Middle East And Africa Renting And Leasing Test And Measurement Equipment Market

Marktgröße in Milliarden USD

CAGR :

%

| 2024 –2031 | |

| USD 322.82 Million | |

| USD 420.82 Million | |

|

|

|

>Marktsegmentierung für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika nach Angebot (Hardware und Dienstleistungen), Komponente (Kabelbaugruppen, Steckverbinder, Zubehör mit Mehrwert und andere), Systemtyp (Sensorsystem, Konnektivitätssystem, Sicherheitssystem, Mensch-Maschine-Schnittstelle (HMI), Strom- und Energiemanagementsystem, Motorsteuerungssystem und Beleuchtungssystem), Typ (Miete und Leasing), Funktionen (Diagnosegeräte, elektrische Sensorik, Mess-ICS und andere), Endbenutzer (IT und Telekommunikation, Automobil, Luft- und Raumfahrt und Verteidigung, Industrie, Unterhaltungselektronik Energie und Versorgung, medizinische Geräte und andere) – Branchentrends und Prognose bis 2031

Marktanalyse für die Vermietung und das Leasing von Test- und Messgeräten

Der Markt für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika verzeichnet ein erhebliches Wachstum. Dies ist auf die Notwendigkeit zurückzuführen, den Betriebsaufwand durch Wartungsunterstützungsdienste zu reduzieren, die steigende Nachfrage nach projektbasierter Ausrüstung und das schnelle Tempo technologischer Innovationen, mit denen Unternehmen Abschreibungsrisiken minimieren und finanzielle Verluste vermeiden können. Der Markt ist jedoch mit Einschränkungen wie hohen Kapitalinvestitionen und der begrenzten Verfügbarkeit von Spezialausrüstung konfrontiert. Chancen liegen in der Bildung von Partnerschaften und Kooperationen mit Technologieanbietern, der Umsetzung umweltfreundlicher Initiativen und Nachhaltigkeit sowie der Nutzung der zunehmenden Industrialisierung und Technologieakzeptanz. Trotz dieser Aussichten wird der Markt durch die Komplexität der Bestandsverwaltung und den intensiven Wettbewerb herausgefordert, was zu einer Marktsättigung führt.

Mieten und Leasing von Test- und Messgeräten Marktgröße

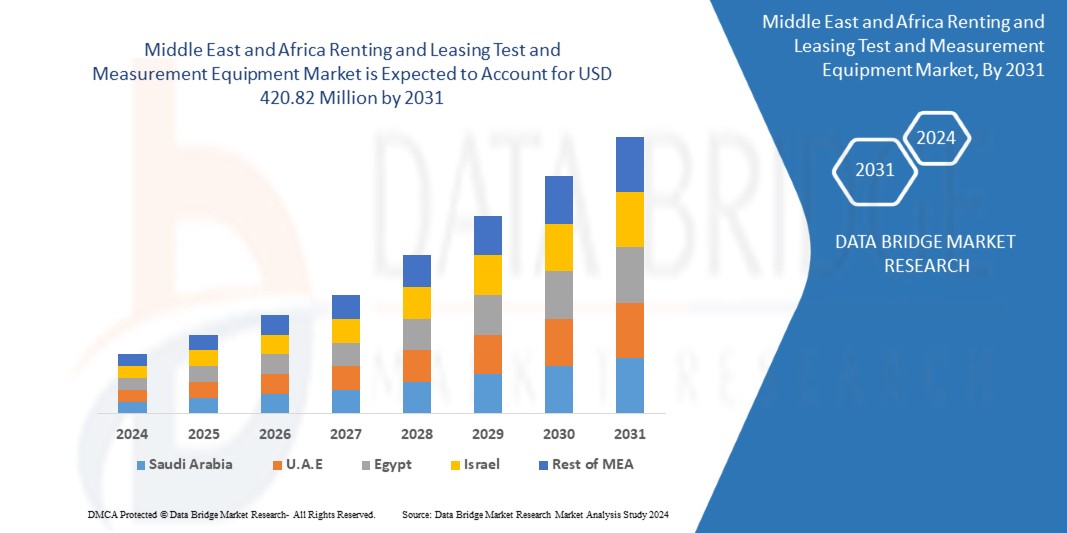

Der Markt für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika hatte im Jahr 2023 einen Wert von 322,82 Millionen US-Dollar und soll bis 2031 einen Wert von 420,82 Millionen US-Dollar erreichen, was einem CAGR von 3,6 % während des Prognosezeitraums von 2024 bis 2031 entspricht. Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

Markttrend für die Vermietung und das Leasing von Test- und Messgeräten

„Nachhaltigkeit und umweltbewusste Entscheidungen“

Nachhaltigkeit und umweltbewusste Entscheidungen werden auf dem Miet- und Leasingmarkt im Nahen Osten und in Afrika immer wichtiger, da die Verbraucher umweltfreundlichen Optionen den Vorzug geben. Unternehmen reagieren darauf, indem sie nachhaltige Produkte wie Elektrofahrzeuge und energieeffiziente Geräte anbieten, die umweltbewusste Mieter anziehen. Dieser Trend trägt nicht nur dazu bei, den CO2-Fußabdruck zu reduzieren, sondern entspricht auch der wachsenden Nachfrage nach sozialer Unternehmensverantwortung. Darüber hinaus integrieren viele Unternehmen nachhaltige Praktiken in ihre Betriebsabläufe, beispielsweise die Reduzierung von Abfall und die Verwendung wiederverwertbarer Materialien. Durch die Umsetzung von Nachhaltigkeit können sich Unternehmen von der Konkurrenz abheben und Markentreue bei umweltbewussten Verbrauchern aufbauen.

