Global Stem Cell Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

16.56 Billion

USD

37.09 Billion

2024

2032

USD

16.56 Billion

USD

37.09 Billion

2024

2032

| 2025 –2032 | |

| USD 16.56 Billion | |

| USD 37.09 Billion | |

|

|

|

|

Stem Cell Manufacturing Market Size

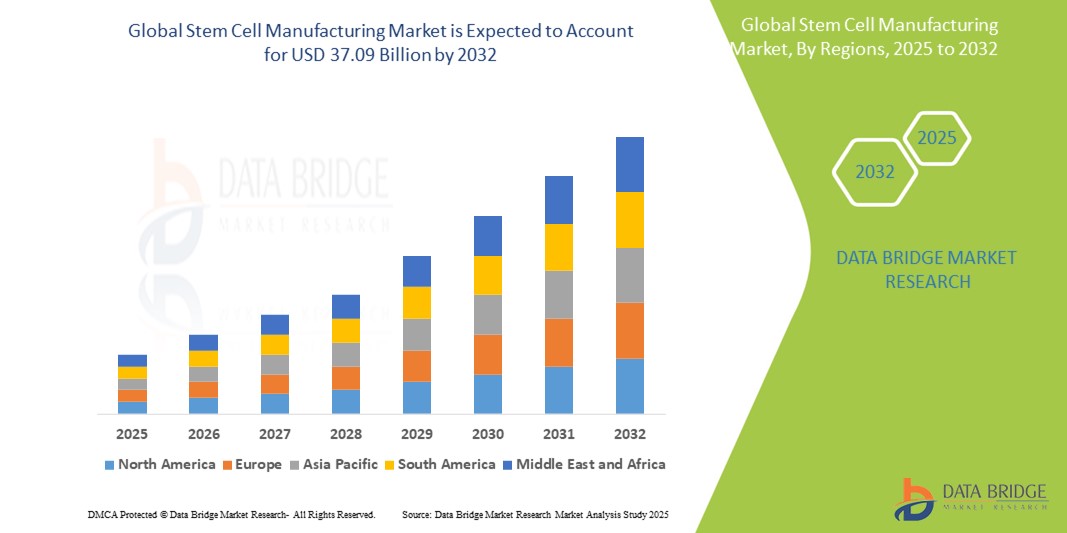

- The global stem cell manufacturing market size was valued at USD 16.56 billion in 2024 and is expected to reach USD 37.09 billion by 2032, at a CAGR of 10.6% during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic and degenerative diseases, growing geriatric population, and advancements in manufacturing technologies

Stem Cell Manufacturing Market Analysis

- Stem cell manufacturing is a critical component in the development of regenerative therapies, providing high-quality stem cells for use in treatments for a wide range of diseases, including neurological disorders, cardiovascular diseases, and cancers. The market includes stem cell expansion, differentiation, cryopreservation, and quality control processes

- The demand for stem cell manufacturing is significantly driven by the increasing prevalence of chronic diseases, rising investments in regenerative medicine, and advancements in cell culture technologies

- North America is expected to dominate the global stem cell manufacturing market, with market share of 45.7%, driven by advanced research infrastructure, significant investments in R&D, strong regulatory support, favourable regulatory frameworks for cell therapy approvals, and high adoption rates, widespread use of stem cell therapies in clinical applications

- Asia-Pacific is expected to be the fastest-growing region in the stem cell manufacturing market with a CAGR of 12.4%, due to rising awareness about regenerative therapies, increasing healthcare spending, and expanding biotechnology sectors

- Clinical applications segment is expected to dominate the market with a market share of 61.2%, driven by the rising adoption of stem cell therapies for treating a wide range of chronic diseases, including cancer, neurological disorders, and cardiovascular conditions

Report Scope and Stem Cell Manufacturing Market Segmentation

|

Attributes |

Stem Cell Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stem Cell Manufacturing Market Trends

“Advancements in Stem Cell Manufacturing Technologies”

- One prominent trend in the evolution of stem cell manufacturing is the increasing adoption of automated, closed system bioreactors and 3D culture technologies

