Global Smart Orthopedic Implants Market

Market Size in USD Billion

CAGR :

%

USD

375.08 Billion

USD

627.78 Billion

2025

2033

USD

375.08 Billion

USD

627.78 Billion

2025

2033

| 2026 –2033 | |

| USD 375.08 Billion | |

| USD 627.78 Billion | |

|

|

|

|

Smart Orthopedic Implants Market Size

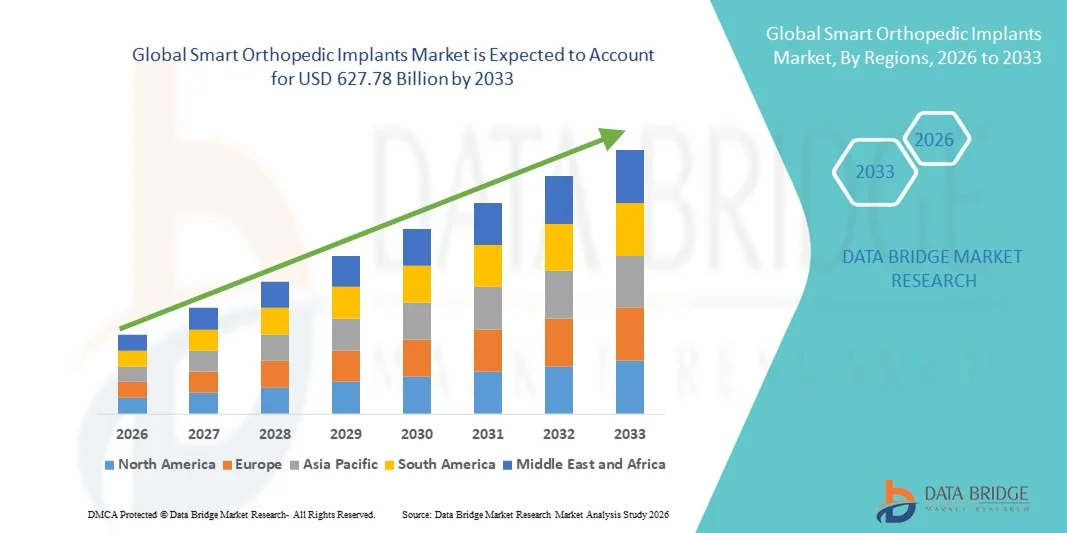

- The global smart orthopedic implants market size was valued at USD 375.08 billion in 2025 and is expected to reach USD 627.78 billion by 2033, at a CAGR of 6.65% during the forecast period

- The market growth is largely fueled by the increasing prevalence of orthopedic disorders, rising geriatric population, and rapid technological advancements in implant materials and digital integration systems, leading to enhanced adoption of smart orthopedic implants across hospitals and specialty orthopedic centers

- Furthermore, growing demand for minimally invasive surgeries, real-time post-operative monitoring, and improved patient-specific treatment outcomes is establishing smart orthopedic implants as an advanced solution in modern orthopedic care. These converging factors are accelerating the uptake of Smart Orthopedic Implants solutions, thereby significantly boosting the industry's growth

Smart Orthopedic Implants Market Analysis

- Smart orthopedic implants, integrating advanced sensors, microelectronics, and wireless connectivity within joint replacement and trauma fixation devices, are becoming increasingly vital components of modern orthopedic care due to their ability to enable real-time performance monitoring, improved implant longevity assessment, and data-driven post-operative management across hospitals and specialty orthopedic centers

- The escalating demand for smart orthopedic implants is primarily fueled by the rising prevalence of osteoarthritis and degenerative bone disorders, increasing geriatric population, growing preference for minimally invasive procedures, and the expanding adoption of digital health technologies that enhance surgical precision and long-term patient outcomes

- North America dominated the smart orthopedic implants market with the largest revenue share of 44.6% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, strong presence of leading medical device manufacturers, and early adoption of digitally integrated orthopedic solutions. The U.S. continues to witness substantial growth in smart joint replacement procedures, supported by favorable reimbursement frameworks and rapid technological innovation

- Asia-Pacific is expected to be the fastest-growing region in the smart orthopedic implants market during the forecast period, owing to increasing healthcare investments, rising orthopedic surgical volumes, expanding medical tourism, and growing awareness regarding advanced implant technologies across countries such as China, India, Japan, and South Korea

