Saudi Arabia Architectural Glass Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2031 | |

| USD 2.85 Billion | |

| USD 3.98 Billion | |

|

|

|

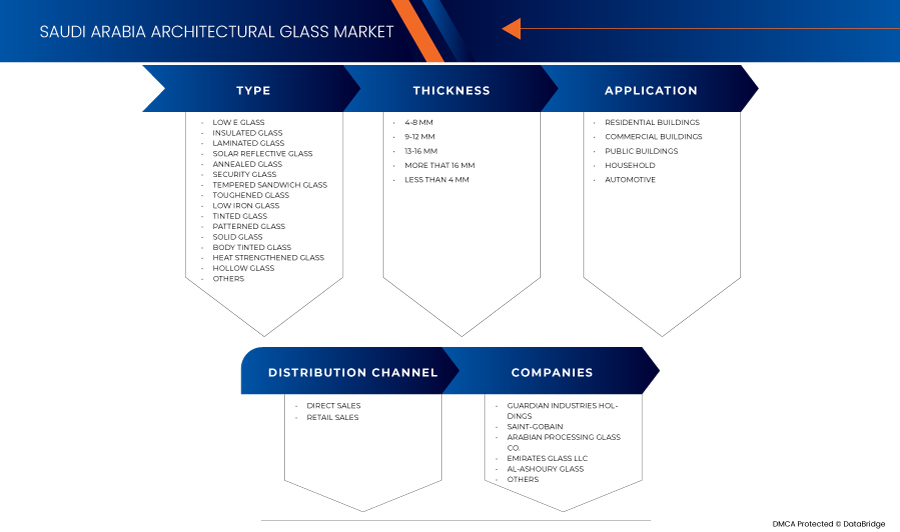

>Segmentation du marché du verre architectural en Arabie saoudite, par type (verre Low E, verre isolant , verre feuilleté, verre réfléchissant solaire, verre recuit, verre de sécurité, verre sandwich trempé, verre trempé, verre à faible teneur en fer, verre teinté, verre à motifs, verre solide, verre teinté dans la masse, verre renforcé thermiquement, verre creux et autres), épaisseur (4-8 MM, 9-12 MM, 13-16 MM, plus de 16 MM et moins de 4 MM), application (bâtiments résidentiels, bâtiments commerciaux, bâtiments publics, ménages et automobiles), canal de distribution (ventes directes et ventes au détail) - Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse du marché du verre architectural

