Global X Ray Devices And Accessories Market

Market Size in USD Billion

CAGR :

%

USD

8.88 Billion

USD

55.87 Billion

2024

2032

USD

8.88 Billion

USD

55.87 Billion

2024

2032

| 2025 –2032 | |

| USD 8.88 Billion | |

| USD 55.87 Billion | |

|

|

|

|

X-Ray Devices and Accessories Market Size

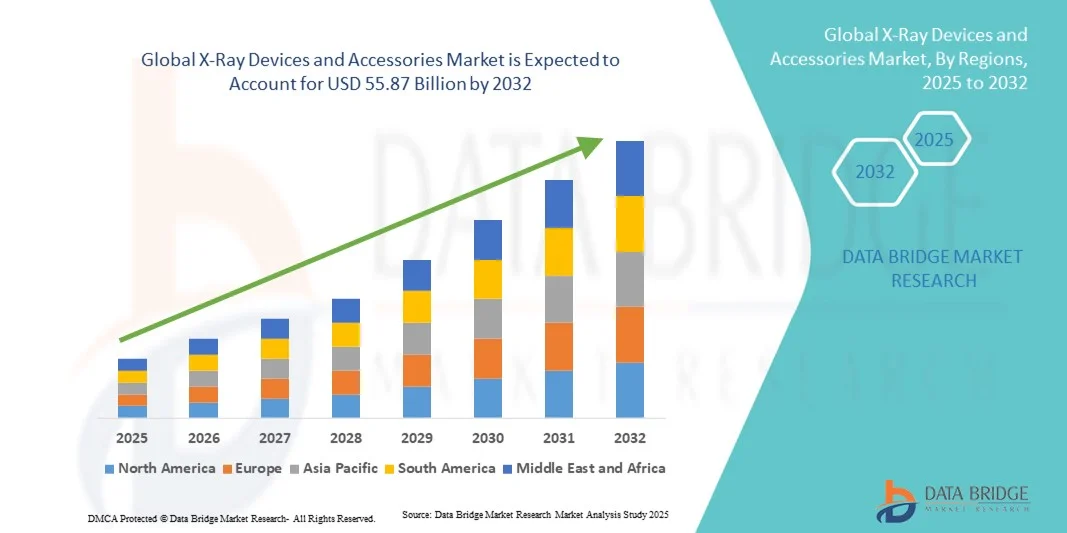

- The global X-Ray devices and accessories market size was valued at USD 8.88 billion in 2024 and is expected to reach USD 55.87 billion by 2032, at a CAGR of 25.85% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging technologies and the continuous technological advancements in radiology equipment, driving higher efficiency, accuracy, and patient throughput in both diagnostic and interventional procedures

- Furthermore, rising demand for early disease detection, improved workflow integration, and portable or compact imaging solutions is establishing X-Ray Devices and Accessories as essential tools across hospitals, clinics, and diagnostic centers. These converging factors are accelerating the uptake of X-Ray Devices and Accessories solutions, thereby significantly boosting the industry's growth

X-Ray Devices and Accessories Market Analysis

- X-Ray Devices and Accessories are critical components in modern medical diagnostics, offering advanced imaging solutions for hospitals, clinics, and diagnostic centers. Their increasing adoption is driven by rising demand for accurate diagnostics, technological advancements, and integration with hospital automation systems

- The escalating demand for X-Ray Devices and Accessories is primarily fueled by increasing healthcare expenditure, rising prevalence of chronic diseases, and the need for early and precise diagnosis

- North America dominated the X-ray devices and accessories market with the largest revenue share of 35.4% in 2024, attributed to advanced healthcare infrastructure, high adoption of modern imaging systems, and strong presence of key industry players in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the X-ray devices and accessories market during the forecast period due to increasing healthcare access, rising disposable incomes, and government initiatives to improve medical infrastructure

- The digital radiography (DR) segment dominated the X-Ray devices and accessories market with a 57.2% share in 2024, driven by its ability to deliver superior image quality, rapid processing, and seamless integration with hospital information and PACS systems

