Saudi Arabia Architectural Glass Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2024 –2031 | |

| USD 2.85 Billion | |

| USD 3.98 Billion | |

|

|

|

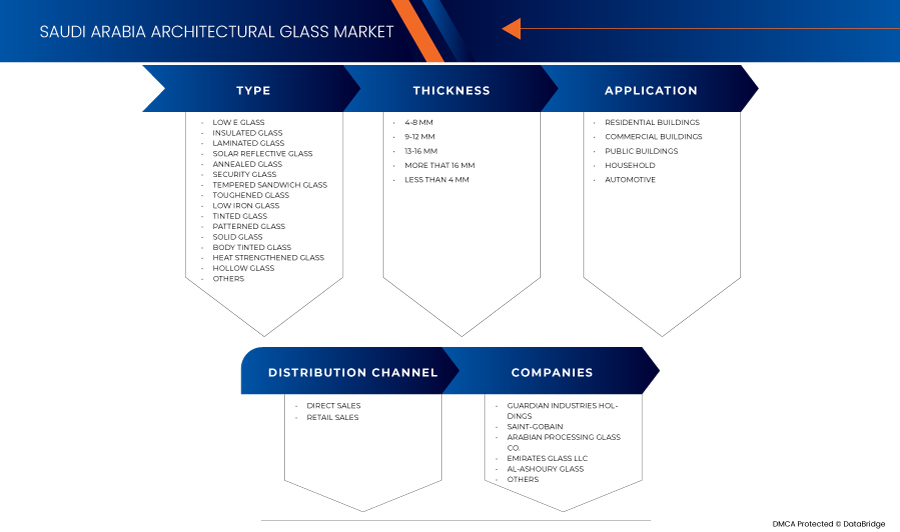

>Segmentação do mercado de vidro arquitetónico da Arábia Saudita, por tipo (vidro low e, vidro isolado , vidro laminado, vidro reflexivo solar, vidro recozido, vidro de segurança, vidro sanduíche temperado, vidro temperado, vidro com baixo teor de ferro, vidro colorido , vidro estampado, vidro maciço, Vidro colorido corporal, vidro reforçado termicamente, vidro oco e outros), espessura (4-8 MM, 9-12 MM, 13-16 MM, mais de 16 MM e menos de 4 MM), aplicação (edifícios residenciais, edifícios comerciais, Edifícios Públicos, Residenciais e Automóveis), Canal de Distribuição (Vendas Diretas e Vendas a Retalho) – Tendências e Previsões do Setor para 2031.

Análise do mercado de vidro arquitetónico

O vidro arquitetónico tem um rápido crescimento e os avanços tecnológicos levaram a opções de vidro energeticamente eficientes, como vidros isolados e de baixa emissividade, transformando ainda mais as possibilidades arquitetónicas. Hoje, o vidro arquitetónico desempenha um papel crucial no design moderno, combinando a estética com a sustentabilidade. Impulsionando assim o crescimento do mercado na Arábia Saudita.

Tamanho do mercado de vidro arquitetónico

O tamanho do mercado de vidro arquitetónico da Arábia Saudita foi avaliado em 2,85 mil milhões de dólares em 2023 e deverá atingir 3,98 mil milhões de dólares até 2031, crescendo com um CAGR de 4,3% durante o período de previsão de 2024 a 2031.

Tendências do mercado de vidro arquitetónico

“Rápida Urbanização e Desenvolvimento de Infraestruturas”

A rápida urbanização e o amplo desenvolvimento das infraestruturas são impulsionadores significativos do mercado do vidro arquitetónico, moldando o panorama da construção e do design modernos na região. À medida que o Reino continua a diversificar a sua economia para longe da dependência do petróleo, projectos de grande escala no âmbito de iniciativas como a Visão Saudita 2030 catalisaram um aumento do desenvolvimento urbano.

Um dos aspectos-chave desta urbanização é o crescimento das megacidades e dos centros urbanos, particularmente em cidades como Riade, Jeddah e Dammam. O aumento da população e a procura de habitação, espaços comerciais e infra-estruturas públicas estão a impulsionar a tendência crescente para soluções arquitectónicas modernas, onde o vidro arquitectónico desempenha um papel crucial. As fachadas de vidro não são apenas esteticamente agradáveis, mas também melhoram a funcionalidade dos edifícios, permitindo a entrada de luz natural, melhorando a eficiência energética e proporcionando isolamento térmico.

