Dominican Republic And The Caribbean Islands Mushroom Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2024 –2031 | |

| USD 192.79 Million | |

| USD 236.79 Million | |

|

|

|

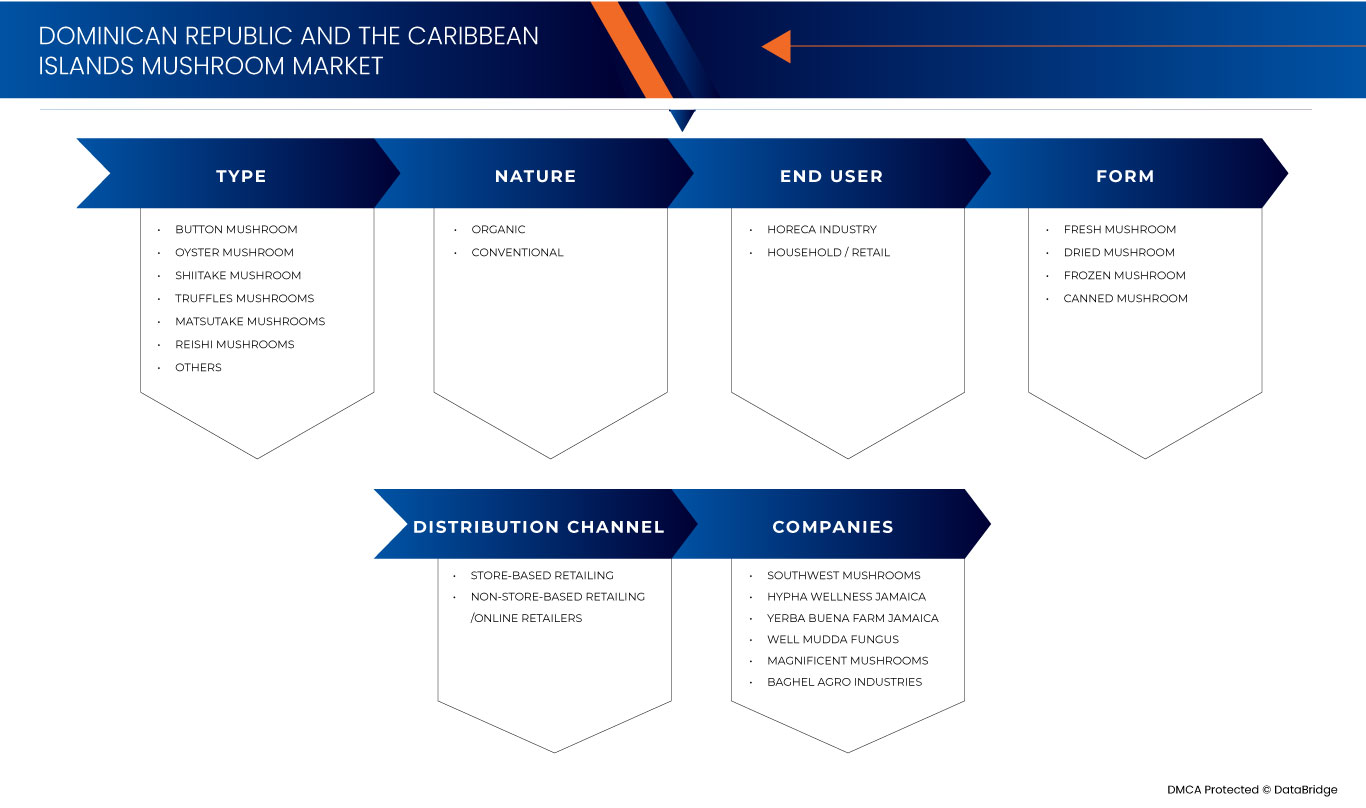

>Segmentação do mercado de cogumelos na República Dominicana e nas Ilhas das Caraíbas, por tipo (cogumelo botão, cogumelo ostra , cogumelo shiitake, cogumelos trufa, cogumelos matsutake, cogumelos reishi e outros), forma (cogumelo fresco, cogumelo seco, cogumelo congelado e cogumelo enlatado ) , Natureza (Biológico e Convencional), Aplicação (Indústria Horeca e Doméstico/Retalho), Canal de Distribuição (Retalho em Loja e Retalho Não-Loja/Retalhistas Online) – Tendências e Previsões do Sector para 2031.