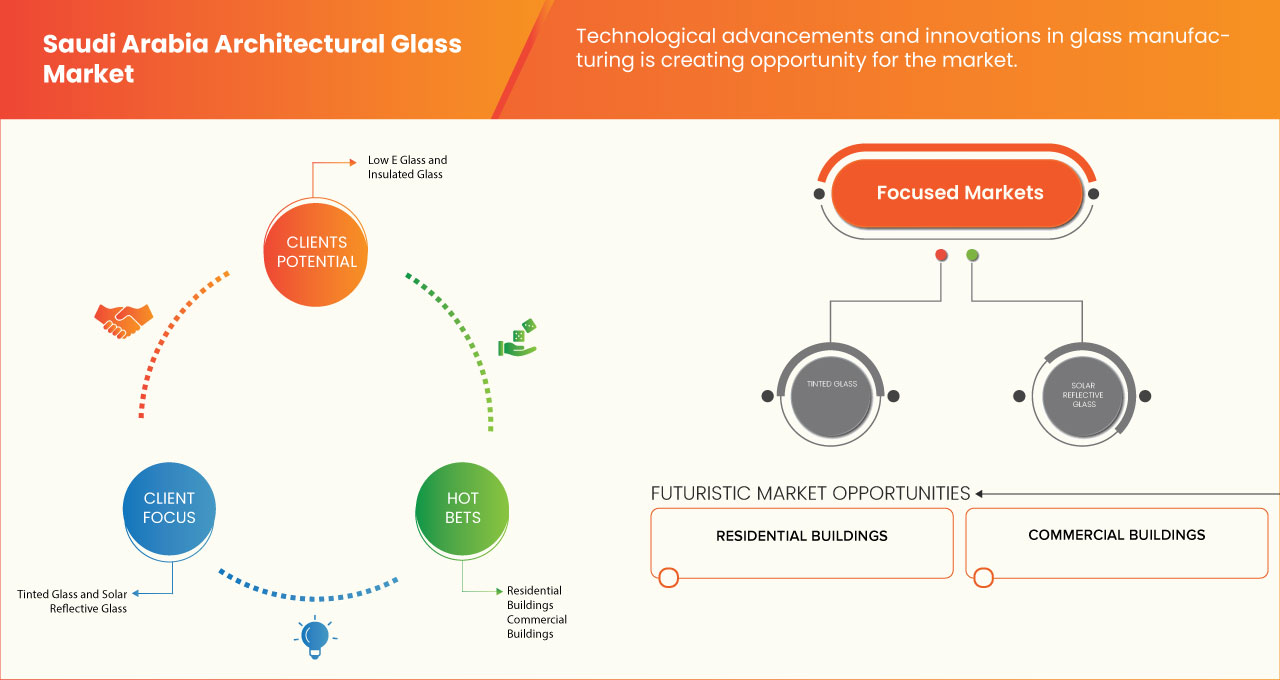

Le verre architectural connaît une croissance rapide grâce aux avancées technologiques qui ont conduit à des options de verre économes en énergie, telles que le vitrage à faible émissivité et le vitrage isolant, transformant encore davantage les possibilités architecturales. Aujourd'hui, le verre architectural joue un rôle crucial dans le design moderne, alliant esthétique et durabilité. Stimulant ainsi la croissance du marché en Arabie saoudite.

Taille du marché du verre architectural

La taille du marché du verre architectural en Arabie saoudite était évaluée à 2,85 milliards USD en 2023 et devrait atteindre 3,98 milliards USD d'ici 2031, avec un TCAC de 4,3 % au cours de la période de prévision de 2024 à 2031.

Tendances du marché du verre architectural

« Urbanisation rapide et développement des infrastructures »

L’urbanisation rapide et le développement des infrastructures sont des moteurs importants du marché du verre architectural, façonnant le paysage de la construction et du design modernes dans la région. Alors que le Royaume continue de diversifier son économie pour s’affranchir de sa dépendance au pétrole, des projets à grande échelle dans le cadre d’initiatives telles que Saudi Vision 2030 ont catalysé une poussée du développement urbain.

L’un des aspects clés de cette urbanisation est la croissance des mégalopoles et des centres urbains, en particulier dans des villes comme Riyad, Djeddah et Dammam. L’augmentation de la population et la demande de logements, d’espaces commerciaux et d’infrastructures publiques sont à l’origine de la tendance croissante vers des solutions architecturales modernes, où le verre architectural joue un rôle crucial. Les façades en verre sont non seulement esthétiques, mais améliorent également la fonctionnalité des bâtiments en laissant entrer la lumière naturelle, en améliorant l’efficacité énergétique et en offrant une isolation thermique.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché du verre architectural |

|

Segments couverts |

· Par type : verre Low E, verre isolant, verre feuilleté , verre réfléchissant solaire, verre recuit, verre de sécurité, verre sandwich trempé, verre trempé, verre à faible teneur en fer, verre teinté, verre à motifs, verre solide, verre teinté dans la masse, verre renforcé thermiquement, verre creux et autres. · Par épaisseur : 4-8 MM, 9-12 MM, 13-16 MM, plus de 16 MM et moins de 4 MM · Par application : bâtiments résidentiels, bâtiments commerciaux, bâtiments publics, ménages et automobiles · Par canal de distribution : Ventes directes et ventes au détail |

|

Pays couvert |

Arabie Saoudite |

|

Principaux acteurs du marché |

Guardian Industries Holdings (États-Unis), Saint-Gobain (France), ARABIAN PROCESSING GLASS CO. (Arabie saoudite), Emirates Glass LLC (EAU), Al-Ashoury Glass (Arabie saoudite), AGC Obeiken Glass (Arabie saoudite), Al Andalus Glass (Arabie saoudite), Alma (Arabie saoudite), IKKGlass (Arabie saoudite), Rawom Trading Company (Arabie saoudite) et REGIONGLASS (Arabie saoudite) |

|

Opportunités de marché |

· Initiatives gouvernementales croissantes en matière de développement urbain · Progrès technologiques et innovations dans la fabrication du verre |

|

Ensembles d'informations sur les données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire |

Définition du marché du verre architectural

Le verre architectural est une catégorie de verre spécialement conçue pour être utilisée dans la construction et la conception de bâtiments, combinant des objectifs à la fois fonctionnels et esthétiques. Ce type de verre comprend diverses formes telles que le verre trempé, le verre feuilleté et le verre isolant, chacun étant adapté pour répondre à des besoins spécifiques. Par exemple, le verre trempé est traité thermiquement pour améliorer sa résistance et sa sécurité, ce qui le rend idéal pour les zones à fort trafic et les façades. Le verre feuilleté, avec ses multiples couches et sa couche intermédiaire, offre une sécurité et une isolation phonique accrues, tandis que les unités de verre isolant (IGU) améliorent l'efficacité énergétique en minimisant le transfert de chaleur entre les environnements intérieurs et extérieurs.

