Global Polyurethane Additives Market

Market Size in USD Billion

CAGR :

%

USD

3.36 Billion

USD

5.54 Billion

2024

2032

USD

3.36 Billion

USD

5.54 Billion

2024

2032

| 2025 –2032 | |

| USD 3.36 Billion | |

| USD 5.54 Billion | |

|

|

|

|

Polyurethane Additives Market Size

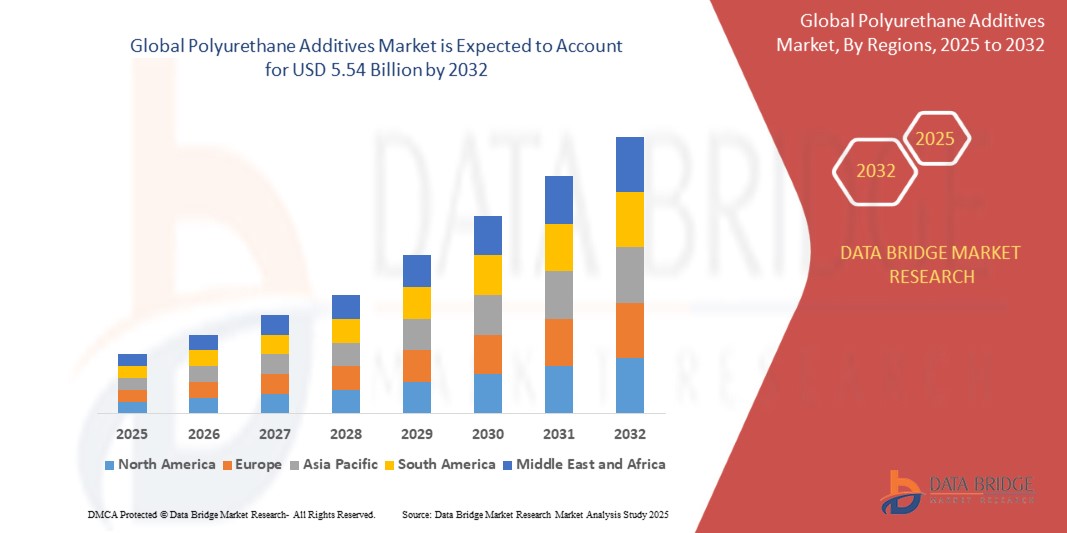

- The Global Polyurethane Additives Market was valued at USD 3.36 billion in 2024 and is expected to reach USD 5.54 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.50%, primarily driven by the factor such as increasing demand for bio-based and sustainable additives.

- This growth is driven by factors such as growth of the polyurethane additives market is the rising demand for energy-efficient and high-performance materials and regulatory pressure and environmental concerns.

Polyurethane Additives Market Analysis

- The global polyurethane additives market is experiencing significant growth, driven by the rising demand for polyurethane-based materials in various industries, including automotive, construction, furniture, and footwear. Polyurethane additives, such as catalysts, stabilizers, and flame retardants, enhance the performance of polyurethane foams, coatings, and elastomers, making them essential in the production of high-quality, durable products.

- Growing environmental concerns and the increasing focus on sustainability are prompting polyurethane manufacturers to develop eco-friendly additives. Innovations in bio-based polyurethane additives and low-VOC solutions are gaining traction, addressing regulatory pressure and consumer demand for environmentally conscious products.

- The rapid growth of the automotive and construction sectors, combined with the rise in demand for energy-efficient and environmentally friendly products, is fueling the demand for polyurethane additives. Polyurethane's superior properties, including insulation, flexibility, and durability, make it an ideal material for applications in both industries.

For instance, in March 2025, BASF introduced a new line of bio-based polyurethane additives aimed at reducing the environmental impact of polyurethane foam production. These additives are derived from renewable resources, offering an eco-friendly alternative to traditional synthetic materials while maintaining the performance characteristics required for automotive seating and insulation applications.

Report Scope and Polyurethane Additives market Segmentation

|

Attributes |

Polyurethane additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyurethane Additives market Trends

“Increasing Demand for Bio-based and Sustainable Additives”

- The polyurethane additives market is experiencing a shift toward bio-based additives, driven by growing environmental concerns and the need to reduce dependency on petrochemical resources. Manufacturers are increasingly turning to renewable materials, such as vegetable oils and natural polymers, to formulate sustainable additives.

- Regulatory pressures are encouraging the use of low-VOC, non-toxic, and biodegradable polyurethane additives, which help minimize the environmental impact of manufacturing processes. These additives meet both stringent environmental standards and consumer preferences for eco-friendly products.

- As sustainability becomes a key factor in consumer purchasing decisions, there is a growing trend towards incorporating bio-based additives into polyurethane products, particularly in industries like automotive, construction, and furniture, where green building materials and eco-friendly products are gaining demand.

- Bio-based additives not only offer environmental benefits but also improve the performance of polyurethane products, including better durability, flexibility, and overall product quality, making them an attractive alternative to traditional petroleum-based options.

Polyurethane Additives market Dynamics

Driver

“Rising Demand for Energy-Efficient and High-Performance Materials”

- The construction and automotive industries are increasingly seeking materials that offer superior insulation and energy efficiency, driving the demand for advanced polyurethane additives.

- Polyurethane additives enhance the thermal insulation properties of foams, contributing to energy savings in buildings and vehicles.

