of blood culture tests

- Asia-Pacific is projected to have the highest market growth rate due to rising income and government support

- Low diagnostic penetration in these regions makes them highly receptive to affordable, rapid test innovations

Restraint/Challenge

“High Cost of Automated Systems in Low-Income Regions”

- Advanced systems such as BD and bioMérieux’s automated platforms are expensive and unaffordable for many low-resource settings

- Costs include not only equipment but also consumables, software, training, and maintenance, creating a financial barrier

- Rural and public healthcare systems often rely on outdated manual methods due to lack of funds and skilled staff

- Regions such as Sub-Saharan Africa and South Asia face critical diagnostic delays and mismanagement due to cost constraints

- Until more affordable and decentralized systems are widely implemented, diagnostic inequality will persist globally

Blood Culture Test Market Scope

The market is segmented on the basis of method, product, technology, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Method |

|

|

By Product |

|

|

By Technology |

|

|

By Application |

|

|

By End-User |

|

In 2025, the consumables is projected to dominate the market with a largest share in product segment

The consumables segment is expected to dominate the blood culture test market with the largest share of 59.4% in 2025 due to its growing number of blood culture tests, rising incidence of infectious diseases, and growing awareness about the benefits of the procedure are major factors responsible for market dominance. Technological advancements and existing product enhancements are anticipated to offer a favorable environment for segment growth.

The conventional/manual methods is expected to account for the largest share during the forecast period in method market

In 2025, the conventional/manual methods segment is expected to dominate the market with the largest market share of 64.2% due to its extensive use in hospitals, pathology laboratories, and clinical laboratories. Furthermore, an increasing number of research & development activities to develop efficient blood culture tests is expected to drive market growth.

Blood Culture Test Market Regional Analysis

“North America Holds the Largest Share in the Blood Culture Test Market”

- North America accounted for 40.63% of the global blood culture tests market. This dominance is attributed to a well-established healthcare infrastructure and advanced diagnostic capabilities

- The region experiences a significant burden of bloodstream infections, this high incidence drives demand for effective diagnostic tools such as blood culture tests.

- North America is at the forefront of technological innovations in blood culture testing, including automated systems that reduce turnaround times and improve accuracy

- Government-funded programs and initiatives aimed at improving infection control and management contribute to market growth. For example, funding from agencies such as BARDA supports the development of advanced diagnostic technologies, which are crucial for timely infection diagnosis

- Favorable reimbursement policies in countries such as the U.S. and Canada encourage healthcare providers to adopt advanced diagnostic tools, further bolstering market growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Blood Culture Test Market”

- The Asia Pacific region is expected to exhibit the highest compound annual growth rate reflecting a significant demand for blood culture tests driven by increasing infection rates and healthcare advancements

- The region faces a growing incidence of bloodstream infections, including sepsis and hospital-associated infections.

- For instance, the World Health Organization estimates that around 49 million people suffer from sepsis globally each year, with a substantial number of cases occurring in Asia Pacific

- Countries such as China and India are investing heavily in healthcare infrastructure and diagnostics, which enhances the capacity for early diagnosis and treatment of infectious diseases. This investment is crucial as the region aims to improve healthcare outcomes

- Increased awareness among healthcare professionals about the importance of accurate diagnosis of bloodstream infections is leading to greater acceptance and utilization of blood culture tests in clinical settings

- Government initiatives and partnerships with key market players are enhancing the accessibility to medical care, boosting the expansion of the market in the Asia-Pacific region

Blood Culture Test Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Eli Lilly and Company (U.S.)

- Terumo Corporation (Japan)

- Bruker (U.S.)

- BIOMÉRIEUX (France)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Siemens Healthcare Private Limited (Germany)

- Danaher Corporation (U.S.)

- ZEPTOMETRIX (U.S.)

- CytoTest Inc. (U.S.)

- Devyser (Sweden)

Latest Developments in Global Blood Culture Test Market

- In March 2023, T2 Biosystems, Inc. announced its plan to add Candida Auris detection technology to its existing T2Candida panel. The company has already received FDA and CE approval for its T2Candida panel

- In April 2023, Bruker Corporation introduced MALDI Biotyper IVD Software. The new software provides a high sample throughput for microbial identification. The software is used in a variety of clinical settings, including hospitals, clinics, and reference laboratories

- In October 2022, BD and Magnolia Medical Technologies partnered with one another to provide cutting-edge technology to hospitals across the U.S. in their efforts to mitigate blood culture contaminations. This partnership enabled the companies to enhance their customer base

- In May 2022, BD and science-first healthcare tech company Babson Diagnostics, through the formation of a strategic agreement increased the company's reach by bringing blood sample collection into the modern healthcare environment. Through this partnership, patients would be able to obtain blood samples at home, making diagnostic testing more convenient. It is anticipated that these changes will provide a profitable environment for industry expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.