Au-delà de ses avantages pratiques, le verre architectural contribue également à l'attrait visuel d'un bâtiment, en offrant des options de clarté, de couleur, de texture et de motifs pour créer divers effets de design et améliorer l'éclairage naturel. Dans l'ensemble, le verre architectural joue un rôle crucial dans la conception des bâtiments modernes, répondant à la fois aux exigences de performance et aux considérations esthétiques.

Dynamique du marché du verre architectural

Conducteurs

- L'accent est mis de plus en plus sur les objectifs de développement durable et les initiatives en matière de construction écologique

The Saudi Arabian architectural glass market is experiencing significant growth, primarily driven by the rising focus on sustainability goals and green building initiatives. As the nation moves towards a more sustainable future, architectural glass plays a crucial role in enhancing energy efficiency, reducing carbon footprints, and promoting environmentally friendly building practices. One of the key drivers for the architectural glass market is its inherent ability to improve energy efficiency in buildings. High-performance glass, such as low-emissivity (low-E) and triple-glazed units, can significantly reduce energy consumption by minimizing heat transfer. In a country like Saudi Arabia, where temperatures can soar, energy-efficient glazing helps maintain comfortable indoor environments, reducing the reliance on air conditioning systems. This not only lowers energy bills for consumers but also contributes to national efforts to reduce overall energy consumption, aligning with Saudi Vision 2030's goals.

For instance,

- In September 2024, according to an article by World Economic Forum, as global efforts to combat climate change intensify, innovative materials like low-emissivity (low-e) glass are crucial for sustainable construction. Buildings, responsible for 39% of global carbon emissions, benefit from low-e glass, which improves insulation and energy efficiency.

Rapidly Growing Tourism and Hospitality Industry

The architectural glass market in Saudi Arabia is experiencing significant growth, largely driven by the rapidly expanding tourism and hospitality industry. As the Kingdom continues to position itself as a leading global tourist destination, particularly following the launch of initiatives like Vision 2030, there is a heightened demand for innovative architectural solutions that reflect modern design aesthetics and enhance the visitor experience. Architectural glass plays a crucial role in the hospitality sector, as it offers numerous benefits that align with the needs of modern architectural design. Its ability to enhance natural light, improve energy efficiency, and provide aesthetic appeal makes it an ideal choice for hotels and resorts. Glass façades, for example, are increasingly popular for their ability to create a seamless connection between indoor and outdoor spaces, allowing guests to enjoy panoramic views of the surrounding landscapes, which is particularly appealing in a country known for its breathtaking desert and coastal scenery.

For instance,

- In May 2024, according to an article by Arab news, Saudi Arabia is rapidly developing its hospitality sector, leading the Middle East in hotel construction with over 42,000 new rooms in 2023. Initiatives like the sustainability-focused Four Seasons Amaala and NEOM's eco-friendly hotels reflect the Kingdom's Vision 2030 goal to integrate responsible tourism and environmental stewardship into its growth strategy.

Opportunities

- Technological Advancements and Innovations in Glass Manufacturing

Saudi Arabia's architectural glass market stands on the brink of significant transformation driven by technological advancements and innovations in glass manufacturing. With the nation's Vision 2030 initiative promoting diversification and sustainable development, there is a growing demand for high-performance glass solutions that enhance energy efficiency and aesthetic appeal in modern architecture. Innovations such as low-emissivity (low-E) coatings and advanced insulating glass units not only improve thermal performance but also contribute to reducing energy consumption, aligning with global sustainability trends. Furthermore, the introduction of smart glasses technologies, which can adjust transparency based on environmental conditions, offers architects unprecedented design flexibility while enhancing user comfort.

For instance,

In May 2024, an article published by Centuro Global stated that Vision 2030 aims to diversify Saudi Arabia's economy away from oil dependency, addressing looming peak oil predictions. Under Crown Prince MBS, the initiative also promotes social reforms, including cultural development. At its halfway point, progress is evident, yet challenges remain in fully achieving these ambitious goals.