Berichtsumfang Markt für Miet- und Leasingtests und -geräte

|

Eigenschaften |

Mieten und Leasing von Test- und Messgeräten – Wichtige Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Vereinigte Arabische Emirate, Saudi-Arabien, Südafrika, Ägypten, Israel, Bahrain, Oman, Katar, Kuwait und der Rest des Nahen Ostens und Afrikas |

|

Wichtige Marktteilnehmer |

ROHDE & SCHWARZ (Deutschland), Keysight Technologies (USA), Electrorent.com, Inc. (USA), Transcat, Inc. (USA), VIAVI Solutions Inc. (USA), General Electric Company (USA), Leonardo DRS (USA), Saluki Technology (Taiwan), Boonton Electronics (USA), FLUKE NETWORKS (USA), Bird (USA), Good Will, Instrument Co., Ltd. (Taiwan), ADLINK Technology Inc. (Taiwan), Leader Electronics of Europe Limited (eine Tochtergesellschaft von Leader, Electronics Corporation) (England), Anritsu (Japan), Yokogawa Electric Corporation (Japan), Fortive (USA), Siemens (Deutschland), Megger (Großbritannien), EXFO Inc. (Kanada), Emerson Electric Co. (USA), Doble Engineering Company (USA), ADVANTEST CORPORATION (Japan), Texas Instruments Incorporated (USA), DS INSTRUMENTS (USA) und STMicroelectronics (Schweiz) unter anderem. |

|

Marktchancen |

|

|

Mehrwertdaten |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Definition des Marktes für die Vermietung und das Leasing von Test- und Messgeräten

Das Mieten und Leasing von Test- und Messgeräten umfasst die Bereitstellung von Spezialgeräten auf Miet- oder Leasingbasis, wodurch Branchen in verschiedenen Sektoren, darunter Telekommunikation, Elektronik, Automobil und Luft- und Raumfahrt, Zugang zu hochwertigen Test- und Messgeräten erhalten, ohne dass erhebliche Kapitalinvestitionen erforderlich sind. Dieser Markt kommt der wachsenden Nachfrage nach flexiblen und kostengünstigen Lösungen entgegen und bietet fortschrittliche Geräte für kurzfristige Projekte, Produktentwicklung oder regelmäßige Testanforderungen. Dadurch können Unternehmen ihre Betriebskosten effizienter verwalten und gleichzeitig an der Spitze des technologischen Fortschritts bleiben.

Mieten und Leasing von Test- und Messgeräten – Marktdynamik

Treiber

- Erhöhte Wartung der Support-Services reduziert den Betriebsaufwand

Die Einbeziehung von Wartungs- und Supportleistungen in Mietverträge steigert die betriebliche Effizienz von Unternehmen erheblich. Durch das Outsourcing von Wartung und Support vermeiden Unternehmen die Komplexität und die Kosten, die mit der internen Verwaltung dieser Funktionen verbunden sind. Diese Vereinbarung ermöglicht es Unternehmen, sich auf ihr Kerngeschäft zu konzentrieren und gleichzeitig sicherzustellen, dass die gemieteten Geräte kontinuierlich gewartet und kalibriert werden. Diese Effizienz ist besonders wertvoll in Umgebungen mit hohen Anforderungen, in denen die Betriebszeit und Zuverlässigkeit der Geräte entscheidend sind, um Projektfristen einzuhalten und die Produktivität aufrechtzuerhalten. Die Einbeziehung von Wartung und Support in Mietverträge hilft Unternehmen, Kosten effektiver zu verwalten. Anstatt die gesamte finanzielle Belastung der Gerätewartung zu tragen, die regelmäßige Wartung, Reparaturen und Fehlerbehebung umfasst, profitieren Unternehmen von vorhersehbaren und oft niedrigeren Mietkosten, die diese Dienste beinhalten. Diese Vereinbarung reduziert unerwartete Ausgaben und hilft bei der Budgetplanung, da Unternehmen nur für die Nutzung der Geräte und den damit verbundenen Support zahlen, ohne dass erhebliche Kapitalausgaben für die Wartungsinfrastruktur erforderlich sind.

Zum Beispiel,

Laut einem Blog von Caterpillar kann die Einbeziehung von Wartungs- und Supportleistungen in Mietverträge zu erheblichen Kosteneinsparungen führen. Durch die Vermeidung hoher Ausgaben für den Gerätebesitz und die interne Abwicklung von Reparaturen profitieren Unternehmen von vorhersehbaren Kosten und geringerer finanzieller Belastung. Dieser Ansatz steigert die Betriebseffizienz und hilft Unternehmen, im Rahmen ihres Budgets zu bleiben und gleichzeitig auf zuverlässige, gut gewartete Geräte zuzugreifen.

