Global Veterinary Pain Management Market

Market Size in USD Billion

CAGR :

%

USD

1.55 Billion

USD

2.39 Billion

2024

2032

USD

1.55 Billion

USD

2.39 Billion

2024

2032

| 2025 –2032 | |

| USD 1.55 Billion | |

| USD 2.39 Billion | |

|

|

|

|

Veterinary Pain Management Market Size

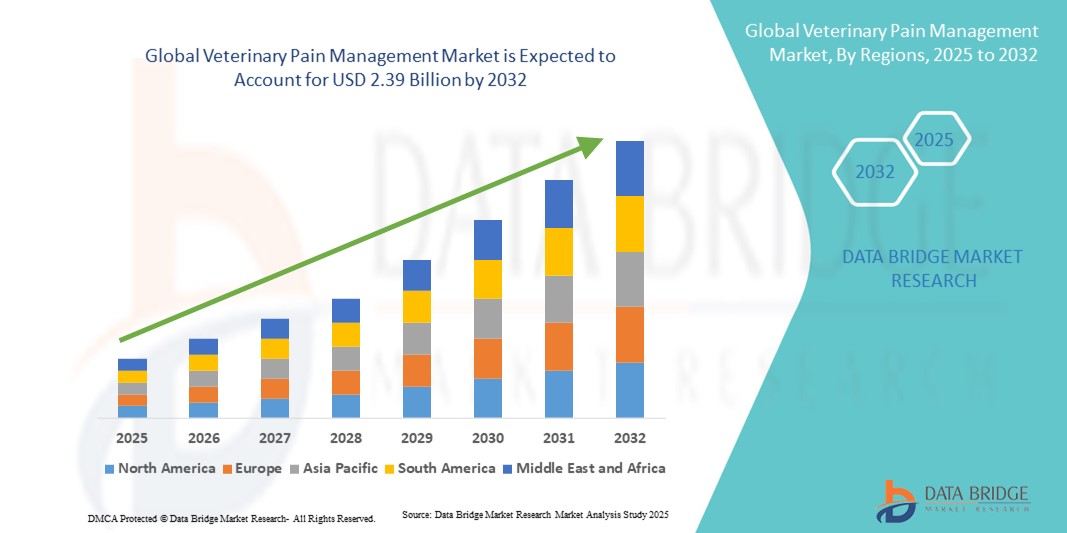

- The global veterinary pain management market size was valued at USD 1.55 billion in 2024 and is expected to reach USD 2.39 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by increasing awareness of animal welfare, rising prevalence of chronic and acute pain conditions in pets and livestock, and advancements in veterinary pharmaceuticals and analgesic therapies

- Furthermore, growing adoption of minimally invasive procedures, improved veterinary healthcare infrastructure, and the demand for effective pain relief solutions are establishing veterinary pain management as a critical component of modern animal care. These converging factors are accelerating the uptake of innovative pain management products, thereby significantly boosting the industry's growth

Veterinary Pain Management Market Analysis

- Veterinary pain management, including pharmaceuticals, biologics, and devices, is increasingly vital in modern veterinary care for both companion animals and livestock due to its role in improving recovery outcomes, animal welfare, and overall quality of life

- The escalating demand for veterinary pain management solutions is primarily fueled by growing awareness of animal welfare, rising prevalence of pain-related conditions, and increasing adoption of advanced analgesic therapies in veterinary practices

- North America dominated the veterinary pain management market with the largest revenue share of 40% in 2024, characterized by advanced veterinary healthcare infrastructure, high pet ownership rates, and a strong presence of key industry players, with the U.S. experiencing substantial growth in veterinary pain management adoption, particularly in companion animal clinics and specialty veterinary hospitals, driven by innovations in multimodal analgesia and targeted pain relief medications

- Asia-Pacific is expected to be the fastest-growing region in the veterinary pain management market during the forecast period due to increasing companion animal ownership, rising awareness of animal welfare, and growing expenditure on veterinary healthcare services

- Analgesics segment dominated the veterinary pain management market with a market share of 50.5% in 2024, driven by their established efficacy and widespread use for both acute and chronic pain management in animals

Report Scope and Veterinary Pain Management Market Segmentation

|

Attributes |

Veterinary Pain Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Pain Management Market Trends

