Infusion Pump Market Accessories Software Market

Market Size in USD Billion

CAGR :

%

USD

12.00 Billion

USD

27.45 Billion

2025

2033

USD

12.00 Billion

USD

27.45 Billion

2025

2033

| 2026 –2033 | |

| USD 12.00 Billion | |

| USD 27.45 Billion | |

|

|

|

|

Infusion Pump Systems, Accessories and Software Market Size

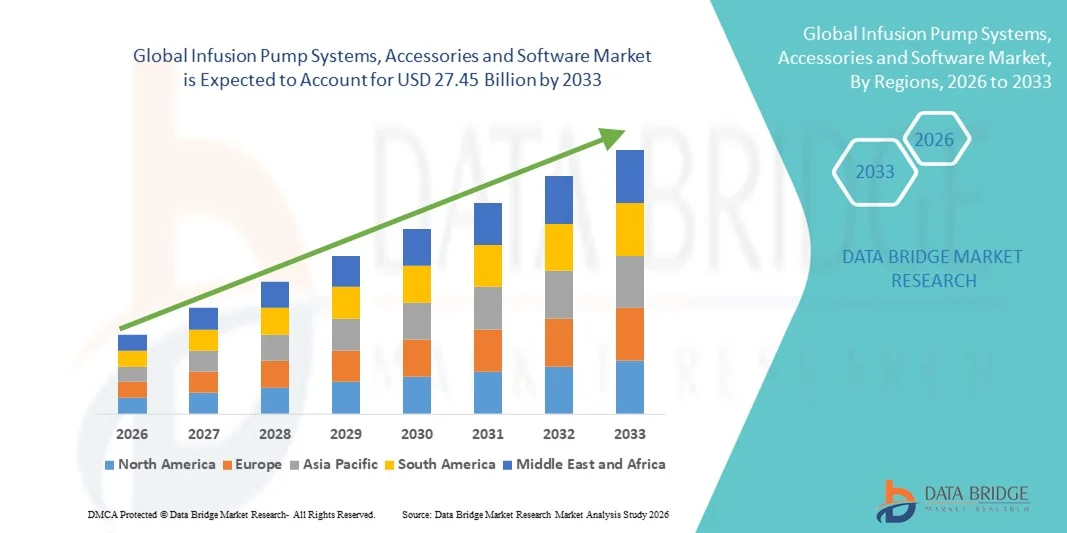

- The global infusion pump systems, accessories and software market size was valued at USD 12.0 billion in 2025 and is expected to reach USD 27.45 billion by 2033, at a CAGR of 10.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, along with the rising demand for accurate and controlled drug delivery systems in hospitals, ambulatory care centers, and homecare settings. Continuous technological advancements in smart infusion pumps, dose error reduction systems, and integrated software platforms are further accelerating adoption across healthcare facilities

- Furthermore, growing emphasis on patient safety, the need to minimize medication errors, and rising demand for connected healthcare infrastructure are establishing infusion pump systems, accessories, and software as essential components of modern clinical care. These converging factors are accelerating the uptake of Infusion Pump Systems, Accessories and Software solutions, thereby significantly boosting overall market growth

Infusion Pump Systems, Accessories and Software Market Analysis

- Infusion pump systems, accessories, and software are increasingly vital components of modern healthcare delivery across hospitals, ambulatory care centers, and homecare settings due to their ability to ensure precise, controlled, and continuous administration of medications, fluids, and nutrients, while enhancing patient safety and clinical efficiency

- The escalating demand for infusion pump systems is primarily fueled by the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, growing surgical procedures, increasing geriatric population, and the need to reduce medication errors through smart pumps integrated with dose error reduction systems and hospital IT infrastructure

- North America dominated the infusion pump systems, accessories and software market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of smart infusion technologies, strong regulatory frameworks focused on patient safety, and the presence of leading medical device manufacturers, with the U.S. witnessing substantial growth in hospital-based and home infusion therapy adoption

- Asia-Pacific is expected to be the fastest growing region in the infusion pump systems, Accessories and Software market during the forecast period, driven by expanding healthcare infrastructure, rising chronic disease burden, increasing healthcare expenditure, and growing adoption of advanced infusion technologies in emerging economies such as China and India

