Global Veterinary Reference Laboratory Market

Market Size in USD Billion

CAGR :

%

USD

4.96 Billion

USD

11.10 Billion

2024

2032

USD

4.96 Billion

USD

11.10 Billion

2024

2032

| 2025 –2032 | |

| USD 4.96 Billion | |

| USD 11.10 Billion | |

|

|

|

|

Veterinary Reference Laboratory Market Size

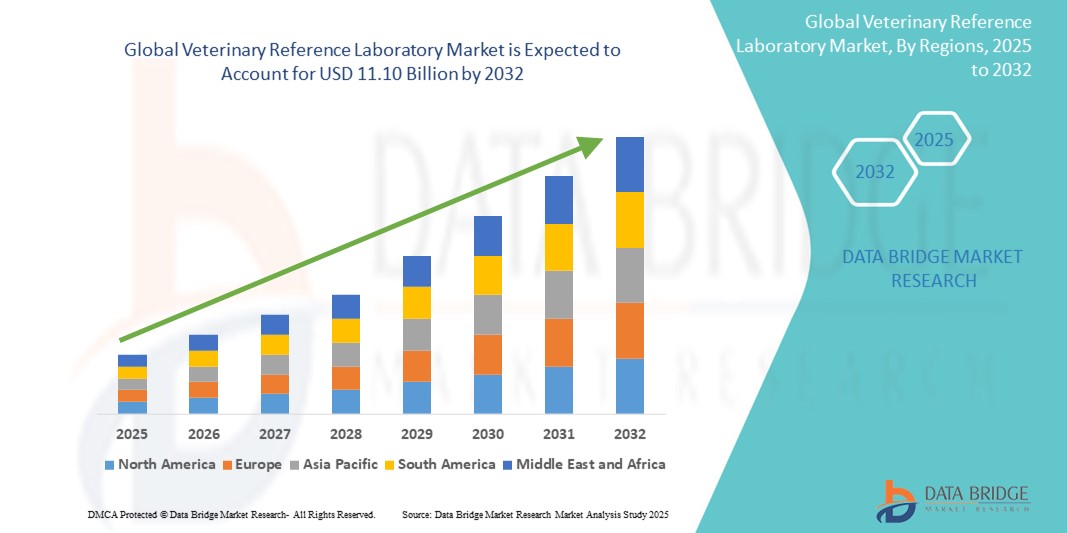

- The global veterinary reference laboratory market size was valued at USD 4.96 billion in 2024 and is expected to reach USD 11.10 billion by 2032, at a CAGR of 10.59% during the forecast period

- This growth is driven by factors such as the rising prevalence of zoonotic and animal diseases, increased pet ownership, and growing demand for advanced diagnostic testing in animal healthcare

Veterinary Reference Laboratory Market Analysis

- Veterinary reference laboratories provide advanced diagnostic testing services for animals, supporting disease detection, treatment, and prevention in both companion and livestock animals

- Growth in this market is primarily driven by the rising prevalence of zoonotic diseases, increased pet adoption, and demand for early and accurate diagnostics in veterinary care

- North America is expected to dominate the veterinary reference laboratory market with a market share of 44.9%, due to well-developed veterinary healthcare system, high pet ownership rates, and robust demand for advanced diagnostic services

- Asia-Pacific is expected to be the fastest growing region in the veterinary reference laboratory market with a market share of 23.5%, during the forecast period due to increasing pet adoption, growing livestock farming, and rising awareness of animal disease diagnostics

- Companion animals segment is expected to dominate the market with a market share of 64.8% due to the rising pet adoption rates, growing awareness of pet health, and increased spending on veterinary diagnostics

Report Scope and Veterinary Reference Laboratory Market Segmentation

|

Attributes |

Veterinary Reference Laboratory Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Reference Laboratory Market Trends

“Integration of Molecular Diagnostics and AI in Veterinary Testing”

- A key trend in the veterinary reference laboratory market is the growing adoption of molecular diagnostics and artificial intelligence (AI) for enhanced disease detection and monitoring