- Rising Government Initiatives for Urban Development

Saudi Arabia's architectural glass market is poised for significant growth, driven by a surge in government initiatives focused on urban development. The Saudi’s Vision 2030 strategy emphasizes diversification and modernization, aiming to transform cities into sustainable, technologically advanced urban centers. This shift is generating increased demand for innovative architectural solutions, particularly in glass manufacturing, which plays a crucial role in enhancing both functionality and aesthetics in modern buildings. Government investments in mega-projects, such as NEOM and the Red Sea Project among many others, highlight the need for high-performance glass products that meet stringent sustainability standards. These projects prioritize energy efficiency, and architectural glass solutions such as low-emissivity (low-E) and insulating glass, which are essential for minimizing energy consumption and optimizing climate control. In addition, the trend towards smart cities incorporates advanced glass technologies that enable dynamic control of light and energy use, further aligning with national sustainability goals.

For instance,

- In October 2024, according to an article published by ScienceDirect, the article discusses advancements in sustainable architecture, emphasizing the integration of eco-friendly materials and energy-efficient technologies. It explores innovative design strategies that reduce environmental impact, enhance occupant comfort, and promote resource conservation. The research highlights the importance of sustainability in modern building practices and its role in addressing climate change challenges.

Restraints/Challenges

- Stringent Environmental Regulations and Building Safety Standards

The architectural glass market in Saudi Arabia faces significant challenges due to stringent environmental regulations and building safety standards. As the nation increasingly prioritizes sustainability, manufacturers and builders are required to comply with rigorous guidelines aimed at reducing environmental impact. While these regulations foster innovation in energy-efficient and sustainable glass products, they also impose constraints on production processes and materials, potentially raising costs for manufacturers. The demand for high-performance glass that meets new energy efficiency standards has become paramount. Low-emissivity (low-E) coatings and insulating glass units are now essential in architectural projects, as they help to minimize energy consumption and enhance thermal comfort. However, the development and integration of such advanced technologies require significant investment in research and development, which can be challenging for smaller companies.

For instances

- According to the document published from the Saudi Building Code National Committee, it outlines the Saudi Building Code, focusing on safety, sustainability, and efficiency in construction. It also establishes standards for various building types, addressing structural integrity, energy performance, and environmental impact. The code aims to enhance the quality of construction and promote responsible development within the kingdom’s urban planning framework.

Fluctuating Raw Material Prices

The architectural glass market in Saudi Arabia is significantly impacted by fluctuating raw material prices, posing substantial challenges for manufacturers and stakeholders. The volatility in the prices of key raw materials such as silica, soda ash, and other additives can disrupt production schedules and impact profit margins. As global demand for these materials fluctuates due to geopolitical tensions, economic conditions, and changes in trade policies, local manufacturers must navigate a complex landscape that complicates budgeting and forecasting. These price fluctuations are particularly concerning in a market striving for growth and sustainability. Manufacturers are under pressure to maintain competitive pricing while also investing in advanced technologies and sustainable practices to meet evolving consumer expectations and regulatory requirements. When raw material costs rise unexpectedly, it can lead to increased production costs, forcing manufacturers to either absorb these costs or pass them on to consumers, which may affect demand.

Climate Change Scenario

The Saudi Arabia architectural glass market faces harsh climate, characterized by extremely high temperatures, has a significant impact on the architectural glass market. Buildings in the region require substantial energy for cooling due to high solar heat gain through glass windows. Traditional glass products often fail to mitigate this heat gain effectively, leading to increased reliance on air conditioning systems. This not only raises energy consumption but also exacerbates the environmental impact by contributing to higher greenhouse gas emissions. The architectural glass market must address this challenge by focusing on products that enhance thermal insulation and reduce heat transfer.

Regulatory Framework Content

The architectural glass market in Saudi Arabia is influenced by a number of regulations, primarily driven by the government’s focus on energy efficiency, safety standards, and sustainability as part of its vision 2030 initiative. These regulations impact both manufacturers and importers of glass products, and compliance is mandatory for companies to participate in major construction projects.