- The Reusable segment dominated with 63.2% revenue share in 2025, supported by strong cost efficiency over long-term usage and frequent deployment in hospitals

Report Scope and Infusion Pump Systems, Accessories and Software Market Segmentation

|

Attributes |

Infusion Pump Systems, Accessories and Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Infusion Pump Systems, Accessories and Software Market Trends

Rising Demand for Smart and Connected Infusion Therapy Solutions

- A significant and accelerating trend in the global infusion pump systems, accessories and software market is the growing integration of advanced connectivity features and digital health technologies to enhance patient monitoring and treatment accuracy. Modern infusion pump systems are increasingly designed with wireless connectivity, real-time data tracking, and interoperability with hospital information systems and electronic health records (EHRs)

- For instance, leading manufacturers are introducing smart infusion pumps equipped with dose error reduction systems (DERS) and integrated drug libraries to minimize medication errors and improve clinical outcomes. These systems enable healthcare professionals to program precise dosages and receive alerts in case of deviations, thereby enhancing patient safety

- The incorporation of advanced software platforms allows centralized monitoring of multiple infusion devices across hospital departments. Clinicians can track infusion status, adjust therapy parameters, and review treatment history remotely, which improves workflow efficiency and reduces manual documentation burdens

- In addition, the increasing adoption of ambulatory and portable infusion pumps is supporting the shift toward outpatient and home-based care. Lightweight and battery-operated devices enable patients to receive long-term therapies, such as chemotherapy, insulin, or pain management, in the comfort of their homes while maintaining clinical oversight

- The growing emphasis on interoperability and data-driven healthcare environments is reshaping infusion therapy practices. Integration with clinical decision support systems ensures accurate medication delivery while supporting hospital-wide safety protocols

- This trend toward technologically advanced, patient-centric, and digitally connected infusion solutions is significantly transforming healthcare delivery models and driving innovation across hospitals, specialty clinics, and homecare settings

Infusion Pump Systems, Accessories and Software Market Dynamics

Driver

Increasing Prevalence of Chronic Diseases and Rising Demand for Accurate Drug Deliver

- The rising global burden of chronic diseases such as cancer, diabetes, cardiovascular disorders, and gastrointestinal conditions is a major driver for the Infusion Pump Systems, Accessories and Software market. These conditions often require precise and continuous administration of medications, fluids, or nutrients, making infusion pumps essential in modern clinical care

- The growing number of surgical procedures and critical care admissions has further amplified the demand for volumetric infusion pumps, syringe pumps, and patient-controlled analgesia (PCA) pumps in hospitals and ambulatory surgical centers. Accurate drug dosing and controlled infusion rates significantly reduce the risk of complications and medication errors

- Healthcare providers are increasingly investing in advanced infusion systems with safety features such as programmable drug libraries, automated alerts, and barcode medication administration compatibility to enhance patient safety and comply with regulatory standards

- The expansion of home healthcare services and outpatient treatment programs is also contributing to market growth. Portable infusion pumps allow patients to manage long-term therapies outside hospital settings, reducing healthcare costs and improving quality of life

- In addition, government initiatives to modernize healthcare infrastructure and improve patient safety standards are encouraging hospitals to replace conventional infusion systems with technologically advanced solutions

- The combination of rising disease prevalence, increasing healthcare expenditure, and a strong focus on minimizing medication errors continues to propel demand for innovative infusion pump systems globally

Restraint/Challenge

High Device Costs and Risk of Infusion-Related Complications

- The relatively high cost of advanced infusion pump systems, along with associated accessories and software maintenance, poses a significant barrier to adoption, particularly in small healthcare facilities and developing regions. Initial procurement costs, staff training expenses, and ongoing software upgrades can strain limited healthcare budgets

- Infusion-related complications, including programming errors, device malfunctions, and catheter-related infections, remain a challenge for healthcare providers. Although smart pumps incorporate safety mechanisms, incorrect settings or human error can still result in adverse drug events