- These innovations enhance scalability, consistency, and cost-efficiency in stem cell production by reducing contamination risks and improving cell quality, making large-scale manufacturing more feasible

- For instance, 3D bioreactor systems allow for the mass production of stem cells with more uniform growth and differentiation, supporting the production of complex cell types required for regenerative medicine and advanced cell therapies

- These advancements are transforming the stem cell manufacturing landscape, enabling the development of more effective therapies, improving patient outcomes, and driving the demand for next-generation manufacturing platforms

Stem Cell Manufacturing Market Dynamics

Driver

“Growing Demand for Regenerative Medicine and Cell Therapy”

- The increasing prevalence of chronic diseases, including cancer, neurological disorders, and cardiovascular diseases, is driving the demand for stem cell-based therapies, which offer promising solutions for disease modification and tissue regeneration

- As the global population ages and the incidence of chronic conditions rises, the need for advanced therapeutic approaches, including stem cell therapies, continues to grow

- Stem cells have the unique ability to differentiate into various cell types, making them ideal for regenerative medicine, where they are used to repair or replace damaged tissues

For instance,

- In January 2025, according to a report published by the Alliance for Regenerative Medicine, the global market for regenerative medicine is projected to reach USD 60 billion by 2028, with stem cell therapies representing a significant portion of this growth. This surge in demand is driven by ongoing clinical trials, technological advancements, and increasing investments in cell-based therapies

- As a result, the stem cell manufacturing market is experiencing significant growth, with companies investing in advanced manufacturing platforms to meet the rising demand for high-quality, scalable stem cell production

Opportunity

“Expanding Applications in Personalized Medicine and Precision Therapies”

- Stem cell manufacturing is increasingly being integrated into personalized medicine, where treatments are tailored to the specific genetic makeup and medical history of individual patients

- Personalized stem cell therapies offer the potential for highly targeted treatments with improved efficacy and reduced side effects, providing a competitive advantage in the rapidly evolving healthcare market

- These therapies are particularly valuable for rare diseases and conditions with limited treatment options, as they can be customized to match each patient's unique cellular requirements

For instance,

- In March 2025, according to an article published in the journal Stem Cells Translational Medicine, personalized stem cell-based therapies are gaining momentum, with researchers developing patient-specific stem cell lines for conditions such as spinal cord injuries, heart failure, and neurodegenerative disorders. These approaches aim to improve patient outcomes by using autologous cells, reducing the risk of immune rejection and complications

- The expansion of personalized medicine is expected to create significant opportunities for stem cell manufacturers, as the demand for customized cell products continues to rise

Restraint/Challenge

“High Manufacturing Costs and Regulatory Complexities”

- The high cost of stem cell manufacturing remains a significant challenge, with expenses related to cell culture, quality control, and regulatory compliance adding to the overall production costs

- Stem cell manufacturing processes are complex and require highly controlled environments to ensure the safety, purity, and potency of the final product, making large-scale production financially demanding

- In addition, navigating the complex regulatory landscape for stem cell therapies can be time-consuming and costly, creating barriers to market entry for smaller biotech firms

For instance,

- In February 2025, according to a report by the International Society for Cell and Gene Therapy (ISCT), the average cost of manufacturing a single dose of CAR-T cell therapy can range from USD 100,000 to USD 400,000, depending on the cell type and manufacturing approach. These high costs pose a significant barrier to the widespread adoption of stem cell therapies, particularly in developing markets

- Consequently, the high cost of stem cell manufacturing can limit market growth, restrict patient access, and slow the commercialization of innovative cell therapies

Stem Cell Manufacturing Market Scope

The market is segmented on the basis of products, applications, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the clinical applications is projected to dominate the market with a largest share in application segment

The clinical applications segment is expected to dominate the stem cell manufacturing market with the largest share of 61.2% in 2025, driven by the rising adoption of stem cell therapies for treating a wide range of chronic diseases, including cancer, neurological disorders, and cardiovascular conditions. The growing focus on personalized medicine and the increasing number of approved stem cell therapies further support the expansion of this segment, enhancing patient outcomes and driving market growth.