Âmbito do relatório e segmentação de mercado

|

Atributos |

Principais insights do mercado de vidro arquitetónico |

|

Segmentos cobertos |

· Por tipo : Vidro Low E, Vidro isolado, Vidro laminado , Vidro reflexivo solar, Vidro recozido, Vidro de segurança, Vidro sanduíche temperado, Vidro temperado, Vidro com baixo teor de ferro, Vidro colorido, Vidro estampado, Vidro sólido, Vidro colorido corporal, Reforçado pelo calor Vidro, Vidro Oco e Outros. · Por Espessura : 4-8 MM, 9-12 MM, 13-16 MM, Mais de 16 MM e Menos de 4 MM · Por Aplicação : Edifícios Residenciais, Edifícios Comerciais, Edifícios Públicos, Residenciais e Automóveis · Por Canal de Distribuição : Vendas Directas e Vendas a Retalho |

|

País coberto |

Arábia Saudita |

|

Principais participantes do mercado |

Guardian Industries Holdings (EUA), Saint-Gobain (França), ARABIAN PROCESSING GLASS CO. (Arábia Saudita), Emirates Glass LLC (EAU), Al-Ashoury Glass (Arábia Saudita), AGC Obeiken Glass (Arábia Saudita), Al Andalus Glass (Arábia Saudita), Alma (Arábia Saudita), IKKGlass (Arábia Saudita), Rawom Trading Company (Arábia Saudita) e REGIONGLASS (Arábia Saudita) |

|

Oportunidades de mercado |

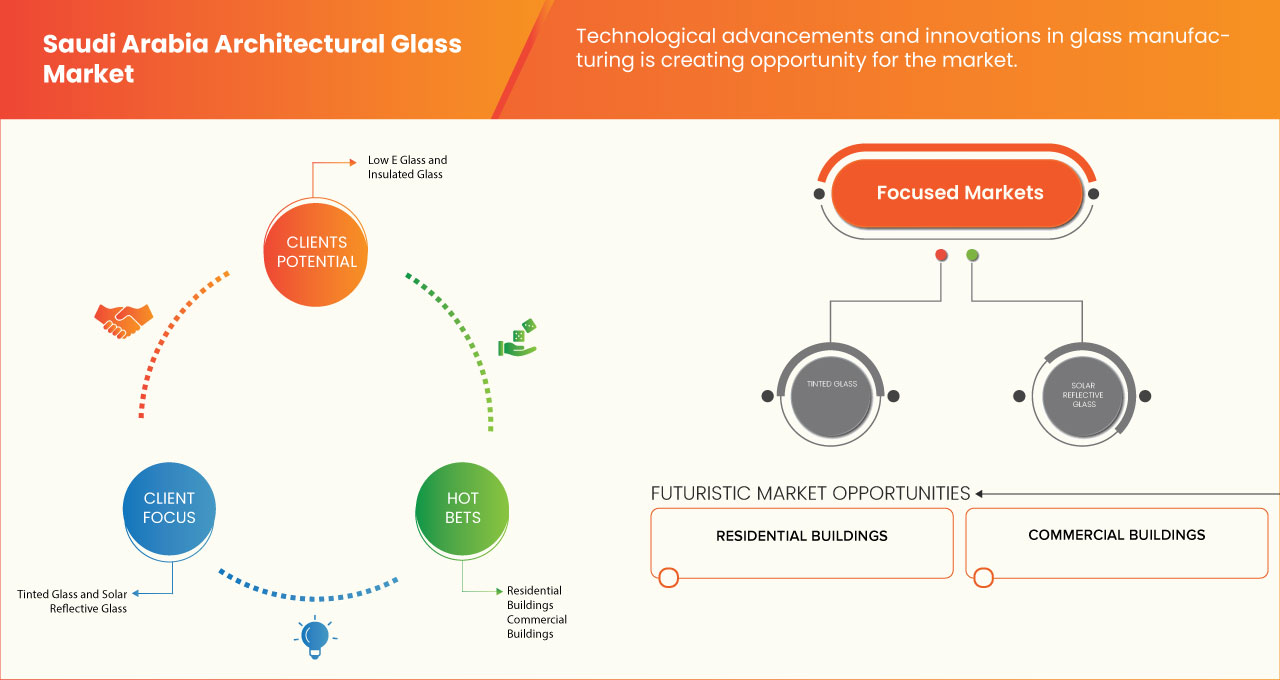

· Crescentes iniciativas governamentais para o desenvolvimento urbano · Avanços tecnológicos e inovações no fabrico de vidro |

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção , análise de consumo de produção, análise de tendências de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória |

Definição de mercado de vidro arquitetónico

O vidro arquitetónico é uma categoria de vidro concebida especificamente para utilização na construção e design de edifícios, combinando finalidades funcionais e estéticas. Este tipo de vidro inclui vários formatos, como vidro temperado, laminado e isolado, cada um adaptado para satisfazer necessidades específicas. Por exemplo, o vidro temperado é tratado termicamente para aumentar a sua resistência e segurança, sendo ideal para áreas de tráfego intenso e fachadas. O vidro laminado, com as suas múltiplas camadas e intercamadas, proporciona maior segurança e isolamento acústico, enquanto as Unidades de Vidro Isolado (IGUs) melhoram a eficiência energética, minimizando a transferência de calor entre os ambientes interiores e exteriores.

Para além dos seus benefícios práticos, o vidro arquitetónico também contribui para o apelo visual de um edifício, oferecendo opções de clareza, cor, textura e padrões para criar diversos efeitos de design e melhorar a iluminação natural. No geral, o vidro arquitetónico desempenha um papel crucial no projeto de edifícios modernos, atendendo tanto aos requisitos de desempenho como às considerações estéticas.

Dinâmica do mercado do vidro arquitetónico

Motoristas

- Aumento do foco nas metas de sustentabilidade e nas iniciativas de construção verde

The Saudi Arabian architectural glass market is experiencing significant growth, primarily driven by the rising focus on sustainability goals and green building initiatives. As the nation moves towards a more sustainable future, architectural glass plays a crucial role in enhancing energy efficiency, reducing carbon footprints, and promoting environmentally friendly building practices. One of the key drivers for the architectural glass market is its inherent ability to improve energy efficiency in buildings. High-performance glass, such as low-emissivity (low-E) and triple-glazed units, can significantly reduce energy consumption by minimizing heat transfer. In a country like Saudi Arabia, where temperatures can soar, energy-efficient glazing helps maintain comfortable indoor environments, reducing the reliance on air conditioning systems. This not only lowers energy bills for consumers but also contributes to national efforts to reduce overall energy consumption, aligning with Saudi Vision 2030's goals.

For instance,

- In September 2024, according to an article by World Economic Forum, as global efforts to combat climate change intensify, innovative materials like low-emissivity (low-e) glass are crucial for sustainable construction. Buildings, responsible for 39% of global carbon emissions, benefit from low-e glass, which improves insulation and energy efficiency.

Rapidly Growing Tourism and Hospitality Industry

The architectural glass market in Saudi Arabia is experiencing significant growth, largely driven by the rapidly expanding tourism and hospitality industry. As the Kingdom continues to position itself as a leading global tourist destination, particularly following the launch of initiatives like Vision 2030, there is a heightened demand for innovative architectural solutions that reflect modern design aesthetics and enhance the visitor experience. Architectural glass plays a crucial role in the hospitality sector, as it offers numerous benefits that align with the needs of modern architectural design. Its ability to enhance natural light, improve energy efficiency, and provide aesthetic appeal makes it an ideal choice for hotels and resorts. Glass façades, for example, are increasingly popular for their ability to create a seamless connection between indoor and outdoor spaces, allowing guests to enjoy panoramic views of the surrounding landscapes, which is particularly appealing in a country known for its breathtaking desert and coastal scenery.

For instance,

- In May 2024, according to an article by Arab news, Saudi Arabia is rapidly developing its hospitality sector, leading the Middle East in hotel construction with over 42,000 new rooms in 2023. Initiatives like the sustainability-focused Four Seasons Amaala and NEOM's eco-friendly hotels reflect the Kingdom's Vision 2030 goal to integrate responsible tourism and environmental stewardship into its growth strategy.

Opportunities

- Technological Advancements and Innovations in Glass Manufacturing

Saudi Arabia's architectural glass market stands on the brink of significant transformation driven by technological advancements and innovations in glass manufacturing. With the nation's Vision 2030 initiative promoting diversification and sustainable development, there is a growing demand for high-performance glass solutions that enhance energy efficiency and aesthetic appeal in modern architecture. Innovations such as low-emissivity (low-E) coatings and advanced insulating glass units not only improve thermal performance but also contribute to reducing energy consumption, aligning with global sustainability trends. Furthermore, the introduction of smart glasses technologies, which can adjust transparency based on environmental conditions, offers architects unprecedented design flexibility while enhancing user comfort.

For instance,

In May 2024, an article published by Centuro Global stated that Vision 2030 aims to diversify Saudi Arabia's economy away from oil dependency, addressing looming peak oil predictions. Under Crown Prince MBS, the initiative also promotes social reforms, including cultural development. At its halfway point, progress is evident, yet challenges remain in fully achieving these ambitious goals.