- Regulatory compliance requirements and product recalls due to technical faults may also hinder market growth. Manufacturers must adhere to stringent quality and safety standards, which can increase development costs and extend approval timelines

- Furthermore, integration challenges with existing hospital IT systems can limit the full utilization of advanced infusion software platforms, particularly in facilities with outdated digital infrastructure

- Cybersecurity concerns associated with connected medical devices present another obstacle. As infusion pumps become increasingly network-enabled, protecting patient data and preventing unauthorized access are critical considerations for healthcare institutions

- Addressing these challenges through cost-effective product innovation, enhanced training programs, robust cybersecurity frameworks, and improved system interoperability will be essential to ensure sustained growth in the Infusion Pump Systems, Accessories and Software market

Infusion Pump Systems, Accessories and Software Market Scope

The market is segmented on the basis of product type, application, type, usage, infusion method, infusion type, operation type, end user, and distribution channel.

- By Product Type

On the basis of product type, the Infusion Pump Systems, Accessories and Software market is segmented into Infusion Pump Systems, Infusion Pump Accessories, and Infusion Pump Management Softwares. The Infusion Pump Systems segment dominated the largest market revenue share of 48.7% in 2025, driven by widespread adoption of volumetric and smart infusion pumps across hospitals and critical care units. Increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders fuels demand for reliable infusion delivery systems. Hospitals rely heavily on pump systems for precise medication dosing and fluid management. Integration with dose error reduction software enhances patient safety. Growing ICU admissions and surgical procedures further support dominance. Established reimbursement structures in developed markets strengthen procurement. Technological advancements such as wireless connectivity and EMR integration improve workflow efficiency. Demand for multi-parameter programmable pumps boosts revenue growth. Expansion of hospital infrastructure in emerging economies adds to volume sales. Continuous upgrades and replacement cycles sustain recurring demand.

The Infusion Pump Management Softwares segment is expected to witness the fastest CAGR of 14.6% from 2026 to 2033, fueled by increasing digitalization of healthcare systems. Hospitals are prioritizing centralized monitoring and interoperability solutions to reduce medication errors. Cloud-based platforms enable real-time data tracking and analytics. Growing regulatory emphasis on infusion safety accelerates smart software adoption. Integration with hospital information systems enhances operational efficiency. Rising adoption of AI-enabled drug libraries strengthens growth prospects. Healthcare providers seek predictive maintenance and compliance management tools. Expansion of connected care ecosystems supports demand. Emerging markets are increasingly investing in digital infusion infrastructure. Remote monitoring capabilities further drive market penetration. Continuous product innovation ensures sustained expansion during the forecast period.

- By Application

On the basis of application, the market is segmented into General Infusion, Pain and Anesthesia Management, Insulin Infusion, Enteral Infusion, Chemotherapy, Pediatrics/Neonatology, Hematology, Gastroenterology, and Others. The General Infusion segment accounted for the largest market revenue share of 29.8% in 2025, owing to its extensive use in hydration therapy, antibiotics, and routine intravenous drug administration. High hospital admission rates and increasing surgical volumes support strong demand. General infusion pumps are widely used in ICUs and general wards for controlled medication delivery. Standardized infusion protocols reinforce segment stability. Hospitals prefer programmable pumps for accuracy and safety. Rising chronic disease burden ensures consistent patient inflow. Expansion of healthcare facilities in developing regions further boosts adoption. Continuous technological improvements enhance system reliability. Favorable reimbursement policies support procurement in developed countries. Increasing need for precise fluid balance management strengthens dominance.

The Chemotherapy segment is projected to register the fastest CAGR of 15.1% from 2026 to 2033, driven by rising global cancer prevalence and increasing adoption of targeted oncology treatments. Infusion pumps are critical for controlled cytotoxic drug administration. Oncology centers are investing in advanced smart pumps to reduce dosing errors. Growing outpatient chemotherapy programs fuel ambulatory pump demand. Technological innovations in portable infusion systems enhance patient comfort. Expanding oncology infrastructure in Asia-Pacific accelerates market growth. Increased awareness about cancer treatment accessibility strengthens demand. Regulatory approvals of novel oncology drugs contribute to expansion. Rising investments in cancer care facilities support long-term growth. Improved reimbursement for chemotherapy treatments further enhances segment prospects.

