Middle East And Africa Renting And Leasing Test And Measurement Equipment Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2031 | |

| USD 322.82 Million | |

| USD 420.82 Million | |

|

|

|

>Segmentation du marché des équipements de test et de mesure de location et de leasing au Moyen-Orient et en Afrique, par offre (matériel et services), composant (assemblages de câbles, connecteurs, accessoires à valeur ajoutée et autres), type de système (système de détection, système de connectivité, système de sécurité et de sûreté, interface homme-machine (IHM), système de gestion de l'énergie et de l'alimentation, système de contrôle de moteur et système d'éclairage), type (location et leasing), fonctionnalités (équipement de diagnostic, détection électrique, ICS de mesure et autres), utilisateur final (informatique et télécommunications, automobile, aérospatiale et défense, industrie, électronique grand public , énergie et services publics, équipement médical et autres) - Tendances et prévisions de l'industrie jusqu'en 2031

Analyse du marché de la location et du leasing d'équipements de test et de mesure

Le marché de la location et du leasing d'équipements de test et de mesure au Moyen-Orient et en Afrique connaît une croissance significative, tirée par la nécessité de réduire les charges opérationnelles grâce à des services d'assistance à la maintenance, la demande croissante d'équipements basés sur des projets et le rythme rapide de l'innovation technologique, qui permet aux entreprises de minimiser les risques d'amortissement et d'éviter les pertes financières. Cependant, le marché est confronté à des contraintes telles que des investissements en capital élevés et la disponibilité limitée d'équipements spécialisés. Les opportunités résident dans la formation de partenariats et de collaborations avec des fournisseurs de technologie, l'adoption d'initiatives écologiques et de durabilité, et la capitalisation sur l'industrialisation croissante et l'adoption technologique. Malgré ces perspectives, le marché est confronté à des complexités de gestion des stocks et à une concurrence intense, ce qui conduit à la saturation du marché.

Taille du marché de la location et du leasing d'équipements de test et de mesure

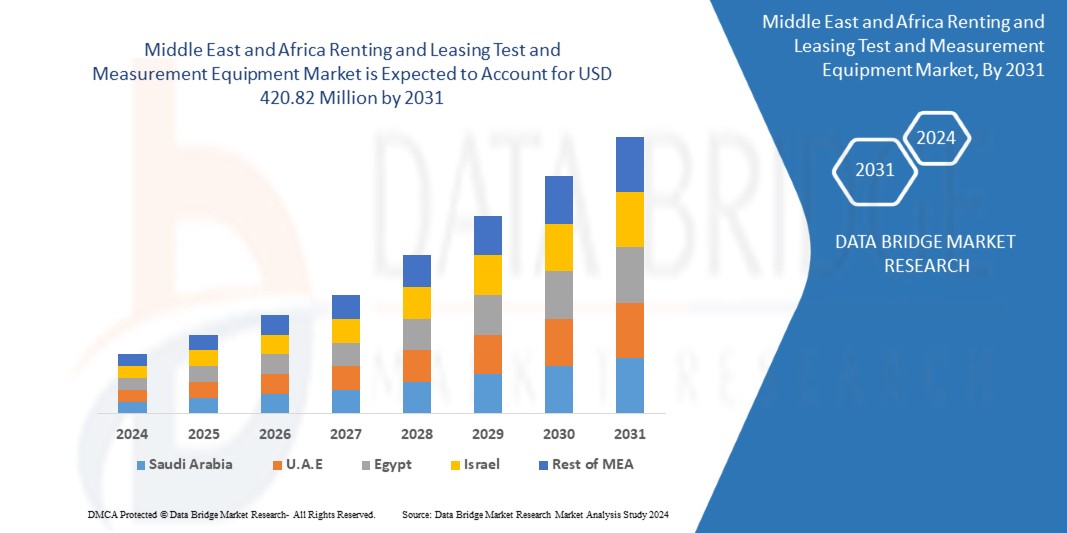

Français La taille du marché de la location et du leasing d’équipements de test et de mesure au Moyen-Orient et en Afrique était évaluée à 322,82 millions USD en 2023 et devrait atteindre 420,82 millions USD d’ici 2031, avec un TCAC de 3,6 % au cours de la période de prévision de 2024 à 2031. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l’équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE.