Below is a detailed coverage of regulations and standards affecting the Saudi Arabia architectural glass market:

Saudi Standards, Metrology and Quality Organization (SASO):

- The Saudi Standards, Metrology, and Quality Organization (SASO) enforces technical standards for various products, including glass. SASO has developed standards for thermal insulation and solar heat gain, which glass manufacturers must comply with. These standards ensure that glass products contribute to energy-efficient buildings, aligning with the country's efforts to reduce carbon emissions

Saudi Energy Efficiency Program (SEEP):

- Saudi Arabia is committed to reducing energy consumption in buildings, and regulations under SEEP have led to the promotion of energy-efficient materials, including architectural glass. The use of Low-Emissivity (Low-E) and solar control glass has become increasingly important, as the government pushes for more sustainable building practices. Glass products must meet specific thermal performance standards that reduce energy usage in cooling buildings

Saudi Building Code (SBC):

- The Saudi Building Code (SBC) sets out regulations related to the safety, fire resistance, and structural integrity of materials used in construction, including glass. Manufacturers are required to produce safety glass (such as laminated or tempered glass) for use in critical areas like windows, facades, and skylights in commercial and residential buildings. The SBC also covers fire safety regulations, which stipulate the use of fire-rated glass in certain buildings, particularly in high-rise structures, hotels, and public spaces. Manufacturers and suppliers of glass are expected to provide certified fire-resistant glass that meets local safety standards.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Architectural Glass Market Scope

The market is segmented on the basis of type, thickness, application distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Low E Glass

- Insulated Glass

- Laminated Glass

- Solar Reflective Glass

- Annealed Glass

- Security Glass

- Tempered Sandwich Glass

- Toughened Glass

- Low Iron Glass

- Tinted Glass

- Patterned Glass

- Solid Glass

- Body Tinted Glass

- Heat Strengthened Glass

- Hollow Glass

- Others

- Low E Glass, By Type

- Solar

- Passive

- Security Glass, By Category

- Bullet Proof Glass

- Fire Proof Glass

- Blast Proof Glass

- Attack Proof Glass

- Others

- Low E Glass, By Type

Thickness

- 4-8 MM

- 9-12 MM

- 13-16 MM

- More than 16 MM

- Less than 4 MM

Application

- Residential Buildings

- Commercial Buildings

- Public Buildings

- Household

- Automotive

- Residential Buildings, By Building Type

- Multi-Level Apartments

- Single Level Apartments

- Condominium

- Others

- Residential Buildings, By End-Use

- Windows

- Doors

- Railings

- Balconies

- Skylights

- Staircases

- Terraces

- Others

- Residential Buildings, By Cities

- Riyadh

- Jeddah

- Mecca

- Dammam

- Medina

- Khobar

- Tabuk

- Buraydah

- Taif

- Al Kharj

- Others

- Commercial Buildings, By Building Type

- Corporate Office

- Shopping Complex

- Hotels

- Hospitals

- Restaurants

- Railway Station

- Airports

- Salons & Spas

- Guest Houses

- Others

- Commercial Buildings, By End-Use

- Façade

- Curtain Wall

- Canopies

- Atriums

- Conference Room Walls

- Staircases

- Terraces

- Others

- Commercial Buildings, By Cities

- Riyadh

- Jeddah

- Mecca

- Dammam

- Medina

- Khobar

- Tabuk

- Buraydah

- Taif

- Al Kharj

- Others

- Public Buildings, By Building Type

- Court Houses/Judicial Centers

- Police Headquarters

- Parliament

- Bank/Treasury Building

- Research and Development (R&D) Buildings

- Datacentre Buildings

- Post Office

- Military Bases

- Others

- Public Buildings, By Cities

- Riyadh

- Jeddah

- Mecca

- Dammam

- Medina

- Khobar

- Tabuk

- Buraydah

- Taif

- Al Kharj

- Others

- Household, By End-Use

- Kitchenware

- Tableware

- Container

- Automotive, By End-Use

- Windshield

- Rear Window

- Door

- Sunroof

- Vent

- Door, By Type

- Front

- Rear

- Vent, By Type

- Front

- Rear

- Residential Buildings, By Building Type

Distribution Channel

- Direct Sales

- Retail Sales

- Retail, By Distribution Channel

- Offline

- Offline, By Distribution Channel

- Distributors and Wholesalers

- Contractors and Fabricators

- Specialty Glass Retailers

- Architects and Designers

- Original Equipment Manufacturers

- Convenience Stores

- Others

- Offline, By Distribution Channel

- Online

- Online, By Distribution Channel

- Company Owned Websites

- Third Party Websites

- Online, By Distribution Channel

- Offline

- Retail, By Distribution Channel

Saudi Arabia Architectural Glass Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Architectural Glass Market Leaders Operating in the Market Are:

- Guardian Industries Holdings (U.S.)

