Global Tantalum Carbide Coating For Graphite Market

Market Size in USD Million

CAGR :

%

USD

2.20 Million

USD

3.07 Million

2025

2033

USD

2.20 Million

USD

3.07 Million

2025

2033

| 2026 –2033 | |

| USD 2.20 Million | |

| USD 3.07 Million | |

|

|

|

|

What is the Global Tantalum Carbide Coating for Graphite Market Size and Growth Rate?

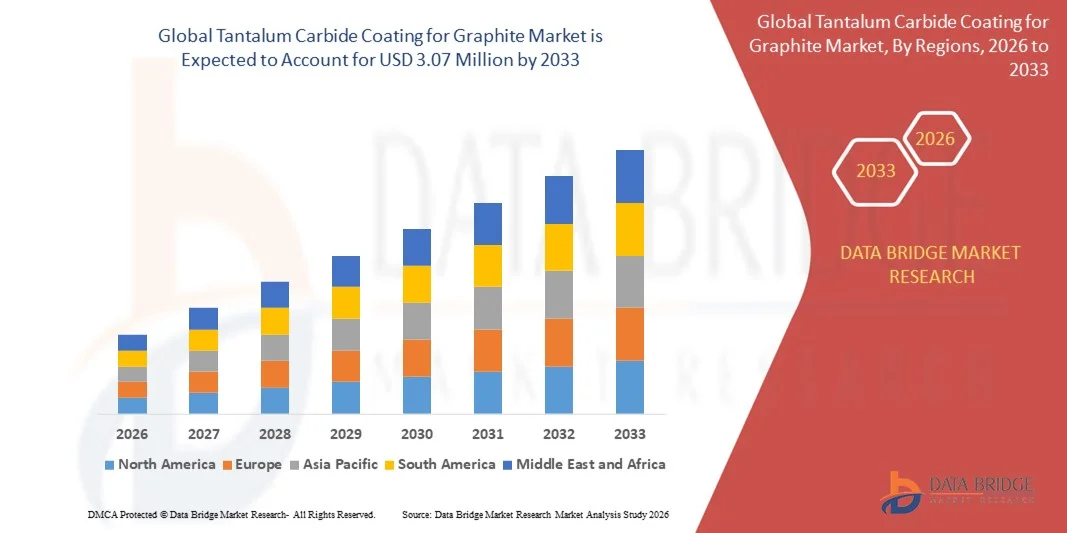

- The global tantalum carbide coating for graphite market size was valued at USD 2.20 million in 2025 and is expected to reach USD 3.07 million by 2033, at a CAGR of 4.20% during the forecast period

- Rise in demand for tantalum carbide coating for graphite by the aviation and aerospace industry is the root cause fuelling up the tantalum carbide coating for graphite market growth rate

- Rising application areas for tantalum carbide coating for graphite such as in the manufacturing and finishing of machine tools and growth and expansion of various end user verticals especially in the developing economies will also directly and positively impact the growth rate of the tantalum carbide coating for graphite market

What are the Major Takeaways of Tantalum Carbide Coating for Graphite Market?

- Growing inclination of foreign investors in the semiconductors industry, surging demand for capacitors in the electronic equipment and increased focus on the innovation in coatings and materials will further carve the way for the growth of the tantalum carbide coating for graphite market

- However, insufficiency in raw material demand and supply owing to the lockdown and volatility in their prices will pose a major challenge to the growth of the tantalum carbide coating for graphite market

- North America dominated the tantalum carbide coating for graphite market with a 41.06% revenue share in 2025, driven by strong growth in semiconductor design, advanced electronics manufacturing, and extensive R&D activities across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.36% from 2026 to 2033, driven by expanding semiconductor manufacturing, electronics production, and adoption of advanced industrial tools across China, Japan, India, South Korea, and Southeast Asia

- The CVD segment dominated the market with a 44.2% share in 2025, driven by its superior uniformity, excellent adhesion, and ability to produce high-purity coatings suitable for high-performance applications

Report Scope and Tantalum Carbide Coating for Graphite Market Segmentation

|

Attributes |

Tantalum Carbide Coating for Graphite Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Tantalum Carbide Coating for Graphite Market?

Rising Adoption of High-Performance, Compact, and PC-Integrated Tantalum Carbide Coating for Graphites

- The tantalum carbide coating for graphite market is seeing strong adoption of compact, USB-powered, and high-speed analyzers designed for embedded systems, IoT devices, FPGA validation, and complex digital protocols

- Manufacturers are introducing multi-channel, software-defined, and high-bandwidth analyzers that offer advanced triggering, deep memory buffering, and seamless integration with modern development platforms

- Rising demand for lightweight, cost-efficient, and portable testing solutions is driving uptake across electronics labs, R&D centers, repair workshops, and academic institutions

- For instance, companies such as Saleae, Tektronix, Keysight, and RIGOL have enhanced their portable analyzers with increased channel counts, SPI/I2C/UART/CAN protocol decoding, and cloud-enabled visualization, supporting advanced testing workflows

- The growing need for rapid debugging, high-speed digital validation, and multi-device testing is accelerating the shift toward PC-integrated, portable analyzers

- As electronics continue to shrink and grow in complexity, tantalum carbide coating for graphites remains essential for real-time testing, fast prototyping, and advanced embedded system analysis

What are the Key Drivers of Tantalum Carbide Coating for Graphite Market?