- By Type

On the basis of type, the market is segmented into Traditional Infusion Pumps and Specialty Infusion Pumps. The Traditional Infusion Pumps segment dominated the largest market revenue share of 56.4% in 2025, due to their extensive use in hospitals for routine intravenous therapies. These pumps are cost-effective and clinically well-established. High patient volumes in acute care settings reinforce demand. Healthcare professionals are familiar with traditional pump systems, ensuring operational efficiency. Hospitals prefer durable and easy-to-maintain equipment. Stable procurement cycles maintain steady revenue streams. Integration with existing hospital infrastructure supports dominance. Continuous need for fluid and drug delivery ensures sustained utilization.

The Specialty Infusion Pumps segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by increasing demand for insulin pumps, enteral pumps, and ambulatory infusion devices. Rising prevalence of diabetes significantly supports insulin pump adoption. Technological advancements in wearable infusion devices improve patient convenience. Growth of home healthcare services accelerates specialty pump demand. Enhanced safety features and programmable capabilities strengthen uptake. Increasing preference for portable and patient-friendly devices further fuels growth. Expanding geriatric population contributes to rising demand.

- By Usage

On the basis of usage, the market is segmented into Disposable and Reusable. The Reusable segment dominated with 63.2% revenue share in 2025, supported by strong cost efficiency over long-term usage and frequent deployment in hospitals. Reusable infusion pumps are widely utilized in intensive care units, surgical wards, and oncology departments. Their durability and compatibility with multiple drug delivery systems strengthen institutional preference. Hospitals favor reusable systems due to structured sterilization protocols and centralized maintenance facilities. Long service life and lower per-use cost improve return on investment. Procurement contracts with service and calibration support enhance reliability. Technological upgrades allow software updates without full device replacement. Integration with hospital information systems improves monitoring efficiency. High patient volumes in tertiary care centers sustain recurring utilization. Reimbursement frameworks in developed markets support capital equipment purchases. Regulatory compliance and safety validation further reinforce adoption. Continuous innovation in smart reusable pumps ensures sustained revenue leadership in 2025.

The Disposable segment is anticipated to grow at the fastest CAGR of 12.8% from 2026 to 2033, driven by rising emphasis on infection prevention and patient safety. Increasing concerns over hospital-acquired infections accelerate demand for single-use infusion devices. Disposable elastomeric pumps eliminate cross-contamination risks and reduce sterilization costs. Growing adoption in ambulatory surgical centers and home healthcare settings strengthens penetration. Convenience, lightweight design, and ease of disposal enhance user acceptance. Expansion of outpatient chemotherapy and antibiotic therapies supports growth momentum. Emerging economies are witnessing increased demand due to limited sterilization infrastructure. Manufacturers focus on cost-effective designs to improve accessibility. Regulatory encouragement for infection control standards further boosts uptake. Rising geriatric population requiring home-based therapy contributes to expansion. Growth of telemedicine and remote care programs supports disposable pump integration. These factors collectively position the segment for robust CAGR growth through 2033.

- By Infusion Method

On the basis of infusion method, the market is segmented into Intravenous, Arterial, Subcutaneous, and Epidural. The Intravenous segment held the largest revenue share of 58.9% in 2025, owing to its extensive application in emergency medicine, surgery, oncology, and intensive care. IV infusion ensures rapid drug administration and precise dosage control in critical scenarios. Hospitals rely heavily on IV pumps for chemotherapy, fluid management, and anesthesia delivery. High clinical familiarity and established protocols sustain widespread adoption. Compatibility with a broad range of medications enhances versatility. Advanced IV smart pumps with dose error reduction systems strengthen patient safety. Strong reimbursement structures in developed healthcare systems further support demand. Increasing hospital admissions and surgical procedures contribute to revenue stability. Integration with electronic health records improves workflow efficiency. Continuous innovation in IV pump technology reinforces reliability. Large-scale procurement by hospitals secures consistent revenue share. These combined factors enabled the IV segment to dominate in 2025.