Advancements in Targeted and Multimodal Analgesics

- A significant and accelerating trend in the global veterinary pain management market is the development of targeted and multimodal analgesics, combining different mechanisms to provide effective pain relief for acute, chronic, and post-operative conditions in animals

- For instance, liposomal formulations of NSAIDs and combination therapies are enabling prolonged pain control with reduced side effects in companion animals, improving treatment compliance and outcomes

- Integration of digital monitoring and smart dosing platforms in veterinary practices allows veterinarians to track response to pain management treatments, optimize dosing schedules, and provide personalized care

- These innovations facilitate more precise, effective, and safe administration of analgesics across various animal types, including companion animals and production livestock, enhancing overall animal welfare

- This trend toward more intelligent, targeted, and multimodal pain management solutions is reshaping expectations among veterinary practitioners and pet owners. Consequently, companies such as Zoetis and Elanco are developing formulations and digital tools for better pain management outcomes

- The demand for advanced and personalized veterinary analgesics is growing rapidly across both companion and production animals, as stakeholders increasingly prioritize efficacy, safety, and overall animal well-being

Veterinary Pain Management Market Dynamics

Driver

Rising Awareness of Animal Welfare and Healthcare Spending

- The increasing awareness of animal welfare and the willingness to invest in veterinary healthcare are significant drivers for the heightened demand for advanced pain management solutions

- For instance, in March 2024, Elanco launched a multimodal pain relief program targeting companion animals, highlighting integrated care approaches to reduce post-operative discomfort

- As pet owners and livestock managers become more aware of pain-related health issues, veterinary pain management products offer effective solutions to improve recovery, mobility, and quality of life

- Furthermore, the growing prevalence of chronic and acute pain conditions in animals and the expanding companion animal population are making veterinary analgesics a critical component of veterinary care

- Availability of user-friendly formulations, digital dosing tools, and professional guidance are key factors propelling adoption in both veterinary hospitals and animal farms, alongside the rising trend of preventive healthcare initiatives

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced veterinary pain management products compared to traditional therapies poses a significant challenge to market adoption, particularly in price-sensitive regions or small-scale farms

- For instance, novel liposomal NSAID formulations or combination therapies often carry premium prices, limiting accessibility for some veterinarians and pet owners

- Strict regulatory requirements for approval of veterinary analgesics, including safety and efficacy testing, create hurdles for market entry and can slow down product launches

- Addressing these challenges through cost-effective formulations, regulatory guidance support, and educational campaigns for veterinarians and pet owners is crucial for market expansion

- While generic and alternative products are gradually increasing affordability, perceived premium pricing and compliance complexities continue to hinder widespread adoption

- Regulations provide strict criteria for the effectiveness, safety, and quality of veterinary pain treatment medications. This gives veterinarians and pet owners the assurance that the therapies they provide are trustworthy and devoid of negative side effects

Veterinary Pain Management Market Scope

The market is segmented on the basis of product type, drug type, mode of purchase, animal type, pain source, dosage, route of administration, and end user.

- Product Type

On the basis of product type, the veterinary pain management market is segmented into analgesics, corticosteroids, and alpha 2 agonists. The analgesics segment dominated the market with the largest revenue share of 50.5% in 2024, driven by their primary role in managing both acute and chronic pain in companion and production animals. Analgesics are widely preferred by veterinarians due to their proven efficacy, rapid onset of action, and compatibility with multimodal pain management protocols. The segment benefits from a broad range of available formulations, including oral, injectable, and topical products, making it suitable for diverse clinical scenarios. The growing awareness among pet owners and livestock managers about effective pain management further fuels this dominance. Analgesics are also supported by strong R&D pipelines focusing on enhanced safety and targeted delivery mechanisms.

The alpha 2 agonists segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing use in sedation, analgesia, and anesthesia protocols for both companion and production animals. Alpha 2 agonists offer the advantage of providing both pain relief and sedation, making procedures more manageable in clinical and farm settings. Rising adoption in veterinary surgical procedures and increasing awareness about stress-free pain management are contributing to market growth. Furthermore, ongoing innovations in combination therapies involving alpha 2 agonists are expanding their applications. These developments are expected to attract veterinarians seeking advanced and efficient pain control solutions.

