North America Modular Data Center Market

Taille du marché en milliards USD

TCAC :

%

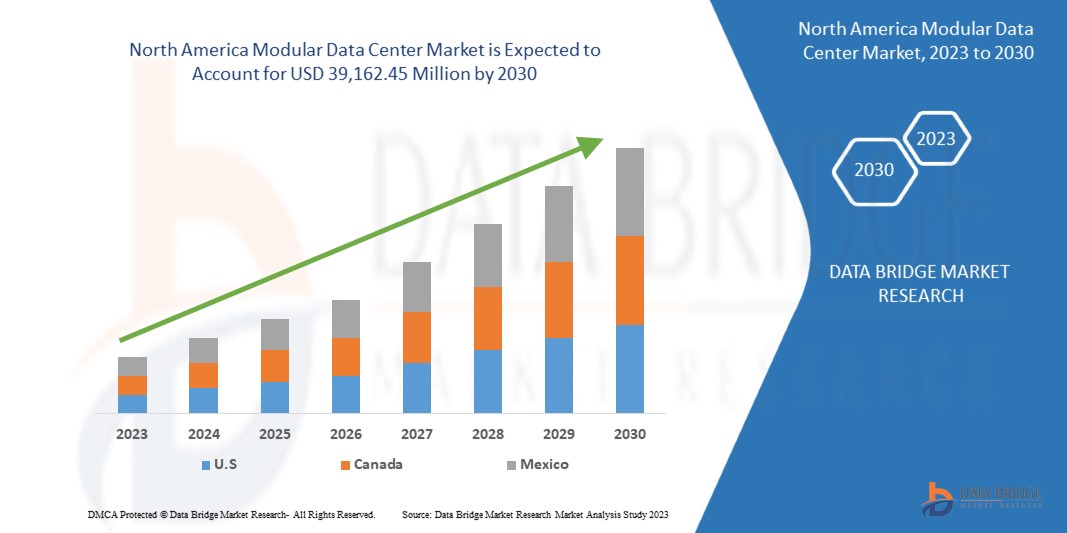

| 2023 –2030 | |

| USD 9,698.19 Million | |

| USD 39,162.45 Million | |

|

|

|

>Marché des centres de données modulaires en Amérique du Nord, par composant (solution et services), type (centres de données entièrement fonctionnels, partiellement fabriqués et micro), application (centres de données plus intelligents, extension de capacité, informatique haute performance/de pointe , reprise après sinistre, déploiement d'urgence et temporaire et extension du centre de données), taille de déploiement (données de grande taille, centre de données de taille moyenne et centre de données de petite taille), type de niveau (niveau 4, niveau 3, niveau 2 et niveau 1), type d'emplacement (extérieur et intérieur), vertical (BFSI, informatique et télécommunications, énergie et services publics, industrie, gouvernement et défense, fabrication, soins de santé, transport et logistique, médias et divertissement, vente au détail, éducation et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des centres de données modulaires en Amérique du Nord

Un centre de données modulaire est une installation préfabriquée et pré-conçue construite à l'aide de composants standardisés. Il peut être facilement transporté, déployé et mis à l'échelle selon les besoins d'une organisation. Il est conçu pour fournir une solution flexible et efficace pour héberger l'infrastructure du centre de données, y compris les serveurs, le stockage, les équipements réseau et les systèmes de refroidissement.