Análise do mercado de cogumelos

A República Dominicana e as Ilhas das Caraíbas possuem um mercado crescente de cogumelos, impulsionado pela crescente consciencialização sanitária e pela procura de produtos biológicos. O clima favorável da região apoia o cultivo diversificado de cogumelos, especialmente variedades como a ostra e o shiitake. O consumo local está a aumentar, complementado pelo turismo, o que impulsiona a procura na restauração e hotelaria. As oportunidades de exportação estão a expandir-se, especialmente para os EUA e a Europa, alimentadas pela tendência global para dietas baseadas em vegetais. No entanto, os desafios incluem infra-estruturas limitadas, acesso à tecnologia e concorrência das importações. No geral, o mercado apresenta um potencial significativo de crescimento e investimento em práticas sustentáveis.

Tamanho do mercado de cogumelos

O tamanho do mercado de cogumelos da República Dominicana e das Ilhas das Caraíbas foi avaliado em 192,79 milhões de dólares em 2023 e deverá atingir os 236,79 milhões de dólares até 2031, com um CAGR de 2,77% durante o período de previsão de 2024 a 2031. Para além dos cenários de perspetiva sobre o mercado, como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research incluem também a análise especializada aprofundada, a análise de preços, análise de quota de marca, inquérito ao consumidor, análise demográfica, análise da cadeia de oferta, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e enquadramento regulamentar.

Tendências do mercado de cogumelos

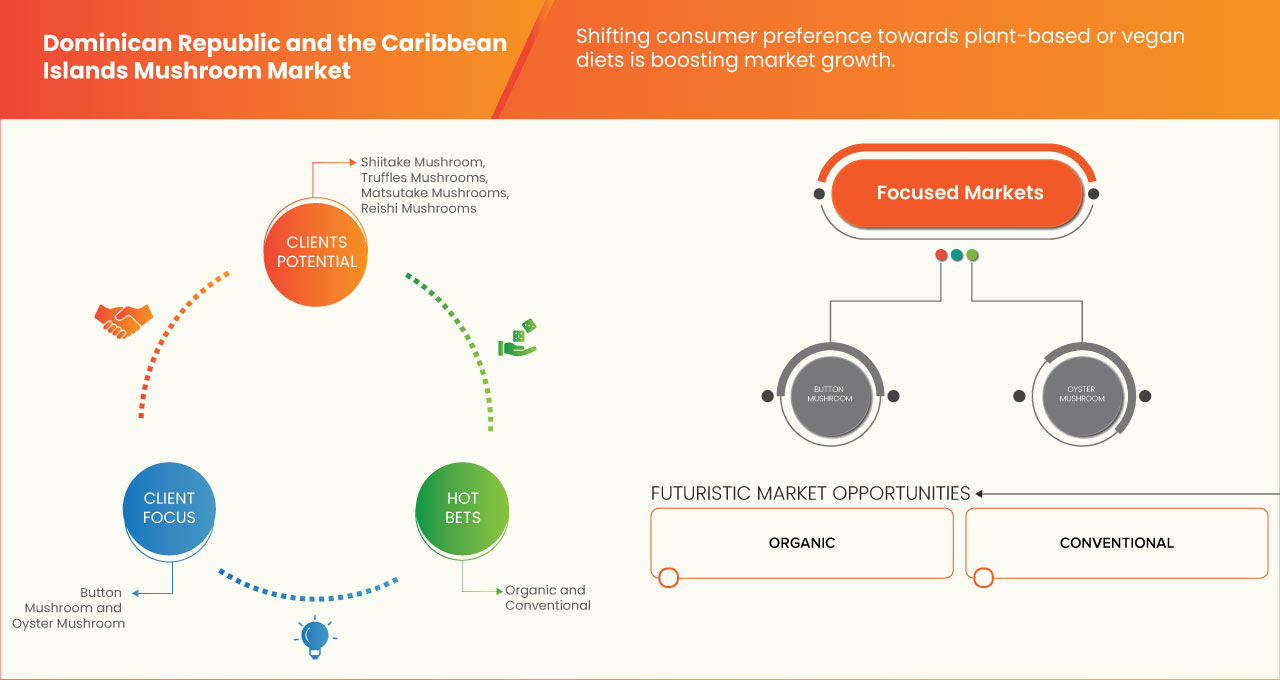

“Mudando a preferência do consumidor por dietas vegetais ou veganas”

