Global Wireless Gas Detection Market

Market Size in USD Billion

CAGR :

%

USD

1.64 Billion

USD

3.06 Billion

2024

2032

USD

1.64 Billion

USD

3.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.64 Billion | |

| USD 3.06 Billion | |

|

|

|

|

Wireless Gas Detection Market Size

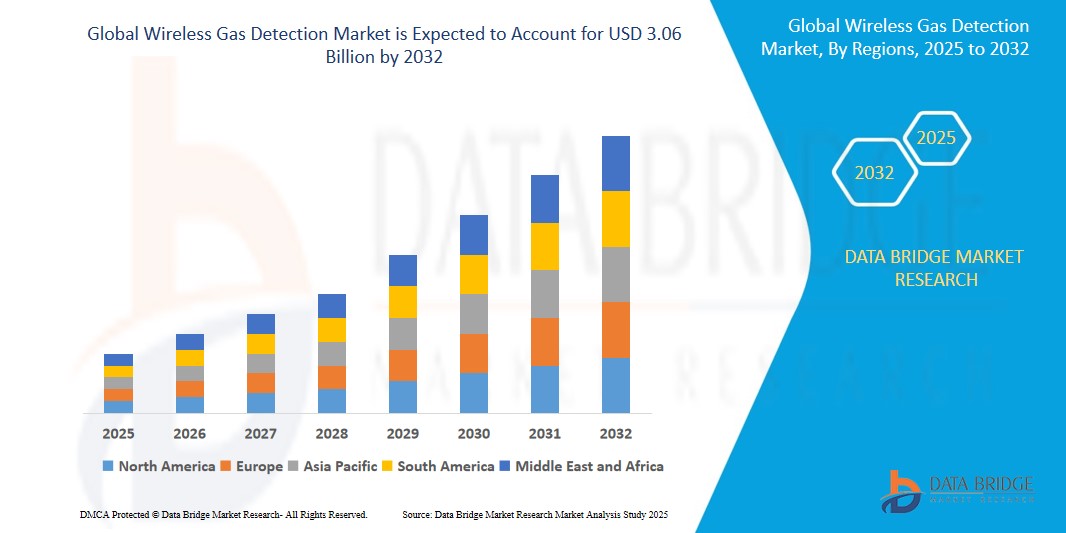

- The global Wireless Gas Detection market size was valued at USD 1.64 billion in 2024 and is expected to reach USD 3.06 billion by 2032, at a CAGR of 8.1% during the forecast period

- This growth is driven by factors such as the Rising Safety Regulations and Standards, Technological Advancements, and Increased Industrialization and Urbanization

Wireless Gas Detection Market Analysis

- Wireless gas detection is used to detect toxic gases in the air. A wireless gas detector monitors the level of toxic gases. In case the level of toxic gases go past a certain limit, the device send signal intimating gas leakage.

- This safety system is adopted to prevent leakage of hazardous gases that can have a serious impact over the workers. These systems are highly accurate, flexible and reliability.

- North America holds a significant market share in wireless gas detection market. This is because of the presence of major key players spread across countries in this region. Increased adoption of internet of things is fostering the market growth.

- Asia-Pacific on the other hand will undergo the highest growth rate during the forecast period owing to rapid urbanisation and industrialization.

- Wi-Fi segment is expected to dominate the market with a market share of 57.32% due to its idespread adoption, ease of integration, and cost-effectiveness in enabling seamless wireless gas detection systems.

Report Scope and Wireless Gas Detection Market Segmentation

|

Attributes |

Wireless Gas Detection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wireless Gas Detection Market Trends

“Increasing Integration with IoT for Real-Time Monitoring and Data Analytics”

- The integration of wireless gas detection systems with Internet of Things (IoT) technology is rapidly transforming the market. IoT-enabled systems allow for real-time monitoring and remote management, which enhances the safety of workers in hazardous environments like oil refineries, mines, and chemical plants.

- These systems provide a wealth of data that can be analyzed for predictive maintenance, safety alerts, and operational efficiency improvements. The adoption of IoT makes it possible to access critical information instantly, even from remote or hard-to-reach locations. This connectivity is essential for industries that need to meet strict safety and environmental regulations.

- IoT-enabled wireless gas detection also offers the ability to connect with other safety systems, creating a more comprehensive safety management solution. As IoT adoption grows, the demand for these integrated wireless systems continues to rise, making real-time data an increasingly important component of gas detection.

- For instance, In July 2024, Honeywell Analytics launched an IoT-enabled wireless gas detection system designed to provide real-time monitoring and remote data analysis. The system, which can be integrated into existing safety infrastructures, offers instant alerts when dangerous gas concentrations are detected. This innovation is a response to the growing need for interconnected safety solutions in industries like oil and gas, where hazardous conditions demand constant vigilance.