- The Titanium segment held the largest market revenue share of 38.9% in 2025, driven by its superior biocompatibility and corrosion resistance properties

Report Scope and Smart Orthopedic Implants Market Segmentation

|

Attributes |

Smart Orthopedic Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Smart Orthopedic Implants Market Trends

Technological Advancement Through Embedded Sensors and Real-Time Monitoring

- A significant and accelerating trend in the global smart orthopedic implants market is the integration of embedded sensors and wireless connectivity within implants to enable real-time monitoring of patient health and implant performance. These advanced systems allow continuous tracking of parameters such as load distribution, temperature changes, implant stability, and healing progression

- For instance, certain smart knee and hip implant prototypes incorporate micro-sensors that transmit post-operative performance data to clinicians, enabling early detection of implant loosening, misalignment, or infection risks. This enhances clinical decision-making and reduces the likelihood of revision surgeries

- The incorporation of Bluetooth-enabled and cloud-connected monitoring platforms allows orthopedic specialists to remotely assess rehabilitation progress and personalize treatment strategies. This data-driven approach improves long-term patient outcomes and optimizes recovery timelines

- The increasing focus on minimally invasive surgeries and precision-based orthopedic procedures is further accelerating the demand for technologically advanced implants capable of providing actionable performance insights. Hospitals and specialty orthopedic centers are gradually adopting such smart systems to enhance procedural success rates

- This shift toward connected, data-enabled orthopedic solutions is redefining post-surgical care standards and strengthening collaboration between patients and healthcare providers. As a result, manufacturers are investing heavily in R&D to develop next-generation smart orthopedic implants with enhanced durability, biocompatibility, and integrated monitoring capabilities

Smart Orthopedic Implants Market Dynamics

Driver

Rising Prevalence of Orthopedic Disorders and Increasing Geriatric Population

- The growing prevalence of orthopedic disorders such as osteoarthritis, rheumatoid arthritis, osteoporosis, and traumatic injuries is a major driver fueling demand for smart orthopedic implants worldwide

- The rapidly expanding geriatric population, which is more susceptible to degenerative bone conditions and joint-related disorders, is significantly increasing the volume of joint replacement and reconstructive surgeries

- For instance, rising cases of knee and hip replacement procedures globally are encouraging healthcare providers to adopt advanced implant systems that offer improved durability and enhanced post-operative monitoring capabilities

- In addition, increasing sports-related injuries and road accident cases are contributing to the demand for technologically advanced implants that ensure better structural stability and faster recovery

- Government initiatives to improve healthcare infrastructure, growing healthcare expenditure, and greater patient awareness regarding advanced treatment options are further supporting market expansion across both developed and emerging economies

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- The high cost associated with technologically advanced smart orthopedic implants remains a significant challenge for widespread adoption, particularly in developing regions with limited reimbursement coverage and budget-constrained healthcare systems

- Smart implants integrated with embedded sensors, wireless data transmission modules, and advanced biocompatible materials involve higher research, manufacturing, and validation costs compared to conventional orthopedic implants, resulting in premium pricing

- For instance, sensor-enabled knee or hip implants designed to provide post-operative performance monitoring can cost substantially more than traditional implants, making hospitals and patients in cost-sensitive markets hesitant to adopt these advanced solutions without clear reimbursement support

- Complex and stringent regulatory approval processes for combination products (medical device plus digital component) further increase time-to-market and compliance expenses. Manufacturers must conduct extensive clinical validation to demonstrate both mechanical safety and digital reliability before obtaining approvals from regulatory authorities

- In addition, concerns related to long-term device durability, cybersecurity of transmitted medical data, and integration with hospital IT infrastructure may slow procurement decisions among healthcare providers

- Overcoming these challenges through cost optimization, expanded reimbursement frameworks, regulatory harmonization, and enhanced data security measures will be essential to ensure sustained and widespread adoption of smart orthopedic implants globally

Smart Orthopedic Implants Market Scope

The market is segmented on the basis of product type, material, and end user.