A crescente preferência dos consumidores por dietas vegetais e veganas na República Dominicana e nas Ilhas das Caraíbas está a tornar-se uma força significativa que impulsiona o mercado dos cogumelos. À medida que aumenta a consciencialização sobre as preocupações ambientais e de saúde, muitas pessoas optam por alternativas aos produtos de origem animal , e os cogumelos estão a emergir como um substituto chave devido aos seus benefícios nutricionais, versatilidade culinária e sustentabilidade. Na região das Caraíbas, as tendências de saúde e bem-estar registaram uma mudança notável em direção à alimentação baseada em vegetais . Os cogumelos, ricos em vitaminas, minerais, fibras e antioxidantes, oferecem uma fonte natural de nutrição com poucas calorias. A ausência de colesterol e gordura nos cogumelos torna-os particularmente atractivos para os consumidores preocupados com a saúde que procuram reduzir o consumo de alimentos processados ou de origem animal. Isto é especialmente verdade nas áreas urbanas, onde a consciência alimentar e a procura por opções alimentares mais saudáveis estão a crescer.

Âmbito do relatório e segmentação do mercado de cogumelos

|

Atributos |

Principais insights do mercado de cogumelos |

|

Segmentos cobertos |

|

|

Países abrangidos |

República Dominicana, Jamaica, Cuba, Haiti, Porto Rico, Dominica, Bahamas, Barbados, Antígua e Barbuda, Hispaniola e Resto das Ilhas das Caraíbas |

|

Principais participantes do mercado |

Southwest Mushrooms (EUA), Hypha Wellness Jamaica (Ilhas das Caraíbas), Yerba Buena Farm Jamaica (Ilhas das Caraíbas), Well Mudda Fungus (Ilhas das Caraíbas), Magnificent Mushrooms (Ilhas das Caraíbas) e Baghel Agro Industries (Índia) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre cenários de mercado, tais como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research incluem também análises especializadas aprofundadas, análise de preços, análise de quota de marca, inquérito ao consumidor, análise demográfica, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e enquadramento regulamentar. |

Definição do mercado de cogumelos

Um cogumelo é o corpo de frutificação carnudo e com esporos de um fungo, normalmente crescendo acima do solo ou na sua fonte de alimento. Mais comummente associados a fungos do género Agarics, como o cogumelo de botão branco, os cogumelos existem em vários formatos, tamanhos e cores. Podem ser comestíveis, medicinais ou tóxicos. Os cogumelos comestíveis, como o shiitake, a ostra e o portobello, são valorizados pelo seu rico conteúdo nutricional, fornecendo vitaminas, minerais, antioxidantes e proteínas. Os cogumelos desempenham também um papel ecológico essencial na decomposição da matéria orgânica. O mercado dos cogumelos abrange o cultivo, colheita, processamento, distribuição e venda de cogumelos comestíveis e medicinais.

Dinâmica do Mercado dos Cogumelos

Motoristas

- Expansão das Práticas Agrícolas Sustentáveis e Aumento do Apoio Governamental ao Agronegócio

O mercado de cogumelos da República Dominicana e das Ilhas das Caraíbas está preparado para um crescimento substancial, impulsionado pela expansão de práticas agrícolas sustentáveis e pelo aumento do apoio governamental ao agronegócio. À medida que a procura global de cogumelos continua a aumentar, estes factores desempenham um papel crucial na definição da dinâmica do mercado na região, contribuindo para o seu desenvolvimento como um sector agrícola chave.