- These technologies enable faster, more accurate diagnostics by identifying pathogens at the genetic level and supporting data-driven clinical decisions

- For instance, PCR-based assays and next-generation sequencing (NGS) are increasingly being used for early detection of infectious diseases in companion and farm animals, while AI tools assist in interpreting complex diagnostic data for improved treatment outcomes

- This integration of advanced technologies is revolutionizing veterinary diagnostics, enhancing operational efficiency, and fueling the demand for high-throughput, tech-enabled veterinary reference laboratories

Veterinary Reference Laboratory Market Dynamics

Driver

“Rising Prevalence of Zoonotic and Companion Animal Diseases”

- The increasing incidence of zoonotic diseases and a growing number of companion animal illnesses are major drivers fueling the demand for veterinary reference laboratory services

- These diseases not only impact animal health but also pose significant public health risks, necessitating accurate and timely diagnostics for effective containment and treatment

- With a surge in pet ownership and livestock farming, the need for routine testing, disease surveillance, and advanced diagnostics continues to grow, further propelling the market

For instance,

- According to a 2022 report by the World Health Organization (WHO), more than 60% of emerging infectious diseases in humans originate from animals, underscoring the importance of early detection through veterinary diagnostics

- Consequently, the growing burden of zoonotic and animal-specific diseases is driving investments in veterinary reference laboratories to ensure rapid, reliable, and comprehensive diagnostic solutions

Opportunity

“Enhancing Veterinary Diagnostics with AI and Big Data Integration”

- The integration of artificial intelligence (AI) and big data analytics in veterinary reference laboratories presents a significant opportunity to revolutionize animal disease diagnostics and management

- AI-driven platforms can rapidly analyze complex diagnostic data, identify patterns, and provide predictive insights for early detection of diseases, enabling veterinarians to make timely and informed treatment decisions

- Furthermore, big data tools can aggregate data across populations, aiding in epidemiological surveillance, trend forecasting, and personalized animal healthcare strategies

For instance,

- In November 2024, the American Veterinary Medical Association highlighted the growing use of AI in veterinary labs, noting that machine learning models are increasingly being used to detect anomalies in blood tests and radiographs, enhancing diagnostic speed and accuracy

- The adoption of AI and big data analytics in veterinary diagnostics holds the potential to improve animal health outcomes, streamline laboratory operations, and support large-scale disease monitoring efforts, especially in livestock and public health management contexts

Restraint/Challenge

“High Operational and Equipment Costs Limiting Accessibility”

- The high costs associated with establishing and operating veterinary reference laboratories, including advanced diagnostic equipment and skilled personnel, pose a significant challenge to market expansion

- Sophisticated diagnostic tools such as PCR machines, sequencing platforms, and automated analyzers require substantial capital investment, which can be difficult for smaller veterinary practices and labs to afford

- In addition to equipment, the cost of maintaining laboratory quality standards, data management systems, and staff training further increases the financial burden

For instance,

- In October 2023, a report by the National Institute of Animal Biotechnology highlighted that advanced molecular testing equipment and skilled workforce requirements are key cost barriers for veterinary labs in emerging economies, slowing their growth and accessibility

- Consequently, these financial constraints limit the establishment of new reference labs, especially in low-resource settings, leading to uneven access to high-quality diagnostic services and potentially delayed disease detection and treatment in animals

Veterinary Reference Laboratory Market Scope

The market is segmented on the basis of service type, application, and animal type

|

Segmentation |

Sub-Segmentation |

|

By Service Type |

|

|

By Application |

|

|

By Animal Type |

|

In 2025, the companion animals is projected to dominate the market with a largest share in animal type segment

The companion animals segment is expected to dominate the veterinary reference laboratory market with the largest share of 64.8% in 2025 due to the rising pet adoption rates, growing awareness of pet health, and increased spending on veterinary diagnostics. Pet owners are increasingly seeking advanced diagnostic services to ensure early disease detection and better health management. In addition, the humanization of pets is driving demand for high-quality, specialized veterinary care

The clinical chemistry is expected to account for the largest share during the forecast period in service type market

In 2025, the clinical chemistry segment is expected to dominate the market with the largest market share of 37.2% due to its broad application in routine health assessments and disease diagnosis across various animal species. This segment enables the analysis of biochemical markers crucial for evaluating organ function, metabolic disorders, and overall animal health. Its widespread use in both preventive care and treatment monitoring drives consistent demand in veterinary diagnostics.