Wireless Gas Detection Market Dynamics

Driver

“Increasing Emphasis on Worker Safety and Industrial Regulations”

- The push for better workplace safety, especially in industries like oil & gas, mining, chemicals, and manufacturing, is a major force behind the growth of wireless gas detection systems. These sectors often expose workers to hazardous gases like methane, hydrogen sulfide, or ammonia, which can be lethal even in small amounts.

- Governments and international bodies are now enforcing stricter rules on monitoring air quality and ensuring a safer working environment. Companies, in response, are adopting smarter, more reliable safety tech—like wireless gas detectors—that can instantly alert teams in real time. Wireless solutions are favored because they eliminate the need for complicated wiring and can be installed quickly even in remote or hazardous locations. They're also scalable and easier to maintain compared to traditional fixed systems. With workers’ lives on the line and legal penalties for safety violations getting steeper, industries are prioritizing investment in detection solutions.

For instance,

- In March 2023, Emerson Electric joined forces with Chevron to introduce wireless gas detection systems on their offshore oil platforms. The goal was to boost worker safety in high-risk environments while cutting down on the upkeep tied to older wired setups. These modern wireless detectors offer live monitoring and instant alerts, helping teams respond faster to any gas leaks. By switching to this system, Chevron improved both safety and operational efficiency on its rigs.

Opportunity

“Increasing Demand for Safety and Compliance Regulations”

- As industries such as oil and gas, chemicals, and manufacturing face stricter safety regulations, the demand for wireless gas detection systems is growing rapidly. These systems allow real-time monitoring and early detection of hazardous gas leaks, ensuring a safer working environment and helping companies comply with regulatory standards.

- The ability to remotely monitor gas levels enhances operational efficiency and minimizes the risk of accidents, contributing to the increasing adoption of wireless gas detection systems across various industries.

- With environmental safety becoming a priority for governments globally, there’s a significant opportunity to develop innovative solutions that cater to both regulatory compliance and workplace safety. This demand is expected to create substantial growth opportunities for wireless gas detection technologies.

For instance,

- In July 2024, Honeywell Analytics launched the BW™ Ultra wireless gas detector, designed to enhance safety and regulatory compliance in hazardous industries. The system provides real-time monitoring and automatic alerts, enabling businesses to meet stringent environmental and safety regulations. It helps in detecting hazardous gases such as methane and carbon monoxide, ensuring a safer workplace and reducing the risk of accidents.

Restraint/Challenge

“High Initial Costs and Maintenance Requirements”

- One of the key restraints in the wireless gas detection market is the high initial costs associated with the purchase and installation of these systems. Advanced wireless gas detectors often require significant capital investment due to their sophisticated technology, sensors, and infrastructure.

- Many small and medium-sized enterprises (SMEs) may find these upfront costs prohibitive, leading to slower adoption rates in certain sectors. In addition to the initial investment, these systems also require regular maintenance to ensure accuracy and longevity. Calibration, sensor replacements, and software updates contribute to ongoing costs.

- For businesses operating on tight budgets or in price-sensitive markets, the total cost of ownership may deter investment in wireless gas detection systems. These financial barriers can slow down the widespread adoption of this technology, particularly in industries where budget constraints are more prominent.

For instance,

- In November 2024, according to an article published by the Ningbo Haishu HONYU Opto-Electro Co., Ltd, one of the main concerns surrounding the high cost of ophthalmic surgical microscopes is its potential impact on healthcare affordability and accessibility. The high cost of ophthalmic surgical microscopes adds to this burden, as it limits the ability of healthcare facilities to invest in the latest technology and equipment, thereby affecting the quality of care provided to patients

- Consequently, such limitations can result in disparities in the quality of care and access to advanced surgical procedures, ultimately hindering the overall growth of the market

Wireless Gas Detection Market Scope

The market is segmented on the basis type, component and service, application and end user.

|

Segmentation |

Sub-Segmentation |

|

Type |

|

|

Component and service |

|

|

Application |

|

|

End user |

|

In 2025, the Wi-Fi is projected to dominate the market with a largest share in segment

In 2025, the Wi-Fi segment is projected to dominate the wireless gas detection market, capturing the largest share of 57.32%. This growth is driven by Wi-Fi's widespread adoption in industries due to its reliable connectivity and ease of integration with existing network infrastructures. Wi-Fi-enabled systems provide real-time monitoring and seamless data transfer, enhancing operational efficiency. With improved network coverage and lower costs, Wi-Fi is becoming the preferred choice for many businesses. Its scalability and convenience make it a dominant force in the wireless gas detection market.