A agricultura sustentável está a ganhar impulso na República Dominicana e nas Ilhas das Caraíbas, à medida que tanto os agricultores locais como as partes interessadas internacionais reconhecem a necessidade de práticas agrícolas respeitadoras do ambiente. O cultivo de cogumelos está perfeitamente alinhado com os princípios da sustentabilidade, uma vez que requer menos recursos como a água e a terra em comparação com as culturas tradicionais. Os cogumelos também podem ser cultivados numa variedade de ambientes, incluindo subprodutos agrícolas reaproveitados, o que promove ainda mais métodos agrícolas circulares. Este apelo à sustentabilidade impulsionou a adopção da cultura de cogumelos tanto nas pequenas explorações agrícolas como nas empresas comerciais, oferecendo benefícios ambientais e económicos às comunidades locais.

Por exemplo,

- Em Março de 2024, de acordo com um artigo publicado pela CS Global Partners, o Projecto de Actividades de Melhoria da Produtividade Agrícola das Caraíbas (CAPA) na Dominica representa uma expansão significativa das práticas agrícolas sustentáveis e um apoio crescente do governo ao agronegócio . Com um investimento de 5,3 milhões de dólares da USAID, a CAPA centra-se no reforço da segurança alimentar, no aumento da produção dos pequenos agricultores e na ligação dos agricultores aos mercados nacionais e regionais. Ao dar prioridade às principais culturas e ao mobilizar fundos do Programa Cidadania através do Investimento, a CAPA está a modernizar as técnicas agrícolas e a promover o crescimento económico. Esta iniciativa não só capacita os agricultores locais com tecnologias avançadas, como também reforça a resiliência das comunidades contra as alterações climáticas, garantindo um sector agrícola mais sustentável e próspero.

Aumento da consciencialização do consumidor sobre os benefícios dos cogumelos para a saúde

The growing consumer awareness of the health benefits associated with mushrooms is playing a significant role in driving the market. As health-conscious consumers become more informed about nutrition and wellness, mushrooms are increasingly recognized for their rich nutrient profile, medicinal properties, and versatility in various culinary applications. This heightened awareness is fueling demand across multiple segments of the market, including fresh produce, dietary supplements, functional foods, and plant-based alternatives. Mushrooms offer a unique combination of essential nutrients, including vitamins, minerals, antioxidants, and bioactive compounds that support overall health. They are particularly valued for their high content of vitamin D, vitamin B, selenium, and potassium, which are known to enhance immune function, energy metabolism, and general well-being. In addition, mushrooms are low in calories, rich in plant-based proteins, and a good source of dietary fiber, making them an attractive option for individuals focused on maintaining a healthy diet. These attributes have also made mushrooms popular among vegetarians, vegans, and those seeking alternative protein sources.

Furthermore, many mushroom varieties, such as shiitake, reishi, and maitake, are known for their medicinal properties, which include immune-boosting effects, anti-inflammatory benefits, and antioxidant activity. This has led to an increase in demand not only for fresh mushrooms but also for mushroom-based products such as powders, extracts, and supplements. Consumers are now incorporating mushroom-derived supplements into their daily routines as natural remedies for immune support, stress reduction, and cognitive enhancement. Varieties like lion’s mane and cordyceps, for instance, are gaining popularity for their role in improving mental clarity, focus, and physical performance.

For instance,

- In May 2024, according to an article published by Springer Nature, mushroom is renowned for their nutritional richness, and culinary versatility are consumed and valued. With abundant crude fiber, protein, vitamins, and minerals, coupled with low fat and calorie content alongside zero starch, mushrooms offer a high-quality carbohydrate source that enhances human health. This nutritional profile positions mushrooms as an indispensable dietary staple, driving their cultivation and consumption worldwide.

Opportunities

- Growing Demand for Functional Foods

Functional foods, which provide health benefits beyond basic nutrition, are increasingly sought after due to rising consumer awareness about health and wellness. This trend is driving interest in natural, nutrient-rich products, positioning mushrooms as an important food in the market. Mushrooms are known for their diverse health benefits, including immune support, antioxidant properties, and potential anti-inflammatory effects. Varieties such as shiitake, reishi, and lion’s mane are particularly popular among health-conscious consumers. This aligns perfectly with the rising global trend of incorporating more plant-based foods into diets, providing a lucrative avenue for local producers.

