Global Table Sauce Market

Market Size in USD Billion

CAGR :

%

USD

8.56 Billion

USD

14.07 Billion

2024

2032

USD

8.56 Billion

USD

14.07 Billion

2024

2032

| 2025 –2032 | |

| USD 8.56 Billion | |

| USD 14.07 Billion | |

|

|

|

|

Table Sauce Market Size

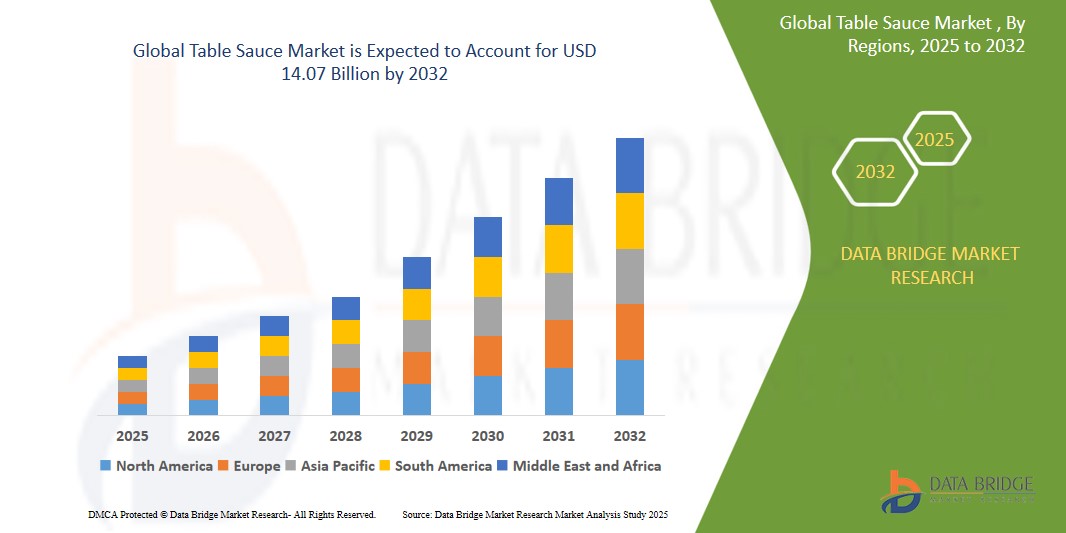

- The global Table Sauce market size was valued at USD 8.56 billion in 2024 and is expected to reach USD 14.07 billion by 2032, at a CAGR of 6.44% during the forecast period.

- This growth is driven by increasing consumer demand for diverse and high-quality table sauces, with a shift toward healthier options like low-sodium and organic sauces. Additionally, the popularity of international cuisines and changing dietary preferences are further boosting market expansion. Consumers’ preference for convenient, ready-to-use sauces in eco-friendly packaging is also fueling market growth

Table Sauce Market Analysis

- Table sauce is an edible substance in the form of liquid, cream or semi-solid and is used to boost the flavour, taste, moisture, and look of the dishes

- The major drivers of the table sauce market are increasing demand of table sauce and dressing product, innovative product launched by key players, rising income and alter in lifestyles, rigorous restrictive framework and health considerations associated with excess consumption of sugar, salt and preservatives

- Europe is expected to dominate the Table Sauce market with a market share of approximately 34.2% due to high consumer preference for premium sauces, well-established retail networks, and a strong culinary tradition of using table sauces in various cuisines

- The Asia-Pacific region is expected to witness the highest growth rate in the Table Sauce market, projected to register a CAGR of 8.10% and account for a market share of 35.7% in 2025. This growth is driven by rapid urbanization, a shift toward Western culinary influences, and increased demand for convenient and ready-to-use sauces in countries like China and India

- In 2025, the supermarkets/hypermarkets and dressings segment is projected to dominate the global Table Sauce market with the largest share of 41.2% in the Distribution Channel segment. This dominance is attributed to the wide product assortment, attractive in-store promotions, and the convenience of one-stop shopping

Report Scope and Table Sauce Market Segmentation

|

Attributes |

Table Sauce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Table Sauce Market Trends

“Flavor Innovation and Ethnic Fusion Driving Consumer Interest”

-

One notable trend in the global Table Sauce market is the rising demand for bold, diverse, and ethnic flavor profiles as consumers seek novel culinary experiences influenced by global cuisines

- Manufacturers are expanding their product lines with unique blends, such as Korean Gochujang, Indian Tikka Masala, and Mexican Chipotle, catering to evolving palates and multicultural food preferences

