Global Position Sensor Market

Market Size in USD Billion

CAGR :

%

USD

6.67 Billion

USD

13.44 Billion

2024

2032

USD

6.67 Billion

USD

13.44 Billion

2024

2032

| 2025 –2032 | |

| USD 6.67 Billion | |

| USD 13.44 Billion | |

|

|

|

|

Position Sensor Market Size

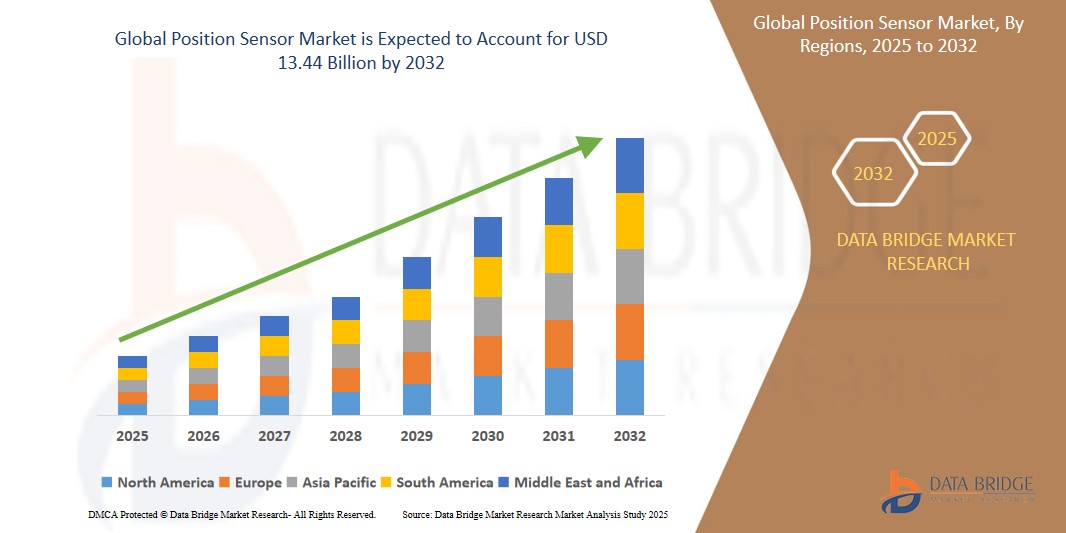

- The global position sensor market size was valued at USD 6.67 billion in 2024 and is expected to reach USD 13.44 billion by 2032, at a CAGR of 9.15% during the forecast period

- This growth is driven by rising personal disposable income and rising research and development opportunities

Position Sensor Market Analysis

- Position sensors play a critical role across sectors such as automotive, consumer electronics, industrial automation, aerospace, and healthcare, delivering high-precision measurement, motion control, and safety assurance

- Market expansion is fueled by the growing demand for advanced sensing technologies, increased deployment of robotics and smart manufacturing systems, and the integration of IoT, AI, and mechatronics in real-time applications

- Advancements in non-contact and miniaturized sensors, rising use in EVs and autonomous vehicles, and regulatory push for safety and energy efficiency are further driving market growth

- Europe is expected to dominate the position sensor market with the largest market share of 40.11%, driven by robust demand across automotive, industrial automation, aerospace, and medical equipment sectors

- Asia-Pacific is expected to be the fastest-growing region in the position sensor market during the forecast period due to rapid industrial expansion, smart city initiatives, and adoption of automated production lines

- The proximity segment is expected to dominate the position sensor market with the largest share of 25.42% in 2025 due to its widespread application in automotive safety systems, industrial automation, and consumer electronics

Report Scope and Position Sensor Market Segmentation

|

Attributes |

Position Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Position Sensor Market Trends

“Miniaturization and Integration in Consumer Electronics”

- The trend of miniaturization in consumer electronics is driving the development of compact, high-precision position sensors for applications in smartphones, wearables, gaming controllers, and AR/VR devices

- Manufacturers are integrating position sensors with MEMS technology to enhance responsiveness and accuracy in motion tracking while reducing power consumption

- This integration improves user experience in smart devices by enabling gesture recognition, device orientation, and navigation support

- For instance, in 2024, STMicroelectronics introduced a new ultra-compact 6-axis motion sensor designed for wearable and portable applications with advanced tracking capabilities

- This trend is expected to significantly boost demand for high-performance, miniaturized sensors across the growing consumer electronics market

Position Sensor Market Dynamics

Driver

“Surging Adoption in Industrial Automation”

- Rising investments in Industry 4.0 and smart manufacturing are pushing the adoption of position sensors for robotic arms, conveyor systems, and machine tools

- Position sensors enable accurate control and feedback in automated machinery, reducing downtime and improving precision

- The expansion of industrial automation in sectors such as automotive, food processing, and packaging is creating strong market momentum

- For instance, in January 2024, Siemens AG upgraded its SIMATIC automation system with advanced position-sensing modules to enhance robotic efficiency and accuracy

- This driver is anticipated to continue propelling growth in factory automation and industrial robotics

Opportunity

“Increasing Use in Medical Devices and Equipment”