Steigende Nachfrage nach projektbasierter Ausrüstung

Die steigende Nachfrage nach projektbasierter Ausrüstung ist ein wichtiger Treiber für den Miet- und Leasingmarkt im Nahen Osten und in Afrika. Projekte erfordern oft spezielle Test- und Messgeräte für begrenzte Zeiträume, und das Mieten bietet eine flexible Lösung, um diesen kurzfristigen Bedarf zu decken. Unternehmen können auf die spezifischen Werkzeuge zugreifen, die sie benötigen, ohne sich an langfristiges Eigentum zu binden, was ideal für Branchen mit schwankenden Projektanforderungen oder solche ist, die vorübergehende Initiativen starten. Das Mieten von Test- und Messgeräten für projektbasierte Arbeit ist kosteneffizient, da Unternehmen die hohen Vorlaufkosten und die Abschreibung vermeiden, die mit dem Kauf verbunden sind. Stattdessen können sie Ressourcen effektiver zuweisen, indem sie nur dann für die Ausrüstung zahlen, wenn sie benötigt wird. Diese finanzielle Flexibilität ist besonders vorteilhaft für Projekte mit variablen Budgets oder für Unternehmen, die ihre Investitionsausgaben optimieren möchten. Durch das Mieten können sie in andere kritische Bereiche investieren und trotzdem auf hochwertige Ausrüstung zugreifen.

Zum Beispiel,

- Im November 2023 hob Keysight Technologies seine erfolgreiche Zusammenarbeit mit MediaTek bei der Erprobung neuer 5G-Funkgeräte hervor. Diese Partnerschaft unterstrich die steigende Nachfrage nach projektbasierten Testgeräten, da Unternehmen nach Spezialwerkzeugen für komplexe, kurzfristige Projekte wie 5G-Bereitstellungen suchten. Die gestiegene projektbasierte Nachfrage treibt den Bedarf an flexiblen Mietlösungen voran, die den Zugang zu fortschrittlicher Technologie für spezifische, temporäre Anwendungen ermöglichen.

Gelegenheit

- Partnerschaft und Zusammenarbeit mit Technologieanbietern

Die Partnerschaften und Kooperationen mit Technologieanbietern stellen eine bedeutende Wachstumschance dar. Durch die Zusammenarbeit mit Spitzentechnologieunternehmen können Unternehmen in diesem Sektor frühzeitig Zugang zu fortschrittlichen Instrumenten und Innovationen erhalten. Diese Zusammenarbeit ermöglicht die Integration der neuesten Technologien in ihre Miet- und Leasingangebote und stellt sicher, dass Kunden Zugang zu hochmoderner Ausrüstung haben, ohne dass erhebliche Kapitalinvestitionen erforderlich sind. Darüber hinaus können diese Partnerschaften zur Entwicklung maßgeschneiderter Lösungen führen, die auf spezifische Branchenanforderungen zugeschnitten sind, den Wertbeitrag für Kunden steigern und die Marktexpansion vorantreiben.

Zum Beispiel,

- Auf dem MWC Barcelona 2023 präsentierte Rohde & Schwarz einen hochmodernen neuronalen Empfänger, der in Zusammenarbeit mit NVIDIA entwickelt wurde und die 6G-Technologie mithilfe von KI und maschinellem Lernen voranbringen soll. Diese innovative Lösung zielte darauf ab, die Signalverarbeitung zu verbessern und die Netzwerkleistung für die drahtlose Kommunikation der Zukunft zu steigern. Die Vorführung unterstrich das Engagement von Rohde & Schwarz, bei der Entwicklung von Technologien der nächsten Generation führend zu sein.

Steigende Nachfrage nach grünen Initiativen und Nachhaltigkeit

Da die Umweltvorschriften immer strenger werden und Unternehmen zunehmend umweltfreundlichen Praktiken den Vorzug geben, steigt die Nachfrage nach Geräten, die Nachhaltigkeitsziele unterstützen. Durch die Einführung umweltfreundlicher Praktiken, wie z. B. die Verwendung energieeffizienter Instrumente, die Minimierung von Abfällen durch optimierte Gerätenutzung und die Einführung von Recyclingprogrammen für veraltete Technologie, können sich Miet- und Leasingunternehmen an umfassenderen Umweltzielen ausrichten. Dieser Wandel entspricht nicht nur den sich entwickelnden Erwartungen umweltbewusster Kunden, sondern positioniert Unternehmen auch als Vorreiter in Sachen nachhaltiger Praktiken innerhalb der Branche.

Zum Beispiel

- Im Mai 2023 untersucht O'Connor die potenziellen Vorteile von Green Leases und hebt sie als bedeutende Chance für Vermieter und Mieter hervor. Green Leases können zu geringeren Betriebskosten, verbesserter Energieeffizienz und einem höheren Immobilienwert führen und gleichzeitig Nachhaltigkeitsziele erfüllen. Der Artikel betont, dass die Einführung grüner Initiativen nicht nur die gesetzlichen Anforderungen erfüllt, sondern auch den Wettbewerbsvorteil erhöht und positive Auswirkungen auf die Umwelt fördert.

Einschränkungen/ Herausforderungen

- Erfordernis eines erheblichen finanziellen Aufwands

Die hohen Kapitalinvestitionen, die für Test- und Messgeräte erforderlich sind, stellen eine Barriere für neue Marktteilnehmer dar. Der erhebliche finanzielle Aufwand, der zum Aufbau eines wettbewerbsfähigen Angebots erforderlich ist, hält potenzielle neue Akteure vom Eintritt in die Branche ab. Dieser Mangel an neuer Konkurrenz kann dazu führen, dass der Markt von wenigen etablierten Unternehmen dominiert wird, was die Innovationskraft verringert und die Optionen für die Kunden einschränkt. Folglich schränkt der hohe Kapitalbedarf nicht nur das Wachstum und die Diversifizierung von Miet- und Leasingunternehmen ein, sondern behindert auch die allgemeine Marktdynamik und die Auswahlmöglichkeiten der Kunden.