Report Scope and X-Ray Devices and Accessories Market Segmentation

|

Attributes |

X-Ray Devices and Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

X-Ray Devices and Accessories Market Trends

Smart Integration and AI-Enabled Convenience in X-Ray Devices

- A significant trend in the global X-Ray devices and accessories market is the increasing integration of artificial intelligence (AI) and advanced automation in imaging systems. AI-enabled X-Ray devices can automatically optimize imaging settings, detect anomalies, and enhance image clarity, improving workflow efficiency in hospitals and diagnostic centers

- For instance, AI-powered digital X-Ray systems like Carestream DRX-Revolution can automatically adjust exposure levels based on patient size, reducing manual intervention and minimizing radiation exposure. Similarly, systems integrated with hospital IT platforms allow radiologists to access images remotely, facilitating faster diagnosis and reporting

- Voice-command or hands-free operation is emerging in some modern X-Ray suites, enabling technicians to control imaging sequences without physical interaction, reducing the risk of contamination and improving procedural efficiency

- The integration of AI and connected hospital systems enables centralized management of multiple imaging devices, allowing staff to monitor performance, track maintenance schedules, and receive alerts for device errors, which enhances operational reliability and patient safety

- This trend toward intelligent, automated, and interconnected X-Ray devices is reshaping expectations in diagnostic imaging, increasing the demand for smart, user-friendly, and workflow-efficient solutions across both large hospitals and smaller clinics

X-Ray Devices and Accessories Market Dynamics

Driver

Growing Need Due to Rising Diagnostic and Healthcare Demands

- The rising prevalence of chronic diseases, increasing patient populations, and a growing focus on early and accurate diagnosis are key drivers of the X-Ray Devices and Accessories market. Healthcare providers are investing in advanced imaging solutions to improve diagnostic speed, accuracy, and patient outcomes

- For instance, in 2024, Siemens Healthineers introduced AI-enabled digital X-Ray systems that optimize exposure settings automatically, reduce imaging time, and enhance image clarity, supporting faster and more precise diagnostics. Such innovations are expected to significantly boost market adoption during the forecast period

- The expansion of healthcare infrastructure in emerging regions, coupled with increasing healthcare expenditure, is also driving demand for portable and fixed digital X-Ray systems in hospitals, clinics, and diagnostic centers

- Technological advancements such as AI-assisted imaging, digital radiography, and integration with hospital PACS (Picture Archiving and Communication Systems) streamline workflow, reduce human error, and enable remote image access, further propelling the market

- In addition, the push for connected healthcare ecosystems, where imaging devices are integrated with electronic health records (EHR) and hospital IT systems, enhances operational efficiency and patient management, making advanced X-Ray devices indispensable for modern healthcare facilities

Restraint/Challenge

High Costs, Technical Complexity, and Data Security Concerns

- The high upfront cost of digital and AI-enabled X-Ray devices remains a major restraint, particularly for smaller clinics and resource-limited healthcare facilities. Such devices often require substantial investment in hardware, software, and operator training

- For instance, Canon’s Radrex series of AI-assisted digital radiography systems requires not only significant capital expenditure but also specialized training for radiology staff, which can delay adoption in smaller healthcare settings

- Maintenance requirements and technical complexity can also be barriers, as improper calibration or handling may compromise image quality and diagnostic accuracy

- Data privacy and cybersecurity are additional concerns for connected X-Ray systems. Hospitals and diagnostic centers must implement robust encryption, secure authentication, and regular software updates to ensure patient data is protected from unauthorized access or breaches

- Furthermore, limited budgets in emerging regions and a shortage of skilled radiology technicians can slow the adoption of advanced X-Ray Devices, even when the clinical benefits are clear. Addressing these challenges through cost-effective solutions, technical support, and cybersecurity measures is critical for sustained market growth

X-Ray Devices and Accessories Market Scope

The market is segmented on the basis of product type, accessories, technology, application, and end-users.

- By Product Type

On the basis of product type, the Global X-Ray Devices and Accessories market is segmented into handheld X-Ray devices and mobile X-Ray devices. The handheld X-Ray devices segment dominated the largest market revenue share of 55.6% in 2024, driven by its portability, ease of use in point-of-care diagnostics, and suitability for bedside imaging in hospitals, clinics, and emergency scenarios. Handheld devices are increasingly preferred for their ability to provide rapid results, reduce patient movement, and enable imaging in remote or resource-limited settings. The segment’s growth is further supported by ongoing innovations that enhance image quality, reduce radiation exposure, and offer ergonomic designs for clinicians. Strong adoption in dental, orthopedic, and emergency care applications is also bolstering revenue.