- Rising Government Initiatives for Urban Development

Saudi Arabia's architectural glass market is poised for significant growth, driven by a surge in government initiatives focused on urban development. The Saudi’s Vision 2030 strategy emphasizes diversification and modernization, aiming to transform cities into sustainable, technologically advanced urban centers. This shift is generating increased demand for innovative architectural solutions, particularly in glass manufacturing, which plays a crucial role in enhancing both functionality and aesthetics in modern buildings. Government investments in mega-projects, such as NEOM and the Red Sea Project among many others, highlight the need for high-performance glass products that meet stringent sustainability standards. These projects prioritize energy efficiency, and architectural glass solutions such as low-emissivity (low-E) and insulating glass, which are essential for minimizing energy consumption and optimizing climate control. In addition, the trend towards smart cities incorporates advanced glass technologies that enable dynamic control of light and energy use, further aligning with national sustainability goals.

For instance,

- In October 2024, according to an article published by ScienceDirect, the article discusses advancements in sustainable architecture, emphasizing the integration of eco-friendly materials and energy-efficient technologies. It explores innovative design strategies that reduce environmental impact, enhance occupant comfort, and promote resource conservation. The research highlights the importance of sustainability in modern building practices and its role in addressing climate change challenges.

Restraints/Challenges

- Stringent Environmental Regulations and Building Safety Standards

The architectural glass market in Saudi Arabia faces significant challenges due to stringent environmental regulations and building safety standards. As the nation increasingly prioritizes sustainability, manufacturers and builders are required to comply with rigorous guidelines aimed at reducing environmental impact. While these regulations foster innovation in energy-efficient and sustainable glass products, they also impose constraints on production processes and materials, potentially raising costs for manufacturers. The demand for high-performance glass that meets new energy efficiency standards has become paramount. Low-emissivity (low-E) coatings and insulating glass units are now essential in architectural projects, as they help to minimize energy consumption and enhance thermal comfort. However, the development and integration of such advanced technologies require significant investment in research and development, which can be challenging for smaller companies.

For instances

- According to the document published from the Saudi Building Code National Committee, it outlines the Saudi Building Code, focusing on safety, sustainability, and efficiency in construction. It also establishes standards for various building types, addressing structural integrity, energy performance, and environmental impact. The code aims to enhance the quality of construction and promote responsible development within the kingdom’s urban planning framework.

Fluctuating Raw Material Prices

The architectural glass market in Saudi Arabia is significantly impacted by fluctuating raw material prices, posing substantial challenges for manufacturers and stakeholders. The volatility in the prices of key raw materials such as silica, soda ash, and other additives can disrupt production schedules and impact profit margins. As global demand for these materials fluctuates due to geopolitical tensions, economic conditions, and changes in trade policies, local manufacturers must navigate a complex landscape that complicates budgeting and forecasting. These price fluctuations are particularly concerning in a market striving for growth and sustainability. Manufacturers are under pressure to maintain competitive pricing while also investing in advanced technologies and sustainable practices to meet evolving consumer expectations and regulatory requirements. When raw material costs rise unexpectedly, it can lead to increased production costs, forcing manufacturers to either absorb these costs or pass them on to consumers, which may affect demand.

Climate Change Scenario

The Saudi Arabia architectural glass market faces harsh climate, characterized by extremely high temperatures, has a significant impact on the architectural glass market. Buildings in the region require substantial energy for cooling due to high solar heat gain through glass windows. Traditional glass products often fail to mitigate this heat gain effectively, leading to increased reliance on air conditioning systems. This not only raises energy consumption but also exacerbates the environmental impact by contributing to higher greenhouse gas emissions. The architectural glass market must address this challenge by focusing on products that enhance thermal insulation and reduce heat transfer.

Regulatory Framework Content

The architectural glass market in Saudi Arabia is influenced by a number of regulations, primarily driven by the government’s focus on energy efficiency, safety standards, and sustainability as part of its vision 2030 initiative. These regulations impact both manufacturers and importers of glass products, and compliance is mandatory for companies to participate in major construction projects.

