North America Cancer Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

41.65 Million

USD

79.99 Million

2024

2032

USD

41.65 Million

USD

79.99 Million

2024

2032

| 2025 –2032 | |

| USD 41.65 Million | |

| USD 79.99 Million | |

|

|

|

|

Cancer Diagnostics Market Size

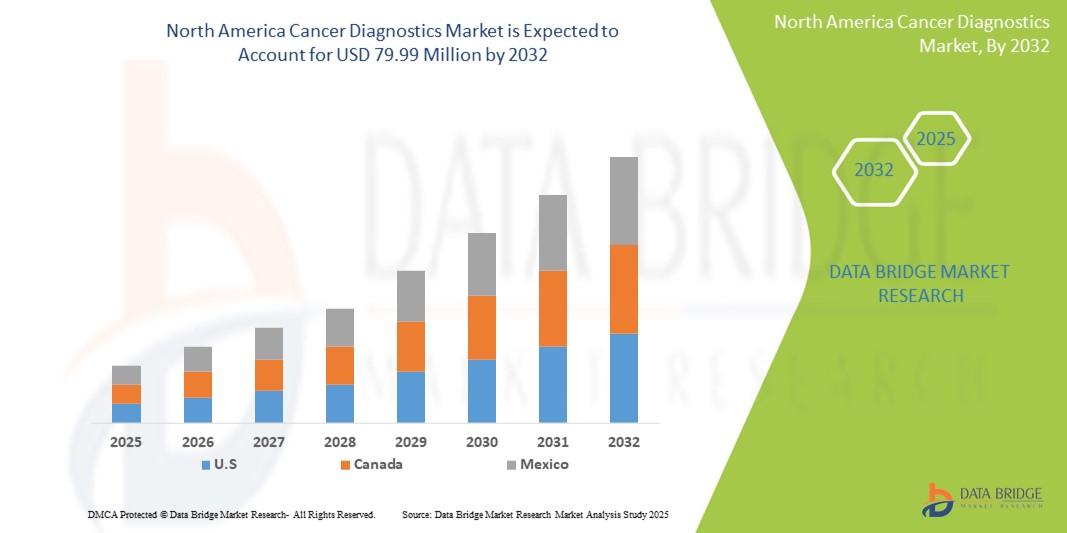

- The North America Cancer Diagnostics market size was valued at USD 41.65 Million in 2024 and is expected to reach USD 79.99 Million by 2032, at a CAGR of 8.5% during the forecast period

- The market's growth is largely fueled by the rising incidence of cancer, increasing government initiatives and funding for cancer research, and the growing demand for personalized medicine. The development of more sensitive and specific diagnostic tests, coupled with the increasing adoption of minimally invasive procedures, is further accelerating market growth. These converging factors are significantly boosting the industry's expansion.

Cancer Diagnostics Market Analysis

- The North America cancer diagnostics market is experiencing substantial growth, driven by the increasing prevalence of cancer, rising awareness about early detection, and technological advancements in diagnostic techniques. This market encompasses a wide range of products and services used for the detection, diagnosis, and monitoring of various types of cancer. The market is characterized by the presence of numerous key players, continuous product innovation, and increasing adoption of advanced diagnostic solutions across healthcare setting.

- The escalating demand for cancer diagnostics is primarily fueled by the increasing geriatric population, the growing prevalence of sedentary lifestyles, and the rising awareness of the importance of early cancer detection.

- The U.S. dominates the Cancer Diagnostics market in North America with the largest revenue share of 83.31% in 2025, characterized by a well-established healthcare infrastructure, high healthcare expenditure, and the presence of leading market players.

- The U.S. is expected to be the fastest-growing country in the North America Cancer Diagnostics market during the forecast period, fueled by the rising prevalence of cancer, growing awareness regarding early cancer detection, and a robust healthcare infrastructure supporting advanced diagnostic technologies. The country also benefits from a high adoption rate of innovative diagnostic tools, increasing investments in oncology research, and a strong presence of leading market players continuously developing and launching novel molecular and imaging-based diagnostic solutions.