The Subcutaneous segment is projected to witness the fastest CAGR of 14.3% from 2026 to 2033, driven by rising use in insulin therapy and biologic drug delivery. Patients increasingly prefer minimally invasive administration methods. Subcutaneous infusion enables convenient home-based management of chronic conditions such as diabetes and autoimmune diseases. Growth in wearable infusion pumps enhances mobility and compliance. Pharmaceutical advancements in biologics stimulate segment demand. Expanding chronic disease prevalence globally accelerates adoption. Technological innovations improve dose accuracy and comfort. Favorable regulatory approvals for wearable pumps strengthen market entry. Rising awareness about self-administration therapies supports uptake. Healthcare systems promoting outpatient care further drive expansion. Emerging markets show increasing demand due to improving healthcare access. These dynamics collectively position the subcutaneous segment for the highest CAGR during the forecast period.

- By Infusion Type

On the basis of infusion type, the market is segmented into Continuous Infusion and Intermittent Infusion. The Continuous Infusion segment dominated with 60.5% share in 2025, attributed to its essential role in ICU care and long-term therapeutic management. Continuous infusion ensures stable plasma drug concentration and improved treatment outcomes. It is widely used in oncology, anesthesia, pain management, and critical care. Hospitals prefer continuous systems for consistent medication delivery without fluctuations. Increasing prevalence of chronic illnesses requiring long-duration therapy sustains demand. Advanced programmable pumps enhance dosing precision. Strong presence in tertiary hospitals supports revenue stability. Integration with monitoring systems strengthens clinical efficiency. Reimbursement policies favor prolonged infusion therapies in developed markets. Growing number of ICU beds worldwide contributes to segment expansion. Technological upgrades in smart infusion systems further consolidate leadership. These factors enabled the segment to maintain dominance in 2025.

The Intermittent Infusion segment is expected to register the fastest CAGR of 12.4% from 2026 to 2033, driven by expanding outpatient and ambulatory treatment models. Intermittent infusion allows flexible dosing schedules for antibiotics and chemotherapy. Increasing shift toward day-care surgical centers supports segment growth. Home infusion services are gaining popularity among chronic patients. Cost-effectiveness compared to prolonged hospital stays enhances attractiveness. Technological advancements enable portable and battery-operated systems. Rising patient preference for convenience accelerates adoption. Growth in specialty clinics strengthens usage. Emerging economies show higher demand due to outpatient infrastructure development. Regulatory support for ambulatory care services further boosts uptake. Improved patient compliance with scheduled dosing enhances outcomes. These factors collectively drive the segment’s projected high CAGR.

- By Operation Type

On the basis of operation type, the market is segmented into Syringe Pump, Elastomeric Pump, Peristaltic Pump, Multi-Channel Pump, and Smart Pump. The Smart Pump segment dominated with 41.7% revenue share in 2025, due to integrated drug libraries, safety alarms, and connectivity features. Regulatory focus on reducing medication errors strongly supports smart pump adoption. Hospitals prioritize digital infusion systems for enhanced patient safety. Integration with electronic health records enables real-time monitoring. Advanced analytics and dose error reduction systems improve outcomes. Increasing healthcare digitization accelerates procurement. Strong capital investment in developed countries sustains demand. Multi-therapy compatibility enhances clinical utility. Training programs for healthcare professionals encourage adoption. Continuous product innovation strengthens competitive positioning. Growing emphasis on quality accreditation standards reinforces usage. These factors collectively supported segment leadership in 2025.

The Elastomeric Pump segment is anticipated to witness the fastest CAGR of 13.6% from 2026 to 2033, supported by rising demand for portable infusion solutions. Elastomeric pumps are lightweight, disposable, and ideal for outpatient therapy. Increasing chemotherapy and antibiotic treatments in homecare settings drive growth. Cost-effectiveness compared to electronic pumps enhances adoption. Ease of use without complex programming supports patient compliance. Expanding ambulatory surgical centers strengthen utilization. Emerging markets favor elastomeric systems due to affordability. Technological improvements enhance flow rate consistency. Reduced need for power supply increases flexibility. Growth of home healthcare infrastructure globally boosts demand. Rising geriatric population requiring chronic therapy supports expansion. These combined factors position the segment for rapid CAGR growth.