The Caribbean’s unique climate and biodiversity make it an ideal region for mushroom cultivation. The Dominican Republic, with its favorable growing conditions, can leverage this advantage to boost local production. By investing in sustainable farming practices and technology, local farmers can enhance yield and quality, meeting the increasing demand for fresh and organic mushrooms. Moreover, the region can capitalize on the export market. As international demand for functional foods continues to rise, Caribbean-grown mushrooms can find a place in health food stores and specialty markets worldwide. Establishing partnerships with distributors and retailers in North America and Europe could further expand market reach.

For instance,

- In June 2022, according to an article published by American Chemical Society, interest in mushrooms as functional ingredients has surged over the time due to their low fat and high fiber and protein content. They are natural sources of beneficial compounds such as ergosterol, polyphenols, and mannitol. While mushrooms have been incorporated into meat- and starch-based food formulations with varying success, their technological and functional roles in food applications—especially in the growing meat-free, clean-label market—remain underexplored. This review presents current scientific data on the unique attributes of mushrooms, their significance in the food industry, and opportunities for developing innovative, protein-rich mushroom-based foods.

Growth of Organized Retail Chains and Supermarkets

As consumer preferences shift towards convenient shopping experiences, organized retail offers a structured platform for introducing and promoting diverse products, including mushrooms. Supermarkets and retail chains are increasingly focusing on fresh produce, organic options, and health-focused foods. This trend aligns perfectly with the growing demand for functional foods, where mushrooms are gaining popularity due to their nutritional benefits. The accessibility of organized retail outlets allows consumers to easily discover and purchase a variety of mushrooms, from traditional to exotic types, thus expanding the market.

Moreover, organized retail chains often emphasize quality and sustainability, which are critical factors for today’s health-conscious consumers. By sourcing locally grown mushrooms, these retailers can support regional agriculture while ensuring freshness and quality. This can create a win-win scenario, as consumers benefit from high-quality products, and local farmers gain a reliable market for their produce. The presence of established supermarket chains also facilitates effective marketing strategies. Retailers can engage in promotional campaigns, sampling events, and educational initiatives to raise awareness about the health benefits of mushrooms. Highlighting mushrooms as a versatile ingredient in various cuisines can stimulate consumer interest and encourage greater usage in everyday cooking.

For instance,

- In June 2023, according to an article published by Hausman & Associates, retail has evolved significantly, especially post-pandemic, with the emergence of the "community store" concept. This approach focuses on creating deeper connections with local customers through engaging events and experiences that go beyond simple transactions. Retailers are reimagining their spaces to attract visitors, fostering brand loyalty by becoming community hubs. This shift allows retailers to stand out in a competitive market, encouraging customer loyalty and positive community relations, ultimately transforming shopping into an engaging social experience.

Restraints/Challenges

- Climate Challenges in Dominican Republic and the Caribbean Islands

Climate challenges significantly impact the mushroom market in the Dominican Republic and the Caribbean Islands, threatening both production and sustainability. The region faces several environmental issues, including rising temperatures, increased rainfall variability, and the heightened risk of hurricanes, all of which pose distinct challenges for mushroom cultivation. Mushrooms are sensitive to environmental conditions, particularly temperature and humidity. Rising temperatures can disrupt the optimal growing conditions required for various mushroom species. Many varieties thrive in cooler environments, and as climate change leads to higher average temperatures, producers may struggle to maintain the necessary conditions for growth. This can result in reduced yields and lower-quality products, ultimately affecting market supply.

In addition, increased rainfall variability poses risks to mushroom cultivation. Excessive rainfall can lead to waterlogging and fungal diseases, which can devastate crops. On the other hand, periods of drought can hinder the moisture levels necessary for mushroom production. This unpredictability makes it difficult for farmers to plan their cultivation cycles, leading to uncertainty in both production and income.

For instance,

- In October 2022, according to an article published by Elsevier B.V., climate change significantly affects human health in the Caribbean, particularly among vulnerable populations in tropical small island developing states.