- For instance, in February 2025, Kraft Heinz launched a global flavor series including sauces inspired by Asian and Latin American recipes, aiming to capitalize on the growing trend of fusion cooking at home

This trend not only enhances product differentiation but also allows brands to tap into new consumer segments, driving innovation, repeat purchases, and global market expansion

Table Sauce Market Dynamics

Driver

“Growing Popularity of Home Cooking and Gourmet Experimentation”

- One of the key drivers propelling the growth of the global Table Sauce market is the surge in home cooking and the increasing enthusiasm for gourmet experimentation. This trend has gained momentum as more consumers, particularly millennials and Gen Z, turn to cooking at home for health, cost, and creative reasons

- Social media platforms like TikTok, YouTube, and Instagram have amplified this shift by popularizing cooking challenges, recipe trends, and exotic culinary content that inspire people to try new dishes

- The demand for ready-to-use sauces that bring restaurant-quality flavors into the home has significantly risen, including offerings such as Sriracha-infused mayonnaise, chipotle barbecue, teriyaki glazes, and truffle aiolis

For instance,

- in January 2025, Unilever’s Knorr brand unveiled a new premium sauce range crafted specifically for at-home chefs. The line includes flavor-rich variants like Black Garlic Truffle, Smoky Harissa, and Thai Coconut Curry, designed to simplify gourmet cooking without compromising on taste or authenticity.

This movement is not only expanding the customer base for table sauces but also encouraging frequent repurchases and experimentation with new cuisines, further stimulating market growth and product innovation

Opportunity

“Increasing Demand for Health-Conscious and Clean Label Products”

- A significant opportunity for the Table Sauce market is the growing consumer demand for health-conscious and clean-label products. As more consumers focus on eating healthier and making informed choices about their food, there is an increasing preference for table sauces with natural, organic ingredients, free from artificial preservatives, additives, and excessive sugar

- Consumers are actively seeking sauces that offer transparent ingredient lists, with an emphasis on quality, nutrition, and health benefits, driving the market for clean-label sauces

For instance,

- In February 2025, McCormick & Company launched a new line of organic table sauces, featuring clean labels with no artificial colors, preservatives, or high fructose corn syrup, catering to the growing health-conscious consumer segment

This trend presents an opportunity for manufacturers to expand their product lines to meet the rising demand for healthier, clean-label alternatives, allowing them to tap into a more health-aware consumer base and increase brand loyalty

Restraint/Challenge

“Rising Popularity of Plant-Based and Vegan Sauces”

- The Table Sauce market has a significant opportunity driven by the growing consumer demand for plant-based and vegan products. As more individuals adopt plant-based diets or reduce their animal product consumption for health, ethical, or environmental reasons, the need for plant-based sauces, including vegan alternatives to traditional mayonnaise, dressings, and dips, is increasing

- Manufacturers can capitalize on this trend by developing new, innovative plant-based and dairy-free options that cater to the vegan and flexitarian markets, offering consumers a wide variety of flavor profiles and healthier alternatives

For instance,

- In March 2025, Unilever launched a new line of vegan sauces under its Hellmann's brand, including plant-based mayonnaise and dressings, aiming to meet the growing demand for plant-based food options while also aligning with sustainability goal

This trend presents an opportunity for brands to expand their product offerings and appeal to a broader, health-conscious, and environmentally aware consumer base

Table Sauce Market Scope

The market is segmented on the basis of materials, type, ingredient and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Ingredient |

|

|

By Distribution Channel |

|

In 2025, the supermarkets/hypermarkets segment is projected to dominate the market with a largest share in Global Table Sauce Market

In 2025, the supermarkets/hypermarkets and dressings segment is projected to dominate the global Table Sauce market with the largest share of 41.2% in the Distribution Channel segment. This dominance is attributed to the wide product assortment, attractive in-store promotions, and the convenience of one-stop shopping. These retail formats offer better visibility and accessibility for both established and emerging table sauce brands, influencing consumer purchase decisions and driving higher sales volumes across urban and semi-urban areas globally

The sauces and dressings is expected to account for the largest share during the forecast period in Global Table Sauce Market

In 2025, the sauces and dressings segment is projected to dominate the global Table Sauce market with the largest share of 38.5% in the type segment, driven by increasing consumer preference for flavor-enhancing condiments, the growing popularity of international cuisines, and rising demand for convenient cooking solutions. Additionally, the availability of a wide variety of sauces from organic and low-calorie options to gourmet and ethnic flavors has further strengthened this segment’s global appeal

Table Sauce Market Regional Analysis

“Europe Holds the Largest Share in the Table Sauce Market”