Below is a detailed coverage of regulations and standards affecting the Saudi Arabia architectural glass market:

Saudi Standards, Metrology and Quality Organization (SASO):

- The Saudi Standards, Metrology, and Quality Organization (SASO) enforces technical standards for various products, including glass. SASO has developed standards for thermal insulation and solar heat gain, which glass manufacturers must comply with. These standards ensure that glass products contribute to energy-efficient buildings, aligning with the country's efforts to reduce carbon emissions

Saudi Energy Efficiency Program (SEEP):

- Saudi Arabia is committed to reducing energy consumption in buildings, and regulations under SEEP have led to the promotion of energy-efficient materials, including architectural glass. The use of Low-Emissivity (Low-E) and solar control glass has become increasingly important, as the government pushes for more sustainable building practices. Glass products must meet specific thermal performance standards that reduce energy usage in cooling buildings

Saudi Building Code (SBC):

- The Saudi Building Code (SBC) sets out regulations related to the safety, fire resistance, and structural integrity of materials used in construction, including glass. Manufacturers are required to produce safety glass (such as laminated or tempered glass) for use in critical areas like windows, facades, and skylights in commercial and residential buildings. The SBC also covers fire safety regulations, which stipulate the use of fire-rated glass in certain buildings, particularly in high-rise structures, hotels, and public spaces. Manufacturers and suppliers of glass are expected to provide certified fire-resistant glass that meets local safety standards.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Architectural Glass Market Scope

The market is segmented on the basis of type, thickness, application distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Low E Glass

- Insulated Glass

- Laminated Glass

- Solar Reflective Glass

- Annealed Glass

- Security Glass

- Tempered Sandwich Glass

- Toughened Glass

- Low Iron Glass

- Tinted Glass

- Patterned Glass

- Solid Glass

- Vidro colorido corporal

- Vidro Reforçado pelo Calor

- Vidro oco

- Outros

- Vidro Low E, por tipo

- Solar

- Passivo

- Vidro de segurança, por categoria

- Vidro à prova de bala

- Vidro à prova de fogo

- Vidro à prova de explosão

- Vidro à prova de ataque

- Outros

- Vidro Low E, por tipo

Grossura

- 4-8MM

- 9-12MM

- 13-16MM

- Mais de 16 milhões

- Menos de 4MM

Aplicação

- Edifícios Residenciais

- Edifícios Comerciais

- Edifícios Públicos

- Agregado familiar

- Automotivo

- Edifícios de habitação, por tipo de edifício

- Apartamentos multiníveis

- Apartamentos de um nível

- Condomínio

- Outros

- Edifícios de habitação, por uso final

- Windows

- Portas

- Corrimãos

- Varandas

- Claraboias

- Escadas

- Terraços

- Outros

- Edifícios de habitação, por cidades

- Riade

- Jidá

- Meca

- Droga

- Medina

- Khobar

- Tabuque

- Buraida

- Taif

- Al-Kharj

- Outros

- Edifícios Comerciais, Por Tipo de Edifício

- Escritório Corporativo

- Complexo Comercial

- Hotéis

- Hospitais

- Restaurantes

- Estação Ferroviária

- Aeroportos

- Salões e Spas

- Casas de Hóspedes

- Outros

- Edifícios comerciais, por utilização final

- Fachada

- Parede Cortina

- Dosséis

- Átrios

- Paredes da sala de conferências

- Escadas

- Terraços

- Outros

- Edifícios comerciais, por cidades

- Riade

- Jidá

- Meca

- Droga

- Medina

- Khobar

- Tabuque

- Buraida

- Taif

- Al-Kharj

- Outros

- Edifícios públicos, por tipo de edifício

- Tribunais/Centros Judiciais

- Quartel-General da Polícia

- Parlamento

- Edifício do Banco/Tesouro

- Edifícios de Investigação e Desenvolvimento (I&D)

- Edifícios de datacenter

- Correios

- Bases Militares

- Outros

- Edifícios públicos, por cidades

- Riade

- Jidá

- Meca

- Droga

- Medina

- Khobar

- Tabuque

- Buraida

- Taif

- Al-Kharj

- Outros

- Doméstico, por uso final

- Utensílios de cozinha

- Talheres

- Recipiente

- Automóvel, por uso final

- Pára-brisas

- Janela traseira

- Porta

- Teto solar

- Ventilação

- Porta, por tipo

- Frente

- Parte de trás

- Ventilação, por tipo

- Frente

- Parte de trás

- Edifícios de habitação, por tipo de edifício

Canal de distribuição

- Vendas Diretas

- Vendas no Retalho

- Retalho, por canal de distribuição

- Off-line

- Off-line, por canal de distribuição

- Distribuidores e Grossistas

- Empreiteiros e Fabricantes

- Retalhistas de vidros especiais

- Arquitetos e Designers

- Fabricantes de equipamento original

- Lojas de conveniência

- Outros

- Off-line, por canal de distribuição

- Online

- Online, por canal de distribuição

- Sites propriedade da empresa

- Sites de terceiros

- Online, por canal de distribuição

- Off-line

- Retalho, por canal de distribuição

Participação no mercado de vidro arquitetónico da Arábia Saudita

O cenário competitivo do mercado fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no país, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, largura e amplitude do produto, aplicação domínio. Os dados acima fornecidos estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de vidro arquitetónico que operam no mercado são:

- Guardian Industries Holdings (EUA)

- Saint Gobain (França)

- ARABIAN PROCESSING GLASS CO.