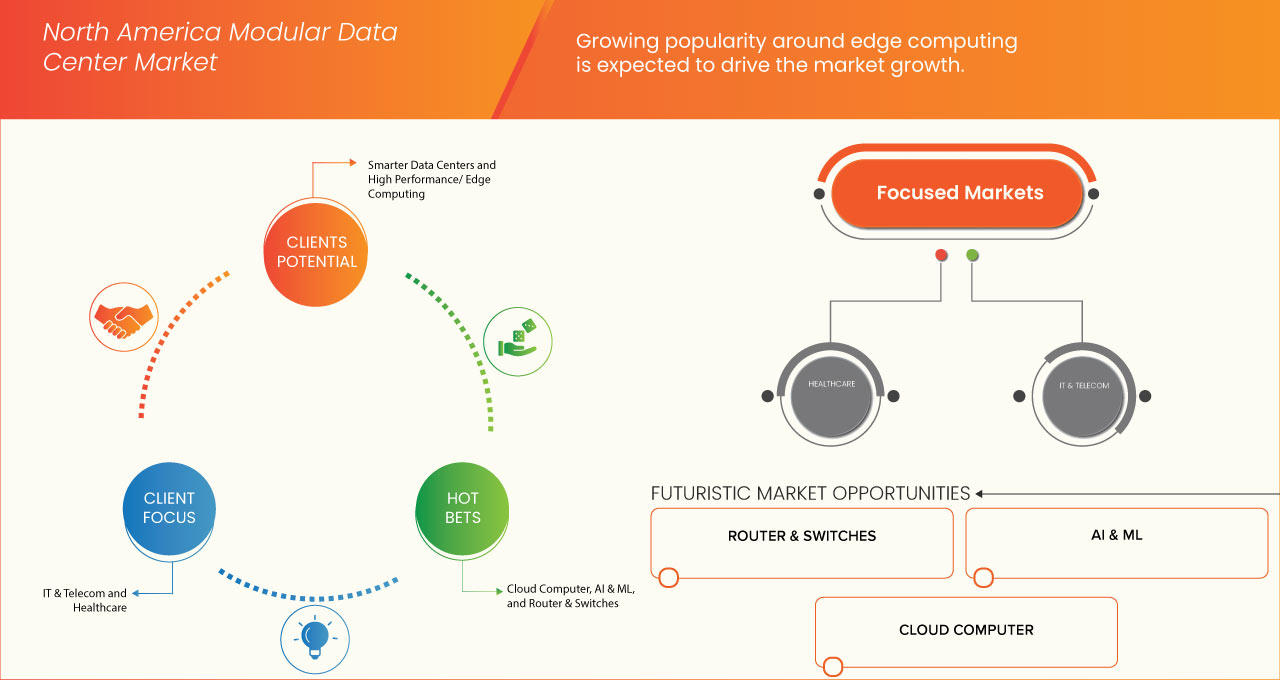

La popularité croissante de l'informatique de pointe, le besoin croissant de centres de données évolutifs de la part des industries de tous les domaines, l'augmentation de la demande de centres de données préfabriqués et la nécessité d'obtenir une visibilité de bout en bout pour prévoir les besoins en gestion de la capacité sont les principaux facteurs qui devraient stimuler la croissance du marché. Cependant, le manque de fiabilité des infrastructures dans les pays en développement, la complexité de l'intégration de différents outils de centres de données et les coûts initiaux élevés des infrastructures devraient freiner la croissance du marché. L'augmentation des tendances en matière de numérisation, les progrès du secteur informatique, la demande croissante d'installations de travail à distance et l'essor de l'adoption de l'IA et du ML offrent des opportunités de croissance du marché. Cependant, le manque de sécurité des données devrait constituer un défi pour la croissance du marché.

