Global Trauma Fixation Market

Market Size in USD Billion

CAGR :

%

USD

12.57 Billion

USD

27.55 Billion

2024

2032

USD

12.57 Billion

USD

27.55 Billion

2024

2032

| 2025 –2032 | |

| USD 12.57 Billion | |

| USD 27.55 Billion | |

|

|

|

|

Trauma Fixation Market Size

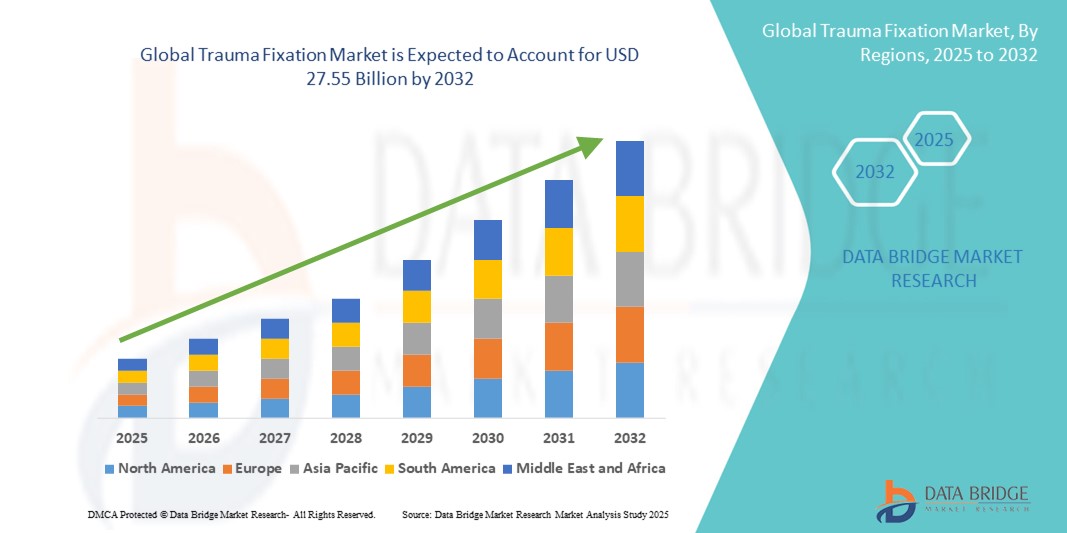

- The global trauma fixation market size was valued at USD 12.57 billion in 2024 and is expected to reach USD 27.55 billion by 2032, at a CAGR of 10.3% during the forecast period

- The market growth is largely fueled by the rising incidence of trauma from road accidents, falls, and sports-related injuries—a trend intensified by urbanization, increasing vehicle usage, and an aging population. These factors are boosting demand for effective trauma fixation devices that stabilize fractures and support recovery

- Furthermore, technological innovation plays a crucial role—advancements such as minimally invasive surgical techniques, bioabsorbable materials in internal fixators, 3D-printed customized implants, and smart device coatings are enhancing device effectiveness, reducing recovery time, and improving patient outcomes

Trauma Fixation Market Analysis

- Trauma fixation devices, essential for stabilizing and supporting fractured bones during the healing process, are increasingly critical in orthopedic and trauma care. These devices are widely used in both hospital and ambulatory surgical center settings due to their effectiveness in improving patient recovery outcomes, reducing complication risks, and enabling early mobilization

- The rising demand for trauma fixation solutions is primarily driven by the growing incidence of road accidents, sports-related injuries, and falls among the elderly population, along with advancements in minimally invasive surgical techniques and the development of bioresorbable materials

- North America dominated the trauma fixation market with the largest revenue share of 39.8% in 2024, supported by advanced healthcare infrastructure, higher healthcare expenditure, and a strong presence of leading medical device manufacturers. The U.S. leads regional growth, fueled by high adoption of innovative fixation systems, favorable reimbursement policies, and increasing geriatric orthopedic cases

- Asia-Pacific is projected to be the fastest-growing region in the trauma fixation market during the forecast period, with a CAGR of 7.9%, owing to rising healthcare investments, growing awareness about advanced treatment options, and expanding access to orthopedic care in countries such as China, India, and Japan