- The shift towards lightweight and fuel-efficient vehicles is also boosting the use of polyurethane materials, necessitating additives that improve performance and durability.

- This growing demand for energy-efficient and high-performance materials is propelling innovation and expansion in the polyurethane additives market.

For instance,

- BASF has introduced an innovative HFO-blown PIR system that improves the energy efficiency of insulation sandwich panels, aligning with the industry's move towards sustainable construction materials.

Opportunity

“Rising Demand for Sustainable and Low-VOC Polyurethane Products”

- Growing regulatory pressure to reduce volatile organic compound (VOC) emissions is pushing the demand for environmentally friendly polyurethane additives, particularly in sectors like construction, automotive, and furniture.

- Manufacturers are increasingly investing in the development of low-VOC catalysts, bio-based surfactants, and other eco-friendly additives that maintain performance while meeting environmental standards.

- The shift toward green chemistry and compliance with global frameworks such as REACH and the U.S. EPA’s Clean Air Act is opening new avenues for innovation in sustainable polyurethane formulations.

For instance,

- Evonik has introduced its new Low Carbon Footprint (LCF) TEGOSTAB R surfactants, based on renewable raw materials, to support sustainable polyurethane foam production. These VOC-optimized surfactants have an ultra-low cyclic siloxane content (<0.1% by weight), aiding formulators in meeting stringent emission targets while producing high-quality foam.

- As buyers across consumer and industrial segments have been increasingly prioritizing sustainability, the polyurethane additive suppliers with utilized green innovation attributes are well-positioned to capitalize on this evolving demand.

Restraint/Challenge

“Stringent Regulatory Environment and Compliance Costs”

- Polyurethane additive manufacturers must adhere to evolving global regulations related to chemical safety, emissions, and environmental impact, which increases operational complexity.

- Compliance with frameworks such as REACH, TSCA, and other regional mandates requires continuous investment in product testing, certification, and documentation.

- Reformulating existing products to meet new regulatory standards often demands significant R&D resources, increasing time-to-market and production costs.

- Smaller manufacturers face greater pressure, as compliance expenses and bureaucratic hurdles can act as barriers to innovation and market entry.

For instance,

- Regulatory frameworks like the EU's REACH and the U.S. EPA's TSCA mandate comprehensive safety assessments for chemical products. For instance, the EPA has increased fees for Pre-Manufacture Notices (PMNs) from $16,000 to $45,000, significantly raising the cost of introducing new additives.

Polyurethane Additives market Scope

The market is segmented on the basis product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-Use Industry |

|

Polyurethane Additives market Regional Analysis

“Asia Pacific is the Dominant Region in the Ink Additives market”

- Asia-Pacific leads the Polyurethane additives market due to rapid industrialization, significant expansion of packaging and printing sectors, and the increasing demand for eco-friendly and sustainable printing solutions across key economies like China, India, and Japan.

- China is the dominant force in the regional market, acting as a global hub for packaging, textiles, and publishing, where Polyurethane additives are crucial for print quality, performance, and durability.

- Japan is at the forefront of developing high-performance ink formulations, particularly in the electronics and label printing segments, supported by advanced R&D infrastructure.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The region is expected to maintain its high growth trajectory, driven by regulatory support for low-VOC and bio-based additives, and growing awareness among consumers and businesses about the importance of sustainable printing practices.

- The booming e-commerce and flexible packaging sectors in Southeast Asia, alongside the rise of digital printing, are major contributors to the region's growth.

- Government initiatives like China’s “dual carbon” goals and India’s environmental packaging regulations are accelerating innovation in ink formulations to meet sustainability targets.

- Rising demand from key industries such as food & beverage, cosmetics, and textile printing is creating abundant opportunities for ink additive manufacturers in the region.

Polyurethane Additives market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Evonik Industries (Germany)

- BASF (Germany)

- Huntsman Corporation (U.S.)

- Covestro (Germany)

- Dow Inc. (U.S.)

- Lanxess AG (Germany)

- Albemarle Corporation (U.S.)

- Tosoh Corporation (Japan)

- Momentive (U.S.)

- BYK (U.S.)

Latest Developments in Global Ink Additives market

- In August 2023, Marelli introduced a new lightweight polyurethane foam designed for use in all foam-in-place (FIP) applications, with a particular focus on the main dashboard panel. This innovation is the outcome of a collaborative development with materials partner Covestro AG.

- In July 2023, Everchem Specialty Chemicals acquired Specialty Products Inc. This acquisition is aligned with Everchem's objective of introducing high-value, solutions-driven chemical technologies to the expansive polyurethane markets, which is expected to boost the PU additive market.

- In September 2022, LANXESS expanded its LF urethane prepolymer range for adhesives with bio-based raw materials. These prepolymers enhance performance, processing, and productivity, allowing companies to reduce CO2 emissions and contribute to achieving climate-neutral objectives.

- In December 2021, Covestro and Eco-Mobilier partnered to collect and recycle discarded furniture, aiming to create value for mattresses and upholstery. Their goal is to expand the waste markets for foam used in these applications, enabling its use in highly efficient industrial chemical recycling processes. BASF also introduced Elastollan Thermoplastic Polyurethane (TPU) for applications in the furniture, automotive, and fashion industries.

- In November 2021, Evonik partnered with The Vita Group to develop an innovative and efficient method for recycling polyurethane mattresses. This collaboration aims to enhance the recycling process for a more sustainable solution.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyurethane Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyurethane Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyurethane Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.