Data Bridge Market Research analyse que le marché des centres de données modulaires en Amérique du Nord devrait atteindre 39 162,45 millions USD d'ici 2030, contre 9 698,19 millions USD en 2022, avec un TCAC de 19,3 % au cours de la période de prévision de 2023 à 2030. Divers acteurs du marché participent à des expositions, des remises de prix et des lancements de produits pour développer leurs activités sur le marché, qui n'a cessé de croître au fil des ans.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Component (Solution and Services), Type (Full Functional, Partial Fabricated, and Micro Data Centers), Application (Smarter Data Centers, Capacity Expansion, High Performance/ Edge Computing, Disaster Recovery, Emergency and Temporary Deployment, and Data Center Expansion), Deployment Size (Large Size Data, Medium Size Data Center, and Small Size Data Center), Tier Type (Tier 4, Tier 3, Tier 2, and Tier 1), Location Type (Outdoor and Indoor), Vertical (BFSI, IT & Telecom, Energy & Utilities, Industrial, Government & Defense, Manufacturing, Healthcare, Transport & Logistics, Media & Entertainment, Retail, Education, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Dell Inc., Hewlett Packard Enterprise Development LP, IBM, Schneider Electric, Vertiv Group Corp., Cisco Systems, Inc., ZTE Corporation, Baselayer Technology, LLC., PCX Holding LLC, Box Modul, Eaton, Rittal GmbH & Co. KG, Cupertino Electric, Inc., Delta Electronics, Inc., Huawei Technologies Co., Ltd., and FiberHome, among others |

Market Definition

Modular data centers are designed to offer flexibility, rapid deployment, and cost efficiency compared to traditional brick-and-mortar data centers. They are often used when organizations require quick expansion of their data center capacity, temporary data center solutions, or in locations with limited space and infrastructure. The market for modular data centers encompasses various aspects, including manufacturing, distribution, installation, and maintenance of these modular units and related services, such as consulting, design, and integration. It involves various industry participants, including data center solution providers, equipment manufacturers, system integrators, and service providers.

North America Modular Data Center Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Popularity of Edge Computing

Edge computing is an emerging computing paradigm that refers to a range of networks and devices. This computing technology brings computing and data storage closer to the device where it is being gathered. In addition, companies using real-time data do not suffer latency issues and can save money.

As companies increasingly leverage edge computing to support multiple types of applications and systems, a massive amount of data is generated for decision-making. However, sending all the data to the cloud can result in latency. Edge computing can drive sub-second responses by moving both computing and data closer to the user. This will reduce latency, minimize data threats, and boost bandwidth.

- Rising Need for Scalable Data Centers from Industries Across All Domains

A data center in the age of digitalization is very important as almost every modern business and government office needs its data center. Depending on the needs, every government institution and corporation may choose to build and manage its data center. Even industries such as education, finance, telecommunication, retailers, and social networking services which generate and process tons of information every day, need a data center. Therefore, these industries need data centers to run their operations. If they fail to deploy, it can lead to the loss of clients and profits. There are four types of data centers such as colocation data centers, enterprise data centers, managed services data centers, and cloud data centers.

An effective data center must have systems that are working together to achieve better capabilities. Enterprise can efficiently function and contribute to the economy when systems such as firefighting systems, integration management, integrated cabling, cooling systems, power supply systems, interior decorations, cabinet systems, and surge protection are all combined.

Opportunity

- Rise in Digitalization Trend

The digitalization or the usage of digital processes to improve business operations is increasing with the usage of relevant components to modernize the business, leading to the evolution of the working process and revenue growth to achieve future success. Converting non-digital things into digital formats makes sharing, saving, and searching for information easier, which further leads to business operations automation by developing automatic workflows or marketing outreach sequences.

Digitalization has a wide range of benefits and requires proper maintenance and additional equipment and infrastructure to manage the working system properly. Thus, this process includes managing collected data, saving, processing, analyzing, sharing, and implementing many more operations. However, digitalization simplifies and automates the core working operations of the business but creates a need for advanced technology and infrastructure.

Restraint/Challenge

- Unreliable Infrastructure in Developing Countries

A data center plays a significant part in IT needs to oversee and store the tremendous assets that are significant for any association's consistent work. MDC is a solitary item, yet it plays a colossal part in the present business. It has been made with various specialized components. The primary work of a data center is figuring, putting away, and organizing. Dependability, effectiveness, security, and consistent advancement are the significant jobs of data centers.