- Imaging is expected to dominate the North America Cancer Diagnostics market with a market share of 21.2% in 2025, owing to their non-invasive nature, high accuracy in detecting tumor location and stage, and widespread use in both screening and monitoring treatment progress. The segment’s growth is further supported by technological advancements such as AI-powered imaging systems, integration with electronic health records (EHRs), and the expansion of cancer screening programs across the region.

Report Scope and Cancer Diagnostics Market Segmentation

|

Attributes |

Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cancer Diagnostics Market Trends

“Development of novel biomarkers for early cancer detection”

- Growing Adoption of Liquid Biopsy: A significant trend in the North America cancer diagnostics market is the increasing adoption of liquid biopsy techniques. This minimally invasive approach involves analyzing biological samples such as blood, urine, or saliva to detect and monitor cancer.

- For instance, liquid biopsies are being used to detect circulating tumor cells (CTCs), cell-free DNA (cfDNA), and other biomarkers that provide valuable information about the presence, stage, and genetic profile of cancer. The technique offers several advantages over traditional tissue biopsies, including the ability to obtain real-time information about tumor dynamics, assess treatment response, and detect minimal residual disease.

- The development of advanced technologies such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) has enhanced the sensitivity and specificity of liquid biopsy assays. Moreover, the integration of microfluidic devices and automation platforms is improving the efficiency and throughput of liquid biopsy workflows.

- The increasing focus on personalized medicine and the need for less invasive diagnostic procedures are driving the demand for liquid biopsy solutions. Companies like Roche Diagnostics and Thermo Fisher Scientific are at the forefront of developing and commercializing innovative liquid biopsy technologies.

- The demand for liquid biopsy is growing rapidly across various oncology applications, including early cancer detection, treatment monitoring, and disease recurrence assessment.

Cancer Diagnostics Market Dynamics

Driver

“Growing geriatric population”

- Rising Incidence of Cancer: The increasing incidence of various types of cancer in North America is a major driver for the growth of the cancer diagnostics market.

- For instance, according to the American Cancer Society, the number of new cancer cases in the U.S. is projected to increase significantly in the coming years. This rise in cancer prevalence is driving the demand for effective diagnostic tools and techniques for early detection and treatment planning

- The growing geriatric population, changing lifestyles, and exposure to environmental risk factors are contributing to the increasing cancer burden. As the prevalence of cancer continues to rise, the need for accurate and timely diagnosis becomes even more critical, driving the demand for advanced cancer diagnostic solutions.

- Additionally, increasing awareness about the importance of early cancer detection and the availability of advanced diagnostic technologies are also fueling market growth

Restraint/Challenge

“High cost of advanced diagnostic technologies”

- High Cost of Advanced Diagnostic Technologies: The high cost of advanced cancer diagnostic technologies, such as next-generation sequencing and molecular diagnostics, poses a significant challenge to market growth, particularly in smaller healthcare facilities and developing regions.

- For instance, the cost of a single next-generation sequencing test can range from several hundred to several thousand dollars, making it unaffordable for many patients and healthcare providers. This high cost can limit the adoption of these technologies, especially in resource-constrained settings.

- Reimbursement challenges and the complexity of regulatory requirements further exacerbate these issues. Addressing these challenges will require efforts to reduce the cost of diagnostic tests, improve reimbursement policies, and streamline regulatory processes.

- The complexity of cancer and the need for highly skilled professionals to interpret diagnostic results also present challenges.

Cancer Diagnostics Market Scope

The market is segmented on the basis type, technology, application and end user.

- By Type

On the basis of type, the cancer diagnostics market is segmented into laboratory tests, genetic tests, tumor biomarkers tests, imaging, endoscopy, biopsy, liquid biopsy, immunohistochemistry, in situ hybridization and others. The imaging segment dominates the largest market revenue share of 21.2% in 2025, the cancer diagnostics market in North America due to their critical role in early detection, staging, and treatment planning. Imaging modalities such as MRI, CT scans, PET scans, mammography, and ultrasound are indispensable tools used extensively for visualizing tumors, assessing spread, and guiding biopsy procedures. The integration of AI and machine learning into imaging platforms has significantly improved detection accuracy, reduced false positives, and enabled better workflow efficiency.