Zum Beispiel,

- Laut KHL Group LLP investierte United Rentals im März 2024 1,1 Milliarden USD in die Übernahme des temporären Straßenbaugeschäfts des britischen Unternehmens A-Plant und erweiterte damit sein Angebot in den Bereichen Infrastruktur und Bau. Ziel dieser strategischen Übernahme war es, das Portfolio des Unternehmens um Spezialausrüstung und -dienstleistungen zu erweitern und so seine Position auf dem Vermietungsmarkt zu stärken. Der Schritt steht im Einklang mit der Strategie von United Rentals, seine Servicekapazitäten regional zu diversifizieren und zu stärken.

Begrenzte Verfügbarkeit von Spezialausrüstung

Der Miet- und Leasingmarkt für Test- und Messgeräte im Nahen Osten und in Afrika ist mit mehreren erheblichen Einschränkungen konfrontiert. Nischengeräte, die auf bestimmte Branchen oder Anwendungen zugeschnitten sind, können die Mietoptionen einschränken, da die Anbieter möglicherweise nicht über die erforderlichen Lagerbestände verfügen, um die spezielle Nachfrage zu decken. Geografische Einschränkungen erschweren die Sache zusätzlich, da bestimmte Gerätetypen in bestimmten Regionen häufiger vorkommen, was für Unternehmen in unterversorgten Gebieten Zugangsprobleme mit sich bringt. Das Aufkommen neuer Technologien trägt ebenfalls zu diesem Problem bei, da die Verfügbarkeit der neuesten Geräte verzögert sein kann, was Innovation und Einführung behindert. Darüber hinaus erschwert die Notwendigkeit der Anpassung von Spezialgeräten es den Vermietern, vielseitige Lösungen anzubieten, was ihre Fähigkeit beeinträchtigt, die vielfältigen Kundenanforderungen effektiv zu erfüllen.

Zum Beispiel,

- Im April 2024 sank das Einzelhandelsmietvolumen in Delhi im ersten Quartal aufgrund begrenzter verfügbarer Flächen um 28 %. Besonders betroffen war die Vermietung von Einkaufszentren mit einem Rückgang von 23 % gegenüber dem Vorquartal. Dieser Platzmangel behinderte die Expansion der Unternehmen und schränkte das allgemeine Marktwachstum ein.

Dieser Marktbericht enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analyst Brief zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für die Vermietung und das Leasing von Test- und Messgeräten

Der Markt für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika ist auf der Grundlage von Angebot, Komponente, Systemtyp, Typ, Funktionen und Endbenutzer in sechs bemerkenswerte Segmente unterteilt. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse von dürftigen Wachstumssegmenten in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Angebot

- Hardware

- Allgemeine Testgeräte (GPTE)

- Multimeter

- Signalgeneratoren

- Oszilloskope

- Spektrumanalysatoren

- Automatisierte Testgeräte (ATE)

- Stromversorgung

- BERT-Lösungen (Bit Error Rate Testers)

- Modulare Instrumente

- Logikanalysatoren

- Leistungsmesser

- Elektronische Zähler

- Halbleiter-Testgeräte

- Netzwerkmessgeräte

- Verdrahtet

- Kabellos

- Mechanische Prüfeinrichtung (MTE)

- Systeme zur Maschinenzustandsüberwachung

- Maschinelle Bildverarbeitungs-Inspektionssysteme

- Zerstörungsfreie Prüfgeräte

- Systeme zur Maschinenzustandsüberwachung

- Maschinelle Bildverarbeitungs-Inspektionssysteme

- Zerstörungsfreie Prüfgeräte

- Sonstiges

- Glasfaser-Anschlussausrüstung

- HF-Testkammern

- Sonstiges

- Allgemeine Testgeräte (GPTE)

- Dienstleistungen

- Verwaltete Dienste

- Professionelle Dienstleistungen

- Reparatur/Kundendienst

- Beratung und Training

- Umweltprodukttests

- Professionelle Dienstleistungen

- Verwaltete Dienste

Komponente

- Kabelbaugruppen

- Anschlüsse

- Mehrwertdienste

- Sonstiges

Systemtyp

- Sensorsystem

- Konnektivitätssystem

- Sicherheitssystem

- Mensch-Maschine-Schnittstelle (HMI)

- Strom- und Energiemanagementsystem

- Motorsteuerungssystem

- Beleuchtungssystem

Typ

- Mieten

- Mieten

Merkmale

- Diagnosegeräte

- Patientenüberwachung

- Blutdruckmessgerät

- Blutzuckermessgerät

- Digitales Thermometer

- Sonstiges

- Elektrische Sensorik

- High-Side-Erfassung

- Low-Side-Erkennung

- Messung von ICS

- Intelligente Zähler und Energiemesslösungen

- ICS für Smart Plugs

- Sonstiges

Endbenutzer

- IT und Telekommunikation

- Angebot

- Hardware

- Dienstleistungen

- Typ

- Telekommunikationszentrum

- Rechenzentrum

- Unternehmensnetzwerke

- Rundfunknetze

- Anwendung

- Leistungsüberwachung

- Netzwerkoptimierung

- Fehlersuche und Fehlerdiagnose

- Systemintegration und Validierung

- Netzwerkinstallation und -wartung

- Prüfung von Kundenendgeräten (CPE)