- Emirates Glass LLC (Emirados Árabes Unidos)

- Al-Ashoury Glass (Arábia Saudita)

- AGC Obeiken Glass (Arábia Saudita)

- Al Andalus Glass (Arábia Saudita)

- Alma (Arábia Saudita)

- IKKGlass (Arábia Saudita)

- Rawom Trading Company (Arábia Saudita)

- REGIONGLASS (Arábia Saudita)

Últimos desenvolvimentos no mercado do vidro arquitetónico

- Em setembro de 2022, a Saint-Gobain lançou o ORAÉ, o primeiro vidro de baixo carbono do mundo, apresentando uma notável redução de 42% na pegada de carbono através de 64% de conteúdo reciclado. Este produto inovador combina sustentabilidade com desempenho superior, tornando-o ideal para projetos arquitetónicos com eficiência energética e ambientalmente conscientes.

- Em Outubro de 2023, a Emirates Glass LLC anunciou que recebeu a certificação ICV (In-Country Value), sublinhando o seu compromisso com o crescimento económico e a diversificação dos EAU. Este reconhecimento destaca o foco da empresa em apoiar as indústrias locais, nutrir o talento e contribuir para uma economia sustentável e orientada para o conhecimento, afirmando o seu papel como parceiro fundamental no desenvolvimento do país.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.1.1 EXTREME TEMPERATURES AND ENERGY USE

4.3.1.2 HEAT ISLAND EFFECT

4.3.1.3 RESOURCE SCARCITY AND ENVIRONMENTAL IMPACT

4.3.1.4 WASTE AND RECYCLING

4.3.2 INDUSTRY RESPONSE

4.3.2.1 ADOPTION OF ENERGY-EFFICIENT GLASS

4.3.2.2 INNOVATIONS IN GLASS PRODUCTION

4.3.2.3 RECYCLING AND CIRCULAR ECONOMY

4.3.3 GOVERNMENT’S ROLE

4.3.3.1 REGULATORY FRAMEWORKS

4.3.3.2 SUPPORT FOR SUSTAINABLE INITIATIVES

4.3.3.3 ENVIRONMENTAL STANDARDS

4.3.4 ANALYST RECOMMENDATIONS

4.3.4.1 EMBRACE TECHNOLOGICAL ADVANCEMENTS

4.3.4.2 LEVERAGE RECYCLED MATERIALS

4.3.4.3 STRENGTHEN SUSTAINABILITY PRACTICES

4.3.4.4 COLLABORATE WITH GOVERNMENT AND INDUSTRY

4.3.5 CONCLUSION

4.4 PRICING ANALYSIS

4.4.1 RAW MATERIAL COSTS

4.4.2 ENERGY COSTS IMPACT

4.4.3 DEMAND-SUPPLY DYNAMICS

4.4.4 TRANSPORTATION AND LOGISTICS COSTS

4.4.5 REGULATORY AND ENVIRONMENTAL COMPLIANCE

4.4.6 CURRENCY EXCHANGE RATES

4.4.7 LABOR COSTS AND AVAILABILITY

4.4.8 COMPETITIVE LANDSCAPE

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 LOGISTICS COST SCENARIO

4.6.1.1 HIGH TRANSPORTATION AND HANDLING COSTS

4.6.1.2 IMPORT TARIFFS AND CUSTOMS DELAYS

4.6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6.2.1 SPECIALIZED TRANSPORT AND HANDLING