The liquid biopsy segment is anticipated to witness the fastest growth rate of 8.4% from 2025 to 2032, fueled by advancements in non-invasive diagnostics and personalized medicine. These tests enable early detection and ongoing monitoring of cancer progression with minimal patient discomfort. North America’s strong healthcare infrastructure, investment in advanced technology, and awareness programs promote the adoption of comprehensive cancer diagnostic solutions. Increasing prevalence of various cancers, along with government initiatives for early diagnosis, is driving demand across all these diagnostic types. Integration of novel biomarkers and multiplex testing platforms further enhances diagnostic accuracy and treatment customization.

- By Technology

On the basis of technology, the cancer diagnostics market is segmented into instrument-based, platform-based, and tumor biomarker tests. The instrument-based technologies segment held the largest market revenue share in 2025, due to its integral role in conventional and advanced diagnostic procedures. This includes imaging systems (MRI, CT, PET, ultrasound), automated histopathology instruments, and digital pathology tools. These instruments are not only critical for disease localization and tissue sampling but also for tracking tumor progression, treatment response, and recurrence.

The Platform-based diagnostics segment is expected to witness the fastest CAGR from 2025 to 2032, including next-generation sequencing (NGS) and polymerase chain reaction (PCR) systems, are rapidly growing due to their ability to analyze genetic and molecular profiles at scale. Tumor biomarker tests, supported by artificial intelligence and bioinformatics, are becoming essential in personalized oncology, helping clinicians tailor therapies based on tumor-specific characteristics. The demand for integrated platforms that combine multiple diagnostic approaches is increasing, as it enhances diagnostic speed and accuracy. North America’s focus on research and innovation ensures continuous development and adoption of cutting-edge diagnostic technologies.

- By Application

On the basis of application, the cancer diagnostics market is segmented into breast cancer, colorectal cancer, cervical cancer, lung cancer, prostate cancer, skin cancer, blood cancer, kidney cancer, pancreatic cancer, ovarian cancer and others. The Breast cancer segment accounted for the largest market revenue share in 2025, driven by its high incidence, robust screening programs, and public awareness. Annual screening mammograms for women aged 40 and above are widely promoted and often covered by insurance policies in the U.S. and Canada. The adoption of 3D mammography (digital breast tomosynthesis) has significantly improved early detection rates, particularly in women with dense breast tissue. Additionally, breast cancer diagnostics benefit from MRI, ultrasound, and core needle biopsy, which are frequently used for suspicious lesions. Innovations in molecular diagnostics and genetic testing (e.g., BRCA1/BRCA2 mutation analysis) further contribute to early risk detection and personalized treatment planning.

The lung and colorectal cancers segment is projected to witness the fastest CAGR from 2025 to 2032, rapidly growing due to increasing awareness, rising incidence, and enhanced screening guidelines. Early and accurate diagnosis of these cancers enables better patient outcomes and personalized treatment regimens. Additionally, emerging diagnostic methods, such as liquid biopsy and advanced imaging, improve detection in hard-to-biopsy or asymptomatic cases. Continuous research on cancer-specific biomarkers across these applications is also propelling growth. As awareness and preventive healthcare rise, diagnostics across all these cancer types are expected to expand steadily in North America.

- By End User

On the basis of end user, the cancer diagnostics market is segmented into cancer research institutes, diagnostic laboratories, hospitals and others. The hospital segment holds the largest market revenue share in 2025, holding the largest revenue share due to their extensive diagnostic capabilities, availability of advanced equipment, and integrated cancer care programs. Most hospitals in the region operate integrated oncology departments equipped with imaging systems (MRI, CT, PET), pathology labs, genetic testing services, and biopsy suites. These institutions are often early adopters of new diagnostic technologies, including AI-enabled diagnostics, liquid biopsy tools, and digital pathology systems.

