Global Synthetic Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

3.79 Billion

2024

2032

USD

1.52 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.52 Billion | |

| USD 3.79 Billion | |

|

|

|

|

Synthetic Monitoring Market Size

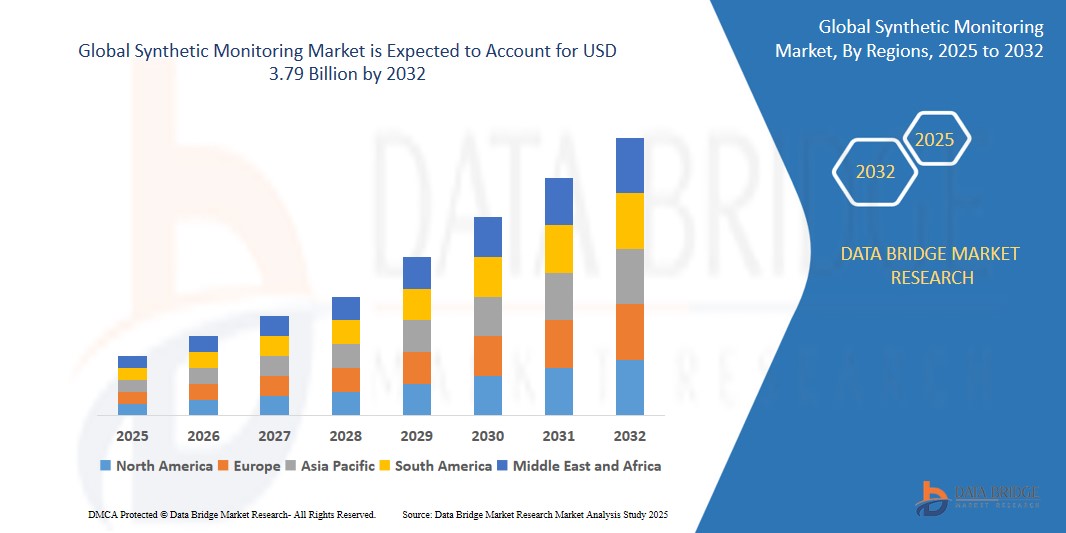

- The Global Synthetic Monitoring Market size was valued at USD 1.52 billion in 2024 and is expected to reach USD 3.79 billion by 2032, at a CAGR of 12.10% during the forecast period

- This growth is driven by factors such as the rising demand for proactive application performance management amid increasing digital transformation and IT infrastructure complexity

Synthetic Monitoring Market Analysis

- Synthetic monitoring plays a crucial role in ensuring optimal digital experience by simulating user interactions across websites, applications, and APIs, allowing organizations to detect performance issues before real users are affected.

- Market growth is driven by the rising demand for proactive performance management, increasing complexity of digital infrastructures, and the rapid shift toward cloud-native and microservices-based applications.

- North America is expected to dominate the global synthetic monitoring market, supported by the presence of major technology companies, widespread cloud adoption, and a strong focus on user experience optimization.

- The Asia Pacific region is anticipated to witness the fastest growth, driven by digital transformation initiatives, increasing internet penetration, and growing adoption of e-commerce and mobile applications across emerging economies.

- The website monitoring segment holds the largest market share 45.67%, as businesses prioritize uninterrupted online presence and fast page load times to retain customers and drive revenue through digital platforms.

Report Scope and Synthetic Monitoring Market Segmentation

|

Attributes |

Synthetic Monitoring Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Synthetic Monitoring Market Trends

“AI-Powered Synthetic Monitoring for Predictive User Experience Optimization”

- A significant trend shaping the synthetic monitoring market is the integration of artificial intelligence (AI) and machine learning (ML) into monitoring tools, enabling predictive insights and automated anomaly detection across web, mobile, and API based applications.

- These AI driven systems not only identify issues before they affect real users but also suggest performance optimizations based on usage patterns, load behavior, and historical performance metrics.

- For instance, In February 2025, Datadog enhanced its synthetic monitoring platform by integrating AI based auto remediation and intelligent alerting capabilities. This update allowed IT teams to predict outages, reduce false alerts, and resolve performance bottlenecks proactively transforming incident management in enterprise environments.

- As digital experience becomes a core differentiator, businesses are rapidly adopting AI-enhanced monitoring to ensure seamless, high-performing digital services at scale.

Synthetic Monitoring Market Dynamics

Driver

“Growing Demand for Seamless Digital User Experiences”

- Businesses across industries are increasingly dependent on digital platforms to interact with customers, making uptime and performance essential.

- Synthetic monitoring allows organizations to simulate user journeys, identify issues before users are impacted, and maintain consistent application performance across geographies

- For example, in July 2024, a major global retail chain implemented API and website synthetic monitoring across its e-commerce platform to detect latency and downtime issues ahead of its holiday season traffic surge, significantly improving customer retention and revenue

- The demand for proactive monitoring is especially high among e-commerce, BFSI, and SaaS sectors where even minor downtimes can lead to revenue losses and customer churn

Opportunity

“Rising Adoption of Cloud-Based Monitoring Solutions Among SMEs

- The increasing availability of cloud-native synthetic monitoring platforms offers a scalable, cost effective solution ideal for small and medium enterprises (SMEs).

- These platforms reduce deployment costs, enable quick onboarding, and offer centralized dashboards with real-time insights into application health and performance.

- In January 2025, several mid sized software firms in Southeast Asia adopted cloud-based synthetic monitoring tools like Pingdom and UptimeRobot to enhance their digital reliability and customer satisfaction, without significant infrastructure investments.

- With remote work, distributed teams, and growing cloud adoption, the demand for SaaS-based synthetic monitoring tools is projected to rise sharply across emerging markets.