Tendance du marché de la location et du leasing d'équipements de test et de mesure

« Durabilité et choix éco-responsables »

Le développement durable et les choix respectueux de l’environnement deviennent de plus en plus importants sur le marché de la location et du leasing au Moyen-Orient et en Afrique, car les consommateurs privilégient les options respectueuses de l’environnement. Les entreprises réagissent en proposant des produits durables, tels que des véhicules électriques et des appareils à faible consommation d’énergie, qui attirent les locataires soucieux de l’environnement. Cette tendance contribue non seulement à réduire l’empreinte carbone, mais répond également à la demande croissante de responsabilité sociale des entreprises. En outre, de nombreuses entreprises intègrent des pratiques durables dans leurs activités, telles que la réduction des déchets et l’utilisation de matériaux recyclables. En adoptant la durabilité, les entreprises peuvent se différencier et fidéliser leur marque auprès des consommateurs soucieux de l’environnement.

Portée du rapport Marché de la location et de la location-bail de tests et d'équipements

|

Attributs |

Informations clés sur le marché de la location et du leasing d'équipements de test et de mesure |

|

Segments couverts |

|

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Afrique du Sud, Égypte, Israël, Bahreïn, Oman, Qatar, Koweït et reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

ROHDE & SCHWARZ (Allemagne), Keysight Technologies (États-Unis), Electrorent.com, Inc. (États-Unis), Transcat, Inc. (États-Unis), VIAVI Solutions Inc. (États-Unis), General Electric Company (États-Unis), Leonardo DRS (États-Unis), Saluki Technology (Taïwan), Boonton Electronics (États-Unis), FLUKE NETWORKS (États-Unis), Bird (États-Unis), Good Will, Instrument Co., Ltd. (Taïwan), ADLINK Technology Inc, (Taïwan), Leader Electronics of Europe Limited (une filiale de Leader, Electronics Corporation) (Angleterre), Anritsu (Japon), Yokogawa Electric Corporation (Japon), Fortive (États-Unis), Siemens (Allemagne), Megger (Royaume-Uni), EXFO Inc. (Canada), Emerson Electric Co. (États-Unis), Doble Engineering Company (États-Unis), ADVANTEST CORPORATION (Japon), Texas Instruments Incorporated (États-Unis), DS INSTRUMENTS (États-Unis) et STMicroelectronics (Suisse) entre autres. |

|

Opportunités de marché |

|

|

Données à valeur ajoutée |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Renting and Leasing Test and Measurement Equipment Market Definition

The renting and leasing test and measurement equipment involves the provision of specialized equipment on a rental or lease basis, enabling industries across various sectors, including telecommunications, electronics, automotive, and aerospace, to access high-quality testing and measurement tools without the need for significant capital investment. This market caters to the growing demand for flexible and cost-effective solutions, offering advanced equipment for short-term projects, product development, or periodic testing needs, thereby allowing companies to manage their operational expenses more efficiently while staying at the forefront of technological advancements.

Renting and Leasing Test and Measurement Equipment Market Dynamics

Driver

- Increasing Maintenance of Support Services Reduces Operational Burden

The inclusion of maintenance and support services in rental agreements significantly enhances operational efficiency for businesses. By outsourcing maintenance and support, companies avoid the complexities and costs associated with managing these functions in-house. This arrangement allows businesses to focus on their core operations while ensuring that the rented equipment is consistently maintained and calibrated. This efficiency is particularly valuable in high-demand environments where equipment uptime and reliability are crucial for meeting project deadlines and maintaining productivity. Incorporating maintenance and support into rental agreements helps businesses manage costs more effectively. Instead of bearing the full financial burden of equipment upkeep, which includes regular servicing, repairs, and troubleshooting, companies benefit from a predictable and often lower rental cost that includes these services. This arrangement reduces unexpected expenses and helps in budgeting, as businesses only pay for the equipment's use and the associated support, without the need for significant capital outlay for maintenance infrastructure.

For instance,

According to blog of Caterpillar, the incorporation of maintenance and support services in rental agreements can lead to significant cost savings. By avoiding high expenses of equipment ownership and managing repair in-houses, businesses benefit from predictable costs and reduced financial burdens. This approach enhances operational efficiency and helps companies stay within budget while accessing reliable, well-maintained equipment.