- The internal fixator devices segment dominated the trauma fixation market with 61.4% of the market revenue share in 2024, driven by their ability to provide stable fixation, enable early mobilization, and reduce recovery times for patients with complex fractures

Report Scope and Trauma Fixation Market Segmentation

|

Attributes |

Trauma Fixation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Trauma Fixation Market Trends

Rise of Minimally Invasive and Patient-Centric Trauma Fixation Techniques

- A significant and accelerating trend in the global trauma fixation market is the growing shift toward minimally invasive surgical (MIS) procedures. These approaches—such as percutaneous fixation, intramedullary nailing, and advanced plating systems—are being increasingly adopted because they reduce tissue trauma, lower infection risks, and significantly shorten patient recovery times, enabling faster discharge and improved clinical outcomes

- For instance, DePuy Synthes offers the VA LCP Periprosthetic Plating System, designed for MIS application, which minimizes surgical exposure while maintaining rigid fixation for complex fractures. Similarly, Smith+Nephew’s TRIGEN INTERTAN Intertrochanteric Nail allows fracture stabilization through smaller incisions, leading to less blood loss and quicker mobilization

- Hybrid fixation systems—combining elements of internal and external fixation—are also gaining traction as they provide customized stabilization strategies for complex fractures. For instance, Orthofix’s Galaxy Fixation Gemini® enables surgeons to transition from external to internal fixation without completely removing stabilization, allowing adaptability to patient-specific needs

- Another major advancement is the rise of patient-specific implants, produced through high-resolution imaging and additive manufacturing (3D printing). For instance, Materialise and Johnson & Johnson have collaborated to produce customized CMF plates tailored to each patient’s unique anatomy, improving implant fit, biomechanical performance, and patient satisfaction

- The adoption of advanced biomaterials is reshaping the market as well. Titanium remains the gold standard for strength and biocompatibility, while bioabsorbable materials such as PLA and PGA are gaining popularity, especially for pediatric cases, eliminating the need for a second surgery for implant removal. Stryker’s Vitoss Bioactive Foam is an instance of a biomaterial that promotes bone regeneration while being resorbable over time

- The push toward ambulatory surgical center (ASC)-friendly fixation devices is also accelerating. Products designed for outpatient procedures—such as Zimmer Biomet’s Periarticular Locking Plate System—support quicker recovery, reduced hospital stays, and lower infection risks, aligning with healthcare systems’ increasing focus on cost-efficiency and patient comfort

Trauma Fixation Market Dynamics

Driver

Growing Need Due to Rising Incidence of Orthopedic Injuries and Advancements in Surgical Procedures

- The escalating prevalence of orthopedic injuries, fractures, and trauma cases caused by road accidents, sports-related incidents, and age-related bone degeneration is a major factor driving the demand for trauma fixation devices globally. Both developed and developing nations are witnessing a surge in cases requiring surgical intervention for bone stabilization and alignment

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) introduced advancements in IoT-enabled surgical planning tools designed to assist orthopedic surgeons in achieving higher precision during trauma fixation procedures. This innovation reflects the growing emphasis on integrating advanced technology into surgical solutions, thereby enhancing patient recovery outcomes and operational efficiency in hospitals and trauma centers

- As healthcare professionals aim to improve recovery times and reduce post-surgical complications, trauma fixation devices—such as plates, screws, rods, and external fixators—are increasingly preferred for their ability to provide immediate bone stability and facilitate early mobilization of patients

- Furthermore, continuous advancements in minimally invasive orthopedic surgeries and the development of biocompatible fixation materials are making trauma fixation solutions more effective and safer. Such innovations are also contributing to reduced hospital stays and improved quality of life for patients

- The growing demand for customized fixation devices, availability of 3D printing in medical manufacturing, and an increasing number of specialized orthopedic trauma care units are further fueling the expansion of the trauma fixation market across both residential-style clinics and large-scale hospital settings

Restraint/Challenge

Concerns Regarding Surgical Risks and High Initial Costs

- Despite strong market potential, trauma fixation adoption faces challenges due to surgical risks such as infection, implant rejection, and the need for revision surgeries. These complications can affect patient confidence and influence surgeons' recommendations, particularly in regions with limited access to advanced post-operative care

- For instance, high-profile clinical reports of post-surgical complications—such as implant loosening or hardware failure—have raised awareness about the importance of quality assurance in trauma fixation manufacturing and surgical skill enhancement