Restraint/Challenge

“Data Privacy and Regional Compliance Concerns”

- One of the major challenges in the synthetic monitoring market is navigating complex data privacy regulations such as GDPR, CCPA, and country specific cloud data laws.

- Simulated traffic and synthetic probes, especially across borders, raise compliance risks related to data storage, transmission, and monitoring practices.

- For instance, In November 2024, a global IT service provider faced delays in deploying synthetic monitoring across EU client websites due to conflicting interpretations of GDPR regarding telemetry data collected via synthetic tests.

- Vendors must invest in localized data centers, transparent privacy policies, and regulatory alignment to maintain trust and market access especially in regulated industries like finance and healthcare.

Synthetic Monitoring Market Scope

The market is segmented on the basis, type, component, technology, deployment mode, end use.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Deployment Mode |

|

|

By Industry Vertical

|

|

In 2025, The website monitoring segment is expected to hold the largest market share and dominate the market

In 2025, the website monitoring segment is projected to dominate the Global Synthetic Monitoring Market by monitoring type, driven by the increasing reliance on digital platforms and e-commerce, where website availability, speed, and performance directly impact customer retention and revenue generation. Organizations are prioritizing continuous website uptime and performance benchmarking to ensure seamless user experiences across different geographies and devices.

The cloud is expected to account for the largest share in the deployment model segment during the forecast period.

The cloud segment is expected to be the second dominant segment in the Global Synthetic Monitoring Market in 2025, owing to its scalability, ease of integration, lower upfront costs, and growing adoption of SaaS applications across enterprises. As organizations increasingly migrate to cloud-native architectures, synthetic monitoring solutions deployed via the cloud offer faster implementation, real-time analytics, and flexible access, making them the preferred choice for modern IT environments.

Synthetic Monitoring Market Regional Analysis

“North America Holds the Largest Share in the Synthetic Monitoring Market”

- North America leads the global synthetic monitoring market due to its advanced IT infrastructure, early adoption of digital transformation, and strong presence of cloud-native enterprises. The region has a high concentration of technology-driven industries such as IT & telecom, BFSI, and e-commerce, all of which rely on real-time performance monitoring to deliver seamless digital experiences.

- The United States, in particular, is the key contributor, with widespread use of synthetic monitoring tools across web services, SaaS platforms, and enterprise applications.

“Asia-Pacific is Projected to Register the Highest CAGR in the Synthetic Monitoring Market”

- Asia-Pacific is expected to witness the fastest growth in the synthetic monitoring market, driven by the region’s rapid digital transformation, increasing cloud adoption, and expansion of online services. Countries like China, India, and Southeast Asian nations are investing heavily in IT modernization, making synthetic monitoring critical for ensuring digital service quality.

- India’s growing startup ecosystem and China’s tech giants are increasingly adopting synthetic monitoring to support scalable, resilient digital platforms for e-commerce, fintech, and mobile apps. Rising internet penetration, 5G rollout, and smart city initiatives are further accelerating the need for robust application performance tools.

Synthetic Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- New Relic (U.S.)

- Datadog (U.S.)

- Pingdom (Sweden)

- Catchpoint (U.S.)

- Broadcom (U.S.)

- ThousandEyes (U.S.)

- Uptrends (Netherlands)

- Apica Systems (Sweden)

- Site24x7 (India)

- Rigor (U.S.)

- Micro Focus (U.K.)

- BMC Software (U.S.)

- SmartBear (U.S.)

- Keynote Systems (U.S.)

- LogicMonitor (U.S.)

- Sematext (U.S.)

- Nagios (U.S.)

Latest Developments in Global Synthetic Monitoring Market

- In March 2025, Datadog launched a new Synthetic Monitoring solution aimed at improving the performance and reliability of web and mobile applications. This new product integrates seamlessly with Datadog’s existing APM (Application Performance Management) tools, enabling real time user experience simulation and proactive monitoring of application performance. This launch helps companies monitor the availability and speed of their services, offering detailed insights for reducing downtime and improving the customer experience across various devices and platforms

- In February 2025, New Relic partnered with Amazon Web Services (AWS) to enhance their synthetic monitoring solutions using AWS's cloud infrastructure. The collaboration aims to deliver more robust, scalable, and flexible synthetic monitoring for cloud-based applications. By leveraging AWS's global infrastructure, New Relic’s synthetic monitoring capabilities can now simulate real user experiences across different regions, helping businesses improve their cloud application performance and customer satisfaction

- In January 2025, Datadog acquired Rigor, a leading provider of synthetic monitoring tools. This acquisition enhances Datadog’s monitoring platform by integrating Rigor’s advanced website and API monitoring capabilities, allowing for detailed performance insights and uptime tracking for both desktop and mobile platforms. The acquisition is expected to drive innovation in the synthetic monitoring space, giving Datadog users enhanced visibility into application performance and enabling faster identification of performance issues before they impact end-users

- In December 2024, Dynatrace unveiled a new AI-powered synthetic monitoring solution. This innovation uses artificial intelligence to automatically adjust monitoring scripts based on real user interactions and environmental factors, enhancing the ability to detect issues before they affect users. By leveraging machine learning models, the product helps businesses predict potential failures and improve the uptime and reliability of digital services. The tool is designed to offer deeper insights into both web and mobile application performance, allowing businesses to proactively address problems.

- In November 2024, Catchpoint, a leader in digital experience monitoring, announced a strategic partnership with Microsoft to integrate its synthetic monitoring capabilities with Microsoft’s Azure Monitor. This partnership enables users to monitor both cloud-based and on-premises environments using Catchpoint’s synthetic testing services. With this integration, Azure users can now get end-to-end visibility of their web and API performance, ensuring better uptime and faster service delivery across diverse digital platforms.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.