Global Telecom Cloud Billing Market

Market Size in USD Billion

CAGR :

%

USD

12.61 Billion

USD

70.35 Billion

2024

2032

USD

12.61 Billion

USD

70.35 Billion

2024

2032

| 2025 –2032 | |

| USD 12.61 Billion | |

| USD 70.35 Billion | |

|

|

|

|

Telecom Cloud Billing Market Size

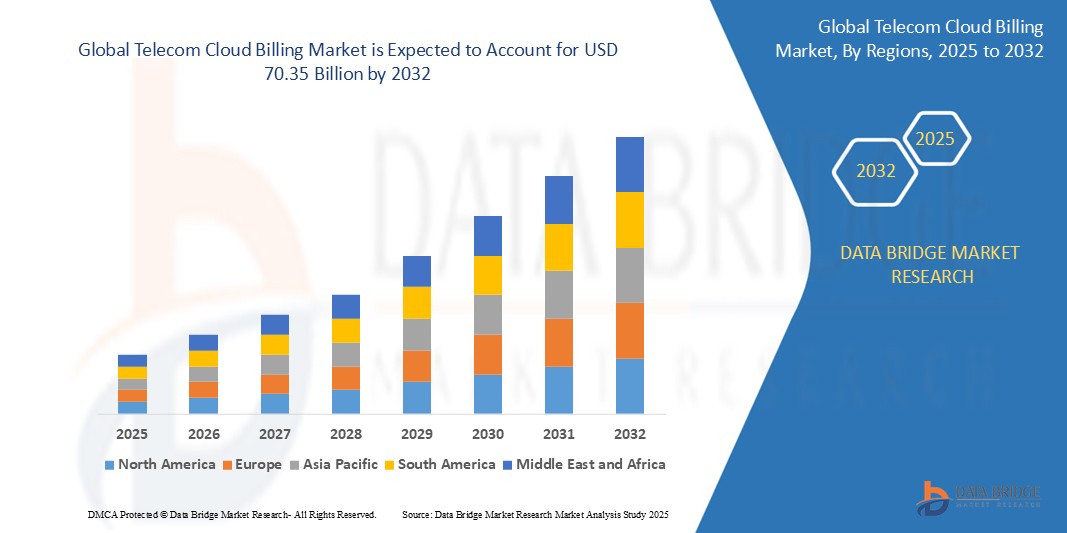

- The global telecom cloud billing market size was valued at USD 12.61 billion in 2024 and is expected to reach USD 70.35 billion by 2032, at a CAGR of 23.96 % during the forecast period

- This growth is driven by factors such as the increasing adoption of cloud-based solutions, the rising demand for digital transformation in telecom services, and the growing need for efficient billing and revenue management systems.

Telecom Cloud Billing Market Analysis

- The telecom cloud billing market is experiencing significant growth due to the increasing shift of telecom operators towards cloud-based solutions for better scalability and flexibility in billing operations. Cloud billing systems are being adopted to improve efficiency and reduce costs for telecom companies

- Telecom cloud billing solutions are gaining popularity as they support advanced features such as real-time billing, automation, and data analytics. This growing trend is contributing to the demand for more sophisticated, cloud-based billing platforms across the telecom sector

- North America is expected to dominate the Telecom Cloud Billing market due to its advanced technological infrastructure, presence of major telecom operators, and the rapid adoption of 5G networks.

- Asia-Pacific is expected to be the fastest growing region in the Telecom Cloud Billing market during the forecast period due to rapidly expanding telecom networks, increasing smartphone and internet penetration, and growing demand for digital services.

- The software as a service segment is expected to dominate the telecom cloud billing market with the largest share of 56.2% in 2025 due to its scalability, cost-efficiency, and ease of deployment, which allow telecom operators to quickly launch and manage complex billing operations without heavy infrastructure investments.

Report Scope and Telecom Cloud Billing Market Segmentation

|

Attributes |

Telecom Cloud Billing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Telecom Cloud Billing Market Trends

“Shift Towards Subscription-Based and Usage-Based Billing Models”

- Telecom providers are shifting from flat-rate to usage-based billing models, allowing users to pay for what they consume

- For instance, AT&T offers data plans with usage caps, and T-Mobile provides flexible billing based on actual data usage

- Subscription-based billing is gaining traction as it helps telecom companies ensure steady revenue

- For instance, Vodafone’s Red plans and Verizon’s monthly service bundles illustrate how recurring payments support financial predictability

- Cloud billing platforms enable these models with automated invoicing and real-time tracking, making it easier to manage complex billing systems, as seen in Amdocs’ cloud billing solution and Netcracker’s cloud-based monetization tools

- Leading telecoms such as AT&T and Vodafone use hybrid billing approaches to create personalized offerings that adapt to customer behavior and preferences

- This trend enhances customer satisfaction by giving users more control over spending and increasing billing transparency, much such as Verizon’s customizable mobile plans and T-Mobile’s real-time usage alerts

Telecom Cloud Billing Market Dynamics

Driver

“Growing Demand for Real-Time Billing and Customer Transparency”

- Real-time billing is increasingly important as telecom services expand to include cloud storage, content streaming, and IoT-based offerings

- Customers expect immediate updates on service usage and charges, which traditional billing systems cannot efficiently provide

- Cloud-based billing enables users to monitor consumption and costs in real time, improving control and transparency

- For instance, Verizon’s real-time data usage tracker and T-Mobile’s billing notifications help users stay informed

- Telecom providers benefit from faster monetization of new services and fewer billing disputes due to accurate, up-to-date information