- By Product Type

On the basis of product type, the Global Smart Orthopedic Implants market is segmented into Hip Reconstruction, Knee Reconstruction, Shoulder Implants, Spinal Implants, and Trauma Implants. The Knee Reconstruction segment dominated the largest market revenue share of 34.7% in 2025, driven by the rising global prevalence of osteoarthritis and degenerative joint disorders. The increasing geriatric population significantly contributes to higher knee replacement procedures worldwide. Technological advancements such as sensor-enabled smart knee implants allow real-time post-operative monitoring of joint performance. Growing obesity rates further increase the risk of knee joint deterioration, supporting procedure volumes. Improved surgical techniques and robotic-assisted orthopedic surgeries enhance implant accuracy and outcomes. Higher awareness regarding early joint replacement improves patient acceptance rates. Favorable reimbursement policies in developed regions also support market expansion. Continuous innovation in minimally invasive knee reconstruction procedures reduces recovery time. Increasing sports-related injuries further stimulate demand. Expansion of orthopedic specialty hospitals globally strengthens procurement. Rising healthcare expenditure in emerging economies supports accessibility. The durability and long-term success rate of smart knee implants further reinforce dominance.

The Spinal Implants segment is anticipated to witness the fastest CAGR of 9.4% from 2026 to 2033, fueled by the growing incidence of spinal disorders such as degenerative disc disease and spinal stenosis. Rising sedentary lifestyles and poor posture contribute significantly to spinal complications. Smart spinal implants equipped with monitoring sensors are gaining traction for post-surgical recovery tracking. Increasing adoption of minimally invasive spine surgeries enhances segment growth. Technological integration enabling data-driven rehabilitation supports patient outcomes. Growing aging populations globally further drive procedural demand. Expansion of advanced neurosurgical centers strengthens adoption. Increasing awareness regarding early intervention for spinal deformities also supports growth. Healthcare infrastructure development in Asia-Pacific and Latin America accelerates demand. Rising research investments in bio-compatible smart materials enhance product innovation. Higher success rates of spinal fusion procedures improve patient confidence. Continuous product approvals and clinical trials further strengthen segment momentum.

- By Material

On the basis of material, the Global Smart Orthopedic Implants market is segmented into Bone Cement, Metal, Cobalt Alloy, and Titanium. The Titanium segment held the largest market revenue share of 38.9% in 2025, driven by its superior biocompatibility and corrosion resistance properties. Titanium implants are lightweight yet highly durable, making them ideal for load-bearing orthopedic applications. The material promotes better osseointegration, enhancing implant stability and longevity. Growing preference for long-lasting implant materials supports its widespread adoption. Technological advancements in 3D-printed titanium implants further strengthen demand. Titanium’s compatibility with smart sensor integration enhances its suitability for next-generation implants. Increasing joint replacement procedures globally contribute to volume growth. The material also reduces allergic reactions compared to other metals. Expanding orthopedic research supports development of advanced titanium alloys. Favorable regulatory approvals further encourage adoption. Rising patient awareness regarding implant quality influences material preference. Continuous innovation in surface modification technologies enhances performance outcomes.

The Cobalt Alloy segment is projected to register the fastest CAGR of 8.7% from 2026 to 2033, owing to its exceptional strength and wear resistance in high-stress orthopedic procedures. Cobalt alloys are particularly suitable for knee and hip implants requiring long-term mechanical durability. Increasing demand for revision surgeries supports material growth. The alloy’s resistance to fatigue and fracture enhances implant lifespan. Growing research into advanced alloy combinations improves performance characteristics. Expansion of complex joint reconstruction procedures further drives usage. Rising demand for high-performance implants in sports injury treatments supports adoption. Improved manufacturing technologies enhance precision and reliability. Emerging markets are witnessing growing acceptance of durable alloy-based implants. Increased surgeon preference for mechanically robust materials strengthens growth. Continuous clinical trials evaluating improved alloy formulations support expansion. Rising healthcare spending globally further contributes to segment acceleration.