- Addressing these risks requires the use of high-grade, biocompatible materials, adherence to strict sterilization protocols, and continuous training for orthopedic surgeons. Companies such as Stryker and Zimmer Biomet highlight their robust R&D efforts to produce fixation systems with improved durability, reduced infection risk, and enhanced patient compatibility

- Another significant barrier is the relatively high initial cost of advanced trauma fixation systems compared to traditional orthopedic repair methods. In price-sensitive regions, especially in low- and middle-income countries, this can deter hospitals and patients from adopting premium solutions. While basic fixation devices are becoming more affordable, advanced systems—integrated with navigation tools or made from specialized alloys—remain expensive

- Overcoming these challenges requires not only making trauma fixation systems more cost-effective but also implementing public health policies that support subsidized orthopedic care, expanding health insurance coverage, and increasing patient awareness about the long-term benefits of high-quality trauma fixation devices

Trauma Fixation Market Scope

The market is segmented on the basis of product type, material, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the trauma fixation market is segmented into internal fixator devices and external fixator devices. The internal fixator devices segment accounted for 61.4% of the market revenue share in 2024, driven by their ability to provide stable fixation, enable early mobilization, and reduce recovery times for patients with complex fractures. Devices such as plates, screws, rods, and nails are widely preferred in both elective and emergency orthopedic surgeries due to their proven long-term outcomes and compatibility with minimally invasive techniques. The segment also benefits from continuous innovation in design, such as anatomically contoured plates and locking screw systems that enhance surgical precision.

The external fixator devices segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, supported by their versatility in treating open fractures, complex bone deformities, and severe trauma cases where internal fixation is not viable. Growing demand for modular and lightweight external fixators, along with increased adoption in low-resource settings due to their reusability, is further fueling market expansion.

- By Material

On the basis of material, the trauma fixation market is segmented into metallic implants (steel, titanium, and other), carbon fiber (thermoplastic), hybrid implants, bioabsorbable materials, and grafts and orthobiologics. The metallic implant segment held 54.8% of the market share in 2024, with titanium dominating due to its biocompatibility, corrosion resistance, and ability to integrate with bone tissue. Stainless steel remains a cost-effective option, particularly in emerging economies, for high-strength load-bearing applications.

The carbon fiber (thermoplastic) segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, driven by its radiolucency—which allows for clear imaging without interference—and lightweight properties that improve patient comfort. The development of hybrid implants combining metallic and composite materials, as well as increased adoption of bioabsorbable implants that eliminate the need for removal surgery, is transforming the material landscape in trauma fixation. Grafts and orthobiologics currently account for 8.7% of the market and are gaining traction for their ability to stimulate bone healing and improve recovery outcomes.

- By Application

On the basis of application, the trauma fixation market is segmented into shoulder and elbow, hand and wrist, pelvic, hip and femur, tibia, craniomaxillofacial, knee, foot and ankle, spinal, and others. The hip and femur segment held the largest revenue share of 28.3% in 2024, driven by the high incidence of fractures in elderly populations and the increasing number of total and partial hip replacement procedures worldwide. These injuries often require robust fixation systems to restore mobility and reduce the risk of complications.

The craniomaxillofacial segment is expected to register the fastest CAGR of 9.1% from 2025 to 2032, fueled by advancements in 3D printing technology for patient-specific implants and the rising demand for reconstructive surgeries following trauma or congenital defects. Growing sports-related injuries and road accidents are also contributing to the rising demand across multiple application segments, including knee (6.3% share in 2024) and ankle fixation.

- By End User

On the basis of end user, the trauma fixation market is segmented into hospitals, ambulatory surgical centers, trauma centers, and others. The hospitals segment dominated the market in 2024 with 66.5% share, due to their advanced infrastructure, skilled orthopedic surgeons, and ability to manage complex trauma cases requiring multidisciplinary care. Hospitals also lead in adopting new surgical technologies and high-end fixation systems through collaborations with medical device manufacturers.

The ambulatory surgical centers segment is expected to experience the fastest CAGR of 8.2% from 2025 to 2032, driven by the shift toward outpatient orthopedic procedures, cost-efficiency, and reduced patient waiting times. Trauma centers accounted for 14.6% of the market in 2024 and continue to play a critical role in emergency fracture management, particularly in regions with high accident rates.