- Saint-Gobain (France)

- ARABIAN PROCESSING GLASS CO. (Saudi Arabia)

- Emirates Glass LLC (U.A.E.)

- Al-Ashoury Glass (Saudi Arabia)

- AGC Obeiken Glass (Saudi Arabia)

- Al Andalus Glass (Saudi Arabia)

- Alma (Saudi Arabia)

- IKKGlass (Saudi Arabia)

- Rawom Trading Company (Saudi Arabia)

- REGIONGLASS (Saudi Arabia)

Latest Developments in Architectural Glass Market

- En septembre 2022, Saint-Gobain a lancé ORAÉ, le premier verre bas carbone au monde, qui présente une réduction remarquable de 42 % de l'empreinte carbone grâce à 64 % de contenu recyclé. Ce produit innovant allie durabilité et performances supérieures, ce qui le rend idéal pour les projets architecturaux économes en énergie et respectueux de l'environnement HALO Trust pour améliorer la détection des mines terrestres

- En octobre 2023, Emirates Glass LLC a annoncé avoir reçu la certification ICV (In-Country Value), soulignant son engagement en faveur de la croissance économique et de la diversification des Émirats arabes unis. Cette reconnaissance souligne l'accent mis par l'entreprise sur le soutien aux industries locales, la formation des talents et la contribution à une économie durable et axée sur la connaissance, affirmant ainsi son rôle de partenaire clé dans le développement du pays.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.1.1 EXTREME TEMPERATURES AND ENERGY USE

4.3.1.2 HEAT ISLAND EFFECT

4.3.1.3 RESOURCE SCARCITY AND ENVIRONMENTAL IMPACT

4.3.1.4 WASTE AND RECYCLING

4.3.2 INDUSTRY RESPONSE

4.3.2.1 ADOPTION OF ENERGY-EFFICIENT GLASS

4.3.2.2 INNOVATIONS IN GLASS PRODUCTION

4.3.2.3 RECYCLING AND CIRCULAR ECONOMY

4.3.3 GOVERNMENT’S ROLE

4.3.3.1 REGULATORY FRAMEWORKS

4.3.3.2 SUPPORT FOR SUSTAINABLE INITIATIVES

4.3.3.3 ENVIRONMENTAL STANDARDS

4.3.4 ANALYST RECOMMENDATIONS

4.3.4.1 EMBRACE TECHNOLOGICAL ADVANCEMENTS

4.3.4.2 LEVERAGE RECYCLED MATERIALS

4.3.4.3 STRENGTHEN SUSTAINABILITY PRACTICES

4.3.4.4 COLLABORATE WITH GOVERNMENT AND INDUSTRY

4.3.5 CONCLUSION

4.4 PRICING ANALYSIS

4.4.1 RAW MATERIAL COSTS

4.4.2 ENERGY COSTS IMPACT

4.4.3 DEMAND-SUPPLY DYNAMICS

4.4.4 TRANSPORTATION AND LOGISTICS COSTS

4.4.5 REGULATORY AND ENVIRONMENTAL COMPLIANCE

4.4.6 CURRENCY EXCHANGE RATES

4.4.7 LABOR COSTS AND AVAILABILITY

4.4.8 COMPETITIVE LANDSCAPE

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 LOGISTICS COST SCENARIO

4.6.1.1 HIGH TRANSPORTATION AND HANDLING COSTS

4.6.1.2 IMPORT TARIFFS AND CUSTOMS DELAYS

4.6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6.2.1 SPECIALIZED TRANSPORT AND HANDLING