- By End User

On the basis of end user, the Global Smart Orthopedic Implants market is segmented into Hospitals, Specialty Centers, Orthopedic Clinics, and Ambulatory Surgical Centers. The Hospitals segment accounted for the largest market revenue share of 45.3% in 2025, driven by the high volume of complex joint replacement and spinal surgeries performed in hospital settings. Hospitals are equipped with advanced surgical infrastructure and robotic-assisted systems. Availability of skilled orthopedic surgeons further strengthens dominance. Higher patient inflow for trauma and emergency cases supports procedural volume. Integration of smart implant monitoring systems is more feasible in hospital environments. Favorable reimbursement frameworks encourage hospital-based surgeries. Expansion of multi-specialty hospitals globally contributes to procurement growth. Increasing government healthcare investments strengthen hospital infrastructure. Access to post-operative care facilities enhances patient outcomes. Rising medical tourism in developed nations further boosts hospital procedures. Continuous technology upgrades support adoption of sensor-enabled implants. The presence of research and clinical trial units further strengthens segment leadership.

The Ambulatory Surgical Centers (ASCs) segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, driven by the growing preference for cost-effective and minimally invasive orthopedic procedures. ASCs offer shorter hospital stays and reduced surgical costs. Increasing adoption of same-day joint replacement surgeries accelerates growth. Technological advancements enable smart implant monitoring even in outpatient settings. Rising patient preference for faster recovery supports ASC procedures. Expansion of private healthcare facilities globally strengthens infrastructure. Favorable reimbursement models for outpatient surgeries enhance adoption. Surgeons increasingly prefer ASCs for elective procedures. Reduced infection risks compared to traditional hospital stays attract patients. Growing healthcare privatization in emerging economies contributes to segment expansion. Continuous improvements in anesthesia and surgical efficiency further support growth. Increasing awareness about outpatient orthopedic care drives patient inflow.

Smart Orthopedic Implants Market Regional Analysis

- North America dominated the smart orthopedic implants market with the largest revenue share of 44.6% in 2025

- Characterized by advanced healthcare infrastructure, high healthcare expenditure, a strong presence of leading medical device manufacturers, and early adoption of digitally integrated orthopedic solutions. The region benefits from well-established hospital networks, increasing volumes of joint replacement surgeries, and rapid incorporation of sensor-enabled and data-driven implant technologies

- The region’s leadership is further supported by favorable reimbursement frameworks, strong clinical research capabilities, and continuous technological innovation in implant materials and embedded monitoring systems. Growing demand for precision-based orthopedic procedures and improved post-operative outcome tracking continues to strengthen market expansion across hospitals and specialty orthopedic centers

U.S. Smart Orthopedic Implants Market Insight

The U.S. smart orthopedic implants market captured the largest revenue share within North America in 2025 and is anticipated to grow at a noteworthy CAGR during the forecast period. Growth is driven by the high prevalence of osteoarthritis and musculoskeletal disorders, rising geriatric population, and strong demand for advanced joint replacement procedures. The country continues to witness substantial adoption of smart knee and hip implants integrated with performance-monitoring capabilities. In addition, supportive reimbursement policies, strong R&D investments, and the presence of key industry players accelerate innovation and commercialization of next-generation smart orthopedic solutions in the U.S.

Europe Smart Orthopedic Implants Market Insight

The Europe smart orthopedic implants market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing orthopedic surgical procedures, a growing elderly population, and rising focus on technologically advanced and minimally invasive treatment approaches. Strong regulatory standards and emphasis on high-quality medical devices support the adoption of digitally integrated orthopedic implants across the region. The region is witnessing consistent demand across public hospitals, private specialty clinics, and academic medical centers, with smart implant technologies being incorporated into both primary and revision joint replacement procedures.

U.K. Smart Orthopedic Implants Market Insight

The U.K. smart orthopedic implants market is anticipated to grow steadily during the forecast period, supported by increasing cases of degenerative joint disorders and a strong public healthcare framework. The country’s focus on early diagnosis, precision-based orthopedic treatments, and improved post-surgical monitoring is encouraging adoption of advanced implant technologies. Continuous healthcare modernization initiatives and research collaborations further stimulate market growth.

Germany Smart Orthopedic Implants Market Insight

The Germany smart orthopedic implants market is expected to expand at a considerable CAGR during the forecast period, fueled by rising demand for high-performance implants and the country’s strong medical device manufacturing base. Germany’s emphasis on engineering precision, clinical innovation, and advanced surgical infrastructure promotes adoption of next-generation smart orthopedic implants, particularly in hip and knee replacement procedures.