- By Drug Type

On the basis of drug type, the veterinary pain management market is segmented into branded and generic drugs. The branded drug segment dominated with 60% revenue share in 2024, owing to high trust in efficacy, consistency, and established veterinary pharmaceutical brands. Branded drugs often offer superior formulations and quality assurance, which encourages veterinarians and pet owners to prefer them over generics. Marketing support, educational programs, and clinical evidence backing branded products further strengthen their position. In addition, regulatory approvals and robust supply chains contribute to the dominance of branded drugs in developed markets. Branded products are also more likely to include support services and digital dosing tools, enhancing adoption among veterinary professionals.

The generic drug segment is expected to witness the fastest growth from 2025 to 2032, driven by cost-effectiveness and increasing demand in price-sensitive regions. Generic analgesics and corticosteroids provide an affordable alternative for both companion and production animals, especially in emerging economies. Growing regulatory acceptance of generics and increasing awareness among veterinarians regarding bioequivalence are fueling adoption. Moreover, patent expiries of key branded drugs are creating opportunities for generics to expand rapidly. The segment also benefits from increasing production capacities and competitive pricing strategies.

- By Mode of Purchase

On the basis of mode of purchase, the veterinary pain management market is segmented into prescription-based and over-the-counter (OTC) products. The prescription-based segment dominated the market with ~70% share in 2024, as most veterinary pain management products require professional supervision due to potential side effects and dosage precision requirements. Prescription-based purchases are preferred in clinics and hospitals, ensuring safe and effective use. Increasing regulatory requirements for controlled drugs further support this segment. The trend of veterinarians providing customized treatment plans also reinforces prescription dominance. Prescription products are often integrated into hospital management systems, facilitating compliance and monitoring.

The OTC segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising availability of safe, easy-to-administer analgesics for minor pain management in companion animals. OTC products offer convenience to pet owners and are increasingly adopted for home-based care. Expanding awareness of animal welfare and preventive care is contributing to growth. In addition, product innovation aimed at safer OTC formulations is accelerating adoption. The OTC market is also supported by e-commerce and retail veterinary outlets expanding access.

- By Animal Type

On the basis of animal type, the veterinary pain management market is segmented into companion animals and production animals. The companion animal segment dominated the market with 65% share in 2024, fueled by rising pet ownership, higher spending on pet healthcare, and increasing awareness of pain management. Companion animals benefit from advanced formulations and veterinary supervision, making this segment a major revenue contributor. The prevalence of chronic conditions and post-operative care needs in pets also drives consistent demand. Social media and awareness campaigns highlighting animal welfare further support this dominance. The segment also benefits from growing veterinary hospital networks focused on companion animal care.

The production animal segment is expected to witness the fastest growth from 2025 to 2032, driven by intensifying livestock farming and increasing adoption of veterinary analgesics to improve productivity and welfare. Pain management in livestock enhances recovery from surgical procedures, reduces stress, and improves overall health. Government initiatives and quality standards for meat, milk, and animal welfare are also promoting the adoption of analgesics. Increasing awareness among farm managers regarding animal welfare and productivity is accelerating this segment.

- By Pain Source

On the basis of pain source, the veterinary pain management market is segmented into chronic pain, acute pain, post-operative pain, and dental pain. The acute pain segment dominated the market with 40.6% share in 2024, due to high demand for rapid relief following injury, surgery, or trauma in both companion and production animals. Veterinarians prioritize acute pain management to prevent complications, accelerate recovery, and improve quality of life. The segment benefits from well-established treatment protocols and readily available analgesic formulations. Increasing surgical procedures in companion animals are further propelling segment dominance. Availability of both injectable and oral analgesics supports this widespread adoption.

The post-operative pain segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising number of surgical interventions in veterinary clinics and hospitals. Post-operative pain management ensures faster recovery, reduces stress, and minimizes post-surgery complications. Technological advancements in sustained-release analgesics and multimodal pain management approaches are accelerating adoption. Veterinary awareness programs emphasizing post-operative care contribute to market growth. The segment also benefits from targeted formulations designed for specific surgical procedures.

- By Dosage Form

On the basis of dosage form, the veterinary pain management market is segmented into solid, liquid, and semi-solid. The solid dosage form segment dominated the market with 45.3% share in 2024, due to ease of administration, longer shelf life, and suitability for both companion and production animals. Tablets and capsules are commonly preferred by veterinarians for standardized dosing and convenience. Solid forms are also widely available in both branded and generic options, contributing to their dominance. They allow for easier transport and storage in veterinary clinics and farms. Growing demand for long-acting solid formulations further supports dominance.