-

Europe dominated the Table Sauce market, accounting for the largest regional share of 34.2% in 2025, driven by high consumer demand for a variety of sauces, including tomato-based, mayonnaise, and mustard, as well as a strong culinary tradition across multiple countries

- The U.K., Germany, and France hold significant shares due to their well-established retail infrastructure, and the growing preference for premium and organic table sauces continues to boost demand

- Technological advancements in production, such as the development of healthier sauce alternatives and eco-friendly packaging, are gaining momentum, supported by consumer demand for convenience and sustainability

- Moreover, shifting consumer preferences toward clean-label products, combined with a rising trend in at-home cooking and gourmet dining, continue to strengthen Europe’s leadership in the global table sauce market

“Asia-Pacific is Projected to Register the Highest CAGR in the Table Sauce Market”

-

The Asia-Pacific region is expected to witness the highest growth rate in the Table Sauce market, projected to register a CAGR of 8.1% and account for a market share of 31.5% in 2025. This growth is driven by rapid urbanization, increasing health consciousness, and the rising popularity of Western cuisines across the region

- Countries such as China, India, and Indonesia are emerging as key markets due to the growing demand for ready-to-use sauces, as well as rising disposable incomes and changing dietary habits

- China, with its expanding middle-class population and strong culinary interest, is investing heavily in the innovation of flavor profiles and packaging solutions to cater to diverse regional tastes

- India’s market is experiencing robust growth, fueled by the rise of organized retail and the increasing availability of table sauces in smaller, more affordable pack sizes. Additionally, both domestic and international brands are focusing on expanding their reach in urban and semi-urban areas, accelerating market growth in the region

Table Sauce Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- The Kraft Heinz Company (U.S.)

- Unilever (U.K./Netherlands)

- Northwest Gourmet Foods (U.S.)

- Nestlé S.A. (Switzerland)

- McCormick & Company, Inc. (U.S.)

- Hain Celestial (U.S.)

- Orkla ASA (Norway)

- ACH Food Companies, Inc. (U.S.)

- Quattro Foods (U.K.)

- Concord Foods, LLC (U.S.)

- The Kroger Co. (U.S.)

- CSC BRANDS, L.P. (U.S.) (Subsidiary of Campbell Soup Company)

- Conagra Brands, Inc. (U.S.)

- The Clorox Company (U.S.)

- OTAFUKU SAUCE Co., Ltd. (Japan)

Latest Developments in Global Table Sauce Market

- In April 2025, Cholula, renowned for its iconic hot sauce, introduced its most extensive product expansion to date, launching 11 new items. These include four new cooking sauces, finishing sauces, and seasoning blends, all designed to bring restaurant-quality Mexican-inspired flavors into home kitchens. This move aims to meet consumers' growing appetite for adventurous meals and diversify Cholula's product portfolio beyond traditional hot sauces

- In April 2025, Heinz caused a stir by discontinuing its traditional tartare sauce and introducing a new product called "Fish and Chips Sauce" as its replacement. Marketed as a fresher, more widely appealing version designed to pair well with dishes like fish and chips, the new sauce has faced mixed reactions from consumers, some of whom view it as a rebranding rather than a genuine innovation.

- In April 2025, The Guardian reported that the popularity of condiments is soaring, driven by the "little treat culture" and consumer desire for affordable luxuries. Retailers such as Delli, Waitrose, and Marks & Spencer have reported significant increases in condiment sales, particularly for high-end and trend-driven items like chili oils, truffle mayonnaise, and global flavors such as miso pesto and green harissa. Social media platforms like #CondimentTok are fueling this trend, with consumers showcasing visually appealing jars and creative uses

- In March 2025, Selfridges, the renowned UK department store, dedicated a window display at its Oxford Street location to hot sauces, stocking over 100 brands. Sales of hot sauce at Selfridges have risen by 55% compared to the previous year, surpassing those of ketchup and mayonnaise combined. This trend is largely driven by Gen Z consumers and social media influencers, with unique flavors like truffle-infused and smoky hot sauces gaining popularity

- In February 2025, Carbone Fine Food introduced five new pasta sauce flavors, including Sweet Pepper & Onion, Mediterranean Marinara, Black Truffle Alfredo, Mac & Cheese Alfredo, and Lemon Pepper Alfredo. Created by chefs Mario Carbone and Rich Torrisi, these sauces aim to offer bold, exciting flavors for easy home dining and are available nationwide at Whole Foods Market and online

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Table Sauce Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Table Sauce Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Table Sauce Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.