- By End User

On the basis of end user, the market is segmented into Hospitals and Clinics, Home Healthcare, Ambulatory and Surgical Centers, and Others. The Hospitals and Clinics segment dominated with 57.8% share in 2025, driven by high inpatient admissions and advanced infusion infrastructure. Large healthcare facilities conduct complex surgeries and critical care treatments requiring infusion pumps. Availability of skilled professionals supports operational efficiency. Strong reimbursement systems enhance equipment procurement capacity. Integration with centralized monitoring systems improves workflow. Increasing ICU capacity sustains demand. Presence of oncology and specialty departments boosts utilization. Capital funding for digital healthcare strengthens purchasing power. Maintenance and service contracts ensure device longevity. Standardized clinical protocols reinforce reliability. Large-scale procurement agreements secure stable revenue. These elements enabled dominance in 2025.

The Home Healthcare segment is expected to witness the fastest CAGR of 14.9% from 2026 to 2033, fueled by rising chronic disease prevalence and preference for home-based care. Portable infusion pumps enhance treatment convenience. Telehealth integration supports remote patient monitoring. Growing geriatric population increases long-term therapy demand. Cost savings compared to prolonged hospitalization accelerate adoption. Expansion of home nursing services strengthens infrastructure. Technological advancements improve device portability and safety. Rising awareness about self-care management supports growth. Favorable reimbursement for home infusion therapy boosts uptake. Emerging markets demonstrate rising demand for decentralized care. Government initiatives promoting community healthcare contribute to expansion. These drivers collectively position the segment for strong forecasted CAGR growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender and Retail Sales. The Direct Tender segment dominated with 55.1% share in 2025, supported by bulk procurement contracts with hospitals and healthcare systems. Large-scale purchasing agreements ensure cost efficiency and stable supply chains. Public healthcare institutions prefer tender-based sourcing for transparency. Long-term supplier partnerships enhance service and maintenance reliability. Bulk discounts strengthen competitive pricing. Established distribution networks improve product availability. Government-funded hospitals rely heavily on direct tenders. Predictable demand from institutional buyers sustains revenue stability. Warranty and after-sales support reinforce buyer confidence. Procurement standardization ensures regulatory compliance. Growing hospital infrastructure globally further supports dominance. These factors enabled the segment to lead in 2025.

The Retail Sales segment is projected to register the fastest CAGR of 12.2% from 2026 to 2033, driven by expansion of homecare treatment models. Availability through medical supply stores and e-commerce platforms increases accessibility. Rising patient awareness about self-administered therapies boosts demand. Growth in online healthcare marketplaces strengthens distribution reach. Affordable portable infusion devices support consumer purchases. Increasing insurance coverage for home therapy enhances affordability. Digital marketing and direct-to-consumer strategies accelerate adoption. Expansion in emerging markets improves retail penetration. Growth in chronic disease management programs supports demand. Rising preference for convenient procurement channels drives sales. Improved logistics and doorstep delivery services enhance user experience. These combined factors contribute to the segment’s projected strong CAGR growth.

Infusion Pump Systems, Accessories and Software Market Regional Analysis

- North America dominated the infusion pump systems, accessories and software market with the largest revenue share of 38.5% in 2025, characterized by highly advanced healthcare infrastructure, widespread adoption of smart infusion technologies, and strong regulatory frameworks emphasizing patient safety and medication error reduction. The region benefits from the strong presence of leading medical device manufacturers, continuous technological innovation, and substantial investments in digital health integration across hospitals and specialty clinics. In addition, the increasing prevalence of chronic diseases, rising surgical procedures, and expanding home infusion therapy programs are contributing significantly to market growth, particularly in the U.S., where both hospital-based and homecare settings are witnessing robust adoption of advanced infusion systems