Increasing Demand of Project Based Equipment

The increasing demand for project-based equipment is a significant driver for the Middle East and Africa renting and leasing market. Projects often require specialized test and measurement equipment for limited periods, and renting provides a flexible solution to meet these short-term needs. Companies can access the specific tools they need without committing to long-term ownership, which is ideal for industries with fluctuating project requirements or those embarking on temporary initiatives Renting test and measurement equipment for project-based work offers cost efficiency, as businesses avoid the high upfront costs and depreciation associated with purchasing. Instead, they can allocate resources more effectively by paying for equipment only when it is needed. This financial flexibility is particularly beneficial for projects with variable budgets or for companies looking to optimize their capital expenditure. Renting allows them to invest in other critical areas while still accessing high-quality equipment.

For instance,

- In November 2023, Keysight Technologies highlighted their successful collaboration with MediaTek on 5G new radio testing. This partnership underscored the rising demand for project-based test equipment, as companies’ seeked specialized tools for complex, short-term projects like 5G deployments. The increased project-based demand is driving the need for flexible rental solutions, enabling access to advanced technology for specific, temporary applications

Opportunity

- Partnership & Collaboration With Technology Providers

The partnerships and collaborations with technology providers represent a significant opportunity for growth. By teaming up with cutting-edge technology firms, companies in this sector can gain early access to advanced instruments and innovations. This collaboration allows for the integration of the latest technologies into their rental and leasing offerings, ensuring that clients have access to state-of-the-art equipment without the need for substantial capital investment. Moreover, these partnerships can lead to the development of tailored solutions that address specific industry needs, enhancing the value proposition for customers and driving market expansion.

For instance,

- At MWC Barcelona 2023, Rohde & Schwarz showcased a cutting-edge neural receiver developed in collaboration with NVIDIA, designed to advance 6G technology using AI and machine learning. This innovative solution aimed to enhance signal processing and improve network performance for future wireless communications. The demonstration highlighted Rohde & Schwarz's commitment to lead the way in next-generation technology developments

Increasing Demand for Green Initiatives and Sustainability

As environmental regulations tighten and companies increasingly prioritize eco-friendly practices, there is a growing demand for equipment that supports sustainability goals. By adopting green practices, such as utilizing energy-efficient instruments, minimizing waste through optimized equipment usage, and implementing recycling programs for outdated technology, rental and leasing companies can align themselves with broader environmental objectives. This shift not only meets the evolving expectations of environmentally conscious clients but also positions companies as leaders in sustainable practices within the industry.

For instances,

- In May 2023, O'Connor explores the potential benefits of green leases, highlighting them as a significant opportunity for landlords and tenants alike. Green leases can lead to reduced operating costs, improved energy efficiency, and increased property value while aligning with sustainability goals. The article emphasizes how adopting green initiatives not only meets regulatory requirements but also enhances competitive advantage and fosters positive environmental impacts.

Restraints/ Challenges

- Requirement of Significant Financial Outlay

The high capital investment required for test and measurement equipment creates a barrier for new entrants into the market. The significant financial outlay needed to build a competitive inventory deters potential new players from entering the industry. This lack of new competition can lead to a market dominated by a few established firms, reducing innovation and limiting options for customers. Consequently, the high capital requirement not only restricts the growth and diversification of rental and leasing companies but also hinders overall market dynamism and customer choice.

For instance,

- In March 2024, according to KHL Group LLP, United Rentals invested USD 1.1 billion to acquire UK-based A-Plant's temporary roadway business, expanding its offerings in the infrastructure and construction sectors. This strategic acquisition aimed to enhance its portfolio with specialized equipment and services, bolstering its position in the rental market. The move aligns with United Rentals' strategy to diversify and strengthen its service capabilities regionaly

Limited Availability of Specialized Equipment

The Middle East and Africa renting and leasing market for test and measurement equipment faces several significant constraints. Niche equipment, tailored for specific industries or applications, can limit rental options as providers may lack the necessary inventory to meet specialized demand. Geographical constraints further complicate matters, with certain types of equipment being more prevalent in specific regions, creating access challenges for businesses in underserved areas. The emergence of new technologies also contributes to the problem, as there can be a lag in availability for the latest equipment, hindering innovation and adoption. Additionally, the need for customization in specialized equipment makes it difficult for rental providers to offer versatile solutions, impacting their ability to meet diverse client needs effectively.