The liquid dosage form segment is expected to witness the fastest growth from 2025 to 2032, driven by ease of administration in young, small, or difficult-to-treat animals. Liquids offer flexibility in dosing and are particularly suitable for accurate measurement in multi-animal settings. Increasing adoption of oral suspensions and palatable formulations for pets supports growth. Veterinary practitioners favor liquids for animals that refuse solid forms. Technological improvements in flavored liquids enhance compliance and market expansion.

- By Route of Administration

On the basis of route of administration, the veterinary pain management market is segmented into parenteral, oral, and topical. The oral route dominated the market with 50% share in 2024, due to convenience, high compliance, and broad applicability in both companion and production animals. Oral administration is preferred for chronic pain and long-term treatments. Availability of palatable formulations and ease of repeated dosing reinforce dominance. Tablets and flavored chews increase adherence among pets. Oral administration also reduces stress in animals compared to injections.

The parenteral route is expected to witness the fastest growth from 2025 to 2032, driven by surgical procedures and acute pain scenarios requiring rapid onset of action. Injectable analgesics are preferred in veterinary hospitals and clinics for precise dosing and controlled effects. Technological advancements in injectable formulations, such as sustained-release options, are boosting adoption. Veterinarians also favor injectables for combination with anesthesia. The segment growth is supported by increasing surgical procedures globally.

- By End User

On the basis of end user, the veterinary pain management market is segmented into veterinary hospitals, veterinary clinics, pet shops, animal farms, academic & research institutes, and others. The veterinary hospitals and clinics segment dominated the market with 70.2% share in 2024, due to professional supervision and widespread use of advanced pain management protocols. Hospitals and clinics offer specialized treatments, including multimodal analgesia, for both companion and production animals. High awareness of animal welfare and adherence to clinical guidelines contribute to dominance. Hospitals also facilitate compliance monitoring and accurate dosing. The growing network of veterinary facilities further strengthens this segment.

The animal farms and pet shops segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing adoption of veterinary analgesics for livestock welfare and minor companion animal care. Rising awareness among farm managers and pet owners, along with government initiatives promoting animal welfare, supports segment growth. Expansion of retail veterinary services and training programs also enhances adoption in this segment. Affordable formulations and improved distribution networks accelerate growth.

Veterinary Pain Management Market Regional Analysis

- North America dominated the veterinary pain management market with the largest revenue share of 40% in 2024, characterized by advanced veterinary healthcare infrastructure, high pet ownership rates, and a strong presence of key industry players

- Consumers and veterinary practitioners in the region highly value the effectiveness, safety, and reliability of analgesics and other pain management solutions, as well as their integration into comprehensive treatment protocols for both companion and production animals

- This widespread adoption is further supported by high pet ownership, strong government regulations and guidelines on animal welfare, and the presence of leading veterinary pharmaceutical companies, establishing North America as a key market for veterinary pain management solutions

U.S. Veterinary Pain Management Market Insight

The U.S. veterinary pain management market captured the largest revenue share of 82% in 2024 within North America, fueled by increasing awareness of animal welfare and the widespread adoption of advanced veterinary analgesics. Pet owners and livestock managers are prioritizing effective pain relief for both companion and production animals. The growing demand for multimodal analgesic therapies, injectable and oral formulations, and post-operative care solutions further propels the market. Moreover, the presence of leading veterinary pharmaceutical companies, coupled with strong veterinary infrastructure, is significantly contributing to market expansion. Increasing regulatory support and veterinary education programs also enhance adoption of veterinary pain management solutions.

Europe Veterinary Pain Management Market Insight

The Europe veterinary pain management market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent animal welfare regulations and the growing need for effective pain relief in pets and livestock. Urbanization and higher disposable incomes are fostering the adoption of veterinary analgesics and multimodal pain management approaches. European veterinarians and pet owners are drawn to safe, reliable, and clinically tested solutions. The market is experiencing significant growth across companion animal clinics, veterinary hospitals, and livestock farms, with analgesics being incorporated into both routine care and post-operative protocols. Government initiatives and public awareness campaigns further support market adoption.