The significant investment volumes and the quality and adequacy of infrastructure services generally vary across nations. The experience of millions of individuals all over the planet shows that just being associated with foundation networks does not ensure dependable administrations. Particularly, the quickly developing urban communities in emerging nations are confronting the difficult outcomes of unacceptable frameworks, frequently at a massive expense. Maturing hardware, underfunding, unfortunate support, and quick extension are a portion of the key variables bringing about temperamental power frameworks, water, and disinfection.

Recent Developments

- In July 2023, Digital Realty chose IBM Corporation's Envizi sustainability software to revolutionize data analysis in its global data centers and offices. This central hub facilitated ESG data collection, management, and insight extraction, aiding progress tracking, improvement identification, performance reporting, and meeting disclosure needs. IBM gained a valuable advantage by helping clients, such as Digital Realty make data-driven, sustainable decisions through the Envizi ESG Suite.

- In June 2023, Hewlett Packard Enterprise Development LP announced the expanded partnership with Equinix to extend the HPE GreenLake private cloud portfolio at Equinix International Business Exchange (IBX) data centers. This partnership will help the company bring the best cloud experience for data centers and enhance the performance of the system.

- In May 2023, Dell Inc. introduced the Dell NativeEdge software platform to secure edge deployments. This new solution will help the company to simplify, secure, and automate edge infrastructure and application deployment. In addition, this will help to manage the data centers and public clouds.

North America Modular Data Center Market Scope

The North America modular data center market is segmented into seven notable segments based on component, type, application, deployment size, tier type, location type, and vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

On the basis of component, the market is segmented into solution and services.

Type

- Full Functional

- Partial Fabricated

- Micro Data Centers

On the basis of type, the market is segmented into full functional, partial fabricated, and micro data centers.

Application

- Smarter Data Centers

- Capacity Expansion

- High Performance/Edge Computing

- Disaster Recovery

- Emergency and Temporary Deployment

- Data Center Expansion

On the basis of application, the market is segmented into smarter data centers, capacity expansion, high performance/ edge computing, disaster recovery, emergency and temporary deployment, and data center expansion.

Deployment Size

- Large Size Data

- Medium Size Data Center

- Small Size Data Center

On the basis of deployment size, the market is segmented into large size data, medium size data center, and small size data center.

Tier Type

- Tier 1

- Tier 2

- Tier 3

- Tier 4

On the basis of tier type, the market is segmented into tier 4, tier 3, tier 2, and tier 1.

Location Type

- Outdoor

- Indoor

On the basis of location type, the market is segmented into outdoor and indoor.

Vertical

- BFSI

- IT & Telecom

- Energy & Utilities

- Industrial

- Government & Defense

- Manufacturing

- Healthcare

- Transport & Logistics

- Media & Entertainment

- Retail

- Education

- Others

On the basis of vertical, the market is segmented into BFSI, IT & telecom, energy & utilities, industrial, government & defense, manufacturing, healthcare, transport & logistics, media & entertainment, retail, education, and others.

North America Modular Data Center Market Regional Analysis/Insights

The North America modular data center market is analyzed and market size insights and trends are provided by country, component, type, application, deployment size, tier type, location type, and vertical, as referenced above.

The countries covered in this market report are the U.S., Canada, and Mexico.

U.S. is expected to dominate the North America modular data center market due to its strong technology infrastructure, high demand for data storage, and the presence of major tech companies. Its booming digital economy, rapid urbanization, and government initiatives support data center construction and digital infrastructure development.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America Modular Data Center Market Share Analysis

The North America modular data center market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Certains des principaux acteurs du marché opérant sur le marché des centres de données modulaires en Amérique du Nord sont Dell Inc., Hewlett Packard Enterprise Development LP, IBM Corp., Schneider Electric, Vertiv Group Corp., Cisco Systems, Inc., ZTE Corporation, Baselayer Technology, LLC., PCX Holding LLC, Box Modul, Eaton, Rittal GmbH & Co. KG, Cupertino Electric, Inc., Delta Electronics, Inc., Huawei Technologies Co., Ltd. et FiberHome, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MODULAR DATA CENTER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT LIFELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY AROUND EDGE COMPUTING