For instance,

- In April, 2024, Delhi retail leasing volume dropped 28% in Q1 due to limited available space. Mall leasing was particularly impacted, with a 23% quarter-over-quarter decline. This shortage of space hindered the expansion of businesses and constrained the overall market growth

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth

Renting and Leasing Test and Measurement Equipment Market Scope

The Middle East and Africa renting and leasing test and measurement equipment market is segmented into six notable segments on the basis of offering, component, system type, type, features, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- General-Purpose Test Equipment (GPTE)

- Multi Meters

- Signal Generators

- Oscilloscopes

- Spectrum Analyzers

- Automated Test Equipment (ATE)

- Power Supplies

- BERT Solutions (Bit Error Rate Testers)

- Modular Instruments

- Logic Analyzers

- Power Meters

- Electronic Counters

- Semiconductor Test Equipment

- Network Measurement Equipment

- Wired

- Wireless

- Mechanical Test Equipment (MTE)

- Machine Condition Monitoring Systems

- Machine Vision Inspection Systems

- Non-Destructive Test Equipment

- Machine Condition Monitoring Systems

- Machine Vision Inspection Systems

- Non-Destructive Test Equipment

- Others

- Optical Fiber Connection Equipment

- RF Test Chambers

- Others

- General-Purpose Test Equipment (GPTE)

- Services

- Managed Services

- Professional Services

- Repair/After Sales Services

- Consulting and Training

- Environment Product Testing

- Professional Services

- Managed Services

Component

- Cable Assemblies

- Connectors

- Value Added Services

- Others

System Type

- Sensing System

- Connectivity System

- Safety & Security System

- Human Machine Interface (HMI)

- Power & Energy Management System

- Motor Control System

- Lighting System

Type

- Rent

- Lease

Features

- Diagnostic Equipment

- Patient Monitoring

- Blood Pressure Monitor

- Glucose Meter

- Digital Thermometer

- Others

- Electrical Sensing

- High-Side Sensing

- Low-Side Sensing

- Metering ICS

- Smart Meters & Energy Metering Solutions

- ICS for Smart Plugs

- Others

End-User

- IT & Telecommunication

- Offering

- Hardware

- Services

- Type

- Telecom Center

- Data Center

- Enterprise Networks

- Broadcast Networks

- Application

- Performance Monitoring

- Network Optimization

- Troubleshooting and Fault Diagnosis

- System Integration and Validation

- Network Installation and Maintenance

- Customer Premises Equipment (CPE) Testing

- Others

- Offering

- Automotive

- Offering

- Hardware

- Services

- Application

- ADAS

- Automotive Motor Control

- In-Vehicle Infotainment

- Mobility Services

- Body and Convenience

- Offering

- Aerospace & Defense

- Offering

- Hardware

- Services

- Application

- Avionics

- Radar

- Communication Systems

- Satellite Technology

- Electronic Warfare Systems

- Others

- Offering

- Industrial

- Offering

- Hardware

- Services

- Application

- Factory Automation

- Energy Generation & Distribution

- Medical & Healthcare

- Metering

- Asset Tracking

- Lighting & Control

- Offering

- Consumer Electronics

- Offering

- Hardware

- Services

- Application

- Smartphones & Tablets

- Audio & Video

- Wearable

- Gaming & Drones

- Augmented/Virtual Reality (AR/VR)

- Others

- Offering

- Energy & Utilities

- Offering

- Hardware

- Services

- Offering

- Medical Equipment

- Offering

- Hardware

- Services

- Offering

- Others

- Offering

- Hardware

- Services

- Offering

Renting and Leasing Test and Measurement Equipment Market Regional Analysis

Middle East and Africa renting and leasing test and measurement equipment market is segmented into six notable segments which are segmented on the basis of offering, component, system type, type, features, and end-user.

The countries covered in the Middle East and Africa renting and leasing test and measurement equipment market report are Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Bahrain, Oman, Qatar, Kuwait, Rest of Middle East and Africa.

Saudi Arabia is expected to be the dominant and fastest growing country in the renting and leasing test and measurement equipment market due to increasing demand for green initiatives and sustainability.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Renting and Leasing Test and Measurement Equipment Market Share

Le paysage concurrentiel du marché de la location et du leasing d'équipements de test et de mesure au Moyen-Orient et en Afrique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'accent mis par l'entreprise sur la location et le leasing d'équipements de test et de mesure sur le marché.

