Global Sugar Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

21.64 Billion

USD

43.11 Billion

2024

2032

USD

21.64 Billion

USD

43.11 Billion

2024

2032

| 2025 –2032 | |

| USD 21.64 Billion | |

| USD 43.11 Billion | |

|

|

|

|

Sugar Substitutes Market Size

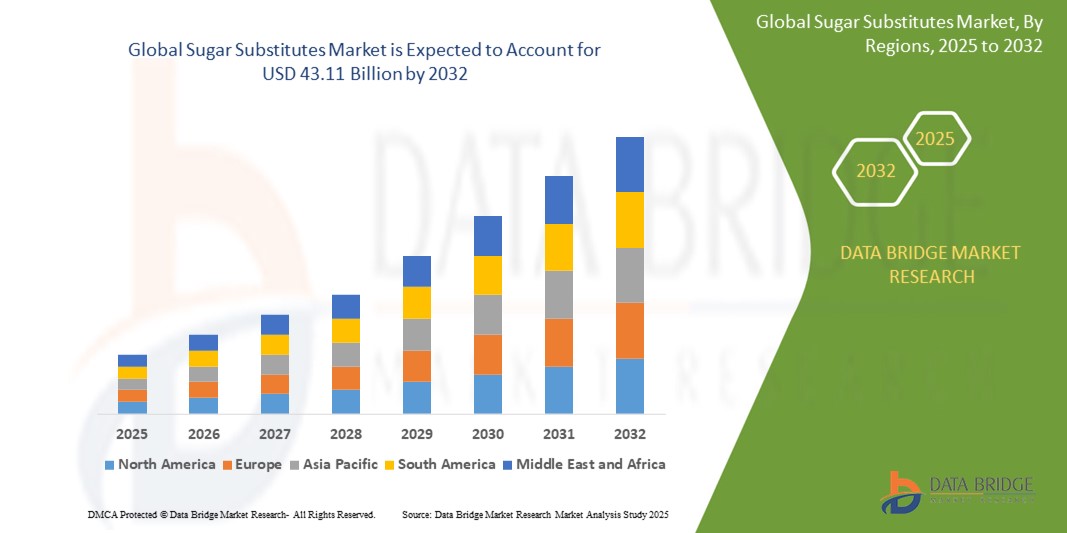

- The global sugar substitutes market size was valued at USD 21.64 billion in 2024 and is expected to reach USD 43.11 billion by 2032, at a CAGR of 9.00% during the forecast period

- This growth is driven by factors such as rising health awareness, government sugar reduction initiatives, demand for low-calorie products, and growing use of natural sweeteners in processed foods and beverages

Sugar Substitutes Market Analysis

- Sugar substitutes are essential ingredients used to provide sweetness without the calories of sugar, playing a vital role in supporting healthier diets and catering to diabetic and health-conscious consumers across diverse food and beverage applications

- The sugar substitutes market is experiencing steady growth, driven by rising health concerns over sugar intake, growing demand for low-calorie and clean-label products, innovation in natural sweeteners, and the expanding global processed food and beverage industry

- North America is expected to dominate the sugar substitutes market with a share of 35.2%, due to the rising health concerns over sugar consumption, strong demand for low-calorie and diabetic-friendly products, and a well-developed food and beverage industry actively reformulating products to include sugar alternatives

- Asia-Pacific is expected to be the fastest growing region in the sugar substitutes market during the forecast period due to increasing health consciousness, rising rates of diabetes and obesity, and a growing demand for sugar-free and reduced-calorie food and beverage options

- High-intensity sweeteners segment is expected to dominate the market with a market share of 70.91% due to their superior sweetness potency compared to sugar, which allows for lower usage volumes, cost-effectiveness in large-scale food and beverage manufacturing, and growing consumer demand for low-calorie and diabetic-friendly products

Report Scope and Sugar Substitutes Market Segmentation

|

Attributes |

Sugar Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar Substitutes Market Trends

“Growing Demand for Natural and Plant-Based Sugar Substitutes”

- One prominent trend in the global sugar substitutes market is the growing demand for natural and plant-based sugar substitutes

- This trend is driven by the increasing consumer awareness of health risks associated with artificial additives, a strong preference for clean-label products, and rising interest in sustainable and minimally processed ingredients

- For instance, companies such as Cargill, PureCircle, and Tate & Lyle are expanding their portfolios with stevia, monk fruit, and other plant-derived sweeteners to cater to the shifting demand for natural sugar alternatives

- The preference for plant-based sugar substitutes is gaining momentum in both developed markets such as North America and Europe, and rapidly growing economies in Asia-Pacific, where health-conscious consumption is on the rise