The Diagnostic laboratories segment is expected to witness the fastest growth from 2025 to 2032, rapidly expanding, driven by the rise in molecular and genetic testing demand and growing outsourcing of complex diagnostics. Cancer research institutes play a crucial role in innovating new diagnostic techniques, validating biomarkers, and supporting clinical trials, which in turn fuel market growth. Increasing collaborations between these end users enable faster translation of research into clinical applications. Moreover, growing patient preference for faster, more accurate diagnosis in accessible settings boosts demand for diagnostic laboratories and specialized centers, supporting overall market expansion.

Cancer Diagnostics Market Regional Analysis

- U.S. dominates the Cancer Diagnostics market with the largest revenue share of 83.31% in 2024, driven by the high prevalence of cancer, advanced healthcare infrastructure, and the presence of major market players. The market is characterized by the early adoption of innovative diagnostic technologies, including liquid biopsies, molecular diagnostics, and advanced imaging techniques.

- Additionally, favorable reimbursement policies and significant investments in cancer research contribute to the market's growth. The increasing focus on personalized medicine and the rising demand for minimally invasive diagnostic procedures are further fueling market expansion.

- The adoption of image-guided biopsy procedures in ambulatory settings and hospitals is also on the rise due to their higher accuracy and reduced patient trauma, thereby fueling overall market growth in the U.S.

Canada Cancer Diagnostics Market Insight

The Canada Cancer Diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing government initiatives for cancer screening and early detection, rising awareness about cancer, and a well-established healthcare system. The market is supported by increasing investments in healthcare infrastructure and the growing adoption of advanced diagnostic technologies. Additionally, the rising geriatric population and the increasing prevalence of cancer are contributing to market growth in Canada.

Mexico Cancer Diagnostics Market Insight

The Mexico Cancer Diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing healthcare expenditure, rising awareness about cancer, and improving healthcare infrastructure. The market is characterized by increasing government initiatives to improve access to healthcare services and growing investments in cancer diagnosis and treatment. However, challenges such as limited access to advanced diagnostic technologies and a shortage of skilled professionals are hindering market growth to some extent.

Cancer Diagnostics Market Share

The Cancer Diagnostics industry is primarily led by well-established companies, including:

- Abbott Laboratories (U.S.)

- Roche Diagnostics (Switzerland)

- Thermo Fisher Scientific (U.S.)

- Siemens Healthineers (Germany)

- Danaher Corporation (U.S.)

- Becton, Dickinson and Company (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- QIAGEN (Netherlands)

- bioMérieux (France)

Latest Developments in North America Cancer Diagnostics Market

- In March 2024, Roche Diagnostics launched a new liquid biopsy test for early detection of lung cancer. This non-invasive test is designed to detect circulating tumor DNA (ctDNA) in blood samples, providing a more convenient and less invasive alternative to traditional tissue biopsies.

- In February 2024, Thermo Fisher Scientific introduced a new next-generation sequencing (NGS) platform for comprehensive genomic profiling of cancer. This platform enables researchers and clinicians to identify a wide range of genetic mutations associated with cancer, facilitating personalized treatment strategies.

- In January 2024, Abbott Laboratories received FDA approval for a new immunohistochemistry (IHC) assay for the diagnosis of breast cancer. This assay helps in the identification of specific biomarkers that can guide treatment decisions and predict patient outcomes.

- In December 2023, Siemens Healthineers launched a new molecular diagnostics system for the detection of infectious diseases associated with cancer. This system enables rapid and accurate identification of pathogens, helping to improve the management of cancer patients with infections.

- In November 2023, Danaher Corporation announced a collaboration with a leading research institute to develop new artificial intelligence (AI)-based tools for cancer diagnosis. This collaboration aims to improve the accuracy and efficiency of cancer detection and diagnosis using advanced AI algorithms.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.