- Sonstiges

- Angebot

- Automobilindustrie

- Angebot

- Hardware

- Dienstleistungen

- Anwendung

- ADAS

- Motorsteuerung für Kraftfahrzeuge

- Infotainment im Fahrzeug

- Mobilitätsdienste

- Körper und Komfort

- Angebot

- Luft- und Raumfahrt & Verteidigung

- Angebot

- Hardware

- Dienstleistungen

- Anwendung

- Avionik

- Radar

- Kommunikationssysteme

- Satellitentechnik

- Elektronische Kriegsführungssysteme

- Sonstiges

- Angebot

- Industrie

- Angebot

- Hardware

- Dienstleistungen

- Anwendung

- Fabrikautomation

- Energieerzeugung und -verteilung

- Medizin & Gesundheitswesen

- Dosierung

- Anlagenverfolgung

- Beleuchtung & Steuerung

- Angebot

- Unterhaltungselektronik

- Angebot

- Hardware

- Dienstleistungen

- Anwendung

- Smartphones & Tablets

- Audio und Video

- Tragbar

- Gaming und Drohnen

- Erweiterte/Virtuelle Realität (AR/VR)

- Sonstiges

- Angebot

- Energie und Versorgung

- Angebot

- Hardware

- Dienstleistungen

- Angebot

- Medizinische Ausrüstung

- Angebot

- Hardware

- Dienstleistungen

- Angebot

- Sonstiges

- Angebot

- Hardware

- Dienstleistungen

- Angebot

Regionale Analyse des Marktes für die Vermietung und das Leasing von Test- und Messgeräten

Der Markt für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika ist in sechs wichtige Segmente unterteilt, die wiederum nach Angebot, Komponente, Systemtyp, Typ, Funktionen und Endbenutzer segmentiert sind.

Die im Marktbericht für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika abgedeckten Länder sind Saudi-Arabien, die Vereinigten Arabischen Emirate, Südafrika, Ägypten, Israel, Bahrain, Oman, Katar, Kuwait sowie der Rest des Nahen Ostens und Afrikas.

Aufgrund der steigenden Nachfrage nach „grünen“ Initiativen und Nachhaltigkeit wird Saudi-Arabien voraussichtlich das dominierende und am schnellsten wachsende Land auf dem Markt für die Vermietung und das Leasing von Test- und Messgeräten sein.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit regionaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Marktanteil von Miet- und Leasinggeräten für Test- und Messgeräte

Die Wettbewerbslandschaft des Marktes für die Vermietung und das Leasing von Test- und Messgeräten im Nahen Osten und in Afrika liefert Einzelheiten zu den Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktzulassungen, Produktbreite und -umfang, Anwendungsdominanz und Produkttyp-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf die Vermietung und das Leasing von Test- und Messgeräten auf dem Markt.

Auf dem Markt für die Vermietung und das Leasing von Test- und Messgeräten sind folgende Akteure aktiv :

- ROHDE & SCHWARZ (Deutschland)

- Keysight Technologies (USA)

- Electrorent.com, Inc. (USA)

- Transcat, Inc. (USA)

- VIAVI Solutions Inc. (USA)

- General Electric Company (USA)

- Leonardo DRS (USA)

- Saluki-Technologie (Taiwan)

- Boonton Electronics (USA)

- FLUKE NETWORKS (USA)

- Vogel (USA)

- Good Will, Instrument Co., Ltd. (Taiwan)

- ADLINK Technology Inc, (Taiwan)

- Leader Electronics of Europe Limited (eine Tochtergesellschaft von Leader, Electronics Corporation) (England)

- Anritsu (Japan)

- Yokogawa Electric Corporation (Japan)

- Fortive (USA)

- Siemens (Deutschland)

- Megger (Großbritannien) Emerson Electric Co. (USA)

- STMicroelectronics (Schweiz)

Neueste Entwicklung auf dem Markt für Miet- und Leasing-Test- und Messgeräte

- Im Januar 2024 betonte Iravati M. in einem auf LinkedIn erwähnten Artikel, dass die Bestandsverwaltung auf dem Markt für die Vermietung und das Leasing von Test- und Messgeräten weiterhin eine große Herausforderung darstellt. Die Komplexität der Verwaltung vielfältiger und spezialisierter Geräte, die Sicherstellung der rechtzeitigen Verfügbarkeit und die Aufrechterhaltung einer genauen Nachverfolgung sind für die betriebliche Effizienz von entscheidender Bedeutung. Effektive Bestandsverwaltungssysteme sind unerlässlich, um diese Herausforderungen zu bewältigen und die Gerätenutzung in einem hart umkämpften und gesättigten Markt zu optimieren.