The mobile X-Ray devices segment is expected to witness the fastest CAGR of 12.4% from 2025 to 2032, driven by rising demand for flexible imaging solutions in hospitals, ambulatory surgical centers, and critical care units. Mobile devices allow imaging in diverse clinical settings, including ICUs and emergency wards, without transferring patients, which reduces procedure time and improves workflow efficiency. The segment benefits from technological advancements such as wireless connectivity, compact design, and integration with PACS and digital record systems. Increasing awareness of portable imaging advantages and the need for rapid diagnostics in orthopedic trauma and pneumonia cases further propel growth.

- By Accessories

On the basis of accessories, the market is segmented into digital sensor holders, film and phosphate plate holders, film processing hangers, and radiography aprons. The digital sensor holders segment dominated with a revenue share of 48.3% in 2024, owing to the increasing adoption of digital radiography systems that require precise and stable sensor placement to capture high-quality images. These holders enhance operational efficiency by minimizing image retakes, reducing patient exposure to radiation, and supporting accurate positioning across dental, orthopedic, and general radiography procedures. Their widespread use in hospitals, diagnostic centers, and clinics reflects their critical role in maintaining workflow efficiency, improving diagnostic accuracy, and supporting advanced imaging techniques such as 3D reconstructions and multi-angle imaging. Furthermore, innovations in sensor holder design, including adjustable and ergonomically optimized holders, have further strengthened their adoption.

Film processing hangers are expected to witness the fastest CAGR of 10.6% from 2025 to 2032, driven by the gradual persistence of hybrid imaging environments that continue to rely on analog films alongside digital systems. Smaller clinics and diagnostic centers in emerging regions are increasingly utilizing these hangers to streamline workflow, reduce manual handling errors, and ensure proper drying and processing of X-ray films. The growth is further supported by the need for cost-effective solutions that integrate with both legacy analog systems and modern digital setups, allowing facilities to maintain high-quality imaging standards without significant capital investment. Additionally, rising awareness of workflow optimization and staff efficiency is encouraging the adoption of these accessories across outpatient facilities, dental offices, and orthopedic centers.

- By Technology

On the basis of technology, the market is segmented into computed radiography (CR), digital radiography (DR), and analog systems. The digital radiography (DR) segment dominated the market with a 57.2% share in 2024, driven by its ability to deliver superior image quality, rapid processing, and seamless integration with hospital information and PACS systems. DR technology enables instant image acquisition, reduced radiation exposure, and real-time diagnostics, making it the preferred choice for hospitals, diagnostic centers, and specialized clinics. The dominance of DR is reinforced by its suitability for a wide range of applications, including orthopedic assessments, dental imaging, and oncology diagnostics, as well as its compatibility with advanced software for image enhancement, storage, and telemedicine solutions. Furthermore, healthcare providers increasingly prioritize DR systems due to their ability to improve patient throughput and operational efficiency, supporting faster diagnosis and treatment planning.

Computed radiography (CR) is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, owing to its cost-effectiveness, adaptability, and compatibility with existing film-based setups. CR systems are particularly favored in mid-sized clinics, outpatient centers, and emerging markets where the transition to fully digital radiography is gradual. The technology provides high-resolution imaging comparable to DR systems while enabling easier integration with legacy workflows, making it relevant for orthopedic, dental, and general radiography applications. Ongoing advancements in CR imaging plates, automated readers, and image processing software are further driving adoption, allowing facilities to achieve improved diagnostic accuracy and operational efficiency while managing costs effectively.