- Healthcare providers across North America prioritize the use of infusion pumps equipped with dose error reduction systems (DERS), integrated drug libraries, and interoperability with electronic health record (EHR) systems. The growing emphasis on improving clinical outcomes, minimizing adverse drug events, and enhancing workflow efficiency is further accelerating the deployment of advanced infusion pump systems, accessories, and centralized software platforms throughout the region

- This widespread adoption is further supported by favorable reimbursement policies, strong healthcare spending capacity, and continuous training programs aimed at improving safe infusion practices. The presence of well-established hospital networks and specialty oncology and critical care centers reinforces North America’s leadership position in the global market

U.S. Infusion Pump Systems, Accessories and Software Market Insight

The U.S. infusion pump systems, accessories and software market captured the largest revenue share in 2025 within North America, driven by extensive integration of advanced medical technologies across healthcare facilities. The country’s strong focus on patient safety initiatives, reduction of medication errors, and compliance with stringent regulatory standards has significantly accelerated the adoption of smart infusion pumps. The increasing burden of chronic conditions such as cancer, diabetes, and cardiovascular diseases has led to heightened demand for precise and continuous drug delivery systems in hospitals, ambulatory surgical centers, and homecare environments. Furthermore, the rapid expansion of home infusion therapy services, supported by improved portable pump technologies, is transforming long-term disease management practices. Healthcare institutions in the U.S. are increasingly investing in interoperable infusion software systems that allow centralized monitoring, real-time data analytics, and seamless integration with hospital IT infrastructure. These advancements are enhancing operational efficiency, improving patient outcomes, and reinforcing the country’s dominant position in the regional market.

Europe Infusion Pump Systems, Accessories and Software Market Insight

The Europe infusion pump systems, accessories and software market is projected to expand at a substantial CAGR throughout the forecast period, supported by strong regulatory oversight, rising healthcare modernization initiatives, and increasing demand for accurate drug delivery systems. European countries are placing greater emphasis on minimizing medication errors and enhancing patient safety through the adoption of technologically advanced infusion systems. The region is witnessing growing investments in digital health infrastructure, including the integration of infusion pumps with hospital information systems and clinical decision support tools. In addition, the increasing prevalence of chronic diseases and a steadily aging population are driving the need for long-term infusion therapies in both inpatient and outpatient settings.

The adoption of ambulatory and portable infusion pumps is also rising across Europe, reflecting the broader shift toward home-based and community healthcare services.

U.K. Infusion Pump Systems, Accessories and Software Market Insight

The U.K. infusion pump systems, accessories and software market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by ongoing efforts to modernize healthcare delivery and improve medication safety standards. Hospitals across the country are increasingly deploying smart infusion pumps with advanced safety features to reduce clinical risks and enhance treatment accuracy. The rising incidence of cancer and metabolic disorders is fueling demand for chemotherapy infusion systems, insulin pumps, and patient-controlled analgesia devices. In addition, government-backed healthcare digitization programs are encouraging the integration of infusion devices with centralized data management platforms to streamline clinical workflows. The expanding role of home healthcare services and community-based treatment programs is further supporting the uptake of portable and user-friendly infusion systems across the U.K.

Germany Infusion Pump Systems, Accessories and Software Market Insight

The Germany infusion pump systems, accessories and software market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s strong healthcare infrastructure and emphasis on technological innovation. Germany’s focus on patient safety, clinical precision, and advanced medical engineering is promoting the adoption of high-performance infusion systems across hospitals and specialty clinics. Increasing investments in hospital modernization and digital healthcare transformation are facilitating the integration of smart infusion pumps with electronic medical records and centralized monitoring systems. In addition, the rising geriatric population and growing prevalence of chronic diseases are contributing to sustained demand for long-term infusion therapies. Germany’s well-established medical device manufacturing ecosystem and commitment to quality standards further strengthen its position within the European infusion pump market.