- As consumers continue to prioritize wellness and transparency in food ingredients, the adoption of natural sugar substitutes is expected to remain a defining trend in shaping the future of the sugar substitutes market

Sugar Substitutes Market Dynamics

Driver

“Rising Demand for Keto and Low-Carb Diets”

- Rising demand for keto and low-carb diets is a significant driver for the sugar substitutes market, as consumers increasingly seek alternatives to traditional sugar that align with their dietary goals

- This shift is accelerating globally, with more individuals adopting low-carb lifestyles to support weight management, improve metabolic health, and reduce sugar intake

- As the food and beverage industry adapts to these preferences, there is growing emphasis on developing sugar substitutes that offer sweetness without affecting blood sugar levels, such as erythritol, stevia, and monk fruit

- Manufacturers are actively innovating to create keto-friendly sweeteners that can be used in baking, beverages, snacks, and supplements, enabling brands to tap into the expanding health and wellness segment

- In addition, the rise of social media trends, influencer-led nutrition movements, and growing availability of low-carb product lines are amplifying consumer demand for sugar substitutes

For instance,

- Brands such as Lakanto and Swerve have seen strong growth by marketing plant-based, zero-calorie sweeteners that cater specifically to keto and low-carb audiences

- Aloha and Perfect Keto are leveraging natural sweeteners such as monk fruit and stevia in their keto-friendly snack bars and protein powders, further fueling the trend

- As these diets continue to gain popularity, the demand for compatible sugar alternatives will remain a major driver shaping the growth of the global sugar substitutes market

Opportunity

“Growing Clean Label Demand”

- The growing demand for clean-label products presents a significant opportunity for the sugar substitutes market, as consumers increasingly prioritize transparency, natural ingredients, and minimal processing in the products they purchase

- Food manufacturers are capitalizing on this trend by reformulating products to include natural, plant-based sweeteners and clearly communicating the absence of artificial additives and preservatives

- This opportunity aligns with the broader consumer shift towards healthier, simpler food options, with an emphasis on products that are both functional and free from synthetic ingredients

For instance,

- Companies such as Cargill and Tate & Lyle are expanding their offerings of clean-label sugar substitutes, such as stevia and monk fruit, to meet the rising demand for natural sweeteners in a variety of food and beverage categories

- Stevia producer PureCircle has partnered with brands such as PepsiCo and Coca-Cola to develop clean-label, reduced-sugar beverages that cater to the growing preference for transparency and natural ingredients

- As consumer demand for clean-label products continues to rise, the sugar substitutes market is well-positioned to benefit from this trend, with opportunities to expand product offerings and cater to the growing need for simple, natural, and healthier alternatives

Restraint/Challenge

“Lack of Availability of Sugar Substitutes”

- The limited availability of sugar substitutes presents a significant challenge for the sugar substitutes market, as manufacturers struggle to meet the growing demand for alternatives that are both effective and affordable

- Finding scalable, cost-efficient sugar substitutes that provide the same taste and functionality as traditional sugar remains a complex task, requiring ongoing innovation and investment in research and development

- This challenge is further complicated by the need to ensure consistent supply chains, meet regulatory standards, and maintain product quality and taste across diverse applications in food and beverages

For instance,

- Companies such as Cargill and Stevia First are working to improve the availability of natural sweeteners such as stevia and monk fruit but face difficulties in scaling production and ensuring cost-effectiveness for mass-market use

- Without a stable, affordable supply of high-quality sugar substitutes, food manufacturers may encounter difficulties in meeting market demands, potentially limiting product offerings and impacting growth in health-conscious and sugar-reduction segments

Sugar Substitutes Market Scope

The market is segmented on the basis of type, manufacturing process, application, and form.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Manufacturing Process |

|

|

By Application |

|

|

By Form |

|

In 2025, the high-intensity sweeteners is projected to dominate the market with a largest share in type segment

The high-intensity sweeteners segment is expected to dominate the sugar substitutes market with the largest share of 70.91% in 2025 due to their superior sweetness potency compared to sugar, which allows for lower usage volumes, cost-effectiveness in large-scale food and beverage manufacturing, and growing consumer demand for low-calorie and diabetic-friendly products.

The beverages is expected to account for the largest share during the forecast period in application segment

In 2025, the beverages segment is expected to dominate the market with the largest market share of 44.77% due to widespread use of sugar substitutes in soft drinks, energy drinks, and flavored water to reduce calorie content, meet consumer demand for healthier options, and comply with sugar reduction regulations in many countries.