- Increasing demand for affordable, accurate, and easy-to-use analyzers to support rapid debugging in microcontroller, FPGA, and digital circuit development

- For example, in 2025, leading companies such as Saleae, Yokogawa, and Good Will Instrument upgraded analyzer portfolios with higher sampling rates, enhanced protocol decoding, and flexible software interfaces

- Rising adoption of IoT devices, consumer electronics, EV systems, robotics, and smart automation is boosting the requirement for digital signal testing tools across North America, Europe, and Asia-Pacific

- Technological advancements in memory depth, waveform compression, signal acquisition, and USB-powered architectures enhance portability, efficiency, and performance

- Increasing use of AI chips, high-speed communication buses, and multi-core processors is driving demand for high-density, multi-channel portable analyzers

- Supported by steady investments in R&D, semiconductor innovation, and testing infrastructure, the Tantalum Carbide Coating for Graphite market is expected to sustain strong long-term growth

Which Factor is Challenging the Growth of the Tantalum Carbide Coating for Graphite Market?

- High costs of premium, multi-channel, and high-bandwidth analyzers limit adoption for small teams and academic institutions

- For instance, during 2024–2025, fluctuations in semiconductor component prices, supply chain disruptions, and longer lead times increased device costs for multiple global vendors

- Complexity in analyzing high-speed digital protocols, mixed-signal systems, and advanced timing sequences increases the need for skilled personnel and training programs

- Limited awareness in emerging markets regarding protocol support, debugging best practices, and analyzer capabilities slows adoption

- Competition from digital oscilloscopes with MSO features, software debuggers, and protocol analyzers creates pricing pressure and limits differentiation

- To overcome these challenges, companies are focusing on cost-optimized designs, enhanced training, cloud-based analytics, and higher software integration to boost global adoption of tantalum carbide coating for graphites

How is the Tantalum Carbide Coating for Graphite Market Segmented?

The market is segmented on the basis of coating method and application.

- By Coating Method

On the basis of coating method, the tantalum carbide coating for graphite market is segmented into Chemical Vapour Deposition (CVD), Physical Vapour Deposition (PVD), and Others. The CVD segment dominated the market with a 44.2% share in 2025, driven by its superior uniformity, excellent adhesion, and ability to produce high-purity coatings suitable for high-performance applications. CVD coatings are widely used in semiconductor wafers, precision machine components, and advanced electronic devices due to their durability, thermal stability, and resistance to wear and corrosion. Their capability to coat complex geometries efficiently makes them highly preferred in industrial R&D, electronics prototyping, and aerospace components.

The PVD segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to increasing adoption in flexible electronics, cutting tools, and high-speed machinery. PVD’s lower processing temperatures, faster deposition rates, and compatibility with lightweight substrates are driving rapid adoption in emerging semiconductor and aviation applications globally.

- By Application

On the basis of application, the market is segmented into Semiconductor and Electronics, Aerospace and Aviation, Machine Tools, and Others. The Semiconductor and Electronics segment dominated the market with a 42.7% share in 2025, supported by rising demand for high-performance coatings on graphite crucibles, substrates, and electrode materials. Tantalum carbide coatings enhance conductivity, wear resistance, and thermal stability, making them essential for IC manufacturing, advanced PCBs, and electronic component testing. Companies are increasingly using these coatings in R&D labs, electronics prototyping centers, and high-reliability industrial setups to improve operational efficiency and product lifespan.

The Aerospace and Aviation segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by adoption in turbine blades, aircraft engine components, and precision aviation machinery. High-temperature resistance, chemical inertness, and mechanical robustness of TaC coatings make them ideal for aerospace applications, driving long-term growth in this segment.

Which Region Holds the Largest Share of the Tantalum Carbide Coating for Graphite Market?

- North America dominated the tantalum carbide coating for graphite market with a 41.06% revenue share in 2025, driven by strong growth in semiconductor design, advanced electronics manufacturing, and extensive R&D activities across the U.S. and Canada. Increasing adoption of high-performance embedded systems, power electronics, and precision industrial equipment fuels demand for TaC coatings in laboratory, industrial, and aerospace applications

- Leading companies in North America are deploying innovative solutions for coating uniformity, thermal stability, and high-purity TaC applications, reinforcing the region’s technological leadership. Continuous investment in EV electronics, AI hardware, and high-performance industrial components further supports long-term market expansion

- Strong engineering talent, well-established semiconductor and industrial clusters, and government-backed technology initiatives reinforce North America’s dominant position

U.S. Tantalum Carbide Coating for Graphite Market Insight

The U.S. is the largest contributor, supported by semiconductor R&D, advanced manufacturing facilities, and extensive utilization of TaC-coated components in aerospace, automotive, and industrial automation sectors. Rising demand for high-temperature resistant, wear-proof, and thermally stable coatings in advanced electronics and machine tools drives adoption. Presence of major research labs and industry leaders further strengthens market growth.