- By Distribution Channel

On the basis of distribution channel, the trauma fixation market is segmented into direct tender, retail sales, and online sales. The direct tender segment accounted for 72.8% of the revenue share in 2024, supported by bulk purchasing by hospitals and government healthcare institutions, which ensures consistent supply and cost savings.

The online sales segment is expected to witness the fastest CAGR of 9.4% from 2025 to 2032, owing to the growing acceptance of digital procurement platforms, increased product visibility, and competitive pricing. Retail sales channels maintain a 14.2% share in 2024 and remain important for smaller clinics and private practices seeking immediate product availability.

Trauma Fixation Market Regional Analysis

- North America dominated the trauma fixation market with the largest revenue share of 39.8% in 2024, driven by the increasing prevalence of traumatic injuries, including fractures from vehicular accidents, sports-related trauma, and workplace incidents

- The region benefits from well-established healthcare infrastructure, widespread availability of advanced trauma care facilities, and a strong focus on adopting cutting-edge surgical fixation technologies. High healthcare expenditure, supportive government reimbursement policies, and growing patient awareness about innovative fixation procedures collectively contribute to North America’s market leadership

- Consumers in the region highly value advanced trauma fixation devices that offer improved patient outcomes, such as reduced healing times, enhanced biomechanical stability, and lower infection risks. The increasing adoption of minimally invasive surgical techniques and bioengineered implants further stimulates demand

U.S. Trauma Fixation Market Insight

The U.S. trauma fixation market captured the largest revenue share of 69% in 2024 within North America, fueled by the rising incidence of orthopedic injuries and fractures due to an active population and increasing elderly demographics prone to osteoporosis. The country’s healthcare providers are increasingly embracing technologically sophisticated fixation systems, including intramedullary nails, locking plates, and external fixators designed for complex fracture management. Innovations in implant materials, such as titanium alloys and bioabsorbable polymers, combined with improvements in surgical procedures, are propelling market growth. In addition, ongoing investments in trauma research and well-established reimbursement frameworks make the U.S. a critical growth engine in this sector.

Europe Trauma Fixation Market Insight

The Europe trauma fixation market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the aging population and a consequent rise in osteoporosis-related fractures. Increasing healthcare awareness and favorable policies encouraging early surgical intervention in trauma cases are further boosting demand. The region also sees a strong focus on regulatory compliance and quality assurance, ensuring the widespread availability of safe and effective trauma fixation devices. Moreover, advancements in hybrid fixation systems and patient-specific implants tailored through 3D printing are gaining traction. Urbanization and an increase in road traffic accidents also contribute to rising trauma cases, especially in countries such as France, Italy, and Spain.

U.K. Trauma Fixation Market Insight

The U.K. trauma fixation market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing numbers of fractures resulting from falls, particularly among the elderly population. The National Health Service’s initiatives aimed at improving trauma care pathways and reducing surgical wait times have spurred the adoption of advanced fixation technologies. Moreover, the rising preference for minimally invasive surgery in trauma treatment to reduce hospital stays and postoperative complications is encouraging the use of modern implants and fixation devices. Increasing investments in healthcare infrastructure and training of orthopedic surgeons also contribute to market expansion.

Germany Trauma Fixation Market Insight

The Germany trauma fixation market is expected to expand at a considerable CAGR during the forecast period, driven by heightened awareness regarding advanced trauma care and rising demand for high-quality, eco-conscious fixation materials such as titanium and bioabsorbables. Germany’s strong medical device manufacturing base and emphasis on innovation provide the market with a competitive edge. In addition, the country’s well-developed healthcare infrastructure and government support for digital health solutions enable faster adoption of newer trauma fixation technologies. The increase in sports-related injuries and road accidents further elevates the demand for reliable and versatile fixation devices.