The consumables and kits is expected to account for the largest share during the forecast period in product market

In 2025, the consumables and kits segment is expected to dominate the stem cell manufacturing market with the largest market share of 55.4%, driven by the frequent use of essential items such as culture media, reagents, and cell growth supplements in stem cell research and therapy. These consumables are critical for maintaining cell viability and promoting differentiation, supporting the rapid growth of regenerative medicine and the increasing number of stem cell-based clinical trials.

Stem Cell Manufacturing Market Regional Analysis

“North America Holds the Largest Share in the Stem Cell Manufacturing Market”

- North America dominates the global stem cell manufacturing market, accounting for 45.7% of the market share. This dominance is driven by advanced research infrastructure, significant investments in R&D, strong regulatory support, favourable regulatory frameworks for cell therapy approvals, and high adoption rates, widespread use of stem cell therapies in clinical applications

- U.S. leads the North American market, commanding 81.2% of the regional share driven by high research funding, substantial government and private sector investments in stem cell research, biotech hub, presence of leading biotech and pharmaceutical companies, and clinical trial activity, large number of ongoing clinical trials for stem cell therapies

“Asia-Pacific is Projected to Register the Highest CAGR in the Stem Cell Manufacturing Market”

- Asia-Pacific is expected to witness the highest growth rate in the stem cell manufacturing market, with an estimated CAGR of 12.4%, driven by rising healthcare investments, rapid expansion of healthcare infrastructure, increasing awareness, growing patient awareness about stem cell therapies, and government support, favorable policies promoting biotechnology

- China dominates the regional market, holding 65.2% of the Asia-Pacific market share, driven by large biotech manufacturing, extensive biopharmaceutical manufacturing capabilities, government funding, significant support for biotech innovation, and clinical trials, high volume of stem cell clinical trials

- India is projected to register the highest CAGR of 11.3% in the Asia-Pacific market, driven by growing medical tourism, expanding healthcare infrastructure, and R&D focus, increased focus on research and development for regenerative medicine

Stem Cell Manufacturing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Organogenesis Inc. (U.S.)

- Vericel Corporation (U.S.)

- ANTEROGEN. CO., LTD. (South Korea)

- VistaGen Therapeutics, Inc. (U.S.)

- American CryoStem Corporation (U.S.)

- PromoCell (Germany)

- Sartorius AG (Germany)

- Vertex Pharmaceuticals Incorporated (U.S.)

- STEMCELL Technologies (Canada)

- Takeda Pharmaceutical Company Limited (Japan)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Bio-Techne (U.S.)

- REPROCELL Inc. (Japan)

- Catalent, Inc. (U.S.)

- Mesoblast Ltd (Australia)

- Astellas Pharma Inc. (Japan)

- FUJIFILM Holdings Corporation (Japan)

Latest Developments in Global Stem Cell Manufacturing Market

- In February 2025, Thermo Fisher Scientific Inc. announced the launch of its next-generation Gibco Stem Cell Culture System, designed to enhance stem cell expansion and differentiation for research and therapeutic applications. This innovative system features advanced media formulations, optimized growth factors, and closed system bioreactors, aimed at improving cell quality and scalability, supporting the growing demand for regenerative medicine and personalized therapies

- In December 2024, BD (Becton, Dickinson and Company) introduced its new BD Rhapsody TCR Targeted Panel for single-cell RNA sequencing, enabling precise immune profiling and stem cell characterization. This technology provides researchers with high-resolution insights into cell populations, supporting the development of advanced stem cell therapies and immunotherapies

- In November 2024, Sartorius AG, a leading provider of bioprocess solutions, launched the Sartoclear Dynamics Lab V filtration system, specifically designed for efficient cell harvesting in stem cell manufacturing. This system simplifies the downstream processing of stem cells, reducing contamination risks and improving overall cell yield, aligning with the industry's move towards closed system manufacturing

- In October 2024, FUJIFILM Holdings Corporation announced the commercial availability of its new iPSC-derived cardiomyocyte cell line for cardiac drug discovery and toxicity testing. This product aims to accelerate the development of precision medicine by providing high-quality, ready-to-use cardiac cells for research and clinical applications, supporting the growing demand for patient-specific cell therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.