4.6.2.2 JUST-IN-TIME DELIVERY (JIT)

4.6.2.3 COLD CHAIN AND CLIMATE-CONTROLLED LOGISTICS

4.6.2.4 INTEGRATED LOGISTICS SOLUTIONS

4.6.3 TECHNOLOGICAL INNOVATIONS TO REDUCE LOGISTICS COSTS

4.6.3.1 DIGITAL SUPPLY CHAIN PLATFORMS

4.6.3.2 AUTOMATED WAREHOUSING

4.6.4 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS, BY MANUFACTURERS

4.7.1 LOW-EMISSIVITY (LOW-E) GLASS

4.7.2 SMART GLASS INTEGRATION

4.7.3 SOLAR CONTROL GLASS

4.7.4 LAMINATED SAFETY GLASS

4.7.5 INSULATED GLASS UNITS (IGUS)

4.8 VENDOR SELECTION CRITERIA

4.9 RAW MATERIAL COVERAGE

4.9.1 KEY RAW MATERIALS FOR ARCHITECTURAL GLASS

4.9.2 SOURCING AND SUPPLY CHAIN CONSIDERATIONS

4.9.3 CHALLENGES AND OPPORTUNITIES

4.9.4 CONCLUSION

5 REGULATION COVERAGE

5.1 DOOR AND WINDOW MANUFACTURERS AND CURTAIN WALL COMPANIES

5.2 LARGE CHINESE COMPANIES UNDERTAKING PROJECTS IN SAUDI ARABIA

5.2.1 CHINA’S CSCEC SAUDI CONSTRUCTION CONTRACT

5.2.2 ADIT TUNNEL PROJECT FOR SAUDI ARABIA'S FUTURISTIC CITY NEOM BY CHINA RAILWAY CONSTRUCTION CORPORATION (CRCC):

5.2.3 CHINA RAILWAY CONSTRUCTION CORPORATION (CRCC) APPOINTED AS PRIMARY CONTRACTOR FOR JEDDAH CENTRAL STADIUM PROJECT:

5.2.4 THE SHEBALA ISLAND DREDGING AND RECLAMATION PROJECT LED BY CCCC'S SUBSIDIARY CHEC

5.2.5 SAUDI NEOM PROJECT CONTRACT ACQUIRED BY FCC CONSTRUCTION:

5.2.6 CHINA HARBOR BAY MIDDLE EAST REGIONAL MANAGEMENT CENTER WON FOUR CONSECUTIVE BIDS FOR PROJECTS IN SAUDI ARABIA

5.2.7 CHINA MACHINERY ENGINEERING CORPORATION AWARDED THE CONTRACT FOR 20,000 RESIDENTIAL UNITS

5.2.8 POWERCHINA’S CONSTRUCTION PROJECT FOR SAUDI MEGA-YARD

5.3 LOCATIONS TO SETUP A GLASS PROCESSING FACTORY

5.3.1 KEY DETAILS ON MACHINERY AND INVESTMENTS:

5.4 NEW CONSTRUCTIONS IN SAUDI ARABIA

5.4.1 SECTOR-WISE CONSTRUCTION BREAKDOWN AND IMPACT ON ARCHITECTURAL GLASS MARKET

5.4.1.1 RESIDENTIAL CONSTRUCTION (2024-2031)

5.4.1.2 COMMERCIAL CONSTRUCTION (2024-2031)

5.4.1.3 PUBLIC BUILDINGS CONSTRUCTION (2024-2031)

5.4.2 IMPACT ON THE ARCHITECTURAL GLASS MARKET FOR 2025-2030

5.4.3 KEY CONSTRUCTION PROJECTS CONTRIBUTING TO ARCHITECTURAL GLASS DEMAND

5.4.3.1 NEOM

5.4.3.2 KING SALMAN PARK

5.4.3.3 QIDDIYA ENTERTAINMENT CITY

5.4.3.4 RED SEA PROJECT

5.4.3.5 JEDDAH TOWER

5.4.3.6 RIYADH METRO

5.4.3.7 DIRIYAH GATE DEVELOPMENT

5.4.3.8 AMAALA

5.4.3.9 KING ABDULLAH FINANCIAL DISTRICT (KAFD)

5.5 QUALITY AND IMPORT VOLUME OF PROCESSED GLASS

5.5.1 SIGNIFICANT INCREASE IN IMPORT VOLUME OF PROCESSED GLASS PRODUCTS (2021-2023)

5.5.2 QUALITY COMPARISON: IMPORTED PROCESSED GLASS VS. LOCAL PRODUCTION

5.6 TOP TEN GLASS DEEP-PROCESSING COMPANIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.2 RISING FOCUS ON SUSTAINABILITY GOALS AND GREEN BUILDING INITIATIVES

6.1.3 RAPIDLY GROWING TOURISM AND HOSPITALITY INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS OF ADVANCED ARCHITECTURAL GLASSES