- By Application

On the basis of application, the market is segmented into pneumonia, dental, orthopedic damage, cancers/tumor, and cardiovascular disease (CVD). The orthopedic damage segment dominated with a market share of 42.5% in 2024, driven by the high prevalence of musculoskeletal injuries, rising incidence of fractures, and growing number of orthopedic surgeries worldwide. X-ray devices play a pivotal role in rapid diagnosis and treatment planning in emergency care and trauma centers, allowing precise assessment of fractures, joint injuries, and post-operative follow-ups. The segment’s strong revenue contribution is further supported by increasing adoption of advanced imaging modalities for orthopedic interventions, growing awareness of early diagnosis among clinicians, and the integration of X-ray imaging into multidisciplinary treatment workflows. Hospitals, clinics, and specialized orthopedic centers rely heavily on these devices for efficient patient management, driving consistent demand across the market.

The pneumonia segment is expected to witness the fastest CAGR of 12.7% from 2025 to 2032, propelled by the rising prevalence of respiratory diseases, increasing emphasis on early detection, and the expansion of portable and handheld X-ray imaging in ICUs, home care, and field settings. The COVID-19 pandemic significantly accelerated demand for X-ray imaging for respiratory care, highlighting the need for rapid, reliable diagnostic solutions. Growing investments in mobile X-ray devices, digital radiography systems, and telemedicine integration are further enhancing accessibility for pneumonia diagnosis and management. This trend is reinforced by rising awareness among healthcare providers and patients regarding timely detection and monitoring of pulmonary conditions, particularly in high-risk populations, contributing to the segment’s rapid growth trajectory.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, ambulatory surgical centers, diagnostic centers, clinics, and ICUs. Hospitals dominated with a revenue share of 60.1% in 2024, owing to their large patient volumes, comprehensive imaging infrastructure, and the adoption of both stationary and portable X-ray devices across multiple departments. Hospitals benefit from integrated workflows, PACS connectivity, and end-to-end service support from manufacturers, enabling seamless diagnostic operations and efficient patient care. The availability of specialized radiology teams and advanced imaging equipment further strengthens the segment’s leadership in market revenue.

Diagnostic centers are expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by the growing establishment of standalone imaging facilities, increasing demand for specialized and cost-effective radiology services, and rising patient preference for outpatient diagnostics. These centers are increasingly adopting digital radiography, mobile X-ray devices, and advanced accessory systems to enhance operational efficiency and image quality. The expansion of outpatient care services, rapid patient turnaround needs, and the adoption of AI-enabled image processing technologies are further supporting rapid growth in this segment, making diagnostic centers a key driver of the overall market expansion.

X-Ray Devices and Accessories Market Regional Analysis

- The North America X-ray devices and accessories market dominated with the largest revenue share of 35.4% in 2024. This leadership is attributed to the region’s advanced healthcare infrastructure, the widespread adoption of modern imaging systems, and a strong presence of key industry players, particularly in the U.S.

- The region benefits from high healthcare spending, the integration of digital radiography and computed radiography technologies in hospitals and diagnostic centers, and increasing investments in portable and mobile X-Ray devices

- North American healthcare providers are increasingly upgrading existing facilities to improve imaging capabilities and patient throughput, further supporting market growth

U.S. X-Ray Devices and Accessories Market Insight

The U.S. X-ray devices and accessories market captured the majority of North America’s revenue, driven by high patient volumes, robust hospital infrastructure, and substantial investment in advanced imaging technologies. Adoption of digital radiography systems, mobile X-Ray devices, and handheld imaging solutions has accelerated due to the demand for faster diagnostics, especially in hospitals, ambulatory surgical centers, and ICUs. Government healthcare programs and private sector expansions are also boosting demand, alongside the need for accurate diagnostics in orthopedic, dental, and oncology applications.

Europe X-Ray Devices and Accessories Market Insight

The Europe X-ray devices and accessories market is projected to expand steadily during the forecast period, supported by increasing prevalence of chronic diseases, growing diagnostic needs, and technological advancements in imaging equipment. Countries like Germany, the U.K., and France are at the forefront, with hospitals and diagnostic centers driving the adoption of both digital and computed radiography systems. Continuous investment in upgrading hospital imaging infrastructure and initiatives to improve diagnostic accuracy are key factors propelling growth.