Canada Tantalum Carbide Coating for Graphite Market Insight

Canada contributes significantly through increasing investment in electronics, aerospace, and industrial applications. Engineering clusters, universities, and industrial R&D centers are leveraging TaC coatings for semiconductor wafers, precision tooling, and embedded system components. Government innovation programs and skilled workforce availability enhance market adoption across the country.

Asia-Pacific Tantalum Carbide Coating for Graphite Market

Asia-Pacific is projected to register the fastest CAGR of 9.36% from 2026 to 2033, driven by expanding semiconductor manufacturing, electronics production, and adoption of advanced industrial tools across China, Japan, India, South Korea, and Southeast Asia. Rapid production of PCBs, automotive ECUs, IoT devices, and high-performance industrial machinery is driving demand for durable, thermally stable, and high-purity TaC coatings.

China Tantalum Carbide Coating for Graphite Market Insight

China is the largest contributor to Asia-Pacific, fueled by massive semiconductor investments, advanced electronics manufacturing infrastructure, and government-backed industrial innovation programs. Demand for TaC coatings in high-temperature, wear-resistant, and high-purity applications is rising steadily, supporting domestic and export markets.

Japan Tantalum Carbide Coating for Graphite Market Insight

Japan shows steady growth, supported by precision electronics, aerospace, and industrial control sectors. High-quality engineering standards and adoption of durable coatings in semiconductor and machining applications reinforce premium product usage.

India Tantalum Carbide Coating for Graphite Market Insight

India is emerging as a key growth hub, driven by electronics manufacturing expansion, startup activity, and government-supported R&D programs. Increasing demand for durable, high-performance coatings for automotive, aerospace, and industrial applications accelerates market adoption.

South Korea Tantalum Carbide Coating for Graphite Market Insight

South Korea contributes significantly due to strong semiconductor and electronics production, 5G systems, and advanced automotive components. Rapid industrial automation and high-performance electronics manufacturing drive TaC coating adoption in high-temperature and precision applications.

Which are the Top Companies in Tantalum Carbide Coating for Graphite Market?

The tantalum carbide coating for graphite industry is primarily led by well-established companies, including:

- Bay Carbon Inc. (U.S.)

- Toyo Tanso Co., Ltd. (Japan)

- Nanoshel LLC (U.S.)

- Momentive (U.S.)

- Materion Corporation (U.S.)

- Hunan WISE New Material Technology Co., Ltd. (China)

- American Elements (U.S.)

- CGT Carbon GmbH (Germany)

- Pacific Particulate Materials (PPM) Ltd. (U.K.)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Merck KGaA (Germany)

- Alfa Aesar (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

What are the Recent Developments in Global Tantalum Carbide Coating for Graphite Market?

- In February 2025, CNVET Energy highlighted emerging trends in TaC-coated graphite susceptor technology, focusing on innovations in CVD processes and enhanced material durability, which are accelerating growth in semiconductor and aerospace sectors where high-performance materials are critical. This advancement is expected to boost adoption of TaC-coated components globally

- In November 2024, Toyo Tanso Co., Ltd. announced a major capital investment to expand tantalum carbide-coated graphite production capacity, with new facilities set to commence operations during 2025-2026, targeting higher market share in SiC and GaN epitaxy applications for semiconductor manufacturing. This expansion will strengthen the company’s position in high-performance TaC solutions

- In August 2024, Momentive Performance Materials launched advanced tantalum carbide coating formulations for MOVPE and CVD applications, integrating improved thermal stability and corrosion resistance to enhance wafer quality and extend equipment lifespan in wide-bandgap semiconductor production. These formulations are expected to set new industry benchmarks for TaC-coated graphite performance

- In May 2024, Semicera announced a breakthrough in TaC coating technology, achieving superior purity, temperature stability, and chemical tolerance, which improved the quality of SiC/GaN crystals and epitaxial layers while prolonging reactor component life. This innovation is such asly to drive higher adoption across semiconductor fabrication facilities

- In May 2024, Bay Carbon Inc. revealed strategic expansion of international distribution partnerships to increase market penetration in Asia-Pacific and Europe, specifically targeting semiconductor equipment manufacturers that require specialized TaC-coated graphite components for advanced epitaxial growth systems. This strategy is expected to enhance the company’s global reach and market influence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tantalum Carbide Coating For Graphite Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tantalum Carbide Coating For Graphite Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tantalum Carbide Coating For Graphite Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.