- Laut einem Blog von Booqable.com vom März 2024 ist die Bestandsverwaltung eine große Hürde in der Vermietungsbranche. Der Artikel betonte die Schwierigkeiten bei der Nachverfolgung unterschiedlicher Geräte, der Verwaltung von Wartungsplänen und der Sicherstellung der rechtzeitigen Verfügbarkeit von Artikeln. Effektive Bestandsverwaltungssysteme sind entscheidend, um diese Probleme anzugehen, den Betrieb zu optimieren und die Kundenzufriedenheit in einem wettbewerbsintensiven Markt zu steigern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USER COVERAGE GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 CASE STUDY

4.3 PATENT ANALYSIS

4.4 REGULATORY STANDARDS

4.5 TECHNOLOGICAL TRENDS

4.6 VALUE CHAIN ANALYSIS

4.7 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING MAINTENANCE OF SUPPORT SERVICES REDUCES OPERATIONAL BURDEN

5.1.2 INCREASING DEMAND OF PROJECT BASED EQUIPMENT

5.1.3 RAPID ADVANCEMENT IN TECHNOLOGICAL INNOVATION

5.1.4 REGULAR MAINTENANCE AND STRATEGIC UPGRADES REDUCE DEPRECIATION RISK AND FINANCIAL LOSS

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF SIGNIFICANT FINANCIAL OUTLAY

5.2.2 LIMITED AVAILABILITY OF SPECIALIZED EQUIPMENT

5.3 OPPORTUNITIES

5.3.1 PARTNERSHIP & COLLABORATION WITH TECHNOLOGY PROVIDERS

5.3.2 INCREASING DEMAND FOR GREEN INITIATIVES AND SUSTAINABILITY

5.3.3 GROWING INDUSTRIALIZATION AND TECHNOLOGICAL ADOPTION

5.4 CHALLENGES

5.4.1 MONITORING AND HANDLING HIGH-VALUE, SPECIALIZED TESTING EQUIPMENT

5.4.2 INTENSE COMPETITION AND SATURATION REQUIRE DISTINCTIVE INNOVATIONS TO STAY COMPETITIVE

6 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 HARDWARE, BY TYPE

6.2.1.1 GENERAL-PURPOSE TEST EQUIPMENT (GPTE)

6.2.1.1.1 GENERAL-PURPOSE TEST EQUIPMENT (GPTE), BY TYPE

6.2.1.1.1.1 MULTI METERS

6.2.1.1.1.2 SIGNAL GENERATORS

6.2.1.1.1.3 OSCILLOSCOPES

6.2.1.1.1.4 SPECTRUM ANALYZERS

6.2.1.1.1.5 AUTOMATED TEST EQUIPMENT (ATE)

6.2.1.1.1.6 POWER SUPPLIES

6.2.1.1.1.7 BERT SOLUTIONS (BIT ERROR RATE TESTERS)

6.2.1.1.1.8 MODULAR INSTRUMENTS

6.2.1.1.1.9 LOGIC ANALYZERS

6.2.1.1.1.10 POWER METERS

6.2.1.1.1.11 ELECTRONIC COUNTERS

6.2.1.2 SEMICONDUCTOR TEST EQUIPMENT

6.2.1.3 NETWORK MEASUREMENT EQUIPMENT

6.2.1.3.1 NETWORK MEASUREMENT EQUIPMENT, BY TYPE

6.2.1.3.1.1 WIRED

6.2.1.3.1.2 WIRELESS

6.2.1.3.1.3 MECHANICAL TEST EQUIPMENT (MTE)

6.2.1.3.2 MECHANICAL TEST EQUIPMENT (MTE), BY TYPE

6.2.1.3.2.1 MACHINE CONDITION MONITORING SYSTEMS

6.2.1.3.2.2 MACHINE VISION INSPECTION SYSTEMS

6.2.1.3.2.3 NON-DESTRUCTIVE TEST EQUIPMENT

6.2.1.3.2.4 OTHERS

6.2.1.4 OPTICAL FIBER CONNECTION EQUIPMENT

6.2.1.5 RF TEST CHAMBERS

6.2.1.6 OTHERS

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 PROFESSIONAL SERVICES, BY TYPE