6.2.2 STIFF COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN GLASS MANUFACTURING

6.3.2 RISING GOVERNMENT INITIATIVES FOR URBAN DEVELOPMENT

6.4 CHALLENGES

6.4.1 STRINGENT ENVIRONMENTAL REGULATIONS AND BUILDING SAFETY STANDARDS

6.4.2 FLUCTUATING RAW MATERIAL PRICES

7 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE

7.1 OVERVIEW

7.2 LOW E GLASS

7.3 INSULATED GLASS

7.4 LAMINATED GLASS

7.5 SOLAR REFLECTIVE GLASS

7.6 ANNEALED GLASS

7.7 SECURITY GLASS

7.8 TEMPERED SANDWICH GLASS

7.9 TOUGHENED GLASS

7.1 LOW IRON GLASS

7.11 TINTED GLASS

7.12 PATTERNED GLASS

7.13 SOLID GLASS

7.14 BODY TINTED GLASS

7.15 HEAT STRENGTHENED GLASS

7.16 HOLLOW GLASS

7.17 OTHERS

8 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 4-8 MM

8.3 9-12 MM

8.4 13-16 MM

8.5 MORE THAN 16 MM

8.6 LESS THAN 4 MM

9 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL BUILDINGS

9.3 COMMERCIAL BUILDINGS

9.4 PUBLIC BUILDINGS

9.5 HOUSEHOLD

9.6 AUTOMOTIVE

10 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 RETAIL SALES

11 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 GUARDIAN INDUSTRIES HOLDINGS

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 SAINT-GOBAIN

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 ARABIAN PROCESSING GLASS CO.

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATES

13.4 EMIRATES GLASS LLC

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 AL-ASHOURY GLASS

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATES

13.6 AGC OBEIKAN GLASS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 AL ANDALUS GLASS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ALMA

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 IKKGLASS

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 RAWOM TRADING COMPANY

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 REGIONGLASS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 DOOR AND WINDOW MANUFACTURERS AND CURTAIN WALL COMPANIES

TABLE 3 SETTING UP A GLASS PROCESSING FACTORY IN SAUDI ARABIA

TABLE 4 IMPORT VOLUME OF ARCHITECTURAL GLASS IN SAUDI ARABIA (THOUSAND SQUARE METERS)

TABLE 5 PROCESSING VOLUME OF TOP 10 GLASS DEEP PROCESSING COMPANIES IN THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET:

TABLE 6 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (THOUSAND SQ.MT)

TABLE 8 SAUDI ARABIA LOW E GLASS IN ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 SAUDI ARABIA SECURITY GLASS IN ARCHITECTURAL GLASS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 10 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY THICKNESS, 2022-2031 (USD THOUSAND)

TABLE 11 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 12 SAUDI ARABIA RESIDENTIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY BUILDING TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 SAUDI ARABIA RESIDENTIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 14 SAUDI ARABIA RESIDENTIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY CITIES, 2022-2031 (USD THOUSAND)

TABLE 15 SAUDI ARABIA COMMERCIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY BUILDING TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 SAUDI ARABIA COMMERCIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 17 SAUDI ARABIA COMMERCIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY CITIES, 2022-2031 (USD THOUSAND)

TABLE 18 SAUDI ARABIA PUBLIC BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY BUILDING TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 SAUDI ARABIA PUBLIC BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY CITIES, 2022-2031 (USD THOUSAND)

TABLE 20 SAUDI ARABIA HOUSEHOLD IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 21 SAUDI ARABIA AUTOMOTIVE IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 22 SAUDI ARABIA DOOR IN ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 SAUDI ARABIA VENT IN ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 25 SAUDI ARABIA RETAIL SALES IN ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 26 SAUDI ARABIA OFFLINE IN ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 27 SAUDI ARABIA ONLINE IN ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

Lista de Figura

FIGURE 1 SAUDI ARABIA ARCHITECTURAL GLASS MARKET

FIGURE 2 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: MULTIVARIATE MODELLING

FIGURE 7 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: SEGMENTATION

FIGURE 12 SIXTEEN SEGMENTS COMPRISE THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT ARE EXPECTED TO DRIVE THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET IN THE FORECAST PERIOD..

FIGURE 16 LOW E GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/SQUARE METER)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS: SAUDI ARABIA ARCHITECTURAL GLASS MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR SAUDI ARABIA ARCHITECTURAL GLASS MARKET

FIGURE 23 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY TYPE, 2023

FIGURE 24 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY THICKNESS, 2023

FIGURE 25 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY APPLICATION, 2023

FIGURE 26 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 27 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.