4.6.2.2 JUST-IN-TIME DELIVERY (JIT)

4.6.2.3 COLD CHAIN AND CLIMATE-CONTROLLED LOGISTICS

4.6.2.4 INTEGRATED LOGISTICS SOLUTIONS

4.6.3 TECHNOLOGICAL INNOVATIONS TO REDUCE LOGISTICS COSTS

4.6.3.1 DIGITAL SUPPLY CHAIN PLATFORMS

4.6.3.2 AUTOMATED WAREHOUSING

4.6.4 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS, BY MANUFACTURERS

4.7.1 LOW-EMISSIVITY (LOW-E) GLASS

4.7.2 SMART GLASS INTEGRATION

4.7.3 SOLAR CONTROL GLASS

4.7.4 LAMINATED SAFETY GLASS

4.7.5 INSULATED GLASS UNITS (IGUS)

4.8 VENDOR SELECTION CRITERIA

4.9 RAW MATERIAL COVERAGE

4.9.1 KEY RAW MATERIALS FOR ARCHITECTURAL GLASS

4.9.2 SOURCING AND SUPPLY CHAIN CONSIDERATIONS

4.9.3 CHALLENGES AND OPPORTUNITIES

4.9.4 CONCLUSION

5 REGULATION COVERAGE

5.1 DOOR AND WINDOW MANUFACTURERS AND CURTAIN WALL COMPANIES

5.2 LARGE CHINESE COMPANIES UNDERTAKING PROJECTS IN SAUDI ARABIA

5.2.1 CHINA’S CSCEC SAUDI CONSTRUCTION CONTRACT

5.2.2 ADIT TUNNEL PROJECT FOR SAUDI ARABIA'S FUTURISTIC CITY NEOM BY CHINA RAILWAY CONSTRUCTION CORPORATION (CRCC):

5.2.3 CHINA RAILWAY CONSTRUCTION CORPORATION (CRCC) APPOINTED AS PRIMARY CONTRACTOR FOR JEDDAH CENTRAL STADIUM PROJECT:

5.2.4 THE SHEBALA ISLAND DREDGING AND RECLAMATION PROJECT LED BY CCCC'S SUBSIDIARY CHEC

5.2.5 SAUDI NEOM PROJECT CONTRACT ACQUIRED BY FCC CONSTRUCTION:

5.2.6 CHINA HARBOR BAY MIDDLE EAST REGIONAL MANAGEMENT CENTER WON FOUR CONSECUTIVE BIDS FOR PROJECTS IN SAUDI ARABIA

5.2.7 CHINA MACHINERY ENGINEERING CORPORATION AWARDED THE CONTRACT FOR 20,000 RESIDENTIAL UNITS

5.2.8 POWERCHINA’S CONSTRUCTION PROJECT FOR SAUDI MEGA-YARD

5.3 LOCATIONS TO SETUP A GLASS PROCESSING FACTORY

5.3.1 KEY DETAILS ON MACHINERY AND INVESTMENTS:

5.4 NEW CONSTRUCTIONS IN SAUDI ARABIA

5.4.1 SECTOR-WISE CONSTRUCTION BREAKDOWN AND IMPACT ON ARCHITECTURAL GLASS MARKET

5.4.1.1 RESIDENTIAL CONSTRUCTION (2024-2031)

5.4.1.2 COMMERCIAL CONSTRUCTION (2024-2031)

5.4.1.3 PUBLIC BUILDINGS CONSTRUCTION (2024-2031)

5.4.2 IMPACT ON THE ARCHITECTURAL GLASS MARKET FOR 2025-2030

5.4.3 KEY CONSTRUCTION PROJECTS CONTRIBUTING TO ARCHITECTURAL GLASS DEMAND

5.4.3.1 NEOM

5.4.3.2 KING SALMAN PARK

5.4.3.3 QIDDIYA ENTERTAINMENT CITY

5.4.3.4 RED SEA PROJECT

5.4.3.5 JEDDAH TOWER

5.4.3.6 RIYADH METRO

5.4.3.7 DIRIYAH GATE DEVELOPMENT

5.4.3.8 AMAALA

5.4.3.9 KING ABDULLAH FINANCIAL DISTRICT (KAFD)

5.5 QUALITY AND IMPORT VOLUME OF PROCESSED GLASS

5.5.1 SIGNIFICANT INCREASE IN IMPORT VOLUME OF PROCESSED GLASS PRODUCTS (2021-2023)

5.5.2 QUALITY COMPARISON: IMPORTED PROCESSED GLASS VS. LOCAL PRODUCTION

5.6 TOP TEN GLASS DEEP-PROCESSING COMPANIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.2 RISING FOCUS ON SUSTAINABILITY GOALS AND GREEN BUILDING INITIATIVES

6.1.3 RAPIDLY GROWING TOURISM AND HOSPITALITY INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS OF ADVANCED ARCHITECTURAL GLASSES