- Position sensors are becoming essential in medical technologies such as robotic surgery, patient monitoring systems, infusion pumps, and imaging equipment

- These sensors provide high-resolution data to support minimally invasive procedures and enhance patient safety

- The growing demand for precision diagnostics and advanced healthcare infrastructure in developing economies is expanding this opportunity

- For instance, in 2024, TE Connectivity launched a new line of position sensors tailored for surgical robotics and diagnostic imaging systems

- This sector represents a significant opportunity for sensor manufacturers to tailor specialized solutions for medical OEMs

Restraint/Challenge

“High Cost of Precision Sensors and Calibration Requirements”

- High-accuracy position sensors often require extensive calibration, temperature compensation, and quality control, increasing production costs

- Small and medium-sized enterprises may find the adoption of such sensors economically challenging, especially in price-sensitive markets

- Frequent recalibration and complex installation in harsh environments can limit widespread deployment

- For instance, a 2023 industry report by MarketsandMarkets highlighted that cost constraints were a primary barrier to adoption for precision magnetic position sensors in mid-tier industrial applications

- Addressing cost-effectiveness and calibration simplicity will be crucial for mass adoption across sectors

Position Sensor Market Scope

The market is segmented on the basis of type, contact type, output, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Contact Type |

|

|

By Output

|

|

|

By Application |

|

|

By End User |

|

In 2025, the proximity is projected to dominate the market with a largest share in type segment

The proximity segment is expected to dominate the position sensor market with the largest share of 25.42% in 2025 due to its widespread application in automotive safety systems, industrial automation, and consumer electronics.

The automotive is expected to account for the largest share during the forecast period in end user segment

In 2025, the automotive segment is expected to dominate the market due to the increasing integration of advanced driver-assistance systems (ADAS), rising demand for electric and autonomous vehicles, and growing emphasis on vehicle safety and comfort features that rely heavily on position sensors.

Position Sensor Market Regional Analysis

“Europe Holds the Largest Share in the Position Sensor Market”

- Europe is expected to dominate the position sensor market with the largest market share of 40.11%, driven by robust demand across automotive, industrial automation, aerospace, and medical equipment sectors

- Germany leads the region due to the presence of major automotive manufacturers, established sensor technology providers, and strong government support for Industry 4.0 initiatives

- High focus on precision engineering, predictive maintenance, and compliance with stringent safety standards is fueling adoption of advanced position sensors

- Accelerated deployment of robotics, smart manufacturing systems, and IoT-enabled machinery further strengthens Europe’s leadership in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Position Sensor Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the position sensor market, driven by rapid industrial expansion, smart city initiatives, and adoption of automated production lines

- Countries such as China, Japan, and India are major contributors due to increasing investment in electric vehicles, consumer electronics, and industrial automation

- Japan stands out for integrating miniaturized, high-precision sensors in robotics and mechatronics, boosting operational accuracy in advanced manufacturing

- Growing demand for affordable sensor solutions, rising penetration of IoT in factory automation, and government-led digital infrastructure programs are propelling market expansion across the region

Position Sensor Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell International Inc. (U.S.)

- SICK AG (Germany)

- ams AG (Austria)

- TE Connectivity (Switzerland)

- MTS Systems (U.S.)

- Vishay Technologies Inc. (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Bourns (U.S.)

- Allegro Microsystem (U.S.)

- Synaptics (U.S.)

- Apple Inc. (U.S.)

- Egis Technology (Taiwan)

- Crucialtec (South Korea)

- Novatek Microelectronics (Taiwan)

- Qualcomm Technologies, Inc. (U.S.)

- Q Technology (China)

- CMOS Sensor Inc. (U.S.)

- ELAN Microelectronics (Taiwan)

- OXI Technology (China)

- Sonavation Inc. (U.S.)

- Touch Biometrix (U.K.)

- Vkansee (U.S.)

Latest Developments in Global Position Sensor Market

- In May 2024, Infineon Technologies AG launched its latest XENSIV TLE49SR angle sensor portfolio, combining high accuracy with stray field immunity. These sensors are ideal for vehicle height balancing and electric power steering in safety-focused automotive chassis systems

- In April 2024, Honeywell and Lilium announced the expansion of their ongoing partnership, with Honeywell set to supply lightweight sensor technology for the Lilium Jet, an electric vertical takeoff and landing (VTOL) aircraft. The new sensor system is designed to boost performance and efficiency by delivering accurate and dependable flight data

- In February 2023, Continental broadened its sensor offerings to meet the surging EV market demand by introducing the High-Speed inductive eMotor Position Sensor OCTRSYS. This innovative solution accurately detects rotor positions in synchronous electric motors, improving efficiency and smooth operation

- In January 2023, CTS Corporation introduced the 286 rotary position sensor series, a multiturn, noncontact Hall Effect sensor built for high-demand applications across industrial, medical, and transportation sectors

- In January 2023, Infineon Technologies AG combined its expertise in magnetic sensing with linearized tunnel magnetoresistor technology to release the XENSIV TLI5590-A6W magnetic position sensor, optimized for precision measurement and durability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Position Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Position Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Position Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.