6.3.2.1.1 REPAIR/AFTER SALES SERVICES

6.3.2.1.2 CONSULTING AND TRAINING

6.3.2.1.3 ENVIRONMENT PRODUCT TESTING

7 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 RENT

7.3 LEASE

8 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES

8.1 OVERVIEW

8.2 DIAGNOSTIC EQUIPMENT

8.2.1 PATIENT MONITORING

8.2.2 BLOOD PRESSURE MONITOR

8.2.3 GLUCOSE METER

8.2.4 DIGITAL THERMOMETER

8.2.5 OTHERS

8.3 ELECTRICAL SENSING

8.3.1 HIGH-SIDE SENSING

8.3.2 LOW-SIDE SENSING

8.4 METERING ICS

8.4.1 SMART METERS & ENERGY METERING SOLUTIONS

8.4.2 ICS FOR SMART PLUGS

8.5 OTHERS

9 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 CABLE ASSEMBLIES

9.3 CONNECTORS

9.4 VALUE ADDED SERVICES

9.5 OTHERS

10 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE

10.1 OVERVIEW

10.2 SENSING SYSTEM

10.3 CONNECTIVITY SYSTEM

10.4 SAFETY & SECURITY SYSTEM

10.5 HUMAN MACHINE INTERFACE (HMI)

10.6 POWER & ENERGY MANAGEMENT SYSTEM

10.7 MOTOR CONTROL SYSTEM

10.8 LIGHTING SYSTEM

11 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 IT & TELECOMMUNICATION

11.2.1 BY OFFERING

11.2.1.1 HARDWARE

11.2.1.2 SERVICES

11.2.2 BY TYPE

11.2.2.1 TELECOM CENTER

11.2.2.2 DATA CENTER

11.2.2.3 ENTERPRISE NETWORKS

11.2.2.4 BROADCAST NETWORKS

11.2.3 BY APPLICATION

11.2.3.1 PERFORMANCE MONITORING

11.2.3.2 NETWORK OPTIMIZATION

11.2.3.3 TROUBLESHOOTING AND FAULT DIAGNOSIS

11.2.3.4 SYSTEM INTEGRATION AND VALIDATION

11.2.3.5 NETWORK INSTALLATION AND MAINTENANCE

11.2.3.6 CUSTOMER PREMISES EQUIPMENT (CPE) TESTING

11.2.3.7 OTHERS

11.3 AUTOMOTIVE

11.3.1 BY OFFERING

11.3.1.1 HARDWARE

11.3.1.2 SERVICES

11.3.2 BY APPLICATION

11.3.2.1 ADAS

11.3.2.2 AUTOMOTIVE MOTOR CONTROL

11.3.2.3 IN-VEHICLE INFOTAINMENT

11.3.2.4 MOBILITY SERVICES

11.3.2.5 BODY AND CONVENIENCE

11.4 AEROSPACE AND DEFENCE

11.4.1 BY OFFERING

11.4.1.1 HARDWARE

11.4.1.2 SERVICES

11.4.2 BY APPLICATION

11.4.2.1 AVIONICS

11.4.2.2 RADAR

11.4.2.3 COMMUNICATION SYSTEMS

11.4.2.4 SATELLITE TECHNOLOGY

11.4.2.5 ELECTRONIC WARFARE SYSTEMS

11.4.2.6 OTHERS

11.5 INDUSTRIAL

11.5.1 BY OFFERING

11.5.1.1 HARDWARE

11.5.1.2 SERVICES

11.5.2 BY APPLICATION

11.5.2.1 FACTORY AUTOMATION

11.5.2.2 ENERGY GENERATION & DISTRIBUTION

11.5.2.3 MEDICAL & HEALTHCARE

11.5.2.4 METERING

11.5.2.5 ASSET TRACKING

11.5.2.6 LIGHTING & CONTROL

11.6 CONSUMER ELECTRONICS

11.6.1 BY OFFERING

11.6.1.1 HARDWARE

11.6.1.2 SERVICES

11.6.2 BY APPLICATION

11.6.2.1 SMARTPHONES & TABLETS

11.6.2.2 AUDIO & VIDEO

11.6.2.3 WEARABLES

11.6.2.4 GAMING & DRONES

11.6.2.5 AUGMENTED/VIRTUAL REALITY (AR/VR)

11.6.2.6 OTHERS

11.7 ENERGY & UTILITIES

11.7.1 BY OFFERING

11.7.1.1 HARDWARE

11.7.1.2 SERVICES

11.8 MEDICAL EQUIPMENT

11.8.1 BY OFFERING

11.8.1.1 HARDWARE

11.8.1.2 SERVICES

11.9 OTHERS

11.9.1 BY OFFERING

11.9.1.1 HARDWARE

11.9.1.2 SERVICES

12 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E.

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 BAHRAIN

12.1.7 OMAN

12.1.8 QATAR

12.1.9 KUWAIT

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SIEMENS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 KEYSIGHT TECHNOLOGIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROHDE & SCHWARZ

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 FORTIVE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 EMERSON ELECTRIC CO

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ADLINK TECHNOLOGY

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ADVANTEST CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ANRITSU

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 BIRD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BOONTON ELECTRONICS

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DOBLE ENGINEERING COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DS INSTRUMENTS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ELECTRORENT COM.INC

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.13.4 RECENT DEVELOPMENTS

15.14 EXFO INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT AND SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 FLUKE NETWORKS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 GENERAL ELECTRIC COMPANY

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 GOOD WILL INSTRUMENT CO, LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 LEADER ELECTRONICS OF EUROPE LIMITED (A SUBSIDIARY OF LEADER ELECTRONICS CORPORATION)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 RECENT DEVELOPMENTS

15.19 LEARNADO DRS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 MEGGER

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SALUKI TECHNOLOGY

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 STMICROELECTRONICS

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TEXAS INSTRUMENTS INCORPORATED

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 TRANSCAT, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENTS

15.25 VIAVI SOLUTIONS

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 YOKOGAWA ELECTRIC CORPORATION

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 REGULATIONS AND STANDARDS FOR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT

TABLE 2 COST OF TEST AND MEASUREMENT EQUIPMENT

TABLE 3 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA RENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LEASE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CABLE ASSEMBLIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CONNECTORS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA VALUE ADDED SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA SENSING SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA CONNECTIVITY SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SAFETY & SECURITY SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA HUMAN MACHINE INTERFACE (HMI) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA POWER & ENERGY MANAGEMENT SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA MOTOR CONTROL SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA LIGHTING SYSTEM IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENCE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 89 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 90 SAUDI ARABIA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 SAUDI ARABIA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 SAUDI ARABIA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 SAUDI ARABIA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 SAUDI ARABIA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 SAUDI ARABIA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 97 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 100 SAUDI ARABIA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 SAUDI ARABIA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 SAUDI ARABIA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 SAUDI ARABIA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 104 SAUDI ARABIA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 105 SAUDI ARABIA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 SAUDI ARABIA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 107 SAUDI ARABIA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 108 SAUDI ARABIA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 109 SAUDI ARABIA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 110 SAUDI ARABIA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 111 SAUDI ARABIA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 112 SAUDI ARABIA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 113 SAUDI ARABIA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 114 SAUDI ARABIA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 115 SAUDI ARABIA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 116 SAUDI ARABIA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 117 SAUDI ARABIA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 118 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 119 U.A.E. HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 U.A.E. GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 U.A.E. MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 U.A.E. NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 123 U.A.E. SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 U.A.E. PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 125 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 126 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 129 U.A.E. DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 U.A.E. ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 U.A.E. METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 U.A.E. RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 133 U.A.E. IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 134 U.A.E. IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 U.A.E. IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 136 U.A.E. AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 137 U.A.E. AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 138 U.A.E. AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 139 U.A.E. AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 140 U.A.E. INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 141 U.A.E. INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 142 U.A.E. CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 143 U.A.E. CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 144 U.A.E. ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 145 U.A.E. MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 146 U.A.E. OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 147 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 148 SOUTH AFRICA HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SOUTH AFRICA GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SOUTH AFRICA MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SOUTH AFRICA NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SOUTH AFRICA SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SOUTH AFRICA PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 155 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 158 SOUTH AFRICA DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SOUTH AFRICA ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SOUTH AFRICA METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SOUTH AFRICA RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 162 SOUTH AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 163 SOUTH AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 164 SOUTH AFRICA IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 165 SOUTH AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 166 SOUTH AFRICA AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 167 SOUTH AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 168 SOUTH AFRICA AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 169 SOUTH AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 170 SOUTH AFRICA INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 171 SOUTH AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 172 SOUTH AFRICA CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 173 SOUTH AFRICA ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 174 SOUTH AFRICA MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 175 SOUTH AFRICA OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 176 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 177 EGYPT HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 EGYPT GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 EGYPT MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 EGYPT NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 EGYPT SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 EGYPT PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 184 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 186 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 187 EGYPT DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 EGYPT ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 EGYPT METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 EGYPT RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 191 EGYPT IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 192 EGYPT IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 EGYPT IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 194 EGYPT AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 195 EGYPT AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 196 EGYPT AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 197 EGYPT AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 198 EGYPT INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 199 EGYPT INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 200 EGYPT CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 201 EGYPT CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 202 EGYPT ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 203 EGYPT MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 204 EGYPT OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 205 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 206 ISRAEL HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 ISRAEL GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 ISRAEL MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 ISRAEL NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 ISRAEL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 ISRAEL PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 213 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 216 ISRAEL DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 ISRAEL ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 ISRAEL METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 ISRAEL RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 220 ISRAEL IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 221 ISRAEL IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 ISRAEL IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 223 ISRAEL AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 224 ISRAEL AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 225 ISRAEL AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 226 ISRAEL AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 227 ISRAEL INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 228 ISRAEL INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 229 ISRAEL CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 230 ISRAEL CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 231 ISRAEL ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 232 ISRAEL MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 233 ISRAEL OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 234 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 235 BAHRAIN HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 236 BAHRAIN GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 BAHRAIN MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 BAHRAIN NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 BAHRAIN SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 BAHRAIN PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 242 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 243 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 244 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 245 BAHRAIN DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 BAHRAIN ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 BAHRAIN METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 BAHRAIN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 249 BAHRAIN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 250 BAHRAIN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 251 BAHRAIN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 252 BAHRAIN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 253 BAHRAIN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 254 BAHRAIN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 255 BAHRAIN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 256 BAHRAIN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 257 BAHRAIN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 258 BAHRAIN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 259 BAHRAIN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 260 BAHRAIN ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 261 BAHRAIN MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 262 BAHRAIN OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 263 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 264 OMAN HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 265 OMAN GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 266 OMAN MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 OMAN NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 268 OMAN SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 269 OMAN PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 270 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 271 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY FEATURES, 2022-2031 (USD THOUSAND)

TABLE 274 OMAN DIAGNOSTIC EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 275 OMAN ELECTRICAL SENSING IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 276 OMAN METERING ICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 OMAN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 278 OMAN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 279 OMAN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 OMAN IT & TELECOMMUNICATION IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 281 OMAN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 282 OMAN AUTOMOTIVE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 283 OMAN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 284 OMAN AEROSPACE & DEFENSE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 285 OMAN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 286 OMAN INDUSTRIAL IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 287 OMAN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 288 OMAN CONSUMER ELECTRONICS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 289 OMAN ENERGY & UTILITIES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 290 OMAN MEDICAL EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 291 OMAN OTHERS IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 292 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY OFFERING, 2022-2031 (USD THOUSAND)

TABLE 293 QATAR HARDWARE IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 QATAR GENERAL-PURPOSE TEST EQUIPMENT (GPTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 295 QATAR MECHANICAL TEST EQUIPMENT (MTE) IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 296 QATAR NETWORK MEASUREMENT EQUIPMENT IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 QATAR SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 298 QATAR PROFESSIONAL SERVICES IN RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 299 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY COMPONENT, 2022-2031 (USD THOUSAND)

TABLE 300 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 301 QATAR RENTING AND LEASING TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2022-2031 (USD THOUSAND)