Insufficient Cold Storage and Transportation Facilities

Mushrooms are highly perishable products that require specific temperature and humidity conditions to maintain freshness and quality. Without adequate cold chain logistics, the risk of spoilage increases, leading to substantial losses for producers and reduced availability for consumers. One of the primary issues is the lack of reliable cold storage infrastructure. Many farmers operate on a small scale and lack access to modern facilities that can preserve their harvests. Without proper storage, mushrooms can deteriorate rapidly, losing both their nutritional value and market appeal. This not only impacts local sales but also limits the potential for exporting mushrooms to international markets, where quality standards are stringent.

Transportation is another critical concern. Many regions in the Caribbean face logistical challenges, including poorly maintained roads and limited access to refrigerated transport. This makes it difficult for farmers to deliver fresh mushrooms to markets promptly. Delays in transportation can result in further spoilage, leading to financial losses for producers and a diminished reputation for local products. Consumers are increasingly seeking high-quality, fresh options, and any compromise in quality can drive them to prefer imported mushrooms instead.

For Instance,

According to an article published by Blue Cold Refrigeration Pvt. Ltd., Blue Cold Refrigeration specializes in cold room systems for mushroom cultivation, ensuring faster, fresher, and firmer growth. A high-humidity environment with moderate airflow is crucial for preserving mushrooms, which are 85-90% water. Key factors contributing to weight loss include transpiration, respiration, improper storage temperatures (ideally 0-4 °C with 95% RH), inadequate packing, and poor handling. Recommendations to reduce weight loss include proper packing, careful handling, rapid cooling to 3 °C, maintaining high humidity, and using protective methods such as antioxidant coatings.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Mushroom Market Scope

The market is segmented on the basis of type, form, nature, application and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Button Mushroom

- Oyster Mushroom

- Shiitake Mushroom

- Truffles Mushrooms

- Matsutake Mushrooms

- Reishi Mushrooms

- Others

Form

- Fresh Mushroom

- Dried Mushroom

- Frozen Mushroom

- Canned Mushroom

Nature

- Organic

- Conventional

Application

- Horeca Industry

- Horeca Industry, By Type

- Restaurants

- Restaurants, By Type

- Quick Service Restaurants

- Dining Restaurants

- Ghost Restaurants (Delivery Only Restaurants)

- Hotel

- Bars and Clubs

- Cafes

- Catering Services

- Others

- Restaurants, By Type

- Household/Retail

Distribution Channel

- Store Based Retailing

- Store Based Retailers, By Type

- Supermarkets / Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

- Non-Store Retailing/Online Retailers

- Non-Store Retailers, By Type

- Company Owned

- Third Party

Mushroom Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, on the basis of type, form, nature, application and distribution channel as referenced above.

The countries covered in the market are Dominican Republic, Jamaica, Cuba, Haiti, Puerto Rico, Dominica, The Bahamas, Barbados, Antigua and Barbuda, Hispaniola, and Rest of the Caribbean Islands.

Dominican Republic is expected to dominate the market due to several key factors. First, the country has a more developed agricultural infrastructure compared to other islands, enabling efficient cultivation and distribution of mushrooms. This includes access to advanced farming techniques and technology that enhance yield and quality.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Mushroom Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Mushroom Market Leaders Operating in the Market Are:

- Cogumelos do Sudoeste (EUA)

- Hypha Wellness Jamaica (Ilhas Caribenhas)

- Quinta Yerba Buena Jamaica (Ilhas Caribenhas)

- Bem, Mudda Fungus (Ilhas das Caraíbas)

- Cogumelos Magníficos (Ilhas das Caraíbas)

- Baghel Agro Industries (Índia)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 PRICING ANALYSIS

4.3 BRAND OUTLOOK

4.3.1 MAGNIFICENT MUSHROOMS

4.3.2 WELL MUDDA FUNGUS

4.3.3 SOUTHWEST MUSHROOMS

4.3.4 HYPHA WELLNESS JAMAICA

4.3.5 YERBA BUENA FARM JAMAICA

4.4 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.5 GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.6.1 CANNED MUSHROOMS

4.6.2 FUTURE PERSPECTIVE

4.7 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.7.1 MAGNIFICENT MUSHROOMS

4.7.2 WELL MUDDA FUNGUS

4.7.3 SOUTHWEST MUSHROOMS

4.7.4 HYPHA WELLNESS JAMAICA

4.7.5 YERBA BUENA FARM JAMAICA

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL INNOVATIONS IN PROCESSING METHODS

4.9.1 COLD CHAIN LOGISTICS

4.9.2 MODIFIED ATMOSPHERE PACKAGING (MAP)

4.9.3 DEHYDRATION AND FREEZE-DRYING

4.9.4 BLOCKCHAIN TECHNOLOGY

4.1 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFTING CONSUMER PREFERENCE TOWARDS PLANT-BASED OR VEGAN DIETS

5.1.2 RISING CONSUMER AWARENESS OF THE HEALTH BENEFITS OF MUSHROOMS

5.1.3 EXPANSION OF SUSTAINABLE AGRICULTURE PRACTICES AND RISING GOVERNMENT SUPPORT FOR AGRIBUSINESS

5.2 RESTRAINTS

5.2.1 IMPACT OF MUSHROOM’S SHORT SHELF LIFE

5.2.2 HIGH PRODUCTION AND OPERATIONAL COSTS OF MUSHROOM CULTIVATION

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR FUNCTIONAL FOODS

5.3.2 GROWTH OF ORGANIZED RETAIL CHAINS AND SUPERMARKETS

5.4 CHALLENGES

5.4.1 CLIMATE CHALLENGES IN DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS

5.4.2 INSUFFICIENT COLD STORAGE AND TRANSPORTATION FACILITIES

6 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE

6.1 OVERVIEW

6.2 BUTTON MUSHROOMS

6.3 OYSTER MUSHROOMS

6.4 SHIITAKE MUSHROOMS

6.5 TRUFFLES MUSHROOMS

6.6 MATSUTAKE MUSHROOMS

6.7 REISHI MUSHROOMS

6.8 OTHERS

7 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY FORM

7.1 OVERVIEW

7.2 FRESH MUSHROOM

7.3 DRIED MUSHROOM

7.4 FROZEN MUSHROOM

7.5 CANNED MUSHROOM

8 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY NATURE

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HORECA INDUSTRY

9.2.1 RESTAURANTS, TYPE

9.3 HOUSEHOLD/RETAIL

10 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE-BASED RETAILING

10.3 NON-STORE-BASED RETAILING /ONLINE RETAILERS

11 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET

11.1 DOMINICAN REPUBLIC

11.2 THE CARIBBEAN ISLANDS

11.2.1 JAMAICA

11.2.2 CUBA

11.2.3 HAITI

11.2.4 PUERTO RICO

11.2.5 DOMINICA

11.2.1 THE BAHAMAS

11.2.2 BARBADOS

11.2.3 ANTIGUA AND BARBUDA

11.2.4 HISPANIOLA

11.2.5 REST OF CARIBBEAN ISLANDS

12 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SOUTHWEST MUSHROOMS

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 HYPHA WELLNESS JAMAICA

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 YERBA BUENA FARM JAMAICA

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 WELL MUDDA FUNGUS

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 MAGNIFICENT MUSHROOMS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 BAGHEL AGRO INDUSTRIES

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 3 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 4 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 6 HORECA INDUSTRY IN DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 7 RESTAURANTS IN DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 9 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 11 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY REGION, 2022-2031 (TONS)

TABLE 13 DOMINICAN REPUBLIC MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 15 DOMINICAN REPUBLIC MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 16 DOMINICAN REPUBLIC MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 17 DOMINICAN REPUBLIC MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 DOMINICAN REPUBLIC HORECA INDUSTRY IN REPUBLIC HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 DOMINICAN REPUBLIC RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 DOMINICAN REPUBLIC MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 21 DOMINICAN REPUBLIC STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 DOMINICAN REPUBLIC NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 24 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 25 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 26 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 27 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 28 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 29 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 30 THE CARIBBEAN ISLANDS HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 THE CARIBBEAN ISLANDS RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 32 THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 33 THE CARIBBEAN ISLANDS STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 THE CARIBBEAN ISLANDS NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 35 JAMAICA MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 JAMAICA MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 37 JAMAICA MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 38 JAMAICA MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 39 JAMAICA MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 40 JAMAICA HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 JAMAICA RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 JAMAICA MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 43 JAMAICA STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 JAMAICA NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 CUBA MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 CUBA MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 47 CUBA MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 48 CUBA MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 49 CUBA MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 50 CUBA HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 CUBA RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 CUBA MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 53 CUBA STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 CUBA NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 HAITI MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 HAITI MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 57 HAITI MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 58 HAITI MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 59 HAITI MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 60 HAITI HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 HAITI RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 HAITI MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 63 HAITI STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 HAITI NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 PUERTO RICO MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 PUERTO RICO MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 67 PUERTO RICO MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 68 PUERTO RICO MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 69 PUERTO RICO MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 70 PUERTO RICO HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 PUERTO RICO RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 PUERTO RICO MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 73 PUERTO RICO STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 PUERTO RICO NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 DOMINICA MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 DOMINICA MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 77 DOMINICA MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 78 DOMINICA MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 79 DOMINICA MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 80 DOMINICA HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 DOMINICA RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 DOMINICA MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 83 DOMINICA STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 DOMINICA NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 THE BAHAMAS MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 THE BAHAMAS MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 87 THE BAHAMAS MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 88 THE BAHAMAS MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 89 THE BAHAMAS MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 90 THE BAHAMAS HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 THE BAHAMAS RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 THE BAHAMAS MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 93 THE BAHAMAS STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 THE BAHAMAS NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 BARBADOS MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 BARBADOS MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 97 BARBADOS MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 98 BARBADOS MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 99 BARBADOS MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 100 BARBADOS HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 BARBADOS RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 BARBADOS MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 103 BARBADOS STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 BARBADOS NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 ANTIGUA AND BARBUDA MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 ANTIGUA AND BARBUDA MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 107 ANTIGUA AND BARBUDA MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 108 ANTIGUA AND BARBUDA MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 109 ANTIGUA AND BARBUDA MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 ANTIGUA AND BARBUDA HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 ANTIGUA AND BARBUDA RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 ANTIGUA AND BARBUDA MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 113 ANTIGUA AND BARBUDA STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 ANTIGUA AND BARBUDA NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 HISPANIOLA MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 HISPANIOLA MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

TABLE 117 HISPANIOLA MUSHROOM MARKET, BY FORM, 2022-2031 (USD THOUSAND)

TABLE 118 HISPANIOLA MUSHROOM MARKET, BY NATURE, 2022-2031 (USD THOUSAND)

TABLE 119 HISPANIOLA MUSHROOM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 120 HISPANIOLA HORECA INDUSTRY IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 HISPANIOLA RESTAURANTS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 HISPANIOLA MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 123 HISPANIOLA STORE-BASED RETAILING IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 HISPANIOLA NON-STORE-BASED RETAILING /ONLINE RETAILERS IN MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 125 REST OF THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 REST OF THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE, 2022-2031 (TONS)

Lista de Figura

FIGURE 1 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET

FIGURE 2 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: MULTIVARIATE MODELLING

FIGURE 7 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: SEGMENTATION

FIGURE 11 SEVEN SEGMENTS COMPRISE THE DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, BY TYPE

FIGURE 12 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: EXECUTIVE SUMMARY

FIGURE 13 SHIFTING CONSUMER PREFERENCE TOWARDS PLANT-BASED OR VEGAN DIETS IS EXPECTED TO DRIVE THE DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET IN THE FORECAST PERIOD

FIGURE 14 THE BUTTON MUSHROOM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET IN 2024 AND 2031

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/KG)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET

FIGURE 18 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: BY TYPE, 2023

FIGURE 19 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: BY FORM, 2023

FIGURE 20 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: BY NATURE, 2023

FIGURE 21 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: BY APPLICATION, 2023

FIGURE 22 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 23 DOMINICAN REPUBLIC AND THE CARIBBEAN ISLANDS MUSHROOM MARKET COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.