Les acteurs du marché de la location et du leasing d'équipements de test et de mesure opérant sur le marché sont :

- ROHDE & SCHWARZ (Allemagne)

- Keysight Technologies (États-Unis)

- Electrorent.com, Inc. (États-Unis)

- Transcat, Inc. (États-Unis)

- VIAVI Solutions Inc. (États-Unis)

- General Electric Company (États-Unis)

- Leonardo DRS (États-Unis)

- Technologie Saluki (Taïwan)

- Boonton Electronics (États-Unis)

- FLUKE NETWORKS (États-Unis)

- Oiseau (États-Unis)

- Good Will, Instrument Co., Ltd. (Taïwan)

- ADLINK Technology Inc, (Taïwan)

- Leader Electronics of Europe Limited (une filiale de Leader, Electronics Corporation) (Angleterre)

- Anritsu (Japon)

- Yokogawa Electric Corporation (Japon)

- Fortive (États-Unis)

- Siemens (Allemagne)

- Megger (Royaume-Uni) Emerson Electric Co. (États-Unis)

- STMicroelectronics (Suisse)

Derniers développements sur le marché de la location et de la location-bail d'équipements de test et de mesure

- En janvier 2024, selon un article mentionné sur LinkedIn, Iravati M. a souligné que la gestion des stocks reste un défi important sur le marché de la location et du leasing d'équipements de test et de mesure. La complexité de la gestion d'équipements divers et spécialisés, la garantie d'une disponibilité rapide et le maintien d'un suivi précis sont essentiels à l'efficacité opérationnelle. Des systèmes de gestion des stocks efficaces sont essentiels pour relever ces défis et optimiser l'utilisation des équipements dans un marché hautement concurrentiel et saturé

- En mars 2024, selon un article de blog de Booqable.com, la gestion des stocks est un obstacle majeur dans le secteur de la location. L'article mettait l'accent sur la difficulté de suivre divers équipements, de gérer les calendriers de maintenance et de garantir la disponibilité rapide des articles. Des systèmes de gestion des stocks efficaces sont essentiels pour résoudre ces problèmes, optimiser les opérations et améliorer la satisfaction des clients sur un marché concurrentiel

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USER COVERAGE GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 CASE STUDY

4.3 PATENT ANALYSIS

4.4 REGULATORY STANDARDS

4.5 TECHNOLOGICAL TRENDS

4.6 VALUE CHAIN ANALYSIS

4.7 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING MAINTENANCE OF SUPPORT SERVICES REDUCES OPERATIONAL BURDEN

5.1.2 INCREASING DEMAND OF PROJECT BASED EQUIPMENT

5.1.3 RAPID ADVANCEMENT IN TECHNOLOGICAL INNOVATION

5.1.4 REGULAR MAINTENANCE AND STRATEGIC UPGRADES REDUCE DEPRECIATION RISK AND FINANCIAL LOSS

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF SIGNIFICANT FINANCIAL OUTLAY