5.1.2 RISING NEED FOR SCALABLE DATA CENTERS FROM INDUSTRIES ACROSS ALL DOMAINS

5.1.3 INCREASE IN DEMAND FOR PREFABRICATED DATA FACILITY CENTERS

5.1.4 NEED FOR GAINING END-TO-END VISIBILITY FOR PREDICTING CAPACITY MANAGEMENT REQUIREMENTS

5.2 RESTRAINTS

5.2.1 UNRELIABLE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.2.2 COMPLEXITIES INVOLVED IN THE INTEGRATION OF DIFFERENT DATA CENTER TOOLS

5.2.3 HIGH INITIAL INFRASTRUCTURE COSTS

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DIGITALIZATION TREND

5.3.2 RISING ADVANCEMENTS IN THE IT SECTOR

5.3.3 RISING DEMAND FOR REMOTE WORKING FACILITIES

5.3.4 SURGE IN THE ADOPTION OF AI AND ML

5.4 CHALLENGES

5.4.1 LACK OF DATA SECURITY

6 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 ALL IN ONE

6.2.1.1 IT MODULE

6.2.1.2 ELECTRICAL MODULE

6.2.1.3 MECHANICAL MODULE

6.2.1.4 COOLING MODULE

6.2.1.5 POWER MODULE

6.2.2 INDIVIDUAL

6.2.2.1 20 FEET

6.2.2.2 20 TO 40 FEET

6.2.2.3 MORE THAN 40 FEET

6.3 SERVICES

6.3.1 INSTALLATION & DEPLOYMENT

6.3.2 MAINTENANCE & SUPPORT

6.3.3 CONSULTING

7 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 FULL FUNCTIONAL

7.3 PARTIAL FABRICATED

7.4 MICRO DATA CENTERS

8 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 SMARTER DATA CENTERS

8.3 CAPACITY EXPANSION

8.4 HIGH PERFORMANCE/ EDGE COMPUTING

8.5 DISASTER RECOVERY

8.6 EMERGENCY AND TEMPORARY DEPLOYMENT

8.7 DATA CENTER EXPANSION

9 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE

9.1 OVERVIEW

9.2 LARGE SIZE DATA

9.3 MEDIUM SIZE DATA CENTER

9.4 SMALL SIZE DATA CENTER

10 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TIER TYPE

10.1 OVERVIEW

10.2 TIER 4

10.3 TIER 3

10.4 TIER 2

10.5 TIER 1

11 NORTH AMERICA MODULAR DATA CENTER MARKET, BY LOCATION TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA MODULAR DATA CENTER MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 BFSI

12.2.1 SOLUTION

12.2.2 SERVICES

12.3 IT & TELECOM

12.3.1 SOLUTION

12.3.1.1 FREE COOLING

12.3.1.2 CHILLED WATER SYSTEMS

12.3.1.3 INDIRECT AIR EVAPORATIVE SYSTEM

12.3.1.4 OTHERS

12.3.2 SERVICES

12.4 ENERGY & UTILITIES

12.4.1 SOLUTION

12.4.2 SERVICES

12.5 INDUSTRIAL

12.5.1 SOLUTION

12.5.2 SERVICES

12.6 GOVERNMENT & DEFENSE

12.6.1 SOLUTION

12.6.2 SERVICES

12.7 MANUFACTURING

12.7.1 SOLUTION

12.7.2 SERVICES

12.8 HEALTHCARE

12.8.1 SOLUTION

12.8.2 SERVICES

12.9 TRANSPORT & LOGISTICS

12.9.1 SOLUTION

12.9.2 SERVICES

12.1 MEDIA & ENTERTAINMENT

12.10.1 SOLUTION

12.10.2 SERVICES

12.11 RETAIL

12.11.1 SOLUTION

12.11.2 SERVICES

12.12 EDUCATION

12.12.1 SOLUTION

12.12.2 SERVICES

12.13 OTHERS

13 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA MODULAR DATA CENTER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 VERTIV GROUP CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 SOLUTION PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 DELL INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SOLUTION PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 IBM CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 SOLUTION PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 CISCO SYSTEMS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BASELAYER TECHNOLOGY, LLC (A SUBSIDIARY OF IE CORP.)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BOX MODUL