U.K. Veterinary Pain Management Market Insight

The U.K. veterinary pain management market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing pet ownership and a desire for improved animal welfare. In addition, rising prevalence of chronic and acute pain conditions in pets encourages the adoption of analgesics and corticosteroids. The U.K.’s robust veterinary infrastructure and advanced e-commerce and retail channels are expected to continue to stimulate market growth. Increased professional guidance from veterinarians on effective pain management and awareness of multimodal approaches also contributes to market expansion.

Germany Veterinary Pain Management Market Insight

The Germany veterinary pain management market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of animal welfare and the adoption of technologically advanced analgesic therapies. Germany’s well-developed veterinary infrastructure, focus on research and innovation, and strong livestock and companion animal care practices promote the use of veterinary pain management solutions. Integration of digital tools for dosing and monitoring, combined with public campaigns on animal health, further supports market growth. A strong preference for clinically proven and safe therapies aligns with local consumer and regulatory expectations.

Asia-Pacific Veterinary Pain Management Market Insight

The Asia-Pacific veterinary pain management market is poised to grow at the fastest CAGR of ~25% during the forecast period of 2025 to 2032, driven by increasing pet ownership, rapid urbanization, and rising awareness of animal welfare in countries such as China, Japan, and India. Growing adoption of companion animal clinics and livestock analgesics, supported by government initiatives on animal health, is driving market expansion. Furthermore, the region’s emergence as a manufacturing hub for veterinary pharmaceuticals enhances affordability and accessibility. Rising disposable incomes and a shift toward professional veterinary care are further propelling adoption.

Japan Veterinary Pain Management Market Insight

The Japan veterinary pain management market is gaining momentum due to the country’s high standards of animal care, increasing pet adoption, and aging pet population. Japanese consumers place a strong emphasis on effective pain relief and post-operative care. The integration of digital monitoring tools and modern analgesic formulations is fueling growth. In addition, the growing number of veterinary hospitals and clinics, along with awareness campaigns on animal welfare, supports market expansion. Advanced therapies for chronic and post-operative pain are becoming increasingly preferred in both companion and production animals.

India Veterinary Pain Management Market Insight

The India veterinary pain management market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rising pet ownership, rapid urbanization, and growing livestock production. Increasing awareness among veterinarians and animal owners about the importance of pain management is driving the adoption of analgesics and corticosteroids. The push towards modern veterinary practices, availability of affordable pain management solutions, and domestic pharmaceutical production are key factors propelling the market. Expansion of veterinary clinics and hospitals in urban and semi-urban areas further enhances market growth.

Veterinary Pain Management Market Share

The veterinary pain management industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Vetoquinol (U.S.)

- Virbac (U.S.)

- Ceva (France)

- Dechra Pharmaceuticals Limited (U.K.)

- IDEXX (U.S.)

- Bayer AG (U.S.)

- Medivir AB (Sweden)

- Vetbiolix (U.K.)

- Can-Fite. (Israel)

- VetStem, Inc. (U.S.)

- VetDC (U.S.)

What are the Recent Developments in Global Veterinary Pain Management Market?

- In February 2025, Zoetis updated the U.S. label for Librela (bedinvetmab injection), a monoclonal antibody therapy for canine osteoarthritis pain. The update was based on post-approval experience since its U.S. launch in 2023. This reflects the company's commitment to enhancing treatment options for dogs with OA

- In September 2024, Elanco announced the FDA approval and launch of Zenrelia (ilunocitinib tablets), a once-daily oral Janus kinase (JAK) inhibitor for controlling pruritus associated with allergic dermatitis and atopic dermatitis in dogs. This introduction expands Elanco's portfolio in canine dermatology

- In June 2024, Can-Fite BioPharma announced that its veterinary partner Vetbiolix reported positive results in an osteoarthritis multicenter clinical study in dogs treated with Piclidenoson. This collaboration highlights the potential of Piclidenoson as a treatment for canine osteoarthritis

- In April 2024, Medivir's partner Vetbiolix announced positive results from a Proof-of-Concept study with VBX-1000, previously known as MIV-701. This development marks a significant step in advancing VBX-1000 as a potential treatment for canine osteoarthritis

- In May 2023, the U.S. FDA approved bedinvetmab (Librela), a monoclonal antibody therapy, for the control of pain associated with osteoarthritis in dogs. This approval represents a milestone in veterinary pain management, offering a targeted treatment option for canine osteoarthritis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.