Asia-Pacific Trauma Fixation Market Insight

The Asia-Pacific trauma fixation market is poised to grow at the fastest CAGR of 7.9% during the forecast period of 2025 to 2032, driven by rapid urbanization, industrialization, and increasing road traffic accidents across countries such as China, India, and Japan. Rising disposable incomes, improved healthcare access, and growing government initiatives aimed at strengthening trauma care infrastructure are major growth catalysts. The region is witnessing a surge in demand for affordable yet technologically advanced trauma fixation devices, supported by local manufacturing hubs. In addition, increasing awareness about orthopedic health and minimally invasive surgical procedures is stimulating market growth. The expanding geriatric population with increased susceptibility to fractures also contributes significantly to the market’s rise.

Japan Trauma Fixation Market Insight

The Japan trauma fixation market is gaining momentum due to the country’s rapidly aging population, which results in a higher incidence of fragility fractures and related trauma cases. The healthcare system’s emphasis on early intervention, patient-specific treatment plans, and minimally invasive fixation techniques drives the demand for advanced trauma fixation devices. Japan’s well-established medical research ecosystem supports continuous innovation in implant design and surgical procedures. Furthermore, technological integration such as improved imaging and robotic-assisted surgery enhances surgical precision and patient outcomes, fueling market growth.

China Trauma Fixation Market Insight

The China trauma fixation market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rapid urbanization, increasing incidence of trauma from traffic accidents and industrial injuries, and expanding healthcare infrastructure. Growing government support in the form of healthcare reforms and increased health insurance penetration are making advanced trauma fixation devices more accessible to the wider population. The presence of strong domestic medical device manufacturers offering cost-effective fixation solutions, coupled with rising patient awareness, supports rapid market expansion. In addition, China’s growing focus on smart hospital initiatives and adoption of minimally invasive fixation techniques are expected to further propel the market in the coming years.

Trauma Fixation Market Share

The trauma fixation industry is primarily led by well-established companies, including:

- Weigao Group (China)

- Orthofix Medical Inc. (U.S.)

- CONMED Corporation (U.S.)

- Wright Medical Group N.V. (Netherlands)

- OsteoMed (U.S.)

- Invibio Ltd. (U.K.)

- Medtronic (Ireland)

- Smith + Nephew (U.K.)

- Zimmer Biomet (U.S.)

- B. Braun SE (Germany)

- Stryker (U.S.)

- Implantate AG (Germany)

- Johnson & Johnson and its affiliates (U.S.)

- Inion OY (Finland)

- Arthrex Inc. (U.S.)

- Jeil Medical Corporation (South Korea)

- Bioretec Ltd. (Finland)

Latest Developments in Global Trauma Fixation Market

- In September 2023, Orthofix Medical announced the full U.S. commercial launch of its Galaxy Fixation Gemini System, a modular external fixation platform offered in sterile, off-the-shelf procedure kits designed for rapid application in acute trauma settings. The company highlighted that the sterile kit format (including the ankle kit with specific clamps) reduces OR preparation time, avoids tray sterilization delays, and supports use in trauma bays or intensive care units — advantages that can materially improve workflow and costs in high-acuity fracture care.

- In January 2025 (agreement announced) and completed in April 2025, Zimmer Biomet announced and then closed its acquisition of Paragon 28, a specialist foot-and-ankle and trauma device company, in a transaction valued at about USD 1.1 billion. Zimmer Biomet stated the deal expands its fracture & trauma and foot & ankle capabilities, brings complementary implant portfolios and distribution channels, and supports growth in ambulatory surgical center (ASC) and international markets — a strategic M&A move reshaping competitive dynamics in trauma fixation.

- In October 2024, Johnson & Johnson MedTech (DePuy Synthes / J&J) launched the VOLT plating system — a next-generation family of mini and small-fragment plating implants cleared for clinical use — aimed at improving fixation flexibility and stability across common fracture types. J&J positioned VOLT as a modern plating portfolio with modularity for wrist and proximal humerus applications and said the platform would roll out across specific anatomies and markets in 2024–2025, signaling renewed large-OEM investment in plating innovation for trauma care.

- In August 2024, DePuy Synthes (Johnson & Johnson) introduced the TriLEAP Lower Extremity Anatomic Plating System, a comprehensive, low-profile titanium plating portfolio designed specifically for foot and ankle surgeons and trauma cases. The TriLEAP system offers procedure-specific implants and instrumentation tailored for reconstructive and fracture fixation needs in the lower extremity, illustrating the ongoing trend of OEMs bringing anatomically contoured, procedure-focused plating solutions to trauma surgeons

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.