Asia-Pacific Smart Orthopedic Implants Market Insight

The Asia-Pacific smart orthopedic implants market is expected to grow at the fastest CAGR during the forecast period, driven by increasing healthcare investments, rising orthopedic surgical volumes, expanding medical tourism, and growing awareness regarding advanced implant technologies across countries such as China, India, Japan, and South Korea. Rapid improvements in healthcare infrastructure and increasing accessibility to specialized orthopedic care are further supporting regional growth. As healthcare systems modernize and disposable incomes rise, patients are increasingly opting for technologically advanced implants that offer enhanced durability and better clinical outcomes.

Japan Smart Orthopedic Implants Market Insight

The Japan smart orthopedic implants market is gaining momentum due to the country’s rapidly aging population and high prevalence of degenerative bone disorders. Strong technological capabilities, advanced hospital infrastructure, and early adoption of innovative medical technologies support steady market expansion. The demand for long-lasting, high-precision implants integrated with monitoring capabilities is particularly prominent in the Japanese market.

China Smart Orthopedic Implants Market Insight

The China smart orthopedic implants market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising orthopedic procedure volumes, expanding middle-class population, and strong government investments in healthcare infrastructure. Increasing medical tourism, improving access to advanced surgical care, and the growing presence of domestic and international implant manufacturers are key factors propelling market growth. Continuous modernization of hospitals and rising awareness regarding advanced joint replacement technologies are further accelerating adoption across the country.

Smart Orthopedic Implants Market Share

The Smart Orthopedic Implants industry is primarily led by well-established companies, including:

- Zimmer Biomet Holdings, Inc. (U.S.)

- Stryker Corporation (U.S.)

- Smith & Nephew plc (U.K.)

- Medtronic plc (Ireland)

- Globus Medical, Inc. (U.S.)

- NuVasive, Inc. (U.S.)

- Exactech, Inc. (U.S.)

- MicroPort Scientific Corporation (China)

- B. Braun Melsungen AG (Germany)

- Arthrex, Inc. (U.S.)

- Wright Medical Group N.V. (U.S.)

- Conformis, Inc. (U.S.)

- LimaCorporate S.p.A. (Italy)

- DJO Global, Inc. (U.S.)

- Corin Group (U.K.)

- Integra LifeSciences (U.S.)

- Aesculap Implant Systems (Germany)

- Amplitude Surgical (France)

OMNIlife science, Inc. (U.S.)

Latest Developments in Global Smart Orthopedic Implants Market

- In August 2021, Zimmer Biomet’s Persona IQ Smart Knee received FDA De Novo classification, making it one of the first sensor-enabled knee replacement systems allowed for clinical use in the United States. This regulatory milestone allowed the implant to transmit real-time biomechanical data to external devices to monitor patient recovery and joint performance, marking a key advancement in connected orthopedic implant technology

- In April 2022, eCential Robotics entered a collaboration with Amplitude Surgical to develop a robotic knee surgery solution aimed at enhancing precision and outcomes in smart orthopedic implant procedures. This cooperation highlighted the growing integration of robotic systems and smart implants to support intraoperative decision-making and data-driven surgical workflows

- In March 2024, Intellirod Spine received FDA clearance for its LoadSmart spinal fusion implant system, which incorporates embedded sensors capable of measuring load and strain across vertebral segments to optimize post-surgical outcomes. This clearance underscored ongoing innovation in sensor-integrated spinal implants designed to improve performance monitoring and rehabilitation strategies

- In March 2025, Zimmer Biomet expanded its smart orthopedic portfolio with the launch of the Persona IQ 30 mm Stem, a new sensor-equipped extension for smart knee solutions designed to accommodate a wider range of patient anatomies and enhance data collection for personalized recovery plans. This product launch strengthened the company’s leadership in sensor-based implant technologies and broadened clinical applicability

- In June 2025, NanoHive Medical LLC partnered with DirectSync Surgical to co-develop Hive Soft Titanium spinal interbody fusion implants with integrated piezoelectric sensors and remote monitoring capabilities, combining advanced 3D-printed structures with smart sensor technology to enable bone stimulation and enhanced data capture for patient-specific care. This strategic collaboration illustrated the trend toward highly customized and connected implant solutions in the smart orthopedic segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.