Asia-Pacific Infusion Pump Systems, Accessories and Software Market Insight

The Asia-Pacific infusion pump systems, accessories and software market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by expanding healthcare infrastructure, rising chronic disease burden, and increasing healthcare expenditure across emerging economies. Governments in the region are investing heavily in hospital development, critical care expansion, and digital health technologies. The growing patient population requiring oncology, diabetes, and critical care treatments is significantly boosting the demand for reliable and cost-effective infusion systems. In addition, improving awareness of medication safety standards and increasing training initiatives for healthcare professionals are accelerating the adoption of advanced infusion technologies. As Asia-Pacific continues to strengthen its manufacturing capabilities for medical devices, improved affordability and wider accessibility of infusion pumps and related software solutions are further supporting regional market growth.

Japan Infusion Pump Systems, Accessories and Software Market Insight

The Japan infusion pump systems, accessories and software market is gaining momentum due to the country’s advanced healthcare system, aging population, and strong demand for precision-based medical technologies. The high prevalence of age-related chronic diseases is driving sustained demand for infusion therapies in hospitals and long-term care facilities. Japanese healthcare providers emphasize safety, accuracy, and technological sophistication, leading to increased adoption of programmable infusion pumps and integrated monitoring systems. The expansion of home healthcare services is also contributing to rising demand for compact, portable infusion devices tailored to elderly patients.

China Infusion Pump Systems, Accessories and Software Market Insight

The China infusion pump systems, accessories and software market accounted for the largest market revenue share in Asia Pacific in 2025, supported by rapid healthcare infrastructure expansion and rising healthcare investments. The country’s growing burden of chronic diseases, particularly cancer and diabetes, is increasing the need for advanced drug delivery systems across hospitals and specialty clinics. Government initiatives aimed at strengthening hospital capabilities and improving patient safety standards are encouraging the adoption of smart infusion technologies. In addition, the presence of domestic manufacturers and expanding production capacity is improving device affordability and accessibility. Overall, Asia-Pacific is expected to emerge as the fastest-growing region in the global Infusion Pump Systems, Accessories and Software market, driven by expanding healthcare modernization efforts, rising patient awareness, and increasing demand for efficient and accurate infusion therapy solutions across both urban and rural healthcare settings.

Infusion Pump Systems, Accessories and Software Market Share

The Infusion Pump Systems, Accessories and Software industry is primarily led by well-established companies, including:

- B.D.(U.S.)

- Baxter International Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- Medtronic (Ireland)

- Smiths Medical (U.K.)

- Terumo Corporation (Japan)

- Moog Inc. (U.S.)

- Nipro Corporation (Japan)

- Mindray Medical International Limited (China)

- Zyno Medical (U.S.)

- Insulet Corporation (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Micrel Medical Devices S.A. (Greece)

Latest Developments in Global Infusion Pump Systems, Accessories and Software Market

- In August 2023, ICU Medical Inc. received 510(k) regulatory clearance from the U.S. FDA for its Plum Duo infusion pump with LifeShield infusion safety software, enabling the system’s commercial rollout as part of its precision infusion platform designed to improve medication safety and delivery accuracy in hospitals and acute care settings

- In June 2023, B. Braun Medical Inc. launched the DoseTrac Enterprise Infusion Management Software, a next-generation infusion fleet management tool providing real-time monitoring, retrospective reporting, and network-wide visibility of up to 40,000 pumps, enhancing clinical decision support and operational analytics

- In February 2023, Mindray Medical International Ltd. introduced the BeneFusion i Series and u Series infusion systems, featuring high precision, adaptive customization, and simplified operation aimed at improving medication safety and workflow efficiency across clinical environments

- In April 2024, Baxter International Inc. received U.S. FDA clearance for its Novum IQ large-volume infusion pump integrated with Dose IQ Safety Software, enabling enhanced interoperability with electronic health records and advanced dose-error reduction features that support standardized medication libraries across healthcare systems

- In April 2025, ICU Medical Inc. obtained FDA 510(k) clearance for its Plum Solo™ precision IV pump, a single-channel complement to the Plum Duo™ system, as part of the expanded ICU Medical IV Performance Platform, which aims to offer improved accuracy, safety alerts, and wireless clinical integration

- In March 2025, Baxter International Inc. launched the Amia IQ smart infusion system, a cloud-connected platform equipped with predictive analytics for enhanced remote monitoring, reduced dosage errors, and improved clinical workflow support in both hospital and homecare settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.