Veterinary Reference Laboratory Market Regional Analysis

“North America Holds the Largest Share in the Veterinary Reference Laboratory Market”

- North America dominates the veterinary reference laboratory market with a market share of estimated 44.9%, driven by well-developed veterinary healthcare system, high pet ownership rates, and robust demand for advanced diagnostic services

- U.S. holds a market share of 86.1%, due to rising expenditure on pet health, increased awareness of zoonotic diseases, and the strong presence of leading veterinary diagnostic companies

- The region benefits from established regulatory frameworks, widespread access to high-throughput diagnostic tools, and ongoing innovations in molecular and genomic testing

- The trend toward personalized veterinary care and preventive diagnostics continues to drive market expansion in North America, particularly in companion animal health management

“Asia-Pacific is Projected to Register the Highest CAGR in the Veterinary Reference Laboratory Market”

- Asia-Pacific is expected to witness the highest growth rate in the veterinary reference laboratory market with a market share of 23.5%, driven by increasing pet adoption, growing livestock farming, and rising awareness of animal disease diagnostics

- Countries such as China, India, and South Korea are emerging as prominent markets due to increasing investments in veterinary infrastructure and government initiatives to curb zoonotic disease outbreaks

- Japan, with its technologically advanced diagnostic labs and a growing base of companion animals, plays a vital role in driving innovation and adoption of veterinary testing solutions

- India is projected to register the highest CAGR in the veterinary reference laboratory market, driven by an expanding veterinary service network, increased pet health awareness, and rising demand for accurate and early disease detection in both companion and farm animals

Veterinary Reference Laboratory Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IDEXX (U.S.)

- Mars, Incorporated (U.S.)

- GD (Netherlands)

- Zoetis Services LLC (U.S.)

- Antech Diagnostics, Inc. (U.S.)

- Cerba HealthCare (France)

- Virbac (France)

- Randox Laboratories Ltd. (U.K.)

- Eurofins Scientific (Luxembourg)

- Thermo Fisher Scientific Inc. (U.S.)

- Neogen Corporation (U.S.)

- PathoSense Laboratory (Belgium)

- VCA Animal Hospitals (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Labcorp (U.S.)

- BASF (Germany)

- Elanco (U.S.)

- MAX PET SUPPLIES PTY LTD. (Australia)

- VetLab (Australia)

Latest Developments in Global Veterinary Reference Laboratory Market

- In June 2024, IDEXX Laboratories introduced the Catalyst Pancreatic Lipase Test, designed to provide quantitative results in under 10 minutes, aiding veterinarians in the rapid diagnosis and treatment of pancreatitis in dogs and cats

- In May 2024, Mars, Incorporated entered exclusive discussions to acquire Cerba HealthCare’s stake in Cerba Vet and ANTAGENE, aiming to enhance its European veterinary diagnostics business through Mars Petcare’s Science & Diagnostics division

- In January 2024, GD Animal Health, based in the Netherlands, acquired PathoSense diagnostics to advance its diagnostic capabilities, focusing on identifying all viruses and bacteria using nanopore sequencing technology

- In February 2024, IDEXX Laboratories launched Vello, a pet owner engagement software solution designed to streamline connections between veterinary practices and clients. Vello integrates with IDEXX practice management software, offering features such as automated reminders, health service alerts, and a user-friendly mobile web platform for easy access to pet records and appointment scheduling

- In November 2022, VolitionRx Limited launched its Nu.Q Vet Cancer Screening Test across the U.S. and Europe through Heska Corporations' veterinary diagnostic laboratories

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.