6.2.2 STIFF COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN GLASS MANUFACTURING

6.3.2 RISING GOVERNMENT INITIATIVES FOR URBAN DEVELOPMENT

6.4 CHALLENGES

6.4.1 STRINGENT ENVIRONMENTAL REGULATIONS AND BUILDING SAFETY STANDARDS

6.4.2 FLUCTUATING RAW MATERIAL PRICES

7 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE

7.1 OVERVIEW

7.2 LOW E GLASS

7.3 INSULATED GLASS

7.4 LAMINATED GLASS

7.5 SOLAR REFLECTIVE GLASS

7.6 ANNEALED GLASS

7.7 SECURITY GLASS

7.8 TEMPERED SANDWICH GLASS

7.9 TOUGHENED GLASS

7.1 LOW IRON GLASS

7.11 TINTED GLASS

7.12 PATTERNED GLASS

7.13 SOLID GLASS

7.14 BODY TINTED GLASS

7.15 HEAT STRENGTHENED GLASS

7.16 HOLLOW GLASS

7.17 OTHERS

8 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 4-8 MM

8.3 9-12 MM

8.4 13-16 MM

8.5 MORE THAN 16 MM

8.6 LESS THAN 4 MM

9 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL BUILDINGS

9.3 COMMERCIAL BUILDINGS

9.4 PUBLIC BUILDINGS

9.5 HOUSEHOLD

9.6 AUTOMOTIVE

10 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 RETAIL SALES

11 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 GUARDIAN INDUSTRIES HOLDINGS

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 SAINT-GOBAIN

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 ARABIAN PROCESSING GLASS CO.

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATES

13.4 EMIRATES GLASS LLC

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 AL-ASHOURY GLASS

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATES

13.6 AGC OBEIKAN GLASS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 AL ANDALUS GLASS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ALMA

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 IKKGLASS

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 RAWOM TRADING COMPANY

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 REGIONGLASS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY COVERAGE

TABLE 2 DOOR AND WINDOW MANUFACTURERS AND CURTAIN WALL COMPANIES

TABLE 3 SETTING UP A GLASS PROCESSING FACTORY IN SAUDI ARABIA

TABLE 4 IMPORT VOLUME OF ARCHITECTURAL GLASS IN SAUDI ARABIA (THOUSAND SQUARE METERS)

TABLE 5 PROCESSING VOLUME OF TOP 10 GLASS DEEP PROCESSING COMPANIES IN THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET:

TABLE 6 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (THOUSAND SQ.MT)

TABLE 8 SAUDI ARABIA LOW E GLASS IN ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 SAUDI ARABIA SECURITY GLASS IN ARCHITECTURAL GLASS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 10 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY THICKNESS, 2022-2031 (USD THOUSAND)

TABLE 11 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 12 SAUDI ARABIA RESIDENTIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY BUILDING TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 SAUDI ARABIA RESIDENTIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 14 SAUDI ARABIA RESIDENTIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY CITIES, 2022-2031 (USD THOUSAND)

TABLE 15 SAUDI ARABIA COMMERCIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY BUILDING TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 SAUDI ARABIA COMMERCIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 17 SAUDI ARABIA COMMERCIAL BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY CITIES, 2022-2031 (USD THOUSAND)

TABLE 18 SAUDI ARABIA PUBLIC BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY BUILDING TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 SAUDI ARABIA PUBLIC BUILDINGS IN ARCHITECTURAL GLASS MARKET, BY CITIES, 2022-2031 (USD THOUSAND)

TABLE 20 SAUDI ARABIA HOUSEHOLD IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 21 SAUDI ARABIA AUTOMOTIVE IN ARCHITECTURAL GLASS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 22 SAUDI ARABIA DOOR IN ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 SAUDI ARABIA VENT IN ARCHITECTURAL GLASS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 25 SAUDI ARABIA RETAIL SALES IN ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 26 SAUDI ARABIA OFFLINE IN ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 27 SAUDI ARABIA ONLINE IN ARCHITECTURAL GLASS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

Liste des figures

FIGURE 1 SAUDI ARABIA ARCHITECTURAL GLASS MARKET

FIGURE 2 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: MULTIVARIATE MODELLING

FIGURE 7 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: SEGMENTATION

FIGURE 12 SIXTEEN SEGMENTS COMPRISE THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET, BY TYPE

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT ARE EXPECTED TO DRIVE THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET IN THE FORECAST PERIOD..

FIGURE 16 LOW E GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA ARCHITECTURAL GLASS MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 SAUDI ARABIA ARCHITECTURAL GLASS MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/SQUARE METER)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS: SAUDI ARABIA ARCHITECTURAL GLASS MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR SAUDI ARABIA ARCHITECTURAL GLASS MARKET

FIGURE 23 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY TYPE, 2023

FIGURE 24 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY THICKNESS, 2023

FIGURE 25 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY APPLICATION, 2023

FIGURE 26 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 27 SAUDI ARABIA ARCHITECTURAL GLASS MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.