The Bluetooth is expected to account for the largest share during the forecast period in market

The Bluetooth segment is expected to account for the largest share of 53.69% in the wireless gas detection market during the forecast period. Bluetooth technology offers a cost-effective and energy-efficient solution for short-range communication. Its low power consumption and easy integration into existing systems make it a popular choice for gas detection applications. Bluetooth-enabled devices allow for seamless data exchange and real-time monitoring, contributing to enhanced safety and operational efficiency.

Wireless Gas Detection Market Regional Analysis

“North America Holds the Largest Share in the Wireless Gas Detection Market”

-

North America holds the largest share in the wireless gas detection market, driven by strict safety regulations and growing industrial adoption. The region's well-established oil and gas, chemical, and manufacturing sectors are increasingly relying on wireless technologies for real-time monitoring and compliance.

- Additionally, North America has a strong focus on environmental safety and regulatory standards, which is pushing the demand for advanced gas detection solutions. Technological innovations and a well-developed infrastructure also support the rapid growth of this market in the region. The presence of key market players, along with significant investments in smart technologies, further fuels market growth.

- As industrial automation and IoT integration gain traction, North America is expected to continue leading the market. The region’s commitment to improving workplace safety and compliance is contributing to the widespread adoption of wireless gas detection systems.

“Asia-Pacific is Projected to Register the Highest CAGR in the Wireless Gas Detection Market”

-

Asia-Pacific is projected to register the highest CAGR in the wireless gas detection market, driven by rapid industrialization and urbanization across the region. Countries like China, India, and Japan are experiencing significant growth in the oil and gas, manufacturing, and chemical industries, increasing the demand for advanced safety solutions.

- Stringent government regulations aimed at improving environmental safety and worker protection are also boosting market adoption. Additionally, the rise of smart cities and IoT integration is enhancing the need for real-time monitoring and efficient gas leak detection.

- The region's growing awareness of environmental hazards and the need for compliance with global safety standards further drive market growth. Technological advancements and increasing investments in wireless communication infrastructure are creating favorable conditions for the market’s expansion. The strong presence of local and international players contributes to the competitive landscape and innovation in the region.

Wireless Gas Detection Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Emerson Electric Co.,

- Honeywell International Inc.,

- Agilent Technologies, Inc.,

- Drägerwerk AG & Co. KGaA,

- Yokogawa India Ltd.,

- MSA.,

- Teledyne Technologies Incorporated.,

- Siemens,

- United Electric Controls.,

- Sensidyne,

- LP,

- Pem-Tech, Inc.,

- Crowcon Detection Instruments.,

- Tek Troniks Limited,

- Ambetronics Engineers Pvt.Ltd.,

- Global Detection Systems Corp.,

- Bacharach, Inc.,

- Gastronics,

- TycoFIS,

- Beijing Sdl

- 3M

Latest Developments in Global Wireless Gas Detection Market

- In March 2025, Emerson Electric Co. introduced the Rosemount 928 Wireless Gas Detector, designed for hazardous environments in industries like oil and gas. This device offers real-time monitoring capabilities and integrates seamlessly with existing wireless networks, enhancing safety and operational efficiency. The launch aims to address the growing demand for reliable and cost-effective gas detection solutions in challenging industrial settings.

- In February 2025, Honeywell launched the Sensepoint XCL, a next-generation wireless gas detector featuring advanced connectivity options and improved sensor technology. The device is designed for use in various industrial applications, providing real-time gas concentration data and enabling proactive safety measures. Honeywell's innovation focuses on enhancing user experience and compliance with stringent safety regulations.

- In August 2024, Drägerwerk AG & Co. KGaA introduced the X-am 8000, a multi-gas detector capable of measuring up to six gases simultaneously. While the primary focus is on wired applications, the device's design allows for potential integration with wireless networks, offering flexibility for future upgrades. This product aims to enhance safety in industries such as mining and firefighting by providing comprehensive gas detection capabilities.

- In April 2025, MSA launched the ALTAIR 5X, a wireless multi-gas detector equipped with advanced sensors and Bluetooth connectivity. The device allows for real-time monitoring and data logging, facilitating improved safety management in hazardous environments. MSA's product aims to provide users with reliable and efficient gas detection solutions, enhancing workplace safety.

- In February 2025, Siemens introduced the Sitrans SL wireless gas detector, designed for continuous monitoring of hazardous gases in industrial applications. The device offers seamless integration with Siemens' existing automation systems, providing real-time data and alerts to enhance safety and operational performance. Siemens' product aims to meet the growing demand for reliable and efficient gas detection solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wireless Gas Detection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wireless Gas Detection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wireless Gas Detection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.