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CUPERTINO ELECTRIC, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DELTA ELECTRONICS, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 EATON

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 FIBERHOME

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HUAWEI TECHNOLOGIES CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PCX HOLDING LLC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 RITTAL GMBH & CO. KG

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 SCHNEIDER ELECTRIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SOLUTION PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 ZTE CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SOLUTION PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 COSTING OF DIFFERENT DATA CENTER COMPONENTS

TABLE 2 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 49 U.S. MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 50 U.S. SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 U.S. MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 57 U.S. MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 U.S. BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 61 U.S. IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 62 U.S. SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 64 U.S. INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 65 U.S. GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 66 U.S. MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 67 U.S. HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 68 U.S. TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 69 U.S. MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 70 U.S. RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 71 U.S. EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 72 CANADA MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 73 CANADA SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 CANADA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 80 CANADA MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 83 CANADA BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 84 CANADA IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 85 CANADA SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 87 CANADA INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 88 CANADA GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 89 CANADA MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 90 CANADA HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 91 CANADA TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 92 CANADA MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 93 CANADA RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 94 CANADA EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 95 MEXICO MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 96 MEXICO SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 103 MEXICO MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 106 MEXICO BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 107 MEXICO IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 108 MEXICO SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 110 MEXICO INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 111 MEXICO GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 112 MEXICO MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 113 MEXICO HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 114 MEXICO TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 115 MEXICO MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 116 MEXICO RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 117 MEXICO EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA MODULAR DATA CENTER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MODULAR DATA CENTER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MODULAR DATA CENTER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MODULAR DATA CENTER MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MODULAR DATA CENTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MODULAR DATA CENTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MODULAR DATA CENTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MODULAR DATA CENTER MARKET: MULTIVARIATE MODELLING

FIGURE 9 NORTH AMERICA MODULAR DATA CENTER MARKET: COMPONENT LIFELINE CURVE

FIGURE 10 NORTH AMERICA MODULAR DATA CENTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA MODULAR DATA CENTER MARKET: SEGMENTATION

FIGURE 12 RISING NEED FOR SCALABLE DATA CENTERS FROM INDUSTRIES ACROSS ALL DOMAINS AND INCREASE IN DEMAND FOR PRE-FABRICATED DATA FACILITY CENTERS ARE DRIVING THE MODULAR DATA CENTER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MODULAR DATA CENTER MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MODULAR DATA CENTER MARKET

FIGURE 15 NUMBER OF INTERNET USERS GLOBALLY

FIGURE 16 NORTH AMERICA MODULAR DATA CENTER MARKET: BY COMPONENT, 2022

FIGURE 17 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE, 2022

FIGURE 18 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2022

FIGURE 20 NORTH AMERICA MODULAR DATA CENTER MARKET: BY TIER TYPE, 2022

FIGURE 21 NORTH AMERICA MODULAR DATA CENTER MARKET: BY LOCATION TYPE, 2022

FIGURE 22 NORTH AMERICA MODULAR DATA CENTER MARKET: BY VERTICAL, 2022

FIGURE 23 NORTH AMERICA MODULAR DATA CENTER MARKET: SNAPSHOT (2022)

FIGURE 24 NORTH AMERICA MODULAR DATA CENTER MARKET: BY COUNTRY (2022)

FIGURE 25 NORTH MODULAR DATA CENTER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 NORTH MODULAR DATA CENTER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 NORTH AMERICA MODULAR DATA CENTER MARKET: BY COMPONENT (2023-2030)

FIGURE 28 NORTH AMERICA MODULAR DATA CENTER MARKET:2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.