- This approach boosts customer satisfaction and trust, contributing to better service retention, as seen in AT&T’s self-service billing tools and Vodafone’s personalized billing alerts

Opportunity

“Expansion into Emerging Digital Services and 5G Monetization”

- The rollout of 5G networks creates demand for flexible billing systems to support services such as ultra-low latency gaming and connected vehicles

- Traditional billing systems lack the agility to manage customized pricing and microtransactions required for advanced digital services

- Cloud billing platforms offer scalability and real-time processing, essential for handling large volumes of data and dynamic pricing

- For instance, Amdocs supports real-time billing for smart city deployments, and Netcracker enables billing for 5G-powered industrial automation

- Growing digital services such as OTT content and cloud storage boost the need for adaptable billing models that can evolve with usage trends

- Telecom companies can leverage cloud billing to create new revenue streams and strategic partnerships with third-party service providers, as seen with Verizon’s partnership with Amazon Web Services and Vodafone’s integration with Microsoft Azure

Restraint/Challenge

“Data Security and Compliance Concerns”

- Security and compliance concerns remain a major challenge as telecom billing involves sensitive data such as payment details and user behavior

- Moving this information to the cloud raises risks of data breaches and unauthorized access, especially without proper safeguards in place

- Strict regulations such as GDPR require telecom providers to ensure their billing partners meet high standards for data protection

- For instance, European operators must maintain compliance with GDPR, and Indian telecoms must align with the Personal Data Protection Bill

- Non-compliance can result in legal penalties, reputational harm, and loss of customer trust, making security a critical concern

- Data residency laws further complicate cloud billing adoption by restricting where customer data can be stored or processed, as seen with Brazil’s LGPD and Canada’s PIPEDA regulations

Telecom Cloud Billing Market Scope

The market is segmented on the basis of type of billing, application, cloud platform, deployment, rate of charging mode, service, user type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type of Billing |

|

|

By Application |

|

|

By Cloud Platform |

|

|

By Deployment |

|

|

By Rate of Charging Mode |

|

|

By Service |

|

|

By User Type |

|

|

By End User |

|

In 2025, the software as a service (SaaS) is projected to dominate the market with a largest share in cloud platform segment

The software as a service segment is expected to dominate the telecom cloud billing market with the largest share of 56.2% in 2025 due to its scalability, cost-efficiency, and ease of deployment, which allow telecom operators to quickly launch and manage complex billing operations without heavy infrastructure investments.

The private segment is expected to account for the largest share during the forecast period in deployment market

In 2025, the private segment is expected to dominate the market with the largest market share of 56.9% due to its enhanced security, better control over data, and compliance capabilities, making it the preferred choice for telecom companies handling sensitive customer information and adhering to strict regulatory standards.

Telecom Cloud Billing Market Regional Analysis

“North America Holds the Largest Share in the Telecom Cloud Billing Market”

- North America dominates the telecom cloud billing market, by holding a market share of 35%

- North America’s robust telecom industry and widespread adoption of cloud technology position it as a dominant player in the telecom cloud billing market

- The demand for advanced billing solutions is driven by the rapid deployment of 5G networks and the need for flexible, integrated billing models that can support convergent services

- The region benefits from the presence of leading cloud billing providers such as Amdocs, Oracle, and Nutcracker, offering innovative solutions tailored to telecom operators

- The mature regulatory environment in North America ensures that telecom operators are compliant with data privacy and security requirements, boosting trust in cloud billing solutions

- The high rate of technological innovation and the early adoption of digital transformation initiatives among telecom companies in North America support the consistent growth of the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Telecom Cloud Billing Market”

- Asia-Pacific region is projected to be the fastest-growing market for telecom cloud billing, driven by rapidly expanding telecom networks and the region's large, tech-savvy population

- The surge in smartphone usage, high internet penetration, and the growing demand for digital services in countries such as China and India create a significant need for flexible, scalable cloud-based billing solutions

- The adoption of 5G networks and the integration of smart technologies in the region open up new opportunities for telecom providers to implement advanced billing solutions

- Government initiatives supporting digital transformation and the push for modernization in the telecom sector accelerate the adoption of cloud billing technologies across the region

- Emerging markets in the Asia-Pacific region present vast growth potential as telecom operators aim to provide more personalized and efficient billing services to their expanding customer base

Telecom Cloud Billing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amdocs (U.S.)

- Oracle (U.S.)

- CGI Inc. (Canada)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Netcracker (U.S.)

- Cerillion Technologies Limited (U.K.)

- AsiaInfo Technologies Limited (China)

- Optiva, Inc. (Canada)

- Huawei Technologies Co., Ltd. (China)

- Mahindra&Mahindra Ltd. (India)

- DXC Technology Company (U.S.)

- Vodafone Group (U.K.)

- Verizon (U.S.)

- NTT Communications Corporation (Japan)

- Deutsche Telekom AG (Germany

- CenturyLink (U.S.)

- BT (U.K.)

- AT&T Intellectual Property (U.S.)

- SAP (Germany)

Latest Developments in Global Telecom Cloud Billing Market

- In September 2023, Optiva launched its MVNO Hubs on Google Cloud, offering BSS (Business Support System) as a service. This development aims to provide Mobile Virtual Network Operators (MVNOs) with a cloud-native, scalable platform for billing, customer management, and service delivery. By leveraging Google Cloud's infrastructure, Optiva enables MVNOs to deploy solutions faster, reduce operational costs, and enhance customer experiences with real-time data and analytics. This launch is expected to streamline MVNO operations and drive market growth by offering more efficient and flexible service models in the telecom industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.