5.2.2 LIMITED AVAILABILITY OF SPECIALIZED EQUIPMENT

5.3 OPPORTUNITIES

5.3.1 PARTNERSHIP & COLLABORATION WITH TECHNOLOGY PROVIDERS

5.3.2 INCREASING DEMAND FOR GREEN INITIATIVES AND SUSTAINABILITY

5.3.3 GROWING INDUSTRIALIZATION AND TECHNOLOGICAL ADOPTION

5.4 CHALLENGES

5.4.1 MONITORING AND HANDLING HIGH-VALUE, SPECIALIZED TESTING EQUIPMENT

5.4.2 INTENSE COMPETITION AND SATURATION REQUIRE DISTINCTIVE INNOVATIONS TO STAY COMPETITIVE

6 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 HARDWARE, BY TYPE

6.2.1.1 GENERAL-PURPOSE TEST EQUIPMENT (GPTE)

6.2.1.1.1 GENERAL-PURPOSE TEST EQUIPMENT (GPTE), BY TYPE

6.2.1.1.1.1 MULTI METERS

6.2.1.1.1.2 SIGNAL GENERATORS

6.2.1.1.1.3 OSCILLOSCOPES

6.2.1.1.1.4 SPECTRUM ANALYZERS

6.2.1.1.1.5 AUTOMATED TEST EQUIPMENT (ATE)

6.2.1.1.1.6 POWER SUPPLIES

6.2.1.1.1.7 BERT SOLUTIONS (BIT ERROR RATE TESTERS)

6.2.1.1.1.8 MODULAR INSTRUMENTS

6.2.1.1.1.9 LOGIC ANALYZERS

6.2.1.1.1.10 POWER METERS

6.2.1.1.1.11 ELECTRONIC COUNTERS

6.2.1.2 SEMICONDUCTOR TEST EQUIPMENT

6.2.1.3 NETWORK MEASUREMENT EQUIPMENT

6.2.1.3.1 NETWORK MEASUREMENT EQUIPMENT, BY TYPE

6.2.1.3.1.1 WIRED

6.2.1.3.1.2 WIRELESS

6.2.1.3.1.3 MECHANICAL TEST EQUIPMENT (MTE)

6.2.1.3.2 MECHANICAL TEST EQUIPMENT (MTE), BY TYPE

6.2.1.3.2.1 MACHINE CONDITION MONITORING SYSTEMS

6.2.1.3.2.2 MACHINE VISION INSPECTION SYSTEMS

6.2.1.3.2.3 NON-DESTRUCTIVE TEST EQUIPMENT

6.2.1.3.2.4 OTHERS

6.2.1.4 OPTICAL FIBER CONNECTION EQUIPMENT

6.2.1.5 RF TEST CHAMBERS

6.2.1.6 OTHERS

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 PROFESSIONAL SERVICES, BY TYPE