Sugar Substitutes Market Regional Analysis

“North America Holds the Largest Share in the Sugar substitutes Market”

- North America dominates the sugar substitutes market with a share of 35.2%, driven by the rising health concerns over sugar consumption, strong demand for low-calorie and diabetic-friendly products, and a well-developed food and beverage industry actively reformulating products to include sugar alternatives

- U.S. holds a significant share of 85.0% in North America due to its high prevalence of lifestyle-related health conditions such as obesity and diabetes, coupled with growing consumer preference for clean-label and natural sweeteners in packaged foods and beverages

- Regional dominance is further reinforced by robust regulatory support for sugar reduction initiatives, strong R&D capabilities, and the presence of leading global manufacturers focused on innovation in high-intensity sweeteners

- With increasing health awareness, expanding applications across the food, beverage, and healthcare sectors, and continuous product development, North America is expected to maintain its leading position in the global sugar substitutes market through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Sugar substitutes Market”

- Asia-Pacific is expected to witness the highest growth rate in the sugar substitutes market, driven by increasing health consciousness, rising rates of diabetes and obesity, and a growing demand for sugar-free and reduced-calorie food and beverage options

- China holds a significant share due to urbanization, changing dietary patterns, and expanding consumption of processed and functional foods that incorporate sugar alternatives

- Regional market expansion is further driven by government initiatives promoting sugar reduction, increasing penetration of Western food trends, and greater availability of sugar substitutes in retail and foodservice channels

- With rising disposable incomes, growing middle-class populations, and heightened focus on health and wellness, Asia-Pacific is set to emerge as the fastest-growing region in the global sugar substitutes market during the forecast period

Sugar Substitutes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- zuChem Inc. (U.S.)

- Ingredion (U.S.)

- BENEO (Belgium)

- Cargill, Incorporated (U.S.)

- DuPont (U.S.)

- Foodchem International Corporation (China)

- JK Sucralose Inc. (China)

- HYET Sweet (U.S.)

- Roquette Frères (France)

- Mitsui Sugar Co.,Ltd. (Japan)

- ADM (U.S.)

- Tate & Lyle (U.K.)

- Pyure Brands LLC (U.S.)

- PureCircle (Japan)

- Ajinomoto Health & Nutrition North America, Inc. (U.S.)

- Alsiano (U.S.)

- StartingLine S.p.A. (Denmark)

- NutraSweet Co. (U.S.)

- MAFCO Worldwide LLC (U.S.)

- Matsutani Chemical Industry Co., Ltd. (Japan)

Latest Developments in Global Sugar Substitutes Market

- In September 2022, Nestlé S.A. launched Resugar Synergy, a groundbreaking ingredient specifically formulated for low-calorie ice cream bars. This plant-based, natural, and non-GMO compound mirrors the sweetness and characteristics of traditional sucrose, making it an attractive option for health-conscious consumers. Resugar Synergy allows Nestlé to provide indulgent frozen treats that align with the growing trend toward healthier eating, without sacrificing flavor or texture

- In July 2022, Swerve, a U.S.-based manufacturer of plant-based sweeteners, announced plans to develop customized sweetener products and packets tailored for U.S. consumers interested in baking. This initiative reflects the rising trend of personalization in food products, allowing bakers to achieve their desired taste profiles and health goals. Swerve's focus on customization aims to empower home bakers with versatile options for sugar alternatives in their culinary creations

- In March 2022, Cargill launched its innovative stevia products featuring EverSweet + ClearFlo technology, which refines the flavor profile of stevia sweeteners. This unique sweetener system combines stevia with enhanced flavors, leading to improved dispersion, solubility, and stability in various applications. Cargill's advancements aim to provide manufacturers with a versatile sweetening option that can be easily integrated into a broad range of food and beverage formulations

- In April 2022, Tate & Lyle expanded its allulose production capacity to meet the sharp increase in demand for crystalline allulose, following its FDA approval for exclusion from added and total sugar declarations on Nutrition Facts labels. Allulose has gained popularity for its versatility and lower calorie content, with bars emerging as a favored application. This expansion supports manufacturers looking to incorporate this innovative sweetener into their product lines

- In December 2021, B.T. Sweets, a company specializing in plant-based sweeteners, launched Cambya, a unique sweetener crafted from soluble fibers, monk fruit, and select botanicals. Cambya is designed for seamless application in various food products, including hot, dry, and cold formulations. This versatile sweetener reflects the growing consumer preference for healthier, natural alternatives, allowing manufacturers to offer innovative products that align with market trends toward plant-based diets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sugar Substitutes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sugar Substitutes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sugar Substitutes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.