Germany X-Ray Devices and Accessories Market Insight

The Germany X-ray devices and accessories market growth is driven by well-established healthcare infrastructure, strong regulatory frameworks, and emphasis on technological innovation. Hospitals, specialty clinics, and trauma centers are investing in advanced X-Ray systems to enhance diagnostic efficiency. Rising demand for digital radiography, particularly in orthopedic, dental, and respiratory imaging, is further supporting revenue growth.

U.K. X-Ray Devices and Accessories Market Insight

The U.K. X-ray devices and accessories market is witnessing notable growth due to rising healthcare investments, expansion of diagnostic services, and increasing adoption of advanced X-Ray technologies in hospitals and diagnostic centers. The emphasis on rapid, accurate imaging and integration of modern digital systems across NHS hospitals and private healthcare facilities is supporting market expansion.

Asia-Pacific X-Ray Devices and Accessories Market Insight

The Asia-Pacific region X-ray devices and accessories market is expected to be the fastest-growing market during the forecast period, driven by rising healthcare access, growing disposable incomes, and government initiatives to improve medical infrastructure. Countries such as China, Japan, and India are leading the adoption of advanced imaging systems, including digital radiography, portable, and handheld X-Ray devices. Increasing prevalence of chronic diseases and growing awareness of early diagnosis are also accelerating demand.

China X-Ray Devices and Accessories Market Insight

China X-ray devices and accessories market accounted for a significant share of the Asia-Pacific market in 2024, driven by rapid urbanization, expanding healthcare infrastructure, and increasing adoption of modern X-Ray devices in hospitals, clinics, and diagnostic centers. Government initiatives to modernize hospitals, combined with a growing middle-class population seeking better healthcare services, are supporting market growth. The demand for both mobile and digital imaging systems is increasing, particularly for orthopedic, dental, and respiratory applications.

Japan X-Ray Devices and Accessories Market Insight

Japan’s X-ray devices and accessories market growth is propelled by a technologically advanced healthcare system, high adoption of digital radiography, and a growing aging population. Hospitals and specialty clinics are investing in both stationary and mobile X-Ray devices to provide efficient diagnostic services. The emphasis on accurate imaging for orthopedic, dental, and cancer care procedures, along with integration of digital technologies for streamlined workflows, further strengthens market demand.

India X-Ray Devices and Accessories Market Insight

India’s X-ray devices and accessories market is expanding rapidly due to increasing healthcare infrastructure, rising demand for advanced diagnostic imaging in hospitals and diagnostic centers, and government initiatives to improve rural and urban healthcare facilities. Adoption of digital radiography, portable X-Ray systems, and affordable imaging solutions is accelerating to meet the needs of a growing patient base. The trend of expanding outpatient diagnostic services is also contributing to the market’s fast growth.

X-Ray Devices and Accessories Market Share

The X-Ray Devices and Accessories industry is primarily led by well-established companies, including:

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Canon Medical Systems Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Fujifilm Holdings Corporation (Japan)

- Agfa-Gevaert Group (Belgium)

- Hitachi Medical Corporation (Japan)

- Carestream Health (U.S.)

- Hologic, Inc. (U.S.)

- Konica Minolta, Inc. (Japan)

- Dentsply Sirona (U.S.)

- Vatech Co., Ltd. (South Korea)

- Shimadzu Corporation (Japan)

- Planmeca Oy (Finland)

- Mindray Medical International Limited (China)

Latest Developments in Global X-Ray Devices and Accessories Market

- In November 2022, Canon Medical Systems Corporation announced the release of two new Canon-branded X-ray products into the U.S. market: the Mobirex i9 mobile system and the CXDI-Elite series of wireless digital radiography detectors. These innovations aim to enhance advanced X-ray control and image generation, contributing to improved diagnostic capabilities in various healthcare settings

- In May 2025, United Imaging received clearance from the U.S. Food and Drug Administration (FDA) for its interventional X-ray system, the uAngio AVIVA. This system features intelligent robotics, voice control, and imaging capabilities, serving as a critically important assistant to clinical staff in the interventional suite

- In July 2025, GE HealthCare launched the Definium Pace Select ET, a new floor-mounted digital X-ray system designed to enable access to affordable, high-quality medical imaging technology. This system aims to increase efficiency in high-throughput settings, contributing to improved patient care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.