6.3.2.1.1 REPAIR/AFTER SALES SERVICES

6.3.2.1.2 CONSULTING AND TRAINING

6.3.2.1.3 ENVIRONMENT PRODUCT TESTING

7 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 RENT

7.3 LEASE

8 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES

8.1 OVERVIEW

8.2 DIAGNOSTIC EQUIPMENT

8.2.1 PATIENT MONITORING

8.2.2 BLOOD PRESSURE MONITOR

8.2.3 GLUCOSE METER

8.2.4 DIGITAL THERMOMETER

8.2.5 OTHERS

8.3 ELECTRICAL SENSING

8.3.1 HIGH-SIDE SENSING

8.3.2 LOW-SIDE SENSING

8.4 METERING ICS

8.4.1 SMART METERS & ENERGY METERING SOLUTIONS

8.4.2 ICS FOR SMART PLUGS

8.5 OTHERS

9 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 CABLE ASSEMBLIES

9.3 CONNECTORS

9.4 VALUE ADDED SERVICES

9.5 OTHERS

10 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE

10.1 OVERVIEW

10.2 SENSING SYSTEM

10.3 CONNECTIVITY SYSTEM

10.4 SAFETY & SECURITY SYSTEM

10.5 HUMAN MACHINE INTERFACE (HMI)

10.6 POWER & ENERGY MANAGEMENT SYSTEM

10.7 MOTOR CONTROL SYSTEM

10.8 LIGHTING SYSTEM

11 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 IT & TELECOMMUNICATION

11.2.1 BY OFFERING

11.2.1.1 HARDWARE

11.2.1.2 SERVICES

11.2.2 BY TYPE

11.2.2.1 TELECOM CENTER

11.2.2.2 DATA CENTER

11.2.2.3 ENTERPRISE NETWORKS

11.2.2.4 BROADCAST NETWORKS

11.2.3 BY APPLICATION

11.2.3.1 PERFORMANCE MONITORING

11.2.3.2 NETWORK OPTIMIZATION

11.2.3.3 TROUBLESHOOTING AND FAULT DIAGNOSIS

11.2.3.4 SYSTEM INTEGRATION AND VALIDATION

11.2.3.5 NETWORK INSTALLATION AND MAINTENANCE

11.2.3.6 CUSTOMER PREMISES EQUIPMENT (CPE) TESTING

11.2.3.7 OTHERS

11.3 AUTOMOTIVE

11.3.1 BY OFFERING

11.3.1.1 HARDWARE

11.3.1.2 SERVICES

11.3.2 BY APPLICATION

11.3.2.1 ADAS

11.3.2.2 AUTOMOTIVE MOTOR CONTROL

11.3.2.3 IN-VEHICLE INFOTAINMENT

11.3.2.4 MOBILITY SERVICES

11.3.2.5 BODY AND CONVENIENCE

11.4 AEROSPACE AND DEFENCE

11.4.1 BY OFFERING

11.4.1.1 HARDWARE

11.4.1.2 SERVICES

11.4.2 BY APPLICATION

11.4.2.1 AVIONICS

11.4.2.2 RADAR

11.4.2.3 COMMUNICATION SYSTEMS

11.4.2.4 SATELLITE TECHNOLOGY

11.4.2.5 ELECTRONIC WARFARE SYSTEMS

11.4.2.6 OTHERS

11.5 INDUSTRIAL

11.5.1 BY OFFERING

11.5.1.1 HARDWARE

11.5.1.2 SERVICES

11.5.2 BY APPLICATION

11.5.2.1 FACTORY AUTOMATION

11.5.2.2 ENERGY GENERATION & DISTRIBUTION

11.5.2.3 MEDICAL & HEALTHCARE

11.5.2.4 METERING

11.5.2.5 ASSET TRACKING

11.5.2.6 LIGHTING & CONTROL

11.6 CONSUMER ELECTRONICS

11.6.1 BY OFFERING

11.6.1.1 HARDWARE

11.6.1.2 SERVICES

11.6.2 BY APPLICATION

11.6.2.1 SMARTPHONES & TABLETS

11.6.2.2 AUDIO & VIDEO

11.6.2.3 WEARABLES

11.6.2.4 GAMING & DRONES

11.6.2.5 AUGMENTED/VIRTUAL REALITY (AR/VR)

11.6.2.6 OTHERS

11.7 ENERGY & UTILITIES

11.7.1 BY OFFERING

11.7.1.1 HARDWARE

11.7.1.2 SERVICES

11.8 MEDICAL EQUIPMENT

11.8.1 BY OFFERING

11.8.1.1 HARDWARE

11.8.1.2 SERVICES

11.9 OTHERS

11.9.1 BY OFFERING

11.9.1.1 HARDWARE

11.9.1.2 SERVICES

12 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E.

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 BAHRAIN

12.1.7 OMAN

12.1.8 QATAR

12.1.9 KUWAIT

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SIEMENS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 KEYSIGHT TECHNOLOGIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROHDE & SCHWARZ

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 FORTIVE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 EMERSON ELECTRIC CO

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ADLINK TECHNOLOGY

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ADVANTEST CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ANRITSU

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 BIRD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BOONTON ELECTRONICS

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DOBLE ENGINEERING COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DS INSTRUMENTS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ELECTRORENT COM.INC

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.13.4 RECENT DEVELOPMENTS

15.14 EXFO INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT AND SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 FLUKE NETWORKS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 GENERAL ELECTRIC COMPANY

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 GOOD WILL INSTRUMENT CO, LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 LEADER ELECTRONICS OF EUROPE LIMITED (A SUBSIDIARY OF LEADER ELECTRONICS CORPORATION)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 RECENT DEVELOPMENTS

15.19 LEARNADO DRS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 MEGGER

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SALUKI TECHNOLOGY

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 STMICROELECTRONICS

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TEXAS INSTRUMENTS INCORPORATED

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 TRANSCAT, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENTS

15.25 VIAVI SOLUTIONS

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 YOKOGAWA ELECTRIC CORPORATION

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATIONS AND STANDARDS FOR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT

TABLE 2 COST OF TEST AND MEASUREMENT EQUIPMENT

TABLE 3 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA RENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LEASE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CABLE ASSEMBLIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CONNECTORS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA VALUE ADDED SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA SENSING SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA CONNECTIVITY SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SAFETY & SECURITY SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA HUMAN MACHINE INTERFACE (HMI) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA POWER & ENERGY MANAGEMENT SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA MOTOR CONTROL SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA LIGHTING SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENCE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 89 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 90 SAUDI ARABIA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 SAUDI ARABIA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 SAUDI ARABIA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 SAUDI ARABIA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 SAUDI ARABIA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 SAUDI ARABIA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 97 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 100 SAUDI ARABIA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 SAUDI ARABIA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 SAUDI ARABIA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 104 SAUDI ARABIA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 105 SAUDI ARABIA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 SAUDI ARABIA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 107 SAUDI ARABIA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 108 SAUDI ARABIA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 109 SAUDI ARABIA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 110 SAUDI ARABIA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 111 SAUDI ARABIA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 112 SAUDI ARABIA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 113 SAUDI ARABIA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 114 SAUDI ARABIA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 115 SAUDI ARABIA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 116 SAUDI ARABIA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 117 SAUDI ARABIA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 118 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 119 U.A.E. HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 U.A.E. GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 U.A.E. MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 U.A.E. NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 123 U.A.E. SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 U.A.E. PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 125 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 126 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 129 U.A.E. DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 U.A.E. ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 U.A.E. METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 133 U.A.E. IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 134 U.A.E. IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 U.A.E. IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 136 U.A.E. AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 137 U.A.E. AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 138 U.A.E. AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 139 U.A.E. AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 140 U.A.E. INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 141 U.A.E. INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 142 U.A.E. CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 143 U.A.E. CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 144 U.A.E. ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 145 U.A.E. MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 146 U.A.E. OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 147 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 148 SOUTH AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SOUTH AFRICA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SOUTH AFRICA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SOUTH AFRICA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SOUTH AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SOUTH AFRICA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 155 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 158 SOUTH AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SOUTH AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SOUTH AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 162 SOUTH AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 163 SOUTH AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 164 SOUTH AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 165 SOUTH AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 166 SOUTH AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 167 SOUTH AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 168 SOUTH AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 169 SOUTH AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 170 SOUTH AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 171 SOUTH AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 172 SOUTH AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 173 SOUTH AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 174 SOUTH AFRICA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 175 SOUTH AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 176 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 177 EGYPT HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 EGYPT GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 EGYPT MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 EGYPT NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 EGYPT SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 EGYPT PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 184 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 186 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 187 EGYPT DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 EGYPT ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 EGYPT METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 191 EGYPT IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 192 EGYPT IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 EGYPT IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 194 EGYPT AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 195 EGYPT AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 196 EGYPT AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 197 EGYPT AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 198 EGYPT INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 199 EGYPT INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 200 EGYPT CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 201 EGYPT CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 202 EGYPT ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 203 EGYPT MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 204 EGYPT OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 205 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 206 ISRAEL HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 ISRAEL GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 ISRAEL MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 ISRAEL NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 ISRAEL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 ISRAEL PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 213 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 216 ISRAEL DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 ISRAEL ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 ISRAEL METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 220 ISRAEL IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 221 ISRAEL IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 ISRAEL IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 223 ISRAEL AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 224 ISRAEL AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 225 ISRAEL AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 226 ISRAEL AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 227 ISRAEL INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 228 ISRAEL INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 229 ISRAEL CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 230 ISRAEL CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 231 ISRAEL ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 232 ISRAEL MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 233 ISRAEL OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 234 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 235 BAHRAIN HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 236 BAHRAIN GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 BAHRAIN MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 BAHRAIN NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 BAHRAIN SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 BAHRAIN PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 242 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 243 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 244 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 245 BAHRAIN DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 BAHRAIN ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 BAHRAIN METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 249 BAHRAIN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 250 BAHRAIN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 251 BAHRAIN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 252 BAHRAIN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 253 BAHRAIN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 254 BAHRAIN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 255 BAHRAIN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 256 BAHRAIN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 257 BAHRAIN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 258 BAHRAIN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 259 BAHRAIN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 260 BAHRAIN ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 261 BAHRAIN MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 262 BAHRAIN OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 263 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 264 OMAN HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 265 OMAN GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 266 OMAN MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 OMAN NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 268 OMAN SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 269 OMAN PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 270 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 271 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 274 OMAN DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 275 OMAN ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 276 OMAN METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 278 OMAN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 279 OMAN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 OMAN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 281 OMAN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 282 OMAN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 283 OMAN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 284 OMAN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 285 OMAN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 286 OMAN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 287 OMAN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 288 OMAN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 289 OMAN ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 290 OMAN MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 291 OMAN OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 292 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 293 QATAR HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 QATAR GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 295 QATAR MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 296 QATAR NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 QATAR SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 298 QATAR PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 299 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 300 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 301 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 302 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 303 QATAR DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 304 QATAR ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 305 QATAR METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 306 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 307 QATAR IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 308 QATAR